Position in Rating | Overall Rating | Trading Terminals |

196th  | 2.7 Overall Rating |  |

FXDD Review

Forex brokers are essential intermediaries between traders and the forex market, providing the platform, tools, and resources needed for executing trades. They offer access to various financial instruments, including currency pairs, commodities, indices, and cryptocurrencies. Choosing the right forex broker is crucial as it impacts trading success significantly. A reputable broker ensures the safety of your funds, offers competitive spreads, and provides reliable trade execution, which are all vital for achieving your trading goals.

FXDD is a well-established forex broker known for its reliable trading platform and excellent customer service. They offer a wide range of trading instruments and provide advanced tools for both beginners and experienced traders. With a strong regulatory framework and competitive trading conditions, FXDD has positioned itself as a reputable choice for forex traders around the world.

In this comprehensive review, I aim to provide an in-depth evaluation of FXDD, highlighting its unique selling points and potential drawbacks. My goal is to offer you essential insights about the broker, including the various account options available, deposit and withdrawal processes, commission structures, and other critical details. Combining expert analysis with real trader experiences, this review will equip you with the necessary information to make an informed decision about considering FXDD as your preferred brokerage service provider.

What is FXDD?

FXDD is a forex and CFD broker established in 2002, offering a variety of trading instruments such as currencies, commodities, indices, and cryptocurrencies. The broker is regulated by multiple financial authorities, including the Malta Financial Services Authority (MFSA) and the Financial Services Commission (FSC) in Mauritius, ensuring client fund security and regulatory compliance.

One of the key aspects that makes FXDD stand out is its diverse range of trading platforms. Traders can choose between MetaTrader 4, MetaTrader 5, and a proprietary web-based platform, each tailored to meet the needs of different trading styles and preferences. The mobile trading options ensure that you can manage your trades on the go, maintaining flexibility and convenience.

Benefits of Trading with FXDD

Trading with FXDD has been a rewarding experience due to several key benefits. One of the standout features is the access to both MetaTrader 4 and MetaTrader 5 platforms, which offer advanced charting tools, automated trading capabilities, and a user-friendly interface. These platforms enhance my trading experience by providing reliable and efficient tools to execute and manage trades.

Another significant advantage is FXDD’s regulatory oversight. Being regulated by the Malta Financial Services Authority (MFSA) and the Financial Services Commission (FSC) in Mauritius, I feel secure knowing that my funds are protected, and the broker operates under strict regulatory standards. This level of security is crucial for maintaining trust and confidence in my trading activities.

The variety of trading instruments available on FXDD is impressive. I can trade forex, commodities, indices, and cryptocurrencies, which allows me to diversify my investment portfolio and explore different markets. This variety ensures that I have multiple opportunities to capitalize on market movements and optimize my trading strategies.

Additionally, FXDD offers competitive trading conditions, including low spreads and fast execution speeds. These features are essential for maximizing my trading efficiency and profitability. The broker’s commitment to providing a high-quality trading environment is evident in these favorable conditions.

FXDD Regulation and Safety

FXDD operates under the regulation of two main financial authorities, the Malta Financial Services Authority (MFSA) and the Financial Services Commission (FSC) in Mauritius. These regulatory bodies ensure that FXDD adheres to strict financial standards, providing a level of oversight that enhances the safety of your investments.

Understanding where a broker is regulated is crucial because it directly impacts the safety and security of your funds. FXDD ensures client funds are held in segregated accounts, which means your money is not used for the broker’s operational expenses. This separation of funds is a significant safeguard against potential financial difficulties the broker might face.

Additionally, FXDD provides negative balance protection, ensuring that you cannot lose more money than you have in your account. This feature is particularly important during volatile market conditions, as it prevents you from incurring debts to the broker. Knowing that your investments are protected by these measures can give you peace of mind while trading.

Furthermore, the MFSA-regulated entity of FXDD is a participant in the Investor Compensation Scheme. This scheme offers compensation up to 90% of your investment (with a maximum limit of 20,000 Euros) if the broker encounters financial issues. Such protections are vital for ensuring the security of your investments, especially in the unpredictable world of forex trading.

FXDD Pros and Cons

Pros

- Multiple trading platforms

- High-speed order execution

- No minimum deposit

- Segregated client funds

- Negative balance protection

- Regulated by MFSA and FSC

Cons

- Limited asset selection

- Higher spreads compared to some brokers

- Inactivity fees apply

- No U.S. clients accepted

- Withdrawal fees for low amounts

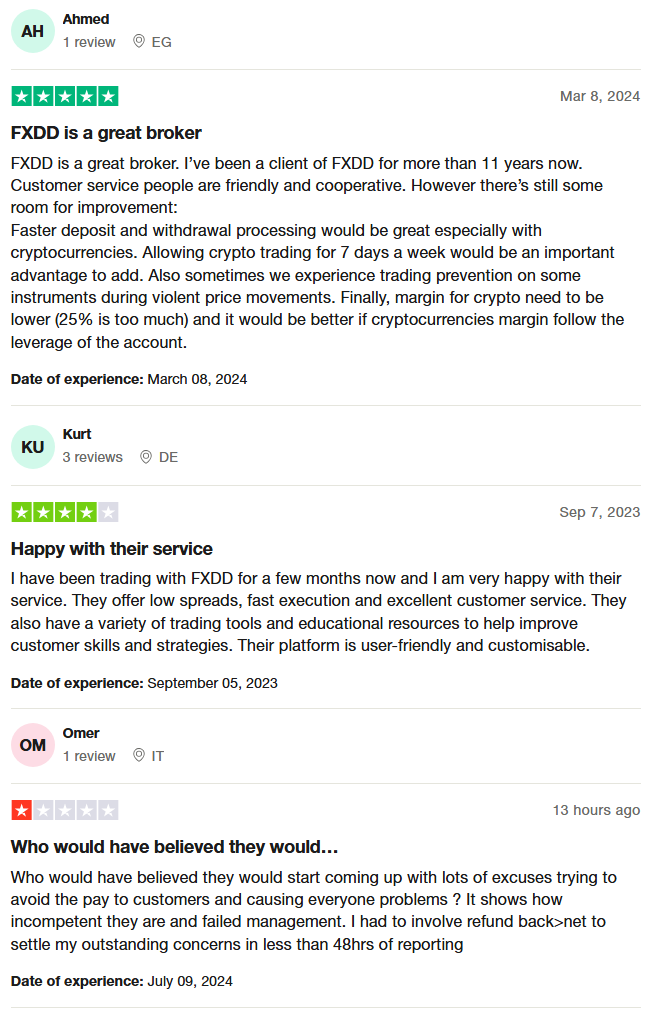

FXDD Customer Reviews

FXDD has received a range of customer reviews. Many long-term clients praise FXDD for its friendly and cooperative customer service and the variety of trading tools and educational resources available. Users appreciate the low spreads, fast execution, and user-friendly platforms. However, some customers have noted areas for improvement, such as faster deposit and withdrawal processing, especially with cryptocurrencies, and the desire for crypto trading to be available seven days a week. A few clients have expressed dissatisfaction with occasional trading restrictions during volatile price movements and higher margin requirements for cryptocurrencies. Despite these concerns, many traders continue to find FXDD a reliable and supportive broker.

FXDD Spreads, Fees, and Commissions

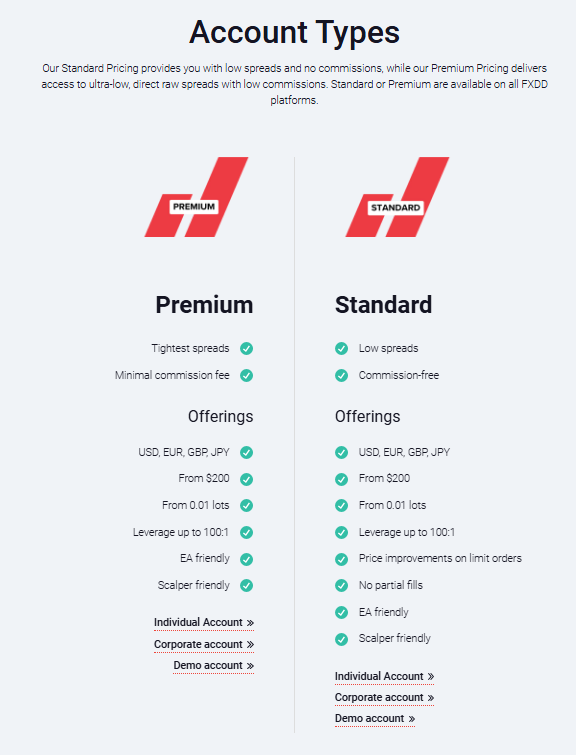

FXDD offers a clear structure for spreads, fees, and commissions tailored to different trading preferences. They provide two main account types: Standard and Premium (ECN). In the Standard account, there are no commissions, but spreads start at around 1.9 pips for major pairs like EUR/USD. This might be higher compared to some other brokers but simplifies cost calculations since there’s no commission involved. On the other hand, the Premium (ECN) account features spreads starting from 0.4 pips for EUR/USD with a small commission fee, typically around $3 per lot. This can benefit high-frequency traders who prefer tighter spreads over commission-free trading.

Additionally, FXDD implements certain fees that traders should be aware of. There is an inactivity fee of $30 if no trading activity occurs within 90 days, which can impact infrequent traders. Withdrawal fees apply for amounts below $100 and for multiple withdrawals within a month; the first withdrawal each month is free, but subsequent ones incur a $40 fee. Overnight positions are subject to standard swap rates, varying by currency pair and market conditions.

Account Types

Standard Account

- Low spreads starting from 1.8 pips

- Commission-free trading

- Supports micro-lots, mini-lots, and standard lots

- No partial fills and price improvements on limit orders

- Suitable for self-directed traders

Premium (ECN) Account

- Spreads starting from 0.2 pips

- Minimal commission fee

- High-speed execution and high fill rate

- Friendly to expert advisors (EAs) and scalpers

Islamic Account

- Available for both Standard and Premium accounts

- Swap-free, complying with Sharia law

- Fixed maintenance fee instead of interest

Demo Account

- Available for both Standard and Premium accounts

- Risk-free environment using virtual funds

- Excellent for getting familiar with platforms and testing strategies

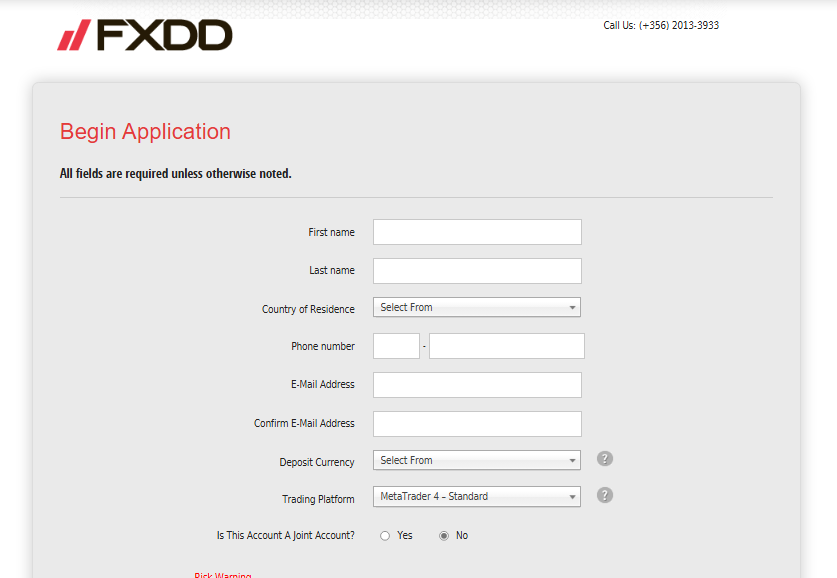

How to Open Your Account

- Visit the FXDD website and click the “Start Trading” button.

- Choose whether to create an account under the Maltese or Mauritian division.

- Complete the registration form with your personal information, including name, date of birth, address, and phone number.

- Provide details about your available capital and the origin of your income.

- Indicate your trading experience and answer questions about trading concepts like Stop Loss and margin trading.

- Submit the registration form and wait for account verification instructions.

- Upload the required documents for identity verification, such as a photo ID and proof of address.

- Once verified, deposit funds into your trading account to start trading.

FXDD Trading Platforms

In my experience trading with FXDD, the broker offers access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most popular trading platforms in the forex industry. MT4 is renowned for its user-friendly interface and robust charting capabilities, making it an excellent choice for both beginner and experienced traders.

On the other hand, MetaTrader 5 provides advanced trading tools and more sophisticated features compared to MT4. I found MT5 particularly useful for its enhanced analytical capabilities and expanded order types, which allowed me to implement more complex trading strategies. Both platforms support automated trading through Expert Advisors (EAs), adding a layer of flexibility and efficiency to my trading activities.

FXDD also offers a WebTrader platform for easy access from any browser, along with mobile trading apps for both Android and iOS devices. This combination ensures that traders can manage their accounts and execute trades on the go, maintaining connectivity to the market regardless of their location.

What Can You Trade on FXDD

Trading with FXDD, I have access to a wide range of instruments, which adds versatility to my trading strategies. The platform offers over 67 forex currency pairs, including major, minor, and exotic pairs. This variety allows me to explore different markets and find trading opportunities across various currency pairs.

In addition to forex, FXDD provides access to commodities like gold, silver, and crude oil, which are great for diversifying my portfolio. The ability to trade commodities helps me hedge against inflation and market volatility. Indices and stocks are also available on FXDD, offering me a chance to speculate on the performance of major global markets and individual companies.

FXDD’s offering extends to cryptocurrencies, including popular options like Bitcoin, Ethereum, and Litecoin. This is particularly exciting as it allows me to engage in the rapidly growing digital asset market. The combination of these trading instruments makes FXDD a comprehensive platform for various trading needs, providing me with numerous opportunities to capitalize on market movements.

FXDD Customer Support

Based on my experience with FXDD, their customer support is both reliable and accessible. The support team is available 24/5 via live chat, phone, and email, ensuring that I can get assistance whenever I need it. This is particularly useful during critical trading hours when immediate help is required.

I found the customer service representatives to be responsive and knowledgeable, addressing my queries promptly. Their multilingual support options cater to a global client base, making it easier for traders from different regions to communicate effectively.

Advantages and Disadvantages of FXDD Customer Support

Withdrawal Options and Fees

With FXDD, withdrawing funds is straightforward, but it’s important to be aware of the options and associated fees. You can withdraw via wire transfer, credit/debit cards, Skrill, and Neteller. These methods offer flexibility, allowing you to choose the most convenient option based on your location and preferences.

However, there are fees to consider. FXDD offers one free withdrawal per month, but subsequent withdrawals within the same month incur a $40 fee. For withdrawals below $100, additional fees may apply. This makes it crucial to plan your withdrawals accordingly to avoid unnecessary charges.

Additionally, the processing times vary depending on the method chosen. Wire transfers typically take 3-5 business days, while e-wallet withdrawals like Skrill and Neteller are processed faster. Credit and debit card withdrawals are also an option, providing further convenience. Understanding these details can help you manage your funds efficiently and avoid unexpected fees.

FXDD Vs Other Brokers

#1. FXDD vs AvaTrade

FXDD and AvaTrade are both established brokers with distinct offerings. FXDD is known for its competitive spreads and flexible trading platforms like MetaTrader 4 and 5. AvaTrade, on the other hand, offers a broader range of trading instruments, including cryptocurrencies, stocks, and commodities, alongside platforms like AvaTradeGO and AvaOptions. While FXDD provides a solid trading environment with lower spreads, AvaTrade offers more comprehensive educational resources and innovative trading tools.

Verdict: AvaTrade is better due to its wider range of trading instruments and superior educational resources. These features make it more suitable for traders looking for diverse investment opportunities and robust learning support.

#2. FXDD vs RoboForex

FXDD and RoboForex cater to different types of traders. FXDD is appreciated for its reliable trading platforms and customer service, while RoboForex is known for its variety of account types and bonus programs. RoboForex offers platforms like cTrader and proprietary R Trader, alongside MT4 and MT5, providing extensive options for traders. RoboForex’s diverse account offerings and promotional bonuses give it an edge over FXDD’s more straightforward approach.

Verdict: RoboForex is the better choice for traders seeking a variety of account types and attractive bonus programs. This makes it more appealing for those looking for flexibility and additional trading incentives.

#3. FXDD vs Exness

FXDD and Exness both offer strong trading platforms, but Exness stands out with its high leverage options and instant withdrawal capabilities. FXDD provides robust regulatory oversight and customer support, while Exness is known for its exceptional trading conditions and low spreads. Both brokers offer MetaTrader platforms, but Exness’s high leverage and instant withdrawals make it a more dynamic option for aggressive traders.

Verdict: Exness is superior due to its high leverage options and instant withdrawal features. These advantages make it more suitable for traders seeking more aggressive trading strategies and quick access to their funds.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: FXDD Review

FXDD offers a comprehensive trading experience with robust platforms like MetaTrader 4 and 5. The broker is well-regulated, ensuring a secure trading environment. Additionally, the availability of a variety of trading instruments, including forex, commodities, indices, and cryptocurrencies, provides ample opportunities for traders to diversify their portfolios.

However, it’s important to note some areas where FXDD could improve. Withdrawal fees can be high if you make multiple withdrawals in a month, and customer support is not available on weekends. Despite these drawbacks, FXDD’s low spreads and reliable execution make it a solid choice for many traders.

Also Read: PaxForex Review 2024 – Expert Trader Insights

FXDD Review: FAQs

What trading platforms does FXDD offer?

FXDD provides access to MetaTrader 4, MetaTrader 5, and their proprietary WebTrader platform. These platforms are known for their user-friendly interfaces and advanced trading tools.

Are there any withdrawal fees with FXDD?

Yes, FXDD charges fees for withdrawals. You get one free withdrawal per month, but subsequent withdrawals incur a $40 fee. Additional fees apply for withdrawals below $100.

Is FXDD regulated?

Yes, FXDD is regulated by multiple financial authorities, including the Malta Financial Services Authority (MFSA) and the Financial Services Commission (FSC) in Mauritius. This regulatory oversight helps ensure a secure trading environment.

OPEN AN ACCOUNT NOW WITH FXDD AND GET YOUR BONUS