Hankotrade Review

In the dynamic world of Forex trading, the role of a Forex broker is pivotal. These brokers act as intermediaries, enabling traders to access the vast currency markets. The importance of choosing the right Forex broker cannot be overstated. It’s akin to selecting a partner for your financial journey – a decision that can significantly impact your trading success and risk management.

Among the plethora of brokers available, Hankotrade has emerged as a notable option. Known for its STP (straight-through processing) model, Hankotrade caters to both retail and professional traders. This broker sets itself apart by offering trading contracts for differences (CFDs) on diverse assets such as currencies, metals, and cryptocurrencies.

In this detailed review, we delve deep into Hankotrade, shedding light on what makes it unique. We explore various aspects, including account options, deposit and withdrawal processes, and commission structures. Combining expert analysis with real trader feedback, our review aims to provide a balanced perspective, helping you decide if Hankotrade is the right choice for your Forex trading needs.

What is Hankotrade?

Hankotrade stands out in the Forex market as a top-tier ECN (Electronic Communication Network) broker. This type of brokerage is known for offering direct access to other participants in currency markets. What sets Hankotrade apart is its commitment to providing traders with excellent conditions, such as tight spreads and no commission charges.

One of the key benefits of trading with Hankotrade is its efficient order execution. As an ECN broker, Hankotrade efficiently forwards your trades straight to liquidity providers. This ensures fast, transparent, and reliable trading, which is crucial in the fast-paced world of Forex. Moreover, Hankotrade is recognized for having some of the most competitive commissions in the industry, making it a cost-effective choice for traders.

Benefits of Trading with Hankotrade

After trading with Hankotrade, I’ve identified several benefits that it offers to traders. One of the most notable advantages is the access to both MetaTrader 4 and MetaTrader 5 platforms. These platforms are widely recognized for their user-friendly interfaces and comprehensive trading tools, making them suitable for both beginners and experienced traders.

Another significant benefit is the competitive spreads offered by Hankotrade, particularly in their STP and ECN accounts. This can be especially advantageous for traders looking to minimize trading costs. Additionally, the option for cryptocurrency withdrawals adds an element of flexibility for those who prefer or are comfortable with digital currency transactions.

Moreover, Hankotrade’s commitment to providing effective customer support enhances the overall trading experience. Their support team is responsive and capable, which is crucial for addressing any issues or queries that may arise during trading. However, it’s important to remember that Hankotrade operates without regulatory oversight, which might be a concern for some traders seeking the assurance of a regulated environment.

Hankotrade Regulation and Safety

As a Forex trader who has personally traded with Hankotrade, I’ve gained insights into its regulatory and safety measures. It’s crucial for traders to know that Hankotrade operates without the oversight of any regulatory authorities. This aspect is important as it impacts the level of trust and security you might feel when investing.

Despite the lack of regulatory control, Hankotrade takes certain steps to protect its clients’ interests. Traders’ funds are kept in separate accounts from the broker’s own funds. This is a critical safety measure as it safeguards your money from being used for any other purposes by the broker. Additionally, Hankotrade provides automated negative balance protection. This feature is essential to ensure that traders do not lose more money than they have in their accounts, a significant risk in leveraged trading.

Moreover, Hankotrade adheres to AML (Anti-Money Laundering) principles, demonstrating a commitment to legal and ethical financial practices. As a trader, I also observed that the broker collects personal information, which is a standard procedure in the industry. It’s vital to be aware of these practices for a transparent understanding of how your data is handled and the overall integrity of the trading environment.

Hankotrade Pros and Cons

Pros

- Access to MetaTrader 4 and 5

- Platforms for desktop, mobile, and web

- Availability of bonuses

- PAMM/MAM options for passive investing

- Demo accounts for strategy testing

- Flexible spreads based on assets

- Fast customer support

- Income opportunities through IB program

Cons

- Not regulated

- Required verification for users

- Limited withdrawal options

Hankotrade Customer Reviews

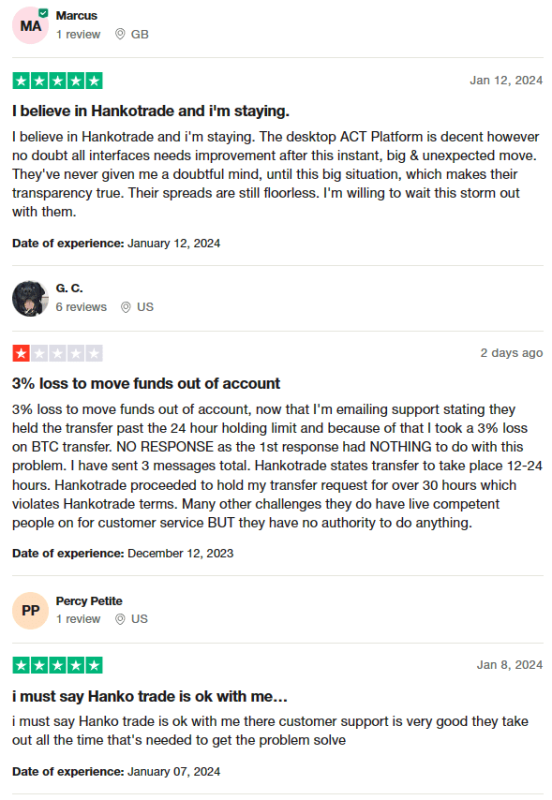

Hankotrade currently holds a 4.5-star rating on Trustpilot, reflecting mixed customer experiences. Some users remain loyal, appreciating the desktop ACT Platform and the broker’s generally reliable transparency. Despite recent challenges, they express a willingness to stay with Hankotrade, citing the broker’s consistent spreads. On the other hand, several customers report issues with fund transfers, mentioning a 3% loss when moving funds and a delay exceeding the promised 12-24 hour window. Furthermore, while customer support is praised for its responsiveness, there are concerns about their limited authority to resolve issues.

Hankotrade Spreads, Fees, and Commissions

As a trader who has explored various aspects of Hankotrade, I’ve found their spreads, fees, and commissions structure to be quite straightforward. No non-trading fees are charged by the broker, which is a significant advantage for traders who are concerned about additional costs.

Regarding spreads, they vary depending on the asset type, especially for STP accounts. This variability in spreads means that costs can fluctuate based on market conditions and the assets you are trading. For those using ECN and ECN Plus accounts, the possibility of zero spreads exists, which is a major draw. However, this comes with a fee per lot – it’s $2 for ECN accounts and $1 for ECN Plus accounts.

Another aspect to consider is the presence of swap accounts and swap fees. This is particularly relevant for traders holding positions overnight, as these fees can impact the overall cost of trading. Understanding these details is crucial for making informed decisions while trading with Hankotrade.

Account Types

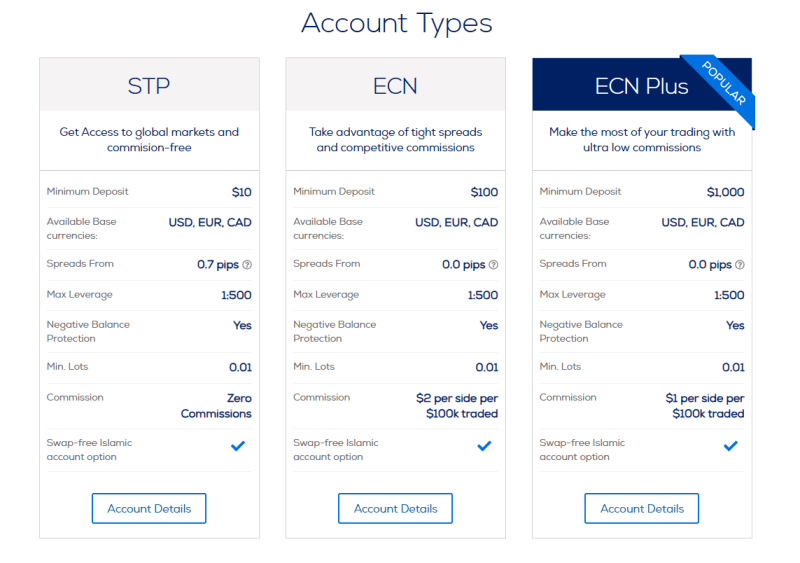

Having personally tested the various trading accounts offered by Hankotrade, I can provide a clear and straightforward overview of each. These accounts are designed to cater to different levels of trading experience and investment capacity.

STP Account

- Minimum Deposit: $10

- Account Currencies: USD, EUR, CAD

- Minimum Spread: 0.7 pips

- Maximum Leverage: 1:500

- Negative Balance Protection: Available

- Minimum Order: 0.01 lots

- Additional Trading Fees: None

ECN Account

- Minimum Deposit: $100

- Basic Currencies: USD, EUR, CAD

- Spread: From 0 pips

- Maximum Leverage: 1:500

- Negative Balance Protection: Available

- Fee: $2 in each direction per $100,000 turnover

ECN Plus Account

- Minimum Deposit: $1,000

- Main Account Currencies: USD, EUR, CAD

- Spread: From 0 points

- Maximum Leverage: 1:500

- Negative Balance Protection: Available

- Fee: $1 in each direction per $100,000 turnover

Each of these accounts has its unique features and benefits, making Hankotrade a versatile platform for traders with varying needs and strategies.

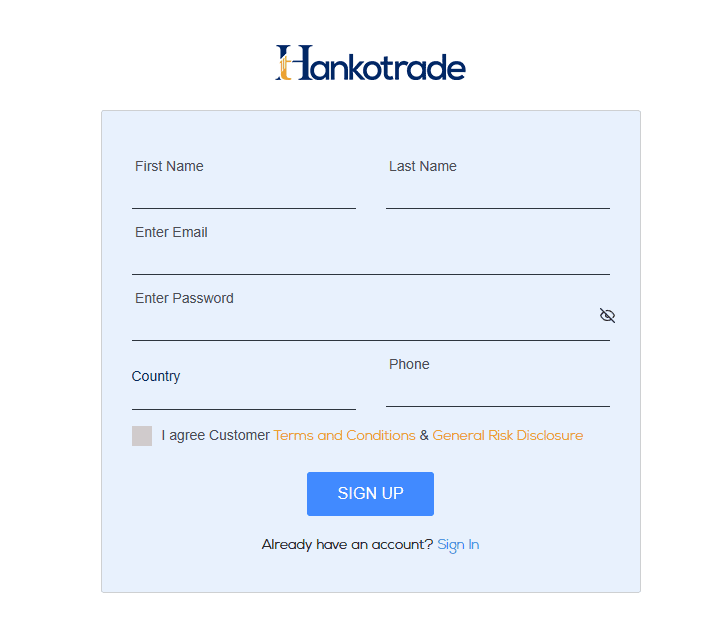

How to Open Your Account

- Visit the Hankotrade website and click on “Register Live Account.”

- Complete the registration form with your details.

- Receive a confirmation code via the email you provided.

- Confirm your account through the received code.

- The system will automatically open your user account.

- Create a live account by selecting “Add Live Account.”

- Choose your preferred type of trading account and platform from the menu.

- Set your desired leverage for the account.

Hankotrade Trading Platforms

Based on my experience with Hankotrade, their trading platforms cater to a wide range of trader preferences and needs. Traders have the option to use MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are among the most popular and versatile trading platforms in the Forex market. These platforms are known for their user-friendly interfaces and robust features.

Hankotrade also offers flexibility in terms of accessibility. Traders can choose between desktop and mobile versions of MT4 and MT5, ensuring they can manage their trades anytime and anywhere. Additionally, for those who prefer not to download software, Hankotrade provides web versions of these platforms. This ensures that traders can access their accounts and the markets directly from their web browsers, making trading more convenient and accessible.

What Can You Trade on Hankotrade

In my experience with Hankotrade, the range of trading instruments available is quite comprehensive, catering to diverse trading preferences. One of the primary offerings is currency pairs, which includes a wide variety of major, minor, and exotic pairs. This allows traders to engage in the dynamic forex market, capitalizing on currency fluctuations.

Besides forex, Hankotrade also provides opportunities to trade CFDs on indices, commodities, cryptocurrencies, and metals. These instruments offer a broader market exposure, enabling traders to diversify their portfolios beyond just currency pairs. Trading CFDs on indices and commodities can be a strategic move for those looking to invest in broader market trends, while cryptocurrencies and metals add a modern edge to traditional trading options.

Hankotrade Customer Support

Based on my interactions with Hankotrade, their customer support system is designed to be accessible and responsive. One of the quickest ways to reach out to their representatives is through the live chat feature on their website. This option provides immediate assistance and is especially useful for urgent queries.

For more detailed inquiries or issues that require documentation, emailing the support team is a viable option. Additionally, within the Account Operation section of the user account, there are specific options for addressing account-related concerns. Another effective method is by creating a ticket directly in the user account, which is helpful for tracking the progress of your request. Each of these channels ensures that traders have multiple ways to seek support, enhancing the overall trading experience with Hankotrade.

Advantages and Disadvantages of Hankotrade Customer Support

Withdrawal Options and Fees

In my experience with Hankotrade, their withdrawal options and fees are straightforward but come with certain conditions. The minimum amount you can withdraw is $50, and Hankotrade typically processes these requests within 24 hours. This swift processing is a key feature, especially for traders who need quick access to their funds.

However, there are some critical points to be aware of. Your withdrawal request might be rejected if it’s not confirmed within 48 hours. Also, withdrawals can be denied if your account has insufficient margin or if the wallet details are incorrect. Notably, while you don’t need to verify your account for deposits, withdrawals over $5,000 may trigger a request for proof of identity.

Another aspect to consider is the policy regarding transfer fee compensation. Hankotrade may refuse to cover this fee if your trading account hasn’t shown any activity. It’s important to note that all withdrawals are processed only in cryptocurrencies, which may limit your options depending on your preferences or needs.

Hankotrade Vs Other Brokers

#1. Hankotrade vs AvaTrade

Hankotrade and AvaTrade are distinct in their offerings and market presence. AvaTrade, established in 2006, has a strong global footprint with over 300,000 customers and is known for its heavy regulation and licensing. It offers a diverse range of over 1,250 financial instruments and is not available to U.S. traders. Hankotrade, on the other hand, focuses on offering STP and ECN accounts, with an emphasis on cryptocurrency withdrawals and lacks the regulatory oversight that AvaTrade boasts.

Verdict: AvaTrade is better for traders looking for a more established, heavily regulated broker with a wide range of instruments. Its regulatory framework provides a higher level of security and trust.

#2. Hankotrade vs RoboForex

RoboForex, operating since 2009 and regulated by the FSC, offers a broad spectrum of more than 12,000 trading options across eight asset classes. It is known for its diverse trading platforms, including MetaTrader, cTrader, and RTrader, and caters to a wide range of traders with different styles and investment levels. Hankotrade, while offering competitive spreads and cryptocurrency withdrawals, does not match the variety of trading options and platforms that RoboForex offers.

Verdict: RoboForex stands out for traders who seek diversity in trading platforms and a wide range of trading options. Its regulatory status and broad offering make it a more versatile choice compared to Hankotrade.

#3. Hankotrade vs Exness

Exness, a Cyprus-based broker started in 2008, offers a significant volume of over 120 currency pairings, CFDs for stocks, energy, and metals, including cryptocurrencies. Known for its low commissions, instant order execution, and the unique feature of infinite leverage for small deposits, Exness offers various account types to cater to different trader needs. Hankotrade‘s focus is more on its STP and ECN accounts with specific features like cryptocurrency withdrawals but lacks the extensive range and innovative leverage options of Exness.

Verdict: Exness is preferable for traders who desire a wider range of trading instruments and innovative features like unlimited leverage. Its diverse account types and strong operational background give it an edge over Hankotrade.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH HANKOTRADE

Conclusion: Hankotrade Review

In conclusion, Hankotrade presents a viable option for traders, particularly those interested in STP and ECN accounts. Its strengths lie in offering access to popular platforms like MetaTrader 4 and 5, flexible spreads, and the unique feature of cryptocurrency withdrawals. The broker’s user-friendly interface and effective customer support add to its appeal.

However, it’s important to approach Hankotrade with caution due to its unregulated status and limitations in withdrawal options. Potential traders should be aware of these aspects, as they might pose risks in terms of security and fund accessibility. The mixed user feedback, especially regarding operational challenges, further underscores the need for careful consideration before choosing Hankotrade as your trading partner.

Also Read: Fullerton Markets Review 2024 – Expert Trader Insights

Hankotrade Review: FAQs

Is Hankotrade regulated?

No, Hankotrade operates without regulatory oversight, which is a significant consideration for traders prioritizing security and regulatory compliance.

What types of accounts does Hankotrade offer?

Hankotrade offers STP, ECN, and ECN Plus accounts, each with different features like varying spreads, leverage options, and commission structures.

Can I withdraw my funds in fiat currency from Hankotrade?

No, Hankotrade only allows withdrawals in cryptocurrencies, limiting options for traders who prefer or require fiat currency transactions.

OPEN AN ACCOUNT NOW WITH HANKOTRADE AND GET YOUR BONUS