Investous Review

Investous is a regulated online broker offering a range of financial products, including Forex, commodities, indices, and CFDs on stocks. It is regulated by the Cyprus Securities and Exchange Commission (CySEC), ensuring that it meets industry standards for transparency and client protection.

Traders can access four different account types—Basic, Silver, Gold, and Platinum—each offering varying levels of benefits like reduced spreads, account managers, and educational resources. Minimum deposit requirements start at $250, making it accessible to new traders, while more native traders can benefit from advanced tools available on higher-tier accounts.

Investous provides both web-based and MetaTrader 4 platforms, allowing users to trade via desktop or mobile. The platform’s interface is user-friendly, which makes it a good option for beginners, but it also offers technical analysis tools for seasoned traders.

This review will give the readers and traders a technical and fundamental analysis on how Investous is an effective forex brokerage company in the trading central. International financial services commission is regulating Investous inside the trading central in terms of forex trading. This forex broker is giving trading accounts, trading tools, and a very user-friendly trading platform to assist the traders.

What is Investous?

Investous is an online trading platform owned and operated by IOS Investments Limited that allows users to trade a variety of financial assets, including Forex, commodities, stocks, and indices. It operates under CySEC regulation, providing traders with a secure environment to trade through CFDs (Contracts for Difference).

IOS Investments Limited designed for both new and honed traders, offering multiple account types based on the trader’s experience and investment level. The minimum deposit starts at $250, which makes it accessible to a broad audience.

Investous provides access to two trading platforms: a web-based platform and the widely-used MetaTrader 4. These platforms offer easy navigation for beginners and advanced tools for more traders, making it suitable for different skill levels.

Investous Regulation and Safety

Investous operates under the regulation of the Cyprus Securities and Exchange Commission (CySEC), a respected regulatory body in the financial industry. Being CySEC-regulated means that Investous follows strict guidelines to ensure transparency, fair trading practices, and client protection.

As part of its regulatory requirements, Investous keeps client funds in segregated accounts, ensuring that customer money is separate from the company’s operational funds. This adds an extra layer of safety, reducing the risk of clients losing their money due to company financial issues.

Investous also follows Anti-Money Laundering (AML) and Know Your Customer (KYC) policies, requiring traders to verify their identity before opening an account. These steps help to protect against fraudulent activities and ensure a safer trading environment.

Additionally, clients are covered by the Investor Compensation Fund (ICF), which offers compensation to eligible traders if the broker faces insolvency. This provides further security for traders, giving them peace of mind while using the platform.

Investous Pros and Cons

Pros

- Regulated platform

- Multiple account types

- Educational resources

- User-friendly interface

Cons

- Withdrawal delays

- Limited assets

- High spreads

- Basic customer support

Benefits of Trading with Investous

One of the key benefits of trading with Investous is its regulated status under CySEC, ensuring a secure and transparent trading environment. Traders can feel confident that their funds and personal information are protected by strict regulatory standards.

Investous offers a variety of account types to suit different levels of experience, from beginners to advanced traders. This flexibility allows traders to choose an account that fits their trading tools and style, with features like lower spreads and access to dedicated account managers on higher-tier accounts.

The platform provides educational resources such as webinars, tutorials, and market analysis to help traders improve their skills. This makes it an excellent choice for those looking to grow their knowledge while actively trading.

Investous Customer Reviews

Many users appreciate Investous for its user-friendly platform, especially beginners who find the interface easy to navigate. The availability of educational materials also gets positive feedback, helping traders improve their skills and knowledge.

However, some traders have reported delays in withdrawals, which can be frustrating when trying to access funds. While the broker offers multiple support options, including phone and live chat, a few customers feel that response times could be improved.

Most of the traders value the access to MetaTrader 4, praising its advanced tools and functionalities. On the downside, some users mention that the spreads are higher compared to other brokers, which may affect profitability, especially for frequent traders.

Investous Spreads, Fees, and Commissions

Investous operates with variable spreads, which means the cost of trading can fluctuate depending on market conditions. While the spreads are generally higher compared to some competitors, they can be reduced for higher-tier account holders, such as Gold or Platinum members.

The platform does not charge commissions on trades, but there are additional fees, such as inactivity fees after a certain period of account inactivity. Traders should also be aware of potential withdrawal fees, which vary depending on the method used and account type.

For traders focused on costs, the higher spreads may be a concern, especially for those placing frequent trades. It’s important to factor these into your overall trading strategy to manage expenses effectively.

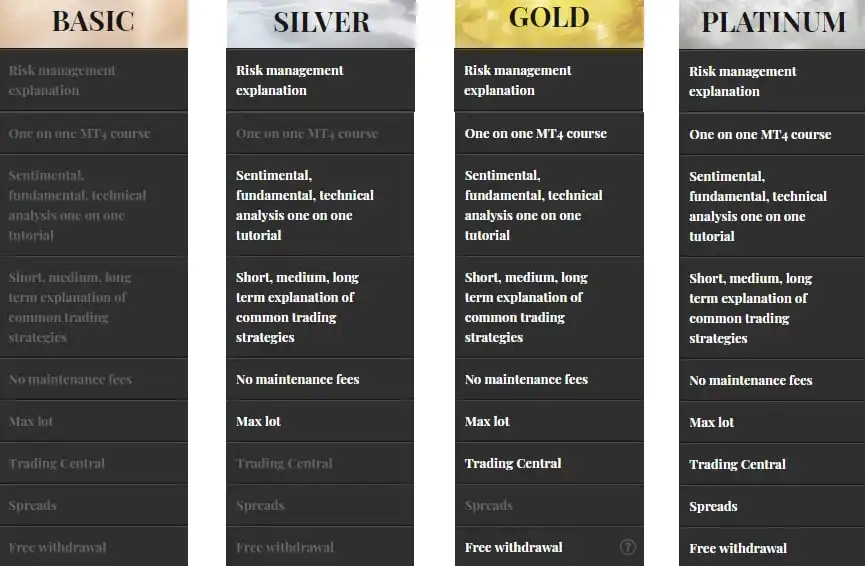

Account Types

Investous offers four distinct account types to cater to different levels of traders, from beginners to professionals. Each account comes with specific features designed to meet the needs of its users, ranging from basic educational tools to advanced trading support. Here’s a quick overview of the Basic, Silver, Gold, and Platinum accounts.

Demo account:

Investous provides a demo account for traders to practice and explore the platform using virtual funds, allowing them to experience real-time market conditions without any financial risk. This feature is helpful for new traders to build confidence and for most traders to test strategies. The demo account gives users access to both the web-based platform and MetaTrader 4, offering a risk-free environment to familiarize themselves with the tools and features before trading with real money.

Basic Account:

This requires a minimum deposit of $250 and is ideal for beginners. It offers standard spreads, access to the web-based platform, and basic educational resources.

Silver Account:

The Silver account includes everything from the other account but adds more educational resources and slightly better spreads. It’s designed for traders who want to enhance their skills while trading.

Gold Account:

The Gold accounts offers tighter spreads, a dedicated account manager, and priority customer support. It’s aimed at more experienced traders who require additional support and lower trading costs.

Platinum Account:

Platinum account holders benefit from the lowest spreads, a personal account manager, and advanced trading tools. This account is tailored for professional traders seeking the best conditions.

1. How to Open Your Account

Opening an account on Investous is a straightforward process designed to get you trading quickly. Whether you’re a beginner or an experienced trader, following a few simple steps will have you ready to trade in no time. Here’s a quick guide on how to open your account and start trading on Investous.

2. Visit the Investous Website

Head to the official Investous website and click on the “Register” button located at the top right corner of the homepage.

3. Fill in the Registration Form

Provide your basic information such as name, email, phone number, and preferred account password. Make sure all details are accurate to avoid any issues during verification.

4. Choose Your Account Type

After registration, select the type of account that best suits your trading experience and financial goals (Basic, Silver, Gold, or Platinum).

5. Verify Your Identity

Complete the KYC (Know Your Customer) process by submitting necessary documents, such as a government-issued ID and proof of address. This is required to ensure security and comply with regulations.

6. Deposit Funds

Once your account is verified, make your initial deposit. The minimum deposit starts at $250 for the Basic account. Choose from available payment methods like credit cards, wire transfer, or e-wallets.

7. Start Trading

After your deposit is processed, you can start exploring the trading platform and executing your first trades. Take advantage of any educational resources or account manager support if available.

Investous Trading Platforms

Investous offers two main trading platforms and trading services: a web-based platform and MetaTrader 4 (MT4). The web-based platform is designed for ease of use, making it ideal for beginners. It allows traders to execute trades directly from their browser without the need for downloading additional software.

For more experienced traders, MetaTrader 4 is a popular choice due to its advanced features like technical analysis tools, charting options, and automated trading capabilities. MT4 is available for both desktop and mobile devices, giving traders flexibility to manage their trades from anywhere.

Both platforms offer access to a wide range of assets, including Forex, commodities, indices, and CFDs on stocks. This ensures that traders of all levels can find the tools and features they need to succeed in their trading conditions, platform strategies and in the trading central.

What Can You Trade on Investous

Investous provides access to a wide variety of assets, including Forex (currency pairs), allowing traders to speculate on the price movements of major and minor currencies. This makes it appealing for those interested in the global currency market.

In addition to Forex, Investous offers commodities such as gold, oil, and silver, giving traders the opportunity to trade in physical assets without owning them. This can be a great way to diversify a portfolio.

You can also trade indices like the S&P 500 and CFDs on stocks, allowing you to invest in major global markets. With such a broad range of assets, Investous caters to different types of traders, whether you focus on currencies, commodities, or global indices.

Investous Customer Support

Investous provides customer support through multiple channels, including phone, email, and live chat. This ensures that traders can easily reach the support team whenever they encounter issues or have questions about the platform.

While support is generally responsive, some users have noted that response times could be improved, especially during busy trading periods. The availability of a dedicated account manager for higher-tier accounts, like Gold and Platinum, offers quicker and more personalized assistance.

Overall, Investous offers a decent range of support options, but traders should be aware that certain issues, like withdrawal delays, may take longer to resolve. Support service also offer assistant on how to use their accumulated trading platform.

Advantages and Disadvantages of Investous Customer Support

Withdrawal Options and Fees

Investous provides several withdrawal options to ensure flexibility and convenience for traders to withdraw funds whatever their currency pairs are. Whether you prefer using credit cards, wire transfers, or e-wallets, each method has its own processing time and fees. Here’s a breakdown of the available options and what you need to know before making a withdrawal.

Credit Cards

Withdrawals to credit cards are typically processed within a few business days. This option is convenient for traders who used a credit card for their initial deposit, as funds are returned to the same card.

Wire Transfers

Wire transfers are available for larger withdrawals but may take longer, often 3-5 business days to process. This method is best suited for traders who prefer direct bank transfers but should be aware of potential bank fees.

E-wallets

E-wallet options, such as Skrill or Neteller, offer faster withdrawal times compared to wire transfers, often within 1-2 business days. This is a good option for traders looking for quick access to their funds with minimal fees.

Minimum Withdrawal Amounts

Each withdrawal method may come with a minimum withdrawal requirement, which varies depending on the chosen method. It’s important to check these limits to ensure the withdrawal request is processed smoothly.

Investous Vs Other Brokers

#1. Investous vs AvaTrade

Investous and AvaTrade both offer a wide range of assets like Forex, commodities, and stocks, but AvaTrade has a more diverse asset offering, including cryptocurrency trading, which Investous lacks. AvaTrade also supports more advanced trading platforms, such as MetaTrader 5 and its proprietary AvaTradeGO app, whereas Investous only offers MetaTrader 4 and a web-based platform. When it comes to spreads and fees, AvaTrade tends to be more cost-effective with lower spreads and no commission fees on trades, while Investous has higher spreads, especially on its basic accounts. Both brokers provide strong educational resources, but AvaTrade has a more established global presence with multiple regulatory licenses, including ASIC and FSCA, giving it broader credibility. Customer support on both platforms is comparable, but AvaTrade edges out slightly with faster response times and 24/7 support.

Verdict: AvaTrade is ideal for traders seeking diverse assets and advanced platforms like MetaTrader 5 and cryptocurrency. Investous, with its user-friendly setup, suits beginners or those preferring a simpler trading experience.

#2. Investous vs RoboForex

Investous and RoboForex differ significantly in their offerings. RoboForex stands out with its wider range of account types, including cent, ECN, and copy trading options, while Investous sticks to a simpler structure with four standard accounts. RoboForex also provides more diverse trading platforms like MetaTrader 5 and its proprietary R Trader, compared to Investous, which only offers MetaTrader 4 and a web-based platform. When it comes to costs, RoboForex typically offers lower spreads and commission-based trading, making it more appealing for experienced traders who prioritize lower fees. On the other hand, Investous caters more to beginners, but its higher spreads and limited asset variety may deter cost-conscious traders. Additionally, RoboForex allows cryptocurrency trading, which is not available on Investous, giving it a more versatile asset offering.

Verdict: RoboForex offers more flexibility in account types and access to cryptocurrency, appealing to traders looking for advanced options and lower costs. Investous provides a simpler, beginner-friendly platform, making it a good choice for new traders seeking an easier entry into the market.

#3. Investous vs Exness

Investous and Exness differ significantly in both trading conditions and features. Exness offers a clear advantage with no minimum deposit and instant withdrawals, making it more accessible and convenient for both beginner and active traders. In contrast, Investous requires a $250 minimum deposit and has reported withdrawal delays. Exness also provides access to MetaTrader 5, alongside MetaTrader 4, giving traders more options, while Investous limits users to MetaTrader 4 and a web-based platform. Exness features lower spreads and a broader range of assets, including cryptocurrency trading, which Investous does not offer. Both brokers are regulated, but Exness provides 24/7 customer support, a step above Investous’ more limited support hours.

Verdict: Exness stands out with no minimum deposit, instant withdrawals, and a broad range of assets, including cryptocurrency, offering more flexibility for active traders. Investous, with its straightforward platform, may be more suitable for beginners looking for a simpler trading experience.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH INVESTOUS

Conclusion: Investous Review

Investous is a solid option for traders looking for a regulated broker with access to a variety of financial markets, including forex, commodities, stocks, and indices. The platform is user-friendly, making it a good choice for beginners, while advanced traders can benefit from tools available on MetaTrader 4.

However, the broker’s higher spreads and occasional withdrawal delays may be a drawback for more cost-conscious or experienced traders. While it provides reliable customer support, the response times could improve, especially during peak trading periods.

Overall, Investous offers a safe and straightforward trading environment, but it may not be the best fit for those looking for lower trading costs or a wider range of assets like cryptocurrencies. Using this fundamental analysis, the traders can identify is they are fit in Investous trading central community.

Investous Review: FAQs

Is Investous a regulated broker?

Yes, Investous is regulated by the Cyprus Securities and Exchange Commission (CySEC), ensuring a secure and transparent trading environment.

What is the minimum deposit required to open an account?

The minimum deposit for a Basic account is $250, making it accessible for new traders.

What trading platforms does Investous offer?

Investous provides access to a web-based platform and MetaTrader 4 (MT4), suitable for both beginner and advanced traders.

OPEN AN ACCOUNT NOW WITH INVESTOUS AND GET YOUR BONUS