FundedNext Review

Proprietary trading firms are intriguing subjects in the complicated world of financial markets, where risk and reward coalesce in a complex dance. The goal of proprietary trading, sometimes known as “prop trading,” is to profit from market changes by trading financial instruments using the firm’s own cash. These businesses use cutting-edge technology, sophisticated trading techniques, and smart tactics to take advantage of market possibilities. One such prominent player in this field is FundedNext, a trailblazing prop trading company tucked away in the heart of the United Arab Emirates.

FundedNext, which was founded in 2016, has become a significant player in the proprietary trading industry. FundedNext, which is based in the thriving and dynamic financial center of the United Arab Emirates, has been slowly changing the prop trading scene with its cutting-edge strategy and unrelenting dedication to trader success.

This FundedNext review seeks to provide useful information about the benefits of trading, the platforms that are offered, the evaluation processes, the trading characteristics, and other crucial details important to starting your enterprise with this proprietary trading company. Additionally, traders and investors will have the chance to learn about the firm’s shortcomings, helping them to choose the best proprietary trading firm for their needs with more knowledge.

What is FundedNext?

FundedNext represents cutting-edge customized trading platforms designed exclusively to revolutionize the trading experience for traders of all levels. It offers traders a lucrative opportunity to trade with a capital of up to $200,000. This initial capital reserve can be expanded in the future, by up to $4 million, if traders successfully adhere to profit targets, maintain loss limitations, and follow specified guidelines.

The possibility of profit sharing ranging from 80% to 90% is what makes FundedNext an appealing proposal for traders looking for investment. This large profit split potential helps to distinguish the platform from its competitors, making it a desirable choice for a wide range of traders.

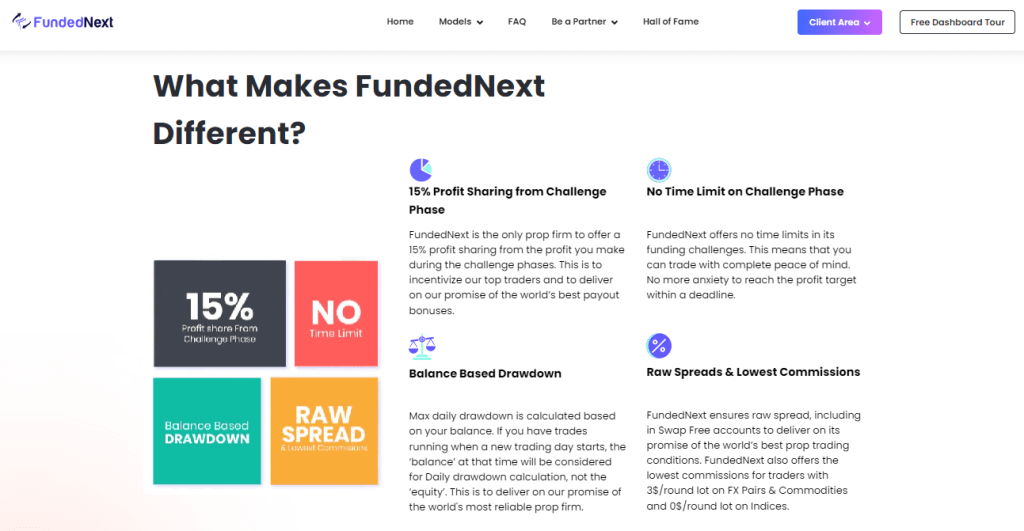

FundedNext’s unwavering commitment to continuous advancement and forward-thinking tactics demonstrates its drive to remain at the forefront of the industry. This constant quest for improvement, as evidenced by the platform’s regular enhancements and ongoing feature development, contributes greatly to its popularity among traders. FundedNext separates itself from comparable proprietary trading services by providing unique features such as a generous 15% profit share during the demo phase and continuously low spreads.

Also Read: Prop Trading: What is it and How Does it Work?

Advantages and Disadvantages of Trading with FundedNext

Benefits of Trading with FundedNext

FundedNext provides various advantages to traders, the most important of which is the considerable capital provision. The platform’s impressive funding lets traders access larger markets and capitalize on larger profit chances, which is sometimes impossible to do when depending simply on personal funds. FundedNext’s increased financial leverage functions as a catalyst in expanding a trader’s potential reach and increasing their profitability.

Furthermore, FundedNext stands out for its risk-mitigation skills. It offers traders a set of risk management tools to assist them navigate investment selections prudently and prevent potential losses. In an industry where volatility can be both a benefit and a curse, having robust risk management tools can make or break your business.

Furthermore, traders benefit from the platform’s unrivaled support. With a specialized crew ready to assist at every level of the trading process, traders can assure that their questions are immediately answered, allowing them to focus on what matters most – trading. This comprehensive support, together with the financial and risk management benefits, makes FundedNext an appealing option for traders.

FundedNext Pros and Cons

Pros:

- Four account types with diverse plans

- Rising profit share

- Credible partnership with ASIC

- Lucrative affiliate program

- Lower trading fees with Eightcap

Cons :

- Lack of free plans

- Vast knowledge of trading is recommended

Difficulties Met by the Traders Who Participated in the Brokers Challenge

#1. Achieving Specific Profit Targets

The FundedNext Challenge requires traders to meet a predetermined profit objective within a specified time frame. This need may be a significant problem because it requires not just smart trading but also the capacity to generate correct market predictions. The trader must have the requisite abilities and expertise to make intelligent decisions that will allow them to accomplish these precise profit targets within the timeframe specified.

How to Overcome the Difficulty

Traders should work on developing their market analysis abilities and refining their trading techniques to overcome the problem of attaining certain profit targets. It is critical to stay current on market news, trends, and events that may have an impact on asset pricing. It is also possible to benefit from the educational resources and tools accessible on the FundedNext platform. Risk-management measures such as establishing stop-loss orders can also assist safeguard against large losses.

#2. Prudent Risk Management

A significant hurdle facing traders engaged in the FundedNext Challenge centers on the artful navigation of risk. Particularly when deploying a funded account, traders must maintain a sharp awareness of potential risks, proceeding with judicious caution to shield their investments. This task is no trivial matter, demanding an acute comprehension of market trends and a deft equilibrium between risk and reward. Crafting a robust risk management strategy becomes imperative, serving as a compass through the intricate landscape of trading uncertainties.

How to Overcome the Difficulty

Effective risk management entails an intimate grasp of market intricacies, steering decision-making with wisdom. Traders can achieve this by diversifying their portfolios and employing stop-loss orders to contain potential losses. An equally vital tenet is adherence to a well-structured trading plan, which charts clear objectives for each trade. Embracing the risk management tools furnished by the FundedNext platform is prudent, while a steadfast resolve never to stake more than one can comfortably afford to lose remains paramount.

#3. Maintaining Discipline and Consistency

Among the foremost challenges a trader may confront within the realm of the FundedNext Challenge lies the task of upholding discipline and unwavering consistency, especially when confronted with losses. The emotional distress brought on by setbacks can trigger impulsive decisions, veering from the trader’s established course. This is a pitfall familiar to many traders, demanding emotional resilience and steadfast adherence to one’s trading strategy, even in the face of financial adversities. Sustaining discipline and consistency emerges as a linchpin for enduring success in the trading arena.

How to Overcome the Difficulty

Nurturing discipline and unwavering consistency in trading, especially during periods of unfavorable outcomes, presents a formidable trial. To surmount this, traders must forge a robust trading plan and steadfastly adhere to it, resisting the allure of impetuous judgments fueled by transient market fluctuations or emotional triggers. Practicing patience assumes significance, acknowledging that trading triumphs arise from a tapestry of judicious decisions made over time, rather than instant gains. Leverage tools like automated trading or setting up alerts for market shifts to fortify adherence to the established strategy and preserve unwavering discipline.

FundedNext Customer Reviews

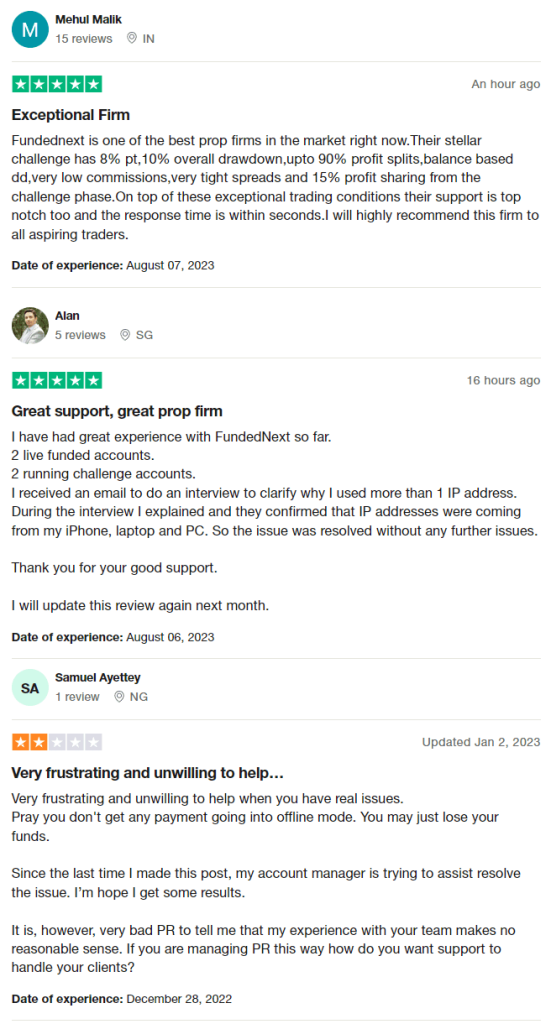

The trading circumstances on the platform, which include an 8% profit target, up to 90% profit splits, low commissions, small spreads, and 15% profit sharing from the challenge phase, are praised by many customers. The firm’s timeliness and top-tier assistance have been lauded, with users praising its speedy response times. The firm’s understanding and fair treatment of users is likewise highly recognized, as seen by the successful settlement of an IP address issue.

However, not all of my encounters have been favorable. Some consumers indicate dissatisfaction with payment and offline mode issues, which may result in the loss of funds. The company’s public relations strategy has also been criticized, particularly its treatment of user complaints. Having said that, the account manager’s attempts to remedy these issues have been noted, indicating FundedNext’s continued effort to address consumer complaints.

Despite the criticisms, the overall feedback suggests that FundedNext has a lot to offer to traders, particularly those seeking optimal trading conditions and responsive support.

FundedNext Fees and Commissions

FundedNext, as a proprietary trading firm, does not impose any trading fees. However, the associated broker, in this case, Eightcap, does levy trading fees. These fees are subject to multiple factors, including but not limited to, the type of asset being traded. For detailed fee information, traders are encouraged to review the broker’s website or will discover the exact amounts during the course of their trading activities.

FundedNext stands by its claim of offering more advantageous conditions in comparison to trading directly with Eightcap. As part of its operational structure, the firm implements an initial fee structure that varies depending on the selected plan. Each plan outlines the trading balance a trader will receive upon successful completion of a challenge.

For instance, for the entry-level plan that provides a $15,000 balance after the challenge, an initial fee of $99 is charged. If a trader aims for the uppermost plan that yields a balance of $200,000, the initial fee increases to $999. It’s important to note that this initial fee is non-refundable under any circumstances. However, traders can take solace in the fact that there’s no limit to the number of attempts they can make to pass the challenge, providing ample opportunities to succeed and earn their desired trading balance.

Account Types

FundedNext offers four types of accounts to meet the needs and preferences of different traders:

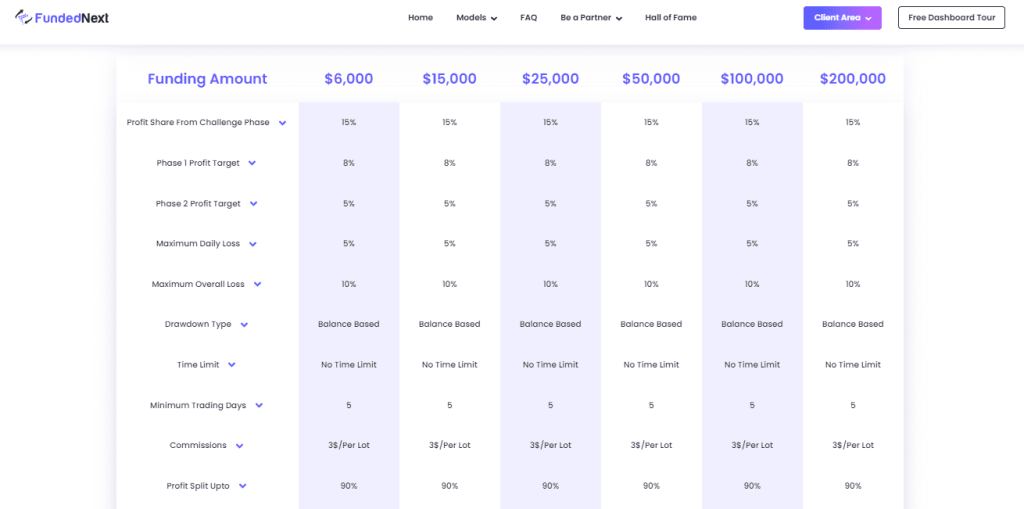

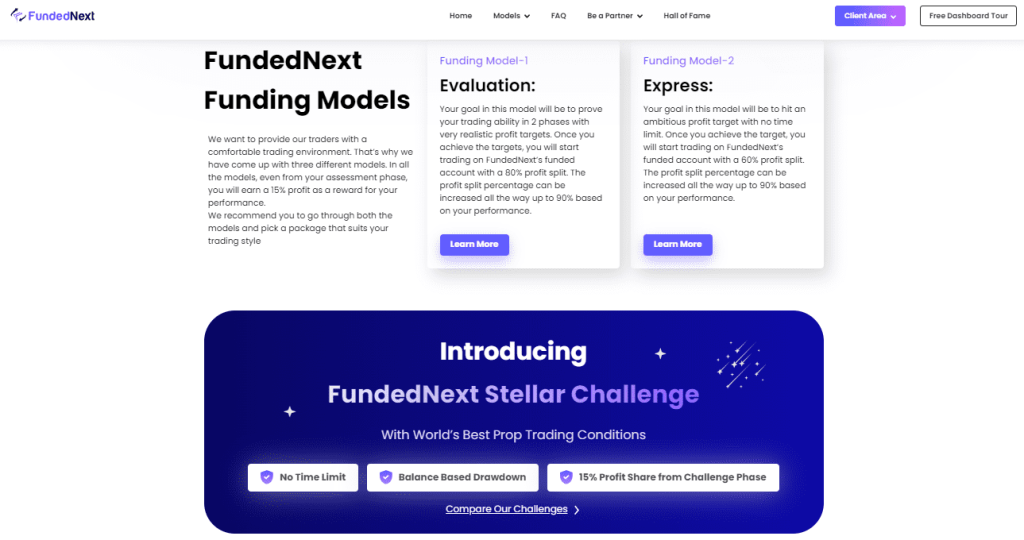

Evaluation Model

In order to pass the evaluation model’s two phases, traders must effectively achieve profit targets while showcasing their trading skills. The funded account of FundedNext, which starts off with a large 80% profit split, becomes available to traders once these targets are reached. Depending on how well the trader does, this split percentage could exceed 90%.

Express Model

In contrast, the Express Model involves only a single-phase challenge, where the trader’s objective is to reach a 25% profit target without any time constraints. Once this target is attained, traders begin trading on FundedNext’s funded account, this time commencing with a 60% profit split. Similar to the Evaluation Model, this profit split percentage can increase up to 90% based on the trader’s performance.

Stellar (1-Step) Model

The Stellar (1-Step) Model is characterized by a single-phase challenge requiring traders to achieve a 10% profit target before earning a funded status. There are daily and overall loss rules in place, limiting losses to 3% and 6%, respectively. Profit splits under this model range between 80% and 90%, and traders also have the opportunity to scale their accounts.

Stellar (2-Step) Model

The Stellar (2-Step) Model encompasses two phases that traders must complete. The first phase stipulates an 8% profit target, followed by a 5% profit target in the second phase. Both phases must be successfully completed to unlock funded account access. The loss rules for this model cap daily and overall losses at 5% and 10%, respectively. Like the 1-Step model, profit splits can vary from 80% to 90%, and account scaling is an available feature.

Also Read: How Forex Prop Firms Fund Forex Traders

How to Open Your Account

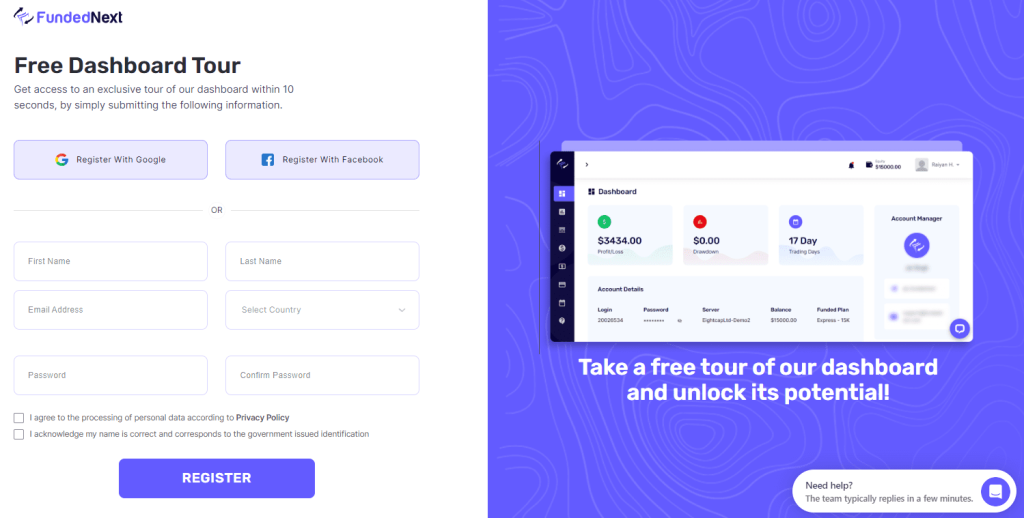

Opening a FundedNext account is a seamless process, aided by the platform’s user-friendly interface. Here’s a step-by-step guide to help you navigate through the process:

- Navigate to FundedNext’s official website. Locate the Client Area drop-down menu situated at the top right corner of the homepage, and click on it.

- From the drop-down menu, choose the Register option.

- You’ll be redirected to a page that offers a free tour of the dashboard. This page is also where you’ll need to provide some essential details to register. For convenience, you may opt to register using your Google or Facebook account if you have one.

- After providing the necessary details, you’ll be prompted to create a password. Once done, click on Register to finalize the preliminary registration.

- Following successful registration, log in to your new account using your user-id and password.

- You will be taken to the sample dashboard of FundedNext after logging in.

- To the left of the screen, you’ll find ten options, ranging from the dashboard to help.

- Scroll down to locate the option that reads ‘Start New Account Get Funded Now’.

- Clicking on this option will present you with three challenge models: Stellar, Evaluation, and Express.

- Each of these models or challenges comes with specific one-time fees and funding amounts that will be allocated to the trader’s account.

- Select the account model that best suits your budget and level of trading expertise.

- Once selected, click on ‘Enroll Now‘.

At this point, you’ll need to wait for a notification regarding the arrival of your initial fees. Once these fees have been received, you can commence your chosen challenge. All your progress will be updated and displayed on your real dashboard.

FundedNext Customer Support

FundedNext’s customer support is robust and easily accessible, ensuring that its traders can receive assistance through a variety of channels. For more detailed or complex inquiries, traders can contact technical support via email. Alternatively, the chat feature on both the website and the app provides real-time assistance for immediate concerns. In addition, traders can fill out a form on the website and expect a response via email.

Beyond these direct contact methods, FundedNext actively engages with traders on several social media platforms. It maintains official accounts on Facebook, Twitter, Instagram, and YouTube, where it regularly publishes relevant information and updates.

Furthermore, traders are welcome to join the company’s Discord and Telegram communities. These platforms provide opportunities for real-time discussions with representatives of the firm as well as with fellow traders.

All of these links are conveniently located in the footer of the FundedNext website, ensuring traders can easily access support and information whenever required.

Advantages and Disadvantages of FundedNext Customer Support

Contact Table

Security for Investors

Withdrawal Options and Fees

FundedNext offers traders an impressive earnings structure and flexible withdrawal mechanisms. Traders can earn 15% of the profits during the challenge phase, which is conducted on demo accounts. Upon moving to live trading, the profit share ranges from 60-80% and could rise to a maximum of 90% based on the trader’s performance. The balance of the profits goes to the prop firm. Initially, traders can withdraw funds once every 30 days. Over time, this frequency increases, allowing them to request a withdrawal once every 14 days.

The platform supports various withdrawal methods, including bank cards, electronic wallets, cryptocurrency wallets, or traditional bank transfers. Profits can be withdrawn in USD or popular cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH), with an automated conversion feature available for convenience. The processing time for withdrawal requests typically spans a few days, ensuring traders can access their earnings without undue delay.

What Makes FundedNext Different from Other Prop Firms

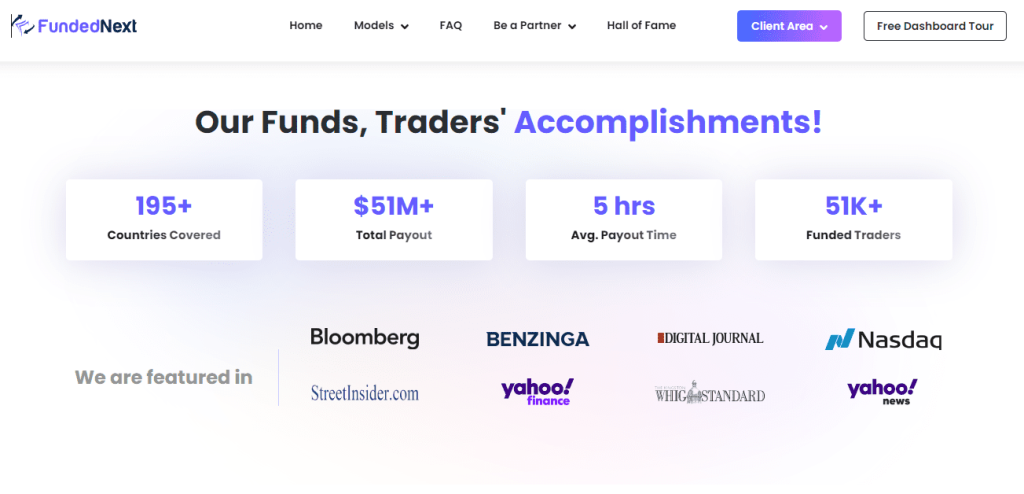

FundedNext distinguishes itself from other proprietary (prop) trading firms through several notable features and offerings. One of the unique aspects of FundedNext is its generous provision of trading capital. The platform provides traders with up to $200,000 in capital, which can potentially escalate to a whopping $4 million. This high level of financial backing is rarely seen in the prop trading industry.

Moreover, the platform offers attractive profit splits. Traders at FundedNext start with a favorable 80% profit split, which can increase up to 90% based on performance. Such lucrative profit-sharing structures add significantly to its appeal. Even more distinctively, FundedNext provides traders the opportunity to earn 15% of the profits made during the challenge phase on demo accounts. This unique feature allows traders to start making money even before they transition to real accounts.

Furthermore, FundedNext prides itself on offering flexible trading conditions. Unlike many other prop firms, there are no restrictions on trading strategies, giving traders a great deal of freedom. The firm also has user-friendly tools such as a comprehensive dashboard and a mobile app that allow for customized trading overviews, direct communication with account managers, and the maintenance of personalized trading journals.

The firm also excels in terms of customer support. FundedNext provides comprehensive trader assistance, which can be accessed through various channels such as email, live chat, or a website form. Plus, they have a strong presence across several social media platforms and offer community engagement through Discord and Telegram groups.

Finally, transparency is a hallmark of FundedNext’s approach to fees and commissions. While the broker charges trading fees, FundedNext asserts that their conditions are more beneficial than if traders were to directly engage with the broker. All these features solidify FundedNext’s position as a prop firm that genuinely caters to the needs and ambitions of its traders, distinguishing it from its competitors.

How Can Asia Forex Mentor Help You Pass FundedNext’s Evaluation?

At Asia Forex Mentor, founded in 2008 by Ezekiel Chew and headquartered in Singapore, we have the expertise and resources to help you navigate and succeed in FundedNext’s evaluation process. What began as a humble project to educate a few close friends about forex trading, soon expanded into a thriving community. As our community grew, so did our methods and teaching style.

Our rapid growth led us to offer live, in-person lessons, attracting not only individual traders but also trading companies and banks who sought our expertise to enhance their teams’ skills. Over time, all our teaching resources have been consolidated into a comprehensive offering known as the AFM Proprietary One Core Program.

Our One Core Program is designed to empower students with the ability to construct a robust trading system, analyze the forex market accurately, and manage their trading accounts effectively. It provides an immersive learning experience that helps forex traders gain a deeper understanding of the trading landscape.

Our course curriculum is thorough and detailed, consisting of 26 comprehensive lessons, covering more than 60 subtopics. Each topic is supported by high-quality online videos. All the lessons incorporate examples and interpretations personally selected by Ezekiel, providing a nuanced understanding of the topic. Our program is recognized as being highly beginner-friendly and low-risk, making it an ideal platform for anyone venturing into forex trading.

Our Journey at Asia Forex Mentor

Here at Asia Forex Mentor, our founder, Ezekiel Chew has had a transformative impact on the lives of thousands of retail traders, bank traders, institutional forex traders, and those working in investment firms. Our unique training methodology has seen students evolve from complete novices to accomplished, full-time forex traders, with some even progressing to become fund managers.

Our One Core Program offers a risk-free, seven-day trial period, following which a one-time participation fee of $997 applies. If you are confident about the course and wish to bypass the trial, you can directly purchase the course for a slightly discounted price of $940.

Our One Core Program at Asia Forex Mentor is the gateway to mastering the nuances of forex trading and excelling in FundedNext’s evaluation process. It’s designed for those serious about turning a new page in their trading career, whether you are a beginner or an experienced trader.

Imagine the thrill of achieving your profit targets consistently and scaling your trading business, all under the guidance of industry veterans like Ezekiel Chew.

You don’t merely learn about trading; you’ll be armed with a time-tested trading system, deep market insights, and proven risk management strategies, setting you on the path to becoming a successful prop trader with FundedNext.

Conclusion: FundedNext Review

In conclusion, FundedNext distinguishes itself as a prop trading firm that provides substantial opportunities for traders at various levels of expertise. Its robust, technologically advanced platform, coupled with beneficial trading conditions and a range of account types, fosters an optimal trading environment. But keep in mind that there are risks involved with every trading opportunity. Trading on any platform, including FundedNext, requires self-control, in-depth market knowledge, and adept risk management.

Also Read: Fidelcrest Review 2023

FundedNext Review FAQs

What is the profit split structure in FundedNext?

In the Express Funded account, traders receive 60% of the profits during their initial withdrawal. The share then increases to 75% and eventually to 90% for subsequent withdrawals. In the Evaluation and Stellar Funded accounts, traders start off with an 80% profit share. As they scale up, they become eligible for a 90% profit share.

What is the minimum number of trading days for FundedNext Challenges?

The required minimum number of trading days for FundedNext’s challenges varies based on the specific challenge. There is no minimum trading day requirement for the Evaluation, Stellar 1-step, and Stellar 2-step Funded accounts. However, the Express Funded account requires traders to actively participate in trading for at least 10 trading days.

Is the registration fee refundable?

Once traders successfully meet the criteria and achieve a payout from their Funded account, FundedNext refunds the initial registration fee. This refund is processed together with their first payout. It’s worth noting that if a trader opts to reset their account at any time, they will be refunded the most recent reset fee that they have paid.