High frequency forex trading is a very popular trading strategy for day traders. In fact, there has been an increase in software, algorithms, and trading platforms that target high frequency traders. Let’s examine how it compares to other forex trading strategies.

Also Read: High Frequency Trading: A Complete Guide

Contents

- What is the Forex Market?

- 2 Types of Forex Traders

- Forex Trading Platform

- Types of Forex Trading

- Binary Options Trading

- Types of Binary Options Contracts

- Wrap Up

What is the Forex Market?

The forex market is an international currency market where people trade currency pairs. Normally, currency is traded in pairs (e.g., EUR/USD, JPY/CHF) Investors trade lots of currency to secure the money they need for their operations or economies, as hedges against potential commercial losses, and as speculative investments. A lot is equal to 100,000 units. If you can envision traders trading overUS$5 trillion per day, you can imagine the global forex market.

Trading Currencies

This trading market is open 24 hours a day, 5 days a week. Forex traders trade in different markets which are located in different time zones. This means that they can trade 24 hours a day for more than 5 days per week (time zone differences) from their laptop.

There are over 120 foreign currencies traded on the forex market. The currencies are traded as pairs (e.g., EUR/USD, JPY/CHF).

There are major and exotic currencies exchanged on the forex market. Major currencies are issued by developed economies and are internationally recognized forms of payment (e.g., USD, EUR, JPY, GBP). Exotic currencies are issued by developing economies, volatile, and not internationally accepted forms of payment (e.g., THB, VND, INR).

Forex Trading Example

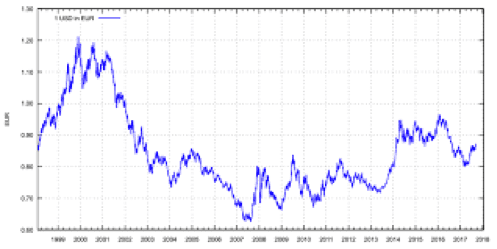

Traders make money by speculating on how a currency’s price movement over time. For example, if an investor is trading EUR/USD, EUR is the base currency and USD is the current currency. A trader may bet that USD will increase in value relative to EUR.

If EUR/USD is equal to 1.20, that means US$1.20 buys 1 euro. If the value of the Euro increases relative to USD, the price ratio increases. However, if USD increases in value relative to the Euro, then the price ratio decreases. Whether the trader makes a profit depends on if the trader correctly predicted the price movements and the degree of change in the ratio.

Major Trading Pairs

75% of forex trades use major currencies. The major currency pairs are EUR/USD, USD/JPY, GBP/USD, USD/CHF, AUD/USD, USD/CAD, NZD/USD, USD/CNY, and USD/HKD. The strongest and most profitable currency pair is EUR/USD.

2 Types of Forex Traders

Institutional investors are responsible for 95% of the trading. The remaining 5% is done by retail traders.

Institutional Investors

Institutional investors place the largest orders and create the market trends. They account for 95% of trading in the forex market. Their decisions affect consumer, retail, and wholesale prices of goods and services around the world. This market also affects loan rates, inflation, trade agreements, and the exchange rate everyday people get when exchanging one currency for another.

Retail Investors

Retail investors account for only 5% of trading on the forex market, In recent years, there has been a significant increase in retail investors and services that cater to their trading needs. More specifically, retail investors are investing in software, trading platforms, and education tools that can help them earn a good return on their investment.

Retail investors are drawn to forex trading because of its low minimum deposit (as little as $10), use of high leverage (up to 500:1) to increase investor’s access to assets and potential gains (and losses), a wide variety of technical analysis tools, low commissions, low fees, high liquidity, transparency, and quick market entry and exit.

The majority of retail investors, over 95%, lose money in forex trading. They are unable to catch a trend, or exit it before it reverses itself. They may also become too confident and end up with losses exceeding their gains.

Retail traders’ market losses can be attributed to the market’s volatility, heavy influence of market makers (i.e., institutional investors), inability to read the market or understand its trends, and access to margins. Moreover, forex investing is not likely to make small investors rich. It is improbable because small investors don’t have enough capital to earn giant profits from a good trade, but they do have enough to bankrupt themselves.

Forex Trading Platform

A forex trader can open a trading account on an online platform operated by a brokerage service like Robinhood. These accounts have low capital requirements, can be accessed 24/7, multiple ways to deposit and withdraw funds, and low withdrawal fees. They also have a user-friendly interface, permit leveraged trading.

New traders or traders unfamiliar with the trading platform can sign up for a demo account. The demo account allows the trader to get practice using the trading platform without risking any ‘real’ money. Traders can sample the trading tools, review the reports on financial markets, and check out the educational tools on the website.

Some trading platforms allow their users to trade other assets too. These assets may include commodities, natural resources, cryptocurrency, and derivatives.

Furthermore, the more popular and successful trading platforms give traders access to an online community with experienced traders, one-on-one sessions with professional brokers, and market news, updates, and reports written by the trading platform’s brokers.

Also Read: Best Forex Trading Platform 2022

Types of Forex Trading

There are a wide variety of trading strategies that can be used by forex traders. The trading tools used will vary based on the trader’s market experience, knowledge of forex markets and trading, risk tolerance, access to capital, and trading experience. Over time, traders may change their trading strategies as they evolve from new traders into professional traders.

Naked Trading

Naked traders don’t use nay technical analysis tools. They only focus on the current market prices, trends, and conduct of traders in the market, They heavily rely on their knowledge of market and industry cycles and patterns, understanding of human behavior, and ability to quickly visually assess market charts. This strategy is often used by professional, experienced traders.

Algorithmic Trading

Algorithmic trading is commonly used by institutional and retail traders. Most traders use algorithmic trading tools when making trading decisions. The tools can be used to analyze historical trends, current trends and predict future trends.

The trader’s interpretation of the charts, intuition about the market, and information collected from online forums and communities influence the trader’s decisions to enter and exit the market. Note, some traders use algorithmic tools as a substitute for market experience and knowledge. For example, they may use trading bots to follow the trades of successful investors and copy them.

Low Frequency Trading

Low frequency traders may make 10 trades in one week. The trades are planned over time, probability of a good ROI determined using daily market charts, and they tend to stay in the position for more than a day. They are likely to hold the positions for days, weeks, and even months. In short, these traders are looking at the big picture and giving less importance to the intraday price movements. If they manage to get into a market trend before it gains momentum and exit before it reverses, they can get a healthy ROI.

HFX Trading

Most retail day traders in the forex market are high frequency traders. They trade multiple times during the trading day and throughout the week. Their goal is to make a lot of profitable small trades that collectively amass into a lot of profit. These small trades may happen over seconds, minutes, or hours, They rarely extend overnight or over the weekend.

Many new HFX traders enter the market with small initial investment and try to build up their investment capital using their trading profits. HFX traders are short-term traders who believe that although they may suffer some trading losses, their trading profits will exceed them, giving them a net trading profit.

HFX Trading Cycle of Despair

An HFX trader who is initially lucky in the market may develop a false sense of confidence and trading skill. This elevated confidence and perception of trading skills will likely result in the trader taking more risks in the market. These risks include using highly leveraged trades, taking more trading risks, having too much confidence in their ability to read, understand, and predict price movements.

When the HFX trader begins to experience more trading losses and fewer trading gains, the trader panics about losing everything. The panic and desperation felt by the trader causes the trader to engage in even riskier trades, see market opportunities where there are none, and possibly use more leverage than is appropriate for a risky trade.

In the end, the HFX trader who falls into the HFX Cycle of Despair loses all invested capital and possibly much more than that before being bankrupted by the market.

Successful HFX Trading

It would be false to claim that there are no successful HFX traders. There are some very successful, professional HFX traders. They spend their entire day make short-term trades and earning a lot of money from them. Most traders want to be like these top-level HFX traders.

There are also times when HFX trading is extremely lucrative. For example, if a skilled HFX trader trades on a triple witching Friday, the trader can make a mind-blowing profit in one trading day. On triple witching Friday, HFX traders must enter and exit trades in seconds in order to realize the potential profit from it. So, there are times when this strategy is highly lucrative and the rewards can outweigh the risks for a trader with good knowledge of how to do HFX trading.

Binary Options Trading

Binary options contracts are also an alternative to HFX trading. With binary options trading, the trader enters an ‘all or none’ deal. In this options contract, the trader selects an asset to be covered by the contract, a contract expiration date, and the price(s) at which there will be a payout to the contract buyer. Contract expiry dates can range from 1 minute, to a day, to an entire year.

Types of Binary Options Contracts

Up/Down (High/Low) Option

The most popular and easiest option to understand. In this contract, the contract buyer creates a contract with a price above or below the asset’s current market price. If the asset price is at or better than the price in the contract, the buyer gets a payout. However, if the asset’s price doesn’t reach or surpass the contract price, then the contract buyer gets nothing.

In/Out (Range or Boundary) Options

The contract buyer sets up a binary option contract with a high and low price. Next, the buyer sets the contract terms. In the contract, the buyer will stipulate whether a payout will occur when the asset’s price is within or outside the range of the buyer’s high and low values.

If the buyer agrees to a payout if the asset price is outside the price range, then that is when a payout will be received by the buyer. On the other hand, if the buyer arranges to be paid only if the asset price is within the price range, then the contract buyer only gets paid if the asset price is within the contract range on the contract expiry date.

Touch/No Touch Option

With this binary option, the contract buyer set price levels higher or lower than the asset’s current market price. When the asset’s price touches one of the pre-set levels (before the expiry date of the contract), the contract buyer receives a payout.

Ladder Option

This binary option has the best payouts and is the riskiest of them all. The contract buyer enters into a contract with staggered price levels. Each price level represents significant price movement. When the asset price hits a pre-set price level, the contract buyer receives a payout in excess of 100%.

HFX Version of Binary Options

HFX traders can enter into binary options contracts with expiry dates of 30 seconds to a minute or more. Most HFX binaries traders will want to set the expiry times for their binary option contracts between 5 and 30 minutes. HFX traders may want to set their contract expiry times for 1 minute. Since the contracts are so short, HFX traders can enter into many of them every trading session.

Binary Options Probability of Payout

Although binary option have swift, known payouts, contract buyers also are more likely to get nothing than receive a payout. For every 70% of profit earned from binaries, there is an 85 % chance of suffering a loss. In short, binary contract buyers have to get a payout at least 55% of the time just to break even.

Are Binary Options Legal?

Binary options have been banned in some countries because companies offering them were scamming and defrauding investors. Now, it is regulated in some countries. Currently, an effort is being made to improve the reputation of binary option and the companies that offer them.

Wrap Up

HFX retail traders are less likely to profit from their trades than low frequency traders. Low frequency traders have more time to set up and plan their trades tan HFX traders. In addition, they pay less in commissions, broker fees, and slippage, and any other trade related fees.

Moreover, if a trader can earn the same profit from 10 trades as a HFX trader can earn from 100 trades, then the low frequency trader is better off than the HFX trader. Besides paying lower trading costs, the low frequency trader has more time to relax, pursue hobbies, exercise, and do other things. Low frequency traders have more time for things that are characteristic of a higher quality of life. The same things that the HFX trader does not have time for because of the time sacrifices that must be made to do the HFX trading.