Fusion Markets Review

In the world of Forex trading, selecting the right broker is important to avoid getting scammed and lessen the risk of losing all your money to a questionable broker. Forex brokers act as intermediaries, granting traders access to the currency market. The right broker not only provides access but also equips traders with essential tools and resources to navigate the Forex market effectively. With a plethora of brokers available, it’s vital to choose one that aligns with your trading style and goals.

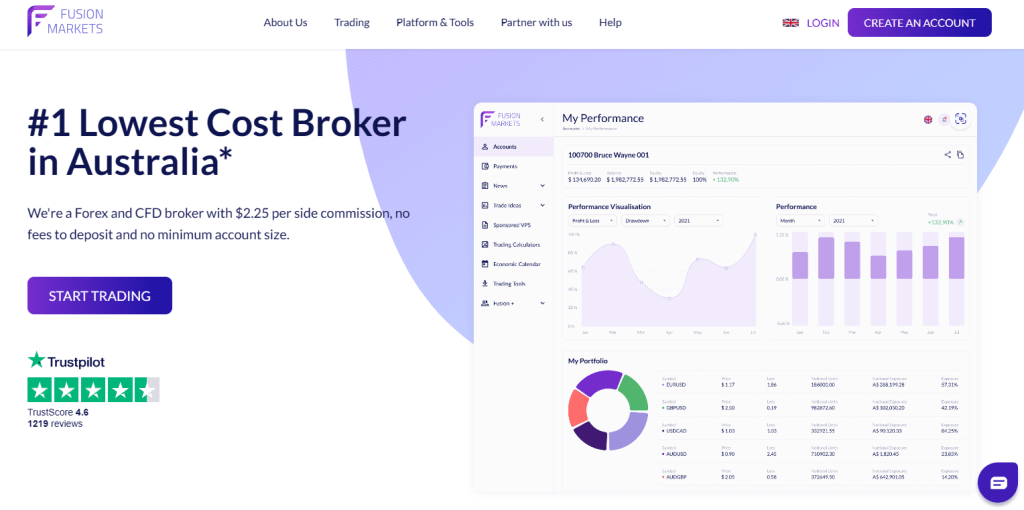

Fusion Markets stands out in the Forex landscape. Founded in 2017, this FX and CFD broker is celebrated for its straightforward trading approach. Headquartered in Melbourne, Australia, and with offices in Vanuatu and the Seychelles, Fusion Markets has swiftly gained global recognition. Its hallmarks are notably low trading and non-trading costs. Moreover, Fusion Markets offers diverse trading options, including spike trading, scaling, and expert advisors, catering to a variety of trading strategies.

This article delves into a detailed review of Fusion Markets. As an expert trader, I aim to illuminate its pros and cons. We’ll scrutinize its features, commission structure, account types, and transaction procedures. This review is a blend of professional analysis and real trader feedback, offering you a balanced view to assist in your broker selection. My goal is to provide insights that help you make an informed decision about whether Fusion Markets aligns with your trading needs.

What is Fusion Markets?

Fusion Markets is a dynamic player in the world of Forex brokerage, focusing on both the foreign exchange and CFD markets. This broker stands out with its extensive selection of trading instruments. Traders can access over 80 currency pairs, major cryptocurrencies, stocks, indices, precious metals, and a variety of commodities for CFD trading. This diversity caters to a wide range of trading preferences and strategies.

Offering both classic and near-zero spread accounts, Fusion Markets provides versatility for trading over 250 financial instruments, including a broad spectrum of currencies and CFDs. The broker adjusts its leverage sizes to align with regulatory standards, ensuring a balanced blend of opportunity and compliance for traders. This approach makes Fusion Markets a suitable choice for both new and experienced traders seeking flexibility and compliance in their trading endeavors.

Benefits of Trading with Fusion Markets

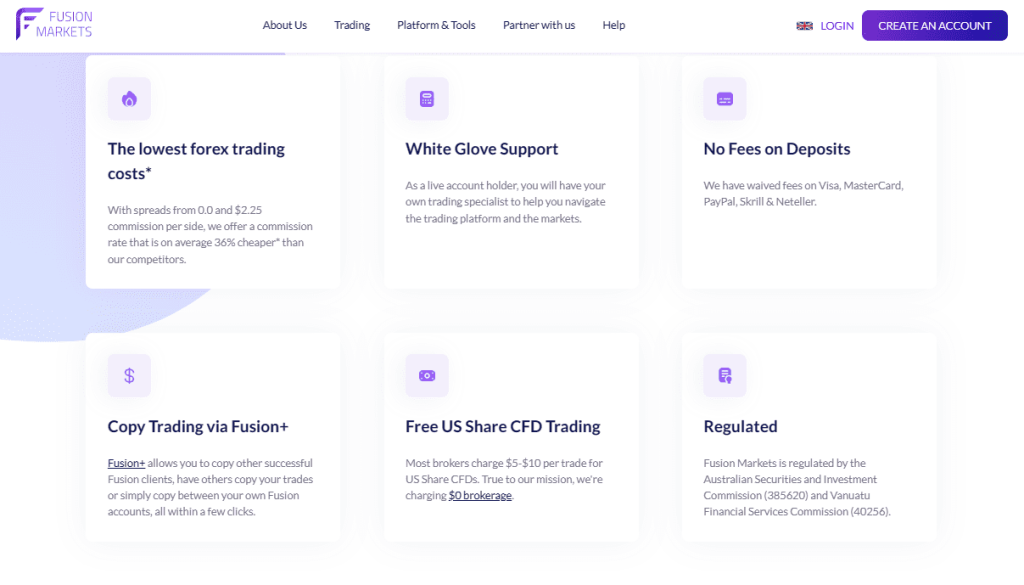

As someone who has actively traded with Fusion Markets, I’ve experienced firsthand the advantages this broker offers. The first noteworthy benefit is its reliable regulation. Fusion Markets holds three licenses: from the ASIC in Australia, VFSC in Vanuatu, and FSA in the Seychelles. This regulatory framework provides a level of security and trustworthiness, which is crucial in the volatile world of Forex trading.

Another significant advantage of Fusion Markets is the absence of non-trading fees. This feature is especially beneficial for traders who are mindful of overhead costs and wish to maximize their trading efficiency. Additionally, the diversity of financial instruments offered is remarkable. With classic and near-zero spread accounts, Fusion Markets enables trading over 250 financial instruments, including a wide array of currencies and CFDs. This diversity allows traders like me to explore various markets and strategies.

Lastly, the Fusion+ proprietary copy trading platform stands out. It’s a unique feature that I found particularly advantageous. The Fusion+ copy service is free of charge, provided you and the follower account execute at least 2.5 lots of FX/Metals per month. This platform offers an opportunity for less experienced traders to learn from more seasoned traders’ strategies, enhancing their trading skills.

Fusion Markets Regulation and Safety

In my experience trading with Fusion Markets, I’ve come to appreciate the importance of regulation and safety in Forex trading. Fusion Markets is regulated by three reputable bodies: the ASIC in Australia, the VFSC in Vanuatu, and the FSA in the Seychelles. These licenses are not just formalities; they’re assurances of the broker’s commitment to adhering to international financial standards and practices.

Understanding the safety of your investments is crucial. Fusion Markets adds a layer of security by storing client deposits in segregated bank accounts. This means that clients’ funds are kept separate from the company’s own finances, offering protection against financial mismanagement or insolvency. As a trader, knowing my funds are handled with such care provides peace of mind and reinforces my trust in Fusion Markets as a reliable trading partner.

Fusion Markets Pros and Cons

Pros

- Quick account setup

- No requirement for initial deposit

- Low trading costs

- Diverse trading options

- No extra fees outside trading

- Trustworthy regulatory compliance

Cons

- Lack of educational resources

- Absence of cent accounts

- No trading using bonus funds

Fusion Markets Customer Reviews

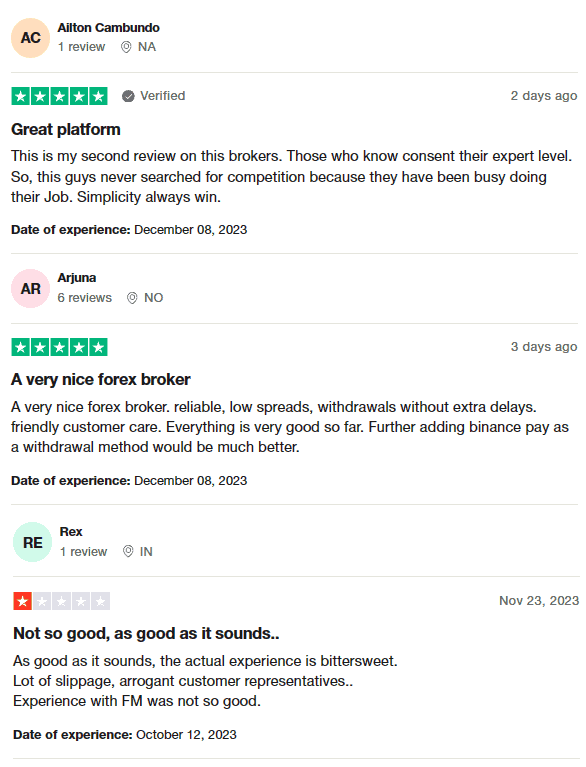

Fusion Markets has garnered considerable attention, reflected in its 4.6-star rating on Trustpilot. Customer reviews generally highlight the broker’s commitment to simple and effective trading solutions. Many appreciate Fusion Markets for its reliability, low spreads, and prompt withdrawal processes, along with responsive customer service. However, some experiences have been mixed, with a few customers mentioning issues such as slippage and less than satisfactory interactions with customer support. Overall, the consensus suggests that while Fusion Markets excels in many areas, there is room for improvement in certain aspects of its service.

Fusion Markets Spreads, Fees, and Commissions

In my experience with Fusion Markets, one of the standout features is their notably low trading fees. In the Classic account, the broker cleverly includes the commission within the spread. This approach simplifies the cost for traders like me, making it easier to understand and manage. On the other hand, Zero accounts have a base commission of $4.5 per round for each lot traded, both opening and closing.

What really sets Fusion Markets apart is the absence of non-trading fees. This means there are no commissions on deposits and withdrawals, a significant plus for any trader. However, it’s important to keep in mind that banks or payment systems might impose their own charges.

The fee structure at Fusion Markets varies depending on the account type. For Australian clients, for instance, the commission starts from USD 2.25 per standard lot. When it comes to cryptocurrency trading, Fusion Markets stands out by not charging any commissions. Additionally, there’s no inactivity fee, but it’s worth noting that rollover fees do apply for positions held open for more than a day.

Account Types

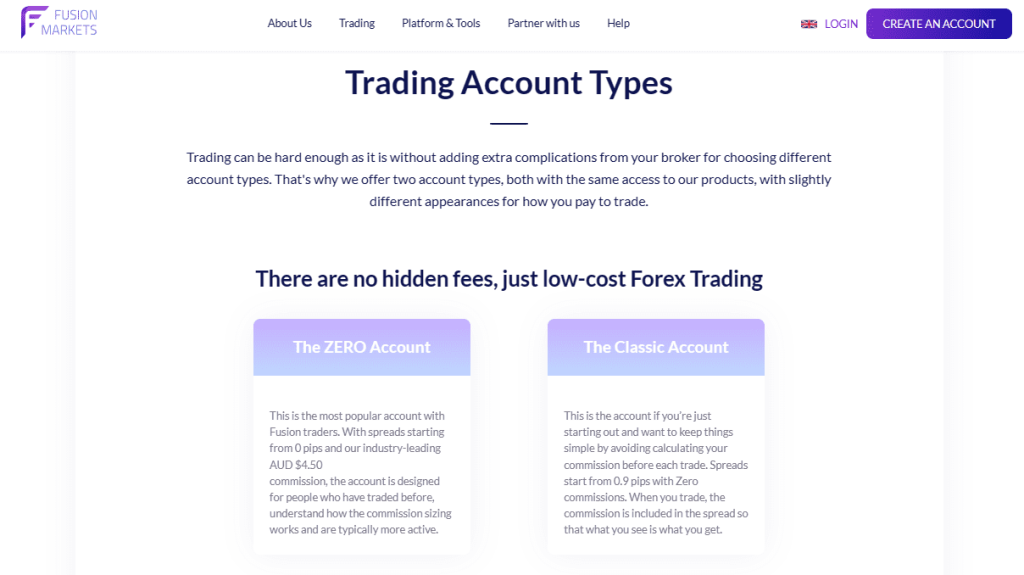

Having personally tested the account types offered by Fusion Markets, I can provide a clear overview of each option. Their account structure caters to diverse trading preferences and needs.

Zero Account

- Commissions: $2.25 per side.

- Spreads: Start from 0.0.

- Features: The Zero Account is ideal for those who prefer low-cost trading with raw spreads. It’s designed for traders who are comfortable calculating their own commissions and embodies Fusion Markets’ philosophy of low-cost trading without compromising quality.

Classic Account

- Commissions: Included in the spreads.

- Spreads: Transparent, with no hidden costs.

- Features: This account is all about ease and simplicity. It’s well-suited for traders seeking a straightforward trading experience, offering a variety of trading platforms and 24/7 customer service.

Swap Free Accounts

- Minimum EURUSD Spread: 1.4 pips.

- Minimum Trade Size: 0.01 lot.

- Commission: $0.

- Minimum Account Balance: $0.

- Features: Designed for traders whose religious beliefs prohibit overnight swaps. These accounts provide a no-interest, swap-free option, allowing access to over 50 popular financial instruments at low rates.

Demo Trading Account

- Features: The Demo Trading Account is a risk-free opportunity to learn, test strategies, or experience Fusion Markets’ tight spreads firsthand. It’s an excellent tool for beginners or those looking to refine their trading skills without risking their capital.

Each account type reflects Fusion Markets’ commitment to accommodating a broad spectrum of trading styles, ensuring that there’s an option for virtually every type of trader.

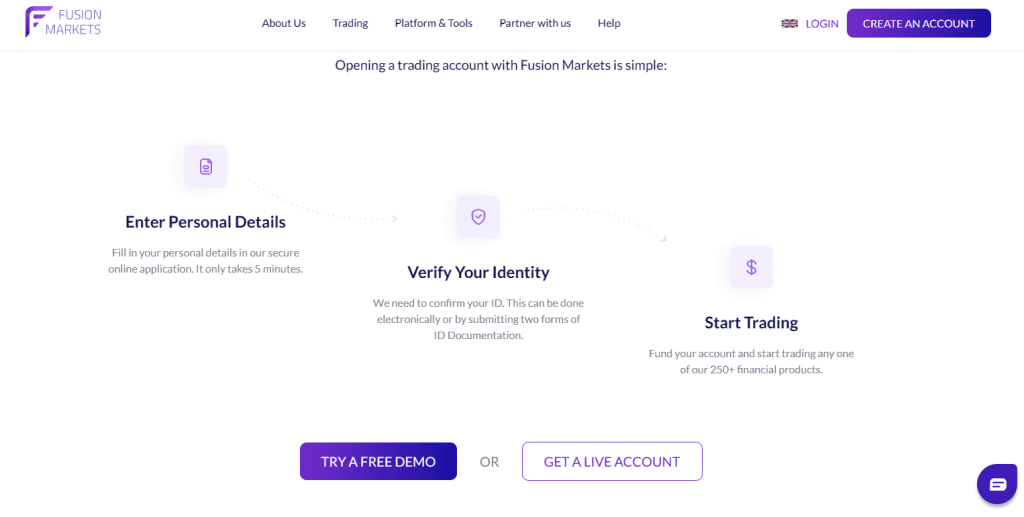

How to Open Your Account

- Start by clicking on ‘Create an Account’ on the Fusion Markets website.

- Complete the registration form and press ‘Sign Up’, agreeing to Fusion Markets’ terms and conditions.

- Undergo ID Verification and pass a quiz to confirm understanding of the risks in Forex and CFD trading, especially for ASIC Retail Clients.

- After verification, choose the ‘Live’ option, then select ‘+New Account’.

- In the ‘Live’ section, pick your preferred account type, trading platform, and base currency.

- Click ‘Create Account’ to finalize your account setup.

- Wait for identity verification to be completed.

- Check your email for login details sent by the Fusion Markets team.

- Install the trading platform you selected.

- Fund your account using one of the available payment methods.

- Begin trading on your newly created Fusion Markets account.

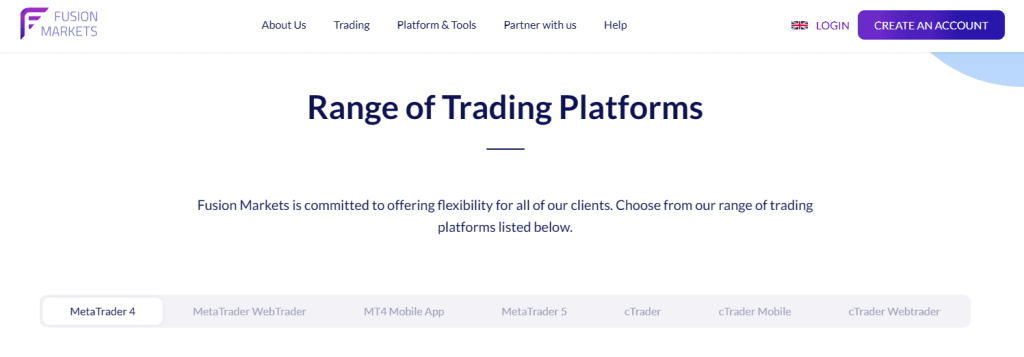

Fusion Markets Trading Platforms

Based on my experience with Fusion Markets, their range of trading platforms caters to various styles of trading. For active traders, Fusion Markets offers the popular MetaTrader platforms, both MT4 and MT5. These platforms are renowned for their user-friendly interfaces, comprehensive analytical tools, and automated trading capabilities. cTrader is another option available, which is particularly appreciated for its advanced charting tools and intuitive design.

For passive traders, Fusion Markets provides several alternatives. Myfxbook AutoTrade and DupliTrade are great for those who prefer copy trading, allowing users to replicate the strategies of experienced traders. The MQL5 community services are integrated into the MetaTrader platforms, offering additional resources for automated trading. Furthermore, the proprietary Fusion+ platform is an innovative addition, designed to enhance the trading experience with unique features tailored to Fusion Markets’ clients.

What Can You Trade on Fusion Markets

Fusion Markets offers a diverse range of trading instruments, each with its unique advantages.

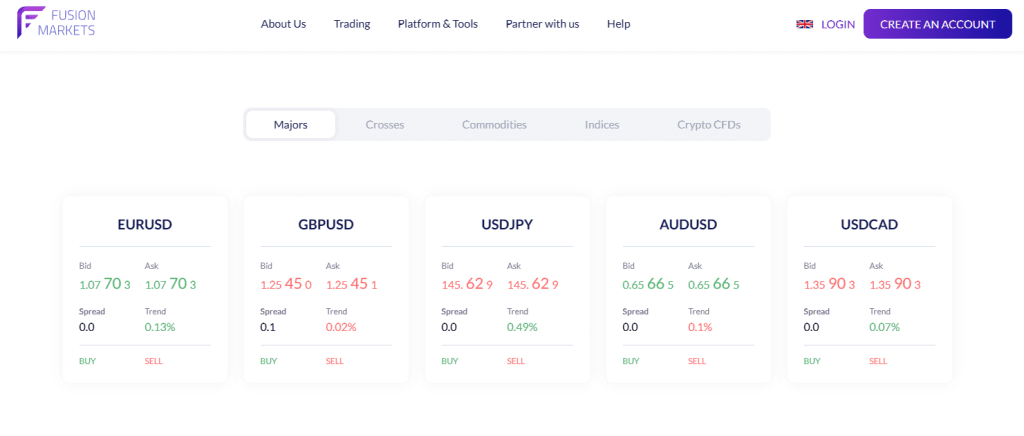

Forex and Energy: The platform shines in the Forex market, boasting over 90 currency pairs with tight spreads and non-dealing desk execution. This is complemented by the energy sector offerings, including Crude Oil, Brent Oil, and Natural Gas, allowing traders to capitalize on the market’s volatility without commission on trades.

Precious Metals and Equity Indices: For those inclined towards more stable assets, precious metals trading—including Gold, Silver, and Platinum—provides a low-cost opportunity for going long or short. Furthermore, Fusion Markets facilitates trading in some of the world’s largest equity markets through CFDs on major indices, combining competitive spreads with flexible leverage.

Commodities and Share CFDs: The platform also enables trading in everyday commodities like coffee and wheat, offering competitive pricing and the ability to go long or short without extra fees. Additionally, Share CFDs on 100 of the world’s largest equities from the USA are available through the MetaTrader 5 platform with $0 brokerage, presenting a cost-effective option for equity market trading.

Fusion Markets Customer Support

I’ve found their customer support to be both accessible and responsive. There are several ways to contact them: via phone, online chat, or email. No matter the method I chose, the response from the brokerage’s staff was prompt and helpful, addressing my queries effectively.

The company also provides a Contact Us form for more in-depth questions. This is particularly useful for complex issues that require detailed explanations. Additionally, their live chat function, available on every page of their website, is extremely convenient. It’s especially handy for quick questions or immediate assistance.

The most impressive aspect is the availability of their support team. They are on hand around the clock during Forex trading hours, ensuring that help is always available when the markets are open. This level of support has been invaluable to me, especially during times of high market volatility or when I needed urgent assistance.

Advantages and Disadvantages of Fusion Markets Customer Support

Withdrawal Options and Fees

From my experience, Fusion Markets offers straightforward and cost-effective withdrawal options. They do not charge any fees for outgoing money transfers, which is a significant advantage. Withdrawals to electronic wallets, cards, and Australian bank accounts are free of charge. However, for international bank transfers, there’s a minimum withdrawal limit of $30, and the fees range from $15 to $25, depending on the bank involved.

The broker is efficient in processing withdrawal requests, typically within 24-48 hours. The processing time largely depends on when the request is made. Notably, I could request a withdrawal without the need to close my open trades, provided there was sufficient margin in my account.

Fusion Markets maintains strict policies regarding fund transfers. Funds are not transferred to third-party accounts. Profits must be withdrawn to a bank account, and if withdrawing to a card, the amount must match the initial deposit. They also offer the option for cryptocurrency withdrawals, which adds another layer of convenience. The time it takes for the funds to reach you can vary from 1 to 5 business days, depending on your chosen method and location.

Fusion Markets Vs Other Brokers

#1. Fusion Markets vs AvaTrade

Fusion Markets is known for its low trading and non-trading fees and offers a variety of trading options. AvaTrade, established in 2006, has a broader global reach with a strong commitment to providing a comprehensive trading experience. AvaTrade is well-regulated and offers more than 1,250 financial instruments.

Verdict: For traders prioritizing cost-effectiveness and simplicity, Fusion Markets may be the better choice. However, for a broader range of financial instruments and a more global presence, AvaTrade stands out.

#2. Fusion Markets vs RoboForex

RoboForex, operating since 2009, emphasizes superb trading conditions and cutting-edge technology. It offers a vast selection of more than 12,000 trading options across various asset classes. Fusion Markets, while more focused on low-cost trading, has a narrower range of instruments.

Verdict: RoboForex is preferable for traders seeking a wide array of trading options and technologies. For those looking for a more streamlined, cost-effective approach, Fusion Markets is a better fit.

#3. Fusion Markets vs Exness

Exness, a Cyprus-based broker, is recognized for its substantial monthly trading volume and offers over 120 currency pairings, including CFDs on stocks, energy, and metals. Fusion Markets, with its focus on low fees and variety of trading options, contrasts with Exness’s broader range of instruments and the unique offering of infinite leverage.

Verdict: If infinite leverage and a wide range of trading instruments are priorities, Exness is the better choice. However, for traders who value low-cost trading and a streamlined selection of instruments, Fusion Markets would be more suitable.

Conclusion: Fusion Markets Review

Based on my insights and user feedback, Fusion Markets emerges as a competitive player in the Forex and CFD brokerage market. It stands out for its low trading and non-trading fees, making it an attractive option for cost-conscious traders. The variety of trading options, including spike trading and expert advisors, caters to diverse trading strategies.

However, it’s important for potential users to be aware of some drawbacks. While the platform offers efficient customer support, there have been instances of mixed reviews and occasional service interruptions in their chat support. Additionally, the limited educational resources might pose a challenge for novice traders.

In summary, Fusion Markets is a solid choice for those prioritizing cost efficiency and a variety of trading instruments. Nevertheless, traders should weigh these benefits against the potential cons, such as the need for more robust educational support and occasional customer service hiccups.

Also Read: YaMarkets Review 2024 – Expert Trader Insights

Fusion Markets Review: FAQs

What types of accounts does Fusion Markets offer?

Fusion Markets provides several account types, including the Zero Account with low commissions, the Classic Account for simplicity with no additional fees, and Swap Free Accounts for traders with specific religious beliefs.

Are there any fees for withdrawals at Fusion Markets?

Withdrawals to electronic wallets, cards, and Australian bank accounts are free. However, for international bank transfers, fees range from $15 to $25, and the minimum withdrawal amount is $30.

How does Fusion Markets handle customer support?

Fusion Markets offers customer support through phone, online chat, and email. The support team is known for quick responses, but there have been occasional breaks in chat availability and mixed client reviews.