- What is Inverted Cup and Handle?

- Inverted Cup Chart Pattern

- Limitations of the Handle Pattern

- Identifying the Inverted Cup and Handle pattern

- What does the Handle Chart Pattern Mean?

- How to Trade

- Price Action

- The Risk in the Chart Pattern

- Chart Pattern Inverted Cup

- Conclusion

- FAQ

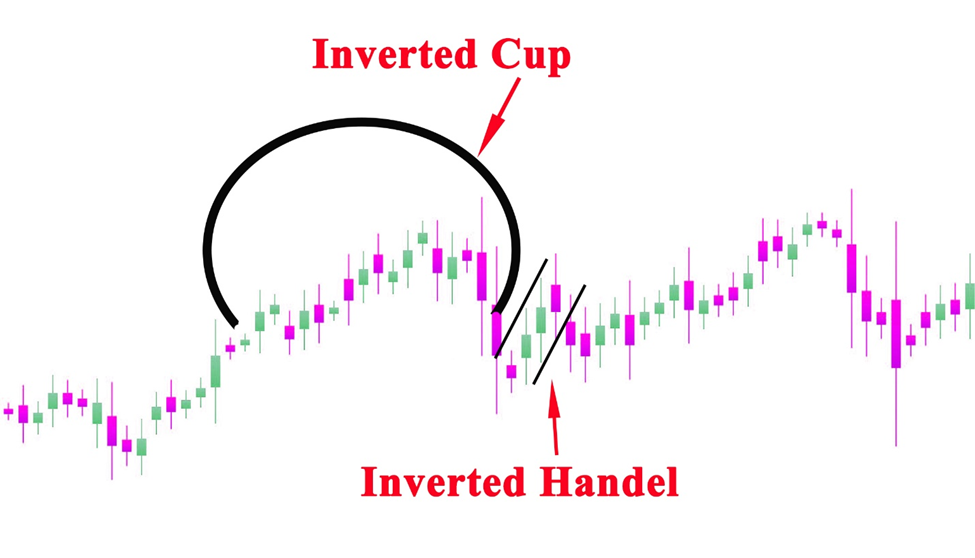

What is Inverted Cup and Handle?

Investors find success by predicting price pattern movements using technical analysis. Several methods are used to accomplish this. They want to capitalize on their initial investment. That is why they look into a prior trend and price target. Most of the data is derived by analyzing chart patterns. The Inverted Cup and Handle pattern is an indicator of an end of a bullish trend. Brokers use it to locate purchasing opportunities.

The name is derived from the form the trend has on the charts. It looks like a crescent that has an upward change in direction. The pattern develops in a time frame of seven weeks, months to half a year. The trend is a signal of a reversal and bearish continuation.

Inverted Cup Chart Pattern

Brokers using the Inverted Cup and Handle method can have success only if it happens after an uptrend was in place. The pattern has two components. The unsuccessful rally in the inverted handle, and rolling over price action in the cup segment.

When the stock eventually loses buyers at high prices. Then sellers come on the stage by bidding the stock down. Then you have the formation of the inverted cup top.

When fully form this pattern of an upside-down cup is a signal of a downtrend. When the stock fell out of the bottom of the inverted cup, short-term investors purchase it. When the potential investors declined to buy the highs of the resistance levels at the top of the inverted cup, then the top is formed.

Also Read: Inspire Brand Stocks

Limitations of the Handle Pattern

As previously mentioned, the pattern does not happen within a given timeframe. It can form within a few days, or up to a year. This is a big minus for this method of identifying trends. False signals are a reality and you need to be proficient in identifying the trends. You need to locate the depth and length of the cup and handle. The biggest restriction of the cup and handle is illiquidity.

Identifying the Inverted Cup and Handle pattern

To recognize the cup and handle pattern, you need to keep track of price movements on a chart. When you notice that in a short time frame there is a drastic downward price movement. It is usually ensuing a period the price stability. It is followed by a rally that is the same as the original decline. The “U” shape that you can see in the chart is the cup pattern.

When the price comes to the top, it moves sideways and creates the handle. But when the handle goes below the cup, the pattern is ended.

Also Read: ABCD Pattern Trading

What does the Handle Chart Pattern Mean?

When the cup lip hits the support levels and has a minor correction that forms the handle. Once the handle forms and the pattern doesn’t break down, the stock will fall further. The handle formation forms both support and resistance. Try to see candlesticks forming the handle. After you get are confirmation of the direction that the handle breaks. There are situations when the stock reverses to test the new resistance level. You want to get a good entry if you use day trading strategies that work.

How to Trade

The Cup and Handle are frequently used in Forex trading . The indicators are reliable indicators when you should enter a profitable trade. If you are trading Forex, you need to define few parameters before opening an order. Things like an entry point, take-profit, and stop-loss.

- Entry Point – You need to enter when the chats show a candlestick that breaks out on the right top of the cup.

- Take-Profit – When the price reaches an increase equal to the height of the cup.

Stop-Loss – The rounding bottom of the pattern’s handle

Price Action

When bulls enter a market, they steadily pressure to oust the bears. These forces the bears at the same time to change direction and pull the rates down. The same process is repeated over a short period. Until the bears go over the cup and handle, which was made by the bulls. This is a bullish continuation pattern.

Price action encounters resistance in a downtrend. It changes direction and slowly moves upwards until it locates support at the previous high point in the pattern. After this point, the price action again changes its movement course and goes downwards. This movement is continuing until it comes to the second resistance and with that, and a cup forms.

At this resistance point, the direction of the price action reverses moves up looking for the second support. This is usually under the first support. The final pattern is made when price action changes its course of movement from the second support and moves down until it breaks the cup pattern and handles line.

The Risk in the Chart Pattern

You need to remember that both stop loss levels are absolute. You need to look for potential reversal and bullish continuation. When using the surface’s breakout rate as stop loss, the ratio of risk to reward will be influenced by the distance between the breakout rate-entry rate concerning the cup’s height.

Using the handle’s high as to stop loss, the ratio of risk versus reward improves when the handle’s height is relatively short compared to the cup’s height. The stop loss rate for your trade needs to be above the levels so the trader can have space to maneuver and preparing his position size needs to be done with those rates in mind.

Chart Pattern Inverted Cup

Patterns function as a map for investor’s business daily activates. It enables them to understand the behavior of stock and price formation. You need to keep in mind that all patterns break down. Technical analysis helps to identify patterns. The Inverted Cup and Handel pattern can be used as a warning of potential problems or as a signal that profits, can be made at this moment.

It shows when a stock begins to rise and when the stock breaks its uptrend. You need to look at the chart and interpret the cup part and cup bottom when opening a short position. No matter if you are trading foreign currency or stock, weekly charts about bull markets give you inside into trading range and risk capital. Other patterns are useful and should be used by money managers.

Conclusion

New buyers need to identify buying opportunities so they can accomplish future results. But past performance is not necessarily indicative of future results.

The chart pattern Inverted Cup and Handle is a bearish trend. Traders can use the handle patterns to create buying opportunities. But they need to be careful, price breaks and every chart indicator can produce a false signal. If used properly then the reversal pattern can give brokers, inside into trading volume and selling pressure. It can open a door for profits.

FAQ

What does an inverted cup and handle mean?

The name comes from the “U” shape the pattern forms on charts. The Inverted Cup and Handle is a chart pattern used by traders, to predict market movements. The pattern is a bearish indicator. It activates a sell signal.

Is inverted cup and handle bullish?

The Inverted Cup and Handle patterns are bearish. Or in other words the opposite of the cup and handle. But the shape is followed by the Bullish trend.

How do you trade an inverted cup and handle pattern?

You start a short position after seeing a drop in trading volume over several days. drop for a few days.

Is cup and handle bullish?

Yes, cup and handle are a bullish signal of a continuous uptrend. Traders use it to locate possibilities to go long. Investors use the signal to place a stop buy order over the upper trendline of the handle part of the pattern.