HFM Review

Brokers are crucial to the forex trading sector. They serve as go-betweens, facilitating traders’ access to international currency markets. In this competitive environment, HotForex Markets (HFM) sticks out. Offering a range of account types, HFM is a part of the HF Markets Group. Because of its adaptability, traders of all needs and preferences choose it as their platform of choice. HFM goes beyond that point. Additionally, the platform provides a wide variety of trading assets supported by state-of-the-art software. This demonstrates their commitment to providing excellent trading services.

I’ll get into the inner workings of HFM in this review. We’ll examine both its advantages and disadvantages to provide you with a clear picture of what to anticipate. Using information from consumer feedback and my experience as a seasoned trader, this assessment seeks to serve as a one-stop shop. To assist you in making an informed choice, we will analyze its features, commissions, account types, and transaction processes.

What is HFM?

HotForex Markets (HFM) is a major player in the forex broker landscape. Not limited to just Forex, the firm also deals in commodities trading. Initially known as HotForex, HFM has diversified its offerings over the years. The broker provides seven distinct account types and a variety of trading platforms. Traders can benefit from tight spreads, with an average of 0.1 EUR USD, enhancing profitability.

HFM stands out for its unrestricted liquidity. This feature allows traders, regardless of size or profile, to select from a range of spreads and liquidity providers. This degree of choice enables tailored trading experiences, catering to both novice and seasoned traders.

The firm’s trading platforms offer a high level of flexibility. Automated trading options let traders implement various strategies, including news trading. This automation increases efficiency and optimizes trading conditions for users.

Founded in 2010 and headquartered in Cyprus, HFM has grown its global footprint. It has additional offices in Dubai, South Africa, and offshore entities in St Vincent and the Grenadines. This global presence amplifies HFM’s reach and allows it to cater to a wide array of traders.

HFM stands out due to its strategic emphasis on the African, Asian, Middle East, and North Africa markets. These markets enhance the value of HFM’s international offerings by providing profitable trading opportunities. HFM goes above and beyond in terms of dependability by possessing the necessary permits in each area where it conducts business. These licenses promote confidence in the broker’s trading services and are necessary for regulatory compliance.

Advantages and Disadvantages of Trading with HFM?

Benefits of Trading with HFM

After trading with HFM, one of the standout features is the broker’s high trust score. The firm is regulated by multiple governing bodies, making it a trustworthy option for traders. Knowing you’re trading with a reputable firm brings peace of mind, an aspect often underrated in the high-stakes world of forex trading.

A noteworthy advantage is the leverage option, which can be as high as 1:2000. While using a lot of leverage can increase your profits, there are risks involved. Although it has two edges, when utilized properly, it may be a very useful instrument.

HF Markets does not let you down in terms of asset variety. There is a wide range of currency pairs available for you to select from. Having this variety gives traders more creative freedom when developing their trading plans.

Ultimately, the trading experience is enhanced even more by the MT4/MT5 Metatrader platforms. These systems are renowned for their strong features and intuitive user interfaces, which facilitate the management of both technical and fundamental analysis.

HFM Pros and Cons

Pros

- Up to 5 million euros indemnity insurance

- Advanced Insights with big data and AI

- Earn interest on unused margin

- 3,500 markets on improved app

- Premium tools and Autochartist signals

- Balanced market analysis and third-party research

- Special in-house research reports

- Correlation and sentiment data available

- Ongoing improvements in myHF portal

Cons

- Above-average trading costs

- Limited indicators on mobile app

- No alternative web app

- Educational content needs improvement

- HFcopy’s high entry cost and limited maturity

HFM Customer Reviews

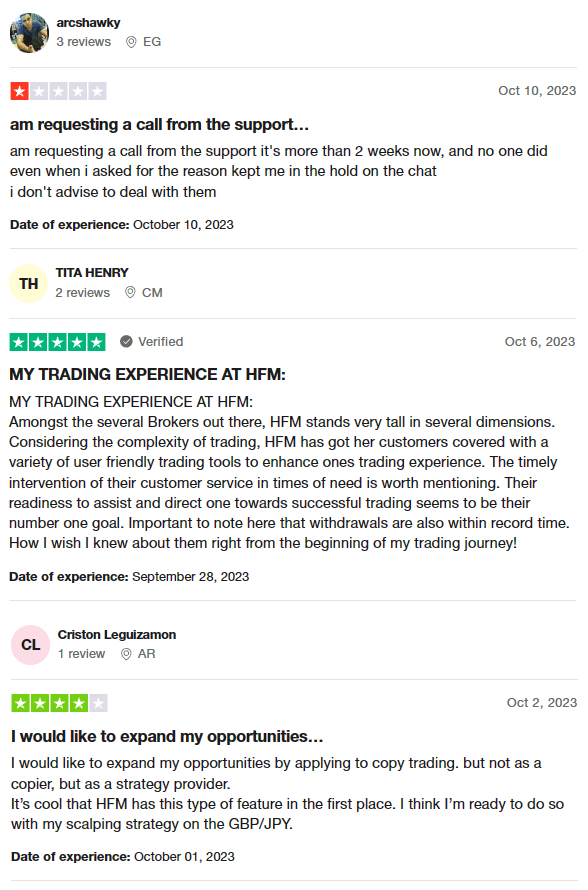

HotForex Markets (HFM), which has a 4.0 Star rating on Trustpilot, receives a mixed response from its users. While some clients compliment the company on its easy-to-use trading tools and quick customer service, others express dissatisfaction with the support staff’s reaction. The platform’s several features, such as copy trading and speedy withdrawal times, are highlighted in the positive reviews. Conversely, some consumers have complained about prolonged hold times from customer service. While HFM’s wide range of trading capabilities is generally praised, its customer service response has come under fire.

HFM Spreads, Fees, and Commissions

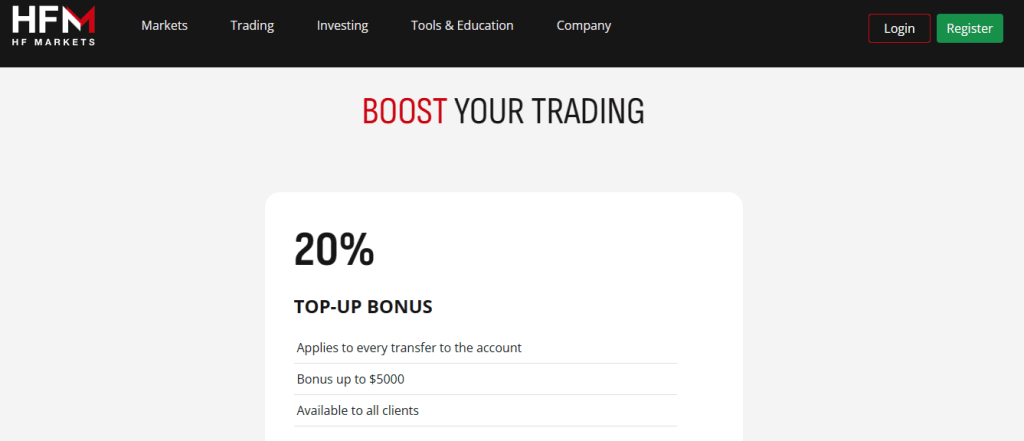

One of the first things I observed when trading with HFM was the cost structure’s competitiveness. The broker mostly uses variable spreads, which, depending on the type of account, might be as low as 0 pip. For traders looking to keep expenses down, HFM is a desirable alternative because of these tight spreads.

The fee structure’s transparency is still another advantage. HFM does not impose additional costs or commissions. Regardless of expertise level, this simplicity is important since it makes it easier to understand the whole cost of a trade.

There are a few non-trading fees to be aware of, though. These consist of withdrawal and deposit fees. If a position is held open for more than a day, additional fees apply, such as rollover or overnight fees. The particular fees associated with each financial instrument are displayed when you open a trade or immediately within the platform. It’s important to note that swap-free accounts—which are designed for traders who follow Sharia law—are excluded from these overnight costs.

Account Types

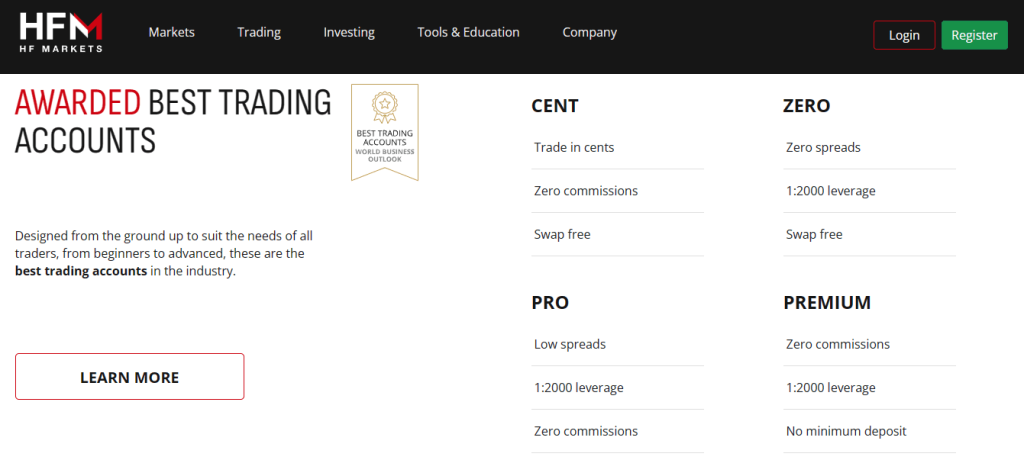

After testing the various trading accounts offered by HFM, I can say they offer a diverse selection of account types to cater to different trader needs. Each account type brings its own set of features, benefits, and customization options. Here’s a straightforward rundown:

- Premium Account: No minimum deposit. Maximum leverage of 1:2000. Variable spreads start at 1.2 pips. Up to 500 open orders are allowed.

- Pro Account: Minimum deposit of $100/₦50,000 / €100 / ¥13,000. Maximum leverage also at 1:2000. Spreads start from 0.5 pips. Up to 500 open orders are allowed.

- Zero Account: No minimum deposit. Variable spreads start from 0 on Forex and Gold. Maximum of 500 open orders or 60 standard lots per position.

- Cent Account: No minimum deposit. Maximum leverage of 1:2000. Spreads start at 1.2 pips. Up to 150 open orders are allowed.

HFM’s tailored account options ensure that traders can find an account that aligns with their trading strategy and financial goals.

How to Open Your Account

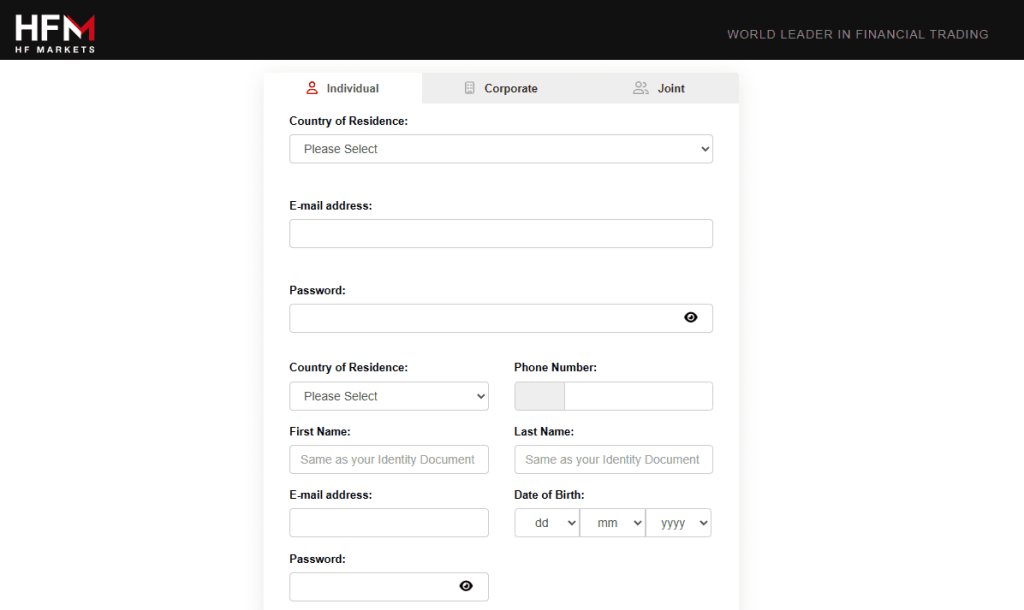

- Visit the HFM homepage and click “Open Live Account” in the top right corner to start.

- Fill in the required personal information.

- Complete additional personal details to set up the trading account.

- Upload the necessary documents for account verification.

- Wait for the account verification, usually completed within minutes.

- Check your email for a verification confirmation.

- Once verified, choose your preferred trading platform.

- Begin trading after your account is fully set up and verified.

What Can You Trade on HFM

At HFM, traders can dive into a wide variety of trading instruments, based on my own experience. The platform offers over 50 currency pairs in the Forex market, including majors, minors, and exotic pairs. This extensive list makes it a compelling choice for Forex traders.

For those interested in precious metals, HFM provides options like palladium, platinum, and silver, as well as gold in both euro and US dollar terms. The metal offerings allow for diverse investment strategies.

If you’re more into trading energies, HFM doesn’t disappoint. It offers UK Brent oil and US Crude oil, giving energy traders flexibility in their portfolios.

You’ll also find a selection of indices available in both spot and futures. Examples include the Australian 200 and Switzerland 20 for spot, and the EU Stoxx 50 and US Dollar Index for futures.

For stock traders, HFM offers up to 95 stocks, featuring big names like Apple, Amazon, and Google. The variety of stock options provides ample opportunities for equity investment.

Commodities are also well-represented, with offerings like US cocoa, coffee, copper, sugar #11, and US cotton no.2. If you’re a commodities trader, you’ll find this range quite comprehensive.

In the bonds category, traders can choose from the Euro Bund, UK Gilt, and US 10-year Treasury notes. These options offer a safer, more stable form of investment.

Last but not least, there are up to 33 ETFs and 40 cryptocurrencies, including Binance, Bitcoin, and Ethereum. The ETFs and cryptocurrencies further broaden the trading landscape, providing something for every type of trader.

HFM Customer Support

My personal experience has shown that HFM’s customer service is excellent and well-suited to traders’ requirements. In line with the Forex trading week, the support staff is accessible around the clock and provides a variety of contact methods, including live chat, email, and phone.

Notable are the reps’ promptness and professionalism. If you have any technical issues or inquiries about trading conditions, the team is here to assist you. For those who prefer self-service, HFM also offers a thorough FAQ section on its website that addresses commonly asked questions.

Advantages and Disadvantages of HFM Customer Support

Security for Investors

Withdrawal Options and Fees

HFM provides a range of options to streamline the money withdrawal procedure. They even provide the HFM MasterCard, a direct and safe transaction card. Other methods of depositing money include credit and debit cards, wire transfers, domestic transfers, and e-wallets like WebMoney and FasaPay. Deposits using cryptocurrencies are also accepted.

You have several ways to withdraw money from HFM, including cards, bank transfers, and e-wallets. One noteworthy feature that guarantees you won’t have to worry about extra costs being deducted from your earnings is the zero withdrawal charge. However, be aware that correspondent fees may apply to wire transactions based on your bank’s overseas policies.

HFM Vs Other Brokers

#1. HFM vs AvaTrade

Although AvaTrade and HFM are well-known, their offerings differ in terms of trading requirements. With its main office located in Dublin, Ireland, AvaTrade provides more than 1,250 financial instruments and is heavily regulated. Traders searching for a variety of assets will find it ideal. Conversely, HFM provides a more affordable pricing structure, usually with tight spreads and no extra commissions or fees for trading.

Verdict: HFM is a better option if cost-effectiveness is your top concern because of its competitive spreads and clear price schedule.

#2. HFM vs RoboForex

Modern technology and an extensive selection of trading platforms, including MetaTrader, cTrader, and RTrader, are two of RoboForex’s best-known features. It provides more than 12,000 trading possibilities for eight different asset classes. With fewer platforms, HFM provides a more straightforward and efficient trading approach that prioritizes cost-effectiveness and a variety of account types.

Verdict: RoboForex is a superior option if you’re searching for a wide variety of trading options and technological diversity. On the expense front, HFM prevails, though.

#3. HFM vs Exness

Exness provides CFDs on a wide range of assets, such as metals, energy, and equities, in addition to more than 120 currency combinations. Their minimal commissions and prompt order execution are well-known attributes. HFM offers a range of account types and no withdrawal fees, although its trading instruments are more basic.

Verdict: Exness is a preferable option for traders seeking a wider selection of trading products. HFM, however, offers an advantage in terms of account flexibility and fee structure.

Conclusion: HFM Review

Conclusively, HFM stands out due to its assortment of account types and reasonably priced trading conditions. The platform offers a range of trading instruments, including forex and commodities, to satisfy different trading needs. Not to mention that HFM’s customer care is available and attentive 24/7, which adds to the platform’s credibility.

The lack of withdrawal fees is an additional benefit that attracts users who move money in and out of their accounts regularly. Their security protocols, which include segregated accounts and negative balance protection, give investors even more peace of mind.

However, it’s crucial to keep in mind that HFM owns entities that are situated in offshore regions. Despite having strong security protocols in place, this may worry some investors. Furthermore, dealers who operate across multiple time zones may find it disadvantageous since customer care is not available 24/7.

Also Read: Admiral Markets Review 2023 – Expert Trader Insights

HFM Review: FAQs

What types of accounts does HFM offer?

HFM offers Premium, Pro, Zero, and Cent accounts tailored to different trading needs.

Is HFM’s customer support available 24/7?

No, customer support is available 24/5, aligned with the forex trading week.

What trading instruments are available on HFM?

HFM offers Forex, metals, energies, indices, stocks, commodities, bonds, ETFs, and cryptos.