Although short ETFs can generate huge profits, amateurs should not get involved with these risky investments. On the other hand, professional traders that plan to earn money from the value reduction of an asset class can use inverse short ETFs.

There are a several important factors to understand if planning to trade inverse ETFs.

Also Read: 3 Types of Exchange-Traded Products

Contents

- What Is an Inverse ETF?

- What Is Short Selling?

- What Is Leveraged Short Selling?

- Why Buy an Inverse ETF?

- Advantages of Inverse ETFs

- Disadvantages of Inverse ETFs

- Who Should Buy Inverse ETFs

- How to Purchase Short ETFs

- Conclusion

- FAQs

What Is an Inverse ETF?

An inverse ETF stays true to its name and is set up to perform the opposite of its target asset. When the asset's price rises, the inverse ETF's price will decline, and it works the other way. The short ETF can get created on the S&P 500 index .

When the index rises in value, the ETF declines in value. Inverse ETFs work with derivatives to generate profits from market declines.

Futures and options are the types of financial derivatives that get used to create short ETFs. They can get designed to move several times the target assets movement. However, the nature of their construction causes a decay in the value of the ETFs over time.

Usually, inverse ETFs attempt to follow the daily production of the specific asset. And keeping this type of asset over a prolonged period can combine losses. When the inverse ETF leverage is bigger, it results in a larger value decay because of the structure.

ETFs are a great option for financial innovation, thanks to the opportunity to trade them during market hours. This is an important advantage when contrasted with mutual funds.

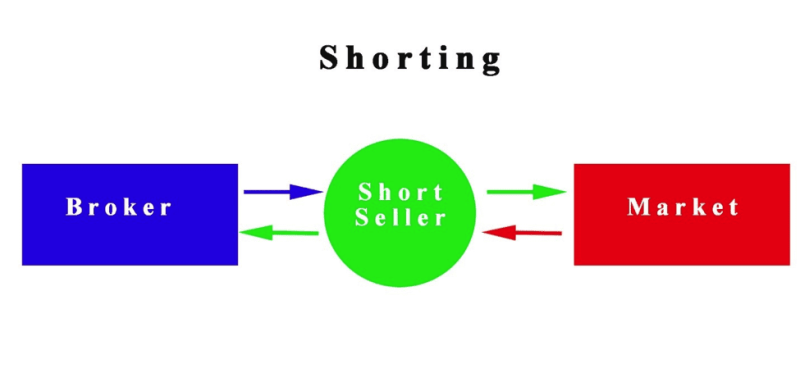

What Is Short Selling?

As an investment strategy, short selling gets implemented by investors to speculate in the stock market on a potential decline in the asset's price. With short selling, investors don't own the asset, they loan it from another party and sell it to other participants in the market.

The idea is to wait until the price goes down and buy it back at a reduced price, return it to the original borrower and earn a profit from the difference between the selling price and the buying price.

This looks great in theory, but in reality, the price may not decline, it can start rising, and in that case, the trader can find himself in a tight spot. Being forced to buy back the stock at a higher price, effectively losing money on the deal.

As a strategy short selling investing involves risk because there is no limit on potential losses, the price may rise to astronomic levels. Let's consider a hypothetical example.

You are buying the stock from a tech company at $20, and if the company goes under, you only lose the $20. But let's implement a short-selling tactic, and you buy the stock for the original price of $20, but the stock starts to gain traction on the market, and the price rises to $200.

Now the problems start because you have to spend $200 to buy the stock back and return it to the lender. And the borrower isn't gifting you the stock, you are paying a fee for renting the stock.

The most popular real-world example of the risk that comes with short selling is the case with Gamestop, when the shares jumped by 900%, forcing the short seller to abandon their positions.

What Is Leveraged Short Selling?

With leveraged short selling, investors can improve their purchasing power by using debt. These extra funds enable traders to buy futures or different financial derivatives to speculate on the bond and stock markets. The additional risk gives investors the chance to make outsized returns.

Margin trading is another name for leveraged trading. The risk is pretty obvious, if the wagers you are making with the strategy turn out to be wrong, the losses are outsized.

When the asset is in a taxable account. Traders must pay taxes on short-term capital gains. Plus, several fees get associated with short selling and margin trading.

Also Read: What is Short Selling: Profit Making Strategy?

Why Buy an Inverse ETF?

Investors implement different strategies for inverse ETFs. One option is to hedge in case of declining prices in deterrent positions. When one position goes down, the alternative is climbing in effect balancing losses.

While investors can also implement inverse ETFs to perform a directional wager on an index or security.

Investors can use leveraged ETFs, with the goal of making at minimum three times the target assets' daily move. With leveraged short ETFs, investors can increase the returns from investment returns. Fund on steroids is one way, you can picture the leveraged ETFs.

However, it's crucial to know that potential losses can be substantial. Negative news can impact financial derivatives. The financial knowledge you possess as a trader and engagement with the investment portfolio are crucial factors that need to be fully analyze.

Veteran traders begin with small moves and have a prepared exit strategy. What is crucial is to stay on the course laid out in the plan and be ready to recognize the moment when the losing position should get abandoned.

Yet inverse ETFs are not appropriate for traders of every level. Regular ETFs can provide solid returns for traders in the absence of significant risks.

Advantages of Inverse ETFs

The benefits of a regular ETF are present with inverse ETFs, elements such as reduced fees, ease of use, and tax breaks.

The advantages of inverse ETFs stem from various options to make bearish bets. But there are investors without a brokerage account that enables them to short sell assets. Trades that are in this situation can buy shares in an inverse ETF, that way they get the identical investment position that they would by shorting an index or ETF.

Inverse ETFs get perceived as a more risky option than standard ETFs and are purchased outright. Reducing the potential for losses when compared with other types of bearish bets.

It should not get forgotten that traders that are shorting an asset face potentially unlimited risk. Traders can lose more money than initially expected.

Disadvantages of Inverse ETFs

The lack of popularity of inverse ETFs is a huge risk. Investors can purchase different types of ETFs, yet there is not a large choice of inverse ETFs. Many traders have discovered that inverse ETFs possess smaller liquidity when compared with other ETFs, because of reduced demand and options.

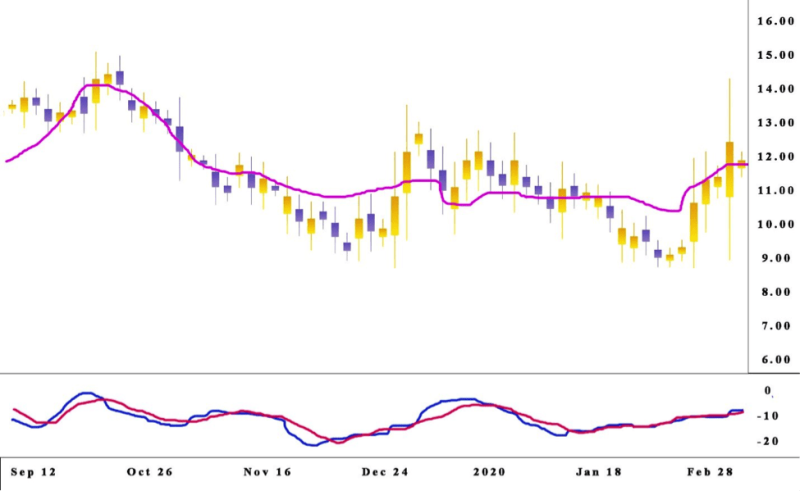

In a long timescale, big stock indexes tend to rise, and this poses a risk. Implementing a buy-and-hold strategy for inverse ETFs creates more risk. Previous experience has shown that the index will recover at some point from the losses it sustained in the previous years.

Traders have to observe the market and try to leave the position before the rally of the analogous index.

Who Should Buy Inverse ETFs

Trading inverse ETF is practical for short-term forecasting and is not recommended for long-term investment, the reason is gains reinvest more than losses.

ETFs that short the market can generate gains that are the market opposite in the short term. However, over time, the daily returns compounding can result in a disconnect.

Because of this investors need to buy inverse exchange-traded funds if they expect a large decline in the stock market very soon. It's advisable to assign a tiny segment of the portfolio to inverse ETFs because it is more difficult to time the market by looking at a previous performance.

How to Purchase Short ETFs

There are many ETF tools, and brokerage firms make them readily available for screenings. Most investors get fixated on looking at daily performance and fees for the management, and although these are crucial factors an in-depth analysis.

The criteria mentioned below can be a good launching point that will help orient you in the right direction when performing research. Some traders prefer to analyze the daily performance of short ETFs before investing their money. The important features include:

Performance of the Fund

Data gets used to getting a real impression of a situation, and when analyzing the market, inspect the daily performance of the fund. Keep in mind that a buy-and-hold strategy is not appropriate for these funds.

Trading Volume

It's always easier to purchase and sell a liquid fund. Check and see the average trading volume and how it compares to ETFs that are similar in structure.

Leveraged ETF

This metric gets identified by the letter “x.” If you observe the Direxion Daily S&P 500 Bull 3X Shares, this means it provides inverse exposure amounting to three times the S&P 500 index. When the index rises, the ETF will respond by a measure of three times. The return for the expected leveraged is for a single day, and not the total over time.

Fees and Expense Ratio

Unlike standard funds, there are bigger fees for inverse ETFs. It's important to remember that this cost can multiply, that's why it's crucial to make an adequate comparison and read the T&C.

Assets Under Management

Traders like this figure, because it provides reassurance about the assets an investor is engaging with a given ETF. Funds longevity is another important number to examine together with the AUM figures.

The Issuer of the Fund

Brands are attractive because they are powerful. It's a rule that applies to ETFs. Some traders prefer to invest solely in large asset managers. Alternatively, some look for newcomers that show potential. The best option is to select the fund that best can meet your investment objectives.

Conclusion

Although they can look promising, the bottom line inverse ETFs are not the best choice for every investor most traders should stay clear of these funds. Only in the hand of experienced investors that have a clear goal and the ability to read the market can they be a valuable market strategy.

Traders that focus on standard ETFs receive good returns by using lower-risk investments that generate decent profits.

FAQs

What is the best ETF for shorting the market?

There is no one definitive choice, what may look promising today, can offer a different perspective in a few days. Many brokers firms offer inverse and leveraged ETFs the best course of action when selecting the best ETF for shortening is to make a list of funds based on specific criteria and chose the one that looks most promising and fits with the investment objectives.

Is there a short sell ETF?

Yes, on exchanges ETFs receive the same treatment as stocks, because of this it's possible to be sold short.

Are short ETFs good?

Inverse or short ETFs can be very risky and are not the best choice for inexperienced or risk-averse traders. This concept is best for sophisticated investors that can manage the risks that are inherent to short ETFs.

How do short ETFs work?

The short exchange traded fund attempts to rise in value when the benchmark asset declines in value.