Hantec Markets

Are you looking for the best platform for automated and social trading? Then, Hantec Markets might be your platform. This intuitive trading platform has been around for years and has consistently been one of the reliable platform choices for both experienced and beginner traders.

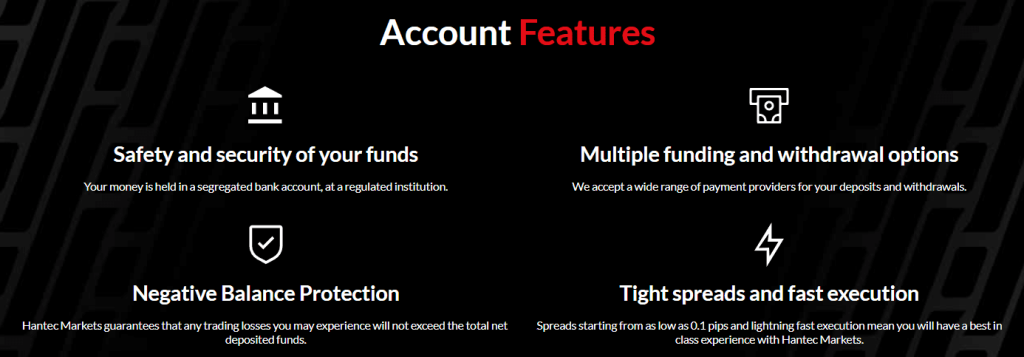

This foreign exchange company offers private and institutional customers the ability to access products, including currency trading, indices, precious metals, commodities, and CFDs. In addition, this broker is committed to providing traders with tight spreads, fast execution with no requotes, and deep liquidity.

This review will discuss the features of the Hantec Markets platform, the different accounts available to customers, and other important factors that make this broker stand out. In addition, we will also deeply analyze the customer service provided by this broker and discuss our overall experience with Hantec Markets.

So, let’s get started.

What is Hantec Markets?

For over 30 years, Hantec Group has been a leading name in global Brokerage and financial services. Their headquarters is in Hong Kong, but they have subsidiaries across Japan, China, New Zealand, Australia, and Europe. Most recently, these operations have mainly taken place via their UK entity with an emphasis on adhering to the regulations of that region.

Additionally, as the company experienced growth and expansion throughout its operation, it was able to secure licenses from local regulatory bodies and improve its online trading offerings to ensure that business operations were at optimal performance.

In addition, Hantec Markets provide MetaTrader 4 account that gives traders access to 32 currency pairs and gold and silver. MT4 is user-friendly for those with little trading experience and offers an impressive array of technical analysis tools and 2,000 indicators across nine timelines. Furthermore, it provides automated trading options through FIX API and social/copy trades by ZuluTrade.

Advantages and Disadvantages of Trading with Hantec Markets

Benefits of Trading with Hantec Markets

Hantec Markets has an impressive record of success, having earned the trust and approval of six regulatory bodies in Europe and Asia over 12 years. In addition, customers can rest assured that Hantec is a transparent broker – its business partners are fully disclosed, and all legal documentation is readily available upon request.

This broker has revolutionized the way market participants communicate. With their developed MT4 ECN Bridge system, orders are quickly processed, and data is accessible across the globe without any involvement from a broker. This liquidity bridge allows for an efficient transfer of information that can be used to make more informed decisions in real-time.

Even though the broker doesn’t possess any unique investment opportunities or trading inventions, its fast order processing and continual liquidity assistance are deemed a benefit compared to other brokers. Moreover, Hantec Markets offers a FIX API solution, which is rare among retail traders. With this solution, traders can interact more efficiently and quickly directly with the market.

Hantec Markets Pros and Cons

Below are the pros and cons of the Hantec Markets:

Pros

- Offers more than 100 trading instruments

- Spreads from 0.1 to 0.5 pips

- Offers FIX API solution for high-frequency trading

- Seamless order processing with MT4 ECN Bridge system

- Variety of educational and research tools

Cons

- Doesn’t accept clients from a few countries like the USA, Iran, or North Korea.

- No individual stock instrument trading options.

- Customer service is not available 24/7.

- A limited number of currency pairs are available for trading.

Hantec Markets Customer Reviews

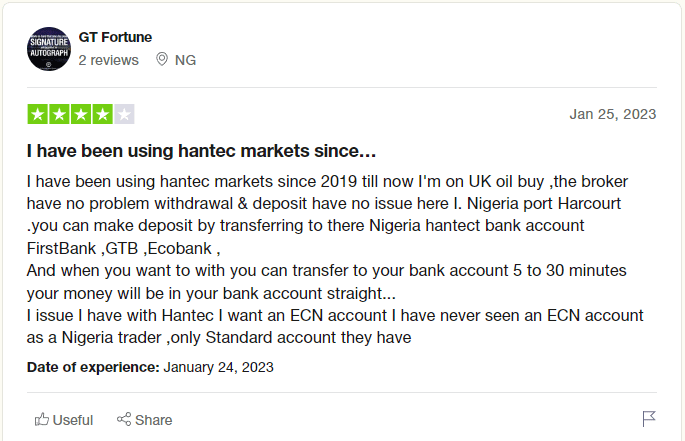

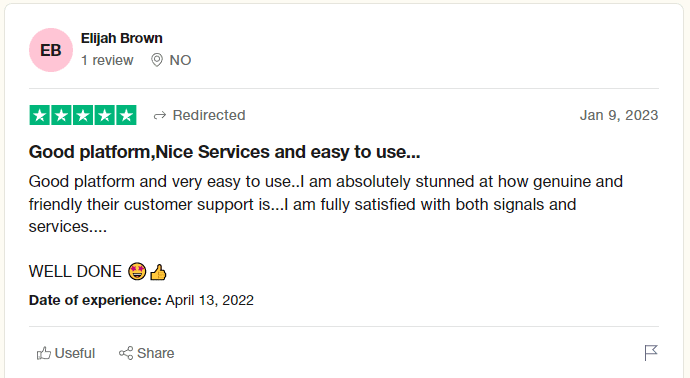

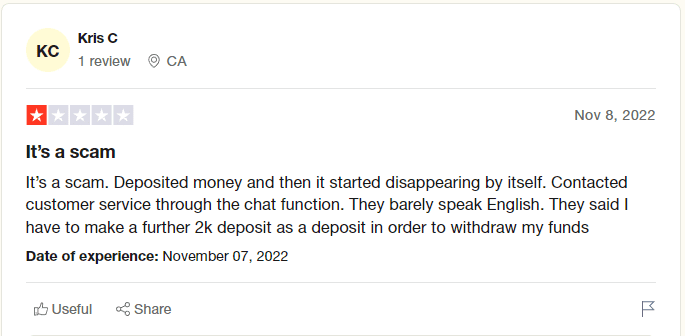

Our review team has found several positive reviews of the satisfied clients of the Hantec Markets. For example, one trader has reviewed this broker, saying it is the best platform with no withdrawal or deposit issues. In addition, the trading experience is excellent, customer support is outstanding, and account managers are always there to assist.

Another trader has stated that the customer service of Hantec Markets is remarkable, and the deposit/withdrawal process is quick and secure. Besides that, clients are satisfied with the signal and services the broker provides.

However, the lack of an ECN account and market maker model has also been noted. Moreover, the absence of individual stock trading is another issue. Some customers have also faced withdrawal issues, which take longer than expected.

Hantec Markets Spreads, Fees, and Commissions

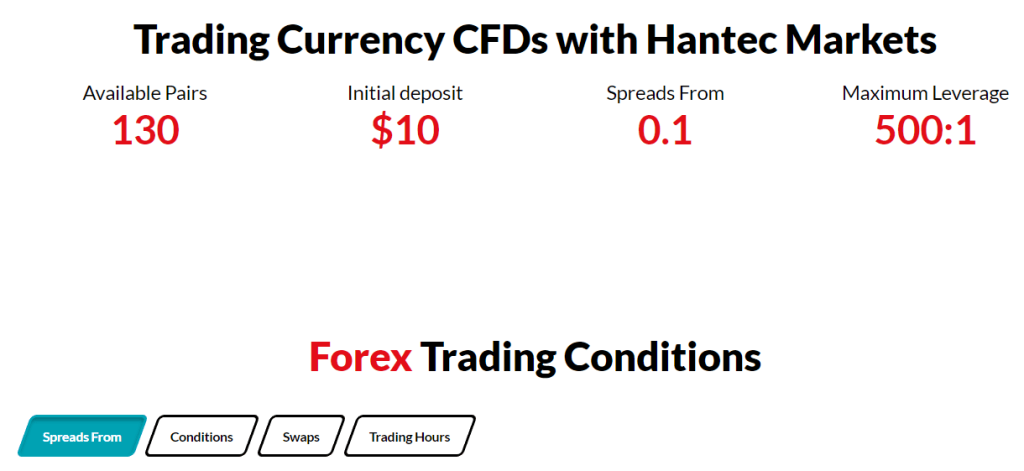

Hantec Markets is proud to offer prices that are difficult to beat, with spreads starting from as low as 0.2 pips on USD/EUR trades. The typical spread for GBP/USD and EUR/GBP orders is 0.5 and 0.7 pips, respectively.

Silver bullion spreads are just 5 cents, and gold is 50 cents. As for commodities, you can expect no commission fees whatsoever! With cryptocurrencies, the rates and commissions differ from case to case as they tend to be highly variable. Additionally, if a position is held overnight, swaps become applicable — though this will depend on your broker’s policies regarding how much a swap rate should be charged.

If you decide to invest with Hantec Markets, the only fee that will affect your trading is a spread or commission if you trade certain CFD markets. Commission rates are negotiable when it comes to trading in index CFDs.

The variance between the ask and bid cost is known as the spread, which can fluctuate depending on market conditions. Hantec Markets applies its fee for trades by adding a variable spread to this amount. Therefore, you may pay a commission or a spread for CFDs, and it differs depending on the instrument you are trading.

Leverage

By investing with Hantec Markets, international clients can attain leverage of up to 1:500 on their Standard Accounts and an even more remarkable 1:1000 using the Cent Account. Despite this, as per ESMA regulations for European customers, maximum leverage levels are much lower, specifically at only 1:30 for major FX pairs,1:20 for minors and exotics, golds and stock indices, and a barely adequate 1:10 ratio against oil and silver investments.

For traders using professional account programs, the leverage levels are negotiable. They must contact the broker’s customer support team to discuss their requirements.

Account Types

Though the Hantec website could be clearer regarding trading accounts, this may change with any updates. Yet, it offers a distinct differentiation between retail and professional investor accounts. Once an individual has been approved for a pro-trader designation, trading terms become less advantageous — without demonstrating the competitive advantages of such accounts.

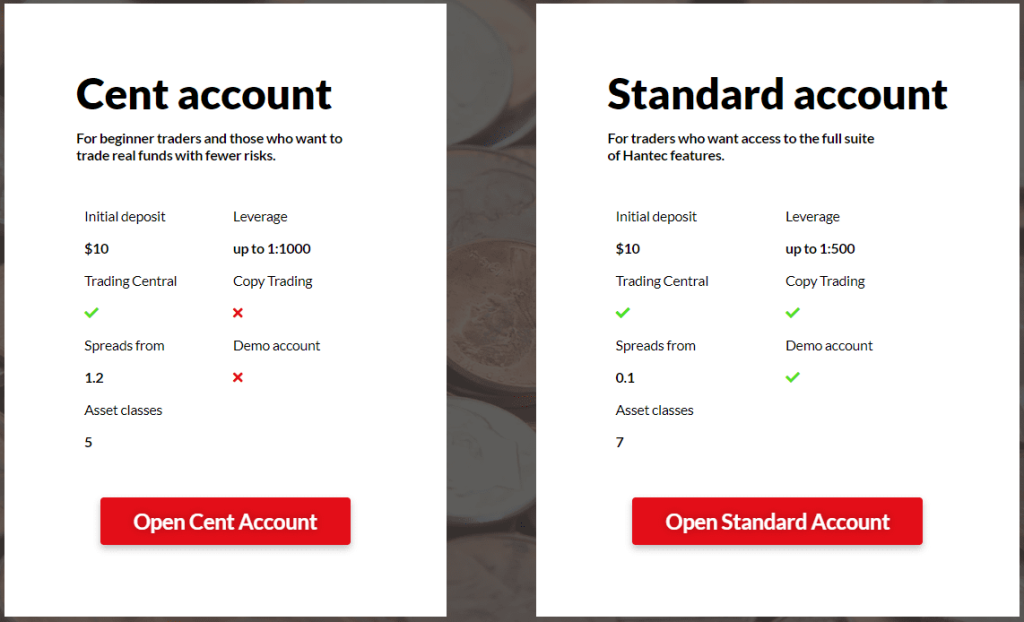

Cent Account

The cent account is most suitable for beginner traders who want to trade real funds while still learning the basics. The minimum deposit for a cent account is $10 with leverage of 1:1000 and spreads start from 1.2 pips. In addition, 5 different trading assets are available for this account type, and traders can access copy trading. Moreover, the cent account doesn’t offer a demo account.

The cent account comes with the following features:

- Floating spread that starts from 1.2 pips

- 5 trading assets are available

- Up to 1:1000 leverage

- A minimum deposit of $10

Standard/Live Trading Account

This account is most suitable for retail customers as it provides fast order execution and tight spreads. A minimum deposit for a standard account is $100, with a leverage of 1:500. Spreads start from 0.1, and traders can perform copy trading. Moreover, 7 different trading assets are available. To access the full features of Hantec Markets, go for this account.

The Standard account comes with the following features:

- Floating spread that starts from 0.1 pip

- The maximum trade lot is 50, while the minimum trade size is 0.1 lot

- Stops out when the equity is 40% of the used margin

- Up to 1:500 leverage

- A minimum deposit of $100

Professional Trading Account

This account is for professional traders and requires an application process. The features are similar to a live trading account, but the spreads tend to be tighter, and the leverage options are higher. With this account, traders can enjoy more flexibility and enhanced trading conditions.

However, to open the pro account, hantec markets clients must meet certain criteria like a financial instrument portfolio exceeding €500,000. In addition, the trader must have experience working in the relevant financial sector for a year and have placed 10 leveraged and significant trades in the past year. Moreover, this account has no negative balance protection, and the EUR/USD account spread is 1.8 pips.

The pro account has the following features:

- Floating spread that starts from 0.2 pips

- The maximum trade lot is 100, while the minimum trade size is 0.1 lot

- Commission applies

- Maximum leverage of 1:500

- A minimum deposit of $1000

Demo Account

A demo account helps traders get familiar with the platform and understand its features before investing money. This type of account offers $10,000 in virtual funds to practice trading.

How To Open Your Account?

Below is the step-by-step guide to opening an account on Hantec Markets:

Step 1: Go to the official website of Hantec Markets and click on ‘Open account.’

Step 2: Fill out the form, including details like client type (individual, corporate), First and last name, email, country, and phone number, and click on ‘Register.’

Step 3: Now, you will see the registration form on the screen. Again fill in your personal details, account details, employment/financial Information, investment experience, and deceleration, and click on ‘Register.’

Step 4: After receiving an email with a verification link, click on the link to verify your account.

Step 5: Now upload your address and identity proof to make a deposit.

Step 6: Finally, you’re ready to start trading on the platform. To select an account type, go to the settings and choose the account type.

And that’s it! You have successfully opened an account on Hantec Markets. Now you can start trading and enjoy the benefits of the proprietary platform.

What Can You Trade on Hantec Markets

Below are the asset classes available to trade on Hantec Markets:

#1. Forex

Hantec Markets offers over 35 currency pairs, including many majors and minors. The most popular are EUR/USD, GBP/USD, USD/JPY, AUD/USD, and GBP/JPY.

#2. Bullion Trading

Hantec Markets offers gold and silver trading, perfect for traders who want to speculate on the price movements of precious metals. It also allows traders to balance their portfolios and benefit from gold’s low volatility.

#3. Indices

Hantec Markets offers index trading, which is a great alternative to Forex. Traders can speculate on the performance of indices like FTSE 100, S&P 500, and more.

#4. Commodities

Hantec Markets offers various commodities, including oil, wheat, and barley. With commodity trading, traders can speculate on the price movements of these assets.

#5. Stocks

Hantec Markets also offers stock trading, allowing traders to speculate on the price movements of individual stocks. A wide range of stocks from major stock exchanges is available, including US, Europe, and Asia stocks.

#5. Cryptocurrencies

Hantec Markets also allows traders to speculate on the prices of cryptocurrencies. Many digital tokens and currencies are available, including Bitcoin, Ethereum, Litecoin, etc.

Hantec Markets Customer Support

Hantec Markets provides various customer support services, including live Chat, email, and telephone. Furthermore, their team is available 24/5 to ensure a suitable response during trading hours. With this level of customer service, you can rest assured that your queries will be answered promptly, no matter the time or day.

In addition, you can connect with them through their social media channels on Facebook, Twitter, Instagram, YouTube, and LinkedIn. When you register for the broker platform, an account manager is assigned to guide your trading journey. Moreover, the website can be translated into 6 languages: English, Portuguese, Española, etc.

However, if you want to contact their team via email or telephone, you need to select the location from their locations list. Overall, Hantec Markets provides customers with a good support both before and throughout the trading process.

Contact Details

Below are the contact details for different locations:

United Kingdom

- London Office

- Tel: +4420 7036 0850

- Email: info-uk@hmarkets.com

Jordan

- Amman office:

- Tel: +96265535999

- Email: Info-jo@hmarkets.com

UAE

- Dubai office:

- Tel: +41225510215

- Email: Info-mu@hmarkets.com

Thailand

- Bangkok Office

- Tel: 025061930

- Email: Info-mu@hmarkets.com

Ghana

- Accra Office

- Tel: +233 50 572 6656

- Email: Info-mu@hmarkets.com

Chile

- Santiago Office

- Address: Oficina 1302, Genesis building, Avenida Apoquindo 6550,

- Las Condes, Santiago, Chile

- Tel: +56232109090

- Email: info-cl@hmarkets.com

Mauritius

- Ebène office

- Email: Info-mu@hmarkets.com

Nigeria

- Lagos Office

- Tel: +234 708 060 1265

- Email: Info-mu@hmarkets.com

Advantages and Disadvantages of Hantec Markets Customer Support

Security for Investors

Hantec Markets is an authorized and regulated broker with the Financial Conduct Authority (FCA) in the United Kingdom. In addition, it is also regulated by the Financial Services Commission (FSC) of Mauritius to provide Forex and CFD services.

The Eastern division of the Hantec Group is regulated by leading financial institutions in Australia (ASIC), Japan (FSA), and Hong Kong (CGSE). This gives traders a sense of assurance that their products are secure and they are getting competitive offers.

With Hantec Markets, customer funds are kept safe and secure through stringent regulations. Funds are placed in individualized segregated accounts with banking giants such as Lloyds Banking Group, BMO Harris Bank, and Barclays to guarantee that those assets cannot be used for any other purpose outside of the company’s financial obligations.

In addition, this company has almost 18 offices in Europe and Asia. With negative balance protection, protection from trading manipulation, and safe credentials storage, customers can be sure that their investments are safe.

Withdrawal Options and Fees

You can withdraw your available funds from your trading account or close it anytime as a trader. However, for security reasons, only the client can withdraw using their verified account; third-party withdrawal requests are not allowed.

All withdrawal requests can be received before 11:00 a.m. (Beijing Time) Any business day will be processed immediately, with funds being remitted the same day or by the following business day at the latest.

Generally, banks process transfers within 2 to 5 business days; however, the timeframe may vary from bank to bank. Moreover, the available withdrawal methods are Visa, Skrill, Neteller, and Wire transfer.

Hantec Markets Vs. Other Brokers

Below is an in-depth comparison of Hantec with other top-tier brokers to help you determine which is right for your trading style.

#1. Hantec Markets vs. AvaTrade

AvaTrade is a well-known Forex and CFD broker regulated in several jurisdictions, including the European Union, Australia, Japan, and South Africa. From 2005, AvaTrade has quickly established itself as a renowned broker for professional traders. With an exponential rise in active traders and profits from this platform, it’s no surprise that AvaTrade is now sought after by investors who require dependable platforms with multiple trading tools and options.

Hantec Markets, on the other hand, offers a far more focused approach to Forex and CFD trading. This company is regulated in multiple jurisdictions and has built a strong reputation for providing an honest and transparent trading environment. With competitive spreads, fast execution speeds, and the ability to trade with leverage, Hantec Markets ensures that traders can get the most out of their investments.

However, when Hantec Markets is compared with AvaTrade, the latter appears to have a significant advantage in terms of markets offered and customer service. AvaTrade provides over 250 assets for Forex, CFD, and Options trading and customer service in over 20 languages, whereas Hantec Markets only has a few dozen assets available. Furthermore, the customer service team is available only in a few languages other than English.

Overall, if you want to trade a wider range of markets with excellent customer service, AvaTrade is the ideal choice. Moreover, this broker has the best reputation, especially among long-term investors.

#2. Hantec Markets vs. RoboForex

RoboForex is an international broker that helps people trade currencies, cryptocurrency, and stocks. It has over three million customers worldwide, including Russia, China, Europe, and the Middle East. RoboForex offers multiple trading instruments like CFDs and precious metals. This company also provides different accounts and insurance tools.

On the other hand, Hantec Markets is a regulated broker that provides trading instruments for Forex and CFDs. It also offers negative balance protection and an array of trading features. The platform helps traders execute orders quickly and gives access to more than 80 global markets.

When comparing the two brokers, it is obvious that RoboForex has a slight edge regarding the variety of available assets. Both brokers offer competitive spreads, fast execution speeds, and leverage; however, RoboForex offers a wide range of accounts, including zero-fee options.

Ultimately, while both brokers feature dependable services and a broad array of instruments, RoboForex stands out as the superior option for traders who wish to have more choices and personalization capabilities. Even better is that the minimum deposit fee of RoboForex is only $10 — perfect for beginner traders.

To sum up, Hantec Markets and RoboForex both offer dependable services with a vast array of instruments. If you are searching for more resources, features, and options, then RoboForex is perfect. Additionally, these two brokers have an outstanding selection of products that cater to various types of traders — making it possible to find one that fits your individual requirements perfectly. Therefore select the broker which meets all your trading goals best.

#3. Hantec Markets vs. Alpari

Backed by over two decades of experience, Alpari is a global Forex and CFD broker. This company offers over 200 instruments, including currency pairs, indices, commodities, etc. Alpari also has a wide range of account types that cater to different trading styles. This broker provides an active Forex trading platform and various investment opportunities.

Alpari has a minimum deposit requirement of just $1, making it a great option for beginner traders. Furthermore, this broker offers an impressive selection of resources and services to help its customers succeed in trading. With a leverage of up to 1:3000, Alpari is great for traders who need to take higher risks.

Hantec Markets, on the other hand, is a regulated broker providing trading instruments for Forex and CFDs. It also offers an array of trading features and a wide range of assets to trade. However, a minimum deposit of $10 for a cent account is required to get started.

Comparing Alpari and Hantec Markets, both brokers are reliable and provide good services. Alpari offers a wide selection of tools and resources to help traders succeed in the Forex market, while Hantec Markets offers an array of trading features and a wide range of assets.

Alpari is great for beginner traders because it has a minimum deposit requirement of just $1, while the minimum deposit for Hantec markets is $10. With its low minimum deposit requirement, Alpari is the ideal broker for novice traders eager to get started with a minimal investment.

To summarize, both Alpari and Hantec Markets provide reliable services with a vast array of instruments. However, Alpari is more reliable for beginner traders as it has the lowest minimum deposit requirement. Choose one that meets all your trading goals best!

Conclusion: Hantec Markets Review

Hantec Markets is committed to delivering a top-notch experience with its tight spreads, competitive prices, and high leverage. All regulations are complied with for our traders’ funds to be safeguarded and protected. In addition, an expansive selection of market instruments is available for trading. Although they do not supply many platforms, MetaTrader4 is an in-demand option among traders from all levels and approaches.

In addition, Hantec Markets has been determined to be an extremely competitive company with transparent conditions and numerous offices in the world’s primary financial hubs. Not to mention their top-notch Straight Through Processing (STP) execution, advanced trading platform capabilities, cutting-edge technologies, and support services — all of which make them stand out.

Even though there may be some confusion regarding certain services due to various jurisdictions having their trading conditions, Hantec Markets seems like a reliable and trustworthy broker. Moreover, it suits beginner, professional, copy, algorithmic, high-volume, and ECN traders.

Overall, whether you are a trader who focuses on currencies or those who want to experiment with a variety of assets and markets, Hantec Markets is the perfect choice for you. First, however, check all the requirements of different market types before signing up.

Hantec Markets Review FAQs

Is Hantec Markets regulated?

Hantec Markets is regulated by the Financial Conduct Authority (FCA) in the United Kingdom and regulated by leading financial institutions in Australia (ASIC), Japan (FSA), and Hong Kong (CGSE). In addition, the Eastern division of the Hantec Group is regulated by the Financial Services Commission (FSC) to provide Forex and CFD services. With all these regulations, Hantec Markets provides investors with the security of knowing that their funds are well-protected and secure.

What is Hantec Market’s minimum deposit?

The minimum deposit required to open a Hantec Markets Standard account is $100. This amount can be used as a margin when trading Forex, Bullion, Stocks, Indices, Commodities, and cryptocurrencies. However, a minimum deposit of $10 is required to open a cent account.

Is Hantec Markets a reliable broker?

Yes, Hantec Markets is a reliable broker. It provides its customers with a comprehensive range of products and services designed to meet the needs of any trader. It is also committed to providing a safe and secure trading environment and has implemented several safeguards, including negative balance protection. Moreover, top-tier authorities regulate this company, providing traders and investors with confidence and security.