Infinox Capital Review

In the financial market, most trading platforms offer trading accounts that work through a “dealing desk”. This means that there is an intermediatory between the client and the liquidity providers which is often criticized for having a conflict of interests. However, now customers prefer ECN and STP account which links them directly to the market without any requotes or slippage. Infinox Capital is also one such trading platform and execution model which supports this trading process.

When we observe Infinox Capital as a trading platform, it is clear that all the features of a competent broker are available here. From the variety of trading instruments to the security of funds, all the basic requirements of a client are addressed on the platform.

However, there is so much competition in the financial market with the most advanced trading technology and easy-to-use interface that it’s difficult for Infinox Capital to cope with. The firm lacks in providing efficient customer service and struggles to keep up with the customer’s requirements for fast and easy withdrawals.

In this Infinox Capital review, we aim to provide all the relevant information regarding this broker for potential traders or investors. From the account types and trading assets to the withdrawal process and commission rates everything is covered in this review. Moreover, readers can also evaluate the advantages and flaws of the platform to figure out the overall performance of the broker.

What is Infinox Capital?

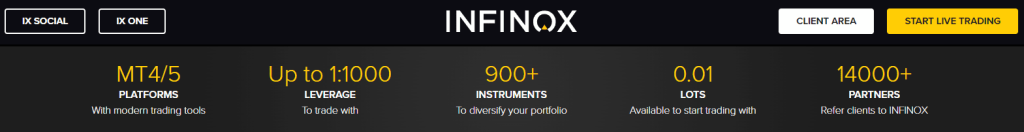

Infinox Capital Ltd is a financial trading platform founded in 2009 that is regulated by the Financial Services Conduct Authority (FSCA), Financial Services Commission (FSC) Mauritius, and Securities Commission of Bahamas (SCB). Basically, it is a CFD and Forex broker that has been proving trading services to customers across the world with offices in more than 15 countries.

Infinox Capital offers around 900 trading instruments in forex, indices, commodities, and cryptocurrencies. However, there are limited options for major and minor currency pairs as well as digital currencies when compared to other leading brokerage platforms. In many ways, Infinox Capital is an average platform because even when all the trading features are available here, the firm still struggles to provide the best services in terms of cost efficiency, prompt customer service, and an easy withdrawal process.

In many ways, we can say that Infinox Capital is a platform for both professional as well as novice traders. The user interface of this broker is simple which helps new traders navigate with ease. Moreover, there are options for educating traders through webinars, expert analysis, and trading tools.

Similarly, seasoned traders and investors can benefit from the fast market executions and low spreads of this platform which is the most important requisite for profitable trading through the ECN and STP accounts. Moreover, there is also the feature of passive income through copy trading on the Infinox Capital platform.

Advantages and Disadvantages of Trading with Infinox Capital?

Benefits of Trading with Infinox Capital

Overall, Infinox Capital is not on the list of the leading online trading platform, still, there are some benefits to selecting it as a trading partner. The biggest benefit is that Infinox Capital offers trading instruments in various underlying assets. From Forex, and indices to futures and cryptocurrencies there is a range of trading options. This allows traders to diversify their portfolios which in turn minimizes their investment risk.

Another advantage of trusting Infinox Capital as a trading platform is that it is a regulated broker by not one but three financial authorities. This ensures that the broker is genuine and not a scam and also guarantees that all the trading transactions of the broker are monitored by a regulator so there is the least chance of misuse of funds.

Infinox Capital also claims to provide segregated accounts and also provides the feature of negative balance protections. This makes the firm a secure and safe place for the client’s funds with quick access to withdrawals. Moreover, Infinox is also among the few brokers which offer trading insurance to its customers.

Other than this there are also many other features that make the overall trading experience successful for customers, For instance, the advanced trading terminals of MT 4 and MT5, high leverage of up to 1:1000, auto-copy trading service, and educational and research resources for inexperienced traders. Another benefit is the minimum deposit requirement of $1 and commission-free withdrawal of funds which minimizes the trading cost for the clients.

Infinox Capital Pros and Cons

Pros

- Facilitates diversified portfolios

- Segregated accounts

- Negative balance protection

- Provision of fund insurance

Cons

- High commission rate

- poor customer service

Infinox Capital Customer Reviews

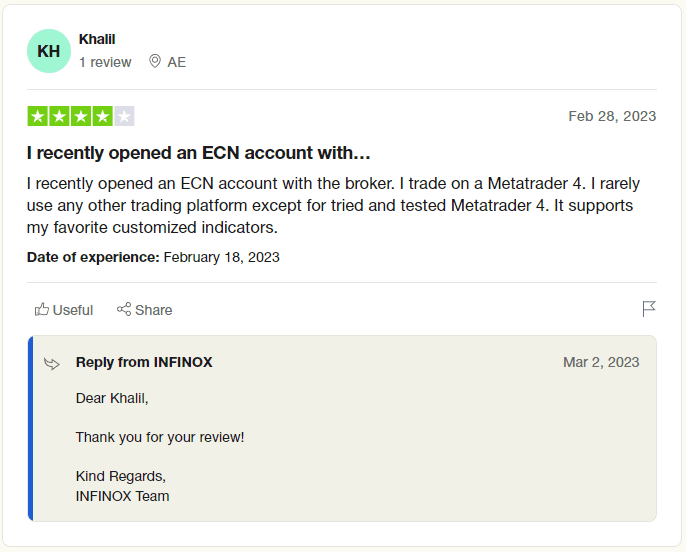

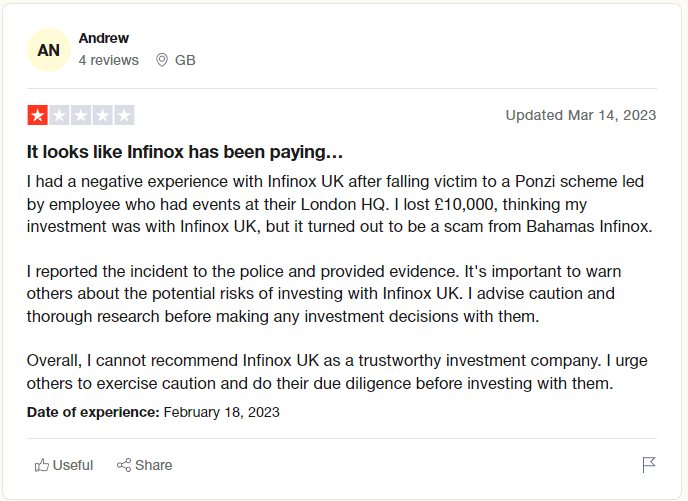

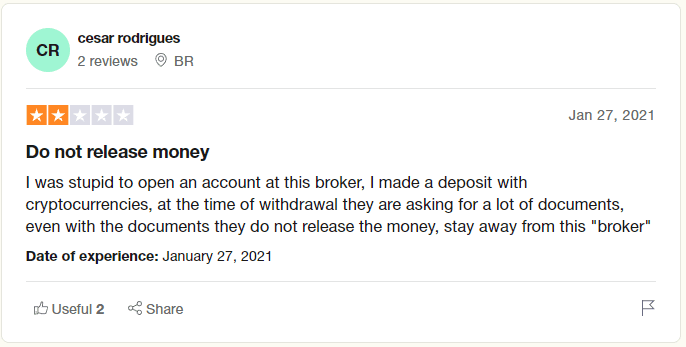

For any online trading platform, customer reviews are crucial to attracting potential customers. Nowadays people look for online reviews before making any investment decision. The advantage of reviews is that new traders can be warned beforehand of any potential scam or threat. However, one should also be aware that it is not a good idea to completely rely on customer reviews as they can be biased and inaccurate too. Therefore one should make decisions based on research along with customer feedback.

The reviews regarding Infinx Capital are not very positive. Customers have complained about the firm being a scam because it is an offshore company and the broker is operating from multiple countries. This led to potential investment risks for the customer which was resolved after multiple complexities.

In addition to this other clients have also blamed Infinox Capital for the poor withdrawal system which consists of prolonged verification stages. For this reason, clients have to wait for a long duration for cashouts. Other customers have also reported poor customer service on the platform and are not satisfied with the technical support.

Among all the negative reviews there were some customers who appreciated the performance of Infinox Capital. The fact that the broker has the advanced Meta trader 4 and 5 trading platform is appreciated by the customer as it supports customized indicators for profitable trading.

Infinox Capital Spreads, Fees, and Commissions

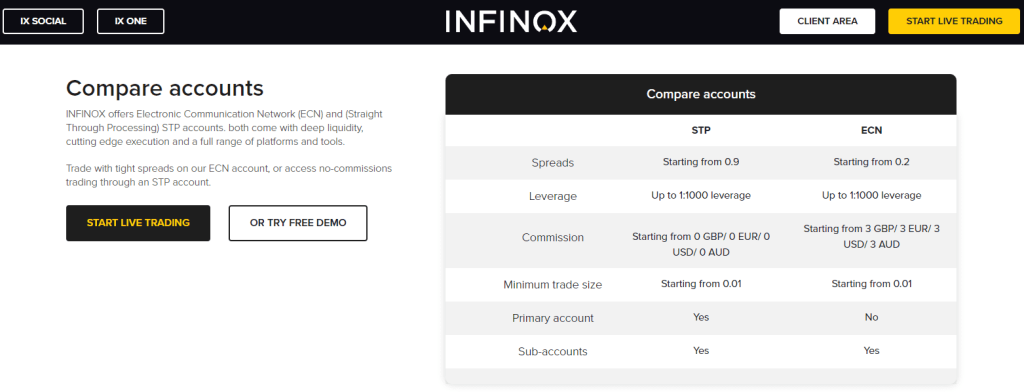

As Infinox Capital provides two account types ECN and STP, the spreads also differ from one account type to the other. On the STP accounts traders there are no fixed spreads as it varies by the type of instrument. However, the lowest spreads start from 0.8 pips per lot. On the other hand, for ECN accounts the tight spreads start from 0.2 pips per lot.

In the STP account the commission structure is not given by the broker and the commission rate is charged according to the spreads. However, in the ECN account, there is a fixed commission rate of $ 7.5 per lot. Commissions for CFDs are also not clearly mentioned by the broker and it is indicated to be dependent on the trading instrument.

Infinox Capital can be said to be an expensive trading platform for customers. As apart from the high commission rate there are a so additional fees. This includes inactive account penalties, overnight fees, and holding charges. The exact amount of these charges is not given by the broker however it is indicated that these charges will be applied.

It should be noted that the exact fee structure is not given by the broker even on their website. Therefore, we can say that there is no transparency in the payment system of Infinox Capital which is not a good sign as the customers would be unaware of the total trading cost before making investments with this broker.

Account Types

Infinox capital does not offer a wide range of account types. This could be seen as a drawback of the firm as traders and investors have different preferences when it comes to account specifications. Moreover, there are also platforms that offer tailor-made trading accounts for the convenience of their customers. In such a scenario, the limited choice between STP and ECN account on Infinox is not the best proposition for the customers.

STP Accounts

STP or Straight Through Processing Accounts are trading accounts where there is no third party involved between the customer and the liquidity providers. This cuts down the threat of conflict of interest which is usually involved in trading accounts with an intermediary. The only difference between STP and ECN accounts is that the former is not operated through an electronic network system.

The STP accounts on Infinox Capital start from tight spreads of 0.8 pips per lot. Also, this account type is considered to be the primary trading account with high leverage of up to 1:1000. The commission rate at the STP account is low compared to the ECN account however, there is no fixed rate and it varies according to the trading instruments. For major currency pairs the commission rate is zero but for other assets, there is the commission charged which is mentioned on the website.

ECN Accounts

Electronic communication network (ECN) accounts are preferred by some traders and investors as there is no middleman involved in this trading process. The customer is linked directly with the liquidity providers which promotes maximum profits in trading. However, the main requirement of this account type is to have fast market executions and tight spreads. only then the traders can earn significant profits as intended.

On the Infinox Capital platform, the ECN accounts are considered secondary accounts however there is an option of linking them to a sub-account. All the features of the ECN accounts are similar to the STP account but it has lower spreads starting from 0.2 pips. Moreover, the broker also claims that this account type has no requotes or slippage which helps in successful trading.

Demo Account

Infinox Capital also provides demo accounts for new traders. This account type helps potential traders and investors to get familiar with the platform and also assess the various features offered by the trading platform. The demo account provided by Infinox capital is free of charge which gives access to the same specifications as the live trading account. The only difference is that rather than trading with real money traders will deal with virtual money.

The purpose of the demo accounts is to familiarize oneself with the platform and its trading features before investing a big amount of money. This is not the case with Infinox Capital as already the minimum deposit of STP and ECN accounts is $1. So traders would prefer to open a live account rather than opening a demo account on this platform.

Sub-Accounts

Another option at Infinox Capital is of opening sub-accounts or secondary accounts. These sub-accounts can be individual, joint, or corporate accounts. Individual accounts are those where a trader would have complete control of their account whereas joint accounts have shared trading access between two or more partners. The corporate accounts, on the other hand, are targeted at organizations and institutions who want to trade in a corporate structure.

How To Open Your Account?

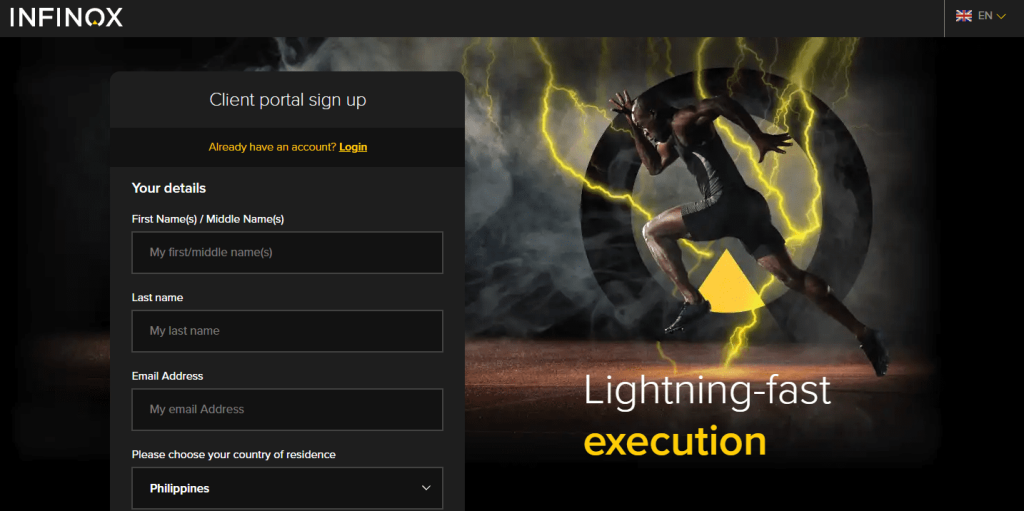

Infinox Capital is an offshore online platform therefore to know more about the company and open an account with the broker, users can visit the official website of the firm. It is recommended that traders should explore the website to find out about all the features of the platform and also look out for answers of any questions that they have in mind. After exploring the website users who wish to open an account with the firm have to register themselves first.

The first step to open an account on Infinox Capital is to click on the “sign up” button on the right corner of the landing page. Next, the user will be redirected to the registration page. Here users will be asked to fill out a registration form including basic information such as Name, Last name, Email, Password, and Residence.

After filling out the basic registration form, users will be asked to provide more detailed information including permanent address, date of birth, nationality, and other details. The users will also have to click on the check box if they agree with the terms and conditions, privacy policy, and other risk warnings.

The last step is the verification process which can take more time than the other steps. Here users will be asked to provide scanned copies of identification cards and other documents. Also, users will have to upload a picture of themselves to verify their identity. When the verification process is complete the user will be able to access their trading account using the given email and password.

What Can You Trade on Infinox Capital

Infinox Capital provides access to multiple asset types including Forex, indices, commodities, futures, and Cryptocurrencies. To trade forex customers have the opportunity to deal in 45 currency pairs. These include a combination of many major, minor, and exotic currency pairs. The tight spreads on the ECN accounts without any requotes or slippage also ensure that traders can earn maximum profits by trading forex.

In Indices, this broker provides a range of shares of various companies. Traders can earn through investing in different equities in different market avenues. Similarly, in commodities, there are options for traders to buy and sell various physical assets including energy, metals, agriculture, and other hard and soft commodities.

Traders and investors can also diversify their portfolios by trading in cryptocurrencies through Infinox Capital there are more than 40 digital currency pairs available for trading including the popular bitcoin, Ethereum, and many others. The advantage of trading in crypto at this trading platform is that users get access to the market 24/7 with tight spreads. This leads to the perfect opportunity for traders to earn significant profits.

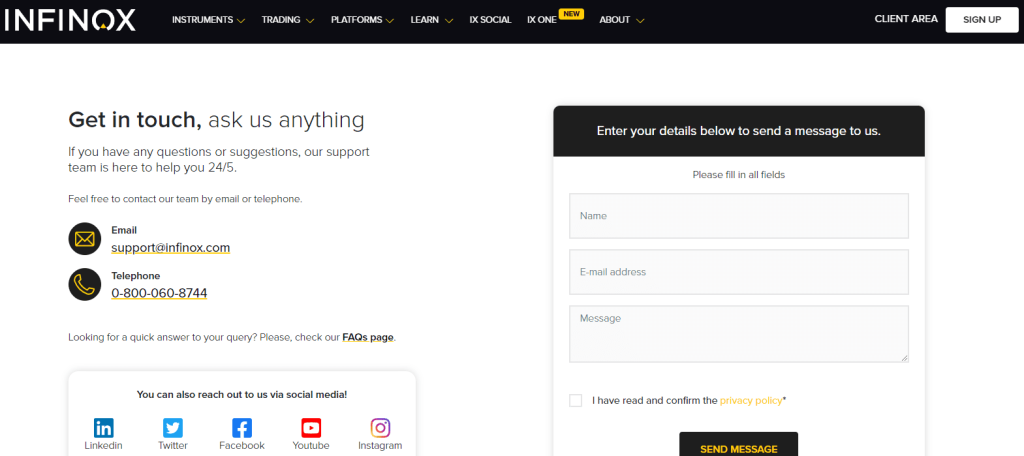

Infinox Capital Customer Support

The reviews regarding the customer service of Infinox capital have been not up to the mark. Customers have complained about the slows responses and lack of technical expertise of the support team on multiple forums and review platforms like Trustpilot. The customer reviews reflect that there are no financial experts available for customer assistance therefore, clients struggle to get their problems solved

Apart from this, there are many communication methods provided by brokers for their clients. This includes toll-free numbers for all their physical offices across the world. In addition to this, users can also contact the broker through the email address shared on the website.

Keeping in mind the need of the hour, the broker is also available on all the popular social media platforms including Youtube, Instagram, Facebook, Twitter, and Linked in. This makes it easier for customers to get the latest information and updates about the firm through social media. There is also a message box option where customers can leave their queries on the website along with their email addresses and the support team would reply as soon as possible.

Customer service is not available on weekends and clients can reach out the support them 24/5 which means that customers will have to wait for the weekend to resolve their issues. Moreover, the support team is available in multiple languages for the convenience of the customers.

Advantages and Disadvantages of Infinox Capital Customer Support

Security for Investors

Withdrawal Options and Fees

The withdrawal process at Infinox Capital has faced a lot of criticism from existing customers which is clearly reflected in various reviews and feedback. Many customers had a problem with the long verification process while others faced difficulty in cashouts.

Regardless of these views, it should be noted that Inifnox Capital provides a range of withdrawal and deposit of fund methods for the convenience of its customers. This includes traditional bank transfers as well as Master and Visa credit cards. On the modern front, clients can deposit or withdraw money through online walletlike Nettler and Skrill and also through cryptocurrencies via the crypto solutions. payment platform.

Another plus point of Infinox Captital is that there is n commission fee on the withdrawal and deposit of funds. Usually, brokers have a transaction fee on the withdrawal and deposit of funds. however, this is not the case with this broker which makes it a cost-effective brokerage platform for traders.

Infinox Capital Vs Other Brokers

#1. Infinox Capital vs Avatrade

It is crucial for any trader to learn about various brokerage services in order to make an informed investment decision. When we compare AvaTrade with Infinox Capital, there are many differences. For one, even when both brokerage platforms are regulated, AvaTrade has an edge over Inifinox. AvaTrade is regulated by not one or two but multiple regulatory bodies including the top tier financial institutions like AISC Australian Securities and Investment Commission.

Moreover, AvaTrade is also ahead in offering multiple bonuses to its customers including welcome bonuses and referral rewards. However, there are no bonuses available on the Infinox platform. In many ways, AvaTrade is rated as a leading brokerage platform by both financial experts as well as traders, and investors. Nevertheless, Infinox capital does have a low minimum balance requirement than Avatrade

#2. Infinox Capital vs Roboforex

Roboforex is another leading trading platform in the financial market. The firm was founded in 2009 and since then there was no turning back for this brokerage firm. When compared to Inifinox Capital, Roboforex is ahead in almost all aspects of trading services. Even when the trading platform at Inifinox Capital is also the advanced MT4 and MT5, Roboforex outperforms every broker by providing a wide range of the latest trading terminals including the popular C trader.

The best part about Roboforex is that it provides all the trading features effectively for traders to do successful trading and all these services are provided at the most competitive rates. So Infinox Capital cannot even step ahead of Roboforex on the financial trading costs front. One disadvantage of Roboforex is that it offers very high leverage to customers. This can lead to significant losses for the customers which should be avoided altogether.

#3. Infinox Capital vs Alpari

Alpari is also a well-known brokerage platform that has been able to make its place in the market for the longest time. Alpari has been known for its legacy in forex trading however, with time the company went completely digital. The similarity between Infinfox capital and Alpari is that both offer a wide range of withdrawal and deposit methods. Moreover, the range of trading instruments is also similar between the two firms including forex, indices, commodities, and cryptocurrencies.

Another common element between the two brokers is that both offer ECN and STP account types. However, when we analyze it deeply it is clear that the overall e efficiency of Alpari is much better than Infinox Capital. In terms of experience, reliability, and affordability AlparI is a better option for traders than investors than Infinox Capital.

Conclusion: Infinox Capital Review

Infonix Capital is a multi-regulated trading platform offering reliable online trading services to customers worldwide. This is not just a forex broker but provides trading opportunities in multiple trading instruments including Forex, Indices, commodities, and cryptocurrencies. With so many trading assets, Infinox provides opportunities for customers to start trading by diversifying their portfolios to earn maximum profits and minimize potential risks.

When it comes to safety, Infinox Capital Ltd is a secure platform for potential traders and investors. For one, it is a multi-regulated firm that ensures that there is a check and balance of funds by the regulatory bodies. Moreover, Infinox is also among the few brokers that provide trading fund insurance to its customers. Another feature of negative balance protection is an added layer in the safety features along with segregated accounts in European banks.

However, with all these advantages Inifnox Capital still struggles to make its place among the best brokerage platforms. The reason for this is that the overall efficiency of the broker is not up to the mark. This includes slow customer service, complicated withdrawal structure, high commission rates, and limited trading account types. Moreover, even when the broker claims to be a platform for both novice and professional traders, there are few facilities for new traders on this platform.

Regardless of all the Pros and Cons of Infinox capital Ltd, it can be concluded that this broker is reliable as it holds licenses from various regulatory bodies and has its reach to a growing number of registered traders across the globe. Moreover, there are many features at this firm that guarantee the safety and protection of clients’ funds and data. However, Infinox Capital is not a broker to expect the best trading services and traders have to be ready for some compromises in their overall trading experience.

Infinox Capital Review FAQs

Is Infinox Capital regulated?

Yes, Infinox Capital is a multi-regulated platform which makes it a reliable broker. The firm is not regulated by one but three financial authorities including the Financial Services Conduct Authority (FSCA), Financial Services Commission (FSC) Mauritius, and Securities Commission of Bahamas (SCB).

These financial authorities keep checks and balances on the broker and make sure that the trading transition of the broker is safe and protected. Therefore, customers always look for an online brokers that are regulated to ensure the protection of data and funds.

What is Infinox Capital minimum deposit?

The minimum deposit at Infinox Capital for all account types is $1. This is the lowest minimum deposit requirement which makes it quite attractive for new traders to invest a dollar and avoid the possibility of a big investment loss. Moreover, such a low deposit fee also minimizes the overall trading cost for traders which is usually welcomed by the customers.

Does Infinox Capital charge withdrawal fees?

Another advantage of trading with InfinoxCapital is that it also doesn’t charge any commission fee on the withdrawal and deposit of funds. Just like the lowest minimum deposit of $ 1, free withdrawals and deposits are also lucrative opportunities for traders.

However, it should be kept in mind that the firm has a high commission rate on trade per lot which in a way covers all the other fees and charges that the broker earns through commission on the withdrawal of funds and initial deposits.