JFD Brokers Review

In Forex trading, choosing the right broker is paramount. Forex brokers serve as the gateway to the global currency markets, where trillions are traded daily. They offer platforms for trading, financial analysis, and access to international markets. However, the sheer number of brokers available can make selecting one a daunting task. It’s essential to pick a broker that aligns with your trading goals, offers robust security measures, and provides excellent customer support.

JFD Brokers stands out in the crowded marketplace. Operating under the brand name of JFD Group Ltd, it’s a broker regulated by top-tier authorities including the Cyprus Securities and Exchange Commission (CySEC), the National Securities Market Commission (CNMV), and the Vanuatu Financial Services Commission (VFSC). This ensures a high level of security and trustworthiness for traders. With the option to open both demo and live accounts and trade in major currencies like USD, EUR, GBP, and CHF, JFD Brokers offers flexibility and convenience for traders at any level.

Our upcoming review will dive deep into JFD Brokers’ offerings. We’ll cover everything from account options to deposit and withdrawal processes, commission structures, and more. Whether you’re new to Forex trading or a seasoned investor, our goal is to provide you with a comprehensive understanding of what makes JFD Brokers unique. By combining expert analysis with real trader feedback, we aim to present a balanced view that will help you decide if JFD Brokers is the right choice for your trading needs. Stay tuned for an insightful review that could guide your decision in selecting your preferred brokerage service provider.

What is JFD Brokers?

JFD Brokers operates as a prominent player in the online brokerage landscape. This brand, part of JFD Group Ltd, is regulated by well-known financial authorities such as the Cyprus Securities and Exchange Commission (CySEC), the National Securities Market Commission (CNMV), and the Vanuatu Financial Services Commission (VFSC). This regulatory framework ensures a secure trading environment for its clients. JFD Brokers is renowned for offering a wide range of trading instruments and account types, catering to various trader needs.

Traders have the flexibility to choose between demo and live accounts, trading in major currencies like USD, EUR, GBP, and CHF. This feature is particularly beneficial for both beginners looking to practice their strategies without financial risk, and experienced traders aiming to test the platform’s capabilities. The broker’s commitment to accessibility and user experience is evident in these offerings.

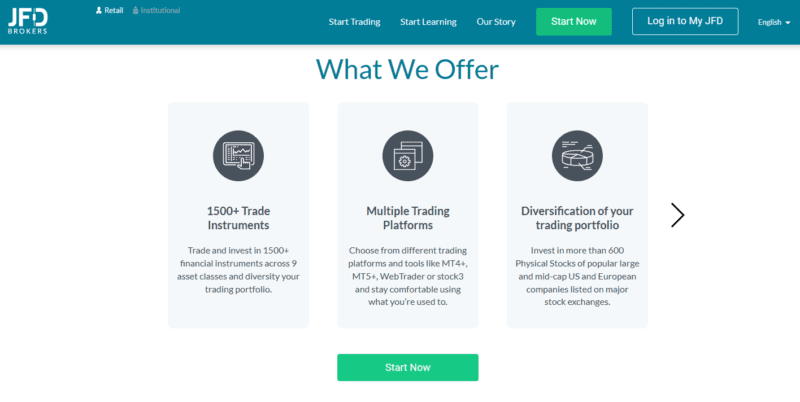

JFD Brokers distinguishes itself with an extensive selection of over 1,500 trading instruments. This includes a wide array of assets such as currency pairs, stocks, precious metals, ETFs, and CFDs on various classes including cryptocurrencies, stocks, indices, commodities, ETFs, and ETNs. The availability of a high leverage ratio up to 1:400 allows traders to maximize their trading potential, though it also comes with increased risk. This broad range of trading options positions JFD Brokers as a versatile choice for traders aiming to diversify their investment portfolio.

Benefits of Trading with JFD Brokers

Trading with JFD Brokers has offered me a wealth of benefits, stemming from their robust regulatory framework. The assurance that comes with their adherence to regulations by CySEC, CNMV, and VFSC has instilled confidence in my trading activities. This level of regulation ensures that my investments are handled with utmost security and transparency, a crucial aspect for any trader.

The diversity of over 1,500 trading instruments available through JFD Brokers has significantly broadened my trading horizons. Having access to a wide array of markets, including forex, stocks, precious metals, and CFDs on various assets, has allowed me to diversify my portfolio efficiently. This variety is a standout feature that appeals to traders looking to explore different financial markets under one roof.

Another notable benefit is the competitive spreads and a clear fee structure. Trading costs can significantly impact profitability, and JFD Brokers’ commitment to competitive pricing has enhanced my trading outcomes. The transparency regarding fees, especially with no hidden charges, has made financial planning and management much more straightforward.

Lastly, the multilingual support and multiple contact methods, including live chat and email, have been invaluable. Although support is not available during weekends, the prompt and helpful service during the weekdays compensates for this. Effective communication channels have ensured that any queries or issues I’ve encountered are resolved swiftly, allowing for a smoother trading experience.

JFD Brokers Regulation and Safety

JFD Brokers is acknowledged for its strict adherence to international regulatory standards, operating under the oversight of three of the largest regulatory bodies: the Cyprus Securities and Exchange Commission (CySEC), the National Securities Market Commission (CNMV), and the Vanuatu Financial Services Commission (VFSC). This tripartite regulation is a critical assurance for traders, indicating a high level of reliability and safety. Knowing the broker is regulated by reputable authorities ensures that it operates within strict guidelines designed to protect traders.

The validation of all licenses held by JFD Brokers confirms that it faithfully observes the stipulated operating conditions. This is pivotal for traders seeking a broker that is not only reliable but also maintains transparent working conditions. It underscores the broker’s commitment to upholding traders’ interests, including the timely payout of profits. This level of regulatory compliance and transparency is why understanding JFD Brokers’ regulatory and safety measures is essential.

Having traded with JFD Brokers, it’s evident that their regulatory standing is not just for show. The experience aligns with their claims of reliability and transparency, offering peace of mind to traders. This reassurance is invaluable, as it allows traders to focus on their trading strategies rather than worry about the safety of their funds.

JFD Brokers Pros and Cons

Pros

- Easy-to-use interface

- Competitive spreads with uniform account terms

- Wide selection of trading and mobile platforms

- Allows all trading strategies, including bots and scalping

- Zero stock purchase fees, access to over 600 assets

- Segregation of client funds and access to a compensation fund in emergencies

- Multiple channels for 24/5 technical support

Cons

- Fees not clear before trading begins

- No options for passive investments like copy trading

- Support not provided on weekends, only weekdays

JFD Brokers Customer Reviews

JFD Brokers consistently receives positive feedback for its customer support, praised for being prompt, helpful, and exceptionally fast. Clients highlight the simplicity of the registration process and the efficiency of support received through both chat and phone. The quick response time and the ability of the hotline to understand and resolve issues immediately stand out as key strengths. This level of service quality underscores JFD Brokers’ commitment to providing a supportive and efficient trading environment, making it a reliable choice for traders seeking responsive customer assistance.

JFD Brokers Spreads, Fees, and Commissions

When exploring the world of Forex trading, understanding how brokers like JFD Brokers manage spreads, fees, and commissions is essential for me. Like many brokers, JFD Brokers employs a fee policy that incorporates spreads and transaction fees. These costs can vary, often being floating rather than fixed, which means they adjust based on market conditions. From my experience, JFD Brokers tends to offer competitive rates, often lower than the market average, making trading more accessible.

A specific fee type that often comes into play is the withdrawal fee. JFD Brokers’ approach to this fee is nuanced, depending on several factors such as the asset being withdrawn and the chosen withdrawal method. For instance, withdrawing profits in USD via JFD Group Ltd within the European Economic Area incurs a fee of 0.15%, with a minimum of €2 and a maximum of €5. This is quite reasonable. However, for withdrawals outside the EU, there’s a fixed fee of €17, which is something to keep in mind. Additionally, bank transfer fees are applicable, further emphasizing the need for clear understanding of all possible charges.

Account Types

Navigating through the account options at JFD Brokers has been straightforward for me. Here’s a simplified rundown of the account types they offer, aiming for clarity and ease of understanding:

Demo Account

- No minimum deposit required: A great feature for those looking to get a feel of the platform without financial commitment.

- Uses real data from the interbank market, ensuring that your practice trading sessions are as realistic as possible.

- Virtual funds for trading: While you can’t earn real profits, this account type is invaluable for learning and strategy testing.

Standard Account

- Minimum deposit: $500, €500, £500, or ₣500. This is the starting point for trading with real money.

- Market access: Offers trading across 4 types of markets, including CFDs, providing a decent range of trading options.

- Multiple withdrawal channels: Flexibility in accessing your funds, a convenience that adds to the trading experience.

For anyone starting out or looking to switch to JFD Brokers, understanding these account types is crucial. Each offers a unique set of features designed to cater to different trader needs, from those just testing the waters with the Demo Account to more experienced traders ready to commit with a Standard Account.

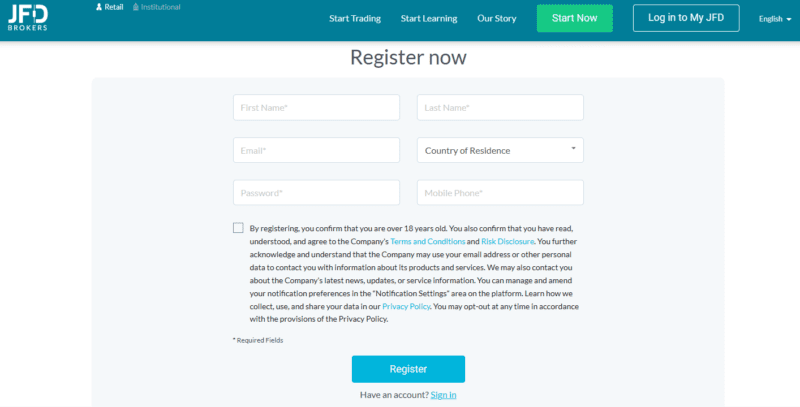

How to Open Your Account

- Visit the JFD Brokers website and choose your preferred language from the top right corner before hitting the “Start Now” button.

- Select your desired account type (personal, demo, or corporate) along with the trading platform, fill in personal details including name, nationality, and contact information, and complete the registration form with your residential and tax information followed by answering a series of simple questions.

- Provide details about your employment status and income, and select how you plan to deposit funds into your account.

- Choose your account currency, preferred trading instruments, and share your trading experience through a set of questions.

- Agree to the terms of service by ticking all necessary boxes to proceed to the final stage of registration.

- Check your email for a confirmation link, click it, and then access your account through the “Login to my JFD” button found in the follow-up email.

- Log into the JFD Brokers site with your email and password, accept the terms of cooperation, and update your password as prompted.

- In your account, upload a document to confirm your identity, enter your bank details for transactions, and select additional payment methods if necessary. The verification process by JFD Brokers’ team will take 1-3 days, after which you can set up your trading account and start trading.

JFD Brokers Trading Platforms

Based on my experience, JFD Brokers offers access to two of the most popular trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are widely recognized for their robust features, including advanced charting tools, automated trading capabilities, and a vast array of technical indicators. MT4 is particularly favored by forex traders for its user-friendly interface and reliability, making it ideal for both beginners and experienced traders.

MT5, on the other hand, builds upon the success of MT4 by offering additional functionalities. It supports more financial instruments, including stocks and commodities, and comes with an improved strategy tester for EAs (Expert Advisors) and higher processing speeds. My time using MT5 at JFD Brokers revealed it to be a powerful platform for traders looking for depth in analysis and flexibility in trading strategies. Both MT4 and MT5 support algorithmic trading, which is a boon for those looking to implement complex trading strategies with minimal effort.

What Can You Trade on JFD Brokers

From my experience, JFD Brokers provides a comprehensive selection of trading instruments, boasting over 1,500 options. This includes a wide array of currency pairs, allowing forex traders to capitalize on major, minor, and exotic market fluctuations. Additionally, traders can access a variety of stocks, which opens the door to some of the world’s largest companies. For those interested in more stable investments, precious metals and ETFs (Exchange-Traded Funds) offer a way to diversify portfolios.

Moreover, JFD Brokers excels in its range of CFDs (Contracts for Difference), covering cryptocurrencies, stocks, indices, commodities, ETFs, and ETNs (Exchange-Traded Notes). Trading CFDs on this platform has allowed me to speculate on the price movements of these assets without owning them directly. The inclusion of cryptocurrencies is particularly noteworthy, given their rising popularity and volatility, which can lead to significant trading opportunities. This extensive selection ensures that traders of all types, whether they’re interested in short-term speculation or long-term investment, can find opportunities that suit their strategies.

JFD Brokers Customer Support

In my journey with JFD Brokers, I’ve found their customer support to be exceptionally responsive and helpful, especially when navigating complex situations. They offer multiple communication channels, ensuring you can reach out in the way that’s most convenient for you. Whether it’s through their global or regional call centers, where you can speak directly to a support agent, or the more modern methods like email and live chat, available both on their website and within your user account, getting assistance is straightforward.

JFD Brokers also maintains a strong presence on social media platforms such as Facebook, Instagram, Twitter, YouTube, and LinkedIn. I’ve found following their official profiles to be incredibly beneficial. Not only do they share valuable analytics and updates, but they also post notifications about periods when technical support might be unavailable, such as holidays. This proactive approach to keeping their traders informed through various channels underscores their commitment to customer satisfaction and support.

Advantages and Disadvantages of JFD Brokers Customer Support

Withdrawal Options and Fees

Trading on a live account with JFD Brokers has proven to be a rewarding experience, as successful trading leads to real income. The income I’ve generated is securely stored within my user account, providing a sense of financial security and ease of access. It’s reassuring to know that the fruits of my trading efforts are just a few clicks away.

When it’s time to enjoy the results of successful trading, submitting a withdrawal request is a simple process, directly through the user account on JFD Brokers’ website. Although the requests are often processed on the same working day, there have been times when it took a bit longer. This slight variability in processing times is something to keep in mind, especially if immediate access to funds is crucial.

The transfer of funds is seamless, with the broker sending the money to my specified bank cards or e-wallets. It’s important to note that minimum limits and fees associated with withdrawals vary depending on the asset and the chosen withdrawal channel. These details are transparently presented in the “Withdrawal” section, and they’re also indicated at the time of submitting a withdrawal request, ensuring there are no surprises.

JFD Brokers Vs Other Brokers

#1. JFD Brokers vs AvaTrade

JFD Brokers and AvaTrade are distinguished brokers in the online Forex and CFD trading sphere. JFD Brokers excels with its broad regulatory oversight from CySEC, CNMV, and VFSC, offering over 1,500 trading instruments, and a focus on transparent trading conditions and competitive fees. AvaTrade, established in 2006, brings a wealth of experience, serving over 300,000 registered customers globally with access to more than 1,250 financial instruments. It stands out for its heavy regulation across multiple jurisdictions and its commitment to client education and support.

Verdict: For traders valuing regulatory oversight and a wide range of trading instruments, JFD Brokers may be the better choice due to its extensive product offerings and transparent conditions. However, for those prioritizing a long-established broker with a strong educational support system, AvaTrade emerges as a strong contender, especially for new traders.

#2. JFD Brokers vs RoboForex

JFD Brokers and RoboForex cater to a diverse trading community but have distinct offerings. RoboForex, operational since 2009 under FSC regulation, boasts a comprehensive suite of over 12,000 trading options across eight asset classes. Its strength lies in its varied trading platform selection, including MetaTrader, cTrader, and RTrader, tailored for different trading styles and volumes. JFD Brokers, on the other hand, emphasizes a regulated trading environment with a vast array of instruments and a commitment to transparency and competitive pricing.

Verdict: For traders looking for a vast selection of trading platforms and a wide range of assets, RoboForex is the superior option, thanks to its customized trading solutions and platform variety. If a regulated and transparent trading environment with a wide instrument selection is more critical, JFD Brokers is the preferable choice.

#3. JFD Brokers vs Exness

Comparing JFD Brokers with Exness highlights unique strengths in each. Exness, started in 2008, shines with a high monthly trading volume and offers CFDs on a variety of assets, including over 120 currency pairings and commodities, with the unique offering of unlimited leverage on small deposits. This feature makes Exness appealing for traders looking to maximize their trading volume with lower capital. JFD Brokers, with its robust regulatory framework and expansive trading instrument catalog, prioritizes a secure and transparent trading experience.

Verdict: For those prioritizing a high-leverage trading environment with a wide array of currency pairs and commodities, Exness stands out as the better option, particularly for traders keen on maximizing returns on smaller deposits. Conversely, JFD Brokers is the go-to for traders valuing a diversified instrument portfolio within a strictly regulated trading environment.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH JFD BROKERS

Conclusion: JFD Brokers Review

Concluding my review of JFD Brokers, it’s clear that this broker offers a highly regulated and transparent trading environment. With oversight from multiple top-tier regulatory bodies, traders can engage with a variety of over 1,500 instruments, including forex, stocks, and CFDs, in a secure setting. This vast selection, combined with competitive spreads and a commitment to no hidden fees, makes JFD Brokers an attractive option for traders at all levels.

However, it’s essential to note the limitations, such as the lack of weekend support and the potential for delays during peak times. While these drawbacks don’t overshadow the broker’s overall benefits, they are points to consider, especially for traders who might require constant access to support or faster transaction processing.

In sum, JFD Brokers stands out for its comprehensive offering and regulatory integrity, appealing to traders seeking diversity in trading options and security in their trading endeavors. While weighing its advantages, prospective traders should also be mindful of the aspects where the broker might not fully meet their needs. This balanced approach ensures that individuals can make informed decisions aligned with their trading strategies and expectations.

Also Read: NAGA Review 2024 – Expert Trader Insights

JFD Brokers Review: FAQs

Is JFD Brokers Regulated?

Yes, JFD Brokers is regulated by several respected bodies, including the Cyprus Securities and Exchange Commission (CySEC), the National Securities Market Commission (CNMV), and the Vanuatu Financial Services Commission (VFSC). This regulatory oversight ensures a secure and trustworthy trading environment.

What Types of Accounts Does JFD Brokers Offer?

JFD Brokers offers a variety of account types to suit different traders’ needs, including Demo Accounts for beginners or those looking to practice strategies without risk, and Standard Accounts for traders ready to trade with real money, requiring a minimum deposit of $500, €500, £500, or ₣500.

Can I Trade Cryptocurrencies with JFD Brokers?

Yes, among the over 1,500 trading instruments JFD Brokers offers, you can trade CFDs on cryptocurrencies, allowing you to speculate on the price movements of various digital currencies without owning the underlying assets.

OPEN AN ACCOUNT NOW WITH JFD BROKERS AND GET YOUR BONUS