Position in Rating | Overall Rating | Trading Terminals |

260th  | 2.0 Overall Rating |  |

FxNet Review

FxNet offers a trading platform designed to cater to both beginner and professional traders. It provides access to forex, commodities, indices, and shares, ensuring a diverse range of currency trading. The platform supports various account types, including a VIP option, offering flexibility based on trading needs.

Traders can utilize FxNet’s competitive spreads and leverage options to optimize their strategies using a trading account. The platform also integrates multiple payment methods and fast withdrawal processes for user convenience. Additionally, it ensures security with regulatory compliance and advanced encryption measures.

FxNet focuses on user support by offering educational resources and a dedicated customer service team. However, traders should evaluate fees and trading conditions to ensure suitability for their strategies. It’s a solid option for those seeking a user-friendly trading experience.

What is FxNet?

FxNet is a forex broker offering trading services across various financial markets, including forex, commodities, and indices which can also be considered as CFD broker. It provides a user-friendly platform, competitive spreads, and a range of account types to suit different trader needs.

With a focus on client protection, FxNet operates under strict regulatory compliance, ensuring fund security and transparency. Its tools and educational resources cater to both beginners and experienced traders, enhancing the overall trading experience.

FxNet Regulation and Safety

FxNet is regulated by the Cyprus Securities and Exchange Commission (CySEC), ensuring compliance with European financial laws under MiFID. This oversight guarantees transparent practices and client fund protection through segregated accounts, enhancing trader security.

The broker follows stringent safety measures like using top-tier financial institutions for client deposits. Additionally, FxNet offers negative balance protection, ensuring clients cannot lose more than their deposited funds. These features make it a reliable choice for both novice and experienced traders.

FxNet Pros and Cons

Pros

- Regulated broker

- Multiple account types

- Mobile trading support

- Diverse instruments

Cons

- Withdrawal fees

- Limited research tools

- No MT5 platform

- Regional restrictions

Benefits of Trading with FxNet

Trading with FxNet offers users access to multiple financial instruments, including forex, stocks, and commodities, on a single platform. The broker ensures a straightforward trading experience with user-friendly tools and flexible account options, catering to both beginners and experienced traders.

FxNet provides a secure trading environment with fast execution speeds and reliable customer support. Their platform is optimized for efficiency, allowing traders to make quick decisions with minimal disruptions.

FxNet Customer Reviews

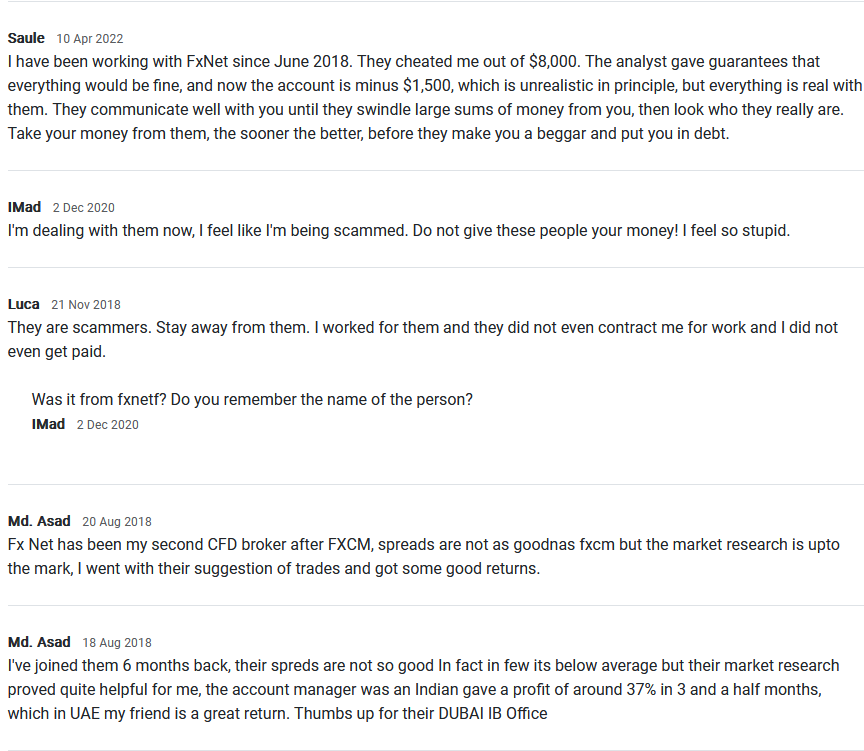

FxNet has received mixed reviews from its users. Customers appreciate its diverse range of trading accounts and platforms, making it accessible to both beginners and experienced traders. However, some users have expressed concerns over higher-than-average fees and occasional delays in withdrawals.

Many traders praise FxNet‘s customer support for being responsive and helpful. On the other hand, others have pointed out limited educational resources compared to competitors, which could be a drawback for new traders seeking guidance. Overall, FxNet appeals to traders looking for multiple account options, but potential users should consider the associated costs and available tools.

FxNet Spreads, Fees, and Commissions

FxNet offers competitive spreads, fees, and commissions designed to attract various levels of traders. The spreads for popular forex pairs like EUR/USD typically start from 2.0 pips, which is slightly higher than some industry competitors. For commodities and indices, the spreads vary depending on market conditions but remain relatively transparent.

Account fees on FxNet are minimal, with no deposit charges and low withdrawal fees for major payment methods. Commission fees are embedded within the spreads, ensuring simpler cost structures for traders. While the overall pricing is accessible, traders should assess whether these rates align with their trading volume and style.

Account Types

FxNet offers a variety of account types tailored to meet the needs of different traders. Each account is designed to provide specific features and benefits, ensuring flexibility and accessibility for beginners and experienced traders alike.

Standard Account

The Standard Account is ideal for beginners entering the trading world. It requires a low minimum deposit of $50 and offers basic trading tools with competitive spreads. This account is suitable for those seeking a straightforward and user-friendly trading experience.

VIP Account

The VIP Account caters to more advanced traders looking for additional perks. It offers lower spreads, higher leverage, and priority customer support. This account provides enhanced trading conditions for those with larger capital.

Platinum Account

Platinum Accounts are designed for professional traders who demand premium features. It includes the tightest spreads, exclusive tools, and the highest level of personalized support. This account is tailored for those aiming to maximize their trading potential with FxNet.

Furthermore, FxNet offers an Islamic account designed for traders adhering to Sharia law, providing swap-free trading without overnight fees. This account is exclusively available to Muslim clients and requires a formal request based on religious beliefs. In addition to the Islamic account, FxNet provides three other account types: Standard, VIP, and Platinum, each with varying minimum deposits, spreads, and features to cater to different trading preferences.

How to Open Your Account

Opening an account with FxNet is a straightforward process designed to get traders started quickly. The platform ensures a user-friendly experience with a few simple steps to access their trading services. Below is a guide to help you through the process.

Step 1: Visit the FxNet Website

Go to the official FxNet website and click on the “Open Account” button. This will direct you to the registration page where you can begin the process.

Step 2: Complete the Registration Form

Fill out the required fields, including your name, email address, phone number, and country of residence. Make sure the details are accurate, as they will be used for verification purposes.

Step 3: Submit Verification Documents

Upload the necessary documents to verify your identity and address, such as a government-issued ID and a utility bill. FxNet requires this step to comply with regulatory standards and ensure security.

Step 4: Fund Your Account

Once your account is approved, log in and deposit funds using one of the supported payment methods. FxNet accepts multiple funding options, including bank transfers, credit cards, and e-wallets.

Step 5: Start Trading

After funding your account, access the trading platform to begin placing trades. FxNet offers tools and resources to help traders make informed decisions.

FxNet Trading Platforms

FxNet Trading Platforms offer users access to versatile tools tailored for both novice and experienced traders. The platform supports MetaTrader 4 (MT4), known for its user-friendly interface, advanced charting tools, and robust technical indicators. Traders benefit from customizable features that enhance precision and efficiency in executing trades even though it doesn’t have multiple trading platforms.

In addition to MT4, FxNet provides a WebTrader option that enables trading directly from browsers without additional software installation which is popular in the financial industry. This platform is optimized for accessibility, allowing users to trade from any device with an internet connection. Both options are designed to ensure seamless navigation and real-time market updates for improved decision-making.

What Can You Trade on FxNet

FxNet offers a diverse range of trading instruments, making it suitable for traders of all levels. These options include forex, commodities, indices, stocks, and more, providing ample opportunities to diversify portfolios and explore various markets. Each category is designed to cater to different trading strategies and risk preferences.

Forex

Forex trading is a core offering on FxNet, featuring major, minor, and exotic currency pairs. Traders can take advantage of competitive spreads and high liquidity, ideal for both short-term and long-term strategies.

Commodities

FxNet allows trading in popular commodities like gold, oil, and natural gas. These assets provide a hedge against inflation and are widely used for diversifying trading portfolios.

Indices

Indices trading on FxNet includes access to global markets like the S&P 500 and FTSE 100. This option enables traders to speculate on the performance of entire market sectors.

Stocks

FxNet offers individual stock trading, providing access to shares of top global companies. This is ideal for traders looking to invest in specific businesses or industries.

Cryptocurrencies

For those seeking modern trading opportunities, FxNet also supports cryptocurrencies. Traders can speculate on the price movements of digital assets like Bitcoin and Ethereum.

FxNet Customer Support

FxNet Customer Support provides reliable assistance to users, ensuring their trading needs are addressed efficiently. The support team is available through various channels, including email, live chat, and phone, making it convenient for traders to get help whenever required.

FxNet’s support operates during standard market hours, catering to inquiries about account setup, trading platforms, or technical issues. The team’s prompt response time and focus on user satisfaction make it a dependable choice for traders of all experience levels.

Advantages and Disadvantages of FxNet Customer Support

Withdrawal Options and Fees

FxNet provides various withdrawal methods to accommodate its global clientele, ensuring convenience and security. The broker outlines specific fees and processing times for each method, allowing traders to plan their transactions effectively.

Bank Transfers

With FxNet, traders can withdraw funds through bank transfers. This method is secure but may take 3-5 business days to process. A standard fee may apply, depending on the bank and transaction amount.

Credit/Debit Cards

FxNet allows withdrawals via major credit and debit cards. This option is faster, typically processed within 1-3 business days. Fees are generally minimal, but users should confirm with their card issuer.

E-Wallets

E-wallet options like Skrill and Neteller are available on FxNet for swift withdrawals. These transactions are often completed within 24 hours, making them a preferred choice for many traders. Nominal fees might be applied by the payment provider.

Internal Transfers

FxNet supports internal transfers between accounts within the platform. This option is free of charge and is completed instantly, offering flexibility for account management.

FxNet Vs Other Brokers

#1. FxNet vs AvaTrade

FxNet and AvaTrade are both online brokers offering access to various financial markets, including forex and CFDs. AvaTrade, established in 2006, is regulated by multiple authorities such as ASIC, CIRO, and CySEC, providing a high level of trust and security for traders. It offers a wide range of trading platforms, including MetaTrader 4 and 5, AvaTradeGO, and AvaOptions, catering to different trading preferences. AvaTrade‘s typical EUR/USD spread is around 0.9 pips, and it provides leverage up to 1:400 for professional accounts. In contrast, FxNet, founded in 2012, is regulated by the International Financial Services Commission (IFSC). It offers the MetaTrader 4 platform and has a minimum deposit requirement of $50, making it accessible for beginners. However, FxNet‘s EUR/USD spreads start from 1.8 pips, which is higher compared to AvaTrade. Additionally, FxNet has faced regulatory challenges in the past, including a fine and license revocation by CySEC for regulatory breaches.

Verdict: AvaTrade stands out as a more reliable and cost-effective option due to its stringent regulatory oversight, competitive spreads, and diverse platform offerings. While FxNet offers a lower entry point with its minimal deposit requirement, its higher spreads and past regulatory issues may be a concern for potential traders.

#2. FxNet vs RoboForex

FxNet and RoboForex are both online trading platforms offering access to various financial markets, including forex, commodities, and indices. FxNet, established in 2012 and regulated by the Cyprus Securities and Exchange Commission (CySEC), provides three account types—Standard, VIP, and Platinum—with a minimum deposit starting at $50. It utilizes the MetaTrader 4 (MT4) platform, supporting mobile trading and offering a range of trading instruments. RoboForex, founded in 2009 and regulated by the International Financial Services Commission (IFSC) of Belize, offers multiple account types, including Pro, ProCent, Prime, and ECN, with a minimum deposit as low as $10. It supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, along with proprietary platforms like R StocksTrader, and provides access to a broader range of trading instruments, including cryptocurrencies and ETFs.

Verdict: RoboForex offers a wider array of trading platforms and instruments, catering to traders seeking diverse options and lower entry deposits. Conversely, FxNet provides a straightforward trading experience with a focus on forex and commodities, suitable for traders who prefer the MT4 platform and a regulated environment under CySEC.

#3. FxNet vs Exness

FxNet and Exness are both online forex brokers offering a range of trading services. FxNet, established in 2012, is regulated by the Cyprus Securities and Exchange Commission (CySEC) and provides access to various instruments, including forex, commodities, indices, and stocks, through the MetaTrader 4 (MT4) platform. The broker offers three account types—Standard, VIP, and Platinum—with a minimum deposit starting at $50 and leverage up to 1:500. Exness, founded in 2008, is regulated by multiple authorities, including the Financial Conduct Authority (FCA) and CySEC. It offers a broader range of trading instruments, including forex, metals, cryptocurrencies, energies, and indices, accessible via both MT4 and MetaTrader 5 (MT5) platforms. Exness provides various account types, such as Standard, Raw Spread, Zero, and Pro, with a minimum deposit of $10 and leverage up to 1:2000. Additionally, Exness supports social trading and offers a proprietary web platform alongside MetaTrader.

Verdict: Exness offers a more extensive range of instruments, higher leverage options, and additional platform choices compared to FxNet. Traders seeking a wider variety of trading options and advanced features may find Exness more accommodating to their needs.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: FxNet Review

FxNet offers a straightforward trading experience with access to various assets, making it suitable for beginners and seasoned traders. The platform provides essential tools, competitive spreads, and flexible account options to cater to diverse trading needs. However, limited educational resources and regional restrictions may pose challenges for some users.

Overall, FxNet delivers reliable services, but traders should carefully assess their goals and requirements before committing. It is an option worth considering for those seeking simplicity and efficient functionality in a trading platform.

FxNet Review: FAQs

Is FxNet a regulated broker?

Yes, FxNet is regulated by the Cyprus Securities and Exchange Commission (CySEC). This ensures that it adheres to European financial standards, providing some level of protection for traders.

What account types does FxNet offer?

FxNet offers three account types: Standard, VIP, and Platinum. Each account caters to different trading needs, with varying spreads, leverage, and other features tailored to suit novice and experienced traders.

Does FxNet support mobile trading?

Yes, FxNet supports mobile trading through the MetaTrader 4 (MT4) platform. This allows users to trade on the go with real-time market access and advanced charting tools.

OPEN AN ACCOUNT NOW WITH FXNET AND GET YOUR BONUS