iBroker Review

Online brokers play a crucial role in enabling access to the global currency markets. They act as intermediaries between retail traders and the broader Forex market. Choosing the right Forex broker is fundamental because it affects your trading experience and potential profitability. The ideal broker should provide reliable trading platforms, competitive spreads, and prompt customer support.

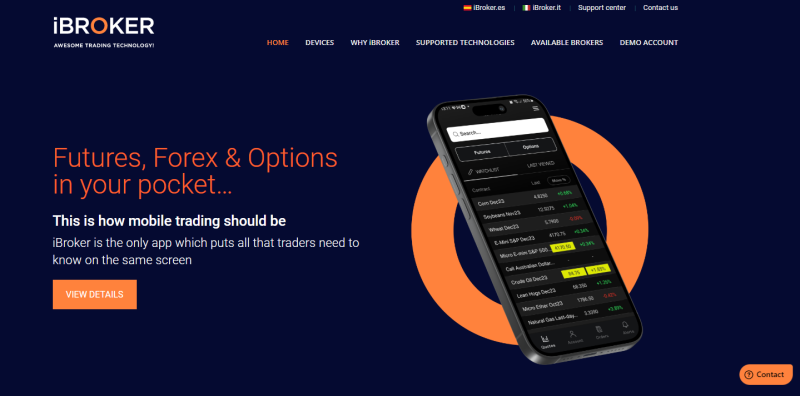

iBroker, established in 2002 and based in Spain, offers a robust online trading environment. This broker allows clients to engage in trading activities involving diverse financial instruments, such as Forex, stocks, options, and futures. iBroker stands out due to its long-standing reputation and comprehensive service offerings.

In this detailed review, we will explore iBroker in depth. We aim to highlight what makes iBroker unique while also covering potential areas of concern. Our review combines expert analysis with real trader feedback to ensure you receive a well-rounded view of iBroker. This information will guide you in determining if iBroker is the right choice for your trading needs.

What is iBroker?

iBroker is a well-established online broker headquartered in Spain. Founded in 2002, it provides a platform for trading a variety of financial instruments, including Forex, stocks, options, and futures. This diversity allows traders to expand and diversify their investment portfolios efficiently.

The broker stands out because it offers not only derivative instruments like CFDs (Contracts for Difference), but also access to underlying assets through partner platforms. This flexibility meets the needs of different trading styles and preferences, broadening its appeal to a range of traders.

iBroker is regulated by the CNMV (Comisión Nacional del Mercado de Valores), ensuring compliance with stringent financial standards and practices. Additionally, its clients’ investments are safeguarded by the FOGAIN (Fondo General de Garantía de Inversiones) fund, providing an extra layer of security. Although based in Spain, iBroker’s services are accessible to traders worldwide, making it a global player in the Forex and stock market trading industries.

Benefits of Trading with iBroker

Trading with iBroker has provided me direct access to real-time market data, which is essential for making informed decisions quickly. This timely information has allowed me to respond promptly to market movements, optimizing my trading strategies for better outcomes.

One of the primary benefits I’ve experienced is the ability to trade stocks across various international markets using iBroker’s platforms. The diverse range of available financial instruments has enabled me to explore and implement varied trading strategies, enhancing my portfolio’s potential.

Regarding trading costs, iBroker maintains transparency, which has helped me manage my trading expenses effectively. The clear structure of spreads and commissions has allowed for straightforward calculation of costs associated with each trade, aiding in more precise budgeting and cost management.

Finally, the account management features at iBroker have simplified how I oversee my investments. The user-friendly interface and the availability of personal account managers have streamlined the process, making it less time-consuming and more efficient to monitor and adjust my trading activities as needed.

iBroker Regulation and Safety

Trading with iBroker has shown that its regulatory status and safety measures are significant factors in choosing it as a broker. Regulated by the CNMV (Comisión Nacional del Mercado de Valores) since 2016, and listed under registry number 260, iBroker adheres to strict guidelines and supervisory standards set by Spain’s financial authority. Knowing the broker’s regulatory compliance is crucial for trust and security in trading.

iBroker is also registered with FOGAIN (Fondo General de Garantía de Inversiones), which offers an additional layer of protection. This fund can safeguard part of an investor’s capital up to €100,000 in the unlikely event of iBroker’s bankruptcy. This protection is a critical aspect for any trader investing significant funds in the financial markets.

Moreover, the safety of deposits at iBroker is further enhanced by the broker’s practice of holding client funds and assets in reputable financial institutions such as Saxo Bank, Altura Markets, CaixaBank, Sabadell, and Banca March. This ensures that the traders’ investments are managed with the utmost security and are separated from the company’s operating funds, offering an extra peace of mind.

iBroker Pros and Cons

Pros

- Secures investments up to €100,000 with FOGAIN.

- Enables trading on both desktop and mobile devices.

- Offers secure and easy deposit and withdrawal methods.

- Provides access to a broad array of financial instruments.

- Adheres to CNMV regulatory standards.

- Compatible with nine international brokers, including U.S.-based ones.

Cons

- Lacks MetaTrader and cTrader platforms.

- Does not offer 24-hour customer support.

- Missing popular Forex trading options like copy trading and PAMM accounts.

- Does not cover losses from trading failures.

iBroker Customer Reviews

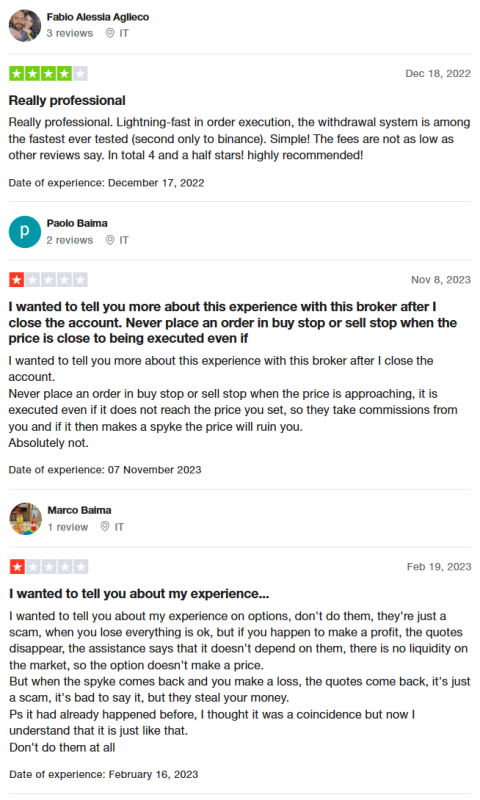

iBroker customer reviews present a mixed perspective on their services. Some users appreciate the professional nature of the platform, noting fast order execution and a quick withdrawal system, though they mention that the fees could be higher than expected. On the downside, other customers have expressed dissatisfaction, particularly with issues around order execution near set price points, suggesting that orders might execute even if the target price isn’t reached, leading to unnecessary commissions. Concerns were also raised about the reliability of option trading, with complaints about disappearing quotes during profitable trades and inadequate support explanations regarding market liquidity. This inconsistency has led some users to describe their experiences as unfavorable.

iBroker Spreads, Fees, and Commissions

At iBroker, the cost structure for trading varies across different types of assets, reflecting a mix of spreads, fees, and commissions. When I trade Forex through iBroker, I pay a spread that starts from 0.0 pips, coupled with a commission of 0.0035% of the nominal value of the secondary currency. This structure ensures competitive pricing, particularly for high-volume traders.

For CFDs on stocks and ETFs, the fees depend on the market: 0.08% of the transaction value for European and Spanish markets, 0.12% for Italy, and $1.25 per share for U.S. stocks. There are also minimum charges in place: $8 per U.S. stock order, €5 for stocks from the Ibex-35 index, and €8 for other markets. These minimums affect cost efficiency for smaller orders.

Trading CFDs on indices, energies, metals, bonds, and cryptocurrencies involves different average spreads, such as 0.554 pips for indices and 0.0003268 for cryptocurrencies. These spreads reflect the market conditions and the liquidity of the assets.

Additionally, iBroker charges a 50% additional fee for orders placed by phone, which encourages the use of electronic platforms. The first five withdrawals each month are free, after which a fee of €2 per withdrawal is applied. This fee structure is relatively user-friendly, particularly for active traders who need frequent access to their funds.

Account Types

At iBroker, I have a choice between different account types tailored to various trading needs, allowing me to participate effectively in the markets. Here’s a concise overview of the account types offered:

Real Account

- Markets: Suitable for trading Forex, CFDs, futures, and options.

- Trading Units: Offers both micro lots (1,000 units of the base currency) and standard lots (100,000 units).

- Spreads: Features variable spreads.

- Commissions: For Forex trading, a commission of 0.0035% of the nominal value is charged.

- Purpose: Ideal for traders ready to engage in live trading with real funds across multiple markets.

Demo Account

- Virtual Funds: Comes with 50,000 virtual U.S. dollars for trading practice.

- Demo Period: Available for a trial period of 14 days.

- Purpose: Perfect for beginners or experienced traders looking to test strategies or get familiar with iBroker’s trading environment without financial risk.

iBroker’s options cater to a broad range of trading activities, ensuring both novice and seasoned traders can find an account that suits their trading style and risk tolerance.

How to Open Your Account

Opening an account with iBroker is a straightforward process. Here’s how you can set up your trading account in eight simple steps:

- Visit the iBroker website to access the client portal.

- Create a user account by selecting the ‘iBroker’ option.

- On the homepage, request to open a real account.

- Choose the type of account you want to open based on your trading needs.

- Specify the assets you intend to trade.

- Complete your profile with personal and financial information.

- Sign the online agreement and upload the required documents such as proof of identity and residence.

- Once your documents are verified and your account is approved, deposit funds to start trading.

iBroker Trading Platforms

In my experience with iBroker, their approach to trading platforms is quite distinct from many other brokers. They do not utilize popular platforms like MT4, MT5, or cTrader. Instead, iBroker offers its proprietary web platform and mobile applications, ensuring a unique trading interface tailored to their system.

Additionally, iBroker integrates with a variety of other platforms such as TradingView, StoneX, S5 Mobile, CQG, dt Pro, PatSystems, AARNA iBroker, and RJO Futures Pro Mobile. They also support trading through Direct API among others. This variety allows traders to select a platform that best fits their trading style and technical needs, enhancing the overall trading experience.

This selection of platforms underlines iBroker’s commitment to providing flexible and comprehensive trading tools. Each platform offers specific features that cater to different aspects of trading, from detailed analysis to fast execution, which significantly aids in making informed trading decisions.

What Can You Trade on iBroker

iBroker offers a comprehensive range of trading options that cater to diverse investment interests and strategies. This includes Forex trading, which involves the exchange of global currencies and is popular for its high liquidity and 24-hour trading opportunities.

Traders at iBroker can also engage in trading CFDs (Contracts for Difference) on various asset classes. These include indices, providing exposure to segments of the stock market; metals such as gold and silver, which are often used as safe-haven assets; and energies, including oil and natural gas, which are crucial commodities in global markets.

Further, iBroker allows trading in stocks, appealing to those looking to invest in individual companies; and cryptocurrencies, a rapidly growing sector known for its volatility and potential high returns. They also offer ETFs (Exchange Traded Funds), which are popular for portfolio diversification; and bonds, typically favored by risk-averse investors.

Additionally, clients have access to options and futures, financial instruments that enable more complex strategies such as hedging and speculating on future prices. Securities trading rounds out their offerings, allowing investments across a broader financial landscape.

iBroker Customer Support

Based on my experience with iBroker, their customer support system is structured to ensure that both newbie and professional traders can receive help efficiently through various methods. Assistance is readily available via phone, WhatsApp, email, and online chat on their website. This variety of communication channels ensures that help is just a few clicks or a call away, catering to different preferences and urgent needs.

Moreover, after opening an account with iBroker, each client is assigned a personal manager. This personal touch is particularly beneficial as it provides direct contact with a knowledgeable individual who understands your trading history and preferences. These managers are equipped to solve relevant issues and respond to queries related to trading, which enhances the overall support experience and can significantly streamline problem resolution.

Advantages and Disadvantages of iBroker Customer Support

Withdrawal Options and Fees

When I need to withdraw funds from iBroker, the process is straightforward. Withdrawal requests are made through my user account on the iBroker website. The funds are then transferred directly to my confirmed bank account once I provide a bank statement. This ensures that the money is sent securely to an account linked to my trading profile.

iBroker does not permit withdrawals to third parties or to accounts that are not registered with my iBroker account. This policy is in place to enhance security and prevent fraudulent transactions. For the first five withdrawals each month, iBroker does not charge a commission. However, starting from the sixth withdrawal within the same month, a fee of €2 per transaction is applied.

The timing of the processing is also quite efficient. If I submit a withdrawal request before 12:00 (GMT+1), iBroker processes it on the same day. Requests made after this time are processed on the next business day. Once processed, the funds typically appear in my bank account within 1-2 business days, depending on my bank’s processing times. This quick and predictable withdrawal process helps me manage my funds effectively and plan my financial activities with confidence.

iBroker Vs Other Brokers

#1. iBroker vs AvaTrade

iBroker and AvaTrade differ significantly in their global reach and regulatory environment. AvaTrade has been operational since 2006 and offers a broad array of more than 1,250 financial instruments. It caters to over 300,000 customers worldwide and is known for its robust regulation across multiple jurisdictions including Australia, Ireland, and Japan. iBroker, while offering a solid range of financial instruments and focusing on a secure trading environment, primarily operates under the regulatory framework of Spain and offers a unique set of trading platforms tailored to its services.

Verdict: AvaTrade might be a better choice for traders looking for a more globally recognized broker with a wider range of financial instruments and stronger regulatory oversight in multiple countries.

#2. iBroker vs RoboForex

iBroker and RoboForex offer different advantages based on technology and range of options. RoboForex excels in providing a wide selection of trading platforms including MetaTrader, cTrader, and RTrader, catering to various trading preferences with over 12,000 trading options across eight asset classes. This makes it suitable for traders who value technological diversity and customization. On the other hand, iBroker focuses on providing services with its proprietary platforms and has a strong regulatory backbone in Spain.

Verdict: RoboForex may be the preferred choice for traders who prioritize a wide variety of trading platforms and a larger selection of financial instruments. Its technological flexibility and broad market access provide a competitive edge.

#3. iBroker vs Exness

iBroker and Exness target different segments of the trading market with distinct features. Exness is known for its high trading volume and offers a remarkable feature of unlimited leverage, which is quite attractive for traders looking to maximize potential on small deposits. It also boasts quick order execution and low commission structures, appealing to active traders. Exness serves a broad international audience with a strong presence in Cyprus and Seychelles. In contrast, iBroker focuses more on offering a tailored trading experience with its proprietary platforms and a strong regulatory framework within Spain.

Verdict: Exness stands out as the better option for traders who seek high leverage and value fast execution and low costs in trading. Its global presence and flexible account options cater well to both novice and experienced traders.

Also Read: AvaTrade Review 2024- Expert Trader Insights

Conclusion: iBroker Review

In conclusion, iBroker offers a reliable trading platform that is particularly well-suited for traders looking for a secure and regulated environment within Spain. Its proprietary platforms cater to those who prefer a broker with a focused and specialized toolset rather than the more common industry-standard options like MetaTrader.

iBroker’s broad range of financial instruments, including Forex, stocks, and futures, alongside its secure deposit and withdrawal processes, makes it an attractive choice for traders. The addition of personal account managers and multiple language support enhances the trading experience, ensuring personalized and accessible service.

However, potential users should be aware of the limitations, such as the lack of 24-hour customer support and the absence of popular trading platforms like MetaTrader and cTrader. These factors may affect traders who rely on these platforms or require round-the-clock assistance. Therefore, while iBroker has significant strengths, it is important for prospective clients to consider these aspects to determine if iBroker aligns well with their trading needs and preferences.

Also Read: Hankotrade Review 2024 – Expert Trader Insights

iBroker Review: FAQs

What types of trading can I do with iBroker?

You can trade a variety of financial instruments with iBroker, including Forex, CFDs, stocks, options, futures, and more, using their proprietary web and mobile platforms.

Is iBroker a regulated broker?

Yes, iBroker is regulated by the CNMV (Comisión Nacional del Mercado de Valores) in Spain, ensuring compliance with financial regulations and standards.

Are there any fees for withdrawing funds from iBroker?

The first five withdrawals each calendar month are free of charge at iBroker. Subsequent withdrawals are subject to a fee of €2 per transaction.

OPEN AN ACCOUNT NOW WITH IBROKER AND GET YOUR BONUS