FXPrimus Review

FXPrimus is a global financial trading broker that offers access to Forex, Stocks, and Commodities through web and mobile platforms. Traders can choose from the MetaTrader Suite and cTrader platforms, which provide advanced tools and features. The broker offers four live trading accounts tailored to different experience levels. This review aims to provide an overview of FXPrimus, highlighting its trading platforms, account types, and emphasis on security and regulation.

FXPrimus stands out for its diverse range of trading platforms, including MetaTrader 4 and 5, as well as cTrader. These platforms offer user-friendly interfaces, advanced charting, and various trading tools. The broker provides four live trading accounts, catering to traders of different skill levels and preferences. This allows individuals to choose an account that aligns with their risk tolerance and trading goals.

In addition to its platform and account offerings, FXPrimus prioritizes security and regulation. The broker is authorized and regulated by reputable financial authorities, ensuring compliance with industry standards. It employs advanced encryption technology to protect client funds and personal information. With a commitment to customer support, FXPrimus offers multilingual assistance around the clock, helping traders with their inquiries and concerns.

In this comprehensive review, our goal is to provide an in-depth assessment of FXPrimus, highlighting its strengths and weaknesses. We aim to equip you with detailed information about the broker, including account options, deposit and withdrawal procedures, commission structures, and more.

By presenting a balanced perspective that incorporates expert analysis and real trader experiences, we aim to empower you to make an informed decision when considering FXPrimus as your brokerage provider.

What is FXPrimus?

FXPrimus is a reputable online trading provider that specializes in Forex (FX) and Contracts for Difference (CFDs). The broker operates under the regulation of multiple jurisdictions, ensuring a secure trading environment for its clients. With a strong focus on delivering exceptional execution speeds and leveraging innovative technology, FXPrimus strives to provide traders with a cutting-edge trading experience.

FXPrimus has garnered recognition and numerous awards, solidifying its position as one of the top Forex providers in the market. The broker has established offices in various countries worldwide, including Vanuatu, Cyprus, South Africa, and others, to cater to the diverse needs of its global client base. By expanding its presence across Europe, Asia, and Africa, FXPrimus has attracted a steadily growing community of traders, with a trader base exceeding 300,000.

Since its establishment in 2009, FXPrimus has made significant strides in the industry. The broker’s headquarters are located in Limassol, Cyprus, a prominent financial hub. Operating as the FXPrimus Group, the company encompasses three main brands, allowing clients to access deep liquidity provided by top-tier banking institutions. This liquidity ensures competitive pricing and ample trading opportunities for traders across the Forex market.

Advantages and Disadvantages of Trading with FXPrimus?

Benefits of Trading with FXPrimus

Trading with FXPrimus offers several benefits that enhance the overall trading experience:

Personal Support

FXPrimus provides access to experienced staff who are available to assist traders through live chat, messaging, or callback. This personal support ensures that traders receive timely assistance and guidance when needed.

Award-winning Safety of Funds Protection

FXPrimus prioritizes the safety of client funds. The broker implements industry-leading mechanisms, such as third-party oversight of client withdrawals, additional global insurance, and negative balance protection. These measures offer peace of mind and safeguard client funds against unforeseen circumstances.

Multiple Competitive Account Types

FXPrimus offers a variety of account types to accommodate traders with different portfolio sizes and trading styles. By providing a range of options, traders can select the account type that best suits their individual preferences and trading objectives.

MetaTrader 4 & 5 & cTrader

FXPrimus stands out as one of the few brokerages that offer both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, along with cTrader. These trading platforms provide traders with access to the extra market depth and a wide array of technical tools, enabling them to make informed trading decisions.

Free Trading Tools & Resources

FXPrimus offers a wealth of free trading tools and resources to enhance traders’ knowledge and support their trading strategies. These include powerful calculators, market calendars, webinars, and articles, which empower traders to plan their trades effectively and stay informed about market developments.

Access to Video Tutorials

FXPrimus provides traders with access to a comprehensive library of video tutorials and walkthroughs. These resources guide traders through various aspects of their trading journey, from registration to executing their first trade and beyond. The video tutorials serve as valuable educational tools to help traders develop their trading skills and knowledge.

Trading with FXPrimus offers personalized support, strong fund protection, diverse account options, access to multiple trading platforms, a wealth of free trading tools and resources, and comprehensive video tutorials. These benefits contribute to an enhanced trading experience and support traders in their pursuit of success in the financial markets.

FXPrimus Pros and Cons

FXPrimus has several notable pros that make it a highly reliable broker with a strong reputation. The broker holds a top-tier regulatory license from CySEC, ensuring a high level of trust and compliance. FXPrimus offers professional education and extensive research materials suitable for beginners, providing valuable resources to enhance traders’ knowledge and skills. The broker’s selection of trading platforms is impressive, offering a variety of options to cater to different preferences. Moreover, FXPrimus is accommodating to all trading styles, allowing traders to implement their preferred strategies.

One of the significant advantages of FXPrimus is its relatively low trading fees compared to other Forex brokers in the market. This makes it an attractive choice, particularly for beginner traders who seek cost-effective trading options. The broker’s commitment to providing competitive fees contributes to a favorable trading experience.

However, there are some cons to consider. The product offering of FXPrimus is relatively narrow, focusing primarily on Forex and CFDs. This limited range of instruments may not appeal to traders seeking a more diverse portfolio. Additionally, the spreads for currencies on FXPrimus are considered to be higher compared to some other Forex brokers, which can impact trading costs for certain strategies.

Another drawback is that the trading conditions and offerings of FXPrimus may vary depending on the entity, which can lead to inconsistency in the services provided. Furthermore, the broker does not offer 24/7 support, which means traders may experience delays in getting assistance during certain times.

It’s worth noting that international trading with FXPrimus is conducted through an offshore entity, which may raise some concerns for certain traders. However, the broker’s solid reputation and regulatory compliance over the years help to alleviate these concerns.

FXPrimus Customer Reviews

Customer reviews of FXPrimus highlight positive experiences with the broker. One customer praised the instant deposit process, noting that their deposit was processed into their account within minutes. They also appreciated the assistance provided by a representative named Mario. Another customer expressed their long-term satisfaction with FXPrimus, considering them one of the best brokers in the industry. They praised the robust and intuitive trading platform, as well as the range of useful features it offers. Another customer described FXPrimus as the most honest broker they have encountered, having been with them since 2019. They also mentioned a PAMM account called LordBot, expressing confidence that others who join will be equally satisfied.

FXPrimus Spreads, Fees, and Commissions

When trading with FXPrimus, traders should be aware of the fees, spreads, and commissions associated with their accounts. The broker charges fees starting from $5 USD, which may vary depending on the specific trading activity and account type chosen. These fees cover various aspects of trading, such as execution, administration, and other operational costs.

The spreads offered by FXPrimus range from 0.5 pips to 1.7 pips. Spreads refer to the difference between the bid and ask prices of a financial instrument, and they represent the cost of executing a trade. Generally, lower spreads are favorable for traders as they indicate lower transaction costs.

In terms of commissions, FXPrimus may charge up to $10 USD depending on the account type selected. Commissions are additional charges applied by the broker for specific trading services, such as trading certain instruments or accessing specialized features.

It’s important to note that the minimum deposit amount required by FXPrimus starts from $15 USD. This amount may vary depending on the account type chosen by the trader. The minimum deposit requirement represents the initial amount of funds that traders need to deposit into their trading account to start trading.

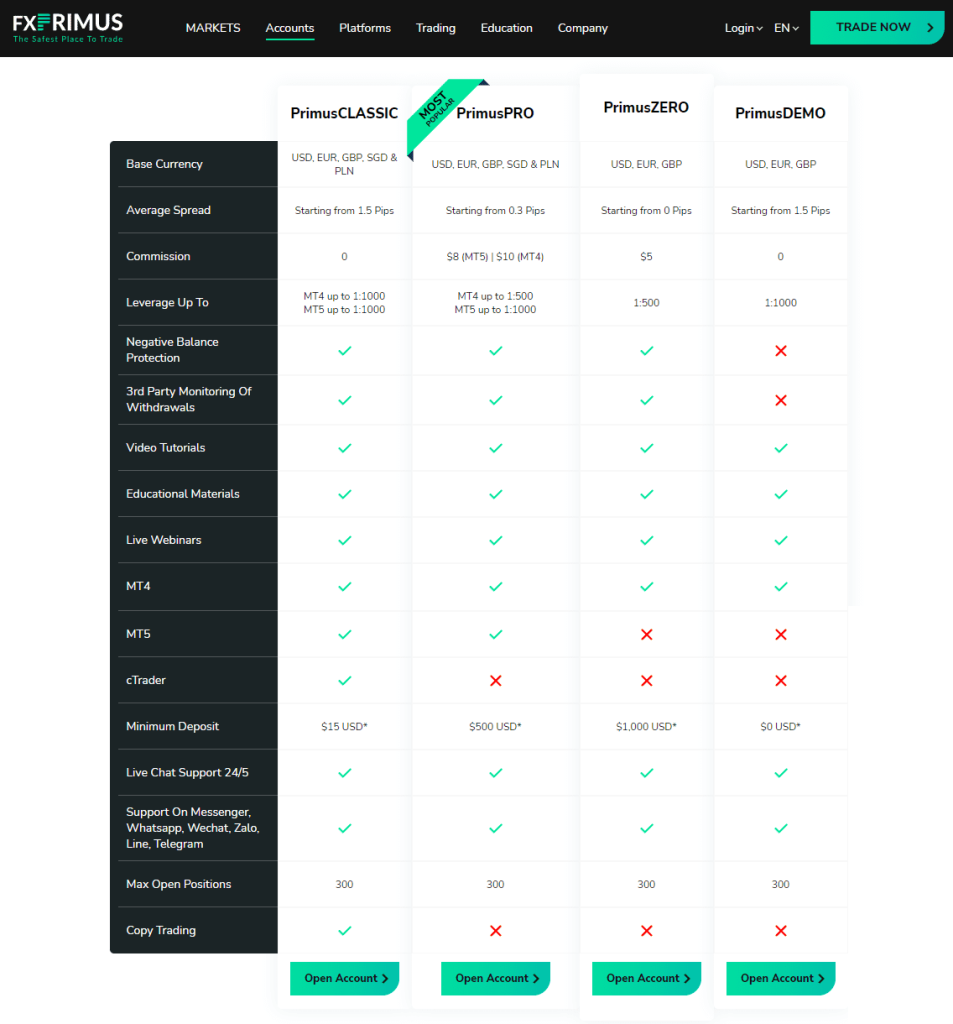

Account Types

FXPrimus offers a range of account types to cater to different traders’ needs. These include Live Accounts and Demo Accounts. Demo accounts are provided for practice and familiarization with the trading platform, allowing traders to test strategies and gain experience without risking real money.

The Live Accounts offered by FXPrimus are divided based on investment size. As traders move up to higher account grades, the spreads tend to become lower. This means that trading with a higher account grade may provide access to tighter spreads, which can be beneficial for cost-conscious traders.

One specific account option is the Micro Account, which allows traders to trade using micro lots. This enables trading with smaller position sizes and is suitable for those who prefer lower-risk trading.

The Premium Account offered by FXPrimus provides additional services such as weekly informative financial trading seminars and is accompanied by the lowest spreads. This account type offers enhanced features and benefits compared to other account types.

The account minimums for each type vary. The Variable Account, also known as the Standard Account, requires a minimum deposit of $1,000. The FXPrimus ECN Premium Account has a higher minimum deposit of $2,500. The VIP Account, designed for high-net-worth traders, requires a minimum deposit of $10,000. It’s important to note that these minimum deposit requirements may vary depending on the entity of FXPrimus that traders are dealing with.

Furthermore, FXPrimus offers the option to request an Islamic Account, also known as a Swap-free account. This type of account is designed for traders of the Islamic faith who wish to trade by Islamic principles. With an Islamic Account, traders can participate in trading without incurring swap charges or experiencing spread widening, aligning with their religious beliefs.

How to Open Your Account

Opening an FXPrimus account is a straightforward process. Here are the steps to get started:

Create an account

Visit the FXPrimus website and locate the account creation form. Click on the provided link to access the form and fill it out with the required information. This typically includes personal details such as your name, email address, and contact information. Follow the instructions to complete the account creation process.

Verify your account

After submitting the account creation form, you will need to verify your account by providing the necessary documents. This is a standard procedure to comply with regulatory requirements and ensure the security of your account. The required documents may include identification documents such as a passport or driver’s license, as well as proof of address like utility bills or bank statements. Follow the instructions provided by FXPrimus to upload and submit these documents for verification.

Fund your account

Once your account is verified, you can log in to your FXPrimus account using the provided credentials. Proceed to fund your account by depositing funds. FXPrimus typically offers multiple deposit options, including bank transfers, credit/debit cards, and online payment processors. Choose the method that suits you best and follow the instructions to complete the funding process.

Trade

After funding your account, you will need to download the MetaTrader 4 (MT4) or MetaTrader 5 (MT5) trading platform to your device. These platforms can be downloaded from the FXPrimus website. Once installed, log in to the platform using your FXPrimus account credentials. You are now ready to place your first trade. Familiarize yourself with the platform’s features and tools, and start executing your trading strategies.

What Can You Trade on FXPrimus

On FXPrimus, traders have access to a variety of tradable instruments. Here are the main categories of assets that can be traded on the platform:

Forex

The forex market allows traders to buy, sell, or exchange currencies at the current market price. It is the largest and most liquid market globally, with a daily trading volume exceeding $6 trillion. FXPrimus offers a wide range of currency pairs, allowing traders to participate in the global forex market.

Metals

Precious metals, such as gold and silver, offer a means of diversifying a portfolio and serve as a hedge against inflation. These metals have intrinsic value, carry no credit risk, and cannot be easily inflated. FXPrimus provides opportunities for traders to trade precious metals, offering exposure to these alternative assets.

Energies

FXPrimus offers a selection of energy instruments for trading, including crude oil, natural gas, and heating oil. Energy trading involves buying, selling, and speculating on the price movements of these commodities. Traders can participate in the energy market and take advantage of price fluctuations.

Equities

Equity trading involves buying and selling shares of publicly traded companies. FXPrimus enables traders to access major stock exchanges and trade shares of large companies. Equity trading allows traders to take positions on the performance of individual stocks and benefit from potential price movements.

Indices

Indices are statistical measures that track the performance of a portfolio of stocks representing a specific market or sector. Trading indices involve analyzing and speculating on the overall movements of a particular market segment. FXPrimus provides opportunities for traders to engage in index trading, allowing them to monitor and trade indices that align with their trading strategies.

By offering a diverse range of tradable instruments, FXPrimus caters to the preferences and strategies of different traders. Traders can explore the forex market, precious metals, energy commodities, equities, and indices to diversify their portfolios and take advantage of various market opportunities.

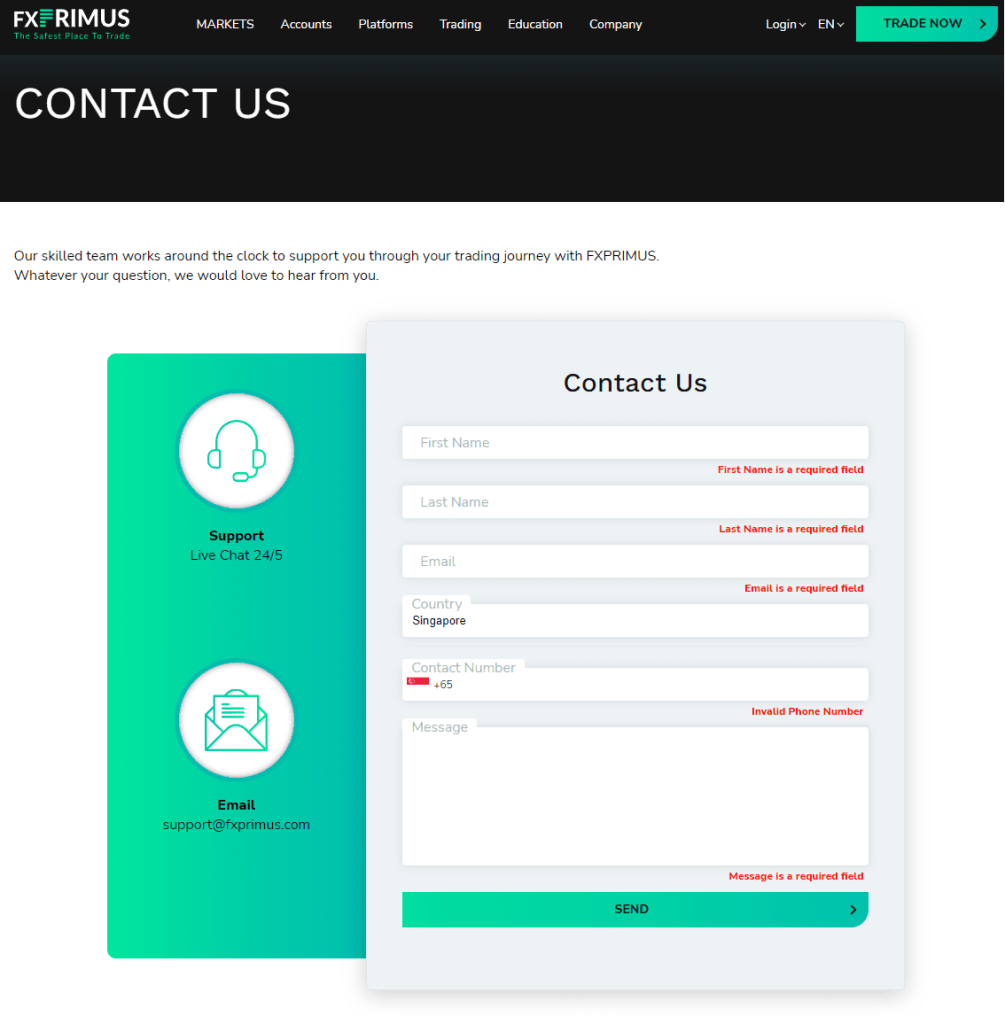

FXPrimus Customer Support

FXPrimus places a strong emphasis on providing excellent customer support, ensuring that traders can easily reach out for assistance whenever needed. The broker offers multiple channels through which clients can contact their support team. One of the most convenient options is the Live Chat feature, allowing traders to have real-time conversations with a support representative directly on the website. Additionally, FXPrimus provides international phone lines, enabling clients from different regions to connect with customer support via phone calls. For those who prefer written communication, email support is also available, allowing traders to submit their inquiries or concerns at any time and receive a response from the support team. With these various contact options, FXPrimus aims to ensure that its clients have easy access to prompt and helpful assistance throughout their trading experience.

Advantages and Disadvantages of FXPrimus Customer Support

Security for Investors

Withdrawal Options and Fees

FXPrimus offers a variety of withdrawal options to cater to the needs of its clients. Traders can choose from options such as Bank Wire, Local Transfers, Credit Cards, and e-wallet solutions when withdrawing funds from their FXPrimus accounts. The minimum withdrawal amount across all methods is $100 USD. One notable aspect is that FXPrimus does not charge any deposit fees, which is advantageous for traders.

It’s important to note that FXPrimus has a policy of not accepting third-party payments, ensuring that all withdrawals are processed securely and in compliance with regulatory requirements. The broker prioritizes the withdrawal or refund process, aiming to complete it within 24-48 hours. Moreover, FXPrimus places importance on returning the funds to the original deposit source whenever possible, enhancing the efficiency and convenience of the withdrawal process for traders.

FXPrimus Vs Other Brokers

#1. FXPrimus vs AvaTrade

FXPrimus is well-known for its top-tier CySEC regulatory license, which ensures a high level of security for traders’ funds. It has reasonable rates, and a wide range of trading platforms, and welcomes all trading types. FXPrimus offers great customer service and a variety of account kinds to accommodate different trading tastes. However, it has a somewhat limited product offering, focusing solely on Forex and CFDs, and currency spreads might be larger when compared to other brokers.

AvaTrade, on the other hand, is a well-established broker with a significant global presence. It provides a diverse selection of trading instruments, such as Forex, equities, commodities, and cryptocurrencies. AvaTrade offers a user-friendly platform, instructional tools, and a variety of account types to meet a variety of trading demands. However, some consumers have noticed concerns with customer service response times, and the costs can be substantially higher than those of other brokers.

Finally, which broker is better depends on personal preferences and trading requirements. Traders who value regulatory compliance, competitive costs, and excellent customer service may prefer FXPrimus. Those looking for a diverse selection of trading instruments and user-friendly interfaces, on the other hand, may prefer AvaTrade. Before making a selection, you must conduct extensive research and examine your personal trading needs.

Also Read: AvaTrade Review 2023

#2. FXPrimus vs RoboForex

A well-regulated broker with an emphasis on offering a secure trading environment is FXPrimus. It accepts all trading types, has reasonable rates, and has a selection of trading platforms. To accommodate various trading tastes, FXPrimus offers a variety of account kinds and great customer service. However, it only offers a small selection of products, mainly focusing on CFDs and Forex, and its currency spreads can be greater than those of other brokers.

On the other hand, RoboForex provides a wider selection of trading options, such as Forex, equities, commodities, indices, and cryptocurrencies. In order to meet varied trading demands, it offers a variety of account kinds and platforms. Additionally, RoboForex provides traders with a variety of instructional tools, cheap costs, and narrow spreads. However, opinions on the level of customer service have been conflicting.

In the end, trading needs and personal preferences will determine which broker is superior. FXPrimus might be a preferable choice for traders who value competitive costs, regulatory compliance, and excellent customer service. RoboForex, on the other hand, can be preferred by individuals looking for a wider selection of trading instruments and platforms. Before making a choice, it is advised to carefully consider one’s own trading requirements and to do extensive study.

#3. FXPrimus vs Exness

Regulated broker FXPrimus is well renowned for placing a high value on dependability and safety. It accepts all trading types, has reasonable rates, and has a selection of trading platforms. To accommodate various trading tastes, FXPrimus offers a variety of account kinds and great customer service. However, it only offers a small selection of products, mainly Forex and CFDs, and its currency spreads may be larger than those of certain other brokers.

Contrarily, Exness is a licensed broker that provides a wide selection of trading options, such as forex, cryptocurrencies, commodities, and indices. It offers a variety of account kinds, affordable spreads, and adaptable leverage options. Exness is renowned for its innovative technology and effective transaction execution. Customers have, however, expressed varying levels of satisfaction with customer service.

Which broker is superior depends on personal preferences and trading requirements. For traders who value security, reasonable pricing, and helpful customer service, FXPrimus might be a better choice. Exness, on the other hand, may be preferred by individuals looking for a bigger selection of trading products and quick trade execution. Before choosing a choice, it is crucial to carefully consider one’s own requirements and to do extensive study.

Conclusion: FXPrimus Review

In conclusion, FXPrimus is a global financial trading broker that offers access to Forex, stocks, and commodities through a user-friendly web and mobile platforms. The broker provides a range of account options to cater to traders of all levels of experience. With its top-tier regulatory license, FXPrimus ensures a safe trading environment for its clients.

Overall, FXPrimus presents itself as a reliable broker with competitive fees, a variety of account options, and a commitment to client satisfaction. Traders, especially beginners, may find value in the educational resources and support provided by FXPrimus. However, individuals with specific trading preferences or a need for a broader range of instruments may need to carefully assess if FXPrimus meets their requirements.

FXPrimus Review: FAQs

Can I trade with FXPrimus if I am a beginner with limited experience in trading?

Yes, FXPrimus is suitable for traders of all levels, including beginners. The broker offers educational resources, free trading tools, and a variety of account options to cater to different trading needs. You can start with a demo account to practice and familiarize yourself with the platform before moving on to a live trading account.

What are the deposit and withdrawal options available with FXPrimus?

FXPrimus provides multiple deposit options, including bank wire transfers, local transfers, credit cards, and e-wallet solutions. The minimum withdrawal amount is $100 USD, and withdrawals are typically processed within 24-48 hours. It’s important to note that FXPrimus does not accept third-party payments, and withdrawal refunds are usually prioritized back to the original deposit source.

Is FXPrimus regulated and safe to trade with?

Yes, FXPrimus is a regulated broker with a top-tier regulatory license from CySEC (Cyprus Securities and Exchange Commission). This ensures that the broker adheres to strict financial regulations and client protection standards. FXPrimus also implements safety measures, such as third-party oversight of client withdrawals and negative balance protection, to safeguard client funds.