FX Opulence Review

FX Opulence is an online forex broker that offers trading in various financial instruments, including forex, metals, and indices. The broker provides high leverage options and promotes services such as tight spreads and quick execution through the Metatrader 5 platform. However, FX Opulence operates without valid regulation, which is a major concern for investors. This lack of oversight means that customer funds are at significant risk, as there is no regulatory body to ensure their protection.

Despite its promises of high returns and professional trading conditions, FX Opulence has been flagged as a suspected scam by numerous sources. Clients have reported price manipulation, withdrawal delays, and platform malfunctions, which have led to significant financial losses. Many users claim that once they deposited money, withdrawal requests were ignored or indefinitely delayed, with some accounts being frozen outright after profit-making attempts. Additionally, the broker is notorious for luring customers with false promises, such as doubling initial deposits and offering unrealistically high returns.

What is FX Opulence?

FX Opulence is an Australian-based brokerage that claims to provide trading services in forex, metals, indices, and cryptocurrencies. Registered under FX Opulence Pty Ltd, the company is a Corporate Authorized Representative (CAR) of MGF CAPITAL PTY LTD, which holds an Australian Financial Services License (AFSL) issued by the ASIC. However, this authorization does not grant full regulatory oversight, meaning FX Opulence is not directly regulated by ASIC. The firm's role as an authorized representative permits it to offer limited financial services in Australia, specifically to wholesale clients, and it is restricted from issuing over-the-counter (OTC) derivatives.

There are inconsistencies in FX Opulence’s regulatory claims. While it suggests a connection to ASIC through its association with MGF Capital, it is not independently authorized to issue certain financial products, such as OTC derivatives. Additionally, the company's services extend beyond Australia, often operating outside of ASIC's jurisdiction. This raises concerns about its transparency and regulatory compliance, particularly given the absence of crucial information about its operational entities and a potential reliance on unregistered counterparts for key services.

FX Opulence Website Status

The FX Opulence website is currently operational, and users can still access its trading platform. However, this should be approached with caution due to numerous red flags. While the site is functional, clients have reported significant issues with withdrawal processes, often facing long delays or outright denial of fund withdrawals. Some users also noted unexpected account freezes and lack of responsive customer support, particularly when attempting to recover their money.

Additionally, the platform continues to face questions regarding its regulatory inconsistencies. Though it claims to operate under an authorized representative license from MGF Capital Pty Ltd, FX Opulence itself is not directly regulated by ASIC. This raises concerns about the safety of client funds and the platform’s overall legitimacy. Traders should be aware of these risks when considering any involvement with FX Opulence.

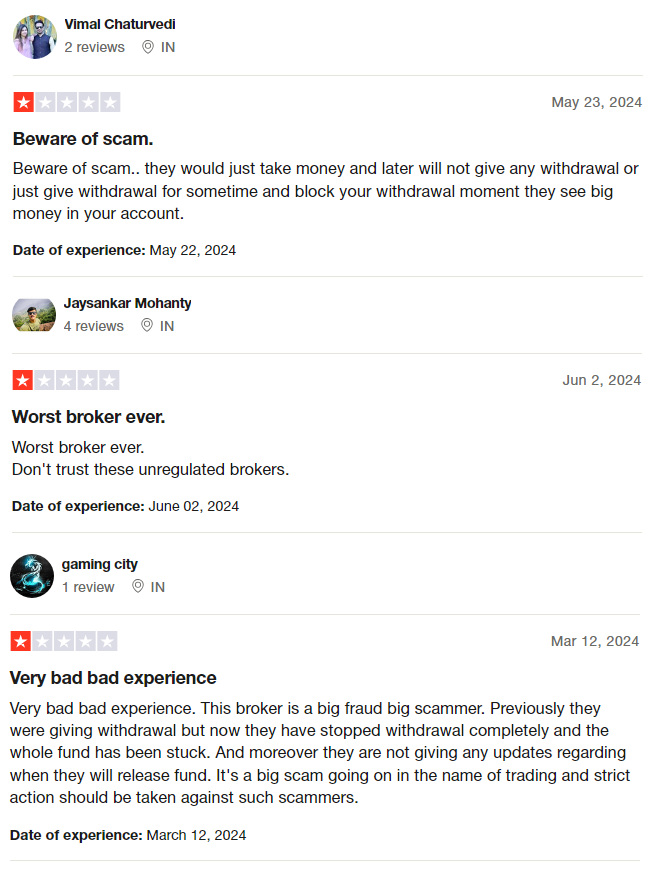

FX Opulence Customer Reviews

FX Opulence has received numerous negative reviews from customers, many of whom describe it as a scam broker. Users report that the company initially allowed withdrawals, but as soon as larger amounts were involved, withdrawals were blocked and accounts were frozen. Several reviewers caution against using the platform, labeling it unregulated and untrustworthy. Customers have shared experiences of their funds being stuck indefinitely, with no communication or updates from the broker. The general consensus is that FX Opulence manipulates withdrawals and engages in deceptive practices, leading many to call for strict action against the company.

FX Opulence Regulatory Status

FX Opulence claims to hold an authorization under MGF Capital Pty Ltd with oversight from the Australian Securities and Investments Commission (ASIC). However, this authorization is limited to offering financial services to wholesale clients in Australia, and it does not grant full regulatory control or protection for retail investors. Despite its ASIC connection, FX Opulence operates in a lax regulatory environment and has been flagged for misleading regulatory claims, particularly when dealing with international clients.

The risks associated with unregulated brokers like FX Opulence include the lack of transparency and safety of client funds. Without direct ASIC regulation or oversight from major financial regulators, traders face significant risks, such as blocked withdrawals and account freezes. Unregulated brokers are notorious for manipulating trades and withholding funds, leaving investors with little recourse in case of disputes. These factors make FX Opulence a high-risk option for traders.

Conclusion: Is FX Opulence a Scam?

Yes, FX Opulence is a scam.

The broker has consistently shown signs of fraudulent behavior, such as blocking withdrawals once significant amounts are involved, and there is no clear regulatory oversight to protect traders. Despite claiming to have ASIC authorization, FX Opulence operates under a weak regulatory framework, putting client funds at serious risk.

User feedback confirms the broker's deceitful practices, with many reporting that their funds were stuck and withdrawals were denied without explanation. Given the significant risks of dealing with unregulated brokers and the history of misconduct, we strongly recommend avoiding FX Opulence and choosing a more transparent and regulated trading platform.

Asia Forex Mentor Reminds You

Asia Forex Mentor is committed to uncovering and exposing fraudulent brokers to protect traders and investors. With the growing presence of unregulated brokers offering forex and CFD trading across different regions, there are increasing concerns about their potential risks. We advise traders to be highly cautious when dealing with unauthorized brokers to safeguard their investments and ensure a safe trading environment.