IronFX Review

Forex brokers play a pivotal role in the world of online Forex trading. They act as intermediaries between retail traders and the global currency market. Choosing the right Forex broker is crucial for traders, as it affects trading efficiency, access to market insights, and overall trading success. In this context, IronFX stands out as a significant contender.

Founded by experts in finance and software development, IronFX has carved a niche in the global online trading platform industry. It’s renowned for its comprehensive range of trading services. We’ll delve into what makes IronFX a top choice for traders worldwide, focusing on its key strengths and features.

IronFX’s global reach is impressive, with services extended to clients in over 180 countries. Its adherence to regulations from multiple authorities underscores its commitment to serving a diverse and global clientele. This review will explore how IronFX’s international presence and regulatory compliance contribute to its standing in the Forex market.

In this review, we aim to provide a balanced and thorough evaluation of IronFX. You’ll gain insights into the broker’s account options, deposit and withdrawal processes, commission structures, and more. We blend expert analysis with real trader experiences, offering a comprehensive perspective. Whether you’re considering IronFX as your go-to brokerage or just exploring options, this review will equip you with vital information for an informed decision.

What is IronFX?

IronFX is an online Forex trading platform launched in January 2010. It was established by a group of finance and software development specialists. Over the years, IronFX has evolved into one of the industry’s leading providers of online trading services.

The broker offers advanced trading platforms, notably the MT4, which is widely recognized for its user-friendly interface and powerful features. Clients have access to over 300 trading instruments across six different asset classes, catering to a diverse range of trading preferences.

IronFX’s client base is extensive, covering both individual and corporate clients. The broker’s global footprint spans over 180 countries, demonstrating its widespread appeal and ability to cater to a variety of trading needs and profiles worldwide.

Benefits of Trading with IronFX

Trading with IronFX has its advantages that I’ve personally experienced. First and foremost, their competitive spreads on various financial instruments have helped me keep my trading costs in check. Additionally, the availability of multiple account types caters to traders with different preferences and experience levels, offering flexibility in my trading journey.

IronFX’s commitment to customer support is noteworthy, providing 24/5 assistance in multiple languages. This has been particularly helpful when I needed real-time support. Furthermore, their educational resources, including tutorials on trading platforms, have helped reduce the learning curve associated with trading, making it accessible for traders of all levels.

IronFX Regulation and Safety

As a trader who has experienced trading with IronFX, I’ve come to understand the importance of regulation and safety in the realm of online trading. IronFX, as an international broker, operates under multiple jurisdictions to support its diverse client base. This aspect is crucial for traders to consider, as it reflects the broker’s commitment to regulatory compliance and client security.

The companies operating under the IronFX brand are well-regulated by several authorities. Notesco Financial Services Limited, a key entity of IronFX, is regulated by the Cyprus Securities and Exchange Commission (CySEC). This regulation ensures adherence to stringent financial standards and offers traders a certain level of protection.

Additionally, Notesco (SA) Pty Ltd is regulated by the Financial Sector Conduct Authority (FSCA), and Notesco UK Limited is authorized by the Financial Conduct Authority (FCA). These regulatory bodies are renowned for their strict oversight. They ensure that the broker operates within legal boundaries and maintains a fair trading environment.

IronFX Pros and Cons

Pros

- Low minimumd deposit

- Regulated by several bodies including ASIC

- Has a good trading technology and ECN features

- Beginner-friendly broker

- Has a traders hub for educational resources

Cons

- High spread on trading stocks

- Possible repeated verification procedures

- Variable trading conditions by entity

- Fees on certain withdrawal methods

IronFX Customer Reviews

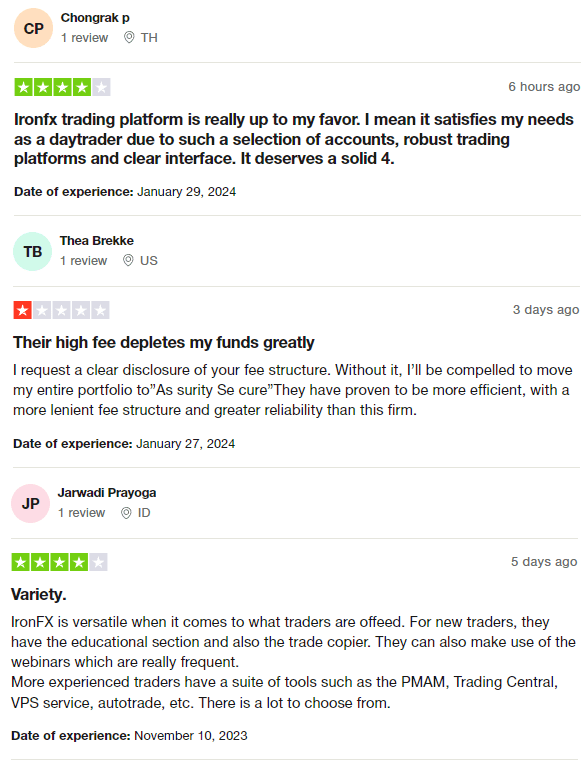

Customer reviews of IronFX reveal a mixed response towards the broker’s services. Several users appreciate its trading platform, citing its suitability for day traders due to a diverse selection of accounts, robust platforms, and a clear interface, often rating it highly. However, some express concerns over the lack of transparent fee structures, comparing unfavorably with competitors known for more lenient fees and reliability.

The versatility of IronFX is highlighted, with offerings tailored to both new and experienced traders. New traders benefit from educational resources, trade copiers, and frequent webinars. Meanwhile, experienced traders have access to a suite of tools including PAMM, Trading Central, VPS services, and autotrade, providing a comprehensive range of options for different trading needs.

IronFX Spreads, Fees, and Commissions

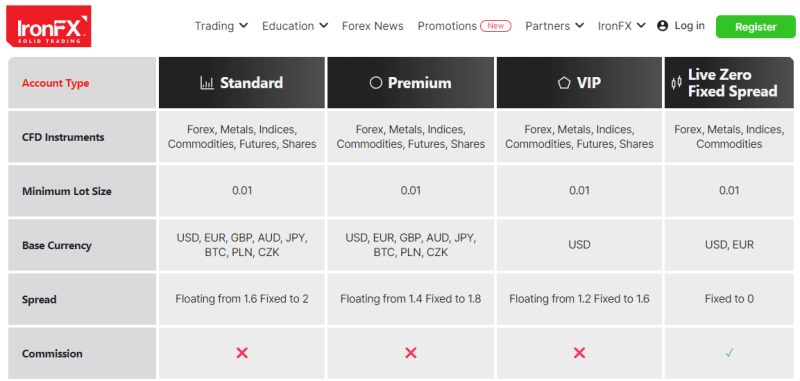

As a trader using IronFX, I’ve noticed their competitive spreads across various financial instruments. The spreads start as low as 1.6 pips, which I find quite cost-effective for trading. This aspect of IronFX has been beneficial in managing my trading expenses.

The broker’s commission structure is variable, depending on the account type and the trading instrument used. In my experience, some accounts offer commission-free trading, which is great for keeping costs low. However, other accounts come with associated commissions. It’s crucial to carefully review the different account types and trading conditions to understand the fees that may apply.

Leverage is another key feature at IronFX, going up to 1:1000. This allows traders like me to amplify our trading positions significantly. However, it’s important to remember that with high leverage comes increased risk. I always advise using leverage judiciously and considering risk management strategies to safeguard investments.

Account Types

Having tested the various account types offered by IronFX, I found a range of options suited for different trading styles and experience levels. Here’s an organized overview:

Standard Account

- Spread from 1.8 pips.

- Leverage up to 1:30.

- Micro-lot trading (0.01 volume).

- No commission.

Premium Account

- Tailored for novice traders with advanced trading conditions.

- Available in multiple currencies: USD, EUR, GBP, AUD, JPY, PLN, CZK.

- Spread starts from 1.6 pips.

VIP Account

- Exclusive to USD currency.

- Spread begins at 1.4 pips.

- Similar terms to Standard and Premium accounts.

Zero Fixed Account

- Aimed at more advanced users.

- Spread from 0 pips.

- Available only in USD.

- Leverage of 1:30.

- No commission.

No Commission Account

- Suitable for experienced traders.

- Available in various currencies: USD, EUR, GBP, AUD, JPY, CHF, PLN, CZK.

- Spread from 1.7 pips.

- Micro-lot trading allowed.

- No commission.

Zero Spread Account

- Professional account.

- Available in multiple currencies: USD, EUR, GBP, AUD, CHF, PLN, CZK, JPY.

- Spread starts from 0.01 pips.

- Commission charged per transaction.

Absolute Zero Account

- Designed for professional trading.

- Opens in USD, EUR, JPY.

- Spread from 0 pips.

- Leverage up to 1:30.

- Micro-lot trading.

- No commission.

Each account type caters to specific trading needs, from beginners to seasoned traders, offering flexibility and tailored trading conditions.

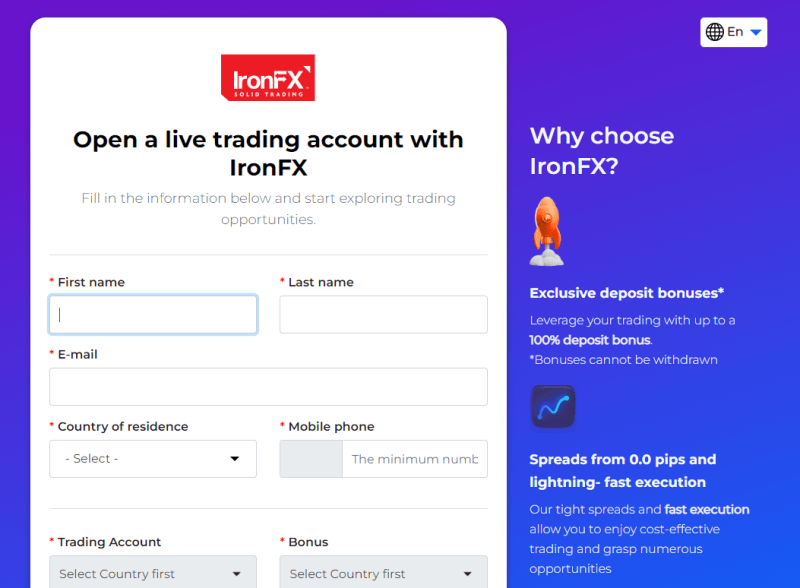

How to Open Your Account

- To open an account with IronFX, first visit their official website.

- Once there, click on “Register” or “Start Trading” found on the main page.

- Complete the registration form with your personal details, including your country of residence.

- Choose your preferred account type, leverage, and base currency.

- Remember to fill in all personal information in English only.

- Create a secure password for your personal account.

- Confirm your registration by clicking on the “Open your trading account” button.

- After your application is submitted, IronFX will confirm it and send your account login details to your email, granting you instant access to your personal account.

IronFX Trading Platforms

In my experience with IronFX, I’ve found that traders are given access to the MetaTrader 4 (MT4) trading platform. MT4 is widely recognized in the trading community for its reliability and range of features. It’s suitable for both beginners and experienced traders, offering advanced charting tools, automated trading capabilities, and a user-friendly interface. This single-platform approach by IronFX ensures that users have a streamlined and focused trading experience.

What Can You Trade on IronFX

Based on my experience with IronFX, traders have the opportunity to engage in a diverse range of trading instruments. These include Forex (foreign exchange), which is a core offering for currency trading. Additionally, Commodities, Indices, Stocks, Metals, and Futures (all offered as Contracts for Difference or CFDs) are available for traders to diversify their portfolios. This wide array of instruments caters to various trading strategies and preferences, allowing traders to explore multiple financial markets within a single platform.

IronFX Customer Support

In my experience with IronFX, I’ve observed their dedication to delivering extensive customer support. They offer 24/5 support, ensuring assistance is available to clients across 180 countries and in 30 different languages. This inclusivity allows for effective communication regardless of one’s background. IronFX provides email and live chat options for convenient and real-time assistance.

I’ve personally found IronFX’s live chat feature to be responsive during multiple contact attempts, highlighting their commitment to prompt customer service. Additionally, the company maintains active Twitter and Meta portals, serving as additional communication channels for updates and inquiries.

Recognizing the importance of comprehensive resources, IronFX offers a detailed FAQ section that addresses common queries, aiding users in finding answers independently. They also provide tutorials on trading platforms, helping clients navigate efficiently and reducing the learning curve associated with trading. This commitment to customer support enhances the overall trading experience for IronFX users.

Advantages and Disadvantages of IronFX Customer Support

Withdrawal Options and Fees

To withdraw funds from IronFX, simply submit an application in your personal account under “Operations” and “Withdrawal.” There’s no limit on withdrawal requests, and the broker doesn’t charge a commission, but keep in mind that payment systems may apply trading fees. You have various options for deposit and withdrawal, including credit/debit cards and electronic payment systems like Neteller, Skrill, and DotPay, with most methods crediting funds within 24 hours. However, bank transfers may take 5 to 7 business days for processing.

IronFX Vs Other Brokers

#1. IronFX vs AvaTrade

IronFX and AvaTrade are both established brokers in the online trading industry. IronFX offers a range of account types, competitive spreads, and a single trading platform, MetaTrader 4 (MT4). On the other hand, AvaTrade boasts a larger customer base, a wide array of financial instruments, and multiple trading platforms, including proprietary ones.

Verdict: If you prioritize simplicity and a focused approach, IronFX may be suitable. However, if you seek diversity in trading options and platforms, AvaTrade’s offering might be more appealing.

#2. IronFX vs RoboForex

IronFX and RoboForex cater to traders with distinct preferences. IronFX provides a straightforward experience with a single platform, MT4, and a choice of account types. RoboForex, on the other hand, offers a vast selection of trading options, various platforms, and personalized terms for traders of all levels.

Verdict: If you value simplicity and a basic approach, IronFX is an option. However, if you seek a more comprehensive and versatile trading environment, RoboForex’s diverse services and platforms could be a better fit.

#3. IronFX vs Exness

IronFX and Exness have their strengths. IronFX offers a simplified trading experience with a single platform, MT4, and various account types. Exness, on the other hand, stands out with a vast monthly trading volume, a wide range of financial instruments, and benefits like low commissions and infinite leverage.

Verdict: IronFX suits those seeking a straightforward approach, while Exness caters to traders looking for a high-volume, cost-efficient, and flexible trading environment.

Also Read: AvaTrade Review 2024- Expert Trader Insights

Conclusion: IronFX Review

In conclusion, IronFX has established itself as a reputable online trading platform with notable strengths. Its competitive spreads, comprehensive customer support, and diverse account options make it a viable choice for traders. Additionally, the availability of educational resources and a user-friendly interface adds to its appeal.

However, it’s important to consider the limitations as well. IronFX’s customer support, while extensive, is not available 24/7, which can be inconvenient for traders in different time zones. Additionally, the absence of a U.K. or international phone number might pose challenges for direct communication.

Also Read: NS Broker Review 2023 – Expert Trader Insights

IronFX Review: FAQs

Is IronFX available to traders in the United States?

No, IronFX does not accept traders from the United States.

What trading platform does IronFX offer?

IronFX provides access to the MetaTrader 4 (MT4) platform.

Does IronFX charge a commission for withdrawals?

IronFX does not charge a commission for withdrawals, but payment systems may apply trading fees.

OPEN AN ACCOUNT NOW WITH IRONFX AND GET YOUR BONUS