FXCM Review

Analyzing different brokers and choosing the one that best suits your trading style and requirements can be a difficult task, due to the many aspects and numbers that must be considered. In this FXCM review, we will examine the various features and offerings of the broker, including its trading station, account types, trading conditions, customer service, and more, to help you evaluate this broker.

Finally, at the end of this FXCM review, we will determine if the broker meets our strict evaluation criteria and whether it would be a great broker to begin your trading career with.

What is FXCM?

FXCM is a leading online forex and CFD trading broker that provides individuals with access to a wide range of financial instruments. Founded in 1999, the company aims to democratize forex trading by offering individuals easy access to the global currency markets.

Over the years, FXCM has grown to become a trusted and reputable broker with a global presence. It serves traders from over 150 countries and is regulated by reputable financial authorities in different jurisdictions. This ensures the safety and security of clients' funds and the integrity of its services.

FXCM's objective as a company is to provide traders with a user-friendly and reliable trading platform that offers competitive pricing, flexible trading options, and advanced trading tools. The broker is committed to providing traders with the education and resources they need to make informed trading decisions, regardless of their level of experience.

The FXCM group has also received numerous global forex awards and recognition for its services, including being named Best Retail FX Provider by FX Week and Best Forex Trading Platform at the UK Forex Awards. With its strong reputation in the industry and commitment to providing a safe and reliable trading environment, FXCM is a great choice for traders of all levels.

With a focus on transparency, innovation, and customer satisfaction, FXCM has become one of the most popular online forex trading platforms worldwide.

Advantages and Disadvantages of Trading with FXCM?

Benefits of Trading with FXCM

FXCM group is a leading forex and CFD broker that offers traders a range of benefits. One of the main advantages of trading with FXCM is its regulation by reputable financial authorities in different jurisdictions, which ensures the safety of clients' funds and the integrity of its services. This level of regulation provides traders with the peace of mind that they are trading with a trustworthy and reliable broker.

In addition to its regulation, FXCM offers a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies, allowing traders to diversify their portfolios. The broker also provides competitive spreads and low commissions, with no hidden fees and flexible leverage options, advanced trading softwares and trading tools.

Moreover, FXCM allows traders to access educational resources and research tools to help them make informed trading decisions and to improve their trading strategies by teaching them how complex instruments work and how to use technical indicators.

Another benefit offered by FXCM is the 24/5 client service via phone, email, and live chat, ensuring that traders can get the help they need whenever they need it.

FXCM Pros and Cons

Pros:

- Demo accounts

- Reputable and reliable regulators

- Low deposit requirements

- Online trading courses

Cons:

- High commission fees for bank wire withdrawals

- No bonuses or incentives offered to clients

FXCM Customer Reviews

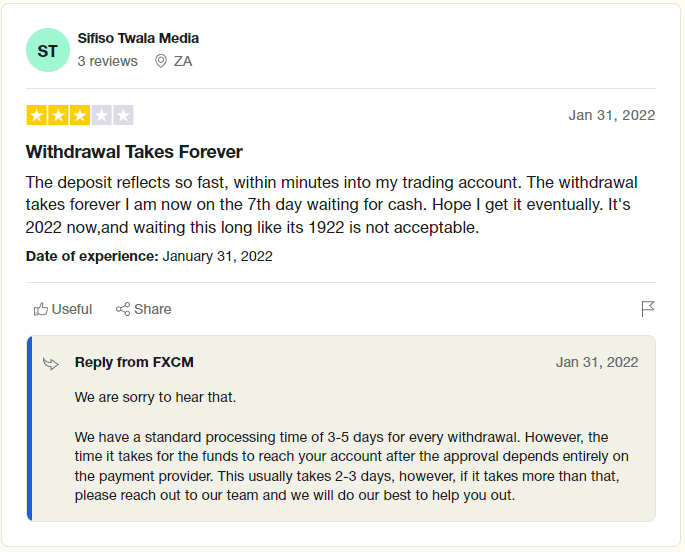

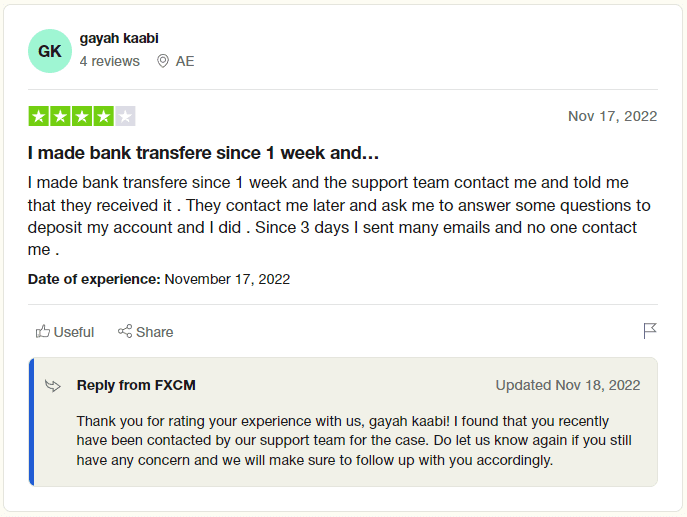

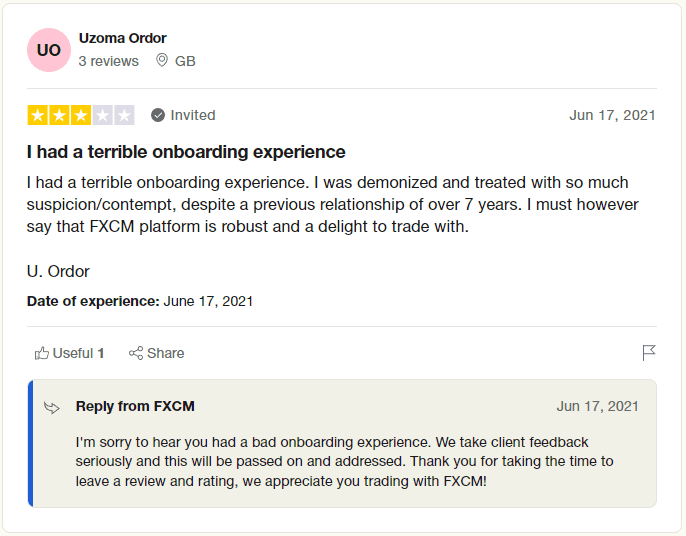

Customer reviews of FXCM are mixed, with both positive and negative aspects of the broker highlighted. However, overall, they can be considered “sufficient” as they are mostly above 3 out of 5.

Some clients highlight the positive aspects of the broker, stating that the trading station is “robust and a delight to trade with”, while others praise the speed at which funds are deposited into trading accounts.

On the other hand, some traders have reported that the withdrawal process often takes more than one week to be completed. FXCM has responded to this critique by explaining that the delays are often caused by the payment provider, and they have stated that if the delays persist, they will do their best to resolve the situation.

FXCM Spreads, Fees, and Commissions

FXCM offers competitive spreads, commissions, and fees for its trading services. The broker provides traders with different account types, each with varying trading conditions, including spreads, commissions, and deposit requirements.

For instance, the Mini account offers spreads starting from 1.3 pips for major currency pairs, while the Standard account provides traders with tighter spreads starting from 0.4 pips for the EUR/USD pair. The Active Trader account, on the other hand, offers even tighter spreads, starting from 0.2 pips for the same currency pair.

Although the minimum spread is competitive and comparable with the market standard, FXCM requires a minimum spread value of $12 for the Standard account, and a minimum of $2 for the Active Trader account. Additionally, FXCM fees have an average value of $7.5, which is considered “high” compared to the average market value of around $3.

In addition to spreads and commissions, FXCM does not charge any hidden fees, making it transparent and easy for traders to understand the costs of their trades.

Account Types

FXCM offers three types of accounts: Mini, Standard, and Active Trader. Each type of account offers different features and trading conditions to suit the needs of traders with different levels of experience and trading styles.

The Mini account is a trading account designed for beginners or those who prefer to trade with smaller volumes. This FXCM account requires a minimum deposit of $50 and provides access to a range of trading instruments, including forex, commodities, and indices. Compared to the other account types, the Mini account has wider spreads starting at 1.4 pips, but it does not charge any commissions.

The Standard account is the most popular account type and is suitable for advanced traders with some trading experience. This account requires a deposit of $250 and offers tighter spreads compared to the Mini account, starting from 0.4 pips for major currency pairs. The Standard account charges a commission of $0.04 per 1K lot traded.

The Active Trader account is designed for professional traders who require tighter spreads, lower commissions, and prefer to trade with higher volumes. This account requires a minimum deposit of $25,000 and offers the tightest spreads starting from 0.2 pips. The Active Trader account charges a commission of $1.50 per 1K lot traded.

It is important to know that all account types share a minimum lot size of 0.01 and leverage that can vary from 1:1 to 1:400, and all accounts have the same access to the same trading tools.

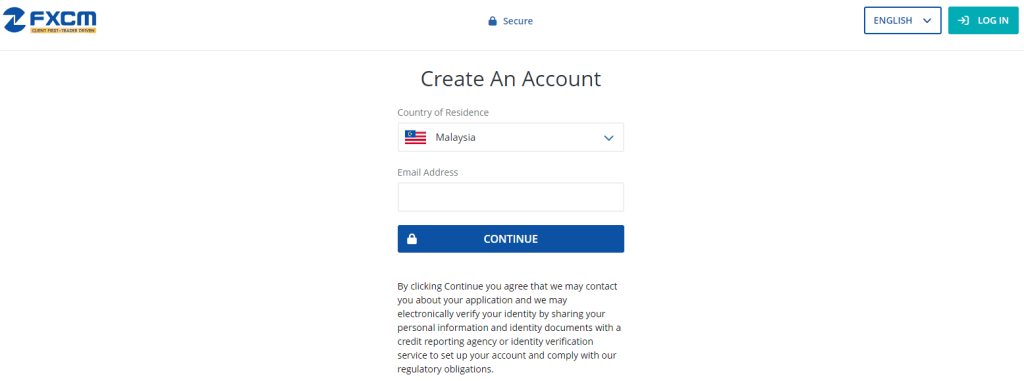

How To Open Your Account?

Opening a trading account with FXCM is a straightforward process that can be completed online in a few simple steps.

First, visit the FXCM website and click on the “Open an Account” button. You will then be directed to a page where you can choose the type of account you would like to open, such as a Mini, Standard, or Active Trader account.

Next, you will need to fill out a registration form with your personal information, such as your name, email address, and phone number. You will also need to provide some additional information, such as your country of residence, date of birth, and employment status.

After completing the registration form, you will be asked to provide some additional documentation to verify your identity and address. This may include a copy of your passport or national ID card, as well as a recent utility bill or bank statement.

Once your trading account has been verified and approved, you can fund your account using one of the available payment methods, such as credit/debit card, bank wire transfer, or e-wallets. FXCM offers a range of funding options to suit your needs.

After funding your account, you can start trading on the platform using the trading platform of your choice.

What Can You Trade on FXCM

FXCM focuses mainly on forex and CFDs trading, but it also offers a wide range of other financial instruments to trade on its trading station platforms, including commodities, indices, and cryptocurrencies.

Forex: FXCM provides access to over 39 currency pairs, including major currency pairs in the forex market, such as EUR/USD and others.

Commodities: Traders can also trade commodities such as gold, silver, crude oil, and natural gas on FXCM's platform.

Indices: FXCM permits CFD trading on major indices such as the S&P 500, Nasdaq 100, Dow Jones Industrial Average, FTSE 100, DAX 30, and Nikkei 225.

Cryptocurrencies: FXCM allows traders to trade CFDs on cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and Ripple.

In addition to these financial instruments, FXCM also offers a range of other trading products, but it is important to know that cryptocurrency trading is not available to UK retail clients. Additionally, as opposed to other brokers, FXCM does not have the possibility to buy and sell ETFs.

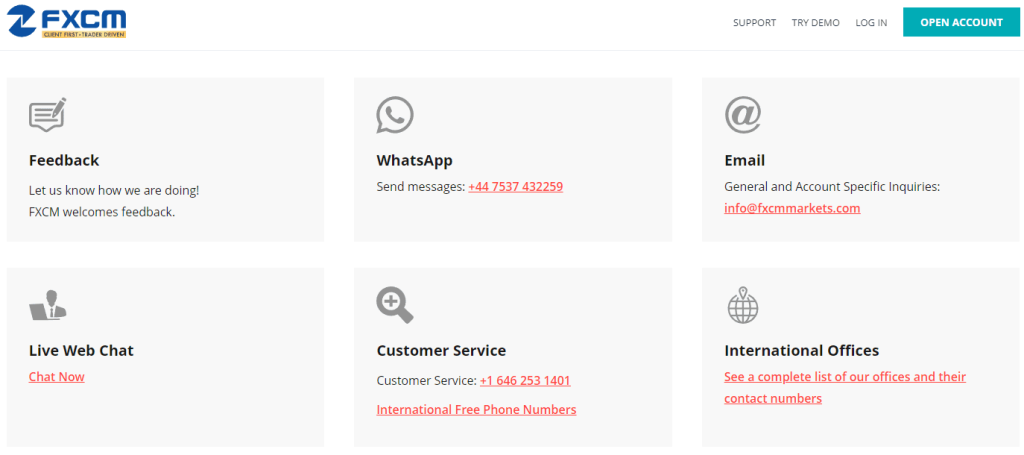

FXCM Customer Support

FXCM offers a variety of client service options to assist traders with their trading needs. Traders can contact the broker's support team via phone or email. FXCM also provides localized support in multiple languages, including English, Spanish, German, French, Italian, and Arabic.

Moreover, FXCM's customer service is available 24/5, but if you prefer to resolve issues on your own, the broker also provides a comprehensive FAQ that can be used to troubleshoot and find answers to your questions.

However, FXCM does not offer an online chat for swift problem resolution, and other methods of contacting client support could take up to a couple of business days.

Advantages and Disadvantages of FXCM Customer Support

Security for Investors

Withdrawal Options and Fees

FXCM provides its clients with multiple withdrawal options to choose from. These include bank wire transfer, credit/debit card, and e-wallets such as Neteller and Skrill. The fees and processing times for each withdrawal method may vary depending on the client's location and the amount being withdrawn.

- Bank Wire Transfer: FXCM charges a $40 fee for withdrawals via bank wire transfer, and it could take up to 5 business days to be deposited in your bank account.

- Credit/Debit Card: FXCM does not charge any fees for withdrawals via credit/debit card, and they are usually processed within 1-2 business days. However, clients may incur fees from their card issuer for processing the transaction.

- E-wallets: FXCM does not charge any fees for withdrawals via e-wallets and they are usually processed within 1-2 business days. However, clients may incur fees from the e-wallet provider for processing the transaction.

It's important to note that some withdrawal methods may have minimum and maximum withdrawal limits, which traders should be aware of before requesting a withdrawal.

Additionally, FXCM does not charge deposit fees for most funding methods. However, some payment providers may charge their own fees for depositing funds, so it is recommended to check with the provider for any additional fees before making a deposit.

FXCM Vs Other Brokers

#1. FXCM vs Avatrade

Both FXCM and AvaTrade are reputable brokers that offer a range of trading platforms, including their proprietary platforms, and instruments for traders. While FXCM may have lower fees and spreads for forex trading, AvaTrade has a wider range of trading instruments available.

Ultimately, the choice between the two brokers will depend on the individual trader's needs and preferences. FXCM could be a better fit for beginner traders, whereas AvaTrade could be more suitable for active traders with years of experience and a larger portfolio, looking to trade a variety of financial instruments and to use advanced trading strategies and tools.

#2. FXCM vs Roboforex

Both FXCM and Roboforex offer proprietary trading platforms, as well as other trading platforms for traders to choose from. The main difference between the two brokers is that Roboforex offers more account types to better suit different trading styles. Additionally, while Roboforex does not offer cryptocurrency trading, they outperform FXCM in most trading aspects, except for crypto trading.

#3. FXCM vs Alpari

There are no significant differences between the trading platforms offered by both brokers, but FXCM provides many more financial instruments for trading. In addition, Alpari only offers Neteller and credit card options as withdrawal methods, while FXCM also offers bank wires and Skrill.

However, Alpari offers a minimum deposit of $1 and a maximum leverage of 1:1000, which is significantly more than the 1:400 leverage offered by FXCM. In conclusion, FXCM can be considered a slightly better option than Alpari due to the availability of more financial instruments and more methods to withdraw money, even if FXCM has more restrictive leverage options.

Conclusion: FXCM Review

In conclusion, FXCM is a transparent forex broker that provides traders with a wide range of financial instruments and trading platforms to choose from. With over 20 years of experience in the industry, FXCM broker has built a solid reputation for its reliability, transparency, and competitive pricing.

FXCM's client service team is knowledgeable and responsive, and the broker provides a range of educational resources and tools to help traders improve their trading strategy and knowledge. The broker's user-friendly platform and low deposit requirements make it accessible to traders of all levels of experience, from beginners to professional traders.

Overall, FXCM is a good choice for traders who are looking for a reliable and trustworthy broker with competitive pricing and comprehensive support. The broker's focus on transparency and regulation ensures that traders can trade with confidence, knowing that their funds are secure and their trades are executed fairly.

FXCM Review FAQs

Is FXCM regulated?

FXCM is regulated by various financial authorities in different jurisdictions. In the UK, it is regulated by the Financial Conduct Authority (FCA) and is also a member of the Financial Services Compensation Scheme (FSCS). In the US, it is regulated by the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC).

The Australian Securities and Investments Commission (ASIC) and the Financial Services Authority of Japan (JFSA) also regulate it. These regulations help to ensure the safety of clients' funds, as well as the integrity of the services offered by FXCM.

What is FXCM minimum deposit?

FXCM's minimum deposit varies depending on the type of account you choose to open. Here are the deposit requirements for each account type:

- Mini Account: The deposit requirement for a Mini Account is $50.

- Standard Account: The deposit requirement for a Standard Account is $250.

- Active Trader Account: The deposit requirement for FXCM's Active Trader Account is $25,000.

How long does FXCM withdrawal take?

The processing time for a withdrawal request on FXCM may vary depending on the withdrawal method and the client's location. Here are some estimated processing times for each withdrawal method:

- Credit/Debit Card: Withdrawals to a credit/debit card typically take 1-2 business days to process. However, it may take up to 5 business days for the funds to reflect in the client's account.

- Bank Wire Transfer: Withdrawals via bank wire transfer can take 1-5 business days to process, depending on the client's bank and location.

- E-wallets: Withdrawals to e-wallets such as Neteller or Skrill are usually processed within 1-2 business days.