FXFlat Review

FXFlat is a leading German online brokerage, famed for its specialization in Forex, CFDs, and futures trading. The firm offers its clientele access to a variety of financial markets through its robust trading platform. Aiding the decision-making process of its traders, FXFlat provides a suite of tools, research and analysis resources, and educational content.

This comprehensive review aims to dissect the various aspects of FXFlat, ranging from its strengths to weaknesses and everything that lies in between. We evaluate the broker's features, commission structure, account types, transaction procedures, and more, amalgamating expert insights and real trader experiences to facilitate your decision-making process.

What is FXFlat?

FXFlat is a Forex broker that is regulated by the German Federal Financial Supervisory Authority (BaFin) and fully follows European Union financial legislation. It provides a variety of account kinds, including regular and professional accounts, as well as a selection of trading platforms, including Trader Workstation and the popular MetaTrader platforms.

FXFlat has been praised for its trading conditions and diverse variety of services since its beginning in 1997. It has constantly strived to provide cutting-edge technology and top-tier service to its clients while conforming to all applicable rules and regulations. FXFlat has gradually increased its service range, emphasizing the value of excellent support, which includes educational resources and advanced training through webinars or seminars.

In keeping with its approach, FXFlat is an active member of the CFD Verband e.V., which promotes transparency and investor protection in the German CFD market. FXFlat also plays an important role in a variety of social obligations, sponsoring a variety of social institutions and hospitals.

Advantages and Disadvantages of Trading with FXFlat?

Benefits of Trading with FXFlat

One of the primary advantages of trading with FXFlat is the diversity of its platform offerings. Traders have the flexibility to choose from three industry-leading trading platforms: MetaTrader 4 & 5, as well as Trader Workstation. These platforms are renowned for their intuitive interfaces, advanced charting capabilities, and powerful trading tools. By supporting these platforms, FXFlat ensures its clients have access to the resources they need for effective trading, regardless of their trading style or experience level.

Moreover, FXFlat provides its traders with an array of additional tools and add-ons. These include AutoChartist, a market scanner tool; a host of trading indicators and signals; as well as various algorithmic trading options, among others. These tools are designed to augment the trader's capabilities, helping them identify trends, set up alerts, and automate their trading processes.

Lastly, FXFlat stands out for its broad variety of instruments. This includes a vast array of Forex pairs, and CFDs on various assets such as indices, commodities, stocks, and cryptocurrencies. By providing such a wide range of instruments, FXFlat allows traders to diversify their portfolios and take advantage of trading opportunities across multiple markets.

FXFlat Pros and Cons

In terms of its pros, FXFlat is a well-established broker with a reputable standing in the trading community. It operates under the strict regulations of the German Federal Financial Supervisory Authority (BaFin), which testifies to its credibility and commitment to secure trading practices. Furthermore, FXFlat boasts an extensive offering of trading instruments, ensuring traders can diversify their trading activities and find opportunities in various markets.

FXFlat also takes pride in its high-quality customer support and advanced educational materials. These resources are designed to help traders, both novice and experienced, navigate the complexities of trading and develop their skills. This commitment to supporting clients is also evident in the broker's competitive fee structure. FXFlat offers low spreads on a majority of its trading instruments, which can significantly reduce the cost of trading for its clients.

Additionally, the broker provides an impressive variety of trading platforms, including MetaTrader 4 & 5 and Trader Workstation. This extensive selection accommodates traders of all skill levels and trading preferences, offering flexibility and user-friendly experiences.

However, there are a few cons that FXFlat could improve. While it provides advanced educational materials, these resources may not be comprehensive enough for beginner traders who require more foundational knowledge. The company might benefit from developing additional educational content targeted specifically at beginners to make their trading journey smoother.

Finally, while FXFlat offers reliable customer service, it's not available 24/7. This may pose challenges for traders who require assistance during off-market hours or who are in different time zones. Having around-the-clock support could be a significant improvement in the broker's service, ensuring that traders have access to help whenever they need it.

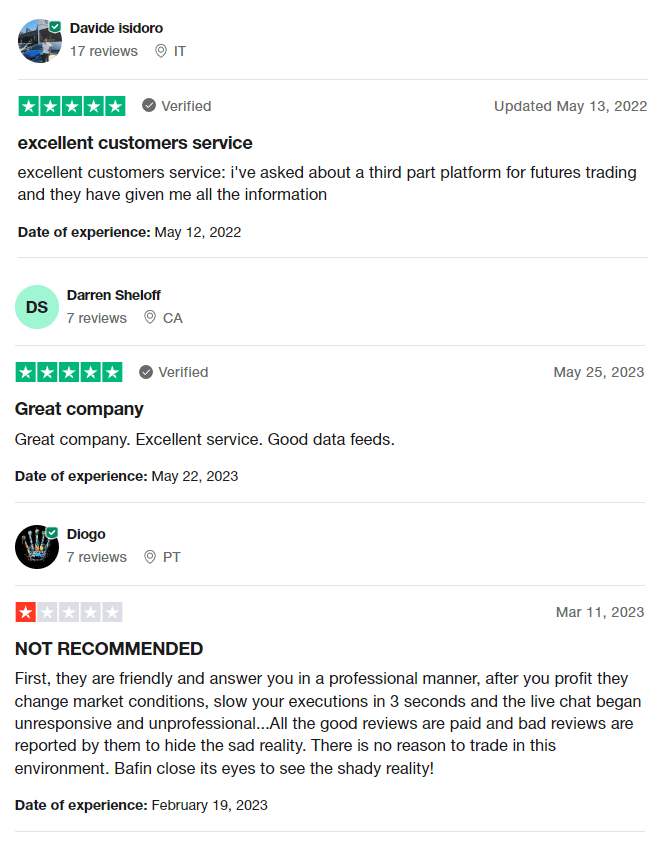

FXFlat Customer Reviews

Opinions on FXFlat's services are mixed. While some traders have praised the company's excellent customer service and data feeds, others have raised concerns about changes in market conditions after profiting, slow execution times, and occasional unresponsiveness from the live chat feature. These contrasting reviews highlight the need for prospective users to fully understand the platform's capabilities and limitations before choosing FXFlat as their preferred broker.

FXFlat Spreads, Fees, and Commissions

The spread at FXFlat can vary based on the specific currency pair or instrument being traded and the prevailing market conditions. While the spread for major currency pairs like EUR/USD is generally low, the spread for exotic or less traded currency pairs might be wider. It's advisable for traders to verify the spread offered by FXFlat for the specific currency pair or instrument they intend to trade and compare it with the spreads offered by other brokers.

FXFlat may impose fees depending on the specific trading products and services utilized by the trader. Typical fees include the spread (the difference between the bid and ask prices of a currency pair) and overnight financing charges for maintaining positions overnight. FXFlat may also levy inactivity fees for traders who do not log in or place trades for a prolonged period. It is advised to review the specific fee structure offered by FXFlat and compare it to those offered by other brokers before making a decision.

Account Types

FXFlat offers a Standard or Professional account on either MetaTrader or TWS platform. The MetaTrader account requires an initial deposit of €200 and offers access to CFDs, forex, and futures. The TWS account, which demands a €2,000 minimum deposit, provides access to stocks, options, futures, CFDs, spot forex, and more.

FXFlat also provides a Corporate Account, designed to support businesses in operating more profitably. This account is accessible to any type of business globally. Furthermore, for traders who follow Sharia law, FXFlat offers the option of an Islamic Account. Traders can convert their live trading account to an Islamic Account, or it can be a standalone account with a separate application procedure.

Finally, FXFlat offers a demo account on MetaTrader or TWS. It can be used for 30 days to test the trading platforms without any obligation or risk. A demo account is beneficial for beginners and experts to try or enhance their trading strategies using virtual funds.

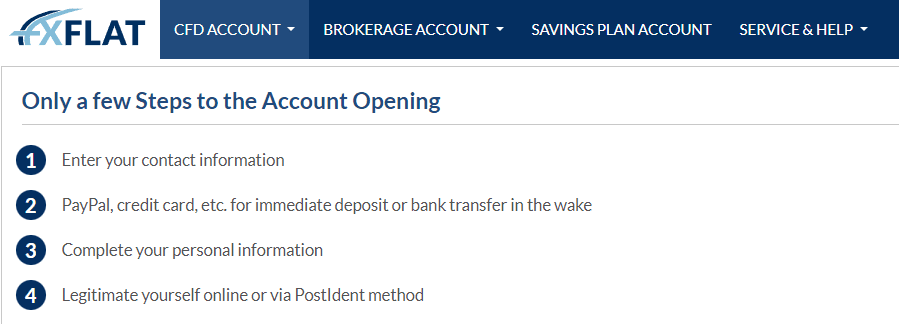

How to Open Your Account

- Start the Process: Navigate to the FXFlat webpage and choose the option to open a live account.

- Select Platforms: Choose the platforms you wish to use.

- Complete Information: Fill in all the requested personal information and register.

- Verify Account: An account verification email will be sent to the registered email account. Once the account is verified, you can log in and start trading.

What Can You Trade on FXFlat

FXFlat provides a comprehensive suite of trading options. It enables you to trade stocks, bonds, options, futures, ETFs, commodities, spot forex, and CFDs on 135 exchanges worldwide. These include financial centers in Europe, the USA, Asia, and Australia, all accessible via one account. Additionally, FXFlat allows depositing in one of 23 currencies, which can be converted at low rates when required.

FXFlat Customer Support

FXFlat’s customer support team is typically available during market hours, although it's advisable to check with the broker directly for the most current information on support hours and availability. FXFlat offers multiple customer support channels, including phone support, email support, live chat support, and an online support center with FAQs and educational resources.

Advantages and Disadvantages of FXFlat Customer Support

Security for Investors

Withdrawal Options and Fees

FXFlat supports several common methods for deposit and withdrawal, including Card Payment, Bank Transfer, PayPal, Skrill, Neteller, Sofort, Giropay, and iDEAL. However, the availability of these options may vary depending on the country of the account holder. FXFlat may also impose certain requirements and fees for depositing and withdrawing funds, so it's recommended to check directly with the broker for the most up-to-date information. FXFlat offers trading accounts in several base currencies, including USD, EUR, and GBP.

FXFlat Vs Other Brokers

#1. FXFlat vs AvaTrade

When comparing FXFlat and AvaTrade, both are reputable brokers regulated by trusted financial authorities. FXFlat is regulated by Germany's BaFin, offering a solid selection of trading platforms and tools, low spreads, and a wide variety of instruments. AvaTrade, regulated by several authorities including ASIC, CBI, and FSA, offers a broader choice of trading platforms and more comprehensive educational content, especially for beginners.

FXFlat stands out with its diverse portfolio and additional trading tools, which can significantly enhance trading capabilities. AvaTrade, however, excels in customer service, offering support in multiple languages and 24/7 availability, which FXFlat lacks.

Verdict: If platform diversity and a wide range of instruments are your priorities, FXFlat may be the better choice. However, if you're a beginner or require superior customer service, AvaTrade could be more suitable for your needs.

#2. FXFlat vs RoboForex

FXFlat and RoboForex both offer competitive trading environments, but they cater to different trader needs. FXFlat, regulated by BaFin, provides a more robust regulatory environment, which ensures better protection for traders. In addition, FXFlat offers a range of platforms, including the MetaTrader suite and Trader Workstation.

RoboForex, regulated by IFSC and CySEC, leans more towards automated trading, offering various solutions for algorithmic trading. RoboForex also provides a wider array of account types and supports cryptocurrencies, which FXFlat does not offer. However, RoboForex's fee structure may be more complex compared to FXFlat's more straightforward and lower-cost framework.

Verdict: If you value strong regulation and a variety of traditional trading instruments, FXFlat is the better choice. However, if you're interested in automated trading, cryptocurrencies, and more account types, RoboForex could be more suitable.

#3. FXFlat vs Exness

FXFlat and Exness are both competitive brokers, each with its unique strengths. FXFlat offers a reliable Forex trading environment, backed by robust German regulation and a wide range of trading platforms. Its low spreads and additional trading tools also give it an edge for experienced retail traders.

On the other hand, Exness, regulated by CySEC and the FCA, stands out for its extremely tight spreads and instant execution, making it an excellent choice for scalpers and high-frequency traders. Exness also provides 24/7 customer support and allows for unlimited demo accounts, which may be beneficial for beginners.

Verdict: If strong regulation, platform diversity, and additional trading tools are essential for you, FXFlat would be the better choice. However, if you're a high-frequency trader or a beginner who values tight spreads, instant execution, and round-the-clock support, Exness may be a more suitable option.

Conclusion: FXFlat Review

After an in-depth review, it's clear that FXFlat is a reputable broker that offers a robust trading environment, excellent platform selection, and a wide array of trading instruments. The broker's strong regulation by BaFin, competitive spreads, and additional trading tools contribute to an offering that can meet the needs of various traders, from novices to seasoned professionals.

However, while FXFlat shines in many areas, there are opportunities for improvement. The broker could strengthen its offerings for beginner traders with more comprehensive educational resources and improve its customer service by extending its availability to 24/7.

Despite these areas for potential growth, FXFlat remains a solid choice for those seeking a reliable, well-regulated broker with a diverse portfolio of instruments and an impressive choice of trading platforms.

FXFlat Review FAQs

What kind of trading platforms does FXFlat offer?

FXFlat offers several trading platforms to suit the needs of different traders. These include the popular MetaTrader 4 and MetaTrader 5 platforms, known for their user-friendly interface, advanced charting capabilities, and an extensive array of trading tools. FXFlat also offers the Trader Workstation platform, which caters to traders seeking more sophisticated tools and features.

How is FXFlat regulated?

FXFlat is regulated by the German Federal Financial Supervisory Authority (BaFin), which is known for its stringent rules and regulations. This means that FXFlat must comply with strict regulatory standards, including maintaining sufficient capital, undergoing regular audits, and ensuring that clients' funds are held in segregated accounts.

Does FXFlat offer educational resources for beginners?

While FXFlat provides educational materials and resources, these are more tailored toward experienced traders looking to refine their strategies and deepen their Forex market knowledge. The broker could improve its services by offering more foundational educational resources designed specifically for beginner traders.