FXPIG Review

To provide traders a full understanding of the expenses involved in this FXPIG review, the evaluation will also analyze FXPIG's pricing structure including spreads and fees. This analysis will enable the users, regardless of experience level, determine whether FXPIG fits the customer's trading requirements.

Online forex broker FXPIG seeks to give traders a clear and quick trading platforms. The main aspects of FXPIG will be discussed in this review together with its trading systems, account kinds, and customer service. Furthermore taught to readers will be the broker's rules and their guarantees of a safe trading environment.

Finally, we will go over any possible drawbacks such account restrictions or platform limits. Readers will get a whole picture of what FXPIG provides in the conclusion as well as whether it fits their trading objectives using this FXPIG review.

What is FXPIG?

FXPIG is an online forex broker that lets both new and expert traders do a lot of different types of trading. The broker gives access to many types of financial products, such as forex, commodities, and indices. FXPIG wants to give traders a clear picture of the market and prices by focusing on openness.

MetaTrader 4 and cTrader are two well-known trading platforms that buses. These platforms are known for having advanced tools and easy-to-use layouts. These tools make it easier for traders to make trades and keep track of their portfolios.

FXPIG is also controlled and follows strict financial standards to make sure that trading costs is safe. For buyers looking for a trustworthy broker with clear business practices, this makes it a good choice.

FXPIG Regulation and Safety

The Vanuatu Financial Services Commission (VFSC) oversees FXPIG and makes sure the broker follows strict rules to keep buyers safe. This rule makes things safer and clearer, so buyers can be sure that their money is being handled properly.

In addition to following the rules, FXPIG makes sure that trader money is kept separate from the broker's operating funds by putting client funds in different accounts. This extra level of security helps protect users in case the broker has any financial problems.

To make things even safer, FXPIG encrypts personal and banking information with SSL. This stops people who aren't supposed to be there from getting in, which gives traders peace of mind when they're using trading instruments or handling their accounts online.

FXPIG Pros and Cons

Pros:

- Regulated by VFSC

- Segregated accounts

- MetaTrader 4 and cTrader platforms

- Transparent pricing

Cons:

- Limited regulation scope

- No 24/7 customer support

- Higher fees for certain accounts

- Limited asset variety

Benefits of Trading with FXPIG

Both new and expert traders can get a lot out of trading with FXPIG. Popular platforms like MetaTrader 4 and cTrader are available through the broker. These platforms are known for being easy to use and having powerful tools. This makes it easier for traders to handle their portfolios and make trades quickly.

Another thing that makes FXPIG stand out is that its prices are clear. Traders can see spreads and fees before they make trades. This openness helps buyers understand the costs better and avoid being charged extra for things they didn't expect.

FXPIG also makes sure that clients' money is safe by keeping it in separate accounts and encrypting personal information strongly. When traders use the platform, these safety steps give them peace of mind.

FXPIG Customer Reviews

Customers who have used FXPIG have mostly said good things about it. A lot of users like how clear the broker's prices are and how well its systems work, especially MetaTrader 4 and cTrader. Most traders find it easy and straightforward to deal with these features.

But some customers are worried about the short hours of customer service. It might be hard for traders in different time zones to get help right away when the market isn't open, which can be inconvenient in markets that move quickly.

Overall, FXPIG is praised for being open and simple to use. However, some traders think the broker could do better by providing help 24 hours a day, seven days a week, and adding more assets to its portfolio.

FXPIG Spreads, Fees, and Commissions

Spreads at FXPIG are competitive, and they change based on the type of account and the state of the market. The gaps are pretty low for most major currency pairs, which makes trading on the forex market affordable for traders using their trading instruments. But when there is a lot of instability, spreads may get wider.

Fees are based on a transparent pricing plan at FXPIG, so traders can see the costs right away. There are no hidden costs for currency pairs, but traders may have to pay overnight swap fees if they hold positions for a long time, especially if they use leverage.

Users paid fees on top of the spreads for some account types. Spreads are usually tighter with these accounts, but there is a small fee for each trade. This set-up is perfect for traders who care more about low spreads than dealing without fees.

Account Types

To meet various account types of trading accounts, FXPIG provides multiple account kinds.

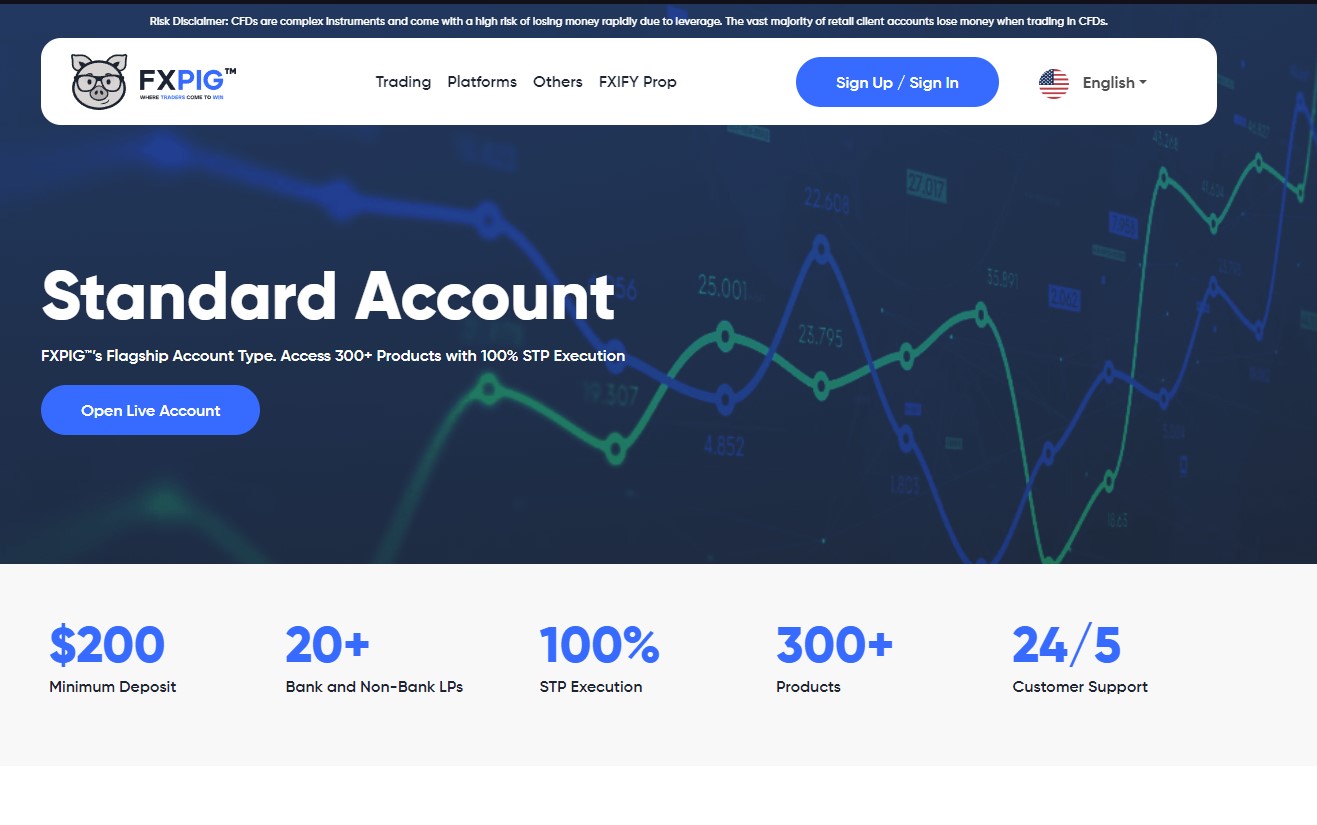

1. Standard Account

The Standard Account lets you trade without paying any fees and with wider spreads. This makes it perfect for new traders or those who like things to be simple and easy. It's made for people who trade less often and want to avoid commission fees.

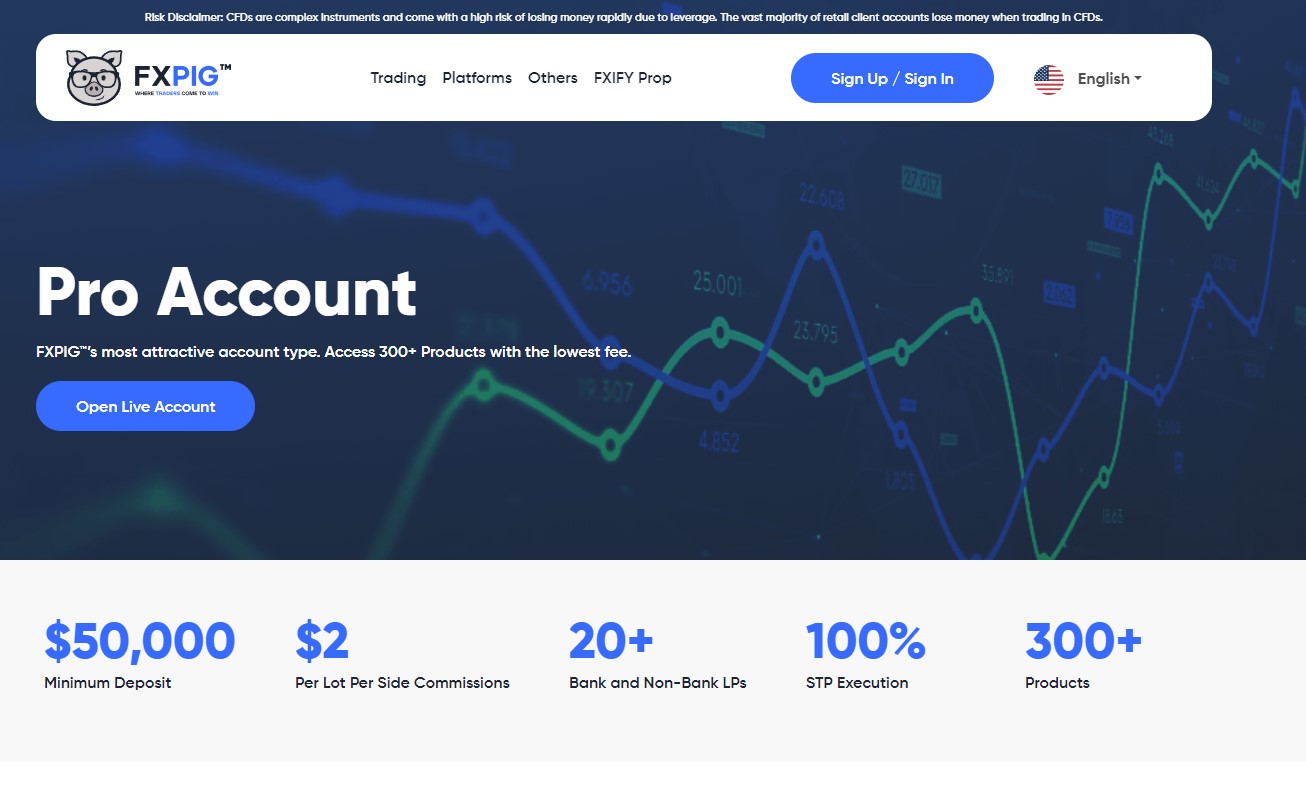

2. Pro Account

Spreads are tighter on the Pro Account than on the Standard Account, it has the lowest trading costs per trade. This account is best for users with more experience who trade more often and want to get better prices while still paying the same amount in commissions.

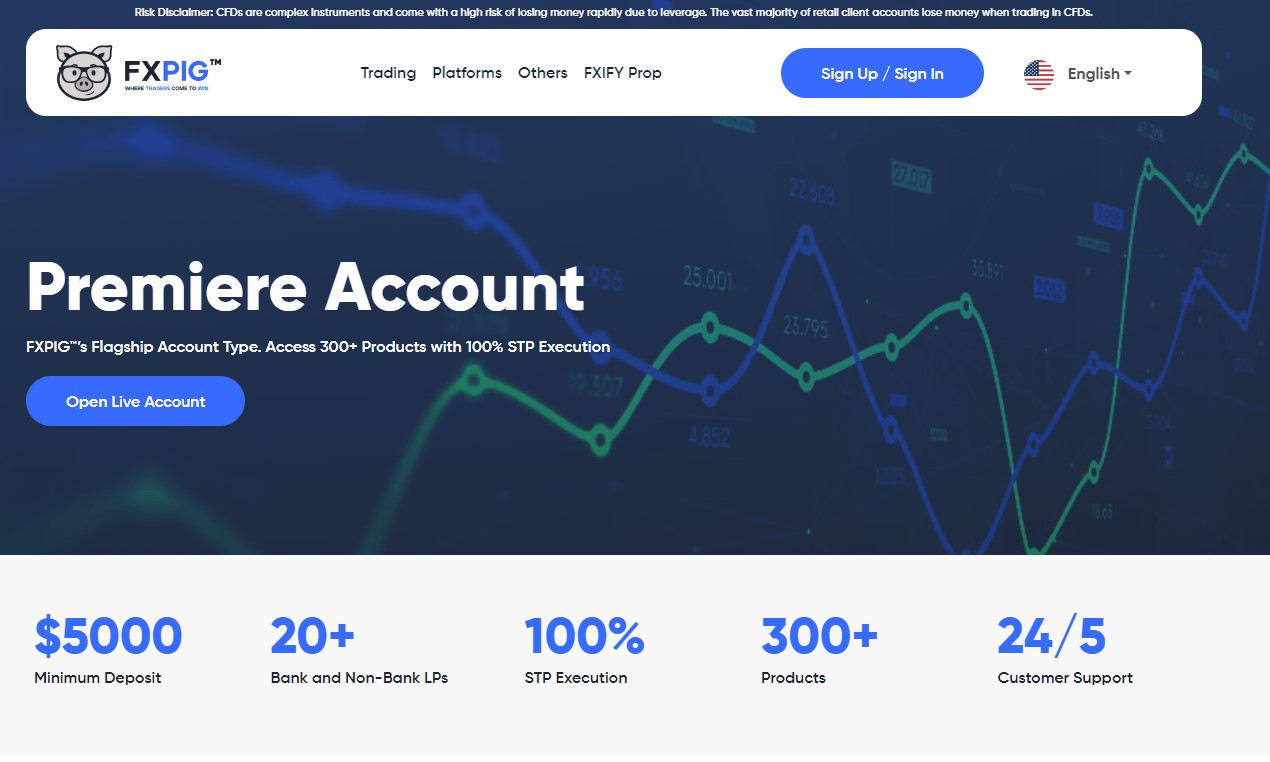

3. Premiere Account

The Premiere Account also provides traders with enhanced support and more personalized services, catering to their specific trading needs. It’s designed to offer a superior trading experience with features tailored for those seeking the highest level of performance on FXPIG's platforms.

4. Demo Account

This demo account is perfect for the traders who wants to test the trading conditions, their trading strategy, trading platform, who wants to skip pro account, and lastly to experience the trading performance of FXPIG.

This account types are managed accounts by their own creator and not being controlled by the broker. It needs minimum deposit and raw spreads starting as a FXPIG broker.

How to Open Your Account

FXPIG are offering demo accounts but here are the steps that makes you to access them:

Step 1: Visit the FXPIG Website

To start, visit the official FXPIG website. Look for the “Open Account” button at the top of the homepage and click it to begin the process.

Step 2: Complete the Registration Form

Fill in your personal details, such as your name, email, and phone number, in the provided registration form. Choose your preferred account type based on your trading needs.

Step 3: Verify Your Identity and Fund Your Account

Submit your identification documents for verification, as required by FXPIG for security purposes. Once your account is approved, you can put some minimum deposit and begin applying your trading strategy.

The last step is you need to choose your preferred account types whether demo account or starting trading account.

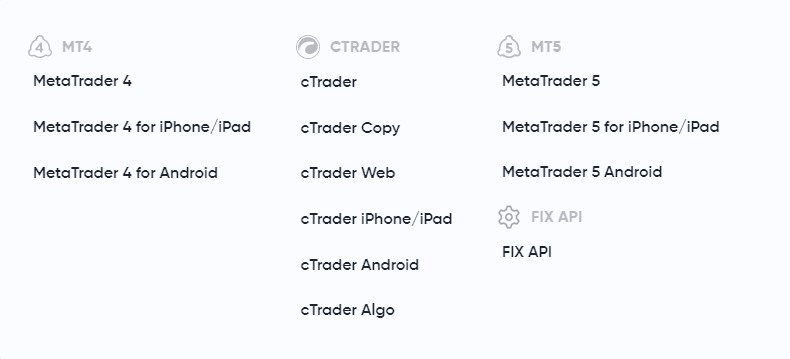

FXPIG Trading Platforms

FXPIG has many trading platform and instruments to meet the wants of all traders. MetaTrader 4 (MT4) and cTrader are the main platforms. Both are known for having advanced trade tools and easy-to-use interfaces. Traders can use these tools to study markets, make trades, and keep track of their positions well.

MetaTrader 4 (MT4) is a popular choice for forex traders because it has tools for making charts, doing basic analysis, and using Expert Advisors (EAs) to automate trading platform. No matter how much knowledge the trader has, this is the best tool for everyone of them.

Another choice that FXPIG offers is cTrader, which has a more modern look and more advanced trading platforms tools. It was made for traders who want quick execution and tools that can be changed to fit their needs. This makes it great for people who want a more advanced platform.

What Can You Trade on FXPIG

Traders can use a lot of different financial tools on FXPIG. Forex is the main service, and users can swap major, minor, and exotic currency pairs. Traders who want to profit from changes in the value of currencies around the world can use it.

FXPIG lets traders deal in commodities like gold, silver, oil, and other precious metals in addition to forex. This gives traders who want to diversify their portfolios more options. People often hold these investments to protect themselves from inflation and market volatility.

FXPIG also has measures that traders can use to guess how global stock markets will do. Traders can use this range of markets to make strategies that work with a wide range of asset types.

FXPIG Customer Support

FXPIG has a lot of ways for customers to get help, like live chat and email. This makes it easy for users to get help with account issues, technical issues, or general questions. The help team is known for getting back to people quickly and correctly.

For extra help, FXPIG's website has a part called “Frequently Asked Questions” (FAQs) where people can find answers to common issues. This can be very helpful for new traders who need help right away but don't want to call support directly.

But FXPIG's customer service isn't open 24 hours a day, seven days a week, which can be a problem for users who work in different time zones. People who need help outside of normal business hours might have to wait for an answer.

Advantages and Disadvantages of FXPIG Customer Support

Withdrawal Options and Fees

FXPIG gives traders a number of ways to withdraw their money, such as bank transfers, credit cards, and e-wallets. This gives them choices when it comes to getting to their money. Users can pick the way that works best for them because the process is simple.

There may be fees for some transfer methods, even though most of them are easy to use. Sometimes there are fees for bank payments that are higher than the fees for e-wallets and credit card withdrawals. This makes e-wallets and credit card withdrawals more cost-effective.

It doesn't take long for FXPIG to process withdrawals; the time it takes to receive funds varies on the method used. Withdrawals from an e-wallet are usually faster than payments to a bank account, which could take a few days.

FXPIG Vs Other Brokers

#1. FXPIG vs AvaTrade

When looking at FXPIG vs. AvaTrade, both brokers have good trading costs, but they are geared toward different types of traders. FXPIG focuses on being open and honest, and it gives access to well-known platforms like MetaTrader 4 and cTrader. AvaTrade, on the other hand, has more platforms, such as MetaTrader 4, MetaTrader 5, and its own AvaTradeGO platform, which users who want a wider range of tools may like.

AvaTrade has different licenses around the world, including ones in the EU, Australia, and South Africa. This gives them a wider range of countries to serve. It is different for FXPIG, which is overseen by the Vanuatu Financial Services Commission, which has a smaller governing area.

AvaTrade has more trading instruments, such as stocks, options, cryptocurrencies, and more. FXPIG, on the other hand, works mostly on forex, commodities, and indices. This makes AvaTrade a better choice for buyers who want to spread their risk across more types of assets.

#2. FXPIG vs RoboForex

When this review took a look at FXPIG vs. RoboForex, both brokers give similar services, but their platforms and features are different. When it comes to trading costs and platforms, FXPIG only offers MetaTrader 4 and cTrader. RoboForex, on the other hand, has a bigger range of platforms, such as MetaTrader 4, MetaTrader 5, and cTrader, for traders who want more choices.

The IFSC in Belize is in charge of regulating RoboForex, while the Vanuatu Financial Services Commission is in charge of regulating FXPIG. Traders are safe with both, but RoboForex is regulated in a wider range of areas.

RoboForex has a wider range of assets to choose from, such as cryptocurrencies, stocks, ETFs, and commodities. FXPIG, on the other hand, works mostly on forex, commodities, and indices. This makes RoboForex a better choice for traders who want to spread their money across a wider range of assets.

#3. FXPIG vs Exness

When compared, FXPIG and Exness, both offer good forex trading costs and services, but they do so in different ways. FXPIG focuses on giving traders access to MetaTrader 4 and cTrader, which makes it appealing to traders who want clear trades and reliable delivery. On the other hand, Exness has MetaTrader 4, MetaTrader 5, and a web-based platform, so buyers can pick and choose which tools they want to use.

Exness is regulated more globally, with licenses from officials in Cyprus, the UK, and South Africa. This makes it more appealing to traders from other countries. It is safe to use FXPIG because it is controlled by the Vanuatu Financial Services Commission, which has a smaller regulatory area.

In terms of trading conditions, Exness lets some accounts use endless leverage and has lower spreads, which makes it appealing to traders who do a lot of trades. FXPIG tries to be as clear as possible about its prices and fees, but it might not have as much leverage or lower spreads as Exness.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: FXPIG Review

In conclusion, FXPIG is a good forex broker that offers clear trading tools such as MetaTrader 4 and cTrader. It has competitive rates and a clear fee structure, which makes it a good choice for traders who like things to be simple.

However, FXPIG's governmental coverage isn't as broad as some of its competitors', and the company doesn't offer 24/7 customer service. Traders who want more advanced features or a wider range of regulated markets may find that other companies are better for them.

Overall, FXPIG is a good choice for traders who want a simple, safe, and open trading experience. However, it might not be the best choice for traders who need more advanced tools or help around the clock.

FXPIG Review: FAQs

Is FXPIG regulated?

Yes, FXPIG is regulated by the Vanuatu Financial Services Commission (VFSC).

What can I trade on FXPIG?

Trading forex, commodities, and indices are available in FXPIG, providing a variety of trading opportunities.

How can I withdraw funds from FXPIG?

FXPIG offers several withdrawal options, including bank transfers, credit cards, and e-wallets, though fees may apply depending on the method.

OPEN AN ACCOUNT NOW WITH FXPIG AND GET YOUR BONUS