Position in Rating | Overall Rating | Trading Terminals |

235th  | 2.0 Overall Rating |

Choosing the right forex brokers is a matter of importance when trading. It ensures secure transactions, spread competitiveness, and good support from the client service section, all of which ensure a great trading experience. FXlift offers a broad range of assets, leverage options, and an intuitive platform, all of which become important considerations when choosing the right broker.

FXlift broker is a CFD trading broker that offers users exposure to a wide range of trading assets, such as currency pairs, metals, indices, commodities, stocks, and futures. Offering more than 300 accessible positions and a leverage ratio of 1:30, FXlift gives beginners and experienced traders access to diversified trading options. This platform is powered by MetaTrader 4 and allows trading on both PC and mobile devices, providing constant access to trading opportunities everywhere.

This article is intended to clearly outline the services that FXlift offers and show how important it is to have a reputable broker. Knowing the main characteristics of FXlift will allow the trader to make better choices that suit his needs for trading.

FXlift is an online trading platform that provides various types of accounts that can suit both new and experienced traders. The platform offers the ability to trade on a global financial market with various assets such as forex, commodities, and stocks. The tools and resources in the platform help traders make informed decisions with advanced charting and risk management features.

FXlift offers different account options, thus offering flexibility with various features including leverage, spreads, and deposit requirements. This enables traders to choose an account that suits their trading style, whether they are beginners or advanced users.

FXlift Regulation and Safety

FXlift has a safety score of 1.5/10, which indicates that the security for traders is low. Any trader needs to select a safe broker who can be reliable for investment. Among the top-tier regulated brokers, only those are highly reliable and follow investor protection schemes. These brokers protect client funds and maintain a strict financial standard.

FXlift provides several trading accounts, but it does not meet the strict standards of Tier-1 regulations. This puts the trader in a vulnerable position if he or she is looking for a safe and reliable trading environment. The more solid regulatory credentials and the longer market history of brokers provide a better trading experience. Such qualities are essential in minimizing risks and protecting the interests of traders.

To ensure safe trading, brokers with track records and great regulatory structures should be emphasized. Such platforms as FXlift are at great risks because they lack thorough scrutiny. A Tier-1 regulated broker reduces these risks and can give traders more peace of mind. Of course, security and regulations are something that a good trader should not compromise in order to be successful in trading.

FXlift Pros and Cons

Pros

- Variety of account types

- Competitive spreads and no commissions

- Leverage flexibility

- Support for various trading platforms

Cons

- High minimum deposit for advanced accounts

- Limited platform options

- Variable spreads

- Lack of extensive educational resources

Flexible Leverage Options

One of the greatest advantages of trading with FXlift is the flexible leverage options. Additionally, FXlift provides a dedicated account manager, available 24 hours a day, five days a week, to offer personalized assistance and resolve queries conveniently. The company offers leverage up to 1:1000 for its unregulated offshore entities, which is suitable for the more experienced traders to get larger positions. However, for those trading under the CySEC-regulated entity, leverage is limited to 1:30, and this is more of a safer approach for the more conservative traders.

Wide Range of Instruments

FXlift offers several ways for deposits and withdrawals through a credit/debit card, wire transfer, and Neteller, Skrill among others. This would cater to the convenience of those using the platform across any region to fund their account and withdraw their profit accordingly, hence making it very user-friendly.

Free Demo Account for Beginners

FXlift offers a free demo account, which is a great benefit for new traders who want to test their trading strategies without risking real money. This gives new traders a chance to familiarize themselves with the platform and build confidence before live trades.

Competitive Spreads

Another advantage of trading on FXlift is that it offers competitive spreads especially on major currency pairs, which are low, so it makes it easy to enter and exit a position with minimal cost and makes the overall profitability better.

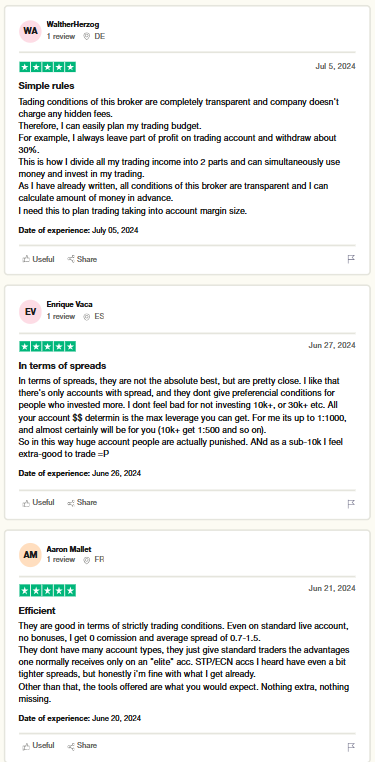

FXlift Customer Reviews

FXlift has received positive feedback from its users, with many praising its straightforward trading conditions and transparency. Customers appreciate the absence of hidden fees and the simple rules that allow for easy budgeting and planning. While some users note that spreads are not the absolute best, they do appreciate the consistency in pricing across account sizes, meaning that smaller traders aren't at a disadvantage compared to their larger counterparts.

FXlift Spreads, Fees, and Commissions

FXlift offers competitive spreads that are transparent and easy to understand. The company's spreads start from as low as 0.1 pips for major currency pairs, making it an attractive option for traders who want to minimize their trading costs. FXlift's spreads are also variable, meaning they can change depending on market conditions.

FXlift charges low fees for its services, with no hidden charges or surprises. The company does not charge fees for deposits made via bank transfer, credit/debit card, or e-wallets, making it easy for traders to fund their accounts. FXlift also does not charge fees for withdrawals, but there may be fees charged by the payment processor.

FXlift does not charge commissions on trades, which means that traders only pay the spread. This can be beneficial for traders who make frequent trades, as they can save on commission costs. However, some account types may have additional fees or commissions, so it's essential to review the terms and conditions before opening an account.

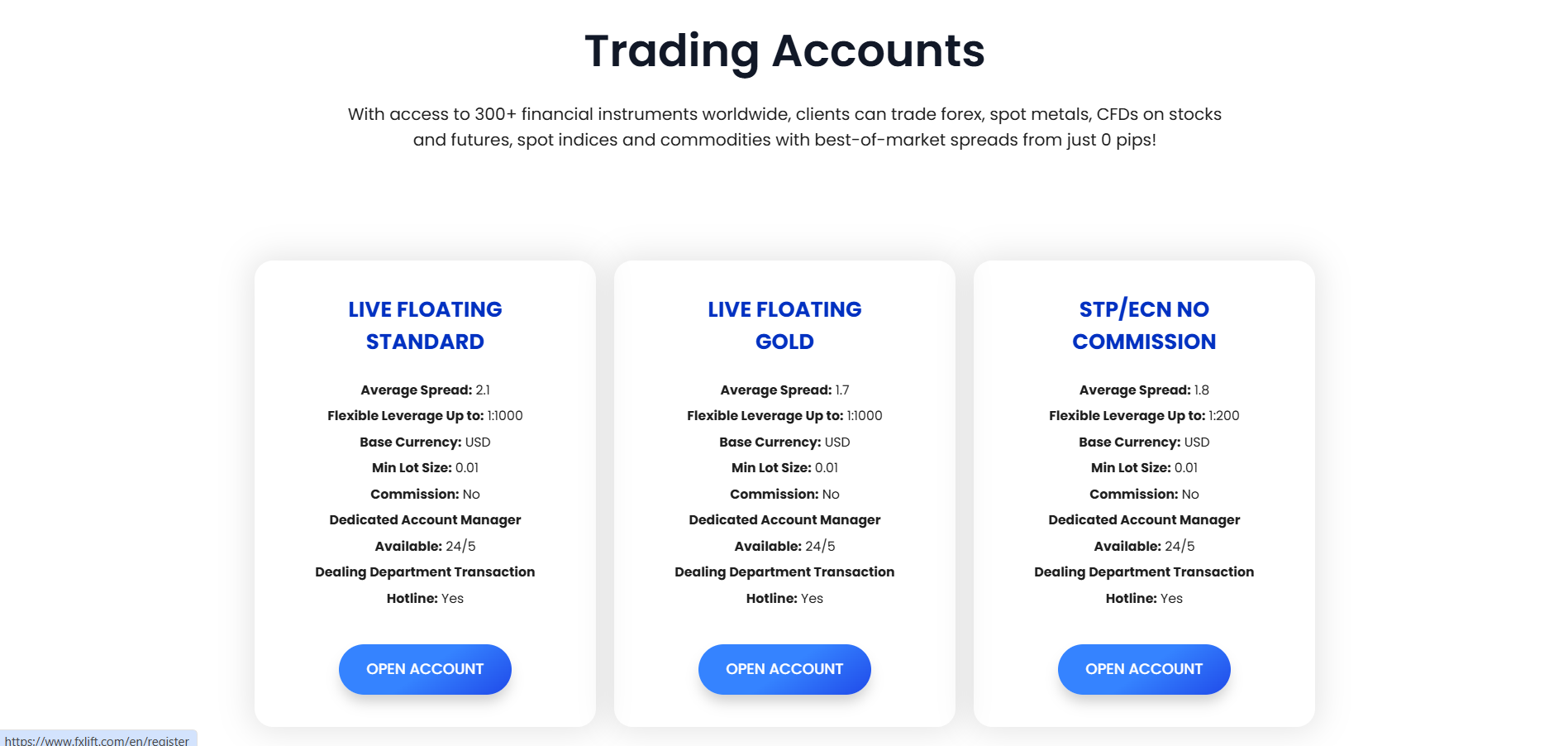

Standard Account

The Standard account is the most basic trading option at FXlift, suitable for traders who want a straightforward trading setup without complex requirements. This account offers access to a wide range of trading instruments and provides leverage options based on the regulatory entity under which the account is registered. It's a good choice for traders who want to start with minimal deposit and simple terms.

Gold Account

The Gold account at FXlift offers more advanced features compared to the Standard account. Traders using this account benefit from lower spreads, increased leverage, and personalized client service. It is aimed at more experienced traders looking for improved trading setup and a more tailored experience.

STP/ECN Account

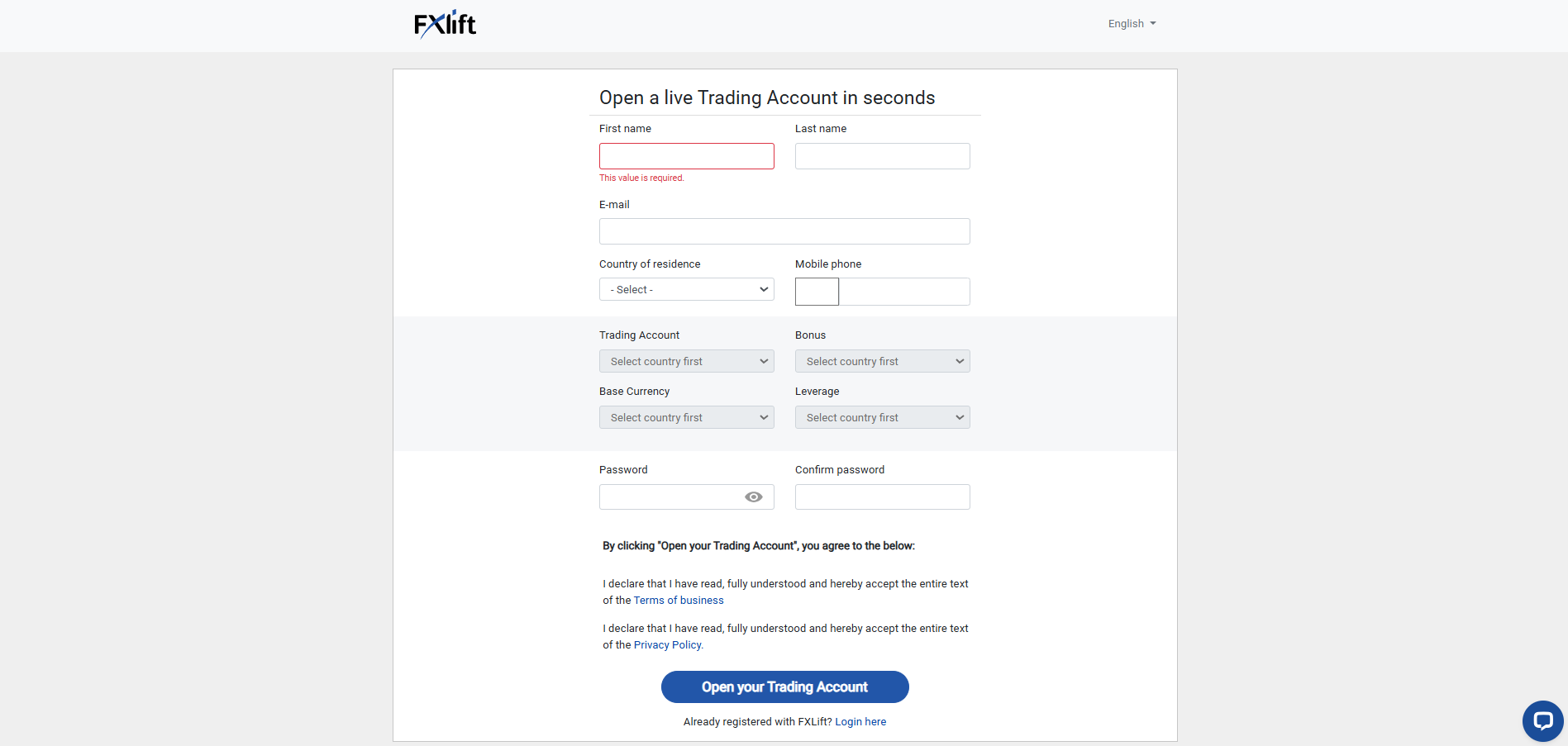

1. Visit the official site of FXlift and choose which type of account you would like to open. Choose either Standard, Gold, or Platinum.

2. Fill out the required registration form with your personal information such as contact information and documents for verification.

3. Deposit the minimum amount to activate your account depending on the type you chose.

4. Once verified and funded, you can start trading using the MetaTrader 4 platform that FXlift will provide.

FXlift Trading Platforms

FXlift is a trade platform that offers a variety of financial instruments, such as currencies, commodities, indices, and CFDs. Different account options support traders at various stages of their trading journey, helping them refine strategies, manage risks, and make informed trading decisions. It is accessible via MT4, which is reachable through web, mobile, and desktop. Advanced charting tools, real-time quotes, and automated features are provided to satisfy even the most demanding and simplest needs of traders. Web traffic data by SimilarWeb shows good engagement, thus very popular within the trading community.

FXlift offers competitive trading conditions with a leverage of up to 1:1000 and minimum spreads starting from 0 pips. In addition to technical indicators, risk management tools, and a demo account to train trading strategies, it equips its users with instruments to help them trade more effectively and make better-informed decisions. Nevertheless, traders should research extensively before investing, as the company has had some reports concerning the operation of the broker.

While FXlift has enticing features, it is vital to weigh the pros and cons before committing. Availability of high leverage and low spreads can be beneficial, but also carries inherent risks. Exploring user reviews and seeking regulatory clarity would help in assessing the credibility of the broker. It would help traders make safe and confident investment decisions.

What Can You Trade on FXlift

FXlift is a trading platform where a variety of financial instruments is offered. It aims at both the new traders and the old ones in trading currencies (forex), shares, commodities, metals, spot indices, and futures. This helps the traders to diversify their portfolios by exploring opportunities in different markets.

Trading through the platform is supported through MetaTrader 4 (MT4), which is accessible both on PCs and Macs and mobile devices. With advanced charting, real-time quotes, and several execution modes, trading will be made more comprehensive through this platform. FXlift aims to provide competitive spreads and commission-free trading with cost-effective options for users.

FXlift Customer Support

FXlift provides client service primarily through phone and email, aiming to address client concerns effectively. The support team can assist with trading issues, account management, and general inquiries. For unresolved matters, clients can escalate their concerns via email with a detailed description and supporting documents, showcasing a structured approach to problem resolution.

While the platform offers multilingual support, reviews indicate mixed feedback regarding responsiveness. Some clients praise the availability of contact options, while others note delays in response times. These experiences suggest that while FXlift attempts to cater to diverse customer needs, the consistency of service may vary.

FXlift’s customer service is supported by educational tools like a demo account for new traders to practice and learn. However, additional educational resources and an interactive help center could improve the overall user experience. This balance of service and learning tools makes it crucial for traders to evaluate FXlift's offerings alongside its limitations.

Advantages and Disadvantages of FXlift Customer Support

Withdrawal Options and Fees

FXlift has also provided several withdrawal options to its clients, which may include bank transfers, credit/debit cards, or popular e-wallets like Neteller and Skrill. Each option depends on the location of each trader and their personal preference. It should also be noted that different modes of withdrawal have varied times for processing, in the sense that e-wallets are faster compared with bank transfers.

While FXlift claims that deposit and withdrawal fees are free for most methods, there may be specific limitations or additional charges depending on the chosen payment method. For example, certain methods might come with a transaction limit or currency restrictions, and fees could apply for large transactions.

Additionally, withdrawal requests are usually processed within 24 hours, but sometimes there may be delays, especially with bank wire transfers, which may take up to three business days. Traders should check the specific terms for each withdrawal option to ensure a smooth experience.

FXlift and XM are both popular online brokers, but they differ in several key aspects. FXlift provides a range of trading accounts with varying leverage options, from regulated CySEC accounts offering up to 1:30 leverage to unregulated offshore accounts offering up to 1:1000 leverage. In contrast, XM offers more flexibility with a wider range of account types, including micro and standard accounts, and a significant bonus system. XM also has a strong reputation for customer support and educational resources, which are more comprehensive than FXlift's offerings. While FXlift offers a demo account for practice, XM is known for its superior educational materials and live webinars.

Verdict: XM offers a broader range of account types, stronger customer support, and better educational tools compared to FXlift, making it a more robust option for traders seeking comprehensive resources. FXlift may be appealing for traders looking for higher leverage options, but it lacks the support and learning tools that XM provides.

FXlift and RoboForex are two brokers that offer competitive spreads and multiple trading instruments, but they differ in terms of their regulatory status and available features. FXlift operates under a mix of regulated (CySEC) and unregulated entities, which may be a concern for risk-conscious traders. However, RoboForex is regulated fully in several countries, such as by the Belize FSC, and features a broader choice of assets- stocks, commodities, indices. It also offers greater platform selection, including MT5 which is not on FXlift. It features lower minimum deposits and also more advanced packages of trading tools compared with FXlift.

Verdict: RoboForex is better regulated, has a wider range of assets, and more sophisticated trading tools. The higher leverage options of FXlift may attract risk-taking traders, but RoboForex offers a more stable and feature-rich trading setup.

One of the significant differences between FXlift and Exness is regulatory status and the reach they cover globally. Exness has been regulated in multiple regions: Europe and Asia, ensuring a better level of security for its traders. On the other hand, FXlift mostly operates under CySEC, with some operations being completely unregulated, which puts some traders at risk. Exness also has more platforms such as MT4, MT5, and its proprietary Exness Trader, whereas FXlift offers only MetaTrader 4 (MT4). Its competitive spreads and no deposit fee are much better than that of FXlift.

Verdict: Exness offers superior regulatory coverage, a wider range of platforms, and stronger client service, making it the most reliable option for traders looking to prioritize security and feature-rich trading. FXlift could be suitable for the demand of increase leverage options, though it cannot offer a level of service like that available with Exness.

Also Read: XM Review 2024 – Expert Trader Insights

Conclusion: FXlift Review

FXlift is one of the online brokers, which offers competitive trading opportunities, and has a series of accounts and leverage selection options for traders with all levels of risk appetite. While it is flexible to conditions in trading, FXlift provides increase leverages for more experienced traders; however, its client service and educational tools are underdeveloped compared to some peers. The regulatory status of the platform is mixed, with some entities being regulated and others operating offshore, which can raise concerns for some traders. For those who seek increase leverage, FXlift offers attractive conditions, but traders seeking more comprehensive support and resources might look elsewhere.

FXlift Review: FAQs

What withdrawal options does FXlift offer?

FXLift offers several withdrawal options, including credit/debit cards, bank transfers, and e-wallets such as Neteller and Skrill. The processing time is different for each, with the e-wallet being quicker than the bank transfer

Is FXlift regulated?

FXLift operates under CySEC regulation for European clients, but it has an unregulated offshore entity which may be a concern to some traders who want higher regulation

What platforms does FXlift support?

FXLift will support MetaTrader 4 for trading, available from both desktop and mobile environments. However, it's not offering MetaTrader 5 or other advanced interfaces, which some traders find preferable.

OPEN AN ACCOUNT NOW WITH FXLIFT AND GET YOUR BONUS