FXPro Review

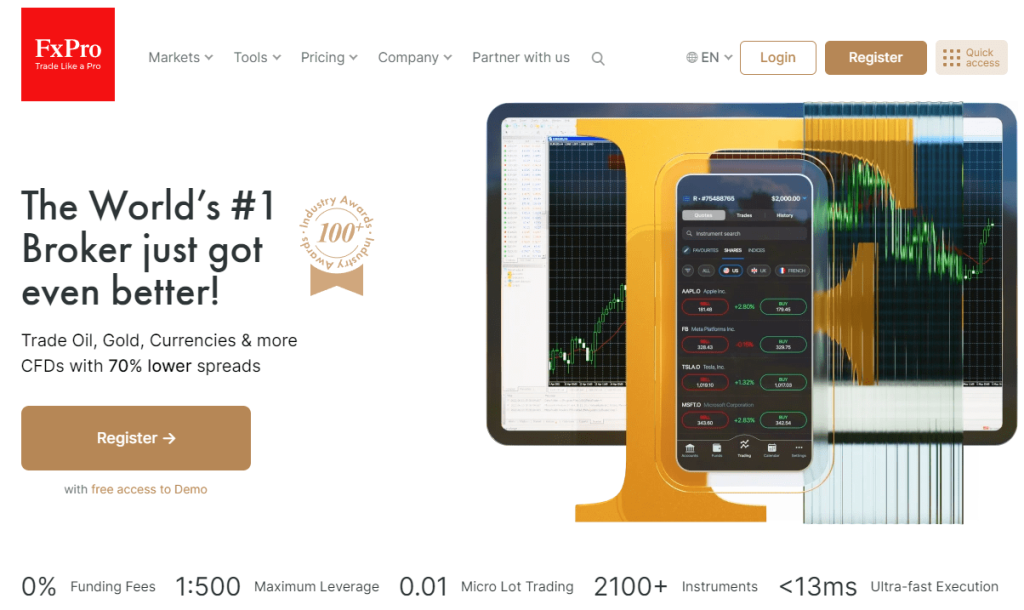

FXPro is a forex and CFD broker providing trading services since 2006. Regulated by multiple financial authorities, including the UK FCA, CySEC of Cyprus, and the SCB in the Bahamas, FXPro operates in more than 170 countries worldwide for retail and institutional clients. The company offers multiple trading platforms and customer support through various channels. The brokerage currently ranks at No 21 in our AFM review list.

This review will delve deeper into FXPro’s account opening process, trading fees, product portfolio, customer support, and more. We will also discuss their regulatory status, safety standards, and trading tools to help you decide whether FXPro is the right broker for you.

What is FXPro?

FxPro is a well-established online brokerage company founded in 2006. It is a CFD and spread betting provider in the UK. The company operates in 173 countries with over 1,866,000 client accounts and €100 million of Tier 1 capital.

The broker has executed over 455 million orders and was voted the UK’s most trusted Forex brand by Global Brands Magazine in 2017. It offers various trading instruments, including FX pairs, indices, futures, and metals. The company also provides demo trading accounts and free educational tutorials for new traders.

FxPro is regulated by the FCA, CySEC, FSCA, and SCB and is known for its trustworthiness and reliability. It offers a comprehensive trading platform with advanced features and tools to help traders make informed decisions. The company also provides competitive spreads and fees, making it an attractive option for traders of all levels. FxPro is a great option for traders seeking a reliable and trustworthy broker.

Advantages and Disadvantages of Trading with FXPro

Benefits of Trading with FXPro

FxPro is a broker that offers No Dealing Desk Execution, which provides traders with professional trading conditions and access to deep liquidity. Through FxPro, traders can trade CFDs on a variety of instruments, such as FX pairs, Futures, Indices, Metals, Energy and Shares.

The brokerage also provides educational material, forex trading tools and demo trading accounts to help traders learn more about CFDs trading. Additionally, FxPro has a customer support team available 24/5 in over 20 languages to answer any queries.

The company offers traders a great benefit of a realtime audio broadcast that informs them of any changes in the market. Additionally, they have a news feed with the most recent market news and a link to Trading Central WebTV.

FXPro Pros and Cons

Pros

- Negative balance protection

- Swap-free accounts are available

- Heavily regulated

- Transparent trade execution

Cons

- High minimum deposit $100

- BnkPro app is not available in all regions

FXPro Customer Reviews

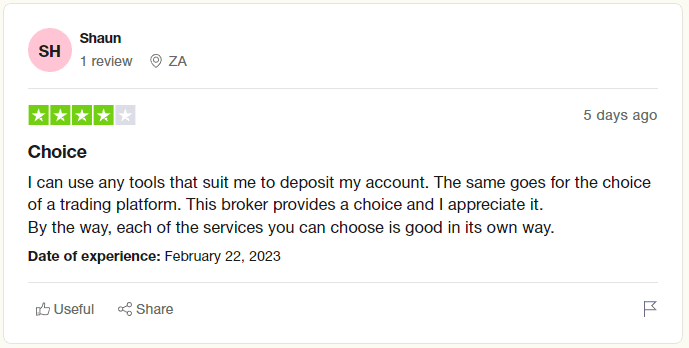

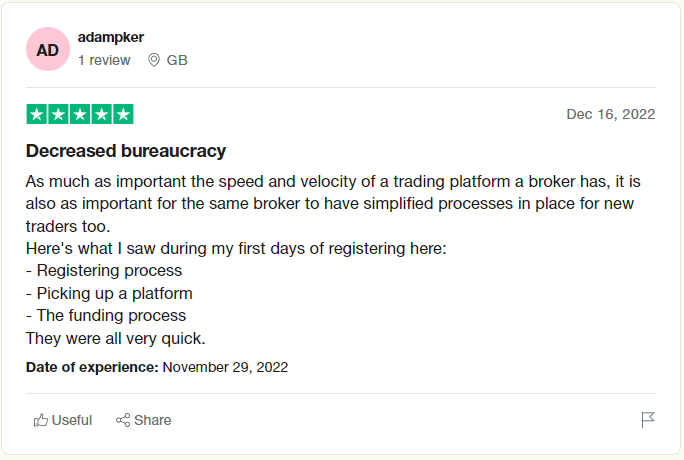

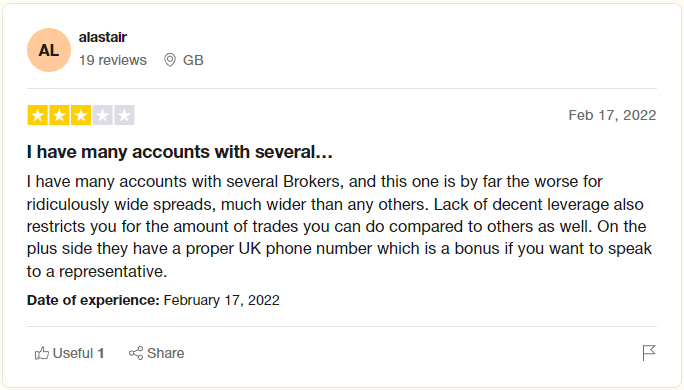

Multiple customer reviews are available on TrustPilot, pointing to the legitimacy of FxPro. Traders are generally pleased with the overall performance of the broker. They appreciate the sign-up process, trading software and deposit process.

One user was pleased with the range of tools and trading platforms available for depositing and trading with FxPro.

Another trader had a great experience with the broker’s trading platform. They applauded the simple registration and funding processes.

One user expressed dissatisfaction with the wide spreads and lack of decent leverage offered by FxPro. According to them, the only plus side is the availability of a proper UK phone number for customer service.

FXPro Spreads, Fees, and Commissions

FxPro offers its clients competitive trading fees, depending on their chosen platform. On the cTrader platform, traders can benefit from commission-based pricing, with an effective spread of 1.27 pips for the EUR/USD pair.

On MT4 and MT5, traders can choose between market execution and instant execution, with spreads of 1.58 and 1.71 pips, respectively. MT5 does not offer a fixed-spread option.

FxPro charges an inactivity fee of $15 after 12 months of no trading activity. This fee is followed by a $5 monthly charge per the CySec jurisdiction. It is important to note that the inactivity fee applies only if there is no trading activity on the account for 12 months or more. Therefore, you do not have to worry about incurring costs if you are an active trader.

However, suppose you plan to take a break from trading. In that case, it is advisable to either withdraw your funds or keep your account active by making at least one trade within 12 months to avoid the inactivity fee.

Account Types

FxPro provides multiple account types to cater to the needs of all traders, i.e., scalpers, day and swing investors. Let us go through their three major offerings.

The FxPro MT4 account is an excellent choice for forex traders. It offers a wide range of markets, including forex, indices, commodities, shares, and crypto, with over 2100 assets in total. The spreads are variable, starting from 0.6 pips, and there is a commission of $3.50 per lot when trading with the MT4 Raw account. The portfolio is available under CySEC, FCA, and SCB regulations, with leverage up to 1:30 (CySEC, FCA) and 1:200 (SCB).

FxPro MT5 account is an excellent choice for non-forex traders, offering access to over 2100 assets across forex, indices, commodities, shares, and crypto. The spreads in this account start from 0.6 pips, and CFD assets are subject to rollover fees. The account is regulated by CySEC, FCA, and SCB, and leverage of up to 1:30 (CySEC, FCA) and 1:200 (SCB) is available. The MetaTrader 5 platform is used for trading, with trade sizes starting from 1 micro lot.

FxPro cTrader account is a great choice for scalpers and traders who wish to take advantage of low spreads and commissions. The account offers access to over 300 assets in forex, commodities, and indices, with spreads as low as 0 pips and a commission of $3.50 per lot. The account also offers leverage up to 1:30 (CySEC, FCA) and 1:200 (SCB). Additionally, FxPro provides a VPS service for $30 per month, and a cTrader demo account is available with a minimum deposit of $100.

How To Open Your Account?

Opening an account with FxPro is quick and easy. All you need to do is fill out the online application form and submit it. The available languages include English, French, German, Spanish, Portuguese, Italian, Russian, Chinese, Japanese, Korean, Thai, Malaysian, Indonesian, Czech, Polish, Hungarian, Arabic, and Vietnamese.

Due to KYC regulations from regulators, the company may also require you to submit your identification documents. This is imposed to avoid fraud and money laundering.

Once your application is submitted, FxPro will verify your account at the earliest. After verification, you can start trading with FxPro and use their wide range of trading instruments and features.

What Can You Trade on FXPro

FxPro offers a broad range of tradable instruments, including 70 currency pairs, making it an excellent choice for forex traders. Additionally, the broker provides access to 29 stock index CFDs and over 1,700 stock CFDs, which is fantastic news for traders interested in diversifying their portfolios with equity investments.

Although ETF CFDs are not currently available on the platform, traders can still access 15 commodity CFDs, making FxPro a solid choice for those looking to invest in gold, silver, and other precious metals.

Cryptocurrency trading is also available on FxPro, with 30 different crypto pairs available to traders depending on their IP address. This feature is handy for traders who want to take advantage of the cryptocurrency market’s volatility without using a different exchange or wallet.

Overall, FxPro offers a diverse range of trading instruments suitable for both novice and experienced traders.

FXPro Customer Support

The FxPro brokerage company offers excellent customer support to its traders. They provide a multilingual support service available 24/7, 5 days a week, in over 20 languages. It allows traders to get help in their native language, making it easier to ask questions and get answers quickly. The customer service team is also available via live chat and phone support so traders can get help promptly.

Traders can also use a callback service. The brokerage representatives will contact the trader and answer any inquiries.

The only downside to FxPro’s customer service is that it is unavailable on Saturday and Sunday. However, this is a minor inconvenience compared to the many advantages of the customer service provided by FxPro.

Advantages and Disadvantages of FXPro Customer Support

Security for Investors

Withdrawal Options and Fees

Withdrawal options include Wire Transfer, Credit Cards – Visa, Maestro, MasterCard, American Express, and e-Wallets such as Paypal, Skrill, Neteller, and UnionPay. Funds withdrawn to electronic systems are credited instantly, while Visa and MasterCard bank cards can take up to 6 business days. There is no withdrawal commission.

FxPro charges a 2.6% withdrawal fee for traders who need to access funds without trading. This fee is designed to cover the withdrawal processing cost.

To avoid fraud, money can only be withdrawn to accounts in your name. Again this comes under the regulations imposed by the regulators.

FXPro Vs Other Brokers

#1. FXPro vs Avatrade

FxPro and AvaTrade are well-established online forex and CFD brokers with a global presence. Both brokers are regulated by multiple financial authorities, with FxPro being regulated in one tier-1 jurisdiction and two tier-2 jurisdictions, while AvaTrade is regulated in three tier-1 jurisdictions and four tier-2 jurisdictions. This makes both brokers safe and low-risk options for traders.

FxPro is best known for its MetaTrader and cTrader platform offerings, which are available for desktop, web, and mobile. The broker offers a variety of pricing options across its account types, including fixed and variable spreads, and provides fully-transparent execution methods that vary by account type. However, FxPro’s proprietary platform, FxPro Edge, is not yet available as a mobile app and can’t compete with the best proprietary trading platforms in the market. Additionally, the broker offers fewer symbols for forex and CFD traders than the leading multi-asset brokers. The pricing isn’t quite competitive enough to challenge industry leaders.

On the other hand, AvaTrade offers its proprietary platforms AvaTrade WebTrader and AvaTradeGO alongside MetaTrader. The AvaOptions app provides clients with an excellent forex options mobile trading platform, and the broker offers 44 forex options in addition to over 1,200 CFDs. AvaTrade ranks Best in Class for Professional traders for 2022. The AvaSocial feature and ZuluTrade and DupliTrade for social copy trading finished Best in Class for 2023. Where FxPro barely stands anywhere in terms of copy trading.

#2. FXPro vs Roboforex

FxPro and RoboForex are multi-asset online brokers offering a range of trading instruments, including forex, CFDs, stocks, and cryptocurrencies. Both brokers have won multiple awards in the industry, with FxPro being regulated by one tier-1 jurisdiction and two tier-2 jurisdictions. In contrast, RoboForex is regulated by the International Financial Services Commission (IFSC).

FxPro is best known for its MetaTrader and cTrader platform offerings, which are available for desktop, web, and mobile, and provides fully-transparent execution methods that vary by account type. FxPro offers a variety of pricing options across its account types, including fixed and variable spreads, and has negative balance protection. However, the pricing at FxPro is not quite competitive enough to challenge industry leaders such as IG and CMC Markets.

On the other hand, RoboForex offers tight spreads on CFDs and spread betting across a wide range of markets and a wide selection of payment methods, including cryptocurrencies. The broker offers a $30 welcome deposit bonus and promotions with a $1.2M prize pool. RoboForex provides a powerful trading aide through its award-winning mobile trading app, named Best Global Mobile Trading App 2020 by the Global Forex Awards B2B.

#3. FXPro vs Alpari

FXPro was named the “Best Broker 2021” at the Ultimate Fintech Awards, the “Best FX Provider 2021” at the Online Personal Wealth Awards, and the “Best Trading Platform 2020” at the Investors Chronicle & Financial Times awards. On the other hand, Alpari has not won as many awards. It has won the Best Forex Broker award at Smart Vision Investment Expo 2022 in Egypt and a few others.

FXPro offers a 30% bonus up to $100 (terms apply), while Alpari does not have a specific bonus offering. However, both brokers offer demo accounts for traders to test their trading strategies and get familiar with their platforms.

FXPro requires a minimum deposit of $100, while Alpari has a lower minimum deposit requirement of $5. Both companies offer a range of payment methods, including credit cards, e-wallets, and wire transfers.

FXPro offers margin trading with a margin rate of 0.5%, while Alpari does not provide any. Both offer the popular MetaTrader 4 trading platform.

Conclusion: FXPro Review

FxPro is a reliable and well-capitalized broker that offers a wide range of trading options and instruments. With competitive pricing and multiple market execution methods, FxPro can be an excellent choice for beginners and amateurs looking to trade CFDs and Forex. The company also offers numerous platform options, including MT 4, 5, and cTrader.

In terms of safety, FxPro is a highly regulated broker, with customer service available in multiple languages. This makes it a low-risk option for traders. The company also has various rewards in the finance niche, which upholds its status.

Multiple withdrawal options are available for traders, and customer support is super helpful in resolving any issues. There are zero slippages while trading, making it a good choice for scalpers and day traders.

FXPro Review FAQs

Is FXPro regulated?

FxPro Group Limited is the holding company of all FxPro operations. Its regulation and licensing vary depending on the traders’ jurisdiction. For example, FxPro Global Markets Ltd is regulated by SCB, FxPro Financial Services Ltd by CySec and FSCA, FxPro UK by FCA and FxPro Canada by IIROC. FxPro is considered a safe and highly regulated trading platform.

What is FXPro minimum deposit?

FxPro minimum deposit is $100. Traders can use various methods, including credit/debit cards, for injecting funds.

How long does FXPro withdrawal take?

As per the company website, withdrawals from a bank account can take 5-7 business days, while international bank transfers may take 3-5 business days. SEPA and local transfers are usually processed within the same business day, as are E-Wallet transfers.