Are you ready to dive into the exciting world of silver trading? If you’ve ever wondered how to leverage the fluctuations in silver prices to your advantage, you’re in the right place. Trading silver isn’t just about buying and selling a precious metal; it’s about understanding the market dynamics, employing smart strategies, and staying ahead of economic trends. Whether you’re a seasoned trader or a beginner, mastering the art of silver trading can open up new avenues for profit and portfolio diversification.

Let’s get started by exploring the basics of silver trading. Unlike traditional investments, trading silver involves various instruments such as silver futures, options, ETFs, and CFDs. Each of these offers unique benefits and risks. For instance, silver futures contracts allow you to buy or sell silver at a predetermined price on a future date, providing a hedge against market volatility. On the other hand, trading silver ETFs can give you exposure to silver prices without the need to hold the physical metal. Understanding these instruments and how to use them effectively is crucial for anyone looking to capitalize on the opportunities in the silver market.

What is Silver Trading?

Silver trading refers to the buying and selling of silver in various forms, including physical silver, futures contracts, options, ETFs, and CFDs. This activity allows traders to capitalize on the price movements of silver without necessarily owning the physical metal.

Forms of Silver Trading:

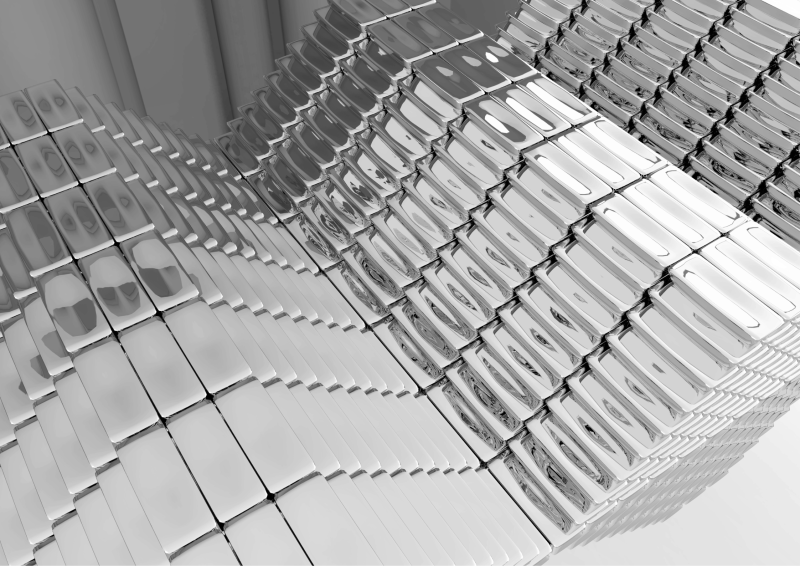

- Physical Silver: This involves purchasing silver bars, coins, or bullion. While holding physical silver can be reassuring and tangible, it requires secure storage and insurance, which can add to the cost.

- Silver Futures: A futures contract is an agreement to buy or sell silver at a specified price on a future date. Silver futures are traded on exchanges like COMEX and allow traders to leverage their positions. However, they come with the risk of margin calls if the market moves against your position.

- Silver Options: Options on silver futures give traders the right, but not the obligation, to buy or sell silver at a predetermined price before the option expires. This instrument provides leverage and can be used for hedging, but it also requires precise timing to be profitable.

- Silver ETFs: Exchange-Traded Funds (ETFs) track the price of silver and trade like stocks on an exchange. They offer exposure to silver prices without the need for physical storage. However, management fees and the performance of the fund manager can impact returns.

- CFDs (Contracts for Difference): CFDs allow traders to speculate on the price movements of silver without owning the asset. They provide the advantage of trading on margin, which can amplify both gains and losses. CFDs are accessible through many regulated brokers worldwide.

Why Trade Silver?

Silver is a highly liquid commodity with significant industrial demand, making it a valuable asset for portfolio diversification and hedging against inflation. It is used in electronics, medical equipment, and various industrial applications, which supports its demand. Additionally, silver is considered a safe-haven asset during economic uncertainty, similar to gold, but with a lower entry price, making it attractive to a broader range of investors.

There are different factors that affect silver prices:

- Supply and Demand: Like any commodity, silver prices are driven by supply and demand dynamics. High industrial demand can drive prices up, while an increase in supply from mining can put downward pressure on prices.

- Global Economy: Economic conditions and geopolitical events significantly impact silver prices. During economic downturns, silver often attracts investors looking for a safe-haven asset, thus driving up its price.

- US Dollar: Silver prices are typically quoted in US dollars. Therefore, fluctuations in the value of the USD can impact silver prices. A weaker dollar makes silver cheaper for foreign investors, increasing demand and driving up prices.

- Industrial Usage: Silver’s extensive use in various industries, including electronics and renewable energy, makes its price sensitive to changes in industrial demand. Technological advancements and new applications can significantly impact silver prices.

Steps to Trade Silver

- Open a Trading Account: Choose a reputable broker that offers a variety of silver trading instruments, such as silver futures, ETFs, and CFDs. Ensure the platform provides comprehensive tools and resources to support your trading strategy.

- Develop a Trading Strategy: Whether you prefer trend trading or range trading, having a clear strategy is crucial. Use technical analysis tools, such as moving averages and trend lines, to identify entry and exit points. Incorporate stop-loss and take-profit orders to manage risk effectively.

- Monitor Market Trends: Stay updated on the latest market news and economic indicators that affect silver prices. Regularly reviewing market trends and adjusting your strategy accordingly can help you stay ahead of price movements.

- Execute Trades: Based on your analysis, decide whether to take a long position (buy) or a short position (sell). Use leverage judiciously and ensure you have adequate margin to cover potential losses.

- Review and Adjust: Continuously monitor your trades and the overall market. Be prepared to adjust your strategy in response to changing market conditions to optimize your performance.

Also Read: Avatrade Review 2024 – From An Expert Trader

Benefits and Risks of Trading Silver

Benefits

- Diversification: Adding silver to your portfolio can reduce risk by spreading investments across different asset classes.

- Inflation Hedge: Silver often performs well during periods of high inflation, protecting the purchasing power of your assets.

- Liquidity: The silver market is highly liquid, allowing for easy entry and exit from trades.

Risks

- Volatility: Silver prices can be highly volatile, leading to significant price swings.

- Leverage Risks: Using leverage can amplify both gains and losses, requiring careful risk management.

- Market Factors: The silver market is influenced by complex factors, including industrial demand and geopolitical events, making it challenging to predict price movements accurately.

Conclusion

Trading silver can be a profitable endeavor if approached with a solid strategy and a keen understanding of market dynamics. By leveraging tools and resources available through reputable trading platforms, and by staying informed about market trends, you can enhance your trading performance and achieve your financial goals.

Also Read: Silver Price Prediction – Technical Analysis

FAQs

What are the different ways to trade silver?

You can trade silver through several methods: Physical silver, silver futures, silver options, silver ETFs, and CFDs. Each method offers unique benefits and risks. Physical silver involves owning the metal, while futures, options, and CFDs allow speculation on price movements without physical ownership. ETFs provide exposure to silver prices via stocks.

What factors influence silver prices?

Supply and demand dynamics, industrial usage, global economic conditions, and fluctuations in the US dollar value are only few of the factors that affect silver prices. Industrial demand and technological advancements can drive prices up, while increased mining supply can lower prices. Economic uncertainty often boosts silver’s appeal as a safe-haven asset.

How can I start trading silver?

pen a trading account with a reputable broker, develop a trading strategy using technical analysis, monitor market trends, and execute trades based on your analysis. Continuously review and adjust your strategy to stay ahead of market conditions and optimize your trading performance.