IC Markets Review

The financial markets are filled with opportunities, and with the right broker, you can take advantage of those opportunities to make huge profits. That’s why we’re here to review IC Markets — a broker that offers trading solutions for professional traders and investors. From their advanced technology to competitive pricing, IC Markets has everything that traders with different expertise levels need for success in the markets.

IC Markets is not only regulated by the Cyprus Securities and Exchange Commission (CySEC) but also by the Australian Securities and Investments Commission (ASIC) and the Seychelles Financial Supervisory Authority (FSA). From a variety of trading instruments, including forex and CFDs, to options trading and a range of commodities, IC Markets has developed an intuitive platform with advanced tools that allow algorithmic traders to benefit from their trading strategies.

In this detailed review of IC Markets, we will dive deep into this reliable broker’s features and services. We will discuss their trading instruments, customer service, account types, fees, deposits & withdrawals, and other important aspects. By the end of this review, traders will have a better understanding of what IC Markets has to offer and how they can use these services to meet their trading needs.

So, let’s get started!

What is IC Markets?

IC Markets is a forex broker founded in 2007. The broker provides access to several instruments, including Forex, trading CFDs on indices, metals, stocks, bonds, futures, 60 currency pairs, and more. The company is based in Cyprus and licensed by the Cyprus Securities and Exchange Commission (CySEC). IC Markets is also registered with the Australian Securities and Investments Commission (ASIC) and the Seychelles Financial Supervisory Authority (FSA).

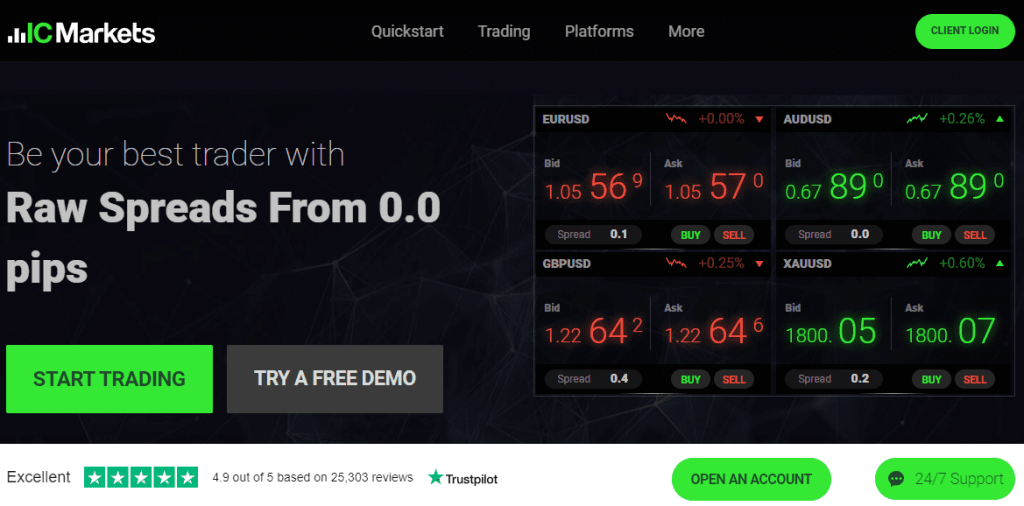

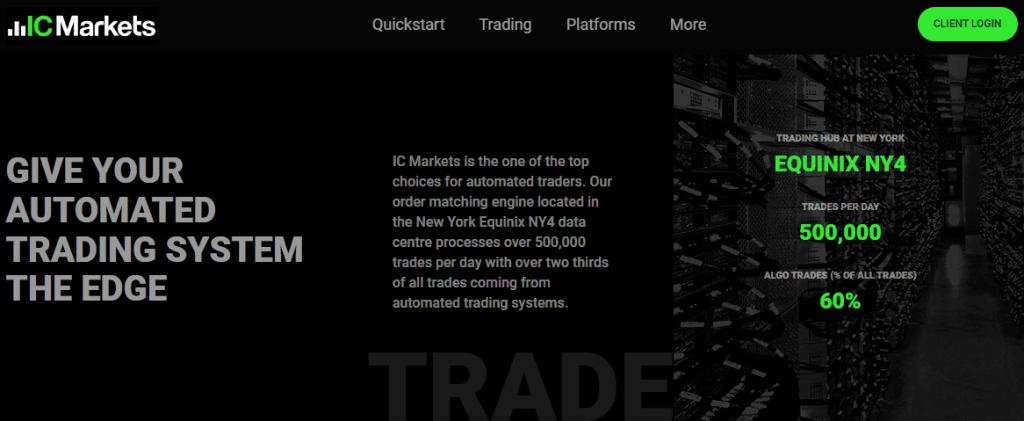

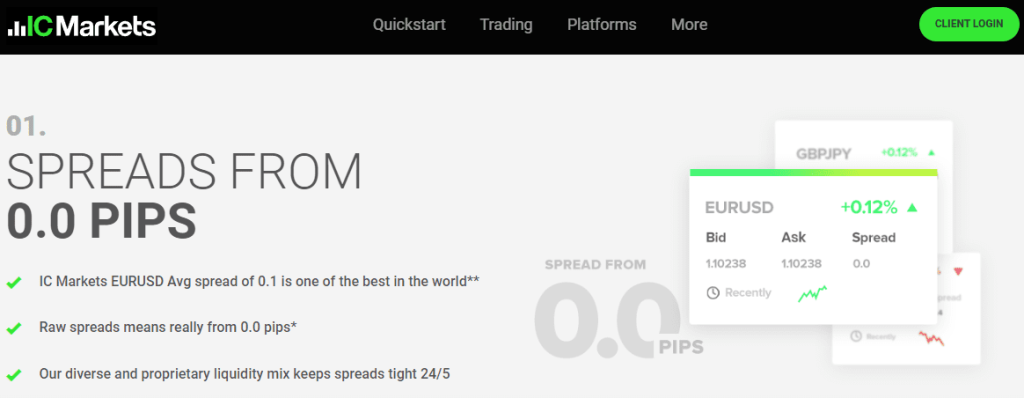

IC Markets offers an ECN trading environment with some of the tightest spreads in the industry, starting at 0.0 pips. They have over 50 banks and dark pool liquidity sources across 60 forex pairs with excellent liquidity and order fills. This broker is an excellent option for algorithmic traders because of its excellent latency and ultra-low trading fees.

IC Markets falls short of its competitors in research and education, though it more than makes up for it in supported third-party tools and plugins. It also offers a wide range of payment options and impressive customer support. With excellent features, IC Markets is sure to be a great choice for any trader. Whether you are new to trading or an experienced investor, IC Markets offers something for all traders.

Advantages and Disadvantages of Trading with IC Markets

Trading with IC Markets has many advantages, but there are some drawbacks as well. We have listed the most important ones below.

Benefits of Trading with IC Markets

IC Markets is a company that provides some of the best working conditions for scalpers. For example, the broker has some of the quickest order executions in the world, and being able to use advisers is a significant benefit for traders who prefer intraday trading. Besides, IC Markets provides traders excellent customer support, a wide variety of trading isntruments and options, and many more advantageous features.

If we talk about the trading servers of IC Markets, they are located in LD5 (London) and NY4 (New York). For its maintenance, the highest quality standards are used. As a result, order execution speed increases, and the delay level is minimized due to the servers connected to price providers via a fiber optic line. Besides that, IC Markets also offers different protection mechanisms to ensure that traders trade with a reliable broker.

IC Markets strives to set itself apart by continuously utilizing modern technologies to improve the quality of its customer service and provide more favorable trading conditions. For example, IC Market traders can use the tools to find the market depth, different spread indicators, and the risk calculator. All these features make trading with IC Markets easier and more profitable for experienced traders.

Another good feature of this broker is its one-click trading system that helps traders to place orders quickly and easily. This is a feature that will be beneficial for both beginners and experienced traders alike. Moreover, concluding transactions is quite easy, and credit goes to its technology that sends and organizes orders directly to the price providers.

Overall, IC Markets is great for traders of all levels — from beginners to experienced investors. With its advantageous features, great customer service, and reliable trading platforms, IC Markets will surely provide the best possible trading experience.

IC Markets Pros and Cons

IC Markets come with their own set of pros and cons depending on what a trader is looking for:

Pros

- Wide range of instruments to trade (up to 60 forex pairs, CFDs on indices, stocks, metals, etc.)

- Low spreads start from 0.0 pips.

- High-technology servers and latency

- Excellent customer service with multilingual support

- Comprehensive third-party tools and plugins

- Various payment options and no fee for withdrawals and deposits

- No manipulations, limiters, and requotes

Cons

- US clients are not welcomed

- The minimum deposit fee is a bit high

- Trading proposals and conditions differ depending on the regulating authority.

Analysis of the Main Features of IC Markets

4.2 Overall Rating |

4.4 Execution of Orders |

4.2 Investment Instruments |

4.0 Withdrawal Speed |

4.6 Customer Support |

4.0 Variety of Instruments |

4.0 Trading Platform |

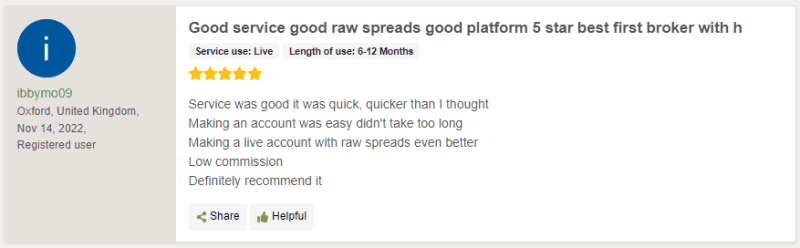

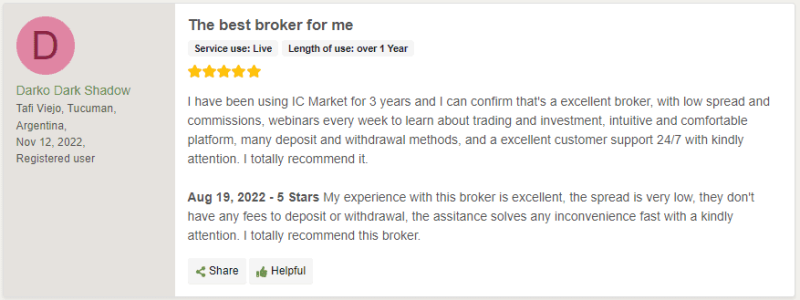

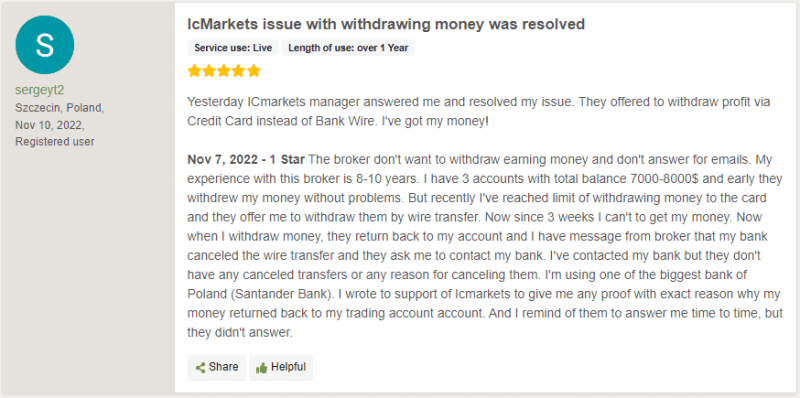

IC Markets Customer Reviews

We have collected a few reviews of IC Markets from different sources and conclude that majority of the traders are happy with their decision to use IC Markets. They are satisfied with the order execution, fast withdrawals, high-security level, and many more advantageous features.

In general, reviews strongly suggest that IC Markets is a great choice for traders of all levels. The broker provides comprehensive services and a wide range of financial instruments that can be used to make market profits.

The only drawback we noticed is the delay of payments in some cases. However, it can be solved by contacting their customer support.

IC Markets Spreads, Fees, and Commissions

IC Markets Spreads

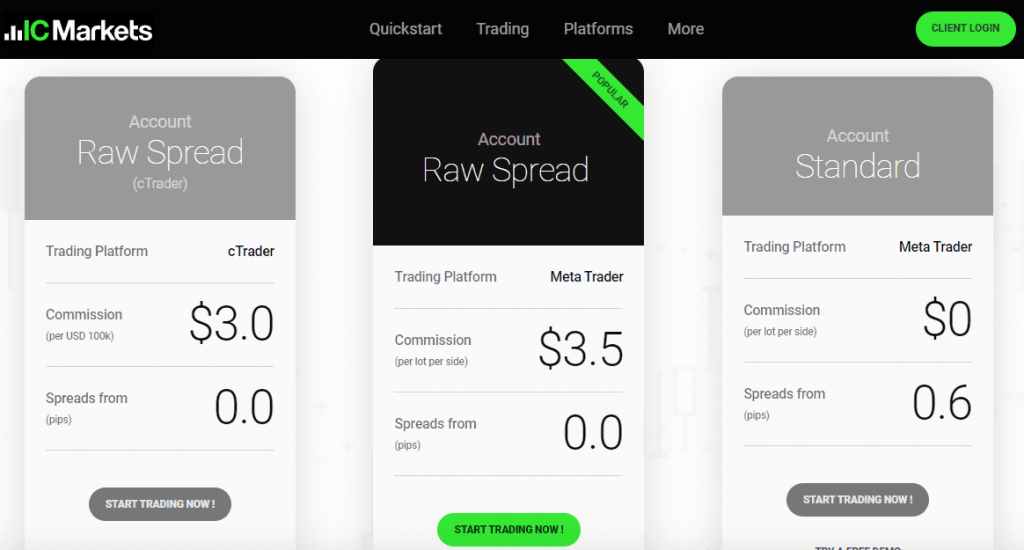

The Standard Account connects to MetaTrader4 with a cross-Connect and only charges 1.0 pips as a spread. If you’re looking for an account that allows micro lot trading from 0.01 size, deep institutional grade liquidity, ECN spreads starting at 0 pips, and a commission of 3.50$ per 100k traded, then look no further than the True ECN account or Raw Account available through MT4.

The cTrader ECN account is similar to the MT4 but with a few notable differences. The main difference is that cTrader is mainly used by professional traders who trade large amounts. Another difference is the applicable spread, which starts at 0 pips, and the commission of 3$ per 100k traded. Finally, the Execution on cTrader happens through Equinix LD5.

IC Markets Fee

Our experts have checked the fees and commissions charged by IC Markets and found them quite competitive.

Under the IC Markets commission structure, a “trading commission” is applied when withdrawing funds from a broker, and a “non-trading commission” is an additional fee. The suggested commissions for ECN accounts – cTrader and Raw Spread – are $3 and $3.5, respectively. While for the standard account, the fee is $0.

Minimum Deposit Fee

IC Markets does not demand a high initial deposit. You can open an account with just $200 and get started. This is quite a small fee compared to the minimum requirements of many other brokers, making IC Markets a great choice for beginners and experienced traders alike.

Overnight Fee

The IC Markets overnight fee is based on the differential in interest rates between the two currencies involved and whether you are buying or selling. Therefore, the fees can vary depending on which currency you’re using, but it’s important to be aware of them so that you can be reassured when they show up in your account balance. However, there is no inactivity fee charged by IC Markets.

Withdrawal Fee

IC Markets doesn’t charge any additional fee for withdrawals and deposits. However, you should check with your bank to ensure they don’t charge any associated fees before withdrawing.

IC Markets Commission

There is no commission on the Standard type of account. The company only charges a fee for international withdrawal transactions, which is approximately 20 AUD.

IC Markets Leverage

IC Markets offers leverage to its users, and the amount you get is based on the entity you trade. Leverage opens up the forex trading market to people who wouldn’t normally have access because it requires a quite low or small initial deposit to cover margins. However, leverage can greatly enhance your losses if not used correctly, so remember that losses can exceed your initial deposit when utilizing this service.

The leverage of IC Markets is as follows:

- For Australian clients: 1:30

- For European traders: 1:30

- For international proposal: 1:500

How IC Markets Fees Compare to other Brokers

Account Types

IC Markets offers a wide range of trading accounts, from the popular MetaTrader 4 and cTrader to FIX API. You will benefit from different spreads, commissions, and fees depending on your account type. The most popular account type is the Standard Account, which offers tight spreads and no commissions.

Below are the 3 types of accounts that traders can choose depending on their needs:

Raw Spread (cTrader)

A commission of $3 is charged for each trade over $100,000. Spread indicators are some of the lowest in the market i-e 0 pips. With over 50 suppliers, traders can create a liquid pool and get low spreads during periods of volatility. This account is ideal for active traders and scalpers as it offers the most cost-effective trading conditions.

Raw Spread (Minimum Spread)

The average spread for the EUR/USD currency pair is 0.1 pips, and the commission charged is 3.5 US dollars per 1 lot used. This account would be ideal for scalpers as well as users of advisers because trading takes place on МetaТrader 4 and 5 platforms.

Standard (MetaTrader 4 and MetaTrader 5)

The average spread for the EUR/USD is one pip, and there are no commissions or fees. This account type is perfect for trust trading as well as users of advisers. It is also suitable for beginner traders as it offers an intuitive and user-friendly interface.

Demo Account

Both MT4 and cTrader offer risk-free demo accounts so that traders can practice their strategies before committing any capital. This is a great way to get started with the broker. Various accounts are also accessible in numerous global currencies, up to 10. These account’s funds are completely segregated from the company too. If you’re a trader that follows Sharia rules, don’t worry! IC Markets has you covered with their Swap free or Islamic account option.

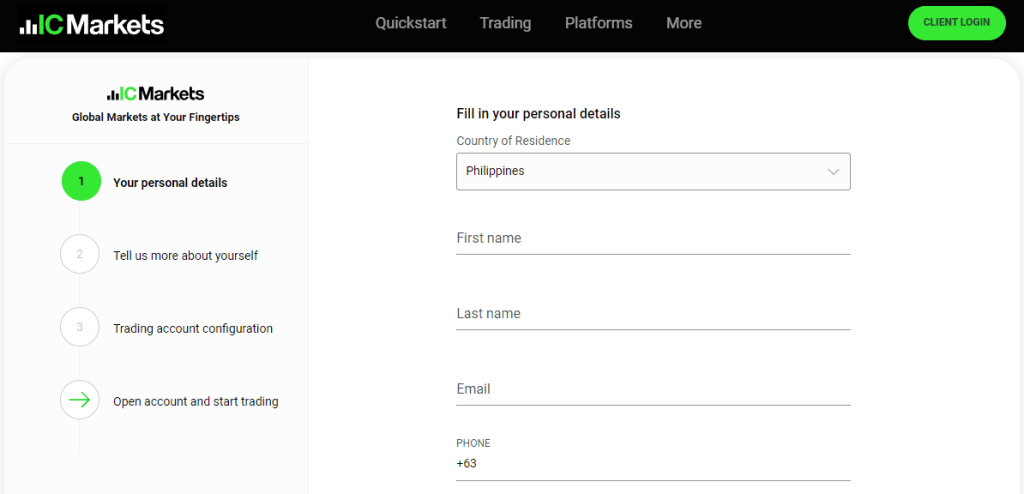

How To Open Your Account?

Here is a step-by-step guide to open an account on IC Markets:

- Go to IC Markets and click “Open an Account” or “Start Trading.”

- Complete your application form and add all your personal details, including country, first and last name, email, and number and click next

- Now click on the type of account you want to create (individual, corporate, or joint) or create an Islamic account.

- Add your Address and date of birth and click on next again.

- In the next window, choose between MetaTrader 4, MetaTrader 5, and cTrader, and your base currency pair.

- Choose your security question and read the terms and conditions before clicking on submit.

After the accounts team approves your online application form, you will receive an email containing your trading account login details and password. With this, you can access your trading account and start trading.

What Can You Trade on IC Markets?

There are around 2250 tradable instruments available for trade with IC Markets through its Australian, Cyprus, and Seychelles-based entities. Below are the main instruments that are available:

- Forex: Traders can trade 60+ currency pairs (major and minor) with tight spreads as low as 0.0 pips.

- Indices: IC Markets offers CFDs on 23 stock indices, including the US30, S&P 500, and Hang Seng.

- Commodities: You can trade CFDs across agriculture, metals, and energy, predicting the USD against various commodities. Over 19 commodities can be traded as both spot and futures CFDs.

- Stocks: Trade up to 120 major stocks on this broker. However, it is only available through the MetaTrader 5 (MT5) trading platform.

- Cryptocurrencies: CFD traders can place bets on whether 18 crypto pairs, like Bitcoin and Ethereum, will increase or decrease in value. If you’re looking to trade cryptocurrency, consider using Eightcap–they offer 250 cryptos.

- Bonds: IC Markets provides CFDs on equity and debt products from different countries, allowing traders to benefit from the bond markets.

- Futures: With no commission fees, you can trade 4+ global futures CFDs, including the ICE Dollar Index and the CBOE VIX Index. However, you must have the MT4 platform to trade futures with this CFD broker.

IC Markets Customer Support

IC markets offer customer support via Phone, Live Chat, and Email. According to several traders’ reviews, IC Markets offers great phone support, and the phone representative responds to customer queries quickly and friendly manner.

The customer support of IC Markets is available 24/7, and they also provide multilingual customer service. The staff is professional, knowledgeable, and always ready to help customers in related technical matters.

The email support department is also responsive, and they reply within a day or two.

The broker also has an online knowledge base with many answers to common questions and issues traders face. The FAQ section is quite detailed and answers most of the queries. However, the live chat support could be better and can be improved.

Overall, IC Market’s customer support is excellent and always provides quick and helpful customer assistance.

For Seychelles Raw Trading Ltd

- Email: support@icmarkets.com

- Phone no: +248 467 19 76

- Office Hours: Monday – Saturday (AEDT) 07:00 – 07:00 | Sunday – Friday (GMT) 22:00 – 22:00

- Legal Address: Eden Plaza, Office 222, Eden Island, Mahe, Seychelles

For Australia International Capital Markets Pty Ltd – Head Office

- Email: support@icmarkets.com.au

- Phone no: +61 (0)2 8014 4280

- Fax: +61 (0)2 8072 2120

- Legal Address: Level 4 50 Carrington Street, Sydney NSW, 2000 AUSTRALIA

For Cyprus IC Markets (EU) Ltd

- Email: support@icmarkets.eu

- Phone no: +35725123504

- Legal Address: 141 Omonoias Avenue, The Maritime Centre, Block B, 1st floor, 3045 Limassol, Cyprus

Advantages and Disadvantages of IC Markets Customer Support

Security for Investors

A broker must have excellent risk management, several assets, as well as qualified employees to obtain a license. Also, IC Markets regularly undergoes an external audit to ensure that its services remain reliable for consumers. Additionally, the broker has implemented two-factor authentication, data encryption protocols, and other security measures to keep customer funds and accounts safe.

When the broker meets all the requirements from the regulatory body, it creates reliable protection for consumers of financial products. It ensures there are regulations in place regarding consumer rights and obligations. It also helps to preserve financial assets that have a license.

IC Market is also well-known for its ultra-low latency order execution. Its 2 two Equinix data centers in NYC and London deliver exceptional results and allow traders to execute trades in a more secure and reliable way. Also, both data servers ensure minimal slippage while executing orders.

Below are a few of the advantages and disadvantages of IC Markets:

Withdrawal Options and Fees

Traders don’t have to pay a single penny for making deposits or withdrawing funds on IC Markets. Although, certain banks charge a fee of $20 for international transfers.

Withdrawals requested through the secure client before 12:00 AEST will be processed on the same day. In addition, several methods to withdraw funds from this broker include Mastercard and Visa card, Wire transfer, Paypal, Neteller, Union Pay, Rapidpay, POLI, Bitcoin Wallet, Klarna, and Vietnamese Internet Banking.

The amount of time it takes to receive the withdrawn funds varies depending on the chosen method, including:

- Credit/Debit Cards = 3 – 5 working days

- PayPal/NETELLER/Skrill = Instant

- Domestic Wire Transfer = 1 working day

However, note that the withdrawal process must be completed with the same method as your chosen deposit. For example, if you use a debit card to make your initial deposit, you will need to use that card for withdrawals. Moreover, only verified users can share requests the payments.

IC Markets’ operations department is prompt, so you won’t have to wait long for your withdrawal. If using an electronic payment system, the transaction will go through immediately; withdrawing to a bank card will take 2-5 business days. The available currencies to withdraw funds are USD, CAD, EUR, SGD, GBP, SGD, NZD, CHF, JPY, AUD, and HKD.

IC Markets Vs Other Brokers

Here is a comparison of IC markets with other top-rated brokers:

#1. IC Markets vs Avatrade

Avatrade is a leading name in the financial market because it is considered low-risk, with an average trust rate of 93 out of 99. IC Markets comparatively is regarded as a moderate risk because of its average trust score of 86 out of 99. It is because of its exceptional trust score that Avatrade’s customers have been increasing at a rapid rate.

Avatrade and IC Markets are both well-established and reliable CFD brokers. Highly understandable educational programs are also a great feature of both brokers. People who look for more comprehensive and simpler asset selection and other low-frequency traders would find it more suitable to trade through Avatrade. This is because they will be able to create a better portfolio at Avatrade, where commission-free trading is more appealing.

Whereas high-frequency traders will benefit more from IC Markets. Even though both brokers have maintained quite a trustworthy reputation, Avatrade is slightly better for emerging traders because of its proprietary mobile trading platform and minimum deposit requirement of $100, which is half of that required at IC Markets. Also, the leverage of 1:500 grants at IC Markets makes it more competitive than that at Avatrade, which is 1:30.

#2. IC Markets vs RoboForex

RoboForex is another trusted broker with a long operational history and a well-maintained reputation. In addition, RoboForex offers various account types, research tools, trading instruments, free exclusive trading signals, and powerful trading capabilities. All these features make this broker more suitable for advanced or experienced traders.

Trading through a reliable broker is necessary as everyone needs surety that their money is in good hands. No doubt, IC Markets and RoboForex are reputable brokers, but they differ in some features. For example, one of the major differences between these brokers is the available currency pairs. IC Markets provides traders approximately 61 currency pairs, while RoboForex provides 36 available currency pairs.

Moreover, RoboForex demands a minimum deposit of $10, while IC Markets requires a $200 deposit. RoboForex is better than IC Markets because of various factors, including trading assets, education, and analytics. RoboForex also offers different bonuses to its traders. At the same time, IC Markets is better for professional brokers because of its lower fees, better regulation, and high liquidity.

#3. IC Markets vs Alpari

Alpari is quite popular among traders because of its low commission rates and strong operational reputation. It is ideal for beginners as well as more experienced traders. Regulated by FSA since 1998, Alpari has always proven its reliability among the other brokers. Its reliability reflects that it is considered low-risk, with an average trust score of 67 out of 99.

IC Markets and Alpari offer their clients MetaTrader 4 (MT4) and MetaTrader (MT5) trading platforms. The major difference between both brokers is that IC Markets provides a diverse range of cryptos with relatively small spreads, while Alpari offers to fix contracts on major markets. In addition, Alpari provides various payouts and contract types available. On the other hand, IC Markets is known for giving multiple cryptocurrencies exclusively available here without any virtual wallet.

IC Markets have 2250 financial instruments for their traders, while Alpari offers only 50 financial tools. So if you are looking for a broker with more stocks, IC Markets is better for you, but if you want to go with a minimum deposit broker, Alpari has only a $1 deposit fee, while it is $200 for IC Markets.

How IC Markets Trading Options Compare against other Brokers

Conclusion: IC Markets Review

IC Markets is a trustworthy and globally recognized forex broker that provides institutional and retail traders access to the global currency exchange markets. This broker is especially popular among algorithmic traders because it offers excellent conditions for using MT4, MT5, and cTrader platforms. Traders also appreciate the low commissions charged by IC Market.

By catering to high-frequency traders, IC Markets achieves way higher trading volumes than its peers because automated trading strategies usually place more orders than manual traders. Furthermore, IC Market’s access to 3rd-party social trading services like ZuluTrade and Myfxbook has made it easier for traders to copy the strategies of experienced traders and take advantage of their expertise.

IC Markets is the one of the best broker for traders of different expertise. However, we highly recommend this broker for algorithmic traders and those willing to do social trading. With the combination of ECN and STP technologies, IC Markets offers traders a secure and fast trading environment with low spreads and commissions. The unique value proposition ensures that all traders have the best possible experience with advanced tools, great speed, and excellent support.

IC Markets Review FAQs

Is IC Markets a trusted broker?

Yes, IC Markets is a trusted broker. It boasts a long operational history and has maintained an excellent reputation among traders. The broker is regulated by the FC and holds several licenses, which helps to assure the security of traders’ funds further. Additionally, it is the most trusted broker, especially for traders who want to run automated trading strategies on cTrader platforms and Meta Trader.

Is IC Markets regulated?

Yes, IC Markets is regulated. It holds three major licenses from the Australian Securities and Investments Commission (ASIC) as well as the Cyprus Securities and Exchange Commission (CySEC) and the Seychelles Financial Supervisory Authority (FSA)’s. These licenses make it a legitimate broker and assure traders of the safety of their funds.

Is IC Markets good for beginners?

Yes, IC Markets is a one of the best trading platforms for beginners. It offers tight spreads, multiple trading instruments, and educational resources to help new traders get familiar with the financial markets. Additionally, it is regulated by several trusted regulatory bodies and offers various trading instruments for traders.