Position in Rating | Overall Rating | Trading Terminals |

267th  | 2.0 Overall Rating |    |

Funding Traders Review

Traders have shared mixed feedback regarding Funding Traders. Many highlight the platform’s streamlined funding process, which offers opportunities for traders to access significant capital without requiring upfront deposits. This feature has been especially appealing to those looking to scale their trading activities quickly.

However, some traders have expressed concerns about the evaluation process, mentioning strict profit targets and time constraints. Despite this, others have appreciated the clear guidelines and transparency of the rules, stating that it helps maintain discipline in trading. The availability of multiple funding options has also been praised for accommodating different trading styles.

Overall, Funding Traders has been commended for its accessibility and innovative approach to supporting traders. While challenges like evaluation stress exist, traders believe the potential rewards outweigh the difficulties, making it a notable option for serious participants in the trading space.

What is Funding Traders?

Funding Traders is a platform that provides financial backing to traders with its trading rules, allowing them to access substantial trading capital without risking their own funds. Traders are required to pass an evaluation process to demonstrate their trading skills and meet specific performance criteria. Once approved, they gain access to funded accounts to trade in the financial markets.

Traders have noted that Funding Traders offers a structured approach with clear rules and guidelines, fostering disciplined trading practices. The platform supports various account types, enabling traders to choose options that align with their strategies and goals. Its flexible model has made it appealing to those seeking growth opportunities without the typical financial barriers.

Funding Traders Regulation and Safety

Traders have shared mixed opinions about the regulation and safety of Funding Traders. While the platform ensures transparency in its terms and conditions, some have raised concerns over the lack of robust regulatory oversight in certain regions. This has made traders cautious about relying entirely on the platform’s promises.

On the positive side, Funding Traders is noted for implementing security measures to protect user data and funds. Many traders have praised the platform’s clear communication regarding safety protocols and its commitment to ensuring a secure trading environment. These efforts have built trust among a significant portion of the trading community.

Funding Traders Pros and Cons

Pros

- Low spreads

- Quick funding

- Diverse assets

- User-friendly

Cons

- High fees

- Limited support

- Withdrawal delays

- Regional restrictions

Benefits of Trading with Funding Traders

Traders have highlighted several benefits of partnering with Funding Traders such as news trading, updated market analysis, prop firms, and smooth trading journey. The most significant advantage is the access to large capital without requiring traders to risk their own funds. This allows traders to focus on their strategies while aiming for higher profits through profit-sharing arrangements.

Another key benefit noted by traders is the platform’s flexible account options and clear evaluation guidelines inclined using news trading and white prop firm. These features accommodate a range of trading styles, making it suitable for both beginners and experienced traders to acquire their profit target with minimum trading. Additionally, the absence of substantial upfront costs has been praised for lowering the barriers to entry in trading.

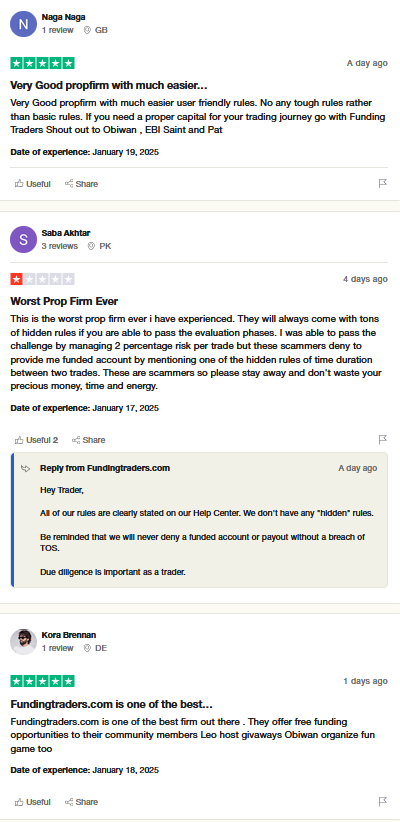

Funding Traders Customer Reviews

Customer reviews of Funding Traders reveal a mix of positive and critical feedback. Many traders appreciate the platform’s funding opportunities, highlighting how it enables them to access significant capital without risking personal funds. The structured evaluation process, while challenging, has been described as fair and designed to promote disciplined trading practices.

On the downside, some customers have expressed dissatisfaction with the profit-sharing percentages and strict evaluation timelines. However, others view these as necessary measures to ensure accountability and professional growth. The platform’s customer support has also been praised for its responsiveness, though some users have reported delays during peak periods.

Funding Traders Spreads, Fees, and Commissions

Traders have shared varied opinions on the spreads, fees, and commissions offered by Funding Traders. Many appreciate the competitive spreads, which allow them to execute trades without significant cost impact. This has been particularly beneficial for those engaging in high-frequency or day trading strategies.

Traders have noted that Funding Traders offers competitive spreads compared to other prop trading firms, making it an attractive option for those engaged in news trading. Many view it as a reliable choice among proprietary trading firms, especially for traders seeking low-cost entry into the markets. Among various prop firms, its fee structure has been highlighted as fair, though some believe greater flexibility could enhance its appeal.

However, some traders have mentioned that the platform’s fees and profit-sharing arrangements can feel restrictive over time. While the costs are clear and outlined upfront, a few users believe they could be more flexible to attract a broader range of traders. Despite this, others find the overall structure reasonable given the access to funded accounts and potential for larger profits.

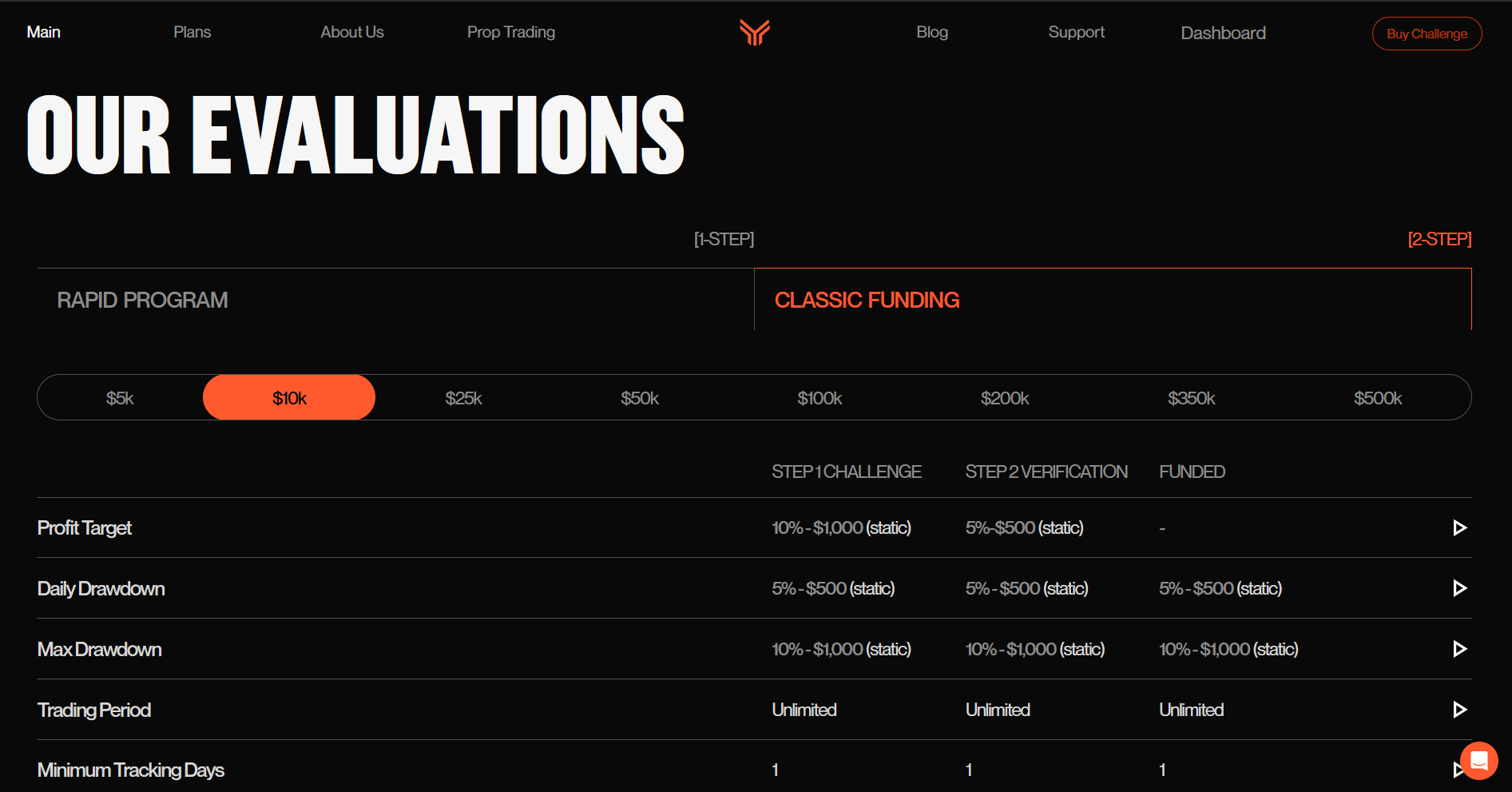

Account Types

Trading account types play a crucial role in tailoring trading experiences to individual preferences and goals. Funding Traders provides various account options to meet diverse needs, ensuring flexibility and accessibility for both beginners and experienced traders.

Standard Account

The Standard Account is ideal for beginner traders looking to get started with minimal risks. Funding Traders ensures a low minimum deposit, basic tools, and access to the platform’s essential features.

Pro Account

The Pro Account is tailored for experienced traders requiring advanced tools and higher leverage. Funding Traders offers this account to those who seek more competitive spreads and additional functionalities.

VIP Account

The VIP Account is designed for professional or high-net-worth traders who prioritize premium features. Funding Traders provides personalized support, exclusive insights, and the most competitive trading conditions through this account type.

How to Open Your Account

Opening an account with Funding Traders is a straightforward process designed for ease and accessibility. By following a few simple steps, traders can gain access to a wide range of features and trading tools to start their journey efficiently.

Step 1: Visit the Official Website

Go to the official Funding Traders website and locate the “Sign Up” button. This is typically found on the homepage or the login page for easy access.

Step 2: Complete the Registration Form

Fill out the registration form with accurate personal information, including your name, email address, and phone number. Ensure all details are correct to avoid any delays in the verification process.

Step 3: Verify Your Email Address

Check your email inbox for a verification email from Funding Traders. Click on the provided link to confirm your email address and activate your account.

Step 4: Submit Required Documents

Upload the necessary identification documents, such as a government-issued ID and proof of address. This step ensures compliance with KYC (Know Your Customer) regulations.

Step 5: Fund Your Account

Choose a preferred payment method and deposit funds for initial account balance into your account. Funding Traders supports various secure payment options for user convenience.

Step 6: Start Trading

Once your account is verified and funded, you can log in and begin trading. Explore the platform’s features to make informed trading decisions.

Funding Traders Trading Platforms

Traders have shared mixed feedback about the trading platforms offered by Funding Traders. Many appreciate the use of widely recognized platforms like MetaTrader, which are user-friendly and equipped with essential tools for analysis and execution. These platforms provide a seamless trading experience, catering to both beginners and experienced traders.

However, some traders have noted limitations in additional platform features, such as advanced analytics or integration with external tools. Despite this, most users agree that the platforms’ reliability and efficiency contribute positively to their trading performance. The accessibility across devices has also been praised for enabling trades on the go.

What Can You Trade on Funding Traders

Funding Traders offers a wide variety of trading instruments designed to cater to both beginner and professional traders. With access to diverse global markets, traders can choose from multiple asset classes to suit their strategies and goals.

Forex

Forex trading on Funding Traders allows access to major, minor, and exotic currency pairs. This market is highly liquid, offering tight spreads and opportunities for traders around the clock.

Stocks

Traders can invest in global stocks, including shares of top companies. Funding Traders provides leveraged trading options, enabling traders to maximize their potential returns.

Indices

Funding Traders enables trading on indices, representing the performance of a group of stocks. Popular indices include the S&P 500, NASDAQ, and FTSE 100, offering opportunities to trade market sentiment.

Commodities

Commodities trading on Funding Traders includes gold, silver, oil, and agricultural products. These assets are ideal for traders seeking diversification or hedging against inflation.

Cryptocurrencies

Funding Traders offers cryptocurrency trading, including Bitcoin, Ethereum, and other major digital assets. This market appeals to those interested in high volatility and potential returns.

Futures

Traders can explore futures contracts, which cover commodities, indices, and other asset classes. Funding Traders provides a platform for leveraging short- or long-term market predictions.

Options

Options trading is available on Funding Traders, giving traders flexibility to hedge risks or speculate on price movements. These instruments allow trading with predefined risk and reward profiles.

Funding Traders Customer Support

Traders have provided a mix of feedback regarding the customer support offered by Funding Traders. Many commend the support team for their responsiveness and professionalism, noting quick resolutions to account-related issues and detailed guidance during the evaluation process. This has been particularly helpful for new users navigating the platform.

However, some traders have reported occasional delays in receiving responses, especially during high-traffic periods. Despite these concerns, the availability of multiple communication channels, such as email and live chat, has been positively acknowledged. Many traders feel that the overall support quality reflects the platform’s commitment to user satisfaction.

Advantages and Disadvantages of Funding Traders Customer Support

Withdrawal Options and Fees

Withdrawing funds is a critical aspect of any trading experience, and Funding Traders ensures diverse options to cater to trader preferences. Understanding the available methods and associated fees is essential for seamless transactions and cost management.

Bank Transfers

Bank transfers are a secure and reliable withdrawal method offered by Funding Traders. While processing times can take 3–5 business days, they are suitable for larger transactions, though fees may vary depending on the bank.

E-Wallets

E-wallets provide a fast and convenient withdrawal option for traders. Platforms like PayPal or Skrill are supported by Funding Traders, offering minimal fees and near-instant processing.

Cryptocurrencies

For traders dealing with digital assets, Funding Traders supports cryptocurrency withdrawals. These transactions are quick and typically have lower fees, depending on network conditions.

Debit/Credit Cards

Withdrawals via debit or credit cards offer a familiar and straightforward option. Funding Traders ensures low fees, but processing can take up to 3 days.

Funding Traders Vs Other Brokers

#1. Funding Traders vs AvaTrade

Funding Traders caters to proprietary trading enthusiasts, offering funded account opportunities that appeal to traders looking to scale without personal capital risk. On the other hand, AvaTrade is a traditional retail broker with extensive asset classes and features like fixed spreads and automated trading tools. While Funding Traders is designed for those aiming to meet performance-based evaluations for account scaling, AvaTrade focuses on user-friendly platforms and global accessibility, catering to both beginners and experienced traders. The target audience and services differ significantly, as one supports traders seeking firm backing while the other provides conventional brokerage services.

Verdict: Funding Traders is ideal for individuals aiming to trade with proprietary funding, while AvaTrade better serves those requiring a broad range of trading tools and assets in a retail trading environment. Both excel within their specific niches, but they are designed for distinctly different trader needs.

#2. Funding Traders vs RoboForex

Funding Traders focuses on providing capital to traders under specific profit-sharing models, catering to individuals seeking opportunities without risking their own funds. In contrast, RoboForex operates as a traditional broker offering a wide range of trading instruments, platforms, and account types. While Funding Traders emphasizes evaluations and performance-based funding, RoboForex attracts a broader audience with competitive spreads, bonuses, and leverage options. Both serve distinct needs: one for funded trading and the other for independent traders managing personal accounts.

Verdict: Funding Traders is ideal for traders confident in their skills but lacking capital, while RoboForex appeals to those seeking flexibility and autonomy in managing their funds. The choice depends on your trading goals and financial strategy.

#3. Funding Traders vs Exness

Funding Traders offers a specialized focus on funded trading programs, catering to traders aiming to scale their capital through evaluation challenges. It emphasizes strict risk management and profit-sharing models, ideal for those seeking backing for forex and other assets. On the other hand, Exness provides a broader platform with low spreads, flexible leverage options, and access to multiple asset classes, including forex, cryptocurrencies, and stocks. Exness is more suited for retail traders looking for flexibility and advanced trading tools, with no requirement for evaluations or performance metrics.

Verdict: Funding Traders is ideal for traders seeking capital backing through evaluations, while Exness is better for independent retail traders who value asset diversity and user-friendly features. Both serve distinct trading needs effectively.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH FUNDING TRADERS

Conclusion: Funding Traders Review

In conclusion, Funding Traders has garnered attention for its innovative approach to providing capital to traders, enabling them to trade without risking their own funds. Positive feedback highlights its competitive spreads, accessible trading platforms, and supportive customer service. The structured evaluation process and clear guidelines have been praised for fostering discipline and professionalism among traders.

However, some challenges, such as strict profit-sharing terms and evaluation criteria, have raised concerns among users. Despite these, the platform’s value in offering growth opportunities and financial backing makes it a viable choice for committed traders. Overall, Funding Traders stands out as a promising option for those looking to advance their trading careers with external funding.

Funding Traders Review: FAQs

What is the process for Funding Traders evaluation?

Traders must meet specific profit targets within a set timeframe to qualify for funded accounts.

How does profit-sharing work with Funding Traders?

Profits are split between the trader and the platform, with clear terms provided upfront.

Is Funding Traders legit?

Yes, it implements safety measures to protect funds and user data, ensuring a secure trading experience.

OPEN AN ACCOUNT NOW WITH FUNDING TRADERS AND GET YOUR BONUS