Fullerton Markets Review

Forex trading is a sector where the choice of a broker can make a significant difference in a trader’s experience and success. It’s essential to choose a broker that offers not only a comprehensive trading platform but also a wide range of financial instruments and exceptional customer support.

Fullerton Markets stands out in the competitive Forex brokerage landscape. Offering a variety of trading options, including currency pairs, metals, oil, and indices, Fullerton Markets also provides the unique opportunity for clients to earn passive income through investment programs. Catering specifically to the Asia-Pacific region, it tailors its services to suit the unique demands of traders in this market. Our in-depth review will offer a balanced exploration of Fullerton Markets, merging expert analysis with real trader experiences. This approach is designed to help you make an informed decision about Fullerton Markets as your potential Forex broker.

What is Fullerton Markets?

Fullerton Markets is a Forex and CFDs broker, renowned for offering a diverse array of trading instruments. Its portfolio includes not only currency pairs, but also indices, precious metals, and oil. Primarily, Fullerton Markets specializes in Forex currency pairs, providing access to over 100 pairs that cover major, minor, and exotic currencies.

Despite striving to be seen as a broker with advantageous conditions, Fullerton Markets has a notable limitation: it is not a regulated broker. It operates under an offshore license, which is an essential factor for traders to consider. This type of licensing doesn’t offer the same level of trader protection as those provided by more stringent regulatory bodies. This means while Fullerton Markets presents various trading opportunities, the absence of robust regulation introduces certain risks for traders.

Benefits of Trading with Fullerton Markets

Trading with Fullerton Markets has offered me several benefits, making my experience as a trader quite positive. One of the key advantages is the access to free trading tools on their website. These tools, available at no extra cost, have been instrumental in helping me make informed trading decisions.

Another significant benefit I’ve noticed is that Fullerton Markets often covers the commissions for deposits and withdrawals. This practice reduces the overall transaction costs, which can be a relief, especially for frequent traders. It’s a feature that adds to the cost-effectiveness of trading with this broker.

The broker also provides investment programs, which I found particularly interesting. These programs offer additional avenues for income, potentially enhancing the overall trading experience. They can be a great option for those looking to diversify their investment strategy.

Furthermore, as a trader seeking a swap-free option, I was able to open an Islamic account with Fullerton Markets. This account type is designed to comply with Sharia law, making it a suitable choice for traders who require swap-free trading conditions. This flexibility in account options caters to a diverse range of trader needs and preferences.

Fullerton Markets Regulation and Safety

During my time trading with Fullerton Markets, I’ve taken a keen interest in understanding their approach to regulation and safety. A crucial aspect I found is their use of segregated accounts to store clients’ funds. This means that the funds I deposit are kept separate from the company’s operating funds, ensuring that my capital is not used for any other purpose by the broker.

Another layer of security provided by Fullerton Markets is the client insurance they offer. This insurance is designed to protect clients like me in the event of losses resulting from inappropriate advice by the broker’s employees or due to fraudulent activities. Knowing this gave me an added sense of security while trading.

However, it’s important to highlight that Fullerton Markets is not regulated by independent authorities. This is a significant consideration for any trader. The lack of oversight from reputed regulatory bodies means there’s an increased need for traders to exercise caution. Understanding this aspect of Fullerton Markets is vital before committing to trade with them, as it directly impacts the level of protection and recourse available in the event of disputes or issues.

Fullerton Markets Pros and Cons

Pros

- Negative balance protection.

- Free trading tools on the website.

- Broker often covers deposit and withdrawal commissions.

- Option for swap-free Islamic accounts.

- Available investment programs.

Cons

- No bonuses for traders with negative balance protection.

- Islamic accounts ineligible for MAM accounts.

- Lack of third-party regulation.

Fullerton Markets Customer Reviews

Fullerton Markets has garnered positive customer feedback, reflected in its current 4.5-star rating on Trustpilot. Customers praise the broker for its educational resources, which have been instrumental in refining trading strategies. The availability of a demo account is highlighted as a significant advantage, allowing traders to practice strategies without the risk of real funds. Users also appreciate the ease of account creation and trading, noting the platform’s user-friendly nature.

The speed of service and the competence of the support staff are frequently commended, with customers finding them helpful for various queries. The broker’s diverse range of trading instruments, especially the SWAP-FREE trading option in the new PRO account, has also been well-received. Overall, Fullerton Markets is often described as one of the best brokerages for trading, thanks to these combined features.

Fullerton Markets Spreads, Fees, and Commissions

In my experience with Fullerton Markets, I’ve found that their approach to spreads, fees, and commissions is quite straightforward. The trading commission largely depends on the type of spread I choose. With a floating spread, there’s no additional commission, which is a cost-effective option for many traders. On the other hand, opting for a fixed ECN spread incurs an additional fee of $10 per lot, but this only applies to currency pairs.

One aspect I appreciate is the absence of any account maintenance fee. However, if my account remains inactive for more than 180 days, Fullerton Markets charges a monthly inactivity fee of $5 or the total account balance if it’s less, which is a fair policy to encourage active trading. It’s important to note that these inactivity fees continue until the account balance reaches zero, at which point the funds are donated to the Fullerton Markets charity.

Regarding withdrawals, Fullerton Markets generally covers the withdrawal fees. The exceptions are bank transfers and cryptocurrency transactions, where the fees are either charged by the bank or range between 2–4% for cryptocurrency. Additionally, in some cases with Neteller, there might be fees. This transparent fee structure is one of the reasons I find trading with Fullerton Markets agreeable.

Account Types

As someone who has tested the account options at Fullerton Markets, I can provide a clear overview of their account types. Fullerton Markets simplifies the choice for traders by offering a single type of trading account, which I found quite straightforward.

- Live Account: This is the primary account type available for trading. Once I opened this account, I had the flexibility to trade using either the MT4 or MT5 platforms. Additionally, options like the MAM account and CopyPip account are accessible, catering to different trading styles and strategies.

- Demo Account: Before committing to a live account, I had the opportunity to test my trading strategies using Fullerton Markets’ demo account. This account accurately mimics real market conditions, providing a realistic and risk-free environment to hone trading skills.

This streamlined approach to account types makes it easier for traders, especially beginners, to navigate and start trading without the confusion of multiple account options.

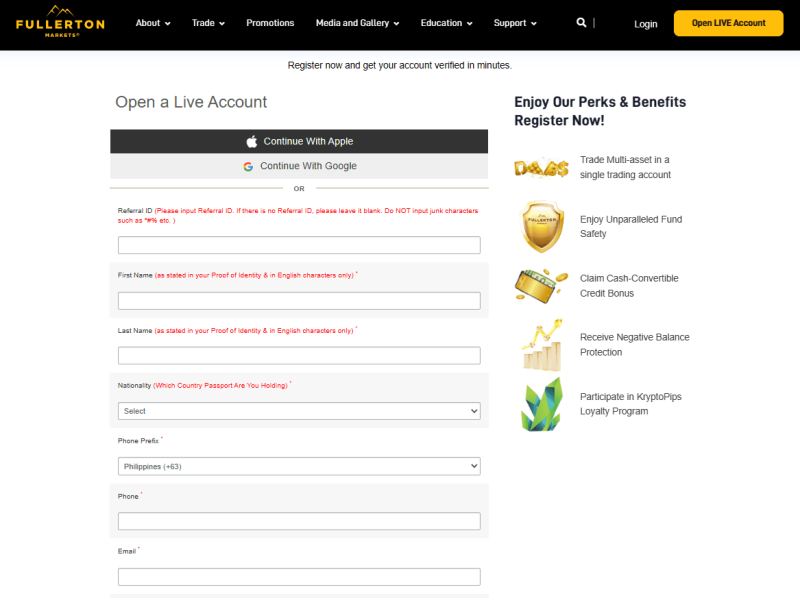

How to Open Your Account

- Visit Fullerton Markets’ website and click on the “Open Account” button on the main page.

- Complete a short registration form with personal details like name, phone number, and email, and choose your preferred interface language. You can also sign up using your Apple, Facebook, or Google account.

- After submitting your details, download the Fullerton Markets mobile app.

- Check your email for a confirmation letter from Fullerton Markets and follow the provided link to confirm your registration.

- Log in to your personal account by re-entering your login details.

- Re-enter your email and password, then click on the Sign In button.

- Confirm your phone number by re-entering the country code and number, then click on “Proceed” and “Confirm” to verify.

- Enter the verification code sent via SMS to your phone in the provided field and click on “Proceed”.

Fullerton Markets Trading Platforms

Based on my experience, Fullerton Markets offers two primary trading platforms: Metatrader 4 (MT4) and Metatrader 5 (MT5). MT4 is well-known for its user-friendly interface and robust technical analysis tools. It’s ideal for both beginners and experienced traders due to its customizable features and comprehensive charting capabilities.

MT5, on the other hand, is a more advanced platform that builds upon the strengths of MT4. It offers additional timeframes, more indicators, and advanced trading tools. This platform is particularly beneficial for traders looking for a deeper analysis and more sophisticated trading strategies. Both platforms provide a reliable and efficient trading experience, making them a strong choice for various trading preferences.

What Can You Trade on Fullerton Markets

Based on my trading experience with Fullerton Markets, their range of trading instruments is impressively diverse. They offer a wide array of currency pairs, including major, minor, and exotic pairs. This variety provides ample opportunities for traders to engage in the Forex market, whether they prefer trading well-known currencies or exploring less common pairs.

In addition to currencies, Fullerton Markets also provides options to trade in metals like gold and silver, appealing to those looking to invest in commodities. Trading in metals can be a strategic choice for portfolio diversification and hedging against market volatility.

Furthermore, Fullerton Markets offers the chance to trade indices and oil. Indices trading allows for speculation on the broader market movements, while oil trading offers a dynamic commodity market experience. These options add depth to the trading experience, enabling traders to diversify their strategies across different markets and asset classes.

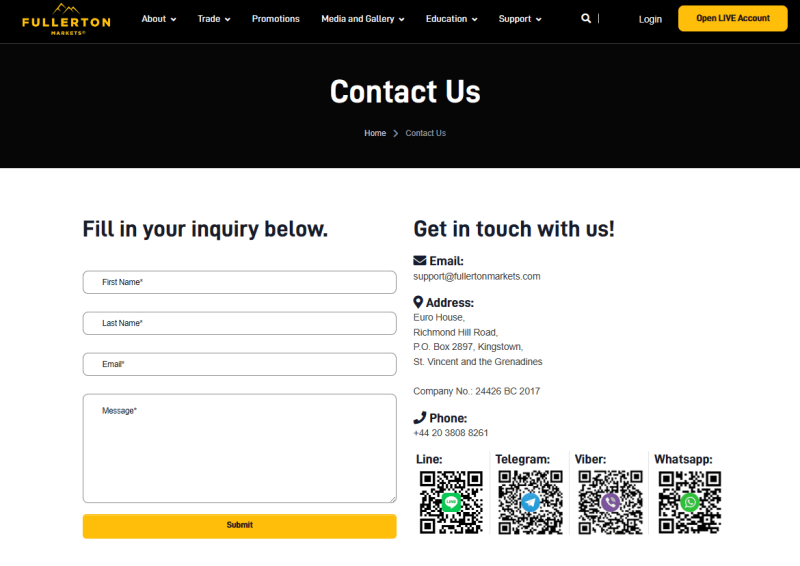

Fullerton Markets Customer Support

Fullerton Markets offers a range of communication channels for their clients, ensuring that support is readily accessible. One of the options is to fill out the feedback form on their website, which I found convenient for non-urgent inquiries. This method allows for detailed queries and feedback, and the response time is reasonably prompt.

For more direct communication, I had the option to send an email or call them on the provided phone number. Emailing was useful for detailed discussions, while phone calls facilitated immediate assistance, especially in situations requiring quick resolution. Additionally, Fullerton Markets has an online chat feature, which I found extremely helpful for getting instant responses to straightforward questions or issues. This multi-channel approach to customer support enhances the overall trading experience with Fullerton Markets.

Advantages and Disadvantages of Fullerton Markets Customer Support

Withdrawal Options and Fees

In my experience with Fullerton Markets, they offer a versatile range of methods for depositing and withdrawing funds. These include MasterCard, Sticpay, Visa, and MasterCard bank cards; electronic payment systems like Skrill, Neteller, FasaPay; cryptocurrency; bank transfers; and local transfers for clients from various countries in Asia. This diversity of options provides flexibility, accommodating different preferences and needs.

Withdrawal requests at Fullerton Markets are efficiently handled by their staff within one business day, and I found that the funds are typically transferred within 2-4 days. However, it’s important to note that for local transfers, cryptocurrency wallets, and bank transfers, there are minimum and maximum withdrawal limits. This is something to consider when planning your fund management.

Regarding fees, Fullerton Markets covers most deposit and withdrawal charges, which is a significant advantage. The exceptions include bank transfers, cryptocurrency funding (with a 2-4% fee), and Neteller transactions (2% fee) for clients from specific countries. This transparent approach to fees ensures that there are no surprises in the withdrawal process.

Fullerton Markets Vs Other Brokers

#1. Fullerton Markets vs AvaTrade

AvaTrade is renowned for its extensive range of financial instruments, boasting over 1,250 options, and is heavily regulated, offering a high degree of security and trust. Fullerton Markets, while offering a diverse range of trading instruments, does not match AvaTrade’s extensive regulatory framework.

Verdict: AvaTrade is preferable for those prioritizing a wide range of instruments and stringent regulation, while Fullerton Markets might be more suitable for traders focusing on specific markets like the Asia-Pacific.

#2. Fullerton Markets vs RoboForex

RoboForex stands out with its advanced technology and wide selection of trading platforms, including MetaTrader, cTrader, and RTrader, catering to various trading styles. In contrast, Fullerton Markets offers a more focused range of trading platforms and instruments.

Verdict: RoboForex is better for traders seeking technological sophistication and a wider array of trading platform options, whereas Fullerton Markets is more suited for traders who prefer a streamlined, focused trading platform experience.

#3. Fullerton Markets vs Exness

Exness is notable for its high monthly trading volume and offers an impressive array of more than 120 currency pairings, including options for stocks and energy. It provides conditions favorable for both small and large deposits, with features like unlimited leverage. Fullerton Markets, with its focus on the Asia-Pacific region, doesn’t provide as vast a range of currency pairings.

Verdict: Exness is better for traders looking for a wide variety of currency pairings and flexible trading conditions, while Fullerton Markets is more focused and might appeal to traders with specific market interests.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH FULLERTON MARKETS

Conclusion: Fullerton Markets Review

In conclusion, Fullerton Markets has established itself as a competent Forex and CFDs broker, particularly appealing to traders in the Asia-Pacific region. Its strengths lie in the diverse range of trading instruments it offers, including over 100 currency pairs, metals, indices, and oil. Additionally, the broker’s approach to covering most deposit and withdrawal fees and providing multiple customer support channels enhances the trading experience.

However, it is crucial for potential traders to weigh these benefits against the significant caveat of Fullerton Markets not being regulated by independent authorities. This lack of stringent regulation poses risks that should not be overlooked. While the broker offers innovative features like investment programs and swap-free Islamic accounts, the absence of robust regulatory oversight remains a point of concern.

Fullerton Markets Review: FAQs

Is Fullerton Markets regulated?

Fullerton Markets is not regulated by major independent authorities. It operates with an offshore license, which provides less oversight compared to more stringent regulatory bodies.

What trading instruments are available with Fullerton Markets?

Fullerton Markets offers a variety of trading instruments, including a wide range of currency pairs, metals, indices, and oil.

Does Fullerton Markets offer Islamic accounts?

Yes, Fullerton Markets provides the option of opening swap-free Islamic accounts, catering to traders who require Sharia-compliant trading conditions.

OPEN AN ACCOUNT NOW WITH FULLERTON MARKETS AND GET YOUR BONUS