HonorFX Review

Forex trading has become a dynamic and complex field, where choosing the right Forex broker is crucial. A reliable broker not only provides access to financial markets but also ensures security, competitive trading conditions, and efficient customer support. For traders, whether novice or experienced, the broker is the gateway to the world of currency trading, making this choice a pivotal part of their trading journey.

In the landscape of Forex trading, HonorFX emerges as a noteworthy option. Founded in 2018, HonorFX is an ECN (Electronic Communication Network) and STP (Straight Through Processing) broker.

As an expert trader, I delve into the intricacies of this broker, evaluating its features, commission structure, account types, and transaction procedures. The review aims to provide a balanced view, incorporating not only my expert analysis but also real trader experiences. This synthesis of information is designed to guide you in making an informed decision about whether HonorFX aligns with your trading objectives and style.

What is HonorFX?

HonorFX is a prominent online FX broker, serving traders globally. This broker stands out by offering advanced technology for trading in international markets. It caters to a diverse range of trading needs by providing low-cost pricing across various instruments, including FX and Futures (such as commodities and indices).

A key aspect of HonorFX is its commitment to high-quality service and premium options for Forex traders. The broker’s approach is tailored to align with the values and needs of its clients, which has been a significant factor in its success and growth. Established in 2017, HonorFX has rapidly developed a reputation for delivering exceptional online trading solutions to a wide spectrum of traders and investors worldwide.

HonorFX distinguishes itself by offering access to over 275 financial instruments with the option of leverage. It specializes in currency trading (Forex) and CFDs (Contracts for Difference), catering to a variety of trading styles and strategies. Importantly, HonorFX is inclusive in its approach, providing three different types of trading accounts, including options for those who prefer to start trading without any minimum deposit requirements.

Benefits of Trading with HonorFX

Trading with HonorFX has offered me several notable benefits, making my trading experience efficient and cost-effective. One of the key advantages is the extremely low spreads, starting as low as 0.2. This feature significantly reduces the cost of trading, which is crucial for frequent traders like myself who are conscious of minimizing expenses.

Another benefit I’ve appreciated is the availability of swap-free accounts. This option is particularly advantageous for traders who prefer to hold positions overnight without incurring swap fees, aligning well with various trading strategies and religious beliefs that prohibit interest.

With HonorFX, I’ve had access to a broad range of over 275 instruments, including Forex, commodities, and indices. This diversity allows me to diversify my trading portfolio and take advantage of multiple market opportunities, enhancing my trading flexibility and potential for profitability.

Lastly, a significant advantage that stands out is the zero fees on both deposits and withdrawals. This policy is extremely beneficial as it ensures that the full amount of my funds is available for trading or withdrawal, without any deductions, making the financial transactions straightforward and cost-effective.

HonorFX Regulation and Safety

Understanding the regulation and safety measures of a Forex broker is crucial, as it directly impacts the security of your investments. My experience trading with HonorFX revealed its strong regulatory framework. The broker is licensed by the Financial Services Commission of the Republic of Mauritius and the Labuan Financial Services Authority (LFSA) in Malaysia. Additionally, a division of HonorFX is registered with the Financial Services Authority of Saint Vincent and the Grenadines, adding another layer of regulatory oversight.

A key safety feature that I found reassuring while trading with HonorFX is the protection against negative balance on all accounts. This protection is vital as it ensures that traders, like myself, do not lose more money than what is in our trading accounts, safeguarding us from unforeseen market volatilities.

Another aspect of HonorFX that simplifies the trading process is the absence of a mandatory confirmation of trading experience when opening an account. This makes it more accessible for new traders to start trading without the need for extensive documentation or proof of experience. Moreover, HonorFX offers high leverage, which can be a powerful tool for amplifying potential profits, although it’s important to use it cautiously due to the increased risk.

HonorFX Pros and Cons

Pros

- Offers a referral program.

- Numerous currency pairs and CFDs available.

- Uses MetaTrader for trading.

- Negative balance protection.

- Standard accounts start with a $1 deposit.

- Regulated by two financial authorities.

- Provides a bonus on deposit.

Cons

- Swap Free option limited to one account type.

- No trading on WebTrader.

- ECN accounts require a $10,000 minimum deposit.

HonorFX Customer Reviews

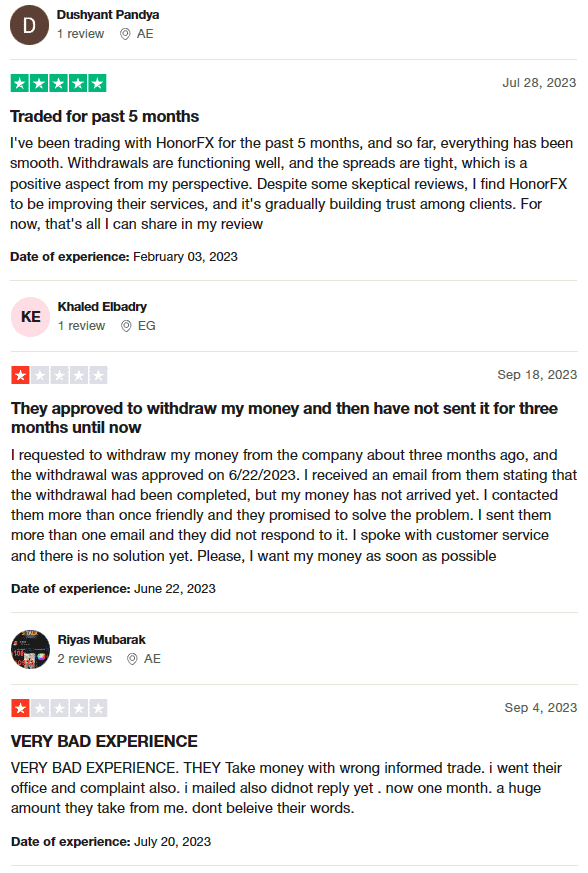

HonorFX currently holds a 3.5-star rating on Trustpilot, reflecting a mixed response from its clientele. Customer reviews highlight varied experiences. Some traders, like a user who has been with HonorFX for five months, report smooth operations, particularly noting efficient withdrawals and tight spreads. This user acknowledges the presence of skeptical reviews but feels the broker is on an upward trajectory in terms of service improvement and trust-building.

In contrast, another customer expresses frustration over a withdrawal request that was approved but not received, despite multiple contacts with customer support.

Additionally, a third review details a very negative experience, citing issues with misinformed trades and a lack of response to complaints, leading to significant financial losses. These accounts collectively illustrate a range of experiences and challenges faced by HonorFX clients.

HonorFX Spreads, Fees, and Commissions

When I traded with HonorFX, I noticed that the spread – the difference between the buying and selling prices – was a key component of the cost. These spreads are floating, meaning they change based on the asset, account type, and market conditions. In my experience, the minimum spreads on the ECN accounts started as low as 0.2 pips, but this came with a commission of $7 per lot.

For those using Standard accounts, which are commission-free, I found the spreads began at 1.5 pips. On Premium accounts, the spreads were slightly higher, starting at 1.8 pips. It’s important to note that while HonorFX doesn’t charge fees for deposits and withdrawals, these transactions might incur charges from banks or electronic providers. This aspect is crucial to consider when calculating the overall cost of trading with this broker.

Account Types

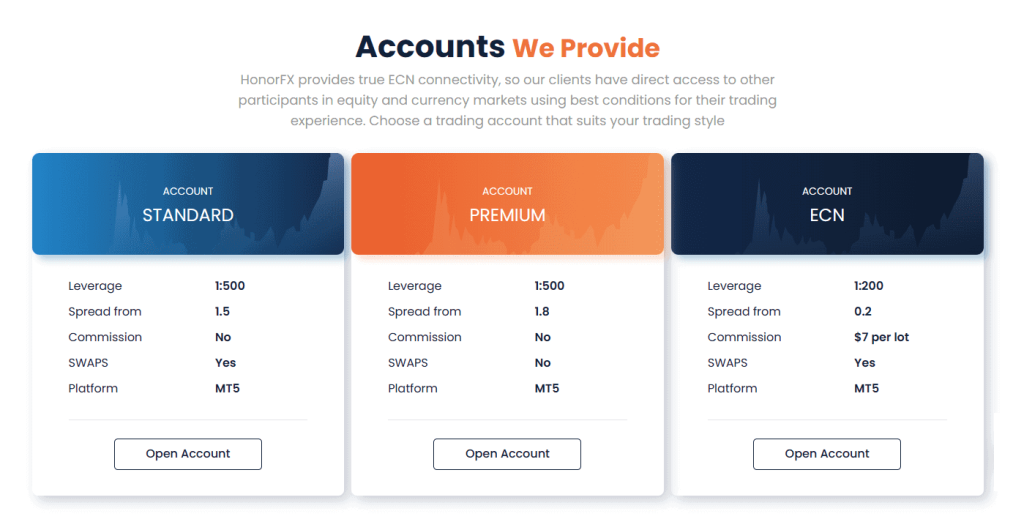

After testing the different account types offered by HonorFX, I found that they cater to a variety of trading needs and preferences. Each account type comes with its own set of features and conditions:

Standard Account

- No minimum deposit requirement, making it accessible for all traders.

- Offers leverage up to 1:500.

- Floating spreads start from 1.5 pips.

- Swap Free option is not available in this account type.

Premium Account

- Swap Free option available, but only for Major currency pairs and spot metals.

- Maximum leverage is also at 1:500.

- Spreads begin from 1.8 pips.

- The amount required for the first deposit varies, offering flexibility.

ECN Account

- Features the narrowest spreads, starting from just 0.2 pips.

- Commission per lot is charged at $7.

- Minimum deposit required is $10,000, targeting more experienced traders.

- Leverage available is up to 1:200.

- An Islamic account without swap commission is not available for this type.

Each of these account types also offers protection against negative balance, adding a layer of security for traders. The diversity in account types ensures that traders can select the one that best suits their trading style and financial capabilities.

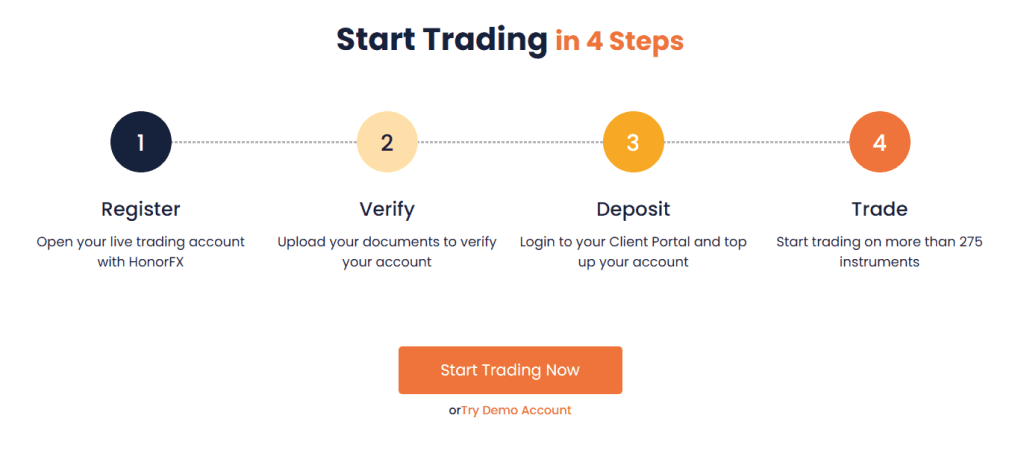

How to Open Your Account

- Visit the HonorFX website and click on either ‘Start Trading Now’ or ‘Register’ to begin.

- Complete the registration form with your details such as surname, name, phone number, email, and address.

- Create a secure password for your account.

- Check your email for a confirmation message from HonorFX.

- Use your email and newly created password to log into your user account.

- Complete the verification process as required by HonorFX.

- Add your personal bank account details to your HonorFX account.

- Once your account is set up, you can open a trading account, deposit funds, access customer support, utilize the economic calendar, view technical analysis from Trading Central, and request profit withdrawals.

HonorFX Trading Platforms

Based on my experience, HonorFX offers a robust platform for Forex trading through MetaTrader 5 (MT5). This platform is known for its user-friendly interface and advanced trading features, making it a popular choice among traders. I found the availability of desktop versions for both Windows and MacOS particularly convenient, allowing for a seamless trading experience on various computer systems.

Additionally, HonorFX caters to traders on the go with its mobile applications for both iOS and Android smartphones. These mobile apps provide the flexibility to manage trades, analyze markets, and access real-time data from anywhere, ensuring that I could stay connected to the markets at all times. The integration of MT5 across multiple devices underscores HonorFX’s commitment to providing accessible and efficient trading solutions.

What Can You Trade on HonorFX

During my trading experience with HonorFX, I discovered a wide array of trading instruments. The broker offers access to more than 275 financial instruments, which provides ample opportunities for diversification and exploring various markets. Among these, there are 44 currency pairs, catering to those particularly interested in Forex trading.

The leverage options provided by HonorFX vary depending on the instrument type. For instance, leverage for stocks goes up to 1:10, which is fairly moderate. In contrast, the leverage for metals can reach 1:333, offering a higher potential for profit (and risk) for metal traders. For currency trading, the leverage can be as high as 1:500, providing substantial opportunities for those skilled in managing leverage risks.

Furthermore, for other CFDs, the broker offers leverage up to 1:100. This range of leverage options across different instruments allowed me to tailor my trading strategies according to my risk tolerance and trading objectives.

HonorFX Customer Support

HonorFX offers a range of options for customer support, ensuring that help is readily available when needed. One of the most convenient methods I found was the Live Chat feature on their website. This tool provided instant responses to my queries, making it ideal for urgent issues.

For more in-depth assistance, I could also reach out to HonorFX via phone calls. The contact numbers are easily accessible on their website, which I found helpful for getting more personalized support. Additionally, the option to communicate through email was there for less urgent inquiries or when detailed documentation was required.

What sets HonorFX apart in terms of customer service is their presence in physical offices. They have locations in the UAE, Malaysia, St. Vincent and the Grenadines, and Mauritius. This physical presence not only adds an element of trust but also provides an opportunity for face-to-face interactions, which can be crucial for resolving complex issues or understanding detailed aspects of trading services.

Advantages and Disadvantages of HonorFX Customer Support

HonorFX Withdrawal Options and Fees

In my experience with HonorFX, I found that they offer a variety of withdrawal methods which cater to a broad range of preferences. These include Bank Transfer, card withdrawal, Paytrust, FasaPay, eCompany, GB Pay systems, and local payment providers in Asia. This flexibility is convenient as it allows for choosing the most suitable option based on personal circumstances or geographic location.

The broker efficiently handles fund withdrawals, typically depositing funds within one business day using any of the aforementioned methods. All withdrawal requests are processed from Sunday to Friday between 9:00 and 18:00 (GMT+8). Requests submitted outside these hours are processed on the next business day, ensuring a systematic and timely handling of transactions.

When it comes to currency options, USD can be withdrawn to a card, bank account, or e-wallet, providing multiple channels for USD transactions. For Asian currencies, withdrawal methods include FasaPay, Paytrust, GB Pay, and local payment systems. EUR withdrawals require a bank transfer or card, while GBP can only be withdrawn to a card. Notably, HonorFX does not charge fees for depositing funds, but it’s important to be aware that banks and payment systems might impose their own fees.

HonorFX Vs Other Brokers

#1. HonorFX vs AvaTrade

HonorFX, with its ECN/STP model and access to over 275 financial instruments, contrasts with AvaTrade’s broader client base and larger range of instruments (over 1,250). AvaTrade has been operational since 2006 and is heavily regulated, offering a more established trading platform. While HonorFX offers low spreads and high leverage, AvaTrade’s strong regulatory framework and global reach might be more appealing to traders seeking a well-established broker.

Verdict: For traders prioritizing a wide range of instruments and strong regulation, AvaTrade might be the better choice.

#2. HonorFX vs RoboForex

RoboForex stands out with its extensive array of over 12,000 trading options compared to HonorFX’s 275+. RoboForex, operating since 2009, offers a variety of trading platforms (MetaTrader, cTrader, RTrader) and caters to a broad range of traders with personalized terms. HonorFX, with its ECN/STP accounts, provides competitive spreads and high leverage.

Verdict: For those seeking a more diverse range of trading platforms and options, RoboForex could be the preferred choice.

#3. HonorFX vs Exness

Exness offers a diverse range of over 120 currency pairs and other CFDs, contrasting with HonorFX’s 275+ instruments. Established in 2008, Exness is known for its low commissions, instant order execution, and offering of infinite leverage on small deposits. While HonorFX provides competitive leverage and ECN/STP accounts, Exness’s unique offering of infinite leverage and a wide range of currency pairs might appeal more to traders looking for extensive forex options.

Verdict: For traders focusing on forex trading with flexible leverage options, Exness could be a more suitable choice.

Conclusion: HonorFX Review

In conclusion, my experience with HonorFX and user feedback paint a picture of a broker with both strengths and areas for improvement. HonorFX excels in offering low spreads, high leverage, and a range of 275+ financial instruments, making it a competitive choice for traders looking for these specific features. The ECN/STP model and the options for different account types cater to a variety of trading strategies and preferences.

However, potential users should be aware of the mixed customer reviews, which indicate experiences with delayed withdrawals and less detailed customer support responses. While the broker is regulated and offers negative balance protection, these operational concerns could affect user experience. Additionally, the $10,000 minimum deposit for ECN accounts might be a barrier for some traders.

Also Read: Purple Trading Review 2024 – Expert Trader Insights

HonorFX Review: FAQs

What types of accounts does HonorFX offer?

HonorFX provides three types of accounts: Standard (with no minimum deposit and leverage up to 1:500), Premium (with Swap Free option for major pairs and metals, and leverage up to 1:500), and ECN (with minimum spreads starting at 0.2 pips and a $10,000 minimum deposit).

Is HonorFX regulated?

Yes, HonorFX is regulated by the Financial Services Commission of the Republic of Mauritius and the Labuan Financial Services Authority (LFSA) in Malaysia.

Are there any withdrawal fees with HonorFX?

HonorFX does not charge fees for depositing or withdrawing funds, but fees may be applied by banks or payment systems involved in the transaction.