GTCFX Review

Forex brokers play an important role in the Forex trading field, offering a gateway to the world’s currency markets. Choosing the right Forex broker is essential for successful trading. It can significantly impact your trading experience, from the ease of executing trades to the security of your funds. Therefore, selecting a broker that aligns with your trading needs and goals is paramount.

Global Trade Capital (GTCFX) stands out as a notable player in the Forex brokerage industry. With its highly regulated status, GTCFX provides traders with a secure and transparent trading environment. Offering a variety of trading platforms such as MT4/MT5 and cTrader, along with multiple account options tailored to different trader preferences, GTCFX positions itself as a versatile choice for both novice and experienced traders.

In our GTCFX review, we delve into the broker’s unique features, comprehensive trading options, and the flexibility it offers through its account structures. Highlighting both the strengths and areas for improvement, our analysis aims to furnish you with a balanced view of GTCFX. By combining expert insights with real trader experiences, we endeavor to equip you with the knowledge to decide if GTCFX is the right broker to support your trading journey.

What is GTCFX?

GTCFX is a Forex broker that provides its clients with the opportunity to trade a diverse range of instruments. Clients can engage in trading currency pairs and CFDs on stocks, indices, precious metals, and energies. This broker offers access through popular platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, catering to various trading preferences and strategies.

One of the standout features of GTCFX is its account diversity. The broker offers a free demo account for those looking to practice or get acquainted with the platform without risk. For more seasoned traders, there are two standard accounts and three professional accounts, designed to meet different trading needs and goals. This flexibility in account options underscores GTCFX’s commitment to catering to a wide audience, from beginners to professionals.

Spreads at GTCFX start from 0 pips, making it an attractive option for traders looking for competitive pricing. Most accounts come with no trading fees, enhancing the potential for profitability. Furthermore, GTCFX ensures a seamless financial transaction process with no fees for depositing or withdrawing funds. Payment methods are versatile, including bank transfers, bank cards, e-wallets, and crypto-wallets, offering convenience and accessibility to traders worldwide. Additionally, GTCFX does not impose restrictions on trading strategies and methods, providing traders with the freedom to execute their preferred trading approaches.

Benefits of Trading with GTCFX

Trading with GTCFX has offered me several key benefits that have enhanced my trading experience. Firstly, the low minimum deposit requirement of just $30 made it accessible for me to start trading without a significant initial investment. This feature is particularly appealing for beginners or those cautious about committing a large amount of capital upfront.

Another significant advantage of trading with GTCFX is the variety of trading platforms available, including MetaTrader 4, MetaTrader 5, and cTrader. These platforms provide a flexible trading environment with advanced tools and features that cater to my trading strategies, whether I am looking for detailed technical analysis or prefer automated trading solutions.

Additionally, the absence of withdrawal fees stands out as a major benefit. It ensures that I can access my funds without extra costs, making the entire process of depositing and withdrawing funds straightforward and cost-effective. This aspect of GTCFX’s service offering adds an extra layer of satisfaction to my trading experience, as I can keep a larger portion of my profits.

From my experience, trading with GTCFX also means enjoying competitive spreads starting from 0 pips. This has allowed me to trade more efficiently, reducing the cost of trading and potentially increasing profitability, especially in fast-moving markets.

GTCFX Regulation and Safety

GTCFX is registered in Vanuatu, highlighting its commitment to operating within a regulatory framework. Its activities are overseen by three regulatory bodies: the Vanuatu Financial Services Commission, the Department of Economic Development of Dubai (DED), and the Financial Services Commission. This multi-layered regulatory oversight can be a strong indicator of the broker’s reliability and dedication to maintaining high standards of operation and safety for its traders.

It’s crucial for traders to be aware of the broker’s regulatory environment because it directly impacts the security of their investments and the integrity of their trading experience. However, it’s important to note that, despite the broad regulatory oversight, GTCFX’s clients do not have the option to address any financial control agency outside of Vanuatu. This means that traders cannot seek recourse with international regulators that do not monitor the activities of GTCFX.

Understanding these regulatory nuances is essential after trading with the broker, as it frames the scope of protection and support available to traders. While the regulation by multiple bodies suggests a certain level of broker reliability, the limitation regarding the addressing of concerns to financial agencies outside of Vanuatu underscores the importance of thoroughly evaluating the regulatory landscape when choosing GTCFX as your broker.

GTCFX Pros and Cons

Pros

- Low initial deposit requirement ($30)

- Competitive spreads starting at 0 pips

- Variety of five live account options

- Freedom in trading strategies

- Access to leading trading platforms

Cons

- Limited to currency pairs and CFD trading

- Lack of a conventional referral program

GTCFX Customer Reviews

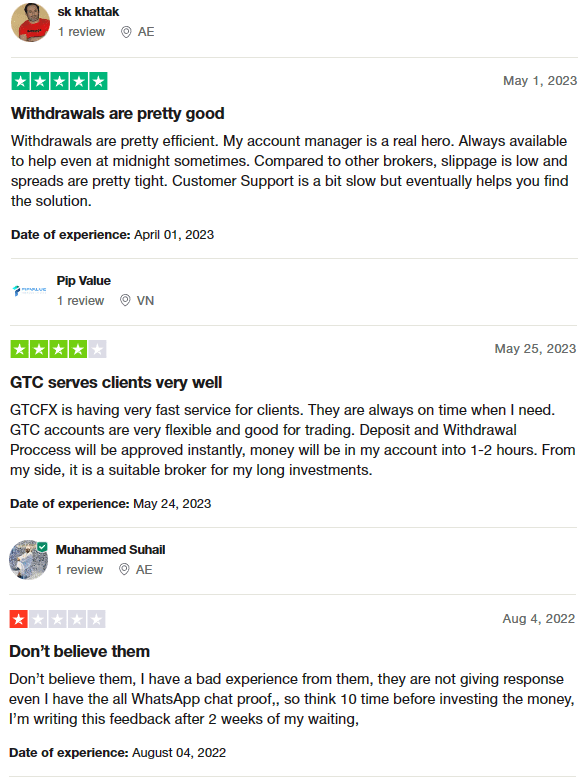

GTCFX customer reviews present a mixed picture of the broker’s services. On one hand, many users praise the efficiency of withdrawals and the availability of account managers, noting their willingness to assist at any hour and highlighting the low slippage and tight spreads compared to other brokers. These positive experiences also extend to the flexibility of GTC accounts and the speed of the deposit and withdrawal process, with funds typically appearing in accounts within a couple of hours. However, not all feedback is glowing, with some customers expressing dissatisfaction with the response time from customer support and cautioning potential clients based on negative experiences and a perceived lack of communication. Despite these concerns, the overall sentiment leans towards GTCFX offering a service that is appreciated for its trading conditions and client support, though areas for improvement remain evident.

GTCFX Spreads, Fees, and Commissions

The cost of trading with GTC Forex varies depending on the account type you choose. Spreads are floating, ranging from 0 to 0.3 pips across all account types, which is quite competitive in the forex trading space.

If you opt for the Raw Spread account, you’ll benefit from the lowest spreads, but there’s a catch: a $3.50 fee per trade. This fee is a small price to pay for those razor-thin spreads. On the brighter side, there are no trading fees on Standard and Pro accounts, making them attractive options for many traders.

Another highlight worth mentioning is the absence of withdrawal fees at GTC Forex. This policy holds true under most circumstances, giving you one less thing to worry about. However, it’s important to note that this doesn’t apply to the withdrawal of bonus funds, which are subject to special conditions. Also, keep in mind that while GTC Forex doesn’t charge you, other parties like banks or electronic payment systems involved in your transaction might, so it’s wise to check this in advance.

Account Types

When choosing an account at GTC Forex, you have several options to fit your trading style and preferences. Here’s a straightforward breakdown of the account types available:

- Standard Cent Account: Perfect for beginners or those looking to trade with smaller amounts. The minimum deposit is $30, spreads start from 0.3 pips, and there’s no fee involved. This account allows micro-lot trading, but you’re limited to currency pairs and metals.

- Standard Account: This account also requires a $30 minimum deposit and offers spreads from 0.3 pips with no trading fees. Unlike the Standard Cent Account, you have access to all assets, making it a versatile choice for various traders.

- Raw Spread Account: Designed for more experienced traders looking for tight spreads. It requires a higher minimum deposit of $3,000, offers spreads from 0 pips, and includes a $3.5 fee per lot. The leverage can go up to 1:500, appealing to those looking to trade more aggressively.

- Zero Account: Similar to the Raw Spread Account with a $3,000 minimum deposit and spreads from 0 pips, but the fee is even lower at $0.2 per lot. This account offers leverage of 1:500 and gives access to all assets, making it ideal for traders seeking minimal costs and maximum flexibility.

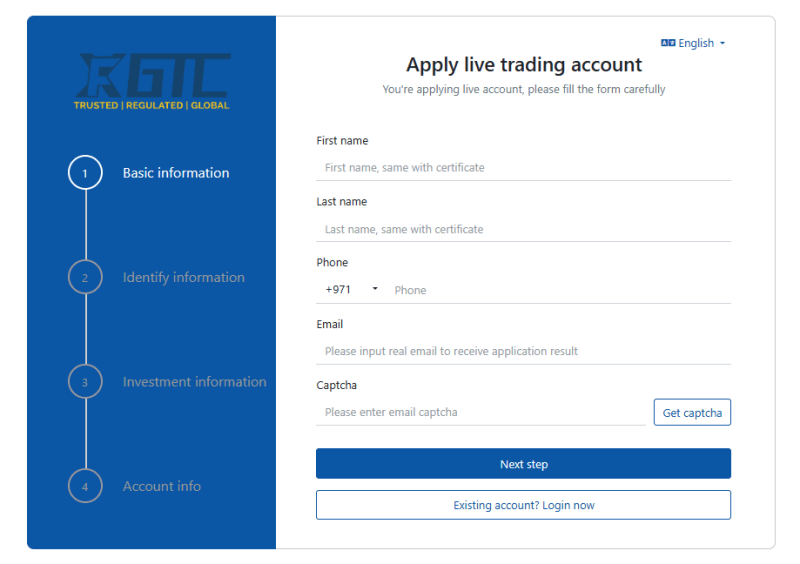

How to Open Your Account

- The user starts by visiting the GTCFX website and selecting their preferred language from the top right corner before clicking on Open Live Account.

- They fill out the form with personal details such as name, email, and phone number, choose an account type and trading platform, select their country, agree to the terms, and click Next.

- The user provides additional information including nationality, date of birth, complete address, and occupation details, then clicks Next.

- To ensure services are tailored to the user’s needs, they answer questions about their trading experience and click Next.

- GTCFX requires users to disclose their financial situation through a series of questions, after which the user proceeds by clicking Next.

- Users complete additional queries and upload necessary verification documents, then review and confirm the documents.

- A confirmation link is sent to the user’s email, which they click to activate their account and gain access to the user area.

- Finally, the user downloads the trading platform from their account, follows the instructions to make a deposit, and is then ready to begin trading with GTCFX.

GTCFX Trading Platforms

Based on my experience, GTCFX offers traders access to three highly regarded trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Each platform caters to different trading needs and preferences, ensuring that every trader finds a suitable environment for their trading activities.

MetaTrader 4 is renowned for its user-friendly interface and robust analytical tools. It’s ideal for both beginners and experienced traders who require reliable technical analysis and automated trading capabilities. MT4‘s popularity stems from its stability and the vast array of support resources available.

On the other hand, MetaTrader 5 offers advanced financial trading functions, along with superior tools for technical and fundamental analysis. MT5 is particularly suited for traders looking for more depth in their trading, with additional timeframes, graphical objects, and technical indicators. It also supports more order types than MT4.

cTrader, meanwhile, is known for its sleek design and intuitive interface. It’s a favorite among traders who prefer an ultra-modern trading experience. cTrader excels in rapid order execution and provides extensive customization options, making it a top choice for scalpers and traders who rely on precision and flexibility.

What Can You Trade on GTCFX

Based on my experience, trading on GTCFX provides a wide variety of instruments that cater to different investment preferences and strategies. The platform allows trading in currency pairs, CFDs on stocks, indices, precious metals, and energies, offering a comprehensive range of options for traders to diversify their portfolios.

The leverage available on GTCFX varies depending on the traded asset, ensuring traders can optimize their trading strategies according to the risk and reward profiles of different markets. For currency pairs, the platform offers a high maximum leverage of 1:500, which is quite generous and allows for significant market exposure with a smaller capital outlay.

Furthermore, GTCFX is flexible in accommodating traders’ needs for even higher leverage. By contacting technical support, traders can request an increase in leverage up to 1:1000 for certain trades. This level of customization and support enhances the trading experience, providing opportunities for higher profits while also increasing risks. It’s important for traders to use this feature judiciously, considering their risk tolerance and trading strategy.

GTCFX Customer Support

Based on my experience, GTCFX offers comprehensive customer support that caters to both existing clients and those considering joining. The broker ensures that assistance is readily available for any trade-related queries or concerns. You can reach out to their technical support through multiple channels, making the process seamless and user-friendly.

You have the option to contact support via the call center, email, submit tickets on the website, or use the live chat feature available both on the website and within the user account. This range of contact methods ensures that you can get the help you need in the manner most convenient for you, whether you prefer speaking directly to a representative or typing out your issues.

Moreover, GTCFX is active on several social media platforms, including Facebook, Twitter, YouTube, LinkedIn, and Instagram. These channels not only provide additional avenues for contacting support but also offer valuable information and updates about the broker. Subscribing to any of GTCFX’s profiles is a great way to stay informed about the latest news and developments, enhancing your trading experience with the broker.

Advantages and Disadvantages of GTCFX Customer Support

Withdrawal Options and Fees

When trading with GTCFX and achieving success, I found that receiving income through the platform is straightforward. Traders have the flexibility to withdraw their profits whenever they choose, using the designated option within their user accounts on the broker’s website. This process is designed to be user-friendly, ensuring traders can access their funds with ease.

GTCFX offers a variety of withdrawal methods, including bank accounts, bank cards, and e-wallets, catering to the diverse preferences of its clients. Impressively, the broker does not impose a withdrawal fee, regardless of the method chosen, the amount withdrawn, or any other factors. This policy contributes significantly to the broker’s appeal, as it means traders can keep a larger portion of their profits. However, it’s important to note that a fee applies when withdrawing profits earned with bonus funds, specifically under the “Welcome Bonus” promotion.

The withdrawal process at GTCFX is generally quick, with most transactions completed within 24 hours. However, depending on the withdrawal channel selected, some transactions may take 1-5 days. Additionally, traders should be aware that only certain currencies are available for withdrawal with some channels. For example, withdrawals to Visa and Mastercard are limited to USD and EUR. This limitation is a minor inconvenience but something to consider when planning your withdrawal strategy.

GTCFX Vs Other Brokers

#1. GTCFX vs AvaTrade

GTCFX offers a robust platform for trading currency pairs, CFDs on stocks, indices, precious metals, and energies, focusing on flexibility and accessibility with low spreads and no withdrawal fees. It’s suited for traders looking for diverse trading instruments and favorable conditions. AvaTrade, established in 2006, caters to a global audience with a wide range of financial instruments across multiple platforms. AvaTrade stands out for its heavy regulation and licensing, offering security and a wealth of educational resources, making it ideal for traders prioritizing a regulated environment and comprehensive trading support.

Verdict: AvaTrade might be better for traders valuing regulatory security and educational resources, while GTCFX could appeal to those prioritizing low costs and trading flexibility.

#2. GTCFX vs RoboForex

GTCFX and RoboForex cater to different trader needs through their unique offerings. RoboForex, with its operation since 2009, offers a vast selection of over 12,000 trading options across eight asset classes, including sophisticated trading platforms and customized terms for various trading styles. GTCFX provides competitive spreads, a range of account types, and efficient withdrawal processes. RoboForex is known for its technological advancements and contest-based approach to trading, appealing to traders looking for innovation and competitive opportunities.

Verdict: RoboForex is potentially better for traders seeking technological sophistication and a wide range of trading instruments. GTCFX suits those looking for competitive spreads and efficient withdrawal processes.

#3. GTCFX vs Exness

Exness and GTCFX both offer comprehensive trading solutions, but with distinct focuses. Exness, established in 2008, is renowned for its high monthly trading volume and offers a significant variety of CFDs and currency pairs, including cryptocurrencies. It is known for its low commissions, instant order execution, and unique offering of infinite leverage on small deposits, catering to a wide range of trading needs and preferences. GTCFX, on the other hand, emphasizes its no withdrawal fee policy, flexible account types, and access to major trading platforms.

Verdict: Exness may be preferable for traders looking for a vast selection of trading instruments, including cryptocurrencies, and the unique feature of infinite leverage. GTCFX appeals to traders prioritizing low costs and ease of withdrawals.

Also Read: AvaTrade Review 2024- Expert Trader Insights

Conclusion: XBTFX Review

Based on the insights and user feedback gathered, GTCFX emerges as a competitive option in the Forex and CFD trading landscape. The broker’s strengths lie in its low entry barrier, with a minimum deposit of just $30, and the provision of floating spreads starting from 0 pips, which can significantly benefit traders looking to minimize costs. Additionally, the absence of withdrawal fees and the availability of multiple trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader, enhance the trading experience by offering flexibility and convenience.

However, potential traders should also weigh the broker’s limitations. The focus on currency pairs and CFDs may not cater to those interested in a broader range of trading instruments. Slow email response times and limited direct phone support could also be a concern for traders who prioritize swift customer service interactions.

Also Read: Exness Review 2023 – Expert Trader Insights

GTCFX Review: FAQs

What trading platforms does GTCFX offer?

GTCFX provides access to MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, catering to a range of trading preferences and strategies.

Are there any fees for withdrawing funds from GTCFX?

No, GTCFX does not charge any withdrawal fees, regardless of the amount or the withdrawal method used. However, fees may apply when withdrawing profits earned through bonus funds.

Can traders use high leverage with GTCFX?

Yes, traders can use leverage up to 1:500 for currency pairs on all accounts. Additionally, GTCFX allows traders to request increased leverage up to 1:1000 by contacting technical support.

OPEN AN ACCOUNT NOW WITH GTCFX AND GET YOUR BONUS