HTFX Review

HTFX has gained traction in the global trading industry, providing a wide array of financial instruments like Forex, indices, commodities, and cryptocurrencies. Known for its versatile account options and user-friendly platforms, HTFX aims to serve both beginners and experienced traders alike. With regulatory oversight to ensure security and transparency, HTFX stands out as a reliable choice for those seeking a safe, structured trading environment. In this review, we’ll take a closer look at HTFX’s features, platforms, and customer support to help you determine if it aligns with your trading needs.

With this review, it’ll give some technical indicators and HTFX basic information overview as this article revolves around multiple official websites and advanced technical analysis of HTFX.

What is HTFX?

HTFX is an international trading platform offering access to a wide range of financial markets, including Forex, indices, commodities, and cryptocurrencies. Known for its flexibility, HTFX provides multiple account types that cater to various trading styles, from beginners to seasoned professionals.

The broker is regulated, giving traders added security and transparency, which is essential in today’s fast-paced trading environment. With a focus on compliance, HTFX provides a safe and structured trading experience that appeals to risk-conscious traders.

HTFX Regulation and Safety

HTFX operates under regulatory oversight, ensuring a level of security and transparency that helps protect traders’ interests. Regulation means that HTFX must follow industry standards, which include maintaining financial accountability and ethical trading practices.

For traders, this oversight provides peace of mind, knowing their funds are managed by a compliant and trustworthy broker. HTFX also keeps client funds in segregated accounts, an added measure to ensure that trader assets are protected and kept separate from the company’s operational funds.

HTFX Pros and Cons

Pros

- Regulated

- User-friendly

- Diverse assets

- Secure funds

Cons

- Limited features

- Higher fees

- Restricted tools

- No weekend support

Benefits of Trading with HTFX

HTFX trading is safe due to regulatory regulation that stresses fund safety and transparency. Traders who appreciate safety would like HTFX because this regulation protects and manages their capital. HTFX offers Forex, commodities, indices, and cryptocurrencies, allowing traders to diversify and adapt their portfolios to market opportunities.

With MetaTrader 4 and MetaTrader 5, HTFX gives traders powerful analytical, automated trading, and market monitoring capabilities. These platforms are easy to use for novices and pros, making trading easy. HTFX offers 24/7 customer support to help global traders, boosting their reliability.

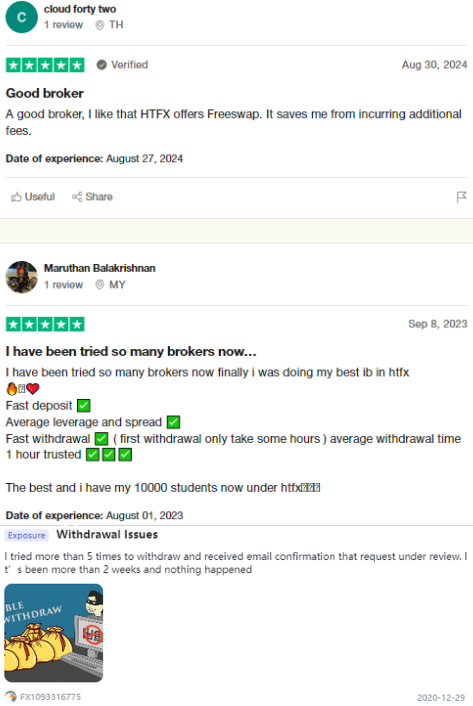

HTFX Customer Reviews

HTFX users have mixed reviews, reflecting their various experiences. Many traders appreciate HTFX’s regulatory control and fund security, which adds trust and transparency. HTFX’s regulatory compliance and fund protection are often cited as security strengths.MetaTrader 4 and MetaTrader 5 are noted for their intuitive design and powerful tools, making market analysis and trading execution easy for novices and experts.

Forex, commodities, and cryptocurrencies attract portfolio diversifiers to HTFX. Traders may find HTFX’s fees higher than other brokers, especially for smaller accounts. However, some users notice delays in customer service, which can be frustrating for those who require immediate solutions.

HTFX Spreads, Fees, and Commissions

HTFX has competitive spreads and fees, although account types and asset classes differ. Standard accounts are easier for beginners to use, whereas premium accounts benefit individuals with bigger trading volumes with narrower spreads. With its required minimum deposits, traders can open an account with maximum leverage.

HTFX imposes commissions on certain accounts, especially skilled traders seeking smaller spreads for fixed trade costs. This commission-based structure helps active traders control costs, especially in big volumes. Longer-term traders may be affected by overnight swap fees. Knowing these costs helps traders make informed decisions and control their trading expenses based on their methods.

Account Types

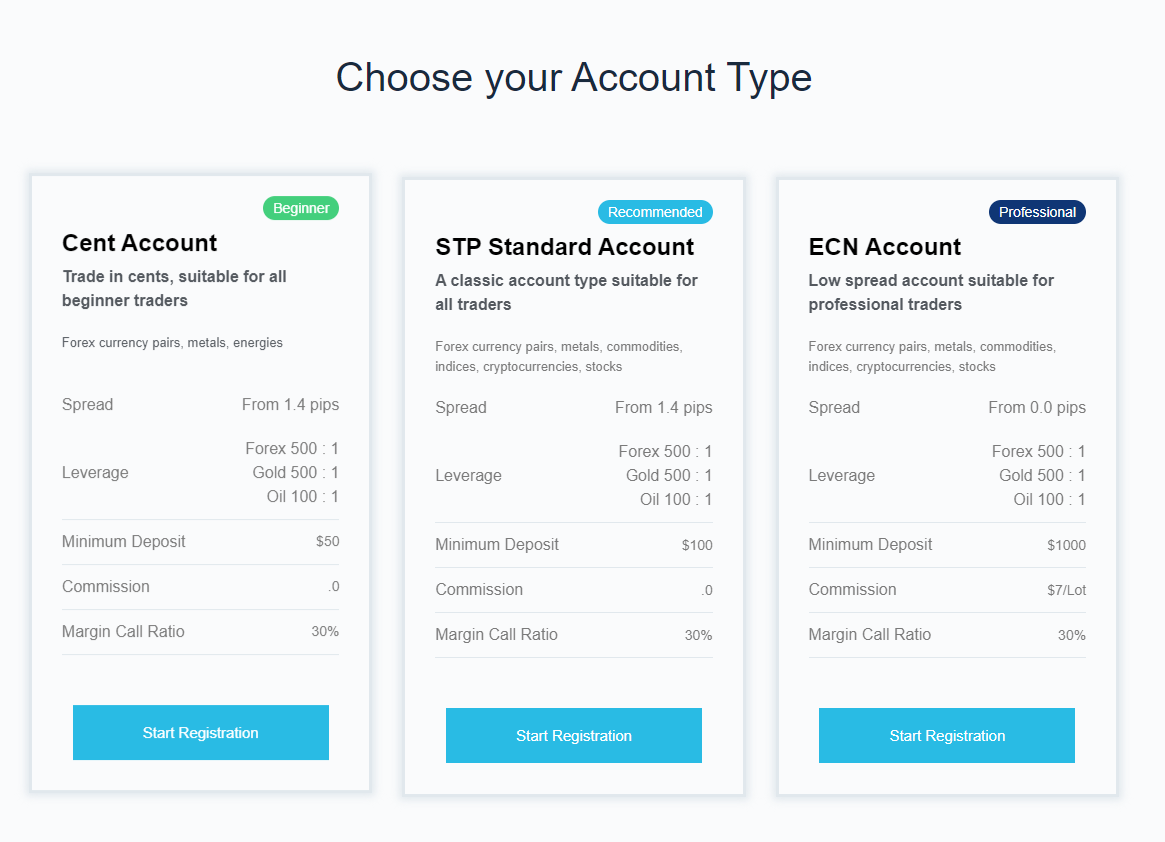

HTFX offers a variety of account types to suit traders with different experience levels, trading volumes, and strategy preferences. Each account option has unique features, spreads, and fees, allowing traders to select the account that best aligns with their goals and trading efficiency.

Standard Account

Ideal for beginners, the Standard Account provides essential trading features with wider spreads, making it accessible for those starting their trading journey and looking to trade with lower commitment.

Cent Account

Designed for intermediate traders, the Cent Account offers tighter spreads and more competitive trading conditions. This account is suitable for those with higher trading volumes who want to minimize costs.

ECN Account

The ECN Accounts are aimed at professional or high-volume traders, featuring the lowest spreads and additional perks like priority support. This account offers a premium trading experience with the most favorable terms for frequent traders.

Every account has the capability to adapt in every traders trading strategies, trading software, trading costs and financial instruments. This forex broker registered to UK Financial Conduct Authority so every account so the minimum deposit that the traders put will be safe.

How to Open Your Account

Opening an account with HTFX is a straightforward process that allows traders to get started quickly and securely. Each step guides users through registration, verification, and setting up their account for trading.

Step 1: Visit the HTFX Website

To begin, users should go to the HTFX website and navigate to the account registration page. Here, they can explore account options and familiarize themselves with the available features.

Step 2: Complete the Registration Form

Traders are required to fill out a form with basic personal details, including name, contact information, and email address. This initiates the account creation process and sets up a profile.

Step 3: Upload Identification Documents

To comply with regulatory standards, HTFX requires proof of identity and address, such as a passport or utility bill. This step is essential for security and account verification.

Step 4: Choose an Account Type

Based on their experience and trading goals, users can select from HTFX’s Standard, Pro, VIP, or Islamic accounts. Each account offers different spreads, fees, and features tailored to various trading needs.

Step 5: Fund the Account

After verification, traders can deposit funds using one of the available payment methods. Funding the account activates it, allowing users to begin trading.

Step 6: Start Trading

Once the account is funded, traders can log in, explore the HTFX platform, and access the full range of assets and tools. With the setup complete, users are ready to make their first trades.

HTFX Trading Platforms

HTFX offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5) for a variety of trading needs. For simple trading, MetaTrader 4 offers charting, indicators, and one-click trading. Its easy-to-use design appeals to newcomers while satisfying experienced traders with powerful capabilities.

MetaTrader 5 adds periods, an economic calendar, and more order types. This tool is great for traders wanting deeper analysis and strategy options. HTFX traders can monitor and handle trades in real time on desktop, web, and mobile with MT4 and MT5.

What Can You Trade on HTFX

With HTFX, traders can diversify their portfolios by accessing multiple asset types, each offering unique trading opportunities:

Forex

HTFX provides a wide range of currency pairs, including major, minor, and exotic pairs. This allows traders to participate in the global currency market, taking advantage of fluctuations in exchange rates 24/5.

Commodities

Traders can invest in commodities like gold, silver, and oil, which are often used as a hedge against inflation. Commodities trading offers a way to diversify into physical assets that can hold value during market volatility.

Indices

HTFX offers popular global indices, such as the S&P 500 and FTSE 100, enabling traders to speculate on the performance of major stock markets. Trading indices gives exposure to an entire economy’s performance without investing in individual stocks.

Cryptocurrencies

For those interested in digital assets, HTFX offers cryptocurrencies like Bitcoin and Ethereum. This option provides traders with access to the dynamic and high-risk crypto market, allowing them to benefit from price movements in leading digital currencies.

HTFX Customer Support

HTFX offers reliable customer support aimed at assisting traders with questions, technical issues, or account inquiries. The support team is available through multiple channels, including live chat, email, and phone, making it easy for users to reach out when they need help.

With 24/5 availability, HTFX’s customer support aligns with global trading hours, ensuring assistance is accessible during active trading periods. This service is especially helpful for those trading across different time zones, providing timely solutions and guidance when issues arise. HTFX prioritizes responsiveness, aiming to enhance the user experience by resolving concerns quickly and efficiently.

Advantages and Disadvantages of HTFX Customer Support

Withdrawal Options and Fees

HTFX provides several withdrawal options to meet different user preferences, each with specific benefits and processing times:

Bank Transfer

HTFX supports withdrawals via bank transfer, which is a secure and commonly used option. Although it may take a few business days to process, it is a reliable choice for those who prioritize fund security.

Credit/Debit Card

This option allows traders to withdraw funds directly to their credit or debit cards, offering faster processing times than bank transfers. It provides the convenience of quick access to funds, making it ideal for those needing immediate liquidity.

E-Wallets

HTFX supports e-wallets like Skrill and Neteller, known for their speed and ease of use. E-wallets enable faster withdrawals, appealing to traders who want quick and seamless access to their funds.

Cryptocurrency Wallet

HTFX allows cryptocurrency withdrawals to compatible wallets, perfect for traders involved in the crypto market. This option lets users transfer digital assets directly, making it convenient for those who prefer managing their holdings in crypto form.

HTFX Vs Other Brokers

#1. HTFX vs AvaTrade

HTFX andAvaTrade both cater to a global trading audience but differ in their approach and offerings. HTFX is regulated and offers the MetaTrader 4 and 5 platforms, providing traders with solid tools for Forex, indices, commodities, and cryptocurrencies. While HTFX emphasizes straightforward trading with essential features and a focus on security, AvaTrade takes it a step further with additional platform options like its proprietary AvaTradeGO app and AvaOptions for options trading. AvaTrade’s broader range includes unique assets such as bonds and ETFs, catering to traders looking for more variety. In terms of fees, both brokers offer competitive spreads, though HTFX’s structure may lean slightly higher depending on the account type. AvaTrade also provides more extensive regulatory oversight, which may appeal to traders seeking broader compliance.

Verdict: HTFX is ideal for traders focused on core trading features and platform stability with MT4 and MT5, while AvaTrade stands out for those seeking broader asset options and diverse platform tools. AvaTrade’s added variety and regulatory reach give it an edge for more diversified or cautious traders.

#2. HTFX vs RoboForex

HTFX andRoboForex offer distinct advantages that appeal to different types of traders. HTFX is regulated and focuses on core assets like Forex, indices, commodities, and cryptocurrencies through MetaTrader 4 and 5, delivering a streamlined trading experience with reliable security measures. In contrast, RoboForex provides a wider array of trading platforms, including cTrader and R Trader, which offer additional tools and flexibility for multi-asset trading. RoboForex also tends to offer lower spreads, especially on select account types, and includes options like cent accounts, making it attractive for traders with smaller capital or those testing strategies. While HTFX emphasizes security and simplicity, RoboForex brings a broader asset range, including more diverse stocks and ETFs, and offers additional trading tools for users seeking variety.

Verdict: HTFX suits traders who prioritize regulation, a straightforward trading experience, and a strong focus on essential markets, while RoboForex is a better fit for those who want lower entry costs, a broader range of assets, and more platform options. RoboForex’s flexibility and range make it appealing for traders looking to experiment and diversify.

#3. HTFX vs Exness

HTFX and Exness each bring unique features to the trading space, catering to different trader preferences. HTFX offers a regulated environment focused on core assets like Forex, commodities, indices, and cryptocurrencies through the MetaTrader 4 and 5 platforms, appealing to those who prefer a straightforward and secure trading experience. Exness, on the other hand, offers a wider selection of assets, including more exotic Forex pairs and cryptocurrencies, along with additional tools for risk management and flexible leverage options. Exness also supports a broader array of platforms, including its own web-based interface, which suits traders seeking more variety in trading tools and platform choices. In terms of costs, Exness generally offers lower spreads, particularly for high-volume accounts, while HTFX maintains competitive pricing but with fewer account types.

Verdict: HTFX is ideal for traders looking for a secure, focused trading experience on MT4 and MT5, with reliable asset choices. Exness, with its broader platform variety and lower spreads, better suits traders seeking diversified assets, enhanced tools, and greater flexibility in trading options.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: HTFX Review

In conclusion, HTFX is a solid choice for traders looking for a regulated, straightforward trading experience with essential assets like Forex, commodities, indices, and cryptocurrencies. By offering MetaTrader 4 and 5 platforms, HTFX ensures that traders at all levels have access to reliable tools for analysis and trade execution. While it may lack some of the extensive asset variety seen in other brokers, HTFX prioritizes security, competitive spreads, and responsive customer support, making it a dependable option for those who value a secure and efficient trading environment.

HTFX Review: FAQs

Is HTFX regulated?

Yes, HTFX is regulated, ensuring security and compliance to protect traders’ funds and maintain transparency.

What trading platforms are available on HTFX?

HTFX offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both known for their user-friendly interfaces and advanced trading tools.

What assets can I trade with HTFX?

Traders can access a range of assets, including Forex, commodities, indices, and cryptocurrencies, enabling portfolio diversification across major markets.

OPEN AN ACCOUNT NOW WITH HTFX AND GET YOUR BONUS