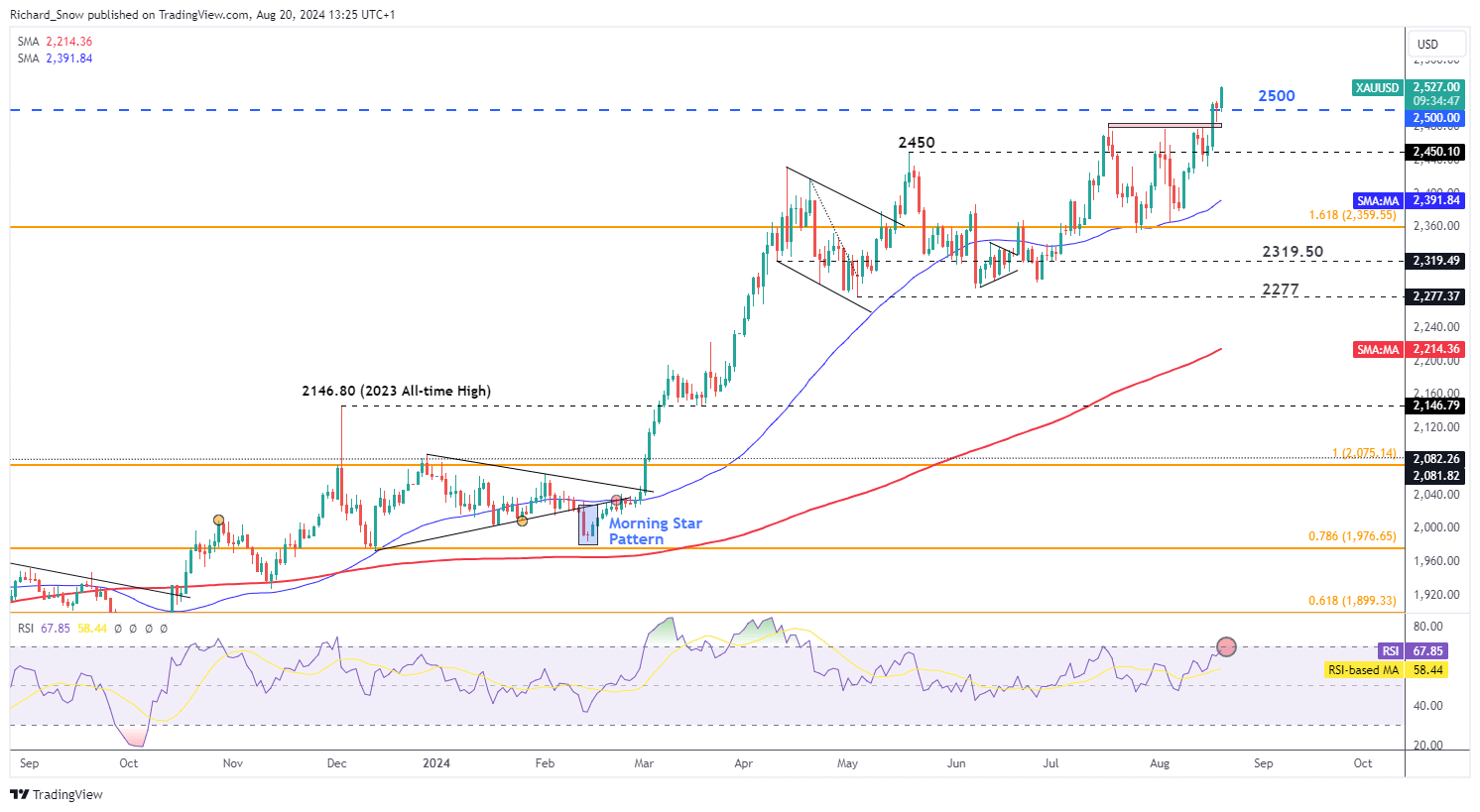

Gold Hits New Peak Amid Fed Rate Speculations

Gold recently reached a new all-time high as markets speculate that the Federal Reserve may soon begin a rate-cutting cycle. The FOMC minutes from last month’s meeting are due for release tomorrow, followed by the highly anticipated Jackson Hole Economic Symposium, starting Thursday, with the main focus being Jerome Powell’s speech on Friday.

Powell’s address presents a chance to signal a potential September rate cut, though the size of the initial cut remains uncertain. Earlier this month, market sentiment leaned toward a 50 basis point cut in September, but that likelihood has now dropped to around 25%. Gold often benefits from lower interest rates, as the opportunity cost of holding the non-yielding metal decreases.

The downward trend of the US dollar has also supported gold bulls, as foreign buyers find the improved exchange rate favorable. Additionally, despite a decrease in Middle East tensions, the lingering threat of Iranian retaliation against Israel continues to provide a boost to the safe-haven asset.

Since mid-July, gold has struggled to break above $2,480, encountering strong resistance until last Friday when it closed above $2,500. The path forward may be challenging as gold is trading at unprecedented levels. Given the recent bullish momentum, a period of consolidation could occur before the next upward push.

The RSI is approaching overbought territory, suggesting that a new catalyst may be required to sustain the current bullish trend. This catalyst might come from the FOMC minutes or the Jackson Hole meeting. A bullish surprise could also stem from a potential downward revision of job numbers added to the US economy between April 2023 and March 2024, expected on Wednesday. While upside targets remain uncertain, support levels are found at $2,480, $2,450, and the 50-day simple moving average.

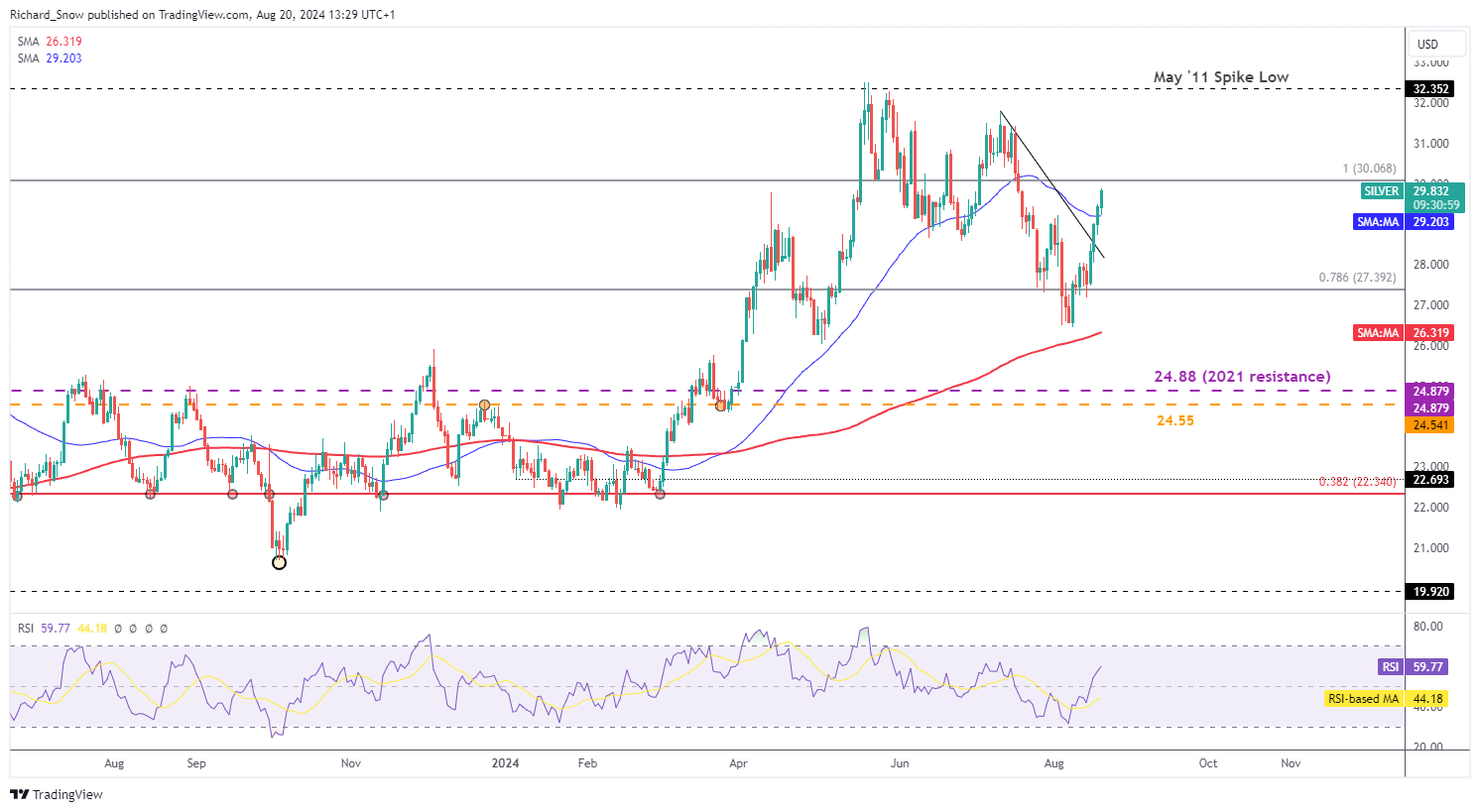

Silver Trails Gold but Gains Momentum

Silver has lagged behind gold but is making efforts to catch up. After failing to test the yearly high at $32.51 in July, silver dropped to $26.45, near the 200-day simple moving average, where it eventually rebounded.

The near-term resistance trendline failed to hold back the bulls, allowing silver to break through it with relative ease. The RSI remains well below overbought levels, indicating that the bullish momentum could continue.

Having risen above the 50 SMA, silver now aims to test the full retracement of the major 2021-2022 decline, targeting $30.06. The next key level to watch is $31.75, which was the July high.