Position in Rating | Overall Rating | Trading Terminals |

248th  | 2.0 Overall Rating |  |

FXCess Review

Forex brokers are a necessity when one wants to venture into forex trading and trade currencies worldwide. They act as bridges between the traders and financial markets, providing the necessary tools and platforms for the trade to be executed. Unfortunately, not all brokers are of the same quality, so the wrong choice can imply unnecessary risks, increased cost, or limited trading capabilities.

The right Forex broker can make all the difference in your trading experience and success. The best brokers provide a reliable platform, competitive fees, and excellent customer support. That is why doing your research is crucial before committing to one.

FXCess stands above the rest in a crowded Forex market by offering flexible account options, streamlined deposit and withdrawal processes, and a completely transparent commission structure. Whether it is a novice or professional trader, FXCess is designed to suit the many needs of its trading force.

In this review, you’ll get a clear breakdown of FXCess, including its strengths and weaknesses. From expert views to actual trader experience, this review equips you with all the information necessary for making that final call-whether FXCess will be your Forex broker of choice or not.

What is FXCess?

FXCess is a global forex and CFD trading broker that offers the most extensive list of trading instruments, including currencies, commodities, indices, and shares. It uses the well-known MetaTrader 4 (MT4) platform, which is famous for its user-friendly interface, advanced charting tools, and automated trading capabilities. This makes it suitable for both beginners who look for simplicity and more experienced traders who rely on advanced tools.

The company also avails the different needs through flexible trading accounts into it, which are both in types of Classic and ECN, while the competitive spread provided, the execution rate on fast, and using maximum leverage of 1: 500 enables one to market exposure. It accommodates multiple payment options toward expediting deposit and withdrawing techniques. The FXCess provides a secure trade.

Security is given at the forefront of FXCess, holding client funds separately to safeguard them. A strict adherence to rules for the betterment of clients and for transparency purposes. This enables the broker to instill confidence among its users. Reliable trading environment along with a dedicated support desk puts it in competition in the trading world.

FXCess Regulation and Safety

FXCess is regulated by the Financial Services Authority in Seychelles and the Financial Services Commission in the British Virgin Islands. These regulatory authorities ensure that FXCess operates according to certain standards, thereby providing a level of oversight over its activities.

While the FSA and FSC can offer regulatory coverage, as offshore authorities, they often do not provide the same measure of investor protection that better-regulated authorities such as FCA or SEC may guarantee. Traders need to carefully weigh these factors, do their due diligence on the broker, and select a broker that aligns with their safety and compliance expectations.

FXCess Pros and Cons

Pros

- Diverse instruments

- Competitive spreads

- High leverage

- MT4 support

Cons

- High deposits

- Limited regulation

- No access

- Withdrawal delays

Benefits of Trading with FXCess

Trading with FXCess holds several advantages for both first-time and professional traders. The broker gives access to more than 300 financial instruments across six asset classes-forex, metals, stocks, futures, indices, and commodities-for diversified portfolios and trading strategies. To professional traders, FXCess also offers sophisticated solutions and service for professional customers.

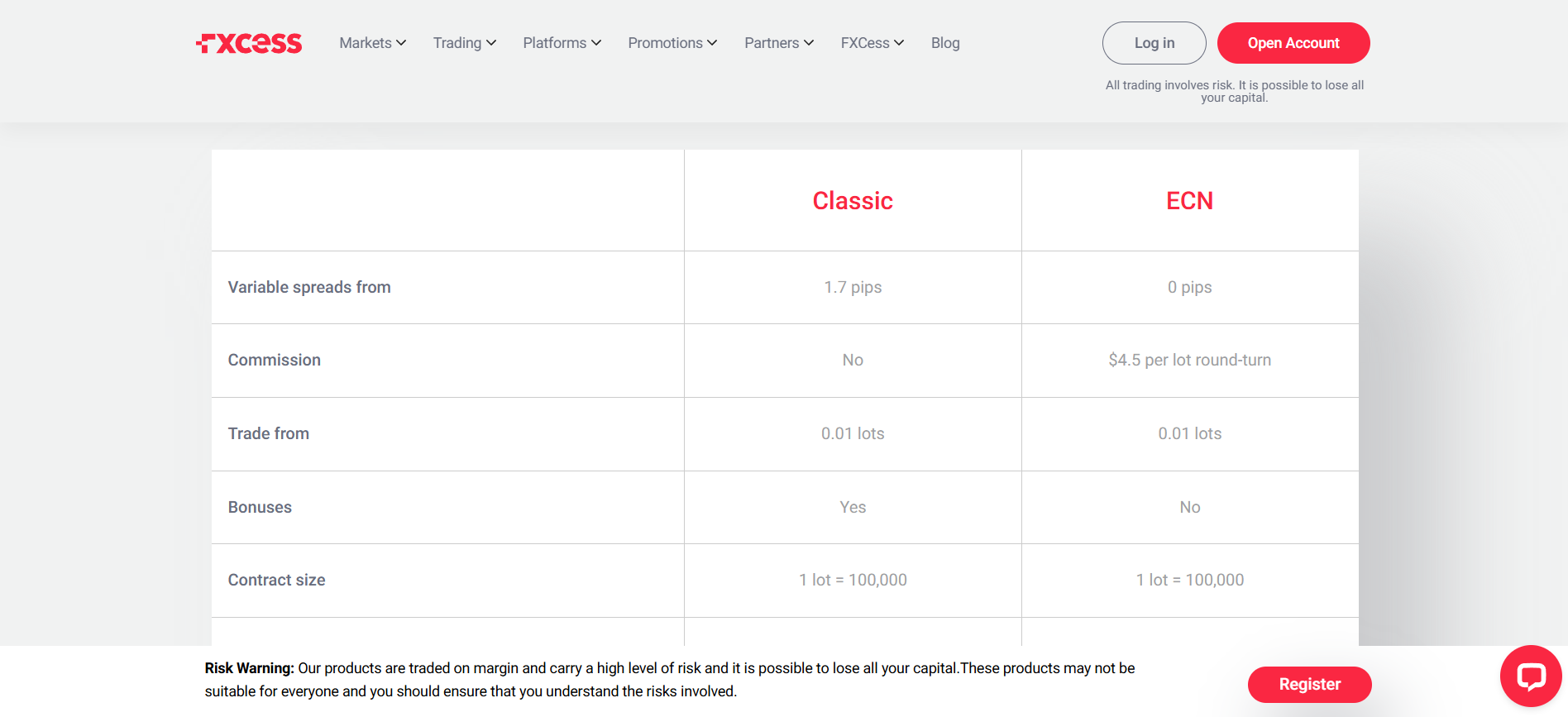

FXCess utilizes the widely known MetaTrader 4 (MT4) platform, which is well-known for its user-friendly interface and comprehensive analytical tools, thus making trading experiences smooth. The broker offers two trading accounts: the Classic account with zero commissions and variable spreads from 1.7 pips, and the ECN account featuring spreads from 0 pips with a low commission of $4.5 per lot round-turn, catering to different trading preferences.

FXCess also offers high leverage options with up to 1:1000 for Classic accounts and up to 1:500 for ECN accounts, thus enabling traders to gain maximum exposure to the markets. The broker ensures rapid and secure transactions through numerous deposit and withdrawal methods; most transactions are processed instantaneously, which increases the efficiency of trading.

FXCess offers a variety of bonuses, including a Credit Bonus up to $5,000, a Power Bonus up to $4,000, and an unlimited Sharing Bonus, giving traders extra value. With multilingual customer support available 24/5, FXCess is committed to helping traders throughout their trading journey, ensuring a supportive trading environment.

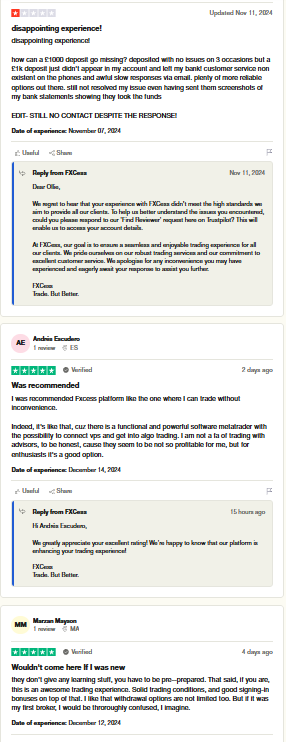

FXCess Customer Reviews

User comments were mixed, with negative reports about customer support and a questionable reliability of the company to deliver safe trading while still being positive about platform features. One user claimed some deposits went missing, despite the proof given by means of bank statements. A person expressed frustration at getting no response from FXCess customer service, and doubted the dependability of their trading for secure purposes.

However, other traders reported positive experiences, mainly concerning the smooth functionality of the platform. Users noted that MetaTrader is very easy to use, with seamless trade execution and support for algorithmic trading. Some mentioned that there are no hidden fees and account setups are simple, which makes FXCess a good choice for prepared traders. It is not suitable for everyone, but the platform is known for its efficiency and reliable tools for trading.

FXCess Spreads, Fees, and Commissions

FXCess provides competitive spreads and has options to make it relatively easy to trade even for new or small levels of traders. The Raw accounts on majors can have starting as low as 0.1 pips on spread; Standard accounts carry higher spreads without charging for commissions. Such an option keeps allowing the option depending upon trading volume or strategies taken by the clients.

When it comes to fees, FXCess makes it pretty simple. Commission accounts are free, and for Raw accounts, they will be charged $3.50 per lot per side. This fee is beneficial for traders who like having low spreads but do pay a small commission. Such transparent pricing allows the cost of the user to be controlled.

FXCess offers tight spreads combined with reasonable commissions to satisfy the needs of both beginner and experienced traders. The flexibility in choosing between Raw and Standard accounts makes it easier for traders to align their costs with their trading goals.

Account Types

Classic Account

The Classic Account suits a new trader looking for something simple with a spread from 1.7 pips. It comes without commission fees, but allows trading from a volume of 0.01 lots, which suits even a beginner. One requires just $10 deposit for the account and its maximum leverage is 1:1000, that suits someone with flexibility and with price affording.

ECN Account

The ECN Account is best suited for advanced traders who require low spreads and direct market access. It has spreads from 0 pips with a $4.5 commission per round-turn lot. The account supports small trade sizes from 0.01 lots, and the minimum deposit is $10 with leverage up to 1:500.

Both FXCess accounts provide 24/5 dedicated account manager support and support multiple base currencies, including USD, EUR, GBP, JPY, and NGN. A trader can choose either based on experience level and goals for trading.

How to Open Your Account

Step 1: Open an Account

Open the FXCess website and click on “Open Account.” Fill in your contact details, including your email, phone number, and country of residence. Create a secure password to proceed.

Step 2: Fill in Trading Details

Select the MT4 platform and your account type. You can choose between a Classic account with zero commission and an ECN account with zero spread. You can also set your base currency (for example, USD) and leverage. Then, you can choose to add a deposit bonus.

Step 3: Personal Details

Fill in your nationality, first name, and last name. Double-check your information for accuracy before proceeding.

Step 4: Investor Declaration

Confirm if you are a U.S. citizen. Accept the terms and conditions by checking the consent box.

Step 5: Open Your Account

Click on the “Open Account” button to complete your registration. Your account will be ready to start trading in minutes.

FXCess Trading Platforms

FXCess also provides seamless trading experience by using a very popular MetaTrader 4 trading platform with an intuitive interface and state-of-the-art features. Its real-time market data and customizable charts provide it as an excellent platform for any type of trader, whether beginners or professional ones. It supports both desktop and mobile and can be accessed from the web.

With FXCess, users enjoy execution speeds and reliable trading facilities to enable accurate analysis and then decision-making. The firm allows for a wide portfolio of instruments, including currency, indices, and commodities to provide the user with a much wider trading portfolio. Using automated trading through Expert Advisors or EAs in MT4 means that traders can execute trades automatically without having to manually monitor the process.

What Can You Trade on FXCess

Forex

Trade popular forex pairs through FXCess and enjoy tight spreads. The platform gives you the best chances to trade major, minor, and exotic currencies.

Metals

FXCess offers you gold and silver trading through CFDs, where you can buy or sell long and short positions. These commodities make it possible for traders to diversify their portfolios and hedge against market volatility.

Indices

Trade leading indices, including UK 100, Wall Street, and Germany 30 with FXCess. You will have an opportunity to trade the entire performance of a market rather than targeting specific shares.

Commodities

Look for trading opportunities in Brent Crude, Coffee, and Sugar through FXCess. Commodities are suited to portfolio diversification, helping you profit from changes in global demand.

Futures

Trade over 50 futures, including US500, USOIL, NATGas, and Coffee. Futures trading on FXCess gives easy access to global markets along with sustainable strategies.

Equities

FXCess enables you to trade major company shares like Apple, Microsoft, and Google. This allows you to make profits from the movement in stock prices without owning them outright.

FXCess Customer Support

FXCess offers reliable customer support to answer any trading inquiries or technical issues. Users can fill in the Contact Us form provided on their website by filling in essential details such as full name, email, and message. Attachments are supported, with a file size limit of 8 MB.

For faster resolutions, FXCess offers a multilingual live chat available 24/5. Traders can also refer to their FAQ section for common questions or reach out to the support team for trading guidance and account-related queries. FXCess ensures smooth assistance to keep traders on track. FXCess also offers informative trading articles to increase the knowledge and skills of traders, which helps build credibility and attracts a diverse audience.

Advantages and Disadvantages of FXCess Customer Support

Withdrawal Options and Fees

FXCess offers several withdrawal options for the convenience of traders, including Visa/Mastercard and Wire Transfers. Withdrawals made through Visa and Mastercard usually happen instantly, giving users access to their money with a very short turnaround. On the other hand, Wire transfers take around 2-5 working days depending on the bank or location.

While FXCess doesn’t specify withdrawal fees on their website, third-party charges may depend on the bank or payment provider used by the trader. Thus, traders should check whether a third-party fee will apply to avoid any surprises when withdrawing. FXCess ensures transparency in processing making withdrawals straightforward and reliable for its users.

FXCess Vs Other Brokers

#1. FXCess vs XM

FXCess and XM are aimed to satisfy different trader needs: one of them, FXCess, focuses on the conditions for flexible trading and the user-friendly interface, while being good for a beginner. On the other hand, XM attracts customers by offering a large list of trading instruments, tight spreads, and robust education that suits every level of experience. Even though FXCess has competitive leverage and easy account options, XM is stronger in terms of global presence, reliability, and better customer support. Both platforms excel in terms of execution speed, but XM is ahead with free webinars and research tools.

Verdict: XM is the better choice for traders who need comprehensive resources and a wider trading portfolio, while FXCess appeals to beginners looking for straightforward and accessible trading conditions.

#2. FXCess vs RoboForex

FXCess and RoboForex are both designed to satisfy different trading needs with strengths in various areas. FXCess emphasizes simplicity, as it offers beginner-friendly platforms and simple account options, thus being the best for a new trader. On the other hand, RoboForex stands out with more trading instruments, advanced tools, and automated trading features that attract experienced traders who want diversity and flexibility. While FXCess gives priority to user-friendly access, RoboForex stands out with technical capabilities and customization, which makes it the best for professional investors.

Verdict: For beginners, looking to trade with ease, FXCess is more user-friendly for such individuals. The professional will need RoboForex, with a broader flexibility in tools.

#3. FXCess vs Exness

FXCess and Exness are two services that will cater to different needs. Exness is ideal for active and experienced traders because it has global presence, low spreads, and high leverage along with quick execution speeds. FXCess, meanwhile, concentrates on user-friendly trading by offering straight account types with competitive conditions, which appeals more to a beginner and an intermediate user. Although both platforms give access to major trading instruments, Exness takes the lead with advanced tools, tighter spreads, and regulatory trust, while FXCess emphasizes simplicity and accessibility.

Verdict: Experienced traders looking for tighter spreads and advanced features would find Exness better. FXCess remains a good option for people who prefer simplicity and ease of use.

Also Read: XM Review 2024 – Expert Trader Insights

Conclusion: FXCess Review

FXCess is a highly competitive option for traders to get simplicity, flexibility along with access to multiple classes of assets. It possesses a user-friendly MetaTrader 4 platform, adaptable account options, and competitive spreads as well, making it perfect both for beginners and experienced traders alike. With high leverage and transparent fees, FXCess ensures a well-rounded trading experience. However, limited regulation and often customer support concerns are other drawbacks.

Despite these limitations, what stands out about FXCess is its efficient trading environment, transactions are fast, and value-added bonuses that provide excellent value for its users. Essential tools and reliable support make FXCess appealing to traders who look forward to a straightforward and approachable Forex broker.

Also Read: BelleoFX Review 2025 – Expert Trader Insights

FXCess Review: FAQs

Is FXCess regulated?

Yes, FXCess is regulated by the FSA in Seychelles and the FSC in the British Virgin Islands.

What trading platforms does FXCess offer?

FXCess uses the popular MetaTrader 4 platform, available on desktop, mobile, and web.

What account types does FXCess offer?

FXCess provides Classic and ECN accounts, each designed to cater to different trading needs.

OPEN AN ACCOUNT NOW WITH FXCESS AND GET YOUR BONUS