The forex market is the biggest liquid market in the world, and that makes it acutely volatile. The volatility is perceived as a normal part of forex trading. Different tactics can be selected to curtail the level of currency risk approximated with each position.

Forex hedging is the method of strategically introducing supplementary positions to safeguard against disadvantageous development in the foreign exchange market. The maneuver decreases losses by entering into one or more currency trades that balance the existing position.

Most traders are looking for opportunities to reduce the potential risk attached to the exposure, hedging is one strategy that they can use.

The aim of hedging is not to totally eliminate risk, but to restrain it to a known amount.

Categories of currency risk that forex hedging can safeguard against are changing interest rates, unexpected news, and inflation levels.

Contents

- How Forex Hedging Works

- Forex Hedging Strategies

- Simple Forex Hedging Strategy

- Multiple Hedge Currency Risk Strategy

- Forex Correlation Hedging Strategy

- Forex Options Hedging Strategy

- Hedging Forex with Trading CFDs

- Gold Hedging Strategies

- Cross Currency Swap Hedge

- Undoing a Hedge in Forex Market

- Conclusion

- FAQ

How Forex Hedging Works

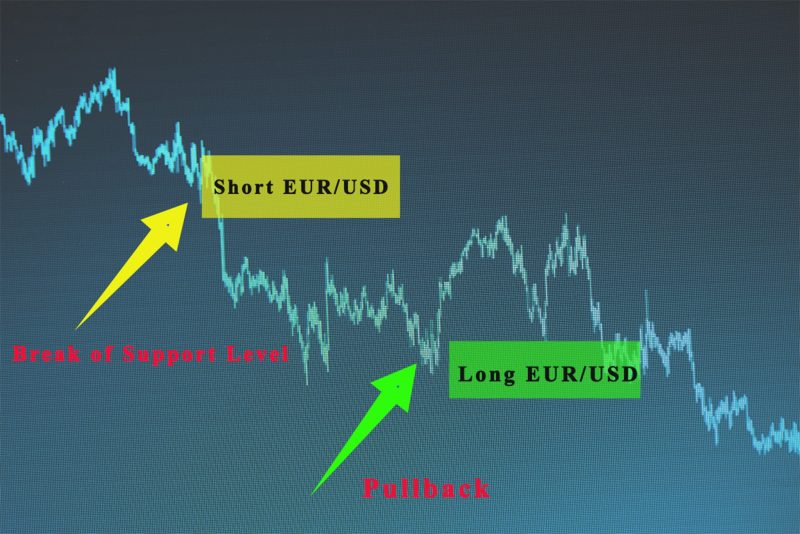

The process of starting a forex hedge is easy. It begins with an actual open position, usually a long position where the original initial trade is expecting a move in a given direction.

The hedge begins by starting a position that goes opposite to your anticipated movement of the currency pair, permitting you to keep an open position on the initial trade without acquiring losses if the price goes opposite to your prediction.

Frequently the hedge is used to protect profits that have been made. If, for example, a trader opens a long position near the low point of that chart and exploits the meaningful gains that emerged in the following days, the investor may decide to open a short position in order to hedge for possible losses.

The trader can close his position and gets his money out, he may want to keep that open position to check how the chart patterns develop over time.

In this situation, the hedge can protect profits or losses as the trader preserves that position and collects more information. If the price goes down traders can cash out the money from the original upswing. Hedging is mostly used in foreign exchange trading to reduce foreign exchange risk and protect a financial asset.

Also Read: ABCD Pattern Trading

Forex Hedging Strategies

There is an ample risk mitigation strategy, that forex brokers can use to reduce their potential losses, and hedging is the most popular. Accepted strategies incorporate simple forex hedging, or more mosaic systems involving several currencies and financial derivatives, like options.

Simple Forex Hedging Strategy

A simple forex hedging strategy entails opening the antagonistic position to an ongoing trade. For example, if you previously had a long position on a currency pair you might decide to start a short position on the identical currency pair also known as a direct hedge.

The net profit of a direct hedge is zero, traders have to retain the authentic position on the market adjusted for when the trend reversals.

When investors do not hedge the position, ending the trade means acknowledgment of any loss, but if the investor chooses to hedge, it would empower the broker to make a profit with a second trade when the market goes against your initial transaction.

Multiple Hedge Currency Risk Strategy

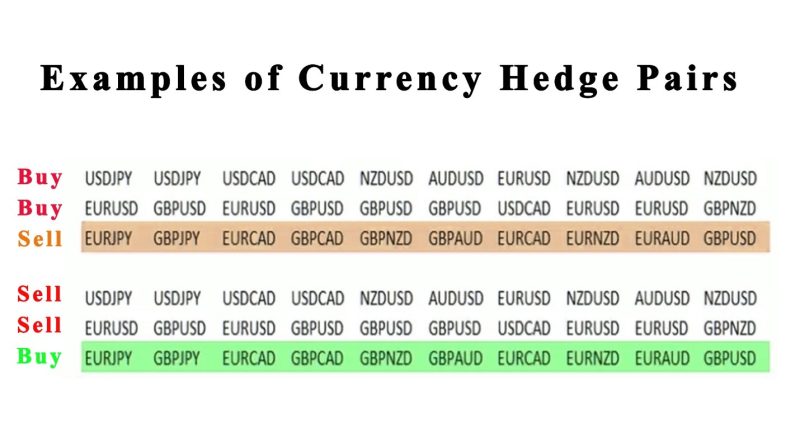

Known as the perfect hedge the multiple currencies hedging strategy involves choosing two positively correlated currency pairs, such as AUD/CAD, and EUR/GBP, and then catching positions on both pairs but in an adverse direction.

Let’s say a trader takes a short position on EUR/GBP but chooses to hedge the GBP liability by starting a long position on EUR/GBP.

If the euro declines against the dollar, the long position on AUD/CAD would have received the loss, but it would be diminished by the benefit of the EUR/GBP position. If the GBP declines the hedge would cancel out any loss to the short position.

It is crucial to learn that hedging more than one currency pair brings its own risks. In the example, the investor hedged his risk to the dollar, but at the same time opened himself to a short liability on the pound and long exposure to the euro.

When a hedging strategy works, the risk is minimized and traders can make a profit. With a direct hedge, the net balance is zero, but with several currency strategies, there is the opportunity that one position can create more profit than the other position produces a loss.

The problem trades face when the tactic doesn’t work, is that they can accumulate losses from several positions.

Forex Correlation Hedging Strategy

Traders can hedge negatively correlated currency pairs, like GBP/USD and USD/EUR, where the US dollar is the counter currency. In these cases, if GBP/USD rises, USD/EUR can appropriately decline.

Going long on GBP/USD, and short on USD/EUR the investor is guarding his USD liability by purchasing and selling trades open at the same time, but in different directions. The strategy is risky, investors are endangering themselves to variations in both EUR and GBP.

To benefit from this forex hedging strategy investors, have to learn multiple currency pairs, how they correspond, and, more important how this connection can change the direction of other currency pairs the broker is trading. This strategy is appropriate for veteran forex traders.

Forex Options Hedging Strategy

The currency option allows the buyer the right, but not the obligation, to exchange a currency pair at an accustomed price before the set time of expiration. Options are popular hedging tools because they offer an opportunity to curtail the exposure while only paying the cost of the option.

Let’s say a Forex trader is long on AUD/USD, he started his position at $0.56. But he is predicting a drastic decline and chooses to hedge his risk with a put option at $0.55 with a one-month expiration.

If at the time of expiration, the price has gone under $0.55, the investor would have experienced a loss on his long position but the option would be in the money and adjust the liability. If USD/CAD had grown then the investor will allow the option to expire and would only pay the premium.

Hedging Forex with Trading CFDs

Traders can use CFDs to trade globally on thousands of markets, including 84 currency pairs, without accepting control of any physical currency.

Hedging strategy can offer protection against inflation, variations in commodity prices, currency exchange rates, and changes in central bank interest rate policies.

Hedging strategies also save time, allowing brokers to regulate their portfolios with daily volatility in financial markets.

Some hedging tools can be used to lock profits for investors, the benefits manifest in long-term earnings.

Gold Hedging Strategies

Gold is a perfect hedge that guards against inflation. Gold benefits when inflation starts to rise and is a good hedge against a weaker US dollar. Gold is perceived as a form of money, which makes it a great hedge option against hyperinflation.

Hedging doesn’t always work, but gold is always a solid alternative for currency.

Cross Currency Swap Hedge

The cross-currency swap is an interest-rate derivative product. Two counterparties concur to swap principal and interest payments as detached currencies. These floating rates can fluctuate depending on the movements of the forex market.

The aim of a cross-currency swap is to hedge the risk of inflated interest rates. The two sides can agree at the beginning of the agreement if they would like to implement a fixed interest rate on the abstract amount in order not to arouse losses from market declines.

The application of interest rates is what detaches cross-currency swaps from derivative products, as FX options and forward currency contracts do not guard traders from interest rate risk. They focus on hedging risk from foreign exchange rates.

Cross-currency swap hedges are useful for global corporations with huge volumes of foreign currency to exchange.

Undoing a Hedge in Forex Market

If you believe the market is going to shift and return to the first trade, you can consistently place a stop-loss on the hedging trade, or close it.

There are several options for hedging forex trades, and they are pretty complex. Many brokers do not grant investors to option to directly hedged positions on the same account, then an alternative option is needed.

Conclusion

Hedging forex is a compound technique and behooves a lot of arrangement. Forex traders need to remember that hedging is a method of strategically opening new positions in the market, to curtail liability on currency risk. Some investors do not hedge, they accept volatility as part of the forex trading process.

Before starting hedge forex, brokers have to learn the market, accept the currency pair and contemplate the capital at your disposal. Testing hedging strategy is recommended before entering the live markets and starting to trade with currency.

Also Read: Rising Wedge Pattern

FAQ

How do You Hedge Forex?

Traders open an account; locate the currency pair they plan to trade. The next move is to select the position size being careful to balance any current positions. They place the trade and observe the market.

Is Hedging in Forex Illegal?

Hedging is an uncommon approach in the financial markets, allowing traders to control risks against market volatility. It is regarded to be illegal in the US. Not all forms of hedging are illegal, the act of buying and selling the same currency pair at identical or different strike prices is illegal.

Is Hedging Good in Forex?

Hedging is a low-risk strategy with limited potential for profits and losses. It can be profitable only if an investor can escape the pitfalls of a market.