iFOREX Review

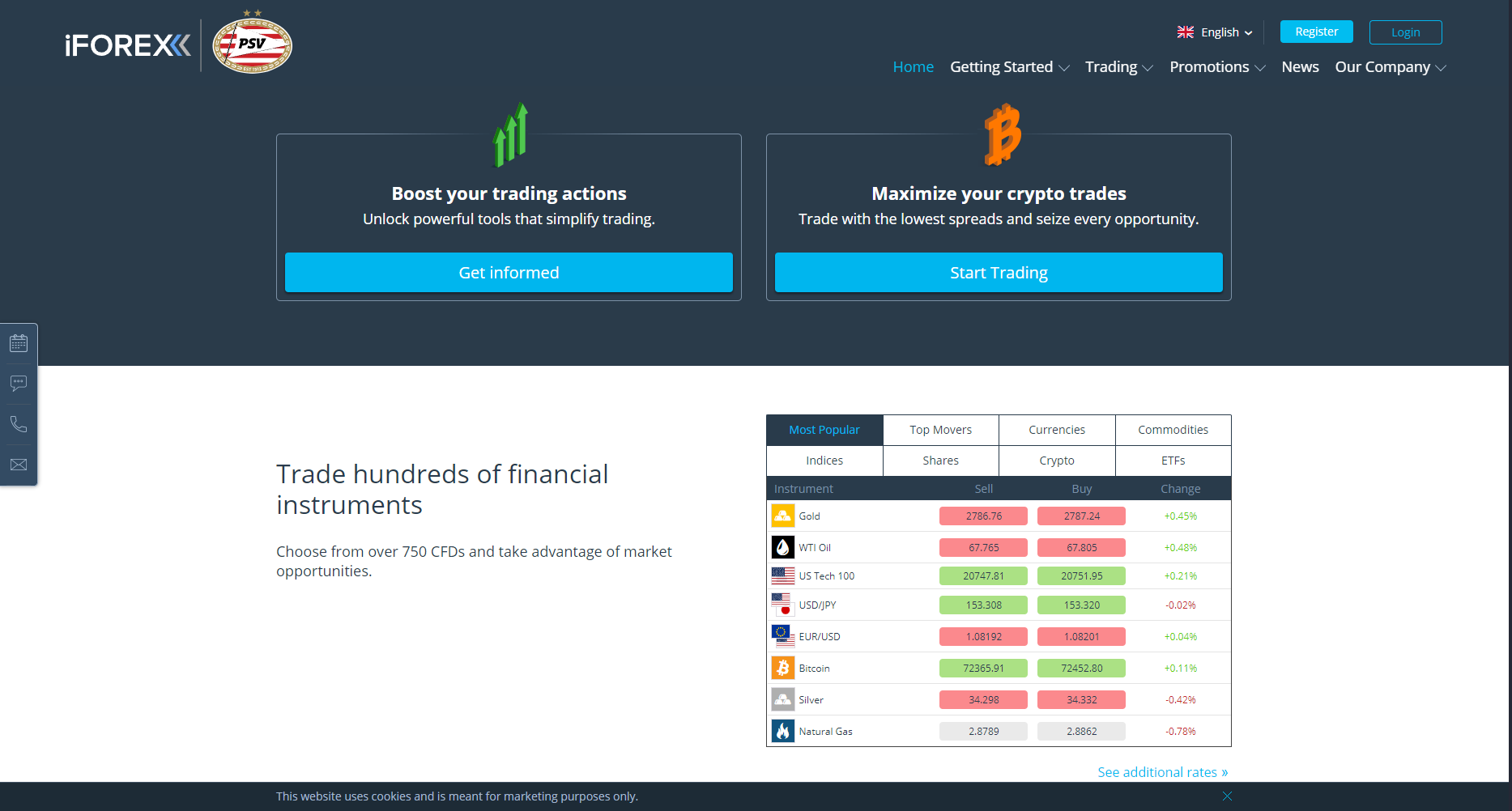

iFOREX is an online trading platform offering access to a variety of markets, including forex, commodities, indices, and cryptocurrencies. With a focus on user-friendly tools, iFOREX aims to provide a straightforward experience for both beginner and experienced traders.

The platform stands out for its educational resources and support, offering training materials and personal coaching to help users improve their trading skills. This makes iFOREX a potentially good option for those who are new to trading and looking for guidance.

iFOREX offers fixed spreads rather than variable ones, allowing traders to have a clearer view of trading costs even in volatile markets. However, some traders may find that iFOREX’s fixed spreads are higher than other brokers’ variable spreads, which can impact profitability for high-frequency traders.

What is iFOREX?

iFOREX is an online trading platform that offers access to global financial markets, including forex, commodities, indices, and cryptocurrencies. Designed for both new and seasoned traders, it provides user-friendly tools and educational resources, like personal coaching, to help clients navigate and improve their trading skills.

The platform operates with fixed spreads, giving traders predictable costs and helping them manage expenses in different market conditions. Additionally, iFOREX emphasizes security and regulatory compliance, ensuring a safe trading environment for its users.

iFOREX broker is a trademark owned by iFOREX Group, a group that owns, operates, and provides services via Formula Investment House Ltd, an investment firm licensed and supervised by the British Virgin Islands Financial Services Commission (BVI FSC). This broker is one of many brokers who on top in the stock market industry. A regulated broker like iFOREX offers classic forex trading using custom trading platform either web or mobile trading. Advanced trading tools offer free trading signals and putting it into economic calendar.

iFOREX Regulation and Safety

iFOREX operates under strict regulatory standards to provide a secure trading environment for its users. The platform is licensed and follows compliance protocols, offering transparency and meeting regulatory requirements to protect clients’ interests.

In terms of security, iFOREX uses encryption technology to safeguard users’ personal and financial information, ensuring that data is handled securely. Additionally, iFOREX provides client fund segregation, meaning users’ funds are kept separate from the company’s operational funds, adding an extra layer of protection for traders. These measures underscore iFOREX’s commitment to creating a safe and reliable trading experience.

iFOREX is using trading software for and other trading instruments. Using the advanced educational resources, this forex broker is leading traders into successful trading whether what trading style they are using.

iFOREX Pros and Cons

Pros

- Wide asset selection

- Fixed spreads for cost predictability

- Strong educational support

- User-friendly platform

Cons

- Higher fixed spreads

- Limited platform customization

- No weekend support

- Inactivity fees

Benefits of Trading with iFOREX

Trading with iFOREX offers several advantages, making it appealing for both new and experienced traders. The platform provides access to a broad range of markets, including forex, commodities, indices, and cryptocurrencies, enabling users to diversify their portfolios.

One key benefit is the platform’s educational support, which includes personal coaching and a library of training materials designed to help users improve their trading skills. This makes iFOREX particularly supportive for beginners looking to build confidence and knowledge in trading.

Additionally, iFOREX offers fixed spreads for greater cost transparency, helping traders understand expenses even during market fluctuations. Combined with a focus on regulatory compliance and security measures like data encryption and fund segregation, iFOREX delivers a reliable trading environment.

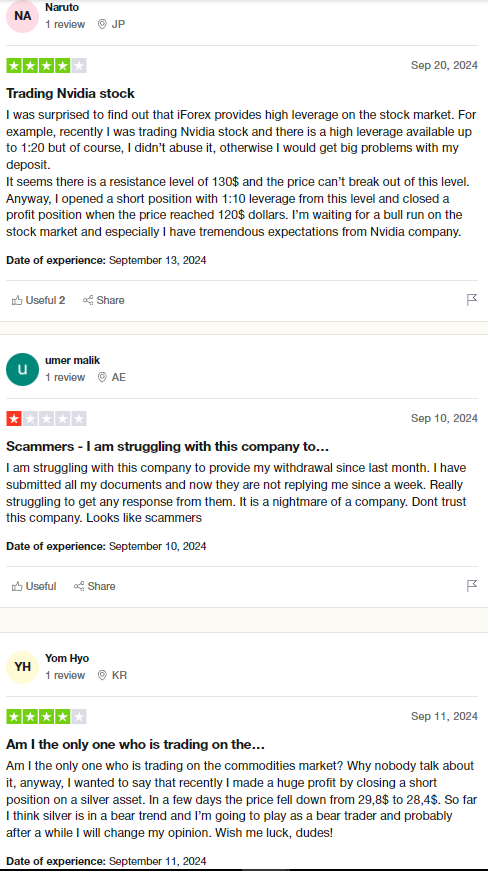

iFOREX Customer Reviews

Customer reviews for iFOREX highlight both positive experiences and areas where the platform could improve. Many users appreciate iFOREX’s educational resources and personal coaching, which help them understand trading fundamentals and develop strategies, particularly useful for beginners.

However, some users note that the fixed spreads can be higher than variable spreads offered by other brokers, which may affect profitability, especially for high-frequency traders. Additionally, while the platform provides reliable customer support, a few customers report longer wait times during peak hours.

Overall, iFOREX receives favorable feedback for its user-friendly interface and strong educational support, though some traders hope for more competitive pricing and quicker response times in customer service.

iFOREX Spreads, Fees, and Commissions

iFOREX operates with fixed spreads rather than variable spreads, meaning trading costs remain stable regardless of market conditions. This can be beneficial for traders who prefer predictable costs, as fixed spreads allow for easier expense management during volatile periods. However, fixed spreads may sometimes be higher than variable ones, which can impact profitability for high-frequency traders.

The platform does not charge additional commissions on trades, as costs are included within the spread. This fee structure keeps trading simple and transparent, especially for beginners unfamiliar with complex fee models.

iFOREX may apply additional fees for specific services, such as overnight positions or inactivity charges. These fees are standard in the industry but are important for traders to consider, particularly those with long-term or infrequent trading patterns.

Account Types

iFOREX offers several trading account types to cater to traders of different experience levels and trading goals. Each account type provides unique features, trading conditions, and access to resources, allowing users to choose an option that aligns with their needs.

Standard Account

The Standard Account is designed for beginners, providing access to essential trading tools and educational resources. With fixed spreads and no additional commissions, it’s suitable for those just starting and seeking a straightforward approach to trading.

Premium Account

The Premium Account offers tighter spreads, higher leverage, and access to more in-depth educational resources. It’s ideal for intermediate traders who are comfortable with slightly more advanced trading features and want additional support from account managers.

VIP Account

The VIP Account is tailored for high-volume and experienced traders, offering the most competitive spreads and priority customer support. VIP clients receive exclusive market insights and faster execution speeds, catering to professionals or serious traders who require top-tier features and benefits.

How to Open Your Account

Opening an account on iFOREX is straightforward, with steps designed to help new users get started efficiently. Here’s a step-by-step guide to completing registration, verification, and funding.

Step 1: Register on the Website

To begin, users should visit the iFOREX website and click on “Open Account.” They will need to provide personal details such as name, email, and phone number. After submitting this information, iFOREX sends a confirmation email to verify the registration.

Step 2: Verify Identity

For regulatory compliance, iFOREX requires identity verification. Users must upload a valid form of ID, such as a passport or driver’s license, along with proof of address, like a recent utility bill or bank statement. The verification process typically takes 1–2 business days to complete.

Step 3: Fund the Account

Once verified, users can log in and choose a preferred deposit method to fund their account. iFOREX supports various payment options, including bank transfers, credit/debit cards, and e-wallets, enabling users to begin trading as soon as the funds are processed.

Step 4: Start Trading

With a funded account, users can select assets and access the iFOREX trading platform. From there, they can explore available tools, educational resources, and market insights to begin trading according to their chosen strategies.

iFOREX Trading Platforms

iFOREX uses its own proprietary trading platform rather than popular third-party options like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). The iFOREX platform is tailored specifically to the needs of its users, focusing on accessibility and user-friendly functionality. Available as a web-based version and mobile app, this proprietary platform includes essential trading tools, integrated educational resources, and one-click trading for ease of use.

The iFOREX platform includes integrated trading tools like charts, technical indicators, and real-time market data, enabling users to make informed decisions. While it may lack some advanced customization options found in platforms like MetaTrader, iFOREX’s intuitive design and accessible features make it straightforward for users focused on efficient trading.

Additionally, iFOREX supports one-click trading and offers access to its educational resources directly through the platform. This integration helps new traders quickly get accustomed to trading basics without switching between platforms for tutorials and market insights.

What Can You Trade on iFOREX

iFOREX offers a diverse range of trading options, enabling clients to explore various financial markets and diversify their investments. The available assets include forex, commodities, indices, and cryptocurrencies, catering to different trading strategies and risk preferences.

Forex

Forex trading is a core feature on iFOREX, with major, minor, and exotic currency pairs available. This market operates 24/5, allowing traders to capitalize on global currency movements in real time, making it appealing to those interested in short- and long-term trading opportunities.

Commodities

iFOREX provides access to popular commodities like gold, oil, and silver, which allow traders to hedge against inflation or market downturns. Commodities are often seen as safe-haven assets and can be a valuable addition for traders looking to diversify.

Indices

Indices trading on iFOREX includes major global indices such as the S&P 500, FTSE 100, and DAX. This asset type enables traders to speculate on the performance of a basket of stocks, offering broad market exposure without focusing on individual companies.

Cryptocurrencies

For traders interested in digital assets, iFOREX offers cryptocurrencies, including popular options like Bitcoin and Ethereum. These assets trade 24/7 and are known for their volatility, which can present high-risk, high-reward opportunities for experienced traders.

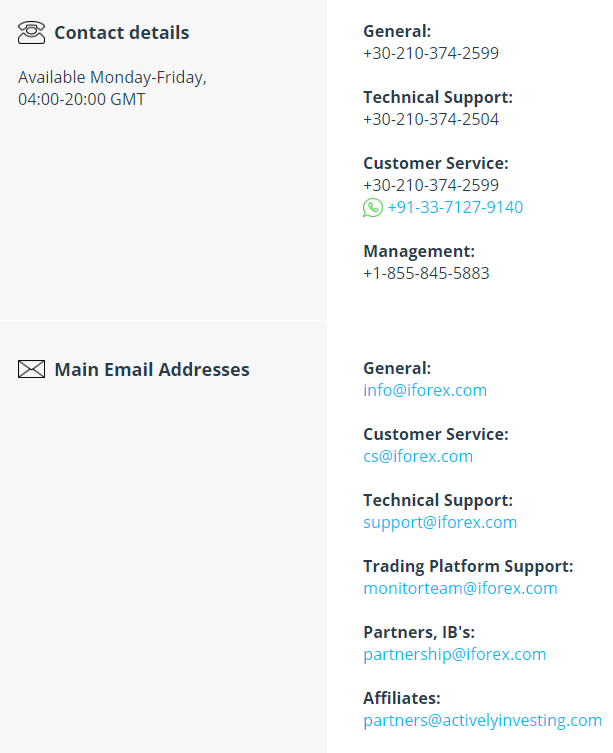

iFOREX Customer Support

iFOREX provides comprehensive customer support designed to assist traders with various needs, from account inquiries to technical assistance. Support is available 24/5, covering the full trading week, and can be accessed through live chat, email, and phone, ensuring users have multiple ways to get help.

Many users appreciate the prompt response times through live chat, though some report delays during high-traffic hours, especially over the phone. iFOREX also offers personal coaching as part of its educational services, which includes support from dedicated account managers to guide new traders. This focus on accessible, personalized support makes iFOREX particularly user-friendly for beginners looking for hands-on assistance.

Advantages and Disadvantages of iFOREX Customer Support

Withdrawal Options and Fees

iFOREX provides a variety of withdrawal options to ensure clients have convenient access to their funds. Each method comes with specific processing times and potential fees, allowing users to select the most suitable choice based on their needs. Here’s an overview of the available withdrawal options and what to expect with each.

Bank Transfer

Bank transfers are a secure and widely used method to withdraw funds directly to a user’s bank account. Though this option provides high security, it typically involves higher fees and may take 3–5 business days to process, depending on the bank’s location and policies.

Credit/Debit Card

iFOREX allows withdrawals back to the credit or debit card used for the initial deposit. Processing times for card withdrawals are generally faster, taking around 1–3 business days, but fees may vary depending on the bank’s policies or regional restrictions.

E-Wallets

For quicker access to funds, users can opt for e-wallets like Skrill or Neteller. E-wallet withdrawals are typically processed within 24 hours, often with lower fees than bank transfers, making them a popular choice for those seeking speed and affordability.

Cryptocurrency

iFOREX supports cryptocurrency withdrawals for users who prefer digital assets. This method is usually fast, with processing times of around 1–2 hours depending on network congestion, though users may incur additional wallet transaction fees based on the chosen cryptocurrency.

iFOREX Vs Other Brokers

#1. iFOREX vs AvaTrade

iFOREX and AvaTrade both offer a variety of assets, including forex, commodities, indices, and cryptocurrencies, as well as robust educational resources. iFOREX uses a proprietary platform focused on simplicity and ease for beginners, which includes fixed spreads for predictable trading costs. AvaTrade, however, provides both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), known for advanced features and customizability, alongside options like AvaOptions and social trading tools for diverse trading strategies. AvaTrade also operates under a wider range of regulatory jurisdictions globally, which may appeal to users seeking additional regulatory oversight.

Verdict: iFOREX is suitable for those prioritizing a straightforward, user-friendly platform with fixed spreads, ideal for beginners. AvaTrade offers more sophisticated trading options and platforms, appealing to experienced traders seeking advanced tools and enhanced regulatory coverage.

#2. iFOREX vs RoboForex

iFOREX and RoboForex both offer access to multiple markets, including forex, commodities, indices, and cryptocurrencies, but they target slightly different audiences. iFOREX focuses on simplicity with a proprietary platform, fixed spreads, and educational support, making it accessible for beginners who value predictability and straightforward costs. RoboForex, on the other hand, caters to more advanced traders with a wide variety of account types, including ECN and cent accounts, high leverage options, and compatibility with popular platforms like MetaTrader 4, MetaTrader 5, and cTrader. RoboForex also provides additional features like cashback programs, bonuses, and copy trading, which may attract higher-volume and experienced traders seeking flexibility and additional perks.

Verdict: iFOREX suits traders who prefer a simpler platform with fixed costs and educational support, ideal for beginners. RoboForex, with its range of accounts, advanced platforms, and added incentives, is better suited for experienced traders seeking more trading flexibility and benefits.

#3. iFOREX vs Exness

iFOREX and Exness each provide access to major asset classes like forex, commodities, indices, and cryptocurrencies, but they cater to different trading needs. iFOREX focuses on simplicity with its proprietary platform and fixed spreads, making it accessible for beginners who prefer predictable costs and a user-friendly interface. Exness, on the other hand, offers advanced features such as extremely low spreads, high leverage options, and rapid withdrawals, all of which are particularly appealing to experienced traders. Exness also provides popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), offering greater flexibility and customization for those with more sophisticated trading strategies.

Verdict: iFOREX is well-suited for beginners or traders who value fixed costs and simplicity in a proprietary platform. Exness, with its low spreads, high leverage, and advanced platform options, caters to experienced traders looking for cost efficiency and flexible trading tools.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: iFOREX Review

iFOREX is a well-rounded platform that aims to make trading accessible for users of all experience levels. With a proprietary trading platform, a wide range of assets, and fixed spreads, it provides a straightforward, predictable trading experience. Its strong focus on educational resources and personal coaching makes it ideal for beginners, while features like one-click trading enhance usability.

The platform’s commitment to regulatory compliance and security measures adds a layer of trust, though the fixed spreads may be less competitive for high-frequency traders. Overall, iFOREX stands out for its user-friendly approach and support, making it a viable option for traders seeking an accessible and secure trading environment.

This market analysis is a perspective view of the reviewer according to the details written in forex broker’s information. The review intention is to give advice and it always depend on the trader’s trading execution, trading journey, and gathering some investment advice on how successful the trader will be.

iFOREX Review: FAQs

Is iFOREX regulated?

Yes, iFOREX operates under regulatory standards, with a focus on compliance and security measures to ensure a safe trading environment.

What assets can I trade on iFOREX?

iFOREX offers a range of assets, including forex, commodities, indices, and cryptocurrencies, providing users with multiple markets for diversification.

Does iFOREX charge commissions?

iFOREX does not charge additional commissions on trades; instead, it operates with fixed spreads, which are factored into the trading costs.

OPEN AN ACCOUNT NOW WITH IFOREX AND GET YOUR BONUS