IFX Brokers Review

Forex trading has become a dynamic and challenging financial activity, attracting numerous traders globally. Selecting the right Forex broker is crucial for successful trading. The choice of a broker can significantly impact your trading experience and profitability. With a myriad of brokers available, it’s vital to choose one that aligns with your trading needs and goals.

IFX Brokers stands out in the crowded Forex market. Established in South Africa in 2018 and regulated by the FSCA (Financial Services Conduct Authority), IFX Brokers offers a comprehensive trading experience. They provide access to cryptocurrencies, metals, CFDs on indices, and commodities, catering to a diverse range of traders from over 180 countries. Their commitment to offering a variety of trading accounts, each with its own conditions, alongside high leverage and access to both mobile and desktop MetaTrader platforms, makes them a compelling choice for traders.

In our detailed review, we delve into the nuances of IFX Brokers. Our goal is to give you a thorough understanding of what makes this broker unique. From exploring the different account options to the deposit and withdrawal processes, and the commission structures, we cover all aspects. Combining expert analysis with real trader experiences, we aim to provide a balanced view that will assist you in deciding if IFX Brokers is the right choice for your Forex trading journey.

What is IFX Brokers?

IFX Brokers is an established online trading broker based in South Africa. This broker has successfully combined traditional trading values with modern technology. Known for its robust platform, IFX Brokers has gained recognition in the financial trading industry. Their services are designed to cater to a broad spectrum of clients, ranging from private individuals to institutional traders.

Benefits of Trading with IFX Brokers

Trading with IFX Brokers has been a unique experience, especially due to their extensive range of educational content. As a trader, I found their educational materials not only diverse but also highly beneficial for both beginners and experienced traders. This wealth of information has significantly enhanced my trading skills and understanding of the market dynamics.

Another notable benefit of IFX Brokers is the variety of trading tools they offer. These tools have been instrumental in refining my trading strategies, allowing for more informed and strategic decisions. The availability of these resources has made trading more efficient and effective, which is crucial in the fast-paced world of Forex trading.

IFX Brokers also offers a selection of four different account types, catering to the varied needs of traders. This flexibility has allowed me to choose an account that best suits my trading style and financial goals. Whether you are a novice or an experienced trader, the range of account options ensures that there is something for everyone.

IFX Brokers Regulation and Safety

My trading experience with IFX Brokers has given me valuable insights into their regulation and safety measures, which are crucial aspects to consider for any trader. IFX Brokers is a licensed and regulated broker, headquartered in Jeffreys Bay, South Africa, and their operations are closely monitored by the local Financial Sector Conduct Authority (FSCA). This regulation by FSCA provides a level of security and reliability that is essential in the Forex market.

One key aspect of trading with IFX Brokers is the negative balance protection on all accounts. This feature is particularly important as it safeguards traders from losing more money than they have deposited, a critical safety measure in volatile trading environments. Additionally, client funds are held separately from the broker’s capital. This segregation ensures that traders’ funds are not used for any other purpose, which is a significant trust factor in Forex trading.

Furthermore, the FSCA’s allowance for trading with high leverage is another notable aspect of IFX Brokers. However, it’s important to be aware that the FSCA does not have a compensation fund to cover the financial losses of traders. This information is crucial for understanding the risk involved in trading.

Most reassuringly, IFX Brokers employs a third-party auditor who monitors the segregation of its capital and client funds daily. This rigorous monitoring adds an extra layer of security. They also have professional liability insurance, which covers trader losses that may result from fraudulent or erroneous actions on the part of IFX Brokers. Knowing these details about IFX Brokers’ regulation and safety measures has given me the confidence to trade with them, understanding the protections and risks involved.

IFX Brokers Pros and Cons

Pros

- Multiple account types available

- MT4 and MT5 platform access

- Advanced support system

- Over 200 trading instruments

- Competitive trading spreads

Cons

- Leverage limited to 1:500

- Lack of FIX API trading

- No service for USA clients

IFX Brokers Customer Reviews

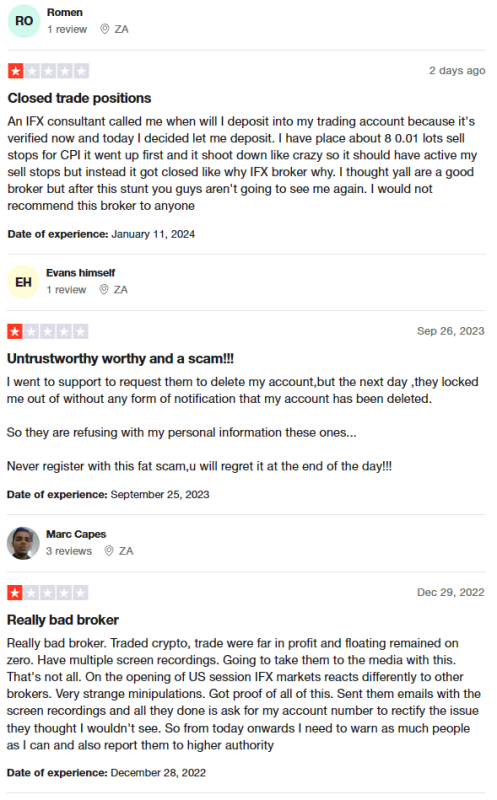

IFX Brokers currently holds a 2.1-star rating on Trustpilot, reflecting a mix of customer experiences. Several reviewers have expressed dissatisfaction with their trading experiences, citing issues such as unexpected closure of trades and challenges with account management. One customer mentioned a problematic situation where sell stops did not activate as expected, leading to a loss of trust in the broker. Another user reported difficulties in account deletion and concerns over personal information security. Additionally, there are claims of unusual market reactions and potential manipulations during specific trading sessions, with one client intending to escalate these issues to higher authorities. These reviews highlight a range of operational and customer service challenges faced by clients of IFX Brokers.

IFX Brokers Spreads, Fees, and Commissions

Trading with IFX Brokers, I’ve noticed their transparent approach to fees, spreads, and commissions, which are vital factors for any trader. The broker primarily generates revenue through spread markups on all account types. Notably, for VIP accounts, there’s an additional fee per lot, which is something traders should consider.

The spreads, which represent the cost of trading, vary depending on the instrument and the type of account. Throughout the trading day, these spreads can fluctuate. To give you a clearer picture, here are the minimum spreads for each account type: Standard and Islamic accounts have spreads starting at 1.3 pips, Premium accounts at 1 pip, VIP accounts at 0.5 pips, and Cent accounts at 1.6 pips.

An attractive aspect of trading with IFX Brokers is the absence of deposit and withdrawal fees when using electronic payment systems and crypto wallets. However, it’s important to be aware of the bank transfer fee, which is 2.5% of the transaction amount. This fee structure is a crucial element to consider for any trader calculating the overall cost of trading with IFX Brokers.

Account Types

Based on my hands-on testing, I’ve identified the following account types at IFX Brokers:.Cent Account: The Cent Account at IFX Brokers is an excellent starting point for beginners, with a minimum deposit requirement of just $10. It features floating spreads that start from 1.6 pips. One of the key advantages of this account is that there are no additional trading fees, making it an economical option for those new to Forex trading or working with smaller budgets.

Standard Account: The Standard Account is another accessible option with a minimum deposit of $10, making it suitable for both beginners and more experienced traders looking for straightforward trading conditions. This account offers spreads starting from 1.3 pips and has the benefit of no per lot trading fees. It’s a great middle ground for traders who want more favorable spreads without a high deposit requirement.

Premium Account: Designed for traders who can afford a slightly higher investment, the Premium Account requires a minimum deposit of $250. It offers more competitive spreads, starting from just 1 pip, and maintains the advantage of no additional fees. This account is ideal for more serious traders looking for tighter spreads to enhance their trading efficiency.

VIP Account: Tailored for experienced traders, the VIP Account demands a higher minimum deposit of $1,000. It stands out with its exceptionally low spreads, starting from just 0.5 pips, offering an advanced trading experience. However, there is a fee of $6 per lot, which is something traders need to consider. This account is best suited for high-volume traders who can leverage the low spreads to their advantage.

How to Open Your Account

- Go to the IFX Brokers website and click on the “Start Trading” button.

- Enter your personal information, including phone number, email address, country of residence, create a password, and select your preferred wallet currency.

- Look for an email from IFX Brokers and click the link within it to confirm your registration.

- Provide the required documents to open either a demo or a live trading account.

- Transfer funds into your new wallet to start trading.

- Choose the type of account you want to open, such as Standard, VIP, or Islamic.

- Set up your trading preferences and options in your user account.

- Download and set up either the MetaTrader 4 or MetaTrader 5 trading platform and start trading or practicing.

IFX Brokers Trading Platforms

In my experience with IFX Brokers, I’ve extensively used both their offered trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). MT4, known for its user-friendly interface, has been a reliable tool in my trading journey. It offers a range of features like advanced charting tools, a multitude of indicators, and automated trading capabilities, which have significantly enhanced my trading strategies.

MetaTrader 5, on the other hand, is a more advanced platform that caters to the needs of experienced traders. With MT5, I’ve had access to additional timeframes, more indicators, and advanced graphical tools. The platform also supports trading in stocks and commodities, providing a more comprehensive trading experience. Its ability to handle more orders simultaneously and the depth of market feature were particularly beneficial for my more complex trading activities.

What Can You Trade on IFX Brokers

During my time trading with IFX Brokers, I explored a diverse range of trading instruments that they offer. The core of their offerings is Forex trading, where I had access to a wide array of currency pairs, including major, minor, and exotic pairs. This variety allowed me to diversify my trading strategies and capitalize on different market conditions.

In addition to Forex, IFX Brokers also provides opportunities to trade in metals, indices, commodities, and cryptocurrencies. Trading in metals like gold and silver added a different dimension to my portfolio, offering a hedge against market volatility. The indices and commodities markets opened up avenues for trading on broader economic trends and specific sectors. Lastly, the addition of cryptocurrencies to their platform allowed me to venture into the dynamic and fast-paced world of digital currencies, which I found both challenging and rewarding.

IFX Brokers Customer Support

My experience with IFX Brokers’ customer support has been quite notable, primarily due to their 24/5 technical support availability. This feature is particularly important for traders like me, who operate across various time zones. The support team’s capability to communicate in an impressive range of 30 languages has significantly enhanced the effectiveness of our interactions, making it easier to resolve issues regardless of language barriers.

IFX Brokers offers multiple channels for client support, which I found to be very convenient. For quick queries, I could easily reach them by phone using the number provided on their website. For more detailed inquiries or specific issues, I had the option to use email communication or submit a ticket through my user account. This multi-channel approach to customer service ensured that I could always find a suitable way to contact them, depending on the nature and urgency of my needs. Their responsiveness and the variety of communication options available made my trading experience smoother and more efficient.

Advantages and Disadvantages of IFX Brokers Customer Support

Withdrawal Options and Fees

In my experience with IFX Brokers, I’ve found their withdrawal process to be quite straightforward, though with some specific conditions. Withdrawal requests are only processed on weekdays, which is standard for most brokers. For clients based in South Africa, transaction confirmations typically occur within 2-4 hours, making the process relatively quick. However, for traders from other countries, while the processing of requests is instant, the actual transfer of funds to a bank account can take up to 5 business days.

For larger withdrawals, specifically amounts exceeding 100,000 ZAR (around USD 5,200), it’s important to note that the funds will be received within 5 business days. This longer timeframe for significant sums is something to consider for your cash flow planning. Another key point is that IFX Brokers ensures security by withdrawing funds only to the bank account of the client who submitted the withdrawal request, which adds a layer of safety to the process.

Regarding the currency of withdrawal, it’s set to ZAR. As a trader, you should be aware of the conversion fees for currency exchange, as these are borne by the trader. This could impact your final received amount, especially if you’re operating in a different currency. This aspect of currency conversion and associated costs is an important consideration when managing your funds with IFX Brokers.

IFX Brokers Vs Other Brokers

#1. IFX Brokers vs AvaTrade

IFX Brokers is a South African-based broker offering a variety of trading instruments, with a focus on Forex and CFDs. They provide services such as high leverage and a range of account types. AvaTrade, on the other hand, is a well-established broker since 2006, headquartered in Dublin, Ireland, with a broader international presence. They offer a more extensive range of financial instruments, serving over 300,000 clients globally. AvaTrade is known for its strong regulation and presence in multiple jurisdictions.

Verdict: AvaTrade might be a better choice for traders looking for a more globally recognized broker with a wider range of financial instruments and strong regulatory backing. However, IFX Brokers could be more suited for traders in South Africa or those who prefer a broker with high leverage options.

#2. IFX Brokers vs RoboForex

IFX Brokers offers a variety of trading instruments and is known for its high leverage and diverse account types. RoboForex, established in 2009, is recognized for its vast array of over 12,000 trading options across eight asset classes. They offer a wide selection of trading platforms and have a unique offering of contests on demo accounts for traders.

Verdict: RoboForex is likely the better option for traders who seek a wide variety of trading instruments and platform choices. However, IFX Brokers could be preferable for traders focusing on Forex and CFDs with a need for high leverage.

#3. IFX Brokers vs Exness

IFX Brokers focuses on Forex and CFDs with a variety of account types and high leverage. Exness, established in 2008, is a Cyprus-based broker with a high trading volume and offers an extensive range of over 120 currency pairings, including cryptocurrencies and stocks. They are known for their low commissions and instant order execution.

Verdict: Exness stands out for traders who prioritize a wide range of currency pairs, low commissions, and instant execution. IFX Brokers, however, may appeal to traders who prefer a South African-based broker with high leverage options.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH IFX BROKERS

Conclusion: IFX Brokers Review

In conclusion, my insights and user feedback suggest that IFX Brokers is a commendable choice for traders, especially those who value a variety of trading instruments and account types. Their platform is particularly appealing to those interested in Forex and CFD trading, with the added benefit of high leverage options. The access to both MT4 and MT5 platforms also enhances the trading experience, offering robust tools for both beginners and experienced traders.

However, it’s important to approach IFX Brokers with an understanding of some noted drawbacks. The significant amount of negative feedback from clients, particularly regarding customer service and account management, cannot be overlooked. Additionally, the absence of certain trading options and limitations in customer support channels might be a concern for some traders.

Also Read: Fullerton Markets Review 2024 – Expert Trader Insights

IFX Brokers Review: FAQs

Is IFX Brokers Regulated?

Yes, IFX Brokers is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, ensuring a certain level of reliability and standards in their operations.

What Trading Platforms Does IFX Brokers Offer?

IFX Brokers offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, providing versatile tools for both beginners and experienced traders.

Can Traders from the USA Use IFX Brokers?

No, IFX Brokers does not provide services to clients from the USA, limiting its accessibility to traders in certain jurisdictions.

OPEN AN ACCOUNT NOW WITH IFX BROKERS AND GET YOUR BONUS