Position in Rating | Overall Rating | Trading Terminals |

1st  | 4.7 Overall Rating |  |

iFunds Review

Many traders who have used iFunds highlight how simple and intuitive the platform is. From registration to actual trading and payouts, the process is fast and straightforward. Users say they were able to start trading within minutes, which is ideal for those who don’t want to deal with complicated requirements.

Traders also point out that iFunds offers a wide selection of trading products. Whether it’s crypto, forex, stocks, or indices, the platform supports diverse trading strategies. The ability to manage risk through tools like leverage settings and stop-loss features has been especially helpful for both beginners and experienced traders.

Another thing users appreciate is the real-time support available through live chat. According to feedback, iFunds responds quickly to concerns and helps resolve issues efficiently. This level of support makes traders feel more confident when using the platform.

What is iFunds?

Based on trader feedback, iFunds is an instant funding proprietary trading firm (Prop Firm) that offers instant access to capital and online trading platform where traders can trade multiple financial markets, including crypto, forex, stocks, and indices. It’s designed to be user-friendly, with a quick sign-up process and a clean interface that makes trading easier, especially for those new to online investing.

Traders say iFunds stands out from other Prop firms because it eliminates all the complex rules such as evaluation phases, daily drawdown limit, consistency rules, and offer a straightforward instant funding with which traders have the same level of freedom as they do with their own live accounts. Many users also mention that the platform runs smoothly on both desktop and mobile, and they praise the speed of payout withdrawal.

iFunds Regulation and Safety

iFunds is not a broker and it doesn’t provide financial services to its clients. It’s a proprietary trading firm that offers its own capital to traders with specific conditions, and it facilitates a regulated broker platform to provide access to the market. While the platform presents itself as secure and user-focused, many users mention that it’s important to do personal research, especially since iFunds does not clearly state if it’s regulated by any major financial authority.

That said, feedback highlights that iFunds uses basic protective measures like encrypted transactions and account verification to safeguard user data. These features give some level of trust to traders, though many still recommend starting with smaller trades to test the platform.

Overall, traders say they feel comfortable using iFunds but advise others to stay cautious and aware. Regulation plays a big role in long-term trust, and without full clarity, it’s smart to monitor your funds closely.

iFunds Pros and Cons

Pros

- Commissions & Swap Fees

- Instant Funding up to $500k

- No Evaluation of Profit Target

- Payouts on Demand

Cons

- No Mobile App

- No Education

Benefits of Trading with iFunds

Traders often say that one of the biggest benefits of using iFunds is its simplicity. The platform is easy to navigate, and getting started takes just a few minutes. This is a major plus for new traders who want to avoid a complicated setup.

Another key advantage is the wide variety of assets available. Users can trade crypto, forex, stocks, and indices all in one place. Many traders appreciate not having to switch between platforms to manage different types of investments.

Lastly, traders mention the platform’s responsive support team. The live chat feature helps resolve issues quickly, making users feel supported while trading. This kind of direct help adds a layer of confidence to their overall experience with iFunds.

iFunds Customer Reviews

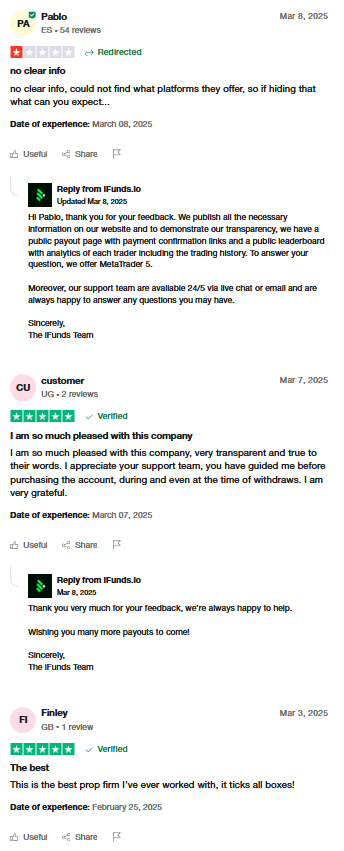

Traders who have used iFunds share mixed but generally positive reviews. Many highlight the platform’s ease of use, especially for beginners who want a quick way to enter the market. The customer support and fast withdrawal process are often mentioned as strong points.

Some users also note the wide selection of assets and trading tools as a reason they continue using iFunds. They say it’s convenient to access multiple markets without needing several accounts. The flexibility to set risk levels and use leverage is another plus for more experienced traders.

However, a few traders point out concerns about the lack of clear regulatory information. While most haven’t reported major issues, they still recommend caution and suggest starting with smaller amounts until full trust is built.

iFunds Fees and Commissions

Traders say that iFunds doesn’t charge any commissions of rollover swap fees, which makes it easier to manage costs while trading. Most users appreciate that there are no hidden charges, and that spreads are clearly shown before placing a trade.

According to trader feedback, the platform offers competitive spreads across major assets like crypto, forex, and stocks. While fees may vary depending on the asset and trading volume, many users feel the pricing is fair for the features provided.

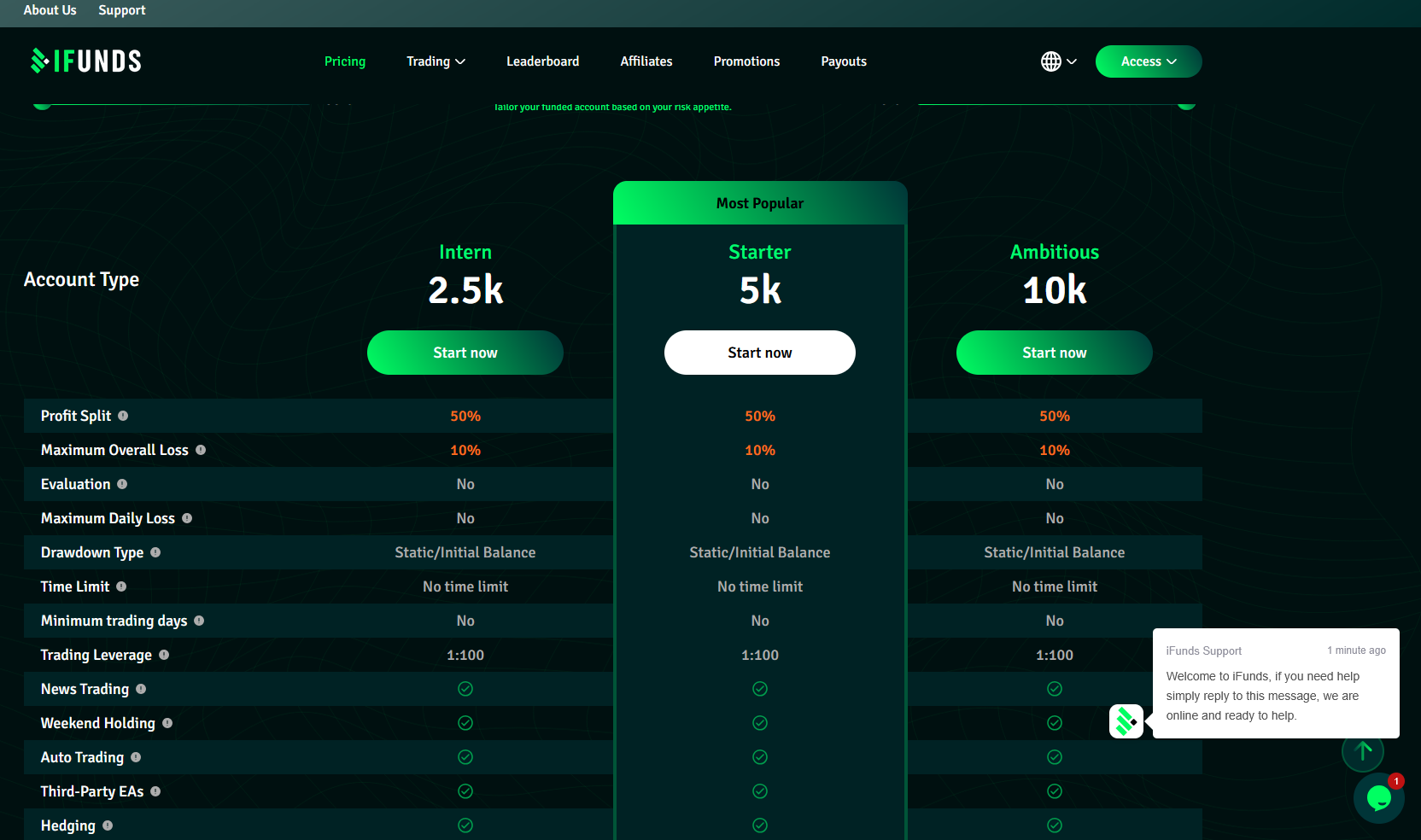

Account Types

iFunds offers different funded account sizes to cater to traders of varying experience and budget levels. The platform provides a range of options, allowing individuals to choose the right account based on their needs and risk tolerance. Moreover, a trader has the flexibility to set their own Maximum Drawdown limit between 6% to 10%, and the profit split updates accordingly, starting from 50% up to 80%.

Intern Account

The Intern account is an entry-level option offering funded account of $2500. It has no time limit or trading restrictions, allowing for flexible trading. Traders opting for this account enjoy a static balance with a leverage of 1:100.

Starter Account

The Starter account is ideal for those seeking a more balanced option, with a $5000 funded capital. Similar to the Intern account, there are no time constraints, and trading can be done at one’s own pace. The account also offers leverage of 1:100.

Ambitious Account

The Ambitious account provides higher capital to work with, offering $10,000 of iFunds own capital to trade. Like the other accounts, it comes with no time limit or minimum trading days. This account is suitable for traders who are more focused on expanding their capital with more flexible terms.

Other account types enjoy the same features and level of flexibility with different sizes varying from $25,000 to $500,000.

How to Open Your Account

Opening an account with iFunds is a straightforward process designed to help you get started quickly and easily. By following a few simple steps, you can create an account and begin managing your finances efficiently.

Step 1: Visit the Website

To begin, visit the official iFunds website. Look for the “Get Funded” button on the homepage and click on it to start the registration process.

Step 2: Provide Your Information

Fill in the necessary details, including your name, email, and password. Make sure to enter accurate information to ensure a smooth account creation.

Step 3: Verify Your Identity

For security purposes, iFunds will require you to verify your identity before requesting a withdrawal. This may include uploading identification documents and proof of address.

Step 4: Select a Payment Method

Link your preferred payment methods to your iFunds account. This will enable you to deposit and withdraw funds easily when using the platform.

Step 5: Agree to Terms and Conditions

Review and accept iFunds‘s terms and conditions to complete your account setup. Make sure you fully understand the platform’s policies before proceeding.

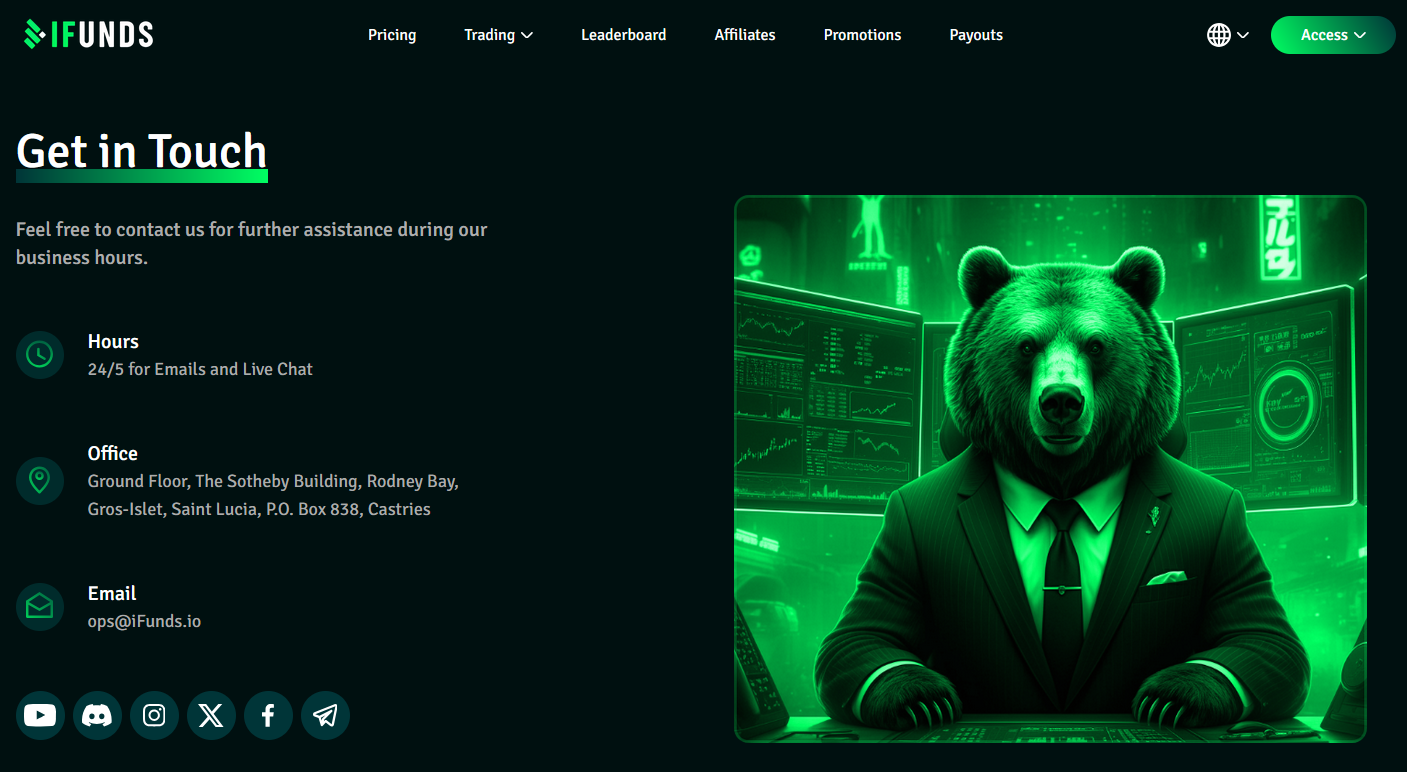

iFunds Customer Support

Traders often highlight the customer support at iFunds as a major part of their positive experience. Unlike prop firms unfortunately known for slow responses, iFunds stands out for its support responsiveness. Many users say they didn’t have to wait to be served, and that the team was always helpful and responsive. Feedback shows that fast processing of payouts and reducing the waiting time as much as possible are treated as top priority for us.

A trader shared that their queries were answered quickly, and the support is always helpful — something not always found in the prop firm space. Located at the Sotheby Building, Rodney Bay, Gros Islet, Saint Lucia, the company has shown commitment to providing the best trading experience for its clients. The team also replies directly to user feedback with phrases like “thank you very much,” “much for your feedback,” and “wishing you successful trading,” often signed with sincerely the iFunds team or marked as a reply from ifunds.io.

Overall, traders believe iFunds is a transparent and trustworthy prop firm that truly listens to its users. Whether it’s about funding programs, instant funded accounts, or just basic questions about trading rules, they’ve found that iFunds.io responds quickly and professionally. In a space filled with delays and unclear processes, iFunds continues to be a secure haven for traders and risk managers alike.

Advantages and Disadvantages of iFunds Customer Support

Withdrawal Options and Fees

When it comes to withdrawing funds from a platform, users have several options available, each with its own set of associated fees. Understanding the different withdrawal methods and their costs is crucial for users to make informed decisions about their transactions.

Bank Transfers

Bank transfers are a common method for withdrawing funds. Users can easily transfer money from their account to their bank, but fees may vary depending on the platform’s policies and the country of residence.

Cryptocurrency Withdrawals

Cryptocurrency withdrawals allow users to send funds directly to a digital wallet. This option often comes with lower fees, but transaction speeds and availability may depend on the specific cryptocurrency network.

E-Wallets

E-wallets offer a fast and convenient method for withdrawing funds. With platforms supporting popular e-wallets, users can quickly transfer money to their account, although fees may be slightly higher than other methods.

iFunds Withdrawal

For those using iFunds, the withdrawal process is streamlined for easy access to funds. Users can withdraw to their iFunds accounts directly, with fees that depend on the transaction amount and platform guidelines.

How Can Asia Forex Mentor Help You Pass iFunds’s Evaluation?

Traders who’ve gone through Asia Forex Mentor say it gave them the structure and skills needed to trade iFunds’s funded accounts. AFM’s One Core Program focuses on risk management, trading psychology, and strategy — all key areas that iFunds monitors during evaluations.

Many users mention that after applying what they learned from Asia Forex Mentor, they were able to stick to the rules set by iFunds, like drawdown limits and proper position sizing. This helped them trade with more discipline and confidence.

Overall, traders believe combining Asia Forex Mentor’s training with iFunds’s platform gives them a real edge. It prepares them not just to pass the evaluation, but to maintain consistency once funded.

GET EZEKIEL CHEW’S FREE TRAINING NOW

Our Journey at Asia Forex Mentor

Traders who joined Asia Forex Mentor often describe it as a turning point in their trading journey. Many started with little to no experience, and the structured approach helped them build a solid foundation. The lessons are practical and focused on what actually works in the market.

During the program, traders say they learned to manage risk, control emotions, and follow a clear trading system. These skills made a big difference when trading on platforms like iFunds, especially during evaluations and live trading.

Looking back, many traders feel that joining Asia Forex Mentor gave them more than just trading knowledge. It gave them the discipline and mindset needed to grow their accounts and treat trading like a real business.

Conclusion: iFunds Review

Tried many prop firms, but iFunds completely changed the game. Signed up and got access to instant funded accounts with clear trading rules and no confusing steps. The fast processing of payouts and customer support responsiveness stood out right away—no need to wait to be served, and replies came fast.

Loved the flexibility with news trading, weekend holding, and the clean scaling plan. No annoying upfront costs, just a simple one time fee to get started. Trading forex pairs and other financial markets felt smooth, and the platform felt like a real secure haven in the crowded prop firm space. Compared to other firms unfortunately that make things difficult, this one actually delivers.

Also Read: Traddoo Review – Expert Trader Insights

iFunds Review FAQs

How fast can I get funded with iFunds?

Instantly, iFunds doesn’t require passing an evaluation phase, you can get your funded account and start trading and receiving payouts from day one.

Does iFunds allow news trading and weekend holding?

Yes, both are allowed. Traders can hold positions over the weekend and trade during major news events.

Are there any hidden fees with iFunds?

No hidden fee. iFunds uses a one-time fee model, with no monthly subscriptions or surprise charges.

OPEN AN ACCOUNT NOW WITH IFUNDS AND GET YOUR BONUS