Copper trading has become a popular venture among traders in the commodity markets due to its significant industrial applications and market volatility. This essential metal is widely used in construction, electronics, and power generation, making it a crucial commodity. The demand for copper is significantly influenced by global economic conditions, industrial growth, and geopolitical stability, particularly in major producing countries like Chile and Peru, and consuming nations such as China.

Understanding how to trade copper effectively can help you maximize your investment potential. Various trading methods, including futures contracts, options, ETFs, and stocks of copper mining companies, offer different levels of exposure and risk. Key factors to consider when trading copper include market research, selecting a reliable broker, developing a robust trading plan, and regularly monitoring market conditions. By staying informed and employing sound trading strategies, traders can navigate the complexities of the copper market and capitalize on its volatility.

What is Copper Trading?

But first of all, what is copper trading? Copper trading involves buying and selling copper in various forms to profit from price fluctuations. This metal is crucial in industries such as construction, electronics, and power generation, making it a vital commodity. Copper can be traded through various instruments including futures contracts, options, ETFs, and stocks of copper mining companies. Each method offers different levels of risk and exposure, catering to diverse trading strategies.

Knowing the basics of copper trading requires knowledge of market trends and economic indicators that influence copper prices. Key factors include global supply and demand dynamics, geopolitical stability, and technological advancements. By leveraging these insights, traders can make informed decisions to maximize their investment potential in this volatile market.

Forms of Copper Trading

- Copper Futures Contracts: These are legally binding agreements to buy or sell copper at a specific future date and price. They are commonly used for hedging against price volatility and speculation. Traders who trade copper futures never actually handle the physical copper, as transactions are settled in cash or offset by other contracts before expiration.

- Options: These contracts give the holder the right, but not the obligation, to buy or sell copper at a predetermined price before a specified expiration date. Options are versatile tools for managing risk and leveraging positions with limited capital.

- Exchange-Traded Funds (ETFs): Copper ETFs track the price movements of copper or copper-related indexes. They can be bought and sold like stocks on an exchange, providing liquidity and diversification without directly handling the commodity. Notable ETFs include the United States Copper Index Fund (CPER) and Global X Copper Miners ETF (COPX).

- Copper Mining Stocks: Investing in shares of companies that extract and produce copper can offer exposure to copper prices. Examples include Freeport-McMoRan, Southern Copper, and Antofagasta. These copper stocks are influenced by copper prices and the operational efficiency of the companies.

- Physical Copper: This involves the direct purchase of copper in the form of bars, coins, or rounds. Physical copper investments require storage and security considerations. While not as liquid as other forms, it can serve as a tangible hedge against inflation and economic instability.

Why Trade Copper?

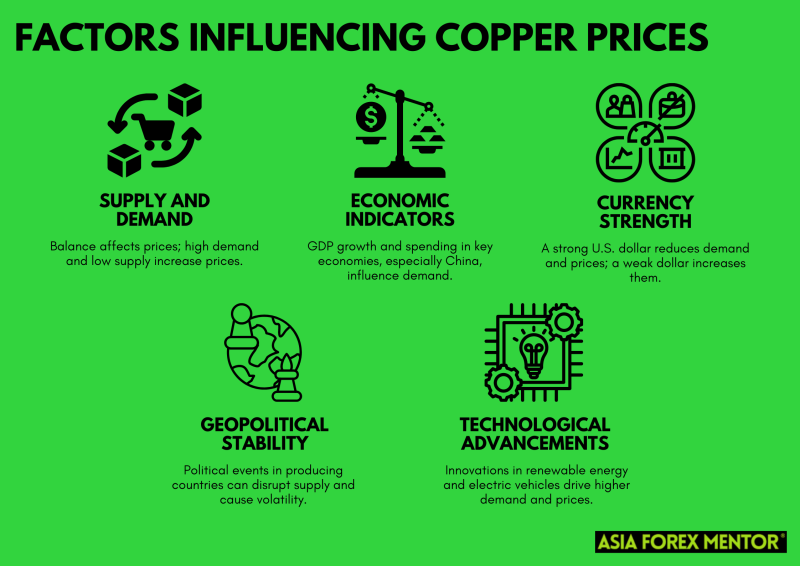

Copper is a highly versatile metal with widespread industrial uses, making it a vital commodity in the global market. Trading copper offers the potential for high returns due to its price volatility. The factors affecting copper prices include:

- Supply and Demand: The balance between global production levels and industrial demand significantly impacts price of copper. High demand and low supply typically drive prices up, while the opposite can lead to price decreases. For instance, disruptions in major copper-producing countries like Chile can lead to supply shortages, affecting prices.

- Economic Indicators: Indicators such as GDP growth, manufacturing activity, and infrastructure spending in major economies, especially China, heavily influence copper prices. Strong economic growth often leads to increased demand for copper, pushing prices higher.

- Currency Strength: Copper is traded globally in U.S. dollars, so the value of the dollar directly affects copper prices. A stronger dollar makes copper more expensive for foreign buyers, potentially reducing demand and lowering prices. Conversely, a weaker dollar can boost demand and drive prices up.

- Geopolitical Stability: Political stability in copper-producing regions is crucial. Events like strikes, government changes, or trade policies in countries like Chile and Peru can disrupt production and supply, leading to price volatility.

- Technological Advancements: Innovations in industries that use copper, such as renewable energy, electric vehicles, and electronics, can increase demand. For example, the shift towards electric vehicles, which require more copper than traditional cars, can drive significant price increases due to higher demand for the metal.

Steps to Trade Copper

- Research the Market: To trade copper successfully, you must understand market trends, copper trading strategies, economic indicators, and geopolitical events that influence copper prices. Analyze historical data, monitor current market conditions, and stay informed about industry news. For example, significant infrastructure projects or technological advancements in key economies can impact demand and prices.

- Choose a Trading Method: Decide between various trading methods such as futures, options, ETFs, stocks, or physical copper. Your choice should align with your risk tolerance, investment goals, and market outlook. Each method offers different levels of exposure and complexity.

- Select a Broker: Choose a reliable broker that offers the trading instruments you prefer. Consider factors such as trading fees, platform usability, customer service, and the range of available resources for market analysis and education. A good broker can enhance your trading experience and execution.

- Develop a Trading Plan: Outline your investment goals, risk management strategies, and entry/exit points. A solid trading plan should include your target profit margins, acceptable risk levels, and specific criteria for entering and exiting trades. This plan helps maintain discipline and focus.

- Monitor and Adjust: Regularly review market conditions and adjust your trading plan as necessary. This involves tracking price movements, staying updated on relevant news, and reassessing your strategies based on market changes. Continuous monitoring allows you to respond quickly to market shifts and optimize your investments.

Also Read: The 10 Best Forex Brokers in 2024 by Asia Forex Mentor

Benefits and Risks of Trading Copper

Benefits:

- High Liquidity: Copper markets are highly liquid, allowing for easy entry and exit from trades.

- Diversification: Adding copper to your portfolio can diversify your investments and reduce risk.

- Profit Potential: Price volatility offers significant opportunities for profit.

Risks:

- Market Volatility: High volatility can lead to substantial losses.

- Economic Dependence: Copper prices are heavily influenced by global economic conditions.

- Geopolitical Risk: Political instability in copper-producing regions can lead to sudden price changes.

Conclusion

Copper trading offers lucrative opportunities but requires thorough market understanding and careful risk management. By following a structured trading plan and staying informed about market conditions, traders can effectively navigate the complexities of copper trading.

Also Read: How to Trade Silver: A Quick Guide for Traders

FAQs

What are the best times to trade copper?

The best times to trade copper are during peak market hours when liquidity and trading volumes are highest, typically overlapping with major commodity exchanges’ operating hours.

How does the performance of the global economy affect copper prices?

The performance of the global economy directly impacts copper demand, as it is widely used in construction and manufacturing. Economic growth typically leads to higher copper prices due to increased demand.

Can individual investors trade copper, or is it only for institutional investors?

Individual investors can trade copper through various instruments like futures, ETFs, and stocks of copper mining companies, making it accessible to both individual and institutional investors.