Position in Rating | Overall Rating | Trading Terminals |

269th  | 2.0 Overall Rating |   |

FXIFY Review

Traders have shared mixed feedback about their experience with FXIFY, emphasizing its unique approach to funding opportunities. Many appreciated the platform’s low entry requirements, which allow traders with varying skill levels to participate. Additionally, its transparent rules and user-friendly interface have been highlighted as major strengths by those who have traded with it.

However, some traders noted challenges with FXIFY, particularly in achieving profit targets within the given timelines. While the rules are clear, a few traders felt that the trading conditions could be restrictive for aggressive strategies. Despite this, most users agree that FXIFY provides a fair platform for disciplined and consistent traders to succeed.

Overall, FXIFY has garnered positive attention for its accessibility and trader-centric design, although it may require strategic adaptability. Many traders recommend it to those seeking funding with straightforward terms.

What is FXIFY?

Traders describe FXIFY as a prop trading firm that provides opportunities for skilled individuals to access a funded account through a structured evaluation process. Feedback highlights that it stands out among other proprietary trading firms for its clear trading rules and realistic approach to profit-sharing. Many users find the platform supportive for disciplined prop traders aiming to succeed in competitive financial markets.

A common theme in trader reviews is the platform’s focus on achievable profit targets and transparent terms, which set it apart from other prop firms. Some traders have shared success stories of leveraging their skills in news trading and other strategies to pass the evaluation. Despite the challenges, FXIFY is viewed as a fair and rewarding platform for those who can trade consistently.

Overall, traders appreciate FXIFY for its flexibility and opportunities to grow through funded trading programs. Its emphasis on discipline and strategic trading makes it a preferred choice for those seeking growth in the world of prop trading firms.

FXIFY Regulation and Safety

Traders have expressed varying opinions about FXIFY regarding its regulation and safety. Many acknowledge that while FXIFY is not heavily regulated like traditional brokers, it operates transparently and provides clear terms for traders. The platform’s straightforward funding process and payout structure have been positively noted, giving traders confidence in its reliability.

Concerns about regulation are common, with some traders wishing FXIFY offered additional regulatory oversight to enhance trust. However, others argue that its focus on funded trading programs rather than client deposits makes it less dependent on strict regulatory frameworks. The platform’s emphasis on operational transparency has helped address safety concerns for many users.

FXIFY Pros and Cons

Pros

- Low spreads

- Fast execution

- Multiple platforms

- 24/7 support

Cons

- Limited assets

- High fees

- No crypto

- Restricted regions

Benefits of Trading with FXIFY

Traders have highlighted that FXIFY provides skilled traders with an opportunity to showcase their abilities through a structured process. Many appreciate the fairness of the system, which allows them to meet profit targets without excessive risk. The platform’s emphasis on transparency has been a strong point, ensuring that participants clearly understand the rules.

Feedback often mentions that FXIFY offers favorable trading conditions, enabling a wide range of strategies to succeed. Traders have also noted the benefit of requiring minimum trading days, which provides flexibility in completing the process at their own pace. This feature is especially appealing for those with consistent but time-constrained trading habits.

The requirement for minimum trading ensures that traders demonstrate consistent performance rather than relying on luck or single trades. Many skilled traders have expressed satisfaction with how FXIFY rewards discipline and strategy, making it a trusted platform for funded trading opportunities.

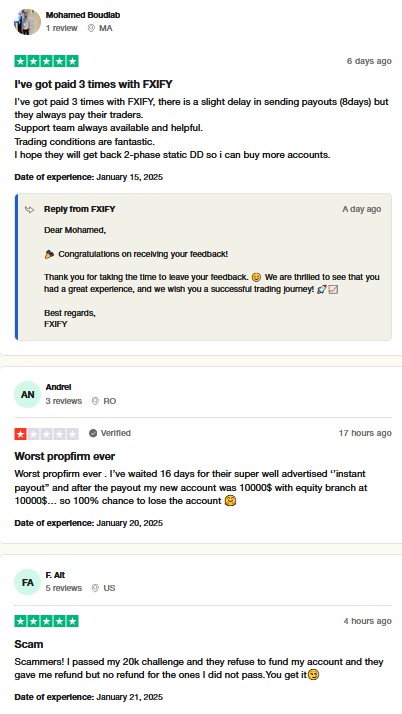

FXIFY Customer Reviews

Traders have shared a range of experiences in their reviews of FXIFY, with many highlighting its structured approach to funded trading. Positive feedback often mentions the platform’s clear guidelines and transparent process, which make it easier for traders to understand and meet the requirements. The profit-sharing model and accessible entry requirements are frequently cited as standout features by satisfied users.

However, some traders have expressed concerns about the challenges of meeting profit targets within strict timelines. A few reviews also mention that while the platform is fair, it may not be suitable for traders with highly aggressive or experimental strategies. Despite this, most traders agree that FXIFY offers a supportive and reliable environment for those with disciplined trading habits.

FXIFY Spreads, Fees, and Commissions

Traders have shared that FXIFY offers competitive spreads, fees, and commissions, making it appealing for those looking to maximize profitability. The platform is praised for its low trading costs, which allow traders to retain more of their earnings. Many have highlighted that FXIFY maintains transparent pricing, ensuring there are no hidden fees to worry about during trading.

However, some traders have mentioned that spreads can vary depending on market conditions, which might impact strategies requiring precise execution. Despite this, most users agree that FXIFY provides a cost-effective trading environment that supports a wide range of strategies. The absence of excessive commissions has also been noted as a positive aspect.

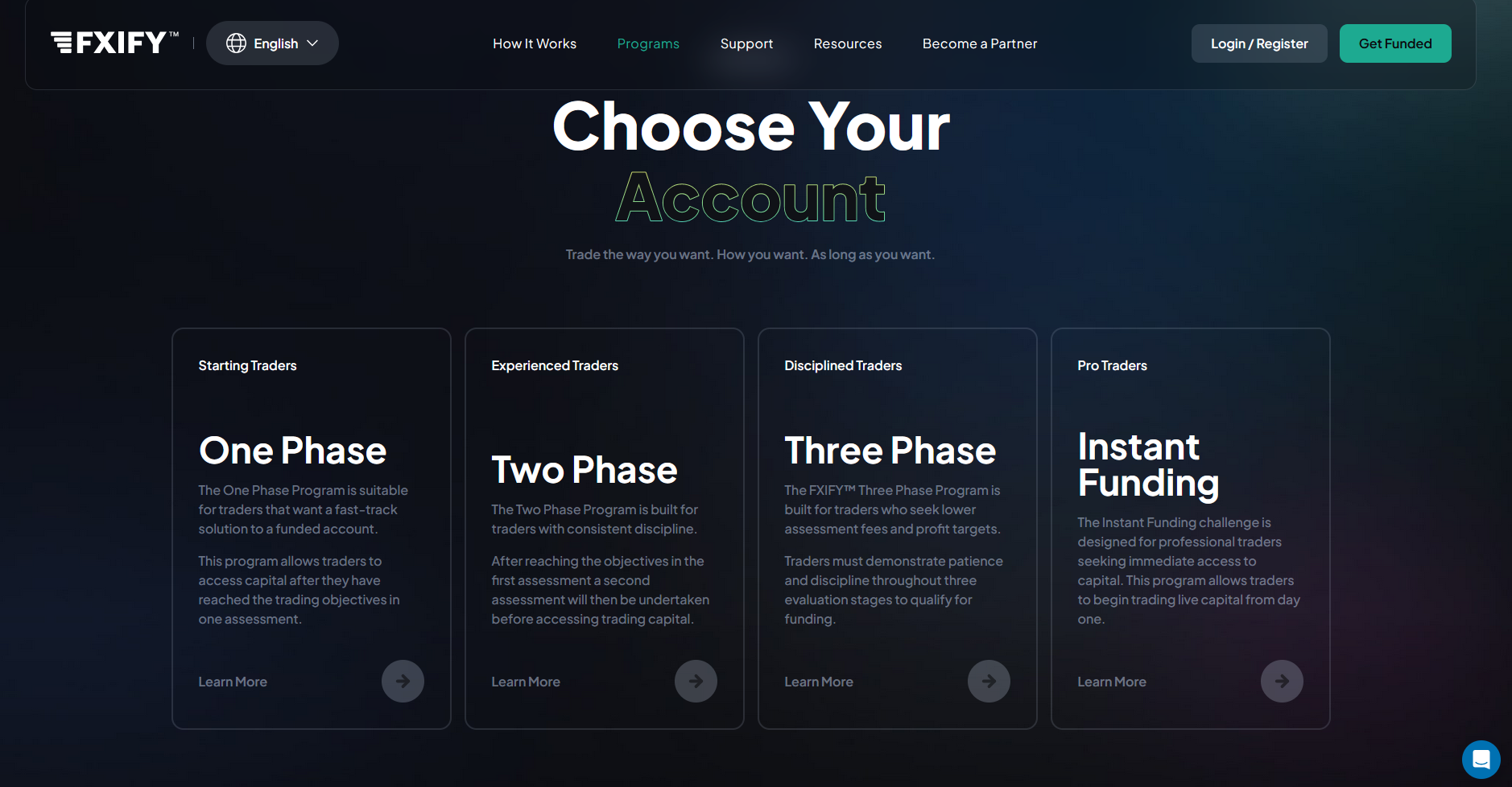

Account Types

FXIFY offers a variety of account types designed to cater to different trading styles and experience levels. Each account type provides unique features, ensuring traders have the flexibility and tools needed to succeed in the financial markets.

Standard Account

The Standard Account by FXIFY is ideal for beginner traders seeking competitive spreads and a straightforward trading environment. It offers access to all major markets with low minimum deposit requirements and no commission fees.

ECN Account

The ECN Account is tailored for experienced traders looking for raw spreads and direct market access. With FXIFY, this account type features lower spreads, faster execution speeds, and a transparent commission structure.

Pro Account

The Pro Account is designed for advanced traders who require premium tools and personalized support. FXIFY offers this account with tighter spreads, higher leverage options, and additional trading resources for enhanced market performance.

How to Open Your Account

Opening an account with FXIFY is a straightforward process designed for ease and accessibility. Traders can quickly register and start their trading journey by following simple steps that ensure a secure and efficient setup. Here’s a detailed guide to help you get started.

Step 1: Visit the FXIFY Website

Go to the official FXIFY website to begin your account registration. Locate the “Sign Up” or “Open Account” button on the homepage and click to proceed.

Step 2: Fill Out the Registration Form

Provide your personal details, including your name, email address, and phone number. Ensure all information is accurate to avoid issues during verification.

Step 3: Verify Your Email Address

Check your email inbox for a verification link from FXIFY. Click the link to confirm your email and activate your account.

Step 4: Upload Identification Documents

Log in to your account and upload the required documents, such as a government-issued ID and proof of address. This step ensures compliance with FXIFY‘s security and regulatory standards.

Step 5: Fund Your Account

Choose a preferred funding method, such as bank transfer or credit card, to deposit funds. Ensure the deposit meets the minimum requirement set by FXIFY.

Step 6: Start Trading

Once your account is verified and funded, you can access the trading platform. Explore the features and start trading with FXIFY.

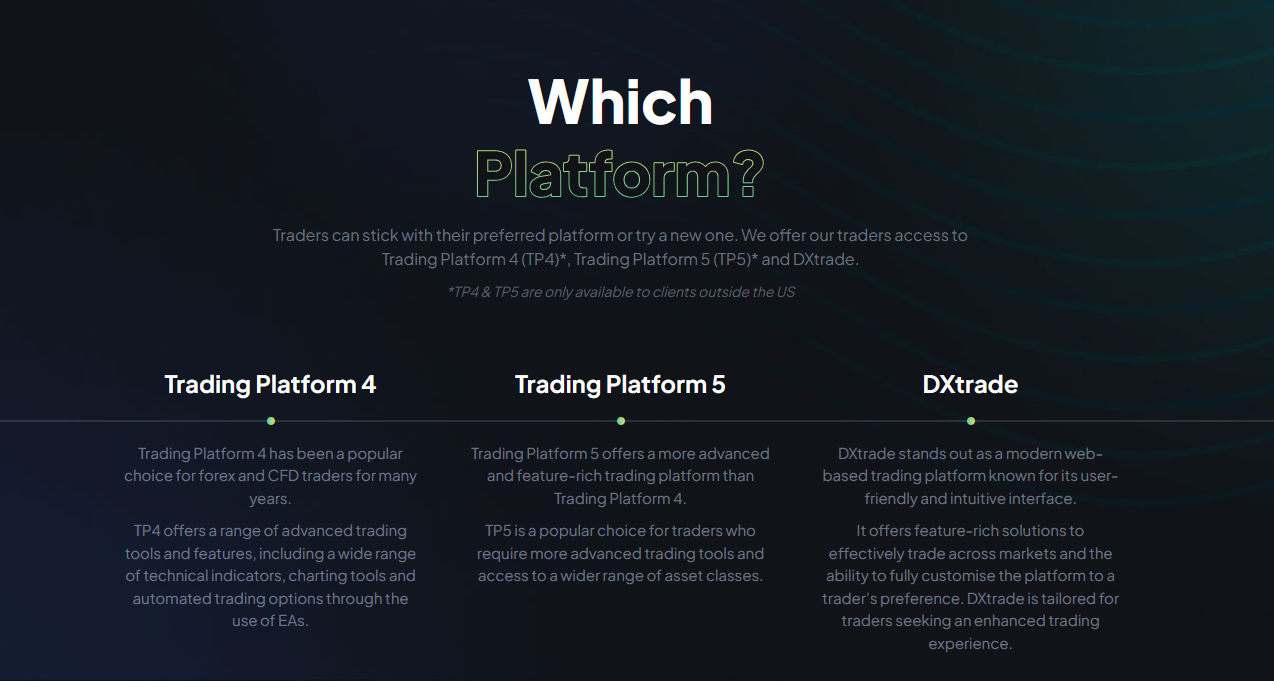

FXIFY Trading Platforms

Traders have positively reviewed the trading platforms offered by FXIFY, emphasizing their reliability and user-friendly design. The platforms are equipped with advanced charting tools, customizable layouts, and efficient order execution, making them suitable for both beginner and experienced traders. Many users appreciate the seamless integration of trading tools that support various strategies.

Some traders have noted minor challenges, such as limited compatibility with specific third-party applications. However, the overall feedback highlights that FXIFY provides a stable and feature-rich trading environment. The platforms are optimized for performance, ensuring minimal disruptions during critical market movements.

What Can You Trade on FXIFY

FXIFY offers a wide range of trading instruments, making it a versatile platform for traders of all levels. From forex to commodities, indices, and cryptocurrencies, the platform caters to diverse trading preferences with competitive spreads and user-friendly tools.

Forex

Forex trading on FXIFY includes major, minor, and exotic currency pairs, providing opportunities for traders to speculate on global currency movements. The platform offers competitive spreads and leverage to enhance trading efficiency.

Commodities

Traders on FXIFY can access commodities like gold, silver, oil, and agricultural products. These assets provide options for diversification and hedging against market volatility.

Indices

FXIFY features global indices, including popular ones like the S&P 500, NASDAQ, and FTSE 100. Trading indices allows investors to speculate on the performance of entire markets rather than individual stocks.

Cryptocurrencies

The cryptocurrency market on FXIFY includes major digital assets like Bitcoin, Ethereum, and Litecoin. Traders can capitalize on the high volatility of these digital currencies with round-the-clock market access.

FXIFY Customer Support

Traders have shared mixed feedback about FXIFY customer support, with many appreciating the quick response times and helpful assistance provided by the team. The support staff is often praised for addressing technical issues and queries related to account setup or funding processes efficiently.

However, some traders have expressed that while FXIFY customer support is generally reliable, there can be occasional delays during peak times. A few users also suggested improvements in offering more proactive updates on account-related concerns. Despite this, most traders agree that the support team is professional and approachable.

Advantages and Disadvantages of FXIFY Customer Support

Withdrawal Options and Fees

Understanding withdrawal options and associated fees is crucial for traders to access their earnings conveniently. FXIFY provides multiple withdrawal methods to ensure flexibility and ease for its users, catering to different preferences and needs.

Bank Transfer

FXIFY offers bank transfer as a secure and reliable withdrawal method. While processing times may take 3-5 business days, this option suits traders who prefer direct transfers to their bank accounts.

E-Wallets

E-wallets are a fast and popular withdrawal method supported by FXIFY. Traders can access their funds within 1-2 business days, benefiting from lower fees compared to traditional bank transfers.

Cryptocurrency

For tech-savvy traders, FXIFY supports cryptocurrency withdrawals. This method provides speed and privacy, with transactions typically processed within 24 hours.

Debit/Credit Cards

FXIFY allows withdrawals directly to debit or credit cards. Although processing may take 2-5 business days, this option is convenient for traders familiar with card transactions.

FXIFY Vs Other Brokers

#1. FXIFY vs AvaTrade

FXIFY focuses on providing proprietary trading opportunities with flexible funding plans tailored to experienced traders. It offers access to advanced trading tools and competitive profit splits. On the other hand, AvaTrade is a traditional brokerage catering to retail clients, providing a wide array of trading instruments, educational resources, and user-friendly platforms like AvaTradeGO. While FXIFY emphasizes a performance-driven trading model, AvaTrade prioritizes accessibility for beginners and offers regulatory assurance across multiple jurisdictions.

Verdict: FXIFY is ideal for traders seeking funded accounts and a results-oriented environment. AvaTrade suits beginners or those looking for diverse assets and robust regulatory protection.

#2. FXIFY vs RoboForex

FXIFY focuses on providing traders with funding opportunities and advanced evaluation processes for accessing trading capital. It caters to professional traders who aim for scalability in their trading activities. On the other hand, RoboForex offers a wide range of account types and trading instruments, appealing to retail traders with its user-friendly platforms, cashback programs, and low initial deposit requirements. While FXIFY emphasizes trader performance and funding, RoboForex centers on accessibility and versatility across multiple trading strategies.

Verdict: For traders seeking growth through funding programs and evaluation-based trading, FXIFY is a stronger choice. Retail traders who prioritize diverse account options and lower barriers to entry may find RoboForex more appealing.

#3. FXIFY vs Exness

FXIFY and Exness cater to different types of traders with distinct features. FXIFY is well-suited for traders looking for funding opportunities, offering funded trading accounts with set profit targets and loss limits. Exness, on the other hand, focuses on flexibility, providing retail traders with low spreads, high leverage, and a variety of account types. While FXIFY emphasizes performance-based progression for professional traders, Exness appeals to a broader audience with its user-friendly platform, diverse instruments, and 24/7 customer support. Both platforms provide competitive conditions, but their target markets differ significantly.

Verdict: FXIFY is ideal for experienced traders aiming to scale up through funding, while Exness is better for retail traders seeking a versatile and accessible trading environment. The choice depends on whether the trader values funding programs or platform flexibility.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: FXIFY Review

In conclusion, FXIFY has earned positive feedback from successful traders who value its structured approach and clear evaluation process. Unlike some other prop trading companies, traders appreciate that FXIFY maintains transparent guidelines and realistic targets, helping them build confidence in their trading abilities. The platform’s emphasis on fair opportunities has resonated with many in the trading community.

Some traders have noted that FXIFY imposes certain trading restrictions, such as maximum drawdowns and time-limited evaluations, which require disciplined strategies to succeed. However, these rules are viewed by many as necessary to ensure the sustainability of their initial account balance and foster responsible trading habits. These aspects contribute to the platform’s appeal among committed traders.

Overall, FXIFY stands out among prop trading companies for providing an accessible yet challenging environment for traders aiming to grow their initial account balance. Its focus on rewarding consistency and discipline has made it a top choice for many successful traders.

FXIFY Review: FAQs

What is the minimum deposit to start with FXIFY?

FXIFY does not require a deposit for trading but charges an evaluation fee to access funded accounts.

How long does it take to complete the FXIFY evaluation?

The duration depends on the trader’s performance, but most evaluations have specific timeframes to meet profit targets.

Does FXIFY offer customer support?

Yes, FXIFY provides customer support through email and chat to assist traders with account and technical queries.

OPEN AN ACCOUNT NOW WITH FXIFY AND GET YOUR BONUS