GMI Review

GMI Markets is a regulated global broker that offers a variety of trading instruments, such as forex, indices, commodities, and precious metals, on platforms like MetaTrader 4 (MT4) and their proprietary GMI Edge trading platforms.

Known for providing tight spreads, some as low as 0.0 pips on specific accounts, GMI aims to create a cost-effective environment for traders, particularly those who engage in high-frequency and high-volume trades.

Additionally, GMI offers a range of account types, including ECN, Cent, and Standard accounts, with minimum deposits starting at $15, which makes it accessible for beginners and experienced traders alike.

The broker is regulated by respected bodies, including the FCA in the UK and the Financial Services Commission (FSC) in Mauritius, which enhances its credibility and security features, such as negative balance protection and segregated client accounts.

While GMI provides these regulatory benefits, the trading asset range is somewhat limited, focusing mainly on CFDs for currencies and commodities, which may restrict traders looking for a broader portfolio. Overall, GMI Markets stands out as a reliable option for those looking for competitive fees and solid regulatory oversight in the forex and commodity markets.

What is GMI?

Global Market Index, also known as GMI is an international forex broker that provides access to various financial markets.

GMI Markets website is known for offering competitive spreads, starting as low as 0.0 pips on certain trading accounts, and is tailored to meet the needs of both novice traders and experienced trader.

The GMI broker operates under the regulation of entities like the Financial Services Commission (FSC) in Mauritius and the Financial Conduct Authority (FCA) in the UK, ensuring a secure trading environment with features such as negative balance protection and segregated client accounts.

GMI Regulation and Safety

GMI Markets operates under two regulatory bodies: the Financial Conduct Authority (FCA) in the UK and the Mauritius Financial Services Commission (FSC). The FCA is recognized as a highly reputable regulator, ensuring that brokers adhere to stringent financial standards and prioritize customer protection.

Meanwhile, the FSC, while offering a level of regulatory oversight, is generally seen as a less stringent regulatory authority. This dual regulatory framework allows GMI Markets to operate in multiple regions, balancing security for clients with flexibility in services.

To further enhance safety, GMI Markets provides negative balance protection, which helps prevent clients from losing more than their initial deposits. Additionally, client funds are stored in segregated accounts, meaning that GMI keeps customer funds separate from its operating funds to reduce financial risks for traders. Together, these measures support a safer trading environment, though users should consider the varied regulatory protections offered by different authorities.

GMI Pros and Cons

Pros:

- Regulated by FCA

- Low spreads

- Multiple platforms

- Demo account

Cons:

- Limited assets

- No 24/7 support

- Withdrawal fees

- Offshore regulation (FSC)

Benefits of Trading with GMI

GMI Markets offers several benefits for traders looking for a regulated and flexible trading environment. Since the broker is licensed by the Financial Conduct Authority (FCA) in the UK and the Financial Services Commission (FSC) in Mauritius, an added layer of security for clients is provided. With regulations in place, traders can rest assured of compliance with industry standards, including protections like negative balance protection and segregated client accounts.

For cost-conscious traders, GMI offers tight spreads on various trading accounts, with some account type features spreads as low as 0.0 pips. This structure allows high-frequency and high-volume traders to minimize costs, making GMI a cost-effective option. Additionally, GMI’s account type, including ECN account and Cent account, cater to both experienced and beginner traders, with minimum deposits starting as low as $15.

The broker supports the widely used MetaTrader 4 (MT4) platform and the proprietary GMI Edge platform, which offer tools for technical analysis, automated trading, and order management. This combination of platforms gives traders access to essential features on both desktop and mobile, making it convenient for trading on the go. These features make GMI Markets a versatile choice for those seeking competitive fees and solid regulatory protections.

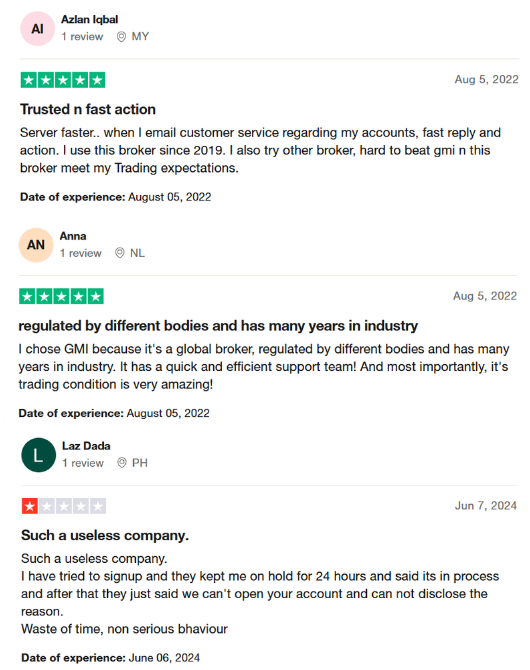

GMI Customer Reviews

Customer reviews has reflected a mixed experience among its GMI clients. Many customers report satisfaction with the platform’s low spreads, fast withdrawals, and responsive customer service. Users particularly appreciate the ECN account conditions and the quick responses from customer support through multiple channels like live chat, email, and phone. These strengths have made GMI Markets popular among traders seeking cost-effective options and reliable service.

However, there are a few negative experiences, with some users citing issues with the account opening process and delays in customer support. One reviewer mentioned a frustrating delay and lack of communication about why their account could not be opened, which led to dissatisfaction. Overall, while GMI is appreciated for its efficiency and service, occasional issues with account setup and support response may affect the user experience for some.

GMI Spread, Fees and Commission

GMI Markets trading platform offers competitive spreads, fees, and commissions, catering to both beginners and experienced traders with various account options. The broker’s ECN account provides spreads starting from 0.0 pips, though it charges a commission of $4 per side per lot, making it suitable for traders focused on cost efficiency and precision. In contrast, the Cent and Standard accounts have no commission fees, with spreads starting from 0.0 to 2.4 pips, which may appeal to traders looking for simpler pricing without additional fees.

In addition to spreads and commissions, GMI has a low minimum deposit requirement starting from $15 for Cent accounts, making it accessible for new traders. However, traders should be aware of additional fees, such as inactivity fees of $10 per month after 90 days of inactivity. Overall, GMI’s flexible fee structure, with options for commission-free trading and low spreads, provides a range of cost-effective solutions across its account types.

Account types

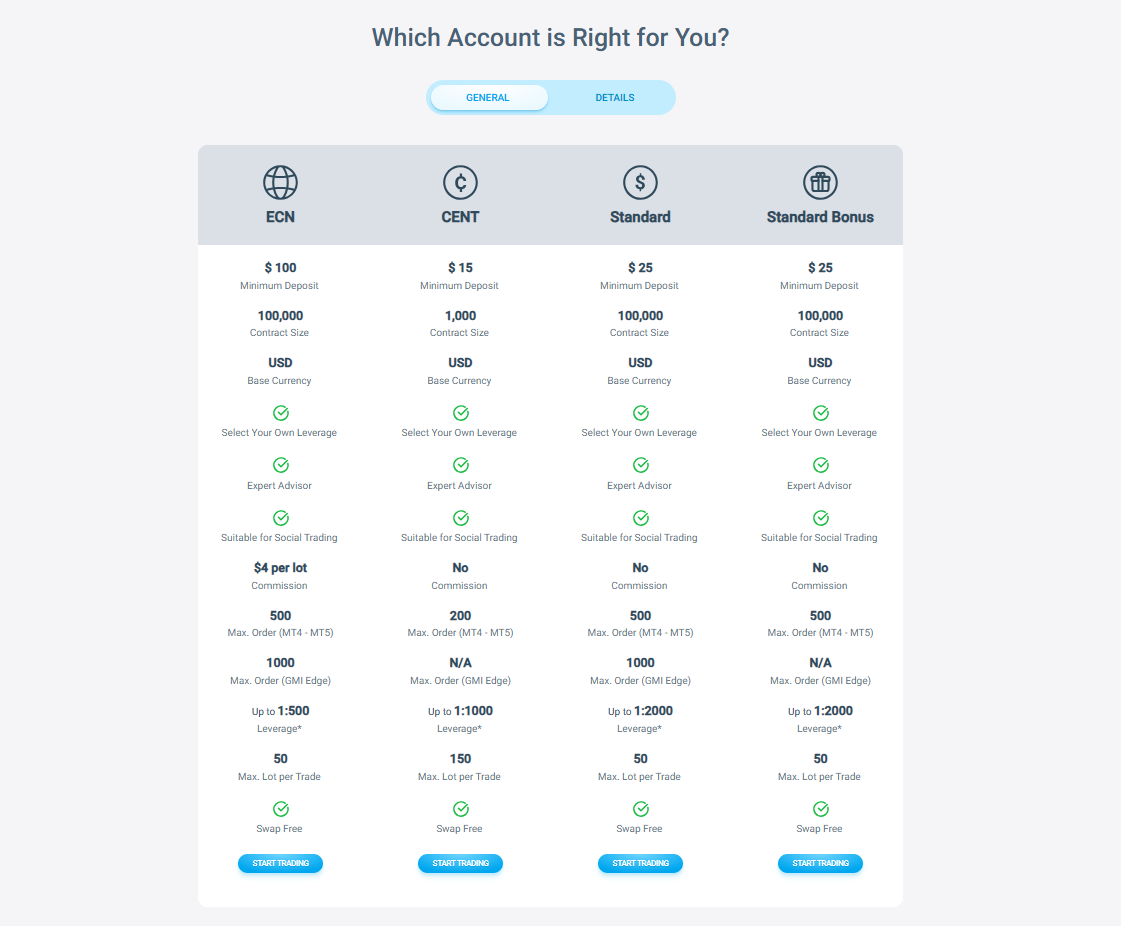

GMI provides a variety of account kinds to accommodate traders with various levels of experience and financial goals. Here’s an overview of each:

ECN Account

The ECN (Electronic Communication Network) account is designed for more experienced traders, offering tight spreads starting from 0.0 pips with a commission of $4 per side per lot. This account requires a minimum deposit of $100 and allows for a leverage of up to 1:500, making it suitable for high-volume or high-frequency traders looking for minimal spread costs and direct market access.

Cent Account

The Cent Account is aimed at beginners or those who want to trade smaller positions with minimal risk. It features a minimum deposit of $15 and leverage up to 1:1000, with spreads starting from 0.01 pips. This account enables trading with cents rather than dollars, making it ideal for testing strategies without significant financial exposure.

Standard Account

The Standard Account provides a more traditional trading environment, with no commissions and spreads from 0.0 to 2.4 pips. It requires a minimum deposit of $25 and allows leverage up to 1:2000, appealing to traders who prefer a simpler fee structure with higher leverage flexibility.

Demo Account

GMI offers a risk-free Demo Account, allowing both beginners and seasoned traders to test strategies or explore the platform’s features using virtual funds. This account replicates live market conditions, making it a useful tool for practice without any financial risk.

How to Open Account

The procedure of opening a GMI account is easy and allows clients to begin trading in the FX and CFD markets right away. This is a comprehensive guide to opening your GMI account that will help you get started right away, including everything from registration to funding.

Step 1: Registration

Begin by visiting the GMI official website and selecting the “Open Account” option. You will need to fill out a form with basic information, such as your name, email, and contact details. After submitting, you will receive a confirmation email to verify your identity.

Step 2: Identity Verification

Once registered, you’ll need to verify your identity by uploading a government-issued ID, such as a passport or driver’s license, and proof of address (e.g., a utility bill). This verification step is crucial to comply with anti-money laundering regulations and ensures the security of your account.

Step 4: Choose Account Type

After identity verification, select the type of account that best fits your trading style, whether it’s the ECN, Cent, Standard, or Demo account. Each account has its own features, so it’s essential to review the trading conditions before finalizing your choice.

Step 5: Fund Your Account

With your account type selected, proceed to fund your account by choosing from GMI’s deposit options, which may include bank transfers, credit/debit cards, or e-wallets. Minimum deposit requirements vary based on the account type, with deposits as low as $15 for Cent accounts.

Step 6: Start Trading

Once funded, you can access the trading platform, which may include MetaTrader 4 or other proprietary platforms offered by GMI. Begin by exploring the platform’s features, analyzing the market, and placing your first trades.

GMI Trading platform

GMI Markets offers traders flexibility with multiple trading platforms that cater to different needs. MetaTrader 4 (MT4) is GMI’s primary platform, known for its stability and advanced charting tools, along with features like Expert Advisors (EAs) for automated trading. MT4 is available on desktop, mobile, and web, allowing users to manage accounts and analyze markets on the go.

The GMI Edge app is another option, providing a mobile-first experience that synchronizes with MT4, allowing users to monitor trades and manage funds conveniently from their smartphones. GMI Edge includes essential charting tools and order execution features, making it a practical solution for traders who prefer mobile access. Additionally, GMI offers a Multi-Account Manager (MAM) platform for professionals who need to manage multiple accounts from a single interface, making it suitable for money managers and those overseeing client portfolios.

These platforms enable GMI traders to access markets through both traditional desktop setups and mobile options, ensuring flexibility and accessibility.

What can you trade on GMI

Both novice and seasoned traders can benefit from the variety of trading instruments offered by GMI Markets. The primary asset classifications that are available are summarized as follows:

Forex

GMI offers a broad selection of currency pairs, allowing traders to participate in the global foreign exchange market. With spreads starting as low as 0.0 pips and leverage up to 1:2000, the forex market on GMI is designed to attract high-volume and high-frequency traders, along with those looking for tight spreads and deep liquidity.

Commodities

GMI also provides access to commodities trading, including popular assets like oil, natural gas, and agricultural products. Commodities are often used as hedges against inflation and market volatility, giving traders options to diversify their portfolios with physical assets that tend to hold value under economic stress.

Precious Metals

For traders interested in safe-haven assets, GMI offers gold and silver trading. These metals are known for their stability, especially during economic uncertainty, and provide an alternative to fiat currencies and equities. GMI supports metals trading with competitive spreads and fast order execution.

Cryptocurrencies

GMI also offers cryptocurrency trading, including popular digital assets like Bitcoin, Ethereum, and Ripple. With leverage up to 1:20 and tight spreads, GMI’s crypto market is suitable for traders interested in digital assets but looking for managed risk and liquidity from a regulated broker.

Indices

The platform includes global indices such as the S&P 500, FTSE 100, and others, allowing traders to speculate on broader market performance without needing to invest in individual stocks. Index trading with GMI provides exposure to major economies, suitable for traders who want to diversify through equity markets in one trade.

GMI Customer Support

GMI Markets provides multiple customer support options, including live chat, email, and phone, allowing traders to reach out for assistance on account setup, platform usage, or trading inquiries. The live chat feature is often the quickest, offering real-time responses to help traders with basic questions or immediate issues. Many users appreciate this feature for its promptness, which makes it suitable for addressing common concerns without delay.

For more complex queries, traders can contact support via email or phone, although response times may vary, particularly during high-demand periods. While customer service is generally reliable, some users have reported delays with account verification and occasional lapses in response times, indicating room for improvement in peak times. Overall, GMI aims to provide accessible support across channels, but faster responses during peak periods could enhance the user experience.

Advantages and Disadvantages of GMI Customer support

Withdrawal Options and Fees

GMI Markets offers a number of withdrawal methods to provide traders more freedom in retrieving their assets. Each method offers distinct fees and processing timeframes, allowing traders to select the best choice for their financial requirements. The following is a summary of the key withdrawal procedures and associated costs.

Bank Transfer

Bank transfers allow direct access to funds, typically processing within 3-5 business days, with fees depending on the bank’s policies. This option is suited for traders who prefer standard bank withdrawals.

Credit/Debit Card

Card withdrawals are convenient for those who initially deposited with a card, with processing usually taking 1-3 business days. Fees depend on the card provider, making this a flexible option for regular users.

E-Wallets (Skrill, Neteller)

E-wallet withdrawals, including Skrill and Neteller, process within 24 hours, offering a faster alternative to traditional banking. Minimal fees may apply, making it a popular choice for traders seeking quick access to funds.

Cryptocurrency

GMI supports crypto withdrawals in Bitcoin, Ethereum, and more, processing within a few hours based on blockchain traffic. Transaction fees vary with network costs, providing a modern option for traders who prefer digital assets.

GMI vs Other Brokers

#1. GMI vs AvaTrade

GMI Markets and AvaTrade are both well-regarded brokers, but they differ significantly in their offerings and target audience. GMI Markets, regulated by the Financial Services Commission (FSC) in Mauritius, provides high leverage options up to 1:2000, with a minimum deposit requirement as low as $15, making it accessible for beginners and small-scale traders. On the other hand, AvaTrade, which holds multiple licenses across major financial jurisdictions, offers a more diverse range of trading instruments, including cryptocurrencies, and provides lower leverage (up to 1:400, or 30:1 for EU clients), catering to a more risk-averse audience.

Verdict: While GMI Markets appeals to traders seeking high leverage and low entry costs, AvaTrade’s stronger regulatory profile and broader asset variety make it a reliable option for those prioritizing regulation and variety in trading options. Each broker offers distinct advantages depending on the trader’s focus on leverage, regulatory oversight, or asset diversity.

#2. GMI vs RoboForex

GMI Markets and RoboForex are both popular brokers, but they target different trader profiles with distinct offerings. GMI Markets, regulated by the Financial Services Commission (FSC) in Mauritius, provides leverage up to 1:2000 and focuses on forex, commodities, indices, and metals. It offers the MetaTrader 4 platform, with a minimum deposit requirement of $15, making it accessible for beginners. RoboForex, regulated by the International Financial Services Commission (IFSC) in Belize, also offers leverage up to 1:2000 but has a broader asset range, including stocks, ETFs, and cryptocurrencies, alongside MetaTrader 4, MetaTrader 5, and its proprietary R StockTrader platform. RoboForex’s $10 minimum deposit and extensive asset options attract traders interested in diversifying across multiple markets.

Verdict: GMI Markets appeals to traders who prefer a straightforward platform and competitive leverage, while RoboForex’s wider asset selection and additional trading platforms make it a suitable choice for those looking to explore a diverse trading portfolio. RoboForex’s range of instruments may be more appealing for traders seeking exposure beyond forex.

#3. GMI vs Exness

GMI Markets and Exness both offer high leverage, but they cater to different trader preferences and needs. GMI Markets, regulated by the Financial Services Commission (FSC) in Mauritius, provides leverage up to 1:2000 and features low minimum deposits, starting at $15, which appeals to newer traders or those wanting to start with a smaller investment. It primarily supports forex and CFD trading with the MetaTrader 4 platform, targeting those interested in straightforward trading options. Exness, on the other hand, is regulated by multiple major authorities, including CySEC and the FCA, and offers even higher leverage (up to unlimited for certain accounts) with access to more trading platforms like MetaTrader 4, MetaTrader 5, and Exness’s own terminal. Exness also supports a wider range of assets, including stocks, indices, commodities, and cryptocurrencies, providing greater diversity for more experienced traders seeking various trading opportunities.

Verdict: GMI Markets is a practical choice for traders looking for high leverage with lower entry costs, while Exness stands out for its extensive asset selection and robust regulatory framework, making it more suitable for those wanting greater variety and flexibility in their trading options.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: GMI Review

GMI Markets offers a variety of trading options, including forex, indices, commodities, and metals, through the MetaTrader 4 platform. With high leverage up to 1:2000 and a low minimum deposit of $15, GMI appeals to both new and experienced traders looking for accessible and flexible trading opportunities.

While GMI’s regulatory oversight by the Financial Services Commission (FSC) in Mauritius provides a level of security, it may not be as comprehensive as stricter global regulators. Overall, GMI is a practical choice for traders who prioritize high leverage and low entry costs, though those seeking broader asset diversity or enhanced regulatory coverage might explore other brokers.

GMI Review: FAQs

Is GMI Markets regulated?

Yes, GMI Markets is regulated by the Financial Services Commission (FSC) in Mauritius. While the FSC provides oversight, it may not be as stringent as some global regulators, so traders should be aware of this when evaluating the platform’s security.

What platforms does GMI Markets offer?

GMI primarily offers the MetaTrader 4 (MT4) platform, popular for its charting tools and automated trading capabilities. Additionally, traders can access GMI’s GMI Edge app, which provides mobile trading and account management on the go.

What is the minimum deposit for GMI?

The minimum deposit on GMI Markets is $15, making it accessible for beginners or those wanting to start with a small investment. This low entry point applies mainly to Cent accounts, while other account types may require higher deposits.

OPEN AN ACCOUNT NOW WITH GMI AND GET YOUR BONUS