Investors use different strategies to get an advantage in the market, and Grid trading is one method that incorporates a sequence of buy and sell order at preordained time frames around an established market price.

The Grid trading method is most effective in markets with competitive nature with typical price fluctuations. It encourages profit with every option when the selling price outperforms the buying price amid an oblique movement in price by automatically accomplishing low buying orders resulting in high sell orders, in effect reducing the necessity for market predictions.

Several different elements have to be taken into account to improve Grid trading profits. The encouraging news is there is an option to profit from the volatility. Most traders would like to be able to automate the trades the is an option to relax and observe profits that come in consistently.

Basically, Grid trading is a bot that automatically purchases and sells futures contracts. It got formulated to make market orders at predetermined time frames within an arranged price range.

It occurs when orders are made over or under a set price, formulating orders grid at small price rises and price drops in the market. Grid trading is most productive in sideways and volatile markets when prices oscillate in a certain range.

The strategy works by creating earnings from small price fluctuations. Investors that incorporate extra grids will improve the number of trades. Still, the drawback is that the cost is reduced profit from every order.

Also Read: Day Trader salary and their profit target – A Short Guide

Contents

- How Does Grid Trading Strategy Work?

- Understanding Grid Trading Strategies

- Benefits of Using a Grid Trading Bot

- Risk Management in Grid Trading

- What Could Go Wrong?

- Some Popular Grid Bots

- Is a Grid a Hedged System?

- Conclusion

- FAQs

How Does Grid Trading Strategy Work?

In Forex trading, a Grid system is an attractive option for investors, and the reason is the opportunity to visualize the trade. An important consideration is the fact that to a degree it’s an automated method, yes the Grid is adjusted manually, but after that, it’s a more or less automated method of purchasing and selling orders.

This makes it a peaceful option for investors that are not burdened with the stress of observing diligently the market and manually reacting to changes to start or close position to make a profit or prevent losses.

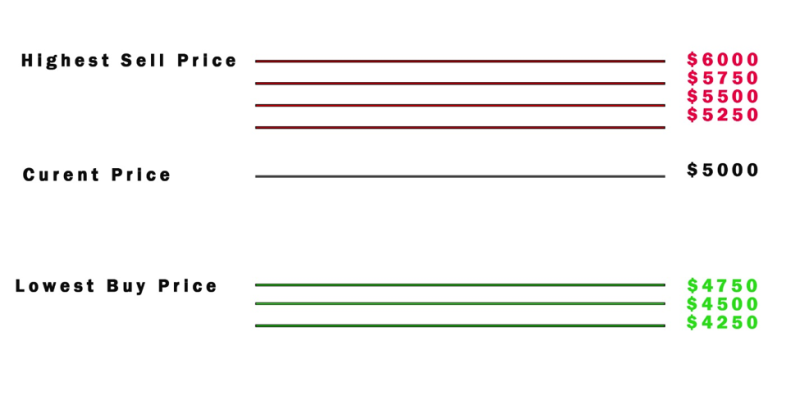

The Grid strategy implements delayed limit purchase and sell orders in preset price intermissions. The price range that is selected needs to be divided into several levels formulating a grid full of orders. Every order is placed over and under the current price.

Typically, the purchase orders are made under the present price, and sell orders usually go over the current market price.

A highly attractive method for markets that by nature are volatile, providing solid opportunities for investments. Making it a lot easier to work in the given volatile market, because the is a reduced need to forecast the course of the market. The only thing an investor has to be aware of is that the market will make a move, every other aspect is taken care of by the strategy.

Advantageous Automated Strategy

The Grid trading system is also beneficial in the trending market, and using the technique is possible with several instruments.

Everything mentioned so far looks very promising, yet it’s important to know that there are no guarantees. When a trader decides to create a manual Grid strategy, they must be aware that success depends on proper implementation.

This depends, on having an understanding of the mechanism of the market, the basic elements, and present dynamics of the market, but also the margins the brokers are making.

Look for Reasonable Broker Fees

The crucial element is to find a broker that charges a normal trading fee. The circumstances we mentioned can influence the potential of the Grid system. However, the fact that the Grid system is practical for Forex markets, there is a minus side, and that is the fact investors have to keep track of the margin.

A margin is a form of guarantee that investors deposit at their broker to take care of the potential risk you create for the broker.

Investors can get an advantage by learning to use other strategies and indicators to improve the grid. One option is using Gann lines to formulate a trading strategy or the Average True Range indicator.

Understanding Grid Trading Strategies

The benefit of grid trading is that there is no need to predict the course of the market and everything can get automated. The biggest con is the option for significant losses if the stop-loss limits are not respected and the intricacy connected with using several positions in a big Grid.

The concept of Grid trading is that the price continues to move in a stable direction the position grows and the options for profit increase. As the price goes up, more purchase orders are activating producing a large position. The position increases the profit potential rises, and the price continues in that direction.

At this point most investors are faced with a dilemma, should they exit the trades, and take the profits. The problem is the price can potentially backtrack and the profits can go away. The losses are managed by the sell orders, also properly spaced, and until the orders are reached the position can switch from earnings potential to losing cash.

Usually, investors reduce the grid to a given amount of orders. They can put four purchase orders over a set price. When the price goes through all purchase orders and exits the trade with some earnings. The way this is accomplished is at once or with a sell Grid.

When the price action is choppy it can activate purchase orders over the set price and sell orders under the set price, producing losses. The technique is profitable if the price goes in a stable direction. When a price moves up and down it usually will not generate solid results.

The biggest issue with the against-the-trend Grid is risk is not managed. The investor can collect a significant losing position when the price goes in one direction and does not range. Finally, the investor will make a stop loss level, most traders will not retain a losing position for a prolonged period.

Against-the-trend Grid trading is most productive in oscillating markets. Investors place purchase orders at standard periods under a set price, and positions sell orders at normal periods over the set price.

When the price declines investors go long. When the price goes up and sell orders are activated to lower the long position and can become short. The trader makes money when the price oscillates sideways, activating the sell orders.

Also Read: Forex Price Action: Inside bars, Bearish Outside Bars etc

Benefits of Using a Grid Trading Bot

This is an excellent option for investors that want to go in the direction of automation, the benefits are numerous, it can get used in most markets and in a different time frame.

Adaptability

Grid trading uses basic trading concepts, meaning it can get used in any type of market. Creating profit potential that is not related to the market attitude. Investors can select the period of the strategy by choosing the price range.

Grids can be used for micro trades capturing small earnings, and alternatively for the long term, by choosing a large range and permitting it to be active for months to generate profits from more extensive changes in a trend.

Trustworthy Crypto Trading Strategy

The practice of Grid Trading is nothing new, it’s a concept that has been tested and has shown its potential. Numerous examples exist of investors using it over the decades in different markets, and the crypto segment has been a solid testing ground for Grid trading because of the serious volatility.

Usability

The strategy is easy to implement, there are no complicated elements, and traders with experience in the crypto or their volatility market can learn to use it quite fast.

Automated Trading

Grid Trading is practical for automation because the step included are selected up from and are not influenced by the market. When using a Grid trading with a Trading Bot is easier and more efficient than attempting to observe a strategy by using manual trades.

Improved Risk Management

The option to select a grid strategy enables traders to manage the risk to reward level more precisely when compared with alternative options for trading. By using a Grid bot to create a stable small profit with practically no risk or make more daring moves for high rewards.

Risk Management in Grid Trading

Traders that don’t have a risk appetite always want to know if their positions are protected. The encouraging news is that Grid trading is intrinsically hedged and the reason for that is the fact it incorporates several trades, and solid trades can outnumber low-performing trades. Investors can reduce the risk by observing bots trade and making stop-losses and take-profits.

Plus, investors have to be in step with trends and news about the market they are trading in and follow industry developments concerning the assets they have in their portfolio and are actively trading. Certain markets like the Forex and crypto get influenced by breaking news and can result in fast price depreciation.

Few key points that investors with a risk management strategy can use in their trading Grid strategy:

- If active in an unstable market or with low liquidity currencies, trades might not be realized at the wanted levels in the Grid, creating more risk for the investor.

- Investors select to place wide stop losses on every trade because if non-opposing trade pairs get closed the system can lose its hedging feature and result in excessive losses.

- Check that the lot sizes and grid settings are not overexposed at any point and result in a margin call.

- Have a clear perspective of the market range to make sure the exit levels are correct.

- The biggest benefit of implementing a Grid system is the averaging of exit and entry prices.

- When implementing a Grid strategy in any market, do not multiply the order volume and exposure to levels over the risk limits you can afford as a trader.

What Could Go Wrong?

We have been singing praises of the grid trading strategy, yet not every time investors implement the strategy results are not guaranteed. There are a few scenarios where things may not go as planned. When prices go over the range, the Grid bot will sell the position living you in a tight spot not able to profit from the rising price. In a situation like this, it’s more this profitable to purchase and hold on to the position.

The alternative situation is when a price goes under the range, resulting in expanding the money supply to purchase the asset, for example, cryptocurrency, and creating losses if the price goes under the range. In a situation like this, the best grid bots will not be able to make profits.

Sell Orders and When to Close a Grid Trade

An experienced trader will know when to end trade and take the profit. Profit is always imperative but it’s crucial to reduce the risk of liquidation if the markets go counter to your position. The guiding principle is to exit a trade when you are happy with the earning made while on the Grid.

It’s crucial to inspect the whole Grid and not only single trades in the Grid. Chose the profitability targets and when you have accomplished them end the trade. The most opportune moments for grid trading are during small price fluctuations under 3% per day. When the price of the asset incises fast, the bots will take profit sooner, while if the price declines fast, there will be activation of the stop losses.

The sideways price action is what makes grid trading attractive in foreign exchange. In forex currency trading, the prices tend to go sideways for years and Grid trading is a great option for this type of sideways movement.

Some Popular Grid Bots

There are different types of Grid bots that investors can use in their trading strategies, and most trading platform offer some form, making it possible to program price, grid quantity, upper and lower limits. An important factor is fees because they affect the results of the trading. When working in exchanges with reduced costs, which in certain instances provide fee refunds that a trader can get as a market maker, can have a big impact on Grid trading.

Locate the best pairs and market conditions and be able to understand the market, and develop an instinct about what you should pay attention to when trading. Observe charts with a sideways movement and search for pairs that have experienced large swings, yet without leaving the price range.

Grid trading bots enable investors to use automated strategies that seriously cut back on manual labor, and the big advantage is they function 24/7. The bots can get modified to respond to investors’ needs. We can have an overview of a few popular grid trading bots that include: Bitsgap , Pionex, KuCoin, Pionex, and Quandency.

Grid Trading Parameters

Most Grid trading bots can be downloaded while some models are integrated into exchanges, but generally have identical parameters. Investors manually program the parameters in the bots that are being used.

A few of the parameters include:

- Take-Profit.

- Lower Limit.

- Grid Number.

- Stop-Loss.

- Upper Limit.

Popular Grid Trading Bots

The Quadency offers user-friendly trading bots. Traders can modify various conditions most directly on at what point the bot needs to stop with the trading, making it possible for inversions to have more control over the strategy.

Pionex offers 5 free grid-trading bots with some fantastic options. Every bot is appropriate for various situations and is practical to use. Alternatively, Bitsgap is great for newbies with extra options like take profit and stop-loss.

Thee 3Commas Grid trading bot implements an AI system that enables investors to not be bothered with selecting limits. While the Kucoin’s Grid bots are presented in several combinations and are free for investors that are active on the trading platform.

Is a Grid a Hedged System?

The grid can remove the fluctuation of the price direction, and this is a complex management condition. It can result in a larger percentage for error, and the reason is controlling simultaneously several trades.

The manual Grid trading can be perceived as a hedged system; the reason is the system for guarding against loss. In a perfect situation, the whole system of trades will be positive, and at that moment a trader can close any position that still is open and make his profit.

Still, trading cannot be assured that the system will defiantly produce sound earnings with the Forex Grid trading strategy. Implementing a reasonable strategy founded on experience and information is crucial for success in this type of tactic as it is a priority in other trading strategies.

Conclusion

The big advantage of Grid trading is that emotions don’t play a role in the trading strategy, everything is automated and guided by computer code. The bot generates orders at successively rising and declining prices making earnings from market volatility. Traders make profits from the imbalance in the price in the market.

Grid trading is automated and the only obligation of investors is to set upper and lower limits. This strategy benefits from volatility on short-term charts. When the price hits the limits designated in the grid settings, the purchase and sells order is activated automatically.

While automated trading sounds like a good tactic, it has some inherent risks that can result in losses. Traders have to research the bot they plan to use and decide if the risk is something they are ready to deal with. The strategy is most appropriate for a sideways market where there are no large variations in price. If investors observe the latest news and adjust the grid the technique can be profitable.

FAQs

Is Crypto Grid Trading Profitable?

Traders can make reasonable profits if they purchase low and sell high, and without the need of complex algorithms., only with the Grid parameters the investors have set in the system. Yet, using Grid trading is not a profitable strategy every time it’s used.

What Is Grid Bot Trading?

Grid trading is a quantitative strategy that’s an automated process of purchasing and selling. It got created to place market orders at previously designated periods within a defined price range. The basic concept is to earn money from tiny price changes.

What Is a Good Profit per Grid?

For optimal results, traders get advised to modify their profit per grid between 0.5% and 2%.

How do You use Grid Trading Bots?

The bots are automated software that works mostly independently, after the investor sets the interval in a defined price range, the bots execute the buy and sell orders automatically.