Position in Rating | Overall Rating | Trading Terminals |

232nd  | 2.1 Overall Rating |

Juno Markets Review

Juno Markets is a forex broker established in 2015, specializing in commodities, CFDs, and FX. It primarily targets the Asian market and provides trading platforms like MT4 and its in-house Juno Auto Trader. The company’s trading servers and liquidity suppliers are registered and located in Asia, ensuring region-specific solutions. Juno Markets Limited operates under a formal license and is regulated by the Vanuatu Financial Services Commission (VFSC) for its financial operations.

Since its founding, Juno Markets has built a strong reputation as an expert in commodities trading, CFDs, and forex. It delivers tailored services to its Asian clientele through platforms like Juno Auto Trader and MT4, supported by servers and providers based in the region. Its dual-regulated status, under the VFSC and ASIC, underscores its commitment to transparency and reliability in the global trading industry.

This review highlights the pros and cons of Juno Markets, including its low spreads, clear fees, and user-friendly trading platforms like MT4 and Juno Auto Trader. This will help traders decide if this broker is the perfect fit for their trading style.

What is Juno Markets?

Juno Markets, a forex and CFD broker, introduces trading opportunities in forex, stocks, indices, and spot CFDs for gold and silver. The company operates its headquarters in Wellington, New Zealand, and St. Vincent and the Grenadines, primarily targeting traders across Asia. Due to its availability of global financial markets for trading, the company has become increasingly popular within that region.

Among the competitive advantages of Juno Markets is its Asia-centric infrastructure, featuring local websites, trading servers, and liquidity providers. This ensures maximum connection speeds and efficient system operations. As a result, traders in the region can enjoy faster execution times, a more stable trading environment, and the ability to take advantage of generous leverage, with up to 200:1 for Juno Accounts and 400:1 for Juno Intro Accounts.

Despite this, Juno Markets continues to attract traders by offering personalized services tailored for the Asian market. It remains a convenient option for those seeking advanced trading tools and access to platforms that provide a localized and seamless trading experience.

Juno Markets Regulation and Safety

The Juno Markets Regulation and Safety is primarily governed by the Financial Service Commission of Vanuatu (VFSC). Everyone agreed that Vanuatu had unsecured regulations in the world until recently, but since 2017, its governance has been gradually moving toward more stricter financial control. In order to attract a wider number of clients, the VFSC has implemented more stringent licensing criteria, which has improved the nation’s financial system’s standing internationally. Due to their compliance with these more strict regulations, brokers like Juno Markets have created a more secure trading environment for its clients.

Under the VFSC’s licensing scheme, Juno Markets is anticipated to fulfill a number of important requirements. These include hiring a local director, maintaining a capital bond of 5,000,000 VT, and conducting yearly financial audits by an independent external auditor. It also includes a recently revised Know-Your-Customer (KYC) and Anti-Money Laundering (AML) policy that was implemented to truly get to know the clients well and prevent fraud. As a result, these rules guarantee Juno Markets‘ openness and dedication to customer safety.

Juno Markets Pros and Cons

Pros

- Asia Centric Infrastructure

- Competitive Leverage

- Wide Range of Instruments

- Low Spreads

Cons

- Not tier-1 regulated

- Not Available in all Countries

- Limited Language Options

- No MT5 Platform

Benefits of Trading with Juno Markets

The low minimum deposit of $25 from Juno Markets is the greatest advantage of trading with them because it allows customers to open accounts without much initial investment. As a fully regulated broker, Juno Markets provides a secure and credible trading environment where clients can trade confidently in international markets. And for further convenience of customers, Juno Markets also offers the flexibility of swap-free trading, an ideal option for traders who want to avoid overnight financing fees.

With spreads as low as 0.0 pips on popular products like forex, commodities, energy, and indices, Juno Markets provides competitive trading conditions. Being the biggest financial market in the world, forex appeals to both beginner and expert traders due to its extremely low spreads and quick execution. Additionally, the broker offers access to energy trading, including US Crude and UK Brent Oil, with no contract expirations, and precious metals, which are renowned for being safe havens during chaotic markets.

The opportunity of leveraging up to 1000:1 when trading with Juno Markets is another major benefit that enables traders to optimize their potential returns with lesser initial commitments. Additionally, the broker provides real-human support, guaranteeing that traders will always get effective help when they need it. Because Juno Markets offers a wide variety of securities and access to major stock exchanges worldwide, it is an excellent option for traders wishing to broaden their investments.

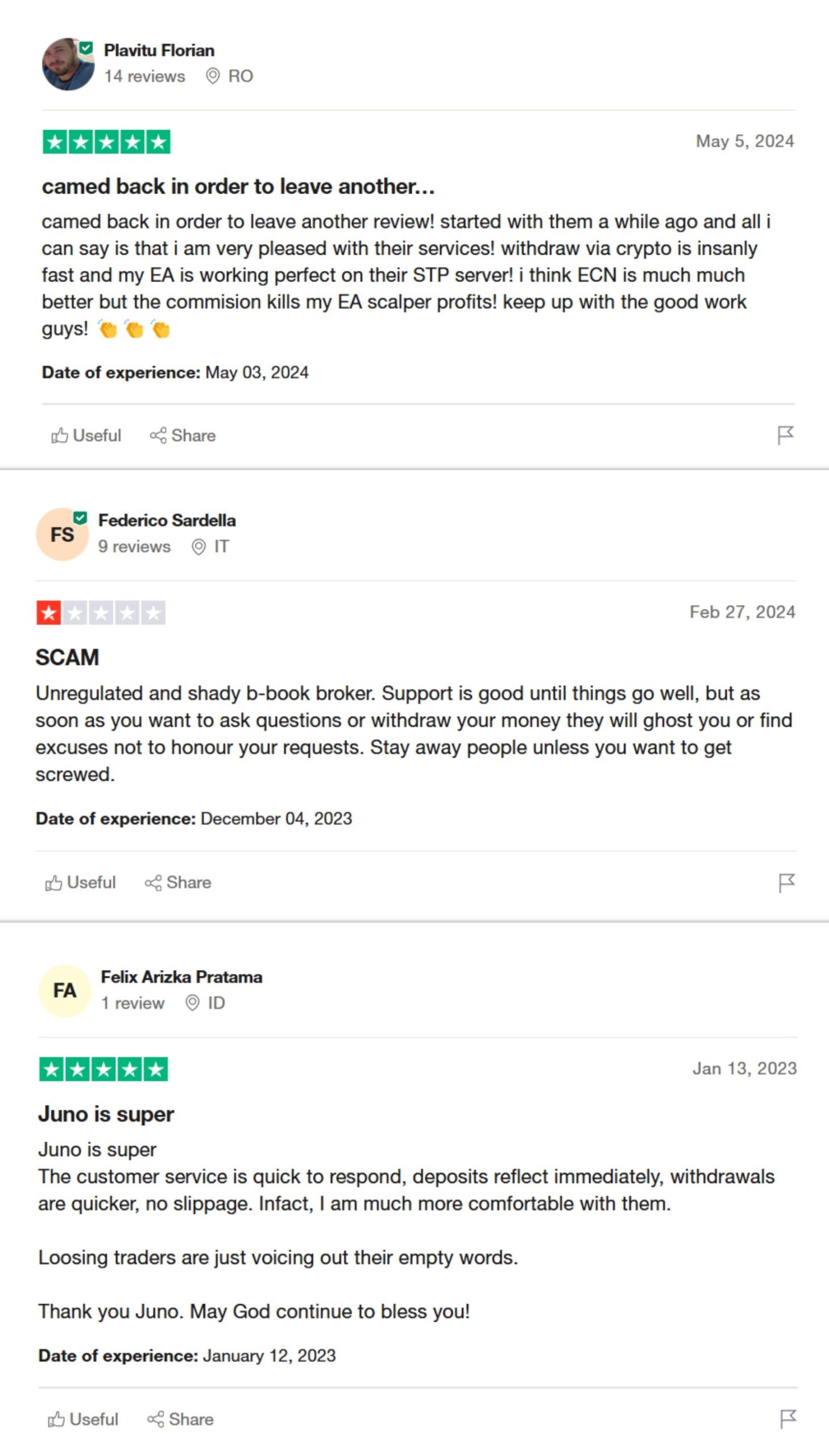

Juno Markets Customer Reviews

Juno Markets Spreads, Fees, and Commissions

Account Types

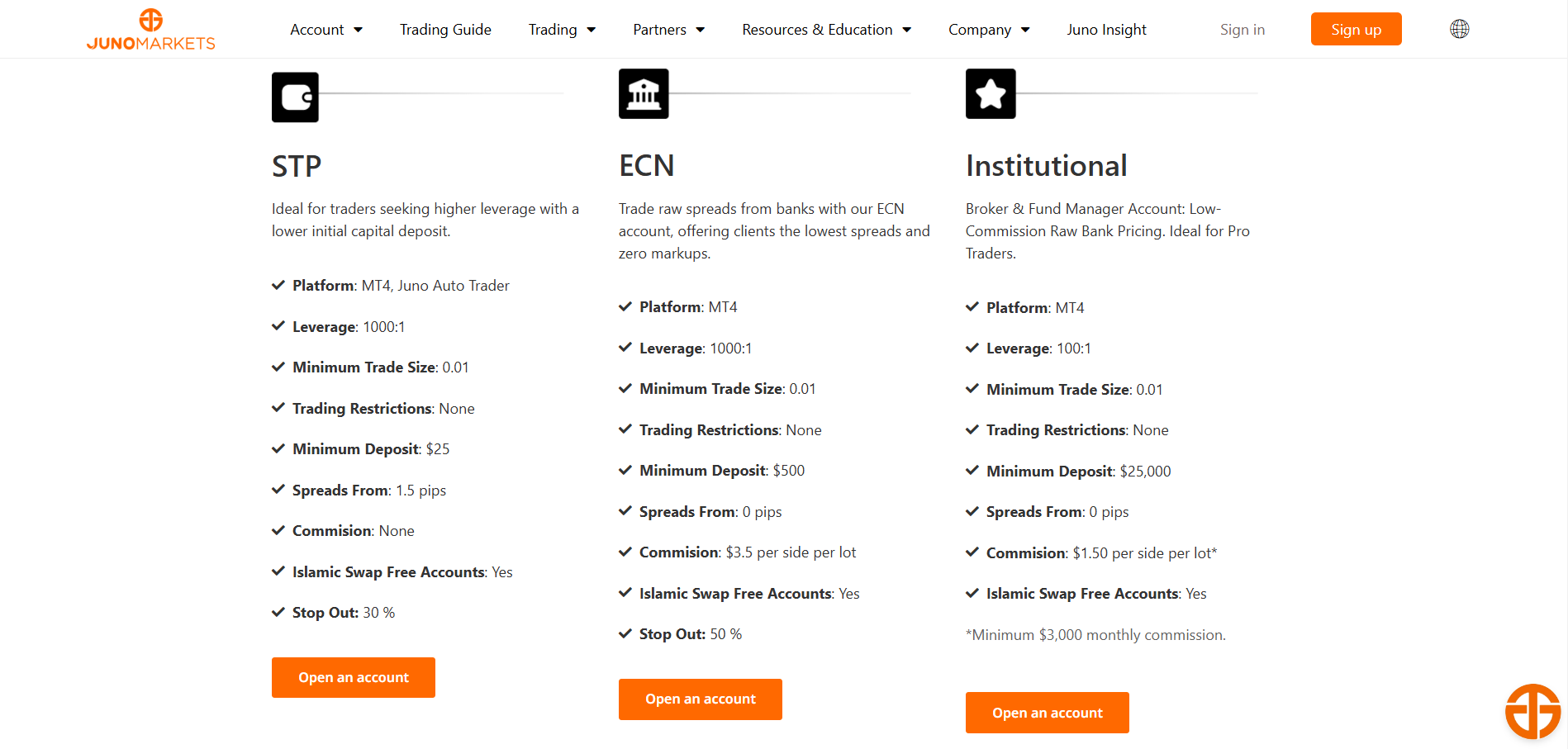

To meet the demands of various traders, Juno Markets offers a different account types . Juno Markets offers solutions that accommodate different trading preferences and techniques, regardless of your level of experience.

Standard Account

The Standard Account is suitable for beginners and casual traders, providing easy access to trading with straightforward conditions. It offers a simple way to engage in the markets, without complex fee structures, making it ideal for those starting their trading journey.

ECN Account

The ECN Account is designed for more experienced traders who require faster execution and tighter spreads. With access to improved market liquidity and more accurate pricing, this account is ideal for traders who utilize automated techniques or engage in high volume trading.

Institution

The Institutional Account provides access to deep liquidity and premium trading conditions for institutions and large traders. This account is designed to satisfy the needs of institutions and professional traders that want dependable and effective execution for trading in large quantities.

How to Open Your Account

Here’s a simple, step-by-step guide on how to open an account with Juno Markets:

Step 1: Visit Juno Markets Website

Open your web browser and go to the official Juno Markets website to get started. This is where you can create your account and access their trading platform.

Step 2:Click “Sign Up”

Find and click on the “Sign Up” button, typically located at the top right corner of the homepage. This will begin the registration process for your Juno Markets account.

Step 3:Select Country and Sign Up Method

Choose a country from the list of countries and decide whether to sign up with your email or mobile number. Both methods are quick and secure for account creation.

Step 4: Enter Your Details

Type in your email address or mobile number, and if you have a Partner Code, enter it in the provided field. This step helps personalize your account and may offer extra benefits.

Step 5: Verify and Complete Registration

After entering the OTP sent to your email or phone, click “Sign Up” to finalize your registration. This verifies your account and grants you access to Juno Markets’ services.

Juno Markets Trading Platforms

In addition, there are low non-trading fees at Juno Markets with quite reasonable trading fees, thereby translating into cost-effective trading for all users. This applies especially since there are no other fees tied to the deposit and withdrawal services. However, traders have to be aware of inactivity fees when an account has been inactive for a long time. Overall, this means that Juno Markets is direct on their fees, which makes it easier for traders to determine fees typically when considering their trading strategies.

What Can You Trade on Juno Markets

Forex trading on Juno Markets offers access to the world’s largest financial market with ultra-low spreads and high-speed execution. Whether you’re a beginner or an experienced trader, the Forex market provides ample opportunities for profit due to its liquidity and 24-hour availability.

Metals

Metals are a popular choice for traders looking for a safe haven during volatile markets. Precious metals like gold and silver are considered reliable investments, and Juno Markets provides competitive spreads to take advantage of these assets.

Energy

Energy trading on Juno Markets includes US Crude and UK Brent Oil, allowing traders to engage in spot trading without worrying about contract expirations. This flexibility offers great potential for profit, especially for those closely following global energy trends.

Indices

Indices provide exposure to major stock exchanges around the world, including the US, Europe, and Asia. With access to global indices, traders can diversify their portfolios and capitalize on movements in leading stock markets.

Juno Markets Customer Support

Juno Markets Customer Support is available to assist traders through multiple channels, including telephone support to their two main offices and email. While chat support is not offered, the team is responsive and committed to resolving any issues or questions promptly. The support team ensures that traders receive the help they need to continue trading smoothly.

For added convenience, Juno Markets customer support operates during 24/5 Asia trading hours, ensuring availability when traders need assistance. The website is available in multiple languages, including English, Indonesian, Korean, and Vietnamese, making it accessible to a diverse global clientele.

Advantages and Disadvantages of Juno Markets Customer Support

Withdrawal Options and Fees

Juno Markets provides multiple withdrawal options tailored to meet the needs of global traders, including bank transfers, cryptocurrencies, and e-wallets. Withdrawals are processed on the same business day they are received, with funds typically arriving in your account within 1-7 days, depending on the method used. While deposits are fee-free, wire transfers incur a $25 withdrawal fee, though accounts with balances over $25,000 qualify for one free withdrawal per month.

Flexible and Fast Withdrawal Methods

Clients in Southeast Asia can utilize instant bank transfers in currencies such as MYR, IDR, THB, VND, and PHP for rapid access to funds. International traders have the option of SWIFT bank wires for AUD transactions, a reliable method for withdrawing trading profits. Cryptocurrency withdrawals in BTC, ETH, USDt, and USDc provide a fast and cost-efficient alternative, while Skrill and Neteller e-wallets allow convenient wire transfers in USD, EUR, or AUD. Union Pay and Alipay are also supported for CNY transactions.

Transparent Fee Structure and Reliable Processing

Juno Markets is committed to ensuring smooth and timely withdrawals. Funds are processed quickly, typically within 24 hours on business days, with no hidden charges for deposits. However, wire transfers include a standard $25 fee per transaction. For accounts exceeding $25,000, traders can enjoy one free withdrawal each month, offering even greater value for high-balance clients.

Juno Markets Vs Other Brokers

#1. Juno Markets vs XM

Juno Markets and XM are popular brokers offering different features. Juno Markets focuses on Forex, CFDs, and commodities, with platforms like MT4 and its own Juno Auto Trader, targeting the Asian market. XM provides access to over 1,000 instruments, including Forex, stocks, and cryptocurrencies, with MT4, MT5, and a mobile app. Juno Markets requires a $25 minimum deposit and offers leverage up to 1:500, while XM’s minimum deposit is just $5, with leverage up to 1:1000 for non-EU countries. XM offers more funding options, including Apple Pay and Google Pay, while Juno Markets supports NETELLER and Alipay. Both brokers offer competitive spreads, with Juno Markets at 0.1 pips and XM at 0.2 pips.

Verdict:XM is the better choice for traders seeking higher leverage, more instruments, and flexible funding. With a lower deposit and wider global reach, XM offers a more versatile platform.

#2. Juno Markets vs RoboForex

Juno Markets and RoboForex offer competitive trading conditions but cater to different needs. Juno Markets specializes in Forex, CFDs, and commodities with platforms like MT4 and its Juno Auto Trader, while RoboForex provides access to over 12,000 instruments, including stocks, indices, and commodities, on platforms like MT4, MT5, and R StocksTrader. Juno Markets offers leverage up to 1:500, whereas RoboForex provides up to 1:2000, offering more flexibility. Both brokers have low minimum deposits ($25 for Juno Markets and $10 for RoboForex) and instant withdrawals, but RoboForex also features a unique CopyFx program for passive income, while Juno Markets offers cash-back incentives. With RoboForex’s broader global reach and competitive spreads, it is a more versatile option for traders.

Verdict: RoboForex stands out with higher leverage, a wider range of instruments, and global accessibility. Its CopyFx program, low minimum deposit, and instant withdrawals offer traders greater flexibility and growth opportunities.

#3. Juno Markets vs Exness

Juno Markets and Exness are both reputable brokers, but they cater to different types of traders. Juno Markets specializes in Forex, CFDs, and commodities, offering platforms like MT4 and its proprietary Juno Auto Trader, with leverage up to 1:500, while Exness offers a wider range of financial instruments, including cryptocurrencies and CFDs on stocks and commodities, with leverage up to 1:unlimited. Juno Markets requires a minimum deposit of $25, whereas Exness has a low deposit starting at just $10 for many account types. Exness also stands out with its multiple licenses and strong security features, such as 24/7 support and fast withdrawals.

Verdict: Exness is ideal for traders looking for higher leverage, more asset options, and top security. With low deposit requirements and diverse account options, Exness offers a versatile and secure trading experience.

Also Read: XM Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH JUNO MARKETS

Conclusion: Juno Markets Review

Juno Markets offers competitive trading conditions, specializing in Forex, CFDs, and commodities. With platforms like MT4 and its proprietary Juno Auto Trader, it provides traders with reliable tools for executing trades. The broker also offers leverage up to 1:500, giving traders the flexibility to take on higher-risk opportunities.

The broker is accessible to traders of all experience levels, with a low minimum deposit requirement of $25. Juno Markets supports a variety of payment methods, including NETELLER and Alipay, making it convenient for traders to fund and withdraw from their accounts. Additionally, cash-back incentives provide extra value for its users.

Juno Markets caters to traders seeking a straightforward and secure platform, primarily targeting the Asian market but offering global access. With its combination of user-friendly tools, competitive spreads, and flexible leverage options, Juno Markets is a solid choice for those focused on Forex and commodity trading.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Juno Markets Review: FAQs

What is the minimum deposit for Juno Markets?

The minimum deposit for Juno Markets is $25, making it accessible for new traders to get started.

What trading platforms does Juno Markets offer?

Juno Markets offers MT4 and its proprietary Juno Auto Trader platform for both desktop and mobile trading.

What leverage does Juno Markets provide?

Juno Markets offers leverage up to 1:500, allowing traders to maximize their positions with flexibility.

Does Juno Markets offer any bonuses or incentives?

Yes, Juno Markets provides cash-back incentives to traders, giving them extra value for their trading activity.

OPEN AN ACCOUNT NOW WITH JUNO MARKETS AND GET YOUR BONUS