InterTrader Review

InterTrader, a Straight Through Processing (STP) and Electronic Communication Network (ECN) broker has been operating since 2009, offering trading services in Forex and Contracts for Difference (CFD) instruments. This broker falls under the umbrella of the large holding company, Entain Plc, a notable player in the sports betting sector with a global presence on five continents. InterTrader is supervised by the Gibraltar Financial Services Commission (GFSC) and registered with the UK Financial Conduct Authority (FCA), a testament to its legitimacy. By leveraging cutting-edge technology, InterTrader provides traders with direct access to financial markets worldwide.

In this detailed review, we will examine all the key aspects of InterTrader, looking at everything from the range of trading assets available to the quality of customer support. The aim is to provide you with a comprehensive and unbiased view of what you can expect when trading with InterTrader.

What is InterTrader?

InterTrader is a brokerage service that offers its clients the ability to engage in spread betting and Contracts for Difference (CFDs) across a wide variety of financial instruments. These include but are not limited to shares, stock indices, Forex, commodities, and more. Since its founding in 2009, the firm has made a name for itself by offering flexible and transparent trading services.

One of the key differentiators of InterTrader is its commitment to a market-neutral trading model. Essentially, this means that for every position a client takes on the InterTrader platform, an identical position is taken in the underlying market. This mechanism helps ensure there is no conflict of interest between the broker and the trader. In practical terms, it means that the broker doesn't profit from a client's losses or lose from a client's profits.

InterTrader's business model ensures that it can cover its risks while offering traders the opportunity to profit from market movements. By mirroring each client's position in the underlying market, the firm is able to provide a trading environment where the potential profits are not limited by the broker's risk tolerance.

This innovative approach, combined with its wide range of financial instruments and user-friendly trading platform, has helped InterTrader build a reputation as a trusted and reliable broker.

Advantages and Disadvantages of Trading with InterTrader?

Benefits of Trading with InterTrader

InterTrader provides access to a vast array of assets; irrespective of the account type, clients can trade currency pairs, indices, commodities, energies, and metals. Another unique advantage is the availability of Percentage Allocation Money Management (PAMM) and Multi-Account Manager (MAM) trust accounts.

Opening an account with InterTrader is a straightforward online process that doesn't require any physical visits to brokerage offices. They offer competitive trading fees with spreads starting from just 0.3 pips and a commission of 3 units of the main currency per lot on ECN accounts for Forex instruments.

In terms of trading tools, InterTrader provides a wide variety, including advanced trading charts from IT-Finance, Autochartist, and an economic calendar from Econoday, along with multiple news feeds, all free of charge. Notably, the broker operates a No Dealing Desk system, which means the execution of orders depends solely on market liquidity and is not influenced by a dealing center.

Deposits and withdrawals can be conveniently made through various channels, including bank cards, Skrill, e-wallets, and bank transfers.

InterTrader Pros and Cons

Pros:

- Regulated broker with the backing of a larger conglomerate, Entain Plc.

- Retail customers are protected by the Gibraltar Investor Compensation Scheme (GICS) up to €20,000/$22,000.

- Overseen by the UK's Financial Conduct Authority (FCA), enhancing its accountability and trustworthiness.

- Offers competitive trading costs, with spreads starting from as low as 0.3 pips and low commissions on ECN accounts.

- Uses the advanced MT5 trading platform, popular for its robust features and user-friendly interface.

- Support team is responsive, knowledgeable, and dedicated to assisting clients.

Cons:

- Terms and conditions can vary depending on the regulatory jurisdiction, which can cause confusion.

- Customer support is not available 24/7, potentially problematic for traders in different time zones or those trading at non-standard hours.

InterTrader Customer Reviews

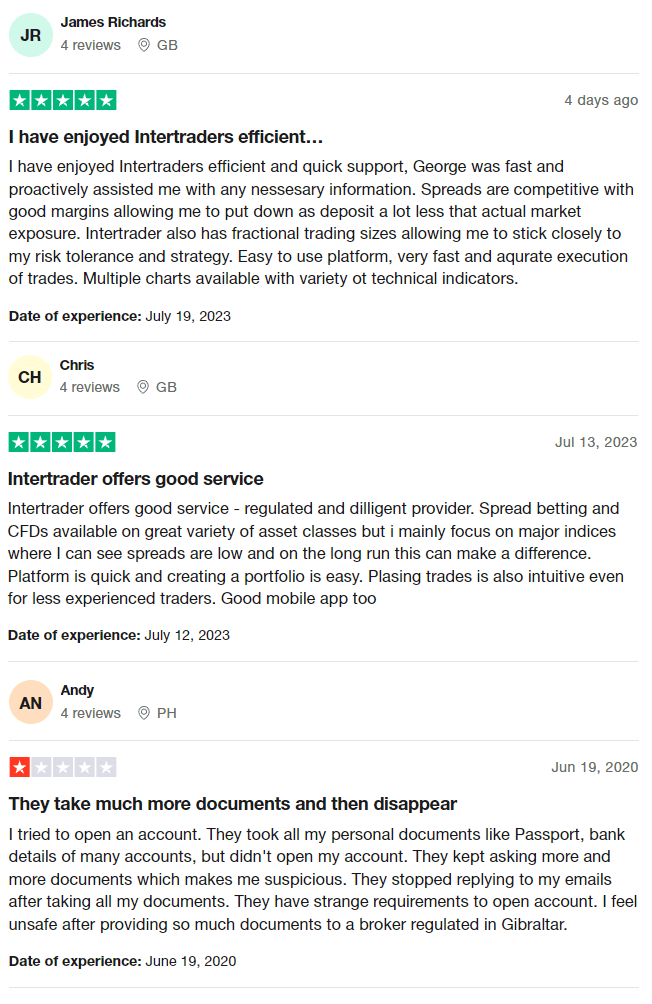

InterTrader has a generally positive reputation among its users. Many have praised its efficient and quick support service, with George being singled out for his proactive assistance. The competitive spreads, good margins, and fractional trading sizes were commended for allowing clients to adhere to their risk tolerance and strategy. The platform is user-friendly, facilitating rapid and accurate execution of trades, and comes with a variety of technical indicators.

However, not all experiences have been positive. One user had a concerning experience while trying to open an account, expressing distrust after being asked for multiple personal documents and not having their account opened, while their emails were subsequently ignored. The broker's Gibraltar regulation was pointed out as a potential concern.

InterTrader Spreads, Fees, and Commissions

InterTrader aims to provide a competitive and transparent pricing structure for its clients. The broker's trading costs and spreads vary depending on the instrument being traded. For example, the spread for the popular EUR/USD forex pair is typically around 0.6 pips, which is quite competitive in the forex market. For UK 100 shares, the commission is set at 0.1% per side.

InterTrader also offers a unique loyalty rebate program known as TradeBack. This program rewards traders who have paid a combined spread cost of over £500 during a month by providing them with an automatic rebate, regardless of their trading results. This feature can help lower overall trading costs for active traders.

The cost of trading with InterTrader is mainly built into the spread, which is the difference between the buying and selling price of an instrument. For spread betting and non-Forex CFDs, the dealing charge is contained in the spread, which is wrapped around the underlying market price.

For Forex CFDs, traders trade at the underlying market price, and a commission is charged. The commission is set at 3 units of the quoted currency per standard lot, per side. For instance, for a USD/EUR trade, a commission of $6 would be charged per $200,000 lot on opening and another $6 on closing.

These relatively low fees and spreads, along with the TradeBack loyalty program, make InterTrader an appealing option for many traders looking for a cost-effective trading environment.

Account Types

InterTrader presents traders with several types of spread betting and CFD accounts, all offering competitive trading conditions and comprehensive solutions and services.

Spread Betting Account

Spread betting offers quick and flexible access to global markets. You bet on price movements instead of buying or selling an actual stock or futures contract. You can start betting with as little as £1 per point movement. Spread betting gives access to thousands of markets in the United States, Asia, the United Kingdom, and Europe, such as commodities, forex, shares, and indices.

CFDs Account

Contract for Difference (CFD) allows you to speculate on market price movements without the need for a physical purchase or sale. You control when to close your position and realize your profit or loss. You need to deposit a margin to open your position, which potentially increases the risk-return on your investment capital. Intertrader traders can trade CFDs from 10p per point on indices, or from 0.01 of a lot on forex.

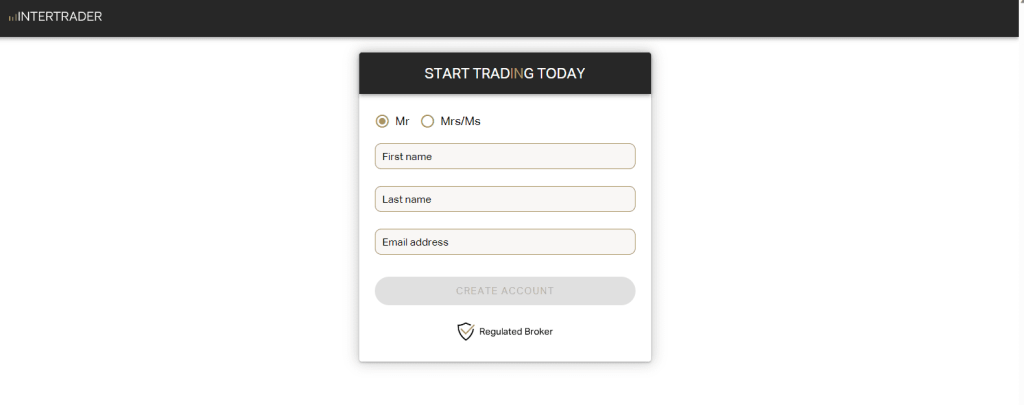

How to Open Your Account

Opening an Intertrader trading account is a streamlined process.

- First, visit the InterTrader website and click on the prominent “Create Account” button next to the “Log In” button on the homepage.

- After this, you'll need to fill out a form with your personal information – ensuring that this information is accurate is crucial for later stages of account verification.

- After submission, an account verification email will be sent to your registered inbox containing detailed instructions on how to verify your account.

- You may also be asked for additional documents like ID and Proof of Address for further verification.

What Can You Trade on InterTrader

InterTrader provides its clients with an extensive selection of trading instruments. These include Contracts for Difference (CFDs) on shares, stock indices, forex, commodities, bonds, and cryptocurrencies. Let's delve into these a bit further:

- Shares: Traders can speculate on the price movements of thousands of individual company shares from across global markets. This includes leading companies from sectors such as technology, finance, healthcare, and many more.

- Stock Indices: This enables traders to bet on the performance of a group of companies represented by a specific index, such as the S&P 500, Dow Jones, FTSE 100, and others.

- Forex: InterTrader provides access to major, minor, and exotic forex pairs, allowing traders to take advantage of the 24-hour global forex market.

- Commodities: Traders can speculate on the price of various hard and soft commodities such as gold, silver, oil, gas, wheat, coffee, etc.

- Bonds: InterTrader also offers CFDs on several major international bonds, giving investors the opportunity to trade based on interest rate movements.

- Cryptocurrencies: With the increasing popularity of digital assets, InterTrader offers the opportunity to trade some of the most popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

By offering such a diverse range of tradable assets, InterTrader caters to the different trading preferences and strategies of its clientele, allowing them to diversify their investment portfolio.

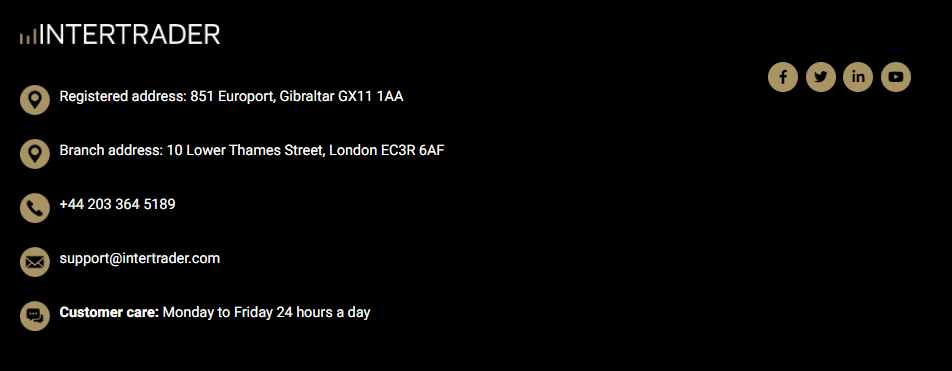

InterTrader Customer Support

InterTrader has a strong focus on providing quality customer support to ensure a smooth trading experience for its clients. Customer support is available five days a week (24/5), during standard trading hours.

Support can be accessed through several communication channels. These include direct phone lines and email, which can be used for detailed queries or concerns that need more comprehensive assistance. The broker's response time is commendable, and the customer service representatives are known for their professionalism and knowledge.

Additionally, InterTrader keeps up with the times by offering support via various social media platforms. Customers can reach out to them on Facebook, Twitter, or LinkedIn through their messenger services, adding another layer of convenience for tech-savvy traders.

Advantages and Disadvantages of InterTrader Customer Support

Security for Investors

Withdrawal Options and Fees

InterTrader prides itself on its efficient and transparent withdrawal process. Once a withdrawal request is submitted, it is processed within 24 hours of receipt. This quick turnaround time is a significant advantage, as it allows traders to access their funds with minimal delays.

The withdrawal methods include bank transfers, debit and credit cards, or e-wallet services like Skrill. It's essential to note that the same account used for making the deposit should be used for withdrawals, ensuring security and preventing potential fraudulent activities.

Withdrawn funds are credited to the receiving account within 3-5 business days following the approval of the withdrawal application. The minimum withdrawal amount is set at 100 USD/€/£, and there's no limit to the number of withdrawals a trader can make.

The first withdrawal within 24 hours (from 12:00 of the current day to 12:00 of the next day, UK time) is free of charge. Subsequent withdrawals of less than 1,000 USD/€/£ will incur a fee of 5 USD/€/£. However, subsequent withdrawals exceeding 1,000 USD/€/£ are not subjected to any commission. It's worth noting that the receiving bank might charge a fee for the transfer of funds, which is independent of InterTrader's policies.

InterTrader Vs Other Brokers

#1. InterTrader vs AvaTrade

InterTrader and AvaTrade are both reputable online brokers with extensive offerings in terms of tradable assets. However, they differ in several key areas:

- Regulation: Both brokers are well-regulated, but AvaTrade has a more global presence with regulation across five continents, which can offer an additional level of assurance to international traders.

- Trading Platform: InterTrader offers its proprietary trading platform alongside the popular MT5, whereas AvaTrade provides a wider selection, including MT4, MT5, and their own AvaTradeGO and AvaOptions platforms.

- Educational Resources: Both brokers provide educational resources, but AvaTrade is known for its comprehensive and interactive educational content suitable for both beginners and seasoned traders.

- Trading Assets: While both brokers offer an extensive array of tradable assets, AvaTrade offers more than 1,250 financial instruments, which is quite a bit more diverse than InterTrader's offering.

Verdict: While both InterTrader and AvaTrade have their merits, AvaTrade has a slight edge due to its extensive regulatory coverage, a greater choice of trading platforms, and more comprehensive educational resources. Moreover, its larger selection of trading instruments may offer more opportunities for traders to diversify their portfolios.

#2. InterTrader vs RoboForex

InterTrader and RoboForex cater to different segments of the market, each with its unique advantages:

- Regulation: Both brokers are regulated; however, InterTrader's regulation by the Gibraltar Financial Services Commission and the UK's Financial Conduct Authority might be viewed as more stringent compared to RoboForex's FSC regulation.

- Trading Platforms: While InterTrader offers the industry-standard MT5 and its proprietary platform, RoboForex stands out by offering a choice between MT4, MT5, cTrader, and RTrader, thus catering to various trading styles and preferences.

- Assets: RoboForex offers a more extensive range of assets, with over 12,000 trading options across eight asset classes, surpassing InterTrader's selection.

- Trading Contests: A unique feature of RoboForex is its ContestFX, where traders can participate in contests on demo accounts with real cash prizes, an offering not available at InterTrader.

Verdict: While InterTrader's strong regulation and straightforward offerings may appeal to some, RoboForex outshines it with its wider selection of trading platforms and assets, as well as its unique trading contests. These features make RoboForex a more appealing choice for traders who value versatility and the opportunity to engage in competitive trading.

#3. InterTrader vs Exness

InterTrader and Exness are both well-respected online brokers, but they have different strengths:

- Regulation: Both are well-regulated; however, Exness's CySEC regulation and additional offices in Seychelles can provide extra reassurance to traders.

- Trading Assets: Exness offers over 120 currency pairings, including stocks, energy, and metals, which is a larger selection than InterTrader. It also provides trading in cryptocurrencies, an offering also available at InterTrader.

- Leverage: Exness offers unlimited leverage on small deposits up to $999, a feature not provided by InterTrader, making it more appealing to traders with smaller accounts or those wishing to trade with higher leverage.

- Account Types: Exness offers various account types, including a demo account, making it easier for both beginner and experienced traders to find an account that suits their needs.

Verdict: Although InterTrader offers a strong platform and customer support, Exness outperforms it in terms of asset diversity, leverage, and account type selection. Therefore, Exness is the more recommended broker due to these benefits, especially for traders looking to utilize high leverage or needing a range of account types to suit their trading style.

Conclusion: InterTrader Review

InterTrader has established itself as a reputable and reliable broker in the industry, catering to a wide range of traders, from novices to professionals. Its impressive regulatory oversight, direct market access, and tight spreads make it a great choice for cost-conscious traders, particularly those interested in trading Forex and CFDs.

While InterTrader offers a respectable range of assets to trade, it may not have the depth and breadth found with some other brokers. However, its proprietary trading platform and customer support are commendable, making the trading experience seamless and user-friendly. Moreover, the absence of commissions on most trades, along with guaranteed stop losses, are significant benefits that add to InterTrader's appeal.

Although some traders might prefer a wider range of educational resources, especially beginners, InterTrader's offering is decent and helpful. Overall, while InterTrader might not outshine some competitors in every area, it certainly holds its ground as a reliable, user-friendly broker that is worth considering for its low costs and strong regulatory oversight.

InterTrader Review: FAQs

Is InterTrader a good broker for beginners?

Yes, InterTrader is a suitable broker for beginners. Its user-friendly proprietary platform makes it easy for novice traders to navigate and execute trades. Additionally, InterTrader offers a range of educational resources that can help beginners understand the basics of trading. However, beginners may find that some other brokers offer more comprehensive educational content.

Does InterTrader offer a demo account?

Yes, InterTrader offers a demo account that allows users to practice trading strategies without risking real money. This can be a valuable tool for both beginner traders looking to familiarize themselves with the platform and experienced traders wanting to test new strategies.

What is the minimum deposit required to start trading with InterTrader?

The minimum deposit requirement at InterTrader may vary depending on the type of account you open. As of the last update, the minimum deposit for a standard account was $500. However, these conditions may change over time, and it's always recommended to check the latest terms on the InterTrader website or contact their customer support for accurate information.