Contents

- What Is Implied Volatility?

- Implied Volatility Structure

- Implied Volatility On Stock Price

- Why Implied Volatility Changes

- How Implied Volatility is Calculated using Strike Price

- Implied Volatility Formula for Black-Scholes Model

- Factors That Can Affect Implied Volatility

- Market Risk When Implied Volatility Decreases or Increases

- Investing When Implied Volatility Decreases

- Considerations When Forecasting IV

- Conclusion

- FAQ

What Is Implied Volatility?

When it comes to options trading, among the important signals which a trader should monitor in order to identify the risks and opportunities in a chart would be the implied volatility to simply estimate volatility. But, exactly what is Implied Volatility and why is important to a trader?

The basic definition of Implied Volatility is the trading metric that shows how much a security's price will move up or down during a particular time or period – usually annual based. For the case of options trading, the period that is covered by the Implied Volatility applies for the life of the contract – or up until the price options contracts' expiration. It helps traders and investors determine the future of market volatility for a specific option or stock. Considering that the current market price or current market option prices are expected to rise, the implied volatility will also tend to rise, whereas if the stock price is expected to drop or fall, the implied volatility also drops.

While it is a fundamental way to measure the volatility of a certain option or stock as well as the risks involved, it is also a theoretical way of measuring historical volatility. Its movement relies on the behavior of the particular option in the market, as well as the events and actions happening around the option or the particular stock.

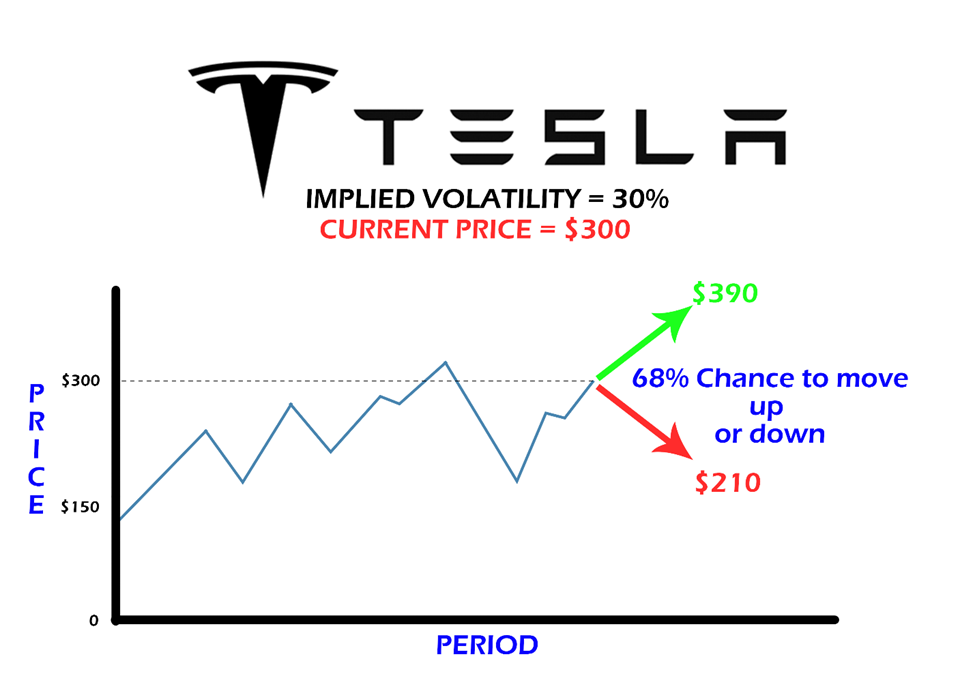

Implied Volatility Structure

As a quick illustration of how the Implied Volatility structure looks like, let’s say an IV of 30% on the Tesla stock is priced at $300. This represents 1 standard deviation range of $90 on the following year. As basic statistics say, a single standard deviation is a measurement that equates to 68% of results or outcomes. Standard deviation with regards to Implied Volatility simply means a 68% chance that the Tesla stock price would go between $390 and $210 in the next year starting today. Standard deviation is an important element to consider because it is the statistical metric for measuring the volatility of market's expectations with regard to price.

Now you can probably tell that the IV is actually not a guaranteed indicator or signal in telling which direction the price will go – all the IV does is measure the uncertainty of given price action. Whenever the future of the underlying asset or option becomes more uncertain, a considerable amount of insurance will be required toward that asset or option. In other words, the price of an option can go high if it anticipates great uncertainty in the future performance of the option or stock. This is the reason why options traders consider IV as a significant deciding factor.

Implied Volatility On Stock Price

While there are many trading platforms today that can give you the IV details of a certain option or stock, they’re usually not free or can be accessed only if you have a premium account. Nevertheless, many trading platforms offer various other ways such as scripts from other traders to determine the implied volatility of a certain option price. While the theoretical value may not be as accurate as those with IV details from paid trading platforms, the provided information can already prove useful in making sound trading decisions. Among those indicators that are closely similar to the computation of IV is Cboe Volatility Index (VIX).

For this particular example, let us use the chart of the asset – Silver. Using the Cboe Volatility Index (VIX) indicator as a reference to the Implied Volatility of the chart, we can see the relative highs and the relative lows. The relative highs and lows indicate the periods of volatility on the chart. as we can see from the chart, the relative highs were the periods when the ideal ‘sells’ would have been made. Meanwhile, the relative lows show the periods when the ideal ‘buys’ would have been made. From this example, traders can immediately assume a possible drop of the options prices after reaching the relative highs, and a specific price rise after reaching the relative lows. As an added note, the VIX can also be considered for measuring the standard deviation, or annualized standard deviation seeing that standard deviation measures market volatility.

Also Read: How To Make Money In Stocks

Why Implied Volatility Changes

It is important to note that Implied Volatility moves in certain cycles just like everything else in a chart. This means, if the price changes, the Implied Volatility will also change. The same goes with the changes in demand and supply , even occurrences of events or announcements will enable change to the Implied Volatility. The best way to take advantage of changing Implied Volatility is to incorporate it with other forecasting strategies and systems for more accurate and better trading judgment. One of which is having a mean or an average line of the volatility of the relative highs and relative lows. The mean can be identified in the chart by simply looking for the average level where most movements take place on the VIX indicator – for this particular example, the mean is around 56 to 60 but for this case, let’s go with 57.63. By establishing a ‘mean,’ a trader would be able to set boundaries or limits for the relative highs and lows. Any volatility that is found above the mean is a potential relative high, while those that are located below the mean are potential relative lows.

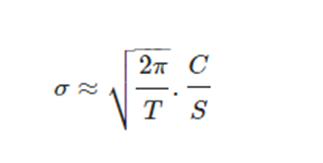

How Implied Volatility Is Calculated Using Strike Price

There are actually a few ways on how to determine the theoretical value of Implied Volatility on an underlying stock using a few considerations such as strike prices and standard deviations for a more accurate calculation. First is through an upfront formula that uses given data, and the other through models such as the Black Scholes model which uses IV in its system.

First is the upfront formula which uses given data. The initial value of Implied Volatility is computed as.

σ ≈ √{(2π/T)x(C/S)

Where:

σ – Initial Implied Volatility

T – Time of contract

C – Call price

S – Strike price

Implied Volatility Formula For Black-Scholes Model

The other formula is used for the Black-Scholes model which considers Implied Volatility as the most important element towards its system. To be able to come up with the Implied Volatility for the Black-Scholes model, this formula is used.

C = SN (d1) – N (d2) Ke -rt

Where:

C – Option Premium

S – Stock Price

K – Strike Price

r – Risk-free Rate

t – Maturity time of the stock

e – Exponential Term of the stock

Now some traders refer to the Volatility Index indicator to get an idea of the IV because VIX computations are similar to the IV formula. The only difference would be the periods wherein IV focuses on a smaller time frame.

To determine implied volatility, it requires a series of trial and error to be able to determine actual volatility points on the chart.

Factors That Can Affect Implied Volatility

Just like everything else in a chart, Implied Volatility also moves in certain cycles and changes. Among the significant contributors to the movement of Implied Volatility is supply and demand. Considering an option has a high demand, the option pricing models have a good probability to rise along with the Implied Volatility. In essence, the option pricing models can drop along with the Implied volatility when there is a lot of supply but less demand.

One more factor that affects Implied Volatility would be time value. Time value refers to the expiration date of the stock or option. If a stock has a relatively short period of time value, it equates to low Implied Volatility. On the other hand, stock or option that is long-dated would have a high Implied Volatility. The primary consideration is the time that is left before the options contract actually expires. With more time available before the expiration, price data or the pricing model can move towards favorable price levels.

Market Risk When Implied Volatility Decreases Or Increases

Another great feature of Implied Volatility is that it shows market's expectations and uncertainties in the market, and informs the trader that options involve risk. Therefore, a trader is able to assess the possible outcomes, uncertainties, or risks of a particular stock or option price. Regardless of the price would rise or fall, the changes would be anticipated through the Implied Volatility.

Implied Volatility that is high will signal a good chance of significant price swings, whereas implied volatility that is low would imply slow price movement. Having to measure the implied volatility of an option can also enable a trader to weigh the sentiment of the market seeing that IV also represents the level of risk or uncertainty on the chart.

Investing When Implied Volatility Decreases

While it definitely seems like when the volatility is down the drain, there are not many opportunities left however it is actually a great time to make investment decisions. With the market expectation decreasing along with the demand for the stock or option, the implied volatility will also go down with it. This is actually an ideal time to make investments for the reason that options with low IV result in much cheaper or lower prices.

Considerations When Forecasting IV

To have a better IV forecast, or more implied volatility assumptions, it is important to bear in mind these considerations before you begin trading options.

The first consideration is to know whether an IV is too high or too low. As IV goes higher, the more expensive the premiums become. On the other hand, if implied volatility drops or goes at a low level it is expected to bounce back to its mean.

For option's price with high IV, know that there is always an explanation for this – usually through the news. This is especially useful when trading options having high IV right before significant events such as earnings announcement events, acquisition rumors, approvals, mergers, and many others.

A good approach to high IV options is usually to sell. As option prices incur high IV, the current pricing model also becomes high therefore causing much less interest from potential buyers or traders. Among the strategies which traders consider for such cases include short sells, short straddles, naked puts, and covered calls.

Also, a good approach to low IV option prices or option pricing model would be to buy. Low volatility means a low price range which is fairly attractive to buy and less attractive to sell for traders.

Lastly, IV forecasts can further be improved or enhanced by using indicators as well as other volatility signals such as RVI and VIX. Comparing the IV with the VIX and RVI can improve the accuracy of the entry and exit levels within a chart.

Conclusion

Implied Volatility IV plays an important role in determining the possible outcomes as well as risks on an option's price. While it is not able to provide the exact direction to where the price is going as what is mentioned in this article reviewed, it can make a good assumption as to how much the price would change.

The ideal implied volatility for entry and exit during trade will come in two options – for the upward movement and the downward movement. For upward price movement assumptions, simply refer to the peaks of the IV line for the ideal entry point for short trades, and exit point for long trades. Whereas the troughs would signal the ideal entry point for long trades and exit point for short trades. The implied volatility measures the risk as well as the uncertainties on a chart.

To take full advantage of Implied Volatility IV, it can be used with other trading strategies, other variables, and volatility metrics such as CBOE VIX or Chicago board options exchange as well as confirmation indicators such as RSI, MACD, standard deviation, and even moving averages. Regardless if you’re a beginner or a seasoned trader, you will always find using IV for your trading decisions highly essential.

Also Read: What Is Good Faith Violation?

FAQ

Why do you need Implied Volatility?

Implied volatility shows the volatility of an option through its life. Knowing the volatile levels at the rise or at the fall will help a trader to determine ideal entry and exit price points. The IV also shows market sentiment which gives a trader a perspective of the movement of other traders.

Which is better – high or low Implied Volatility?

The answer is both. Depending on the strategy or kind of trade that is being made – either short or long, both IV options can be taken advantage of. For the case when Implied Volatility increases, the market assumes that the price will make a significant price swing toward either direction. For the case of low IV, it signals slow pricing options movement.

How to know if IV is high or too low?

An easy way to determine if an IV is high or too low is to compare it with the historical volatility (HV) of the specific stock at the same period or price options contracts' expiration.

Which is better – Historical Volatility or Implied Volatility?

While implied volatility considers the current stock price and projected or future volatility of a certain stock or option, it is a good metric to use for self directed investors who are looking for a good investment strategy when aiming for volatile stocks. On the other hand, using Historical Volatility which looks back at the past stock price movements of a certain stock or option would be ideal for traders who use trading systems and strategies based on the theoretical world or on historical data. Regardless of which metric to use, high volatility means higher risk and vice-versa.