Position in Rating | Overall Rating | Trading Terminals |

265th  | 2.0 Overall Rating |  |

JP Markets Review

JP Markets is a well-known broker in South Africa, offering a range of trading instruments including forex, commodities, and indices. The platform is user-friendly, catering to beginners and experienced traders alike. With competitive spreads and leverage options, JP Markets provides flexibility for various trading strategies.

The broker supports multiple account types, including ECN and Standard accounts, to suit different trading preferences. JP Markets also offers a reliable mobile app, allowing traders to monitor their accounts and execute trades on the go. Deposit and withdrawal processes are straightforward, with various payment methods available.

Customer support is a strong feature of JP Markets, offering assistance through email, phone, and live chat. Educational resources, including webinars and tutorials, are also available to help traders improve their skills. Overall, JP Markets provides a comprehensive trading experience for traders at all levels.

What is JP Markets?

JP Markets is a South African-based forex and CFD broker that offers a range of trading services to retail and professional traders. The platform provides access to forex, commodities, and indices, making it suitable for diverse trading needs. Known for its competitive spreads and flexible leverage options, JP Markets caters to traders with varying strategies and experience levels.

The broker is regulated and offers several account types, including ECN and Standard, to match different trading preferences. JP Markets supports trading through MetaTrader 4, a widely trusted platform, along with a mobile app for seamless trading on the go. The broker also provides various deposit and withdrawal options for convenience.

JP Markets Regulation and Safety

JP Markets SA operates as a South African-based broker, providing trading services under the oversight of local regulatory bodies in the financial markets. The company is registered with the Financial Sector Conduct Authority (FSCA), ensuring that it adheres to industry standards and practices. This regulatory compliance adds a layer of safety for traders, as it mandates transparency and fair dealing in operations.

To enhance client protection, JP Markets follows measures such as segregating client funds from company operational accounts. This ensures that trader deposits are secure even in unforeseen circumstances. The broker also employs robust encryption technology to protect user data and transactions on its platform.

JP Markets Pros and Cons

Pros

- Competitive spreads

- User-friendly platform

- Diverse account types

- 24/7 support

Cons

- Limited regulations

- Withdrawal delays

- High minimum deposit

- Regional restrictions

Benefits of Trading with JP Markets

Trading with JP Markets offers several benefits, making it a popular choice among forex and CFD traders. The broker provides access to various trading instruments, including forex, indices, and commodities, catering to diverse investment preferences. Competitive spreads and high leverage options enable traders to maximize their potential returns.

JP Markets offers user-friendly platforms, including MetaTrader 4 and a mobile app, ensuring a seamless trading experience. Multiple account types, such as Standard and ECN, allow traders to select options that align with their strategies and goals with minimum deposit. The broker also supports fast deposit and withdrawal processes, making fund management efficient.

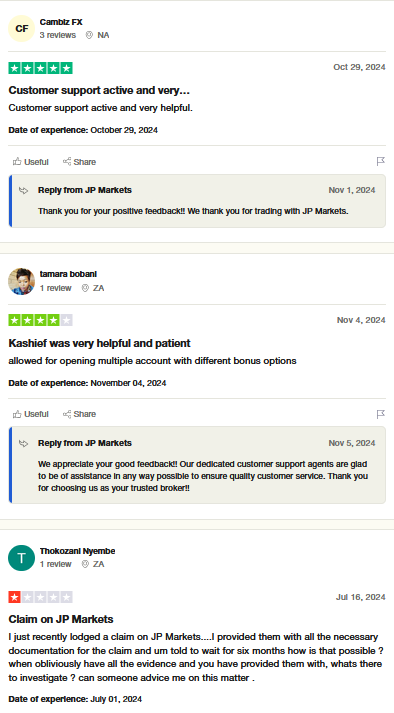

JP Markets Customer Reviews

Customer reviews for JP Markets highlight a mix of positive and critical feedback, reflecting varied experiences among traders. Many users appreciate the platform’s competitive spreads, wide range of trading instruments, and efficient mobile app, which make trading accessible and convenient. The availability of educational resources and responsive customer support also receives praise from beginners and seasoned traders alike.

However, some reviews point out occasional delays in withdrawal processing and limited advanced features compared to other brokers. While many traders find the services reliable, a few have raised concerns about account verification issues. Despite these challenges, this broker is still a preferred choice for many due to its user-friendly offerings and focus on customer support marking JP Markets safe.

JP Markets Spreads, Fees, and Commissions

JP Markets offers competitive spreads, fees, and commissions designed to suit various trading styles. The broker provides tight spreads on popular forex pairs, especially for ECN accounts, giving traders cost-effective entry points. Standard accounts also feature reasonable spreads, making them suitable for beginners and casual traders.

Fees at JP Markets are transparent, with no hidden charges for minimum deposits and withdrawals, although third-party payment processors may apply their own fees. The broker primarily earns through spreads, with no additional commissions on most account types. This structure benefits traders who prefer a straightforward cost model.

Account Types

A lot of JP Markets trading accounts are offered tailored to meet the needs of traders at different levels. These JP Markets accounts are designed to provide flexibility, competitive spreads, and access to diverse trading instruments.

Standard Micro

This account provides access to FX, Metals, Indices, and Commodities markets. With a minimum deposit of R100, users can leverage up to 500. The account currency is USD or ZAR, and order execution takes place at the market.

JPM Micro 300

This account offers similar market access as the Standard Micro but includes a 300% bonus on your deposit. The minimum deposit is R100, with leverage up to 500. Account currency options are USD or ZAR, with market order execution.

Premium

The Premium account encompasses FX, Metals, Indices, Commodities, and US and EU shares. It requires a minimum deposit of R100 and offers leverage up to 2000. Swaps are applicable, and the account currency is USD or ZAR, with market order execution.

VIP Account

Catering to advanced traders, the VIP Account provides access to FX, Metals, Indices, Commodities, and US and EU shares. A minimum deposit of R5000 is required, with leverage up to 500. The account features a minimum trade size of 0.01, a fixed commission of 3 USD, and uses USD or ZAR as the account currency.

Islamic Account

Designed for traders seeking swap-free options, the Islamic Account offers access to FX, Metals, Indices, and Commodities. The minimum deposit is R100, with leverage up to 500. Account currency options are USD or ZAR, with market order execution.

25% Draw Down Bonus (Rescue Bonus)

This account type provides a 25% Drawdown Bonus, allowing traders to benefit from additional margin. With a minimum deposit of R100, users can leverage up to 500. The account currency is USD or ZAR, and order execution occurs at the market.

Zero Stop Out

The Zero Stop Out account offers access to FX, Metals, Indices, and Commodities markets. A minimum deposit of R100 is required, with leverage up to 500. The account currency is USD or ZAR, and it features a minimum trade size of 0.01.

JPM Bonus 300

This account grants access to FX, Metals, Indices, and Commodities markets, with a 300% credit boost on every internal transfer. The minimum deposit is R100, with leverage up to 500. The account currency is USD or ZAR, ensuring a seamless trading experience.

Each account type is designed to accommodate different trading preferences and strategies, providing flexibility and tailored options for traders.

How to Open Your Account

Opening an account with JP Markets is a straightforward process designed to cater to both beginners and experienced traders. The platform provides a user-friendly registration experience, ensuring quick access to its trading features.

Step 1: Visit the Official Website

Navigate to the official JP Markets website. Look for the “Open an Account” or “Register” button on the homepage and click it to begin.

Step 2: Fill in Your Details

Complete the registration form by entering your personal details, including your full name, email address, and phone number. Ensure all information is accurate to avoid delays in verification.

Step 3: Verify Your Email

Check your email for a confirmation link from JP Markets. Click the link to verify your email address and activate your account.

Step 4: Upload Required Documents

Log in to your account and upload verification documents such as a valid ID and proof of address. This step complies with JP Markets‘ KYC requirements.

Step 5: Fund Your Account

Choose a preferred minimum deposit method and add funds to your trading retail account. JP Markets supports various secure payment options for your convenience.

Step 6: Start Trading

Once your account is funded and verified, you can begin trading. Access the trading platform and explore the available tools to enhance your trading experience in the financial markets generally.

JP Markets Trading Platforms

JP Markets provides access to popular trading platforms, ensuring a seamless and efficient trading experience. The broker primarily supports MetaTrader 4 (MT4), a widely trusted platform known for its user-friendly interface, advanced charting tools, and automated trading capabilities. MT4 is ideal for both beginners and experienced traders, offering flexibility in executing various strategies.

For traders on the move, JP Markets offers a mobile trading app that allows users to monitor the market, manage accounts, and execute trades in real-time. The app integrates key features of the desktop platform, ensuring no compromise in functionality. These platform options make JP Markets a versatile choice for traders seeking reliability and convenience.

What Can You Trade on JP Markets

JP Markets offers a diverse range of trading instruments suitable for various traders. The platform provides access to multiple markets, enabling users to explore opportunities in forex, commodities, indices, and cryptocurrencies.

Forex

Forex trading on JP Markets includes major, minor, and exotic currency pairs. Traders can capitalize on the dynamic forex market with competitive spreads and high liquidity.

Commodities

JP Markets allows trading in commodities like gold, silver, and crude oil. These assets provide diversification and are ideal for hedging against inflation.

Indices

Trading indices on JP Markets gives access to popular markets such as the S&P 500, NASDAQ, and FTSE 100. Indices represent the performance of a group of stocks, offering broad market exposure.

Cryptocurrencies

JP Markets supports cryptocurrency trading, including Bitcoin, Ethereum, and other digital assets. This market offers high volatility and potential for significant returns.

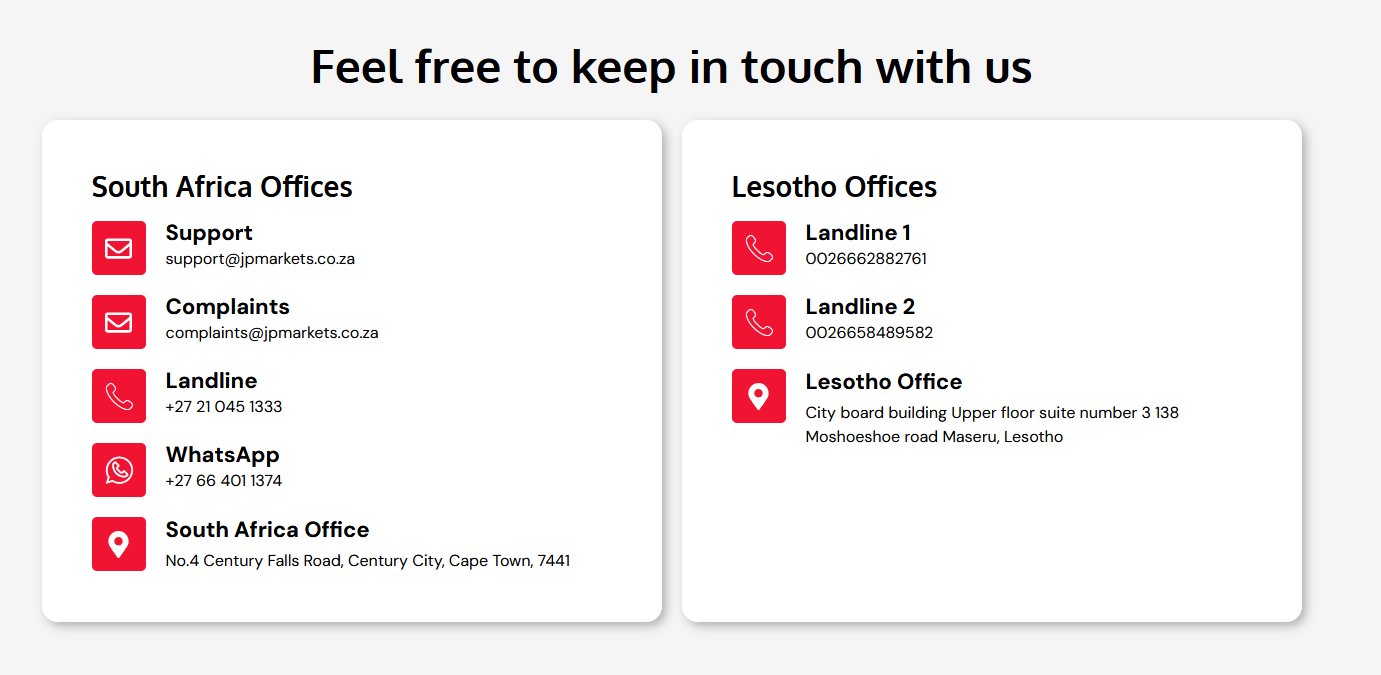

JP Markets Customer Support

JP Markets provides comprehensive customer support to ensure traders receive assistance when needed. The broker offers multiple communication channels, including live chat, email, and phone support, enabling quick resolution of inquiries. Their support team is available during standard business hours, providing timely and professional assistance.

In addition to direct support, JP Markets offers educational resources like webinars, tutorials, and trading guides to help clients improve their knowledge and skills. This combination of responsive customer service and accessible learning tools makes JP Markets a reliable choice for traders seeking guidance and support.

Advantages and Disadvantages of JP Markets Customer Support

Withdrawal Options and Fees

When trading with JP Markets, understanding withdrawal options and associated fees is essential for effective financial management. The broker offers a variety of withdrawal methods tailored to meet the needs of different traders, ensuring flexibility and convenience.

Bank Transfers

JP Markets supports withdrawals through bank transfers, allowing traders to transfer funds directly to their local bank accounts. This method is reliable, but it may involve processing times of up to 3-5 business days and fees depending on the bank used.

E-Wallets

E-wallets are a popular withdrawal option with JP Markets, providing faster transaction times compared to traditional bank transfers. Common e-wallets like Skrill or Neteller are supported, often with minimal or no additional fees.

Debit and Credit Cards

Withdrawals via debit or credit cards are another option for JP Markets clients. This method is convenient for traders who prefer to access their funds directly through their card, though it may involve small transaction fees or limits based on the card provider.

Cryptocurrencies

For traders seeking more innovative methods, JP Markets allows cryptocurrency withdrawals. These transactions are often completed quickly with lower fees, making them a preferred choice for tech-savvy traders.

JP Markets Vs Other Brokers

#1. JP Markets vs AvaTrade

JP Markets primarily targets African traders, offering ZAR-denominated accounts, a local focus, and a range of account types, including a beginner-friendly offering. It supports the widely used MetaTrader 4 platform, providing a user-friendly interface and robust trading tools. On the other hand, AvaTrade operates globally, boasting regulation in multiple jurisdictions and offering a diverse array of assets, including forex, stocks, and cryptocurrencies. AvaTrade provides proprietary platforms alongside MetaTrader, catering to both beginners and advanced traders, but its focus on advanced features can make it less tailored for regional needs compared to JP Markets.

Verdict: JP Markets is ideal for traders in South Africa seeking local currency support and tailored services, while AvaTrade suits those seeking broader market access and a global trading environment. The choice depends on the trader’s geographical focus and asset preferences.

#2. JP Markets vs RoboForex

JP Markets primarily caters to African traders, offering localized services such as ZAR accounts and convenient funding options, making it ideal for regional clients. It provides flexible leverage up to 1:500, alongside MetaTrader 4 for its trading platform. RoboForex, on the other hand, is a globally recognized broker with multiple account types and access to a broader range of instruments like CFDs, stocks, and cryptos. It supports advanced trading tools like R Trader and offers higher leverage options of up to 1:2000. While JP Markets emphasizes accessibility for its target market, RoboForex is more diversified and technologically advanced.

Verdict: RoboForex is better suited for traders seeking extensive market exposure and advanced tools. However, JP Markets excels for local African traders prioritizing ease of funding and ZAR-based accounts.

#3. JP Markets vs Exness

JP Markets is a South African broker offering a wide range of trading instruments, focusing on competitive spreads and a user-friendly platform. It emphasizes local customer support and a straightforward account setup. In contrast, Exness is a global broker known for its tight spreads, high leverage options, and reliability in trade execution. While JP Markets caters primarily to regional clients with ZAR accounts, Exness provides a more international approach with multi-currency accounts and a wider range of trading platforms, including MT4 and MT5. Exness also stands out with its instant withdrawals and robust regulation across multiple jurisdictions.

Verdict: Exness is a better choice for traders seeking global accessibility, advanced platforms, and tighter spreads. JP Markets, however, remains a strong option for local South African traders valuing regional support and simplicity.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH JP MARKETS

Conclusion: JP Markets Review

JP Markets stands out as a reliable broker for traders seeking a diverse range of instruments, user-friendly platforms, and competitive pricing according to this market analysis. With features like multiple account types, MetaTrader 4 integration, and responsive customer support, the broker caters to both beginners and experienced traders. Its focus on regulatory compliance and secure fund management further enhances its appeal.

While some areas, like withdrawal processing, have received mixed reviews, JP Markets remains a strong choice for those prioritizing affordability and convenience. The broker’s commitment to trader education and support solidifies its position as a reputable option in the forex and CFD trading market.

JP Markets Review: FAQs

What withdrawal methods does JP Markets offer?

JP Markets provides options such as bank transfers, e-wallets like Skrill, debit/credit cards, and cryptocurrency withdrawals for flexible fund management.

Are there any fees for withdrawals?

Yes, JP Markets may charge fees depending on the chosen withdrawal method. Fees vary by payment provider and transaction type.

How long do withdrawals take to process?

Processing times with JP Markets depend on the method, ranging from instant for e-wallets and cryptocurrencies to 3-5 business days for bank transfers.

OPEN AN ACCOUNT NOW WITH JP MARKETS AND GET YOUR BONUS