Interactive Brokers Review

Interactive Brokers is a leading online broker firm offering a wide range of investment products, including stocks, options, futures, forex, and bonds. Known for its low trading fees and advanced trading platforms, it caters to experienced traders and professional investors. With access to over 150 global markets, Interactive Brokers provides extensive opportunities for international trading.

The brokerage offers powerful platforms like Trader Workstation and IBKR Mobile, equipped with advanced trading tools and customizable features. These platforms provide real-time market data, comprehensive charting tools, and algorithmic trading capabilities. Additionally, Interactive Brokers offers competitive margin rates and supports multiple currencies, making it ideal for global investors.

However, the advanced features and complexity of Interactive Brokers' platforms may pose challenges for beginner investors. The lack of user-friendly interfaces and limited educational resources can be a drawback for those new to trading. Despite this, for seasoned traders seeking low commissions, advanced tools, and access to global markets, Interactive Brokers remains a top choice.

What is Interactive Brokers?

Interactive Brokers is a global online broker firm that provides direct access to trade stocks, options, futures, forex, bonds, and funds on over 150 markets worldwide. Founded in 1978, it caters to professional traders and institutional investors with advanced trading platforms and low commission fees. The company is renowned for its sophisticated trading tools and comprehensive market access.

Its flagship platform, Trader Workstation (TWS), offers customizable features suitable for experienced traders. The platform supports algorithmic trading, real-time monitoring, and extensive charting and analytical tools. Interactive Brokers also provides mobile and web-based platforms, allowing users to trade on the go.

While Interactive Brokers delivers a wide range of services, its platforms may be complex for beginners due to advanced features and a lack of simplified interfaces. The firm's focus on professional traders means novice investors might find the learning curve steep. However, for seasoned traders seeking low costs and extensive global market access, Interactive Brokers remains a top choice.

Interactive Brokers Regulation and Safety

Interactive Brokers is a globally regulated brokerage firm overseen by multiple financial authorities. In the United States, it is regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Internationally, it holds licenses from bodies like the UK's Financial Conduct Authority (FCA) and Australia's Securities and Investments Commission (ASIC).

The company employs robust security measures to protect client assets and personal information. It utilizes advanced encryption technologies and offers two-factor authentication for secure account access. Additionally, client funds are held in segregated accounts to safeguard assets in the event of company insolvency.

Interactive Brokers is a member of the Securities Investor Protection Corporation (SIPC), which provides insurance coverage up to $500,000, including $250,000 for cash claims. This membership adds an extra layer of protection for investors. Overall, its adherence to strict regulatory standards and commitment to security make Interactive Brokers a reliable choice for safety-conscious investors.

Interactive Brokers Pros and Cons

Pros:

- Low Fees

- Advanced Tools

- Global Access

- Diverse Assets

Cons:

- Complex Interface

- Steep Learning

- High Minimums

- Limited Education

Benefits of Trading with Interactive Brokers

Interactive Brokers offers low commission rates, making trading cost-effective for investors. Its advanced trading platforms provide sophisticated tools suitable for professional traders. With access to over 150 global markets, users can diversify their portfolios internationally.

The brokerage supports a wide range of asset classes, including stocks, options, futures, forex, and bonds. Real-time data and customizable charting tools enhance the trading experience. Competitive margin rates and multi-currency support benefit global investors.

Interactive Brokers prioritizes security with robust measures like two-factor authentication. The firm is regulated by top-tier financial authorities, ensuring a trustworthy trading environment. For those seeking low costs and advanced tools, Interactive Brokers presents significant benefits.

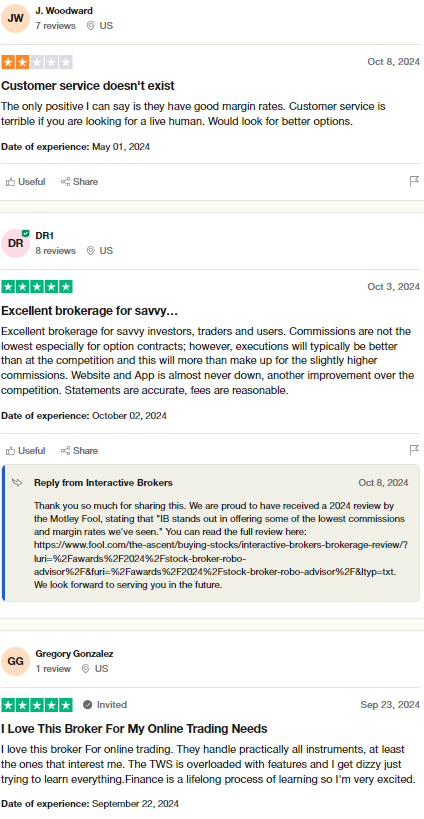

Interactive Brokers Customer Reviews

Interactive Brokers is a widely recognized brokerage firm offering a comprehensive trading platform for both professional and retail investors. Customer reviews highlight its low trading fees and extensive range of investment options, though some users find the platform complex to navigate. Overall, Interactive Brokers remains a popular choice for those seeking advanced trading tools and global market access.

Interactive Brokers is a prominent brokerage firm known for its advanced trading platform and competitive fees. Customers appreciate its wide range of investment options and access to global markets, though some find the platform's complexity challenging. Overall, Interactive Brokers receives positive reviews from traders seeking comprehensive tools and low-cost trading.

Interactive Brokers Spreads, Fees, and Commissions

Interactive Brokers is known for offering tight spreads and low trading fees, making it appealing to cost-conscious traders. Its pricing model is transparent, with commissions varying depending on the asset class and trading volume. This structure allows traders to manage costs effectively across different markets.

The broker provides competitive rates for stocks, options, futures, and forex, ensuring flexibility for diverse trading strategies. For forex, Interactive Brokers offers tight spreads with no hidden markups, which is a significant benefit for active traders. This cost-efficient approach is ideal for those who trade frequently or in large volumes.

Overall, Interactive Brokers is praised for its straightforward fee system and global market access. Traders who prioritize minimizing costs and maximizing trading options often choose this platform. Its reputation for competitive fees and clear pricing continues to attract both new and experienced investors.

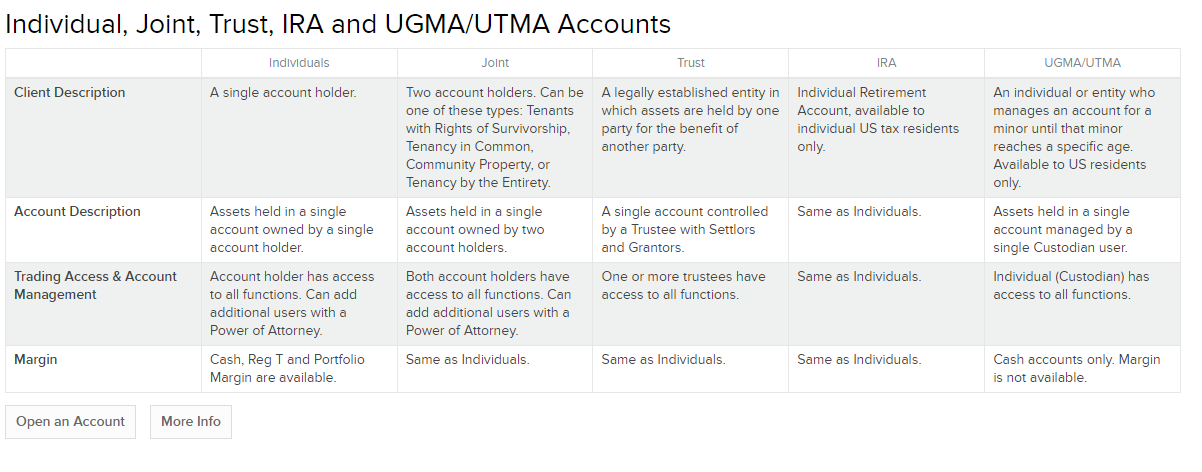

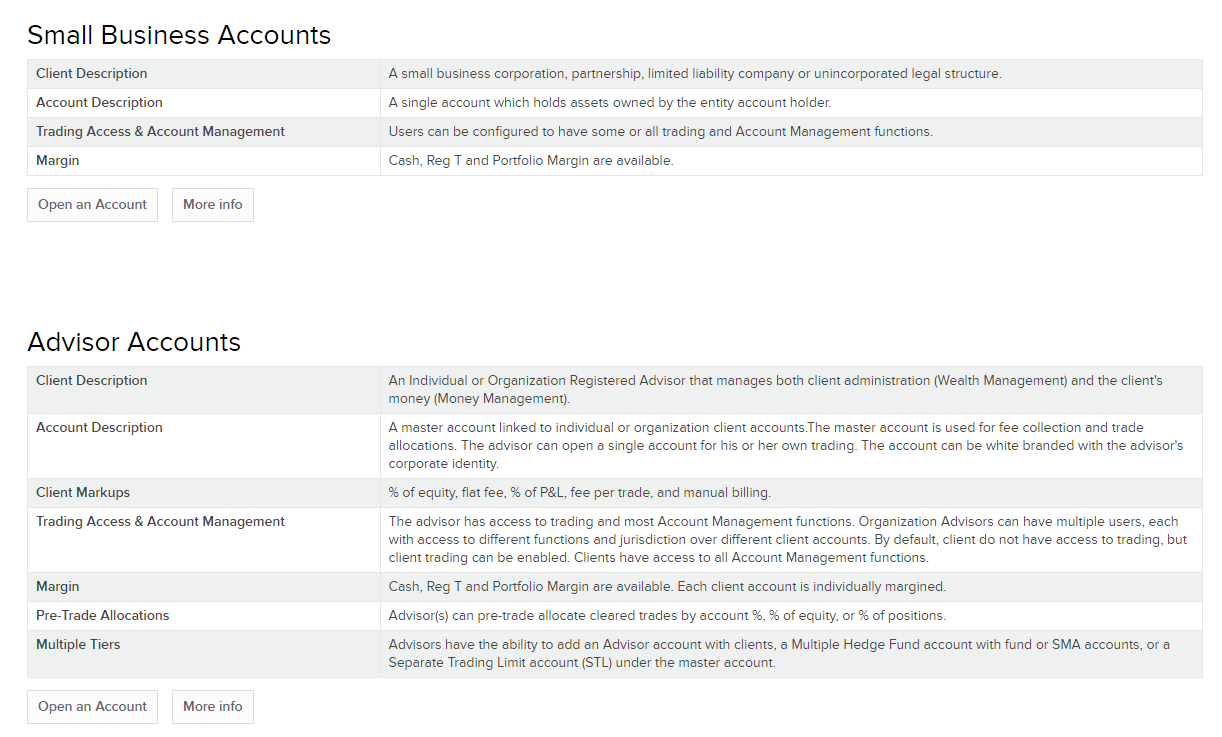

Account Types

Interactive Brokers Account Types

Individual Account

An Individual Account is tailored for a single investor who wants direct access to trade a variety of financial instruments. It provides full control over trading decisions and portfolio management. This account type is ideal for self-directed traders seeking to invest in global markets through Interactive Brokers' platforms.

Joint Account

A Joint Account is shared by two or more individuals who wish to invest together. It allows equal access and responsibility for all account holders. This account type is suitable for couples, business partners, or family members aiming to manage investments collectively.

Retirement Account (IRA)

Interactive Brokers offers Retirement Accounts such as Traditional IRA, Roth IRA, SEP IRA, and SIMPLE IRA. These accounts provide tax-advantaged ways to save for retirement while trading a wide range of assets. Investors can benefit from Interactive Brokers' low fees and extensive market access within their retirement planning.

Trust Account

A Trust Account is established by a trustee to manage assets on behalf of beneficiaries. This account type supports both revocable and irrevocable trusts, offering flexibility for estate planning. Trust accounts allow for professional management of assets while meeting fiduciary responsibilities.

Friends and Family Account

The Friends and Family Account is designed for an individual managing multiple accounts for up to 15 friends or family members. It enables the account manager to trade on behalf of others without needing professional advisor registration. This setup simplifies portfolio management across several accounts under one platform.

Financial Advisor Account

A Financial Advisor Account caters to registered investment advisors managing client portfolios. It provides tools for client onboarding, portfolio management, and performance reporting. Advisors can efficiently oversee multiple client accounts while adhering to regulatory compliance through Interactive Brokers' system.

Institutional Account

Institutional Accounts are intended for businesses, corporations, and other entities requiring advanced trading services. These accounts offer sophisticated tools, risk management features, and customizable reporting options. Institutions benefit from dedicated support and access to a broad range of global markets.

Introducing Broker Account

An Introducing Broker Account is for brokers who refer clients to Interactive Brokers and earn commissions. This account type allows brokers to utilize Interactive Brokers' trading platforms and infrastructure. It includes client management tools and customizable commission structures to support business growth.

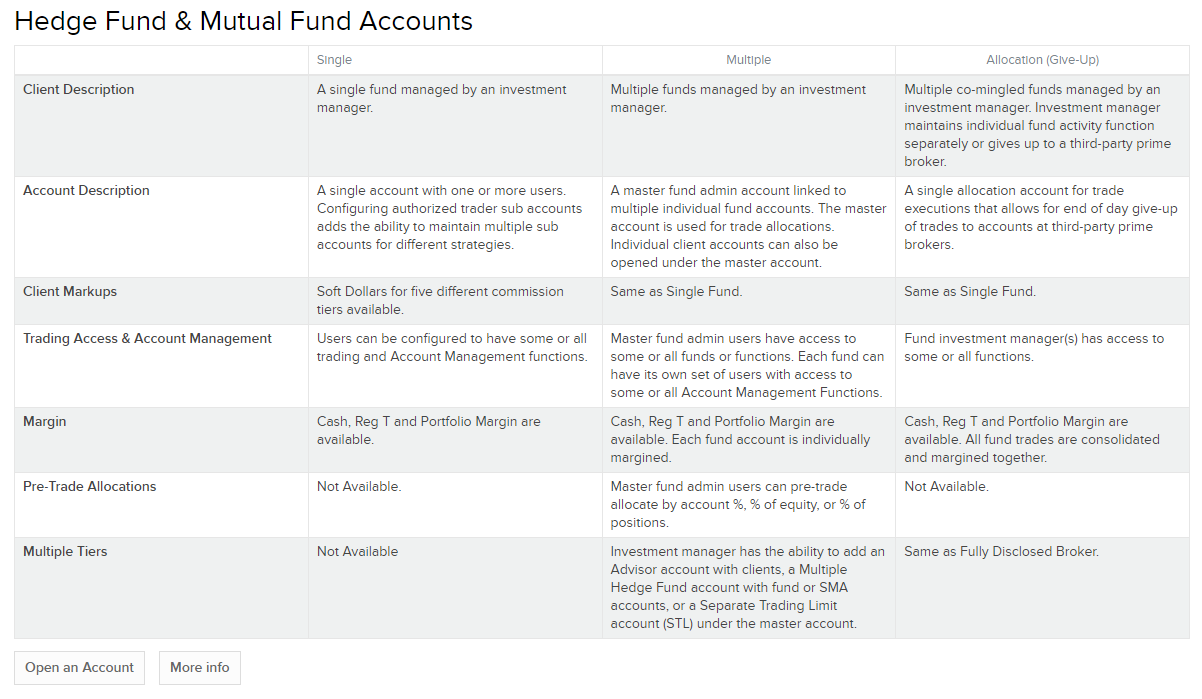

Hedge Fund and Money Manager Account

This account type is designed for hedge funds and professional money managers needing advanced trading capabilities. It offers features like algorithmic trading, extensive market data, and risk management tools. Managers can execute complex strategies while overseeing multiple client or fund accounts.

Proprietary Trading Group Account

A Proprietary Trading Group Account is for firms trading the company's capital with multiple traders. It provides centralized fund management alongside individual trading accounts for each trader. The account includes firm-wide risk controls and consolidated reporting for efficient oversight.

How to Open Your Account

To open an account with Interactive Brokers, the process starts by visiting Interactive Brokers website website and selecting the “Open Account” button. Users will be prompted to choose between individual, joint, or institutional accounts. After selecting the appropriate account type, users can proceed by entering basic personal information like name, email, and country of residence.

Next, the system will guide users through providing detailed financial information, such as employment status, income, and trading experience. Interactive Brokers also requires identity verification, which involves submitting government-issued identification and proof of address. Once the necessary documents are uploaded, users can review and agree to the terms of service.

Finally, after verification, users will be prompted to fund their account. Interactive Brokers offers multiple funding options, including wire transfer and bank deposits. Once the funds are processed, the account is ready for trading, providing access to a broad range of global markets.

Interactive Brokers Trading Platforms

Interactive Brokers offers multiple trading platforms, starting with the Trader Workstation (TWS), designed for advanced traders. TWS provides powerful charting tools, real-time data, and access to a wide range of markets. This platform is ideal for those who need in-depth analytics and comprehensive trading features.

For traders on the go, the IBKR Mobile app offers a streamlined version of the desktop platform. It includes essential tools like order placement, portfolio monitoring, and market data. The mobile app is a convenient solution for managing trades and checking market updates anytime, anywhere.

In addition, Interactive Brokers provides Client Portal, a web-based platform for casual traders. It offers simplified navigation with essential tools for placing trades and tracking account performance. This option caters to traders seeking an easy-to-use interface without compromising on essential commodity futures trading commission.

What Can You Trade on Interactive Brokers

Interactive Brokers offers a wide range of financial instruments for trading. Users can trade stocks from major global exchanges, including shares from the U.S., Europe, and Asia. The platform also provides access to exchange-traded funds (ETFs) and mutual funds for diversified investment options.

In addition to equities, Interactive Brokers allows trading in options and futures contracts. These derivatives cover various assets like commodities, indices, and currencies, providing opportunities for hedging and speculative strategies. Forex trading is also available, enabling users to trade major and minor currency pairs.

Fixed income investors can trade bonds through Interactive Brokers, including corporate, municipal, and government bonds. The platform supports trading in precious metals like gold and silver. Furthermore, users can access cryptocurrencies through certain exchange and regulatory fees, expanding the range of available assets.

Interactive Brokers Customer Support

Interactive Brokers offers customer support through various channels, including phone, email, and live chat. Their support services are available 24 hours a day during the trading week, from Sunday afternoon to Friday evening Eastern Time. This continuous availability ensures that traders from different time zones can access assistance when needed.

The company provides support in multiple languages to cater to its global clientele. Interactive Brokers also maintains an extensive online Knowledge Base with FAQs, user guides, and tutorial videos. These resources help users find answers to common questions without needing to contact support directly.

While Interactive Brokers delivers comprehensive support options, some users may experience varying response times depending on the contact method. The complexity of their advanced trading platforms might require detailed assistance, which can affect resolution times. Overall, the availability of multiple support channels enhances the user experience for traders on the platform.

Advantages and Disadvantages of Interactive Brokers Customer Support

Withdrawal Options and Fees

Interactive Brokers offers several withdrawal options for clients to access their funds. Users can withdraw money via bank wire transfers, Automated Clearing House (ACH) transfers, or the Single Euro Payments Area (SEPA) for European customers. These methods provide flexibility based on the client's location and banking preferences.

Regarding fees, Interactive Brokers typically provides one free withdrawal per calendar month. Subsequent withdrawals within the same month may incur fees, which vary depending on the withdrawal method and currency. For example, additional wire transfers might have a fee, while ACH transfers are usually free for U.S. clients.

To initiate a withdrawal, clients must log in to their account management portal and follow the withdrawal instructions. Processing times can vary, with ACH transfers taking up to two business days and wire transfers processed within one business day. It's important for clients to ensure their banking information is accurate to avoid delays or additional fees.

Interactive Brokers Vs Other Brokers

#1. Interactive Brokers vs AvaTrade

Interactive Brokers and AvaTrade both offer comprehensive trading platforms, but they cater to different types of traders. Interactive Brokers is known for its advanced tools, low fees, and wide market access, making it ideal for experienced traders. In contrast, AvaTrade focuses on simplicity, offering a user-friendly platform with competitive spreads, which appeals to beginners.

When it comes to market access, Interactive Brokers provides access to global markets, including stocks, options, and futures. AvaTrade, on the other hand, specializes in forex and CFDs, offering a more streamlined selection of assets. This makes Interactive Brokers a better choice for those looking to diversify their portfolios, while AvaTrade suits traders focused on forex and CFDs.

In terms of fees, Interactive Brokers has a complex, tiered pricing structure, which can be cost-effective for high-volume traders. AvaTrade offers commission-free trading with fixed spreads, making costs predictable for retail traders. Overall, traders seeking advanced tools and lower costs may prefer Interactive Brokers, while AvaTrade is better suited for those seeking simplicity and a straightforward fee structure.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

#2. Interactive Brokers vs RoboForex

Interactive Brokers and RoboForex both offer trading services, but they cater to different types of traders. Interactive Brokers is designed for advanced and institutional traders, providing access to global markets, low fees, and professional tools. In contrast, RoboForex targets beginner to intermediate traders, offering simpler platforms with a focus on forex and CFD trading.

In terms of market access, Interactive Brokers allows trading in a wide variety of assets, including stocks, options, and futures, across global exchanges. RoboForex specializes in forex and CFDs, offering a more limited range of assets but with high leverage options. This makes Interactive Brokers better suited for those looking to trade across multiple asset classes, while RoboForex appeals to traders who prefer forex and high-leverage trading.

Regarding fees, Interactive Brokers has a complex, tiered fee structure based on volume, which can benefit high-frequency traders. RoboForex offers lower minimum deposits and commission-free accounts with variable spreads, making it more accessible for retail traders. Overall, Interactive Brokers is ideal for professional traders seeking advanced tools, while RoboForex caters to those who prioritize ease of access and flexibility in forex trading.

Also Read: RoboForex Review 2024 – Expert Trader Insights

#3. Interactive Brokers vs Exness

Interactive Brokers and Exness are both prominent online brokerage firms, but they cater to different types of traders. Interactive Brokers is known for offering a wide range of financial instruments, including stocks, options, futures, forex, and bonds, targeting professional and institutional traders. Exness, on the other hand, specializes primarily in forex and CFD trading, appealing to retail traders seeking access to currency markets.

When it comes to trading platforms, Interactive Brokers provides advanced tools like the Trader Workstation (TWS), which offers sophisticated features suitable for experienced traders. Exness offers platforms like MetaTrader 4 and MetaTrader 5, which are popular among forex traders for their user-friendly interfaces and extensive plugin support. Both brokers offer mobile trading options, but Interactive Brokers' platforms might be more complex for beginners compared to Exness's more straightforward solutions.

In terms of fees and commissions, Interactive Brokers typically charges low commissions but has a more complex fee structure, which can be advantageous for high-volume traders. Exness often offers tight spreads and commission-free trading on certain accounts, making it attractive for traders looking for cost-effective forex trading. Ultimately, the choice between Interactive Brokers and Exness depends on the trader's experience level, preferred markets, and specific trading needs.

Also Read: Exness Review 2024 – Expert Trader Insights

CREATE AN INTERACTIVE BROKERS ACCOUNT

Conclusion: Interactive Brokers Review

Interactive Brokers stands out as a platform for experienced traders due to its advanced tools and low fees. The platform offers a wide range of assets and global market access, making it an attractive option for those looking to diversify their portfolios. However, the complexity of the platform may be overwhelming for beginners.

For active traders, the platform's tiered fee structure and comprehensive features provide cost savings and flexibility. Additionally, Interactive Brokers offers multiple trading platforms, including the powerful Trader Workstation and a user-friendly mobile app. This makes it suitable for traders who need advanced tools both on desktop and on the go.

While its robust features and global access set it apart, Interactive Brokers may not be the best choice for casual traders or those seeking simplicity. The platform's learning curve and detailed fee structure require time and understanding. Ultimately, Interactive Brokers is ideal for those who prioritize professional-grade tools and market diversity.

Interactive Brokers Review: FAQs

Is Interactive Brokers suitable for beginners?

Interactive Brokers is best suited for experienced traders due to its complex platform, though beginners can use the Client Portal or mobile app for a simpler experience.

What are the fees associated with Interactive Brokers?

Interactive Brokers offers a tiered fee structure based on trading volume, providing competitive rates for stocks, options, and forex. The exact fees vary by asset class.

Which markets can I access through Interactive Brokers?

Interactive Brokers provides access to global markets, allowing users to trade stocks, options, futures, forex, and more across different exchanges.

OPEN AN ACCOUNT NOW WITH INTERACTIVE BROKERS AND GET YOUR BONUS