FXCC Review

In the financial markets, there is always commotion in the prices of the underlying assets. This commotion can lead to either disastrous losses for some or tremendous opportunities for others. However, traders and investors can only save themselves from losses or earn maximum profits if they find the right online brokerage firm that would comply with their trading needs. In this regard, FXCC is one online broker that can save the day for traders and investors.

FXCC is an online trading platform, among many other brokers, that serves a good possible trading features and services for traders, investors, and financial institutions worldwide. Mostly FXCC deals with ECN and STP trading account for their customers and provides the trading conditions to get the maximum capital returns from the investments.

This FXCC review seeks to provide all the necessary information that a trader, investor, or financial institution would look for before investing in any underlying asset with this trader. After reading this review, you will be able to make an informed decision about whether or not FXCC is the right option as a trading partner to achieve its financial goals.

What is FXCC?

FXCC is an online brokerage firm that provides trading services to traders, investors, and financial corporations globally. FXCC was established in the year 2010 and has been regulated by the Cyprus Securities and Exchange Commission (CySEC) and registered by the Financial Services Authority (SVG FSA). However, FXCC is not a member of any financial commitment, which limits its overall credibility for the users.

FXCC offers multiple investment choices in various asset classes, including ECN/STP forex trading, Commodities, Indices, and Cryptocurrencies. However, the selection of trading accounts is very limited on the FXCC platform. There are only two account options, out of which one, the corporate account, is intended specifically for financial institutions.

Other than this, FXCC claims to provide the best forex trading account with fast executions, narrowest spreads, high leverage, and a commission-free trading environment. With all these facilities, it is worth noting that FXCC is also devoid of many trading features that are essential for the trading needs of different individuals, such as the latest and most advanced trading platforms, availability to fundamental analysis and research, and most importantly, useful trading tools for the customers.

Advantages and Disadvantages of Trading with FXCC

Benefits of Trading with FXCC

FXCC is a trading platform that provides multiple benefits to its customers. Even when this brokerage firm offers multiple investment options to traders, investors, and corporate firms, FXCC specifically ensures to provide the best ECN forex trading accounts. Therefore, we can say that FXCC is amongst the best online brokers in trading forex.

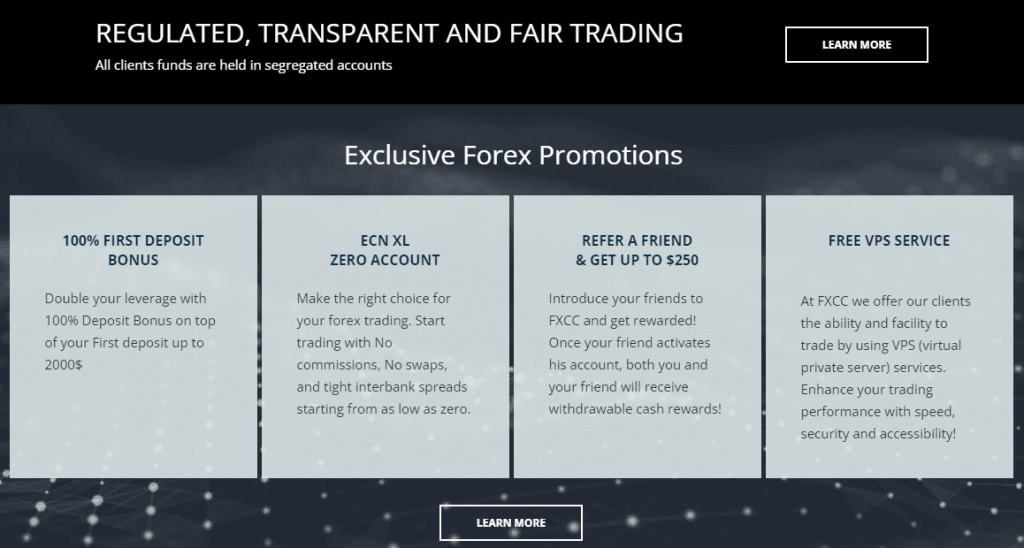

As for trading forex successfully, certain trading conditions are required by the brokerage firm, and all these features are offered on the FXCC platform. Firstly, this broker offers only two account types and one of them is the ECN XL account which includes tight spreads from 0.0 pips, fast order executions, and high leverage of 1:500. Hence, FXCC has all the right ingredients for successful and profitable forex trading.

Another advantage of FXCC is that this trading platform is very cost-effective for the users. As there are initial deposit requirements by the firm, even new and under-budget traders are encouraged to participate in the trading activity. Moreover, with zero commission rate, negative balance protection, and no deposit fee, FXCC helps in cutting down the trading costs for traders, investor as well as financial institutions.

There are also multiple other trading features of FXCC that make trading beneficial and profitable for the clients. These features include trading without requotes, expert advisors, fundamental and technical analysis, useful tools such as analytical indicators and trading charts, and, most importantly, effective customer support services.

FXCC Pros and Cons

PROS

- High Leverage

- No minimum deposit

- No deposit fees

- 100% Deposit bonus

CONS

- Limited trading tools

- Absence of dealing desks

Analysis of the Main Features of FXCC

2.7 Overall Rating |

2.7 Execution of Orders |

2.8 Investment Instruments |

2.5 Withdrawal Speed |

3.0 Customer Support |

2.6 Variety of Instruments |

2.6 Trading Platform |

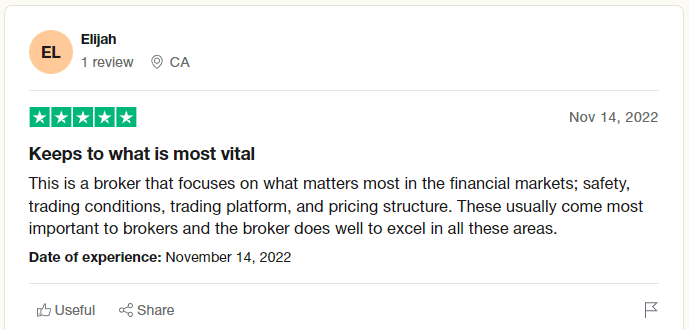

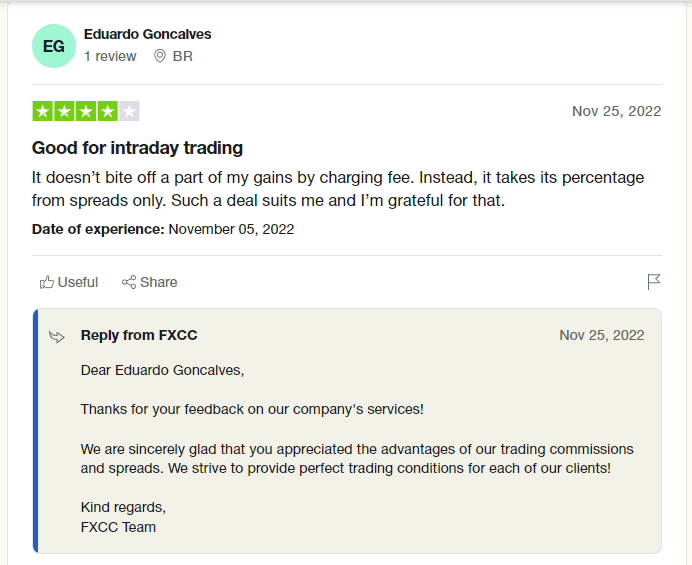

FXCC Customer Reviews

The reviews and feedback of the FXCC customers provide the best analysis of this brokerage firm. As customers are unbiased and do not have any conflicts of interest, they provide accurate details regarding the broker so that we can see a clear image.

The customer reviews we observed were mostly positive, with some negative comments about the withdrawal method and payment options of the FXCC trading firm. Customers are mostly concerned about the cash-out procedures as this is where the firm’s real identity is revealed. However, the flaws highlighted by the customers were regarding the high withdrawal fees and limited payment options.

On the positive side, the customers appeared to be pleased with the broker and its services. Some appreciated the tight spreads and pricing structure whereas others admired the commission-free system without any trading manipulations. All in all, customers gave clearance to FXCC as a reliable forex broker.

FXCC Spreads, Fees, and Commissions

FXCC offers tight spreads on its ECN XL trading account and claims to provide floating 0.0 pips to its trading clients. As success in forex trading solely depends on getting the narrowest spreads, FXCC provides ECN/STP forex accounts where there are no chances of manipulation or variance. This is so because, through the automated trading system, all client orders are directly processed to the financial institutions without interference from the dealing desk broker.

FXCC has a low-cost trading policy, and for this reason, there are no trading commissions on any trading instruments. Not just this, but there is also a no minimum deposit requirement by this brokerage firm which all the other trading firms often apply. Similarly, there are also zero deposit fees which help in cutting down trading costs.

Besides these fees, the FXCC website does not provide any information regarding any additional fees or hidden costs charged to the trader while trading on the platform. Moreover, the FXCC offers a discount of 100% refund as a first deposit bonus. So traders who deposit the first amount on the ECN XL account can claim a deposit bonus of up to $ 2000.

Account Types

#1. ECN XL account

The ECN XL account is a free funding trading account with the specifications of a fully automated forex account. This account allows traders and investors to trade at 1:500 maximum leverage with the fastest market executions on 0.1 pip spreads.

#2. Corporate account

The corporate account is specifically intended for big financial institutions, banks, and other corporate organizations at the FXCC trading platform. As financial experts and advisors handle the corporate account for the corporations, clients can earn massive profits through sizeable investments.

#3. Islamic account

Users on the FXCC platform can also open an Islamic account with swap-free trading. The traders opening this account will have the same trading facility of no minimum deposit, high leverage, and tight pips as all other account types without additional cost.

#4. Demo account

The FXCC trading platform also provides the facility of a free demo account for traders and investors so that they can run a test trading account. Since all the features of a demo account are similar to a live trading account, it is very useful for any trader to explore that platform and then go for opening a trading account.

How To Open Your Account?

To open an account on the FXCC platform, users must open the official website of the trading platform. The users, at this point, can also surf through the website to inquire about any first-hand information that is looking for. Next, the user will have to click on the “Open account now” or” Register” at the upper right corner of the landing page.

After clicking on this tab, the website will be redirected to the registration page, where the user can see a registration form. The form will have to fill in all the accurate personal information of the user, including a First name, last name, and email, and choose a password. After filling out the form, the user will have to click on the “register” or “open account” button.

At this point, the user will be sent a verification link to the provided email address. Furthermore, the user will be led to another page where the process of opening an account starts. The user will be asked to fill in more information on the open account page, such as the account specifications that the user wants to open: an ECN xl account or a demo account.

After choosing the platform, leverage, and currency from the given options, the user will have to click on the “open account” button. This was the final step, after which is user account would be activated, and their login details would be shared so that they could start trading as soon as they want.

One thing to keep note of is that users can open a demo account and choose the demo account option on the “open an account” page. The users can immediately shift from a demo account to a live trading account after paying the initial deposit amount.

What Can You Trade on FXCC?

There are multiple investment options to choose from when it comes to trading on the FXCC platform ranging from forex, indices, commodities, and cryptocurrencies. Forex, traders have the advantage of opening an ECN account where traders can trade more than 70 major, minor and exotic currency pairs.

Moreover, along with the ECN account, the traders also have the benefit of having the highest spreads starting from 0.1 pips and fast order execution. Hence, FXCC provides all the right conditions for profitable forex trading.

If the traders and investors are not interested in the forex market, then they can also choose from trading stocks and indices with competitive executions and combative prices. The same is the case with commodities including metals where traders can opt for gold, silver, or precious stones and make profits using effective trading strategies.

Similarly, traders and investors who are passionate for digital currencies can also trade in cryptocurrencies with most of the major currency pairs at tight spreads and fast market executions.

All in all, there are plenty of investment options for the customers of FXCC to choose from. However, if we compare the trading instruments with the top brokerage platforms, FXCC surely has a limited selection of asset classes for traders, investors, and financial institutions.

FXCC Customer Support

The customer support system for any online brokerage is crucial as it is the only way for the customers to stay connected with the broker. Moreover, whenever a customer faces any technical issues, has questions, or needs advice, it is the customer support department that deals with all these problems for the clients. Therefore, a prompt and easily accessible customer support system is of utmost importance.

In this regard, FXCC customer support has multiple communication options for the customers to stay connected with the firm. This includes phone, fax, live chat box, and a query box on the firm’s website. Moreover, FXCC also claims to provide 24 support, five days a week, with multilingual assistance for the customers. Since FXCC has clients from different parts of the world, the support in multiple languages is a big plus.

With all the advantages mentioned above, a few flaws are visible in the FXCC support system. Firstly, since the forex market is operational 7 days a week, the unavailability of customer service on the weekends can be a hassle for traders.

Secondly, there are no social messaging options available to communicate with the customer service staff, such as WhatsApp, Viber, skype, telegram, etc., which a common communication medium for the majority of the people.

Advantages and Disadvantages of FXCC Customer Support

Contacts Table

Security for Investors

Withdrawal Options and Fees

When it comes to withdrawing money from the trading account, the procedure and payment options differ from one brokerage firm to another. As far as FXCC is concerned, the withdrawal procedure is straightforward. Traders can withdraw money as soon as they reach the minimum $ 50 limit by requesting withdrawals from their ECN XL account dashboard on the FXCC platform.

There are limited withdrawal options available for the clients of the FXCC platform. However, the firm recommends traders use the bank wire transfer method. Other than bank transfers, there is also the option of multiple online payment options and e-wallets such as Neteller, Skrill, Visa and master cards, bit pay, and crypto. Traders can also use other options such as Web pay, Boleto, OXXO, etc. However, the withdrawal charges would be the same as the bank wire charges.

The withdrawal fee for a bank wire transfer is $ 30- 45, and for other online platforms, the fixed fee is 2.7% for Neteller and Skrill, 2.0 % for bit pay and crypto, and 3.4% for Eezie pay and 2we pay. However, the percentage on the online payment methods would sum up to a much higher withdrawal fee than the $30- 45 bank transfer. For this reason, bank wire transfers are the most cost-friendly method out of all the withdrawal methods available on this platform. The only free withdrawal option is a Master or visa card.

FXCC Vs Other Brokers

To examine the benefits and flaws of FXCC and to evaluate the different features of this platform, it is necessary to do a comparative analysis of FXCC with other leading forex brokers. Consequently, the potential traders, investors, and interested financial institutions would be in a better position to learn about FXCC and make an informed investment decision about trading with this broker.

#1. FXCC vs Avatrade

We chose Avatrade to compare with FXCC because AvaTrade is one of the leading finance brokers in the market currently, with millions of affiliated customers and serving in more than 120 countries worldwide. Avatrade has a maximum of 250 options of trading instruments with the most advanced trading platform, MT5.

When we compare FXCC with Avatrade there are some features that are positive about Avatrade but FXCC lacks them and vice versa. For instance, Avatrade has a high inactive fee and a minimum deposit requirement of $ 100, whereas FXCC has no inactivity fee or minimum deposit requirement but the withdrawal charges are high.

Similarly, Avatrade has state of the art trading tools and is regulated by multiple security commissions for the protection of customer’s funds whereas FXCC provides the ideal forex trading conditions through ECN/STP accounts, fast market executions and spreads of 0.1 pips per trade.

#2. FXCC vs Roboforex

Roboforex is a competitive trading platform for FXCC, as it provides the best trading scenario for any trader or investor be it inexperienced or seasoned. With leverage as high as 1:2000, most advanced technological platforms MT4, MT5, C trader, multiple customized account types, fast market executions and floating spreads of 0.0 pips, Roboforex offers everything a trader is looking for.

However, in many ways FXCC is also as good as Roboforex with its ECN Xl account, forex traders are at the center of focus with provision of all their trading needs. Furthermore, the trading feature of 0 spreads per lot is also comparable with Roboforex. In addition to this, the no minimum deposit requirement by FXCC is also something which Roboforex lacks.

Nevertheless, it is quite obvious that Roboforexhas a an upper hand overe FXCC in many ways. However, FXCC is certainly a good choice for forex traders. Hence, traders interested in automated forex trading with effective trading conditions can choose FXCCC over Roboforex.

#3. FXCC vs Alpari

Alpari is a brokerage company that has been present in the financial market for more than two decades, therefore the firm has a lot of trading experience for its customers. Moreover, the broker is not only regulated by the CySEC but is also a member of the financial commission, making it a reliable and trustworthy broker.

Additionally, the high leverage of 1:3000, 24/7 fast customer service and advanced trading platforms like MT4 and MT5, make Alpari stand out among other brokerage platforms.

When compared with Alpari, FXCC has more options of trading instruments including Cryptocurencies and a low-cost no commission policy which Alpari do not possess. Other than this, Alpari offers seven types of trading accounts for its customers whereas FXCC only has two account type options where one is specifically for corporate clients.

All in all, we can say that both Alpari and FXCC has their own flaws and strengths and traders needs to do some background research before choosing the right brokerage firm for themselves, one which would be helpful in achieving their trading goals.

How FXCC Trading Compare Against Other Brokers

Conclusion: FXCC Review

FXCC is an online brokerage platform that has been providing trading facilities since 2015 to a large number of traders, investors and financial institutions worldwide. It allows traders to invest in multiple underlying assets including forex, indices, stocks, commodities and cryptocurrenies and provides the best trading facilities for forex traders.

FXCC is owned by the fx central clearing ltd and is regulated by the CySEC making it a credible and legitimate brokerage firm that can be trusted for investment objectives. Moreover, there are also other highlights of this broker including its cost cutting, commission free services, no minimum deposit requirement, 100% first deposit bonus and free funding.

With all these advantages there are also some loopholes in the FXCC brokerage firm just like any other firm. Firstly there are only two account options, excluding demo and Islamic account, for customers to choose from. This condition limits the traders and does not provide the tailor-made trading services the customers are looking for.

Another flaw of FXCC is that the withdrawal fee is not waived off by the broker. Where most of the brokers do not charge any withdrawal fee, this is not appreciated by customers. Moreover, the withdrawal processing time is longer as withdrawals option is bank wire transfer. This could be another deal breaker fr FXCC as traders are always looking for instant cash outs.

To sum up, we can say that FXCC is just like any other compatible brokerage platform providing valuable trading features like zero spreads, negative balance protection, 100% first deposit bonus, and zero trading commission making it a good choice for all types of traders, investors, and financial institutions.

FXCC Review FAQs

Is FXCC legit?

Yes, FXCC is operating as an online broker since 2015 and it is providing its brokerage services in more than 120 countries. It is a regulated firm and can be trusted for investments objectives.

The firm consists of a passionate, competent and reliable team of professionals with extensive experience in the financial industry.Hence, potential traders who are looking to invest in a brokerage platform for ECN trading can certainly rely on FXCC.

Is FXCC regulated?

Yes, FXCC is regulated by the Cyprus securities and exchange commission and holds a legal license from Vanuatu Financial Services Commission VFSC which keeps the broker under survillene for all its financial transactions. Therefore, FXCC is regulated to provide brokerage services to traders, investors as well as financial institutions worldwide.

Moreover, the broker is owned by the company named Fx central clearing ltd which is basically a group of foreign exchange market professionals with tons of trading experience financial expertise.

Is FXCC an ECN broker?

Yes, FXCC is an ECN broker that provides the best ECN services to its customers. As FXCC is no dealing desks brker, it specifically provides trading facilities through an automated trading robots where order executions are faster. Moreover, as there are no thrid party interferances, traders , investors and corporate firms can trade directly with leading liquidity providers. This makes the overall trading experience profitable for its customers.