FXView Review

FXView is a regulated broker offering access to forex and CFD markets with a focus on transparency and low-cost trading. The broker supports multiple trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, giving traders flexibility and access to advanced trading tools for technical analysis.

FXView’s account options include ECN and RAW ECN accounts, designed for different trading needs, with competitive spreads and low commissions on ECN accounts. For traders seeking high leverage, FXView provides leverage options up to 1:500, depending on the asset class, account type, and the trading conditions of the forex market.

The broker is regulated by multiple financial authorities, including CySEC and the FCA, ensuring strong regulatory oversight for safer trading. FXView also offers 24/5 multilingual support and a range of educational resources, catering to both beginners and experienced traders looking to enhance their skills.

What is FXView?

FXView is a global forex and CFD broker that provides retail and professional traders with access to a wide range of markets, including forex, indices, commodities, and cryptocurrencies. Known for its focus on low-cost trading, FXView offers ECN and standard accounts with competitive spreads and low commission fees on select accounts.

The broker supports popular platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, giving traders flexibility in trading tools and features for technical analysis and automated trading. FXView is regulated by top-tier financial authorities, including CySEC and the FCA, providing a safe trading environment with strong oversight and compliance.

FXView Regulation and Safety

FXView is regulated by multiple top-tier financial authorities, including the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA) in the UK following the local or international laws. These regulatory bodies enforce strict compliance standards, ensuring FXView adheres to robust financial practices and client protection measures.

In terms of safety, FXView implements segregated client accounts, which keep traders’ funds separate from the broker’s operational funds, reducing the risk of misuse. The broker also uses SSL encryption to secure transactions and personal information, providing an added layer of security for clients trading across its platforms. These regulatory and security measures collectively enhance trust and confidence for FXView’s users.

FXView Pros and Cons

Pros

- Low fees

- Multiple platforms

- Tight spreads

- High leverage

Cons

- Limited 24/7 support

- Withdrawal delays

- No proprietary platform

- Inactivity fees

Benefits of Trading with FXView

Trading with FXView comes with a range of benefits, particularly for traders seeking a low-cost, flexible trading environment. The broker provides access to multiple trading platforms—MetaTrader 4, MetaTrader 5, and cTrader—giving users advanced charting tools, automate trading strategies, and extensive analysis features to suit different trading styles. FXView is also offering good educational resources including glossary of trading terms, market news and video tutorials.

FXView is known for its competitive spreads and low commissions, especially on ECN accounts, making it appealing to cost-conscious traders. Additionally, with leverage options up to 1:500, FXView offers the potential for higher returns, which can be attractive for experienced traders looking to maximize their strategies.

Regulated by CySEC and the FCA, FXView also emphasizes regulatory compliance and safety, providing a secure trading environment. The broker’s 24/5 multilingual support and educational resources further enhance the experience, making it accessible for both beginners and advanced traders looking to improve their skills.

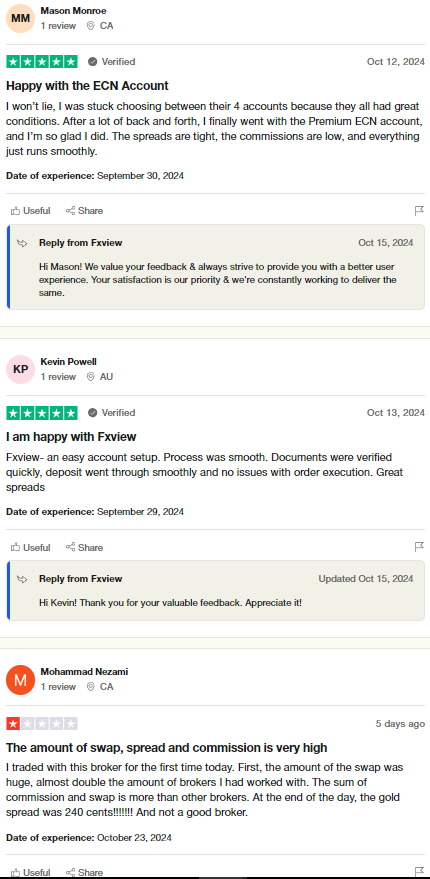

FXView Customer Reviews

FXView has generally positive customer reviews, with many traders appreciating the low-cost structure of the good broker, particularly the tight spreads and low commissions available on ECN accounts. Users also find the range of platform options—MetaTrader 4, MetaTrader 5, and cTrader—convenient and versatile, allowing them to select the trading tools that best match their trading needs.

However, some reviews mention delays in withdrawal processing and occasional connectivity issues on the platform during peak hours. While FXView’s 24/5 multilingual support is praised for responsiveness, a few users feel that adding 24/7 support could improve the experience. Overall, FXView is valued for its cost-effectiveness and flexibility, though it may have room for improvement in service consistency and accessibility.

FXView Spreads, Fees, and Commissions

FXView is known for its competitive spreads and low-cost trading structure, particularly with its ECN account offerings. Spreads are generally tight across forex pairs and CFDs, with major currency pairs like EUR/USD typically having minimal spread costs, which is beneficial for high-frequency traders.

In addition to spreads, FXView charges low commissions on ECN accounts, allowing traders to benefit from reduced overall trading costs. Standard accounts do not have commission fees but come with slightly wider spreads. Beyond trading fees, FXView’s non-trading fees are minimal, though withdrawal fees may apply depending on the payment method used.

FXView’s transparent pricing makes it easy for traders to understand their costs, enhancing budget management and making it attractive for those who prioritize affordability and clarity in their trading.

Account Types

FXView offers a selection of trading accounts tailored to suit different trading needs and experience levels. Each account type features competitive pricing, varied spreads, and flexibility in leverage, allowing traders to choose an account that aligns with their goals and trading style.

Zero Commission Account

FXView’s Zero Commission Account offers traders a cost-effective option with no additional fees on trades, making it ideal for those focused on reducing trading costs. This account provides competitive spreads, allowing traders to execute strategies without commission charges impacting their profitability.

RAW ECN Account

Designed for straightforward trading, the Standard Account features commission-free trading with slightly wider spreads, making it ideal for traders who prefer simple cost structures without additional fees.

Premium ECN Account

The raw ECN Account is aimed at experienced traders, offering tighter spreads with a small commission, which can help reduce trading costs for high-frequency and high-volume traders.

Islamic Account

A swap-free account option for traders who need Sharia-compliant trading, ensuring no interest charges on overnight positions, available on request.

Demo Account

Equipped with virtual funds, the Demo Account allows beginners to practice trading and test strategies risk-free on FXView’s platforms before moving to a live account.

How to Open Your Account

Opening an account with FXView is straightforward and can be completed in just a few steps. This process allows traders to quickly start accessing the platform’s wide range of trading instruments and account features.

Step 1: Visit the FXView Website

Head to FXView’s official website and click on the “Open Account” or “Sign Up” button to begin the registration process.

Step 2: Complete the Registration Form

Fill out the required details, including personal information like name, email, and phone number, and select the preferred account type that best suits your trading needs.

Step 3: Verify Your Identity

Submit identification documents, such as a valid ID and proof of address, as part of FXView’s regulatory compliance to secure client accounts.

Step 4: Fund Your Account

Once approved, select your preferred funding method, deposit funds, and start trading. FXView supports various payment options, including bank transfers, credit cards, and e-wallets.

Step 5: Start Trading

With funds in your account, log into FXView’s trading platform and access a range of instruments, including forex, indices, commodities, and cryptocurrencies.

FXView Trading Platforms

FXView provides traders with access to MetaTrader 5 (MT5) and ActTrader platforms, offering a versatile trading experience for all skill levels. MT5 is known for its advanced features, including enhanced charting tools, multiple timeframes, and support for automated trading, making it ideal for in-depth market analysis and strategy execution.

With ActTrader, FXView brings additional flexibility, offering a user-friendly interface designed to cater to both beginner and professional traders. ActTrader includes customizable charting options and a wide range of order types, giving traders greater control over their trades.

By offering MT5 and ActTrader, FXView enables clients to choose the platform that best fits their trading style and goals. This diverse platform selection supports a seamless trading experience, whether traders are focused on forex, commodities, indices, or cryptocurrencies.

What Can You Trade on FXView

FXView provides access to a wide range of trading instruments across multiple markets, allowing traders to diversify their portfolios and explore various trading opportunities. These instruments cover key asset classes, making FXView a versatile option for both new and experienced traders.

Forex

Trade major, minor, and exotic currency pairs with competitive spreads, making forex a primary option for traders seeking high liquidity and global market access.

Indices

FXView offers popular global indices, enabling traders to speculate on broader market movements without needing to invest in individual stocks.

Commodities

Diversify with commodities like gold, silver, and oil, allowing traders to hedge against inflation or volatility in other markets.

Cryptocurrencies

Trade leading digital assets, including Bitcoin and Ethereum, to capitalize on the fast-moving and highly volatile cryptocurrency market.

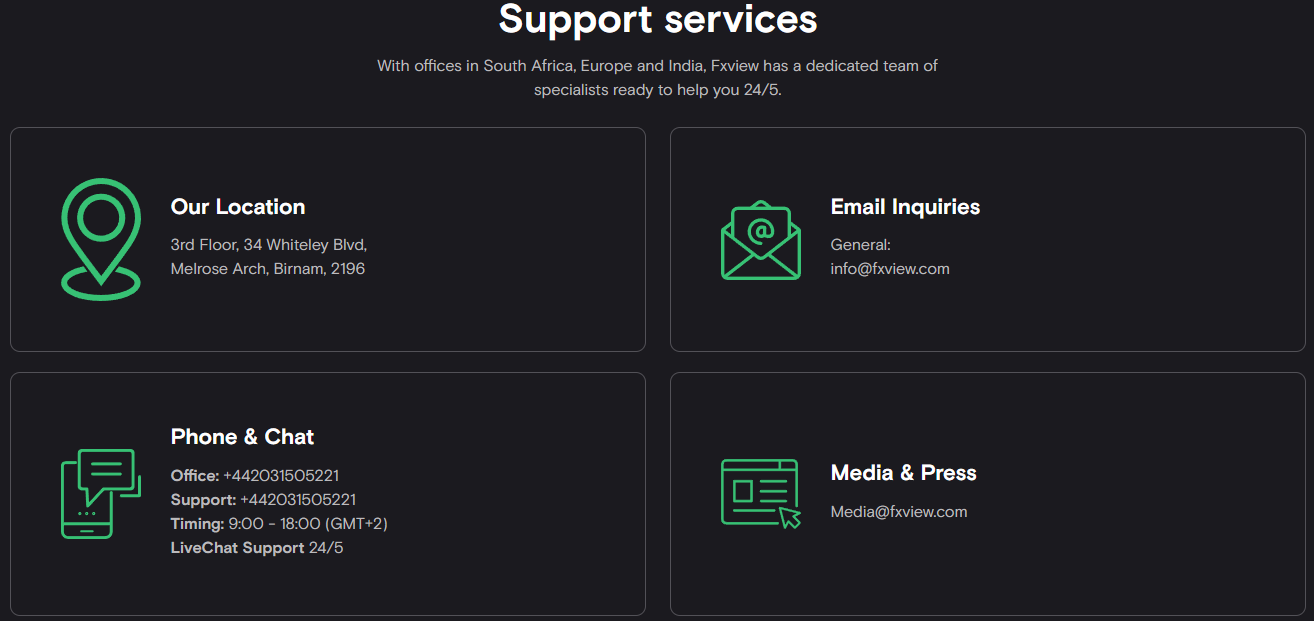

FXView Customer Support

FXView offers 24/5 multilingual customer support to assist traders during active market hours. The support team is available through various channels, including live chat, email, and phone, providing flexibility for traders to reach out with inquiries related to accounts, platform issues, or general trading support.

Customer reviews generally highlight the responsiveness and helpfulness of FXView’s support staff, particularly for resolving platform-related concerns or transaction queries. However, some traders feel that 24/7 support would further improve accessibility, especially for those trading in different time zones or with urgent issues outside of standard market hours. Overall, FXView’s support structure is reliable and suitable for most traders, though limited hours may be a drawback for some.

Advantages and Disadvantages of FXView Customer Support

Withdrawal Options and Fees

FXView offers multiple withdrawal options designed to make accessing funds simple and convenient for traders. Each method comes with its own processing time and fee structure, allowing traders to choose the most suitable and cost-effective option based on their needs and location.

Bank Wire Transfer

Ideal for larger withdrawals, bank transfer is secure but may incur higher fees and typically take 2-5 business days to process.

Credit/Debit Card

Withdrawals to credit or debit cards are fast and convenient but may carry processing fees, depending on the card provider and location.

E-wallets

Options like Skrill and Neteller provide quick and low-fee withdrawals, making them popular among traders who prioritize speed.

Cryptocurrency

FXView supports crypto withdrawals, allowing for secure and fast transactions with minimal fees, suitable for those preferring digital currency transfers.

FXView Vs Other Brokers

#1. FXView vs AvaTrade

FXView and AvaTrade are both well-regarded brokers but cater to slightly different trader preferences and markets. FXView offers a straightforward trading experience with low spreads, low commissions, and access to MT4, MT5, and cTrader platforms, focusing on cost-effective forex and CFD trading. AvaTrade, however, provides a broader platform range that includes MT4, MT5, AvaOptions, and its proprietary WebTrader and AvaTradeGO app, which appeal to traders seeking variety in trading instruments like options, forex, CFDs, and even social trading. Additionally, AvaTrade is regulated by multiple top-tier authorities, including ASIC and the FCA, which strengthens its appeal for traders looking for enhanced regulatory oversight compared to FXView’s CySEC and FCA licensing.

Verdict: AvaTrade is better suited for those seeking platform diversity and comprehensive regulation. FXView, however, is ideal for traders focused on low trading costs and simplicity with reliable platform options.

#2. FXView vs RoboForex

FXView and RoboForex both offer competitive trading services but are tailored to different trader needs. FXView focuses on a low-cost, streamlined trading experience with access to MT4, MT5, and cTrader, providing competitive spreads and low commissions, especially on ECN accounts. RoboForex, on the other hand, supports a broader platform selection, including MT4, MT5, cTrader, and its proprietary R Trader platform, which allows for a wider variety of trading styles and includes specialized features like cent accounts and copy trading options. RoboForex also supports more asset classes, such as stocks, commodities, forex, and cryptocurrencies, providing extensive market options. In terms of regulation, RoboForex is regulated by CySEC and IFSC, while FXView is regulated by CySEC and FCA, with FCA regulation offering a more stringent level of oversight.

Verdict: RoboForex is a strong choice for traders wanting diverse asset options and innovative platform features. FXView is ideal for those who prioritize cost-effectiveness and regulatory assurance through FCA oversight, focusing on core forex and CFD trading.

#3. FXView vs Exness

FXView and Exness both cater to forex and CFD traders but with different approaches to trading platforms, costs, and support. FXView emphasizes low-cost trading with access to MetaTrader 4, MetaTrader 5, and cTrader, making it a suitable option for traders who prefer cost-effective, straightforward trading. Exness, however, supports both MT4 and MT5 while also offering a unique WebTrader platform, appealing to those who want additional flexibility and ease of access. Exness stands out with its high leverage options, reaching up to 1:2000 on some accounts, which is significantly higher than FXView’s cap of 1:500. Additionally, Exness provides 24/7 customer support in multiple languages, while FXView’s support is available only 24/5. In terms of regulation, Exness holds licenses from the FCA and CySEC, while FXView is regulated by CySEC and the FCA, giving both brokers strong regulatory credibility.

Verdict: Exness is ideal for traders who need high leverage and 24/7 support for round-the-clock trading. FXView is better suited for traders focused on low costs and platform flexibility without the need for extremely high leverage.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: FXView Review

In conclusion, FXView offers a low-cost, flexible trading experience well-suited for traders seeking competitive spreads and advanced platform options. With access to MetaTrader 4, MetaTrader 5, and cTrader, FXView provides a versatile trading environment for various trading styles, from beginners to advanced traders.

The broker’s commitment to regulatory oversight by CySEC and the FCA ensures a secure and compliant trading framework, appealing to those who prioritize safety. While FXView’s 24/5 customer support is responsive and helpful, expanding to 24/7 availability could enhance accessibility. Overall, FXView is a strong choice for traders looking for affordable, feature-rich trading with reliable regulatory backing.

FXView Review: FAQs

What is FXView?

FXView is a forex and CFD broker that offers access to multiple financial markets, including forex, commodities, indices, and cryptocurrencies. The broker focuses on low-cost trading and supports platforms like MetaTrader 4, MetaTrader 5, and cTrader.

Is FXView regulated?

Yes, FXView is regulated by top-tier financial authorities, including CySEC (Cyprus Securities and Exchange Commission) and the Financial Sector Conduct Authority (FSCA), which ensures compliance with strict regulatory standards.

What account types does FXView offer?

FXView provides several account types, including Standard, ECN, Islamic, and Demo accounts. Each account is tailored to different trading needs, from cost-effective options to swap-free trading.

OPEN AN ACCOUNT NOW WITH FXVIEW AND GET YOUR BONUS