Position in Rating | Overall Rating | Trading Terminals |

185th  | 2.7 Overall Rating |

GCM Forex Review

Choosing the right Forex broker is crucial for any trader, as it significantly impacts the trading experience and potential success. A reliable broker offers a secure trading environment, fair trading conditions, and quality customer support, which are essential for executing trades effectively and managing risks. The right broker also provides access to a wide range of financial instruments, competitive spreads, and user-friendly trading platforms, enabling traders to maximize their potential.

GCM Forex is a prominent broker based in Turkey, offering a variety of trading instruments, including Forex, CFDs, and commodities. Established in 2008, GCM Forex is regulated by the Capital Markets Board of Turkey (CMB), ensuring compliance with strict financial regulations and providing a level of security for traders.

In this detailed review, I aim to provide a comprehensive evaluation of GCM Forex, highlighting its unique selling points and potential drawbacks. I will offer essential insights into the broker, covering various account options, deposit and withdrawal processes, commission structures, and other critical details. By combining expert analysis with actual trader experiences, my goal is to equip you with the necessary information to make an informed decision about whether GCM Forex is the right brokerage service for you.

What is GCM Forex?

GCM Forex is a well-established Forex broker based in Turkey, offering a variety of trading instruments like Forex, CFDs, and commodities. The company was founded in 2008 and is regulated by the Capital Markets Board of Turkey (CMB), which ensures compliance with strict financial regulations and provides a level of security for traders.

The broker offers several account types, including demo accounts for beginners and live accounts for more experienced traders. One of the standout features of GCM Forex is its user-friendly account registration process, which can be completed quickly and easily online. The minimum deposit to start trading is quite accessible, making it a good option for traders at different levels.

Benefits of Trading with GCM Forex

Trading with GCM Forex offers several benefits that can enhance your trading experience. One major advantage is the access to the MetaTrader4 platform, which is well-known for its advanced charting tools and ease of use. This platform supports both manual and automated trading, making it versatile for various trading strategies.

Another benefit is the 24/7 customer support in both Turkish and English, ensuring you can get help whenever you need it. This is particularly useful for non-Turkish speakers and those trading during off-hours. Additionally, the low minimum deposit requirement of $100 makes it accessible for traders with different budget levels, allowing more people to start trading.

GCM Forex also provides a secure trading environment regulated by the Capital Markets Board of Turkey (CMB). This regulation ensures that your funds are protected and that the broker operates transparently. Furthermore, the availability of demo accounts with virtual currency allows beginners to practice without risking real money, which is invaluable for learning and testing strategies.

GCM Forex Regulation and Safety

GCM Forex operates under the regulation of the Capital Markets Board of Turkey (CMB), which ensures that the broker adheres to strict financial standards and practices. Knowing that a broker is regulated is crucial because it provides a level of assurance that your investments are protected under local financial laws. Regulation by a reputable authority like the CMB means that GCM Forex must maintain transparency and integrity in all its dealings.

The broker employs tier-1 banks for handling client funds, which adds an extra layer of security to your transactions. This means your money is kept in segregated accounts, reducing the risk of misuse. The use of highly reliable banks for fund management ensures that your deposits are safe and that withdrawals are processed smoothly and efficiently.

Additionally, GCM Forex is required to undergo regular audits and provide detailed financial reports. These audits help ensure that the broker operates fairly and that all client funds are managed properly. Regular oversight by the CMB helps maintain trust and reliability, which is critical when choosing a Forex broker.

GCM Forex Pros and Cons

Pros

- Regulated by the CMB

- User-friendly trading platforms

- Multiple account types

- Low minimum deposit

- Variety of trading instruments

- No deposit fees

Cons

- Limited leverage

- Withdrawal delays reported

- Limited trading signals

- Restricted in some countries

- Limited non-Forex instruments

GCM Forex Customer Reviews

Customer reviews of GCM Forex are mixed but highlight some key aspects of the broker. Many traders appreciate the variety of trading platforms offered, including MT4, WebTrader, and mobile options, which cater to different trading preferences. The 24-hour customer service in both Turkish and English is also seen as a positive, especially for non-Turkish speakers.

However, some users are dissatisfied with the high trading spreads starting from 2 pips, which they feel are not competitive. While the educational resources and overall trading conditions receive praise, there is a desire for more language options in customer support. Overall, the broker provides good trading conditions, but there are areas that could benefit from improvement.

GCM Forex Spreads, Fees, and Commissions

When trading with GCM Forex, understanding the spreads, fees, and commissions is essential. The broker offers spreads starting from 2 pips on their account. While this might not be the lowest in the industry, it is fairly standard and manageable for many traders. The spreads can impact your overall trading costs, so it’s important to factor this in when planning your trades.

In terms of fees, GCM Forex does not charge any deposit fees, which is a significant advantage. This means you can deposit funds into your account without worrying about additional costs eating into your trading capital. However, there are withdrawal delays reported, which might be inconvenient for some traders, though these issues are not widespread.

Regarding commissions, GCM Forex operates primarily on a spread-based model, meaning there are no additional commission fees for most trades. This setup can be beneficial for those who prefer a more straightforward fee structure without unexpected charges. Additionally, the broker has no inactivity fees, but there are non-trading fees to be aware of, such as those for account maintenance if left inactive for extended periods.

Account Types

When exploring the account types offered by GCM Forex, you’ll find options tailored to different trading needs and preferences. Here’s a breakdown of the available accounts:

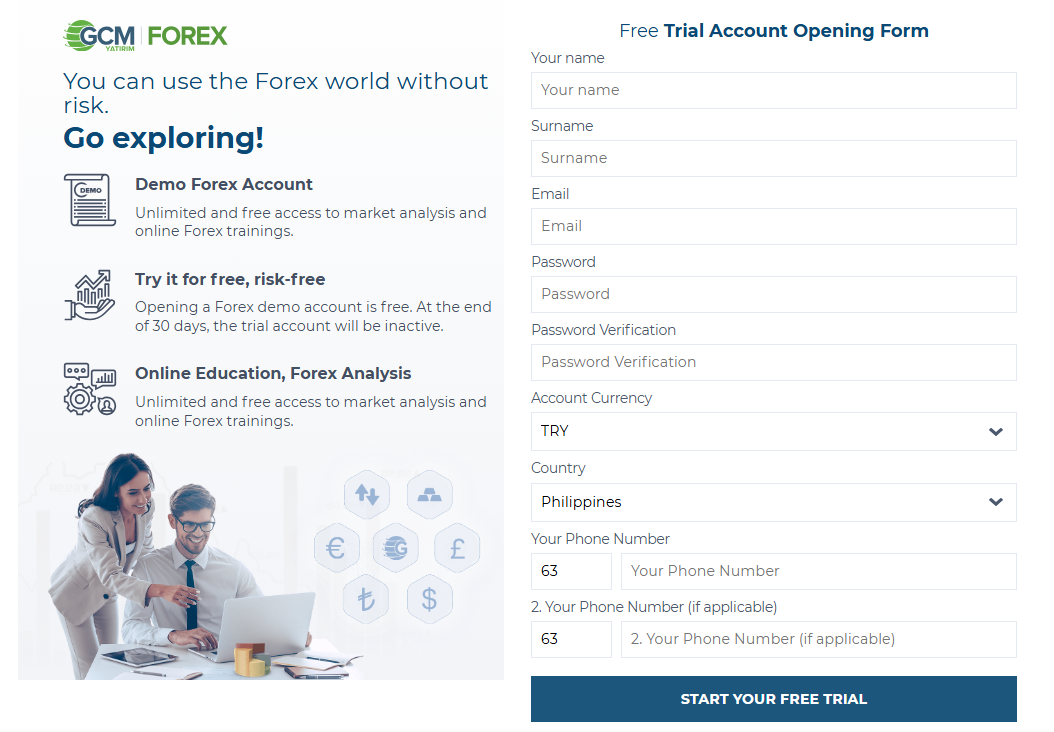

Trial (Demo) Account

- This account type allows you to practice trading with 100,000 virtual currency.

- It is a great way to get familiar with the platform without risking real money.

- Note that the demo account is active for 30 days, but you can open multiple demo accounts if needed.

Real (Standard) Account

- The standard account is designed for those ready to trade with real money.

- It features low spreads and a personal sales manager, which can help enhance your trading experience.

- The minimum account size is $100, and the spreads are fixed.

- With this account, you can trade a variety of instruments, including forex, gold and silver, CFDs, oil, stocks, indices, metals, and commodities.

VIP Account

- The VIP account is ideal for traders interested in futures and options trading on the Istanbul Exchange.

- It offers over 30 instruments with leverage, providing more opportunities for strategic trading.

- This account type includes tax advantages and bi-directional trading, focusing on Turkey’s major companies and the Istanbul Exchange (Borsa) 30 Index.

How to Open Your Account

- Visit the GCM Forex website. Note that the website is in Turkish so you might want to translate the page to English.

- After translating, click on the “Open a New Account” button located on the homepage.

- Fill out the registration form with your personal details, including your first name, last name, phone number, and email address.

- Choose a secure password and select your account currency.

- Submit the registration form to receive your account number via email.

- Log in to your personal account using the account number and password provided.

- Complete the KYC verification process by uploading the necessary identification documents.

- Once your account is verified, you can deposit funds and start trading.

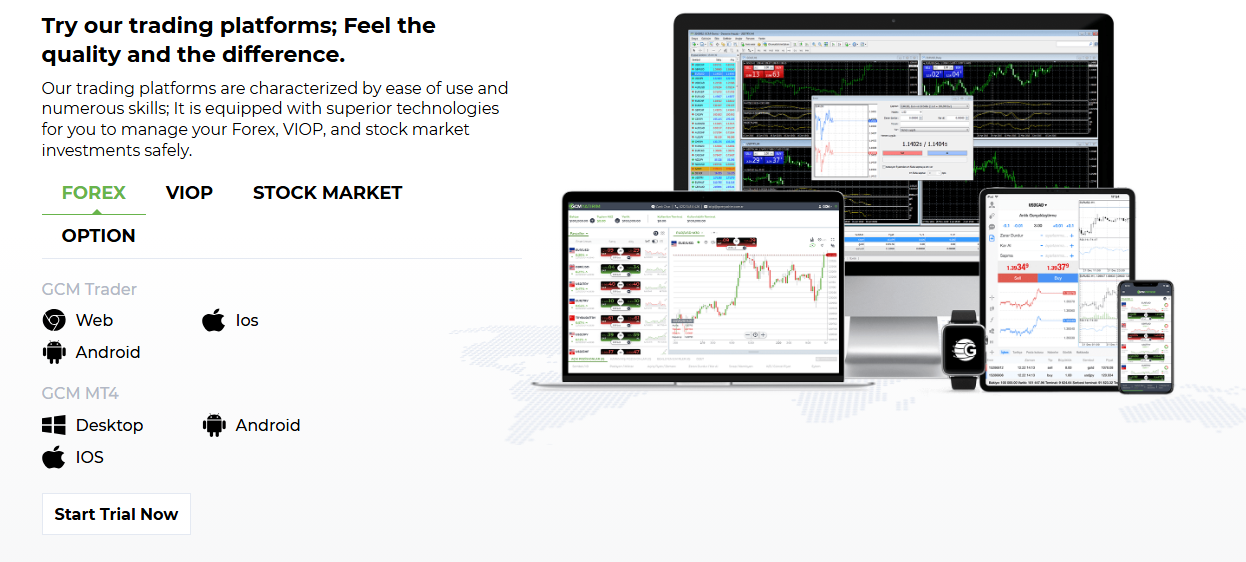

GCM Forex Trading Platforms

From my experience, GCM Forex provides access to the highly reliable and popular MetaTrader4 (MT4) platform. This platform is well-regarded in the trading community for its user-friendly interface and one-click trade execution, making it easier to manage trades efficiently.

MT4 is equipped with a wide range of advanced charting tools and indicators, which helps in performing detailed technical analysis. This platform supports both manual and automated trading, allowing traders to implement their strategies seamlessly.

In addition to the desktop version, GCM Forex offers WebTrader, which allows you to trade directly from your browser without any software installation. The WebTrader platform is convenient and ensures that you can access your trading account from any device with internet connectivity.

For those who prefer trading on the go, GCM Forex also provides Mobile Trader and Tablet Trader platforms. These mobile versions of MT4 ensure that you can monitor and manage your trades anytime, anywhere, providing flexibility and convenience for active traders.

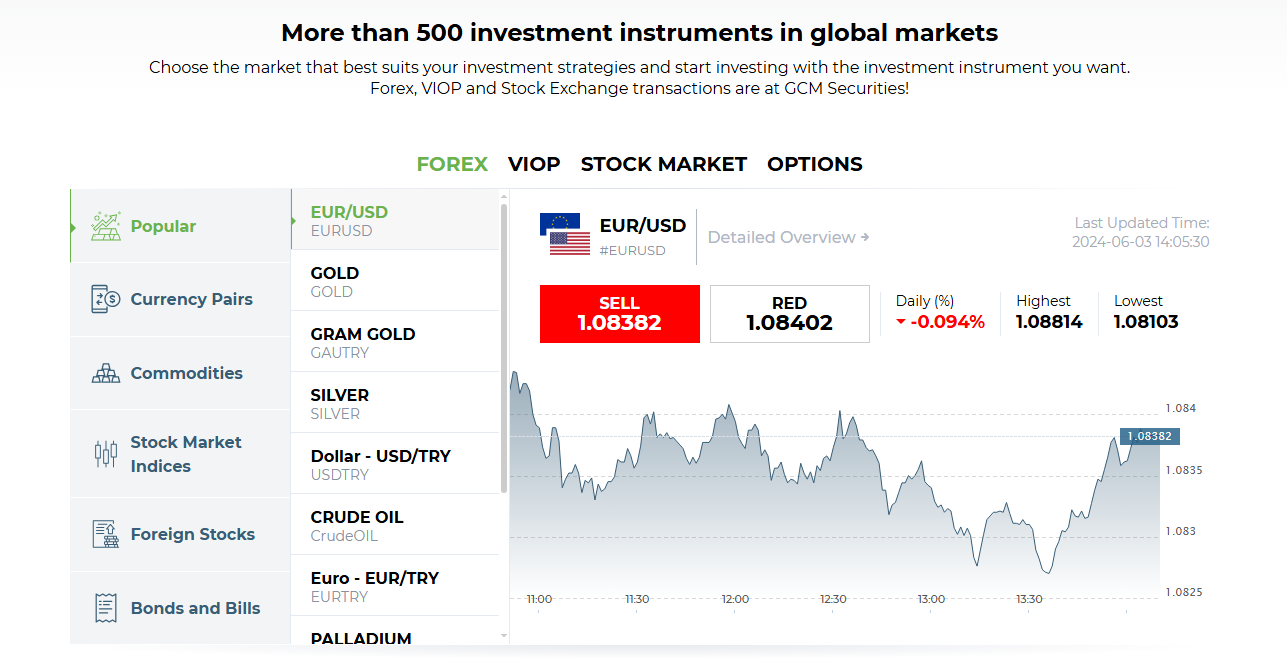

What Can You Trade on GCM Forex

Based on my experience, GCM Forex offers a diverse range of trading instruments, which provides ample opportunities to diversify your trading portfolio. You can trade 51 different currency pairs, allowing you to take advantage of various forex market movements and currency correlations.

Additionally, GCM Forex provides access to 21 CFDs on commodities, including popular options like gold, silver, and oil. This variety enables you to hedge your investments or capitalize on commodity price fluctuations.

For those interested in trading indices, GCM Forex offers 14 different indices from major global markets. Trading indices can be a great way to gain exposure to broader market trends without focusing on individual stocks.

If you prefer trading individual stocks, GCM Forex has 137 stocks available. This selection covers various sectors, allowing you to build a well-rounded stock portfolio.

Moreover, GCM Forex provides bonds and promissory notes, with three options available. These instruments can be a valuable addition for those looking to diversify further with lower-risk investments.

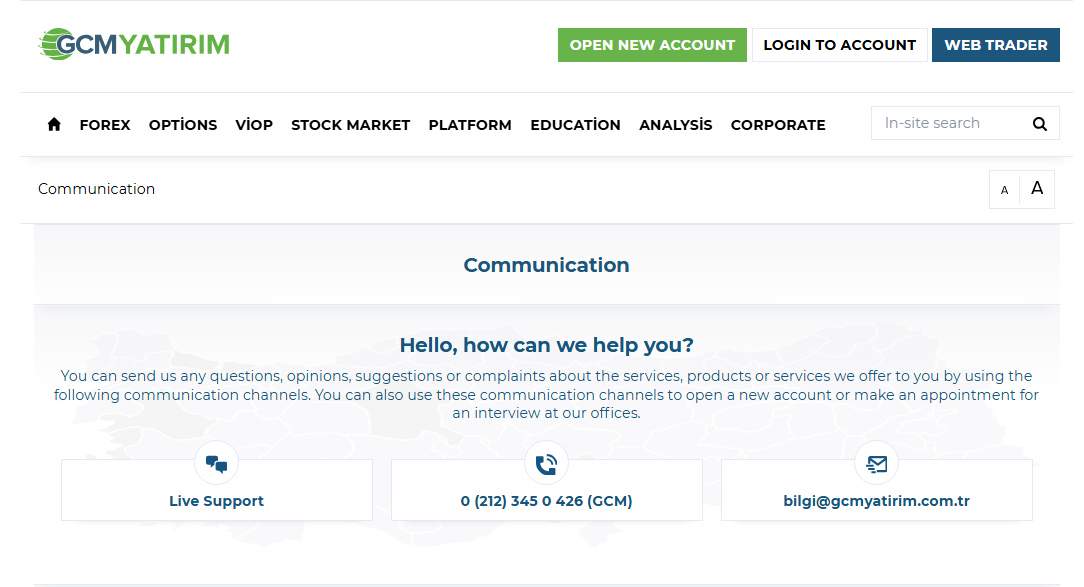

GCM Forex Customer Support

When I contacted them, GCM Forex offered solid customer support to its clients. You can reach them through multiple channels, including live chat, email, and phone support. This ensures that help is always available, no matter your preferred method of communication.

Their customer service is available 24/7, which is crucial for traders who need immediate assistance, especially during volatile market conditions. Additionally, GCM Forex provides support in both Turkish and English, catering to a broader audience and ensuring that language barriers do not impede access to help.

For more detailed inquiries or issues, GCM Forex has a comprehensive support system with local offices in several cities. This local presence can be incredibly beneficial for resolving more complex issues that might require face-to-face interaction.

Advantages and Disadvantages of GCM Forex Customer Support

Withdrawal Options and Fees

When it comes to withdrawals at GCM Forex, the only available option is wire transfer. Unfortunately, the company does not support transfers to cards, electronic wallets, or cryptocurrency wallets, which might be limiting for some traders.

Withdrawal requests are processed by the financial department on the same day they are submitted, but it can take up to 7 days for the bank to complete the transaction. This means you might need to plan ahead to ensure timely access to your funds.

One of the advantages is that GCM Forex does not charge a withdrawal fee. However, keep in mind that the recipient bank may impose its own charges. Funds can be withdrawn in Turkish lira, Euro, and US dollars, offering some flexibility in currency options.

Verification is a mandatory step for all withdrawals, ensuring that security and compliance are maintained throughout the process. This step might take additional time but is crucial for protecting your account.

GCM Forex Vs Other Brokers

#1. GCM Forex vs AvaTrade

GCM Forex is a Turkey-based broker offering a range of trading instruments and platforms like MetaTrader4, but its primary strength lies in its local focus and regulation by the Capital Markets Board of Turkey. AvaTrade, on the other hand, is a global broker with a significant presence in multiple countries, offering over 1,250 financial instruments and a variety of trading platforms. AvaTrade is heavily regulated and serves a larger, more diverse client base compared to GCM Forex.

Verdict: AvaTrade is better for traders seeking a highly regulated global platform with a wide range of instruments and comprehensive international support. GCM Forex is more suitable for traders focusing on the Turkish market with specific regulatory preferences.

#2. GCM Forex vs RoboForex

GCM Forex provides a solid local trading environment with essential instruments and platforms like MetaTrader4. RoboForex, however, offers a broader global trading experience with over 12,000 trading options and eight asset classes, including unique features like trading contests and a wide selection of platforms such as MetaTrader, cTrader, and RTrader. RoboForex is known for its advanced technologies and personalized trading terms.

Verdict: RoboForex is better for traders looking for a global broker with extensive trading options and advanced platform choices. GCM Forex suits those preferring a more localized trading experience within Turkey’s regulatory framework.

#3. GCM Forex vs Exness

GCM Forex focuses on providing a secure trading environment with standard instruments and platforms, regulated by the Capital Markets Board of Turkey. Exness, operating globally with offices in Cyprus and Seychelles, offers more than 120 currency pairs, including cryptocurrencies, with attractive conditions like low commissions and infinite leverage. Exness also provides various account types and an environment conducive to both beginners and experienced traders.

Verdict: Exness is superior for traders needing a wide array of instruments, including cryptocurrencies, and favorable trading conditions like infinite leverage. GCM Forex remains ideal for those who prefer trading under Turkish regulatory conditions with a local focus.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH GCM FOREX

Conclusion: GCM Forex Review

In conclusion, GCM Forex offers a solid trading platform with a variety of instruments and user-friendly options like MetaTrader4. Their regulation by the Capital Markets Board of Turkey provides a secure trading environment, which is essential for local traders. The availability of demo accounts and educational resources also supports beginner traders.

However, there are some limitations, such as higher spreads starting from 2 pips and the sole reliance on wire transfers for withdrawals, which might not be convenient for all users. Additionally, while customer support is available 24/7, it’s limited to Turkish and English, which could be restrictive. Overall, GCM Forex is a reliable choice for those who prioritize trading within a regulated Turkish framework, but it might not suit traders looking for lower spreads or more versatile withdrawal options.

Also Read: FXNovus Review 2024 – Expert Trader Insights

GCM Forex Review: FAQs

What trading platforms does GCM Forex offer?

GCM Forex offers the MetaTrader4 platform, WebTrader, Mobile Trader, and Tablet Trader, providing various options for different trading preferences.

What are the withdrawal options and associated fees at GCM Forex?

GCM Forex only supports withdrawals via wire transfer. While the broker does not charge withdrawal fees, the recipient bank may impose its own fees.

Is GCM Forex regulated, and by whom?

Yes, GCM Forex is regulated by the Capital Markets Board of Turkey (CMB), ensuring compliance with strict financial standards and providing a secure trading environment.

OPEN AN ACCOUNT NOW WITH GCM FOREX AND GET YOUR BONUS