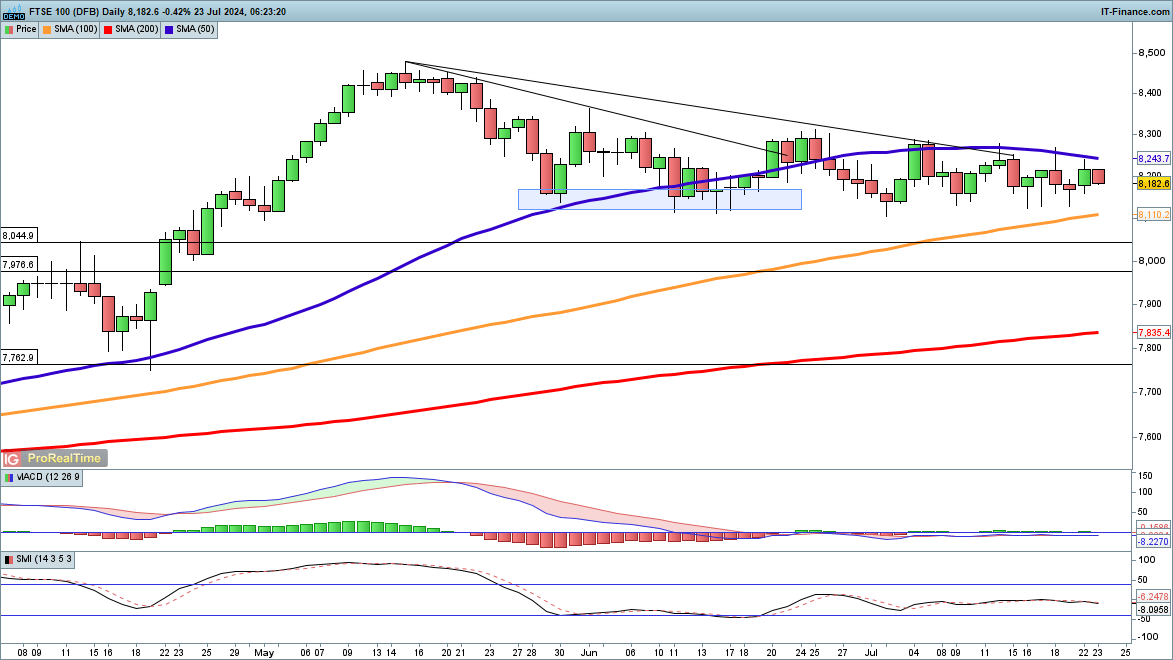

FTSE 100 Faces Resistance

The FTSE 100 index experienced a rally yesterday, but momentum waned in early Tuesday trading.

Despite its inability to maintain a sustained rally, the price has consistently held above 8100 since May, establishing a robust support area. A close below 8100 could lead to a quick decline, targeting 8044 and then dropping to 7976.

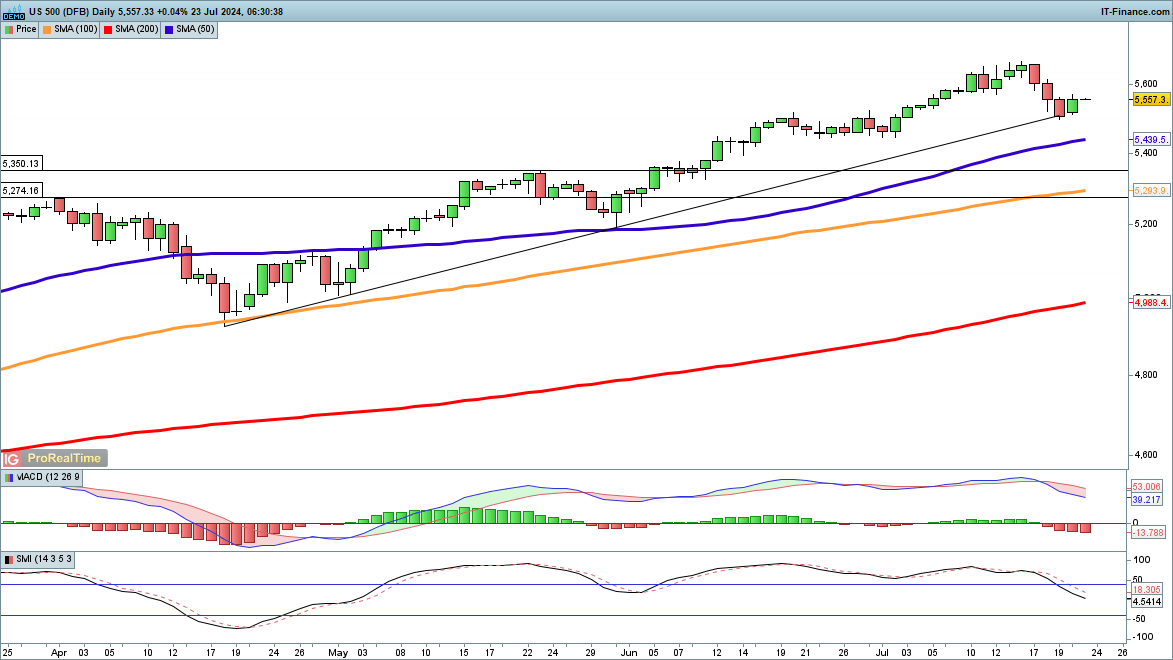

S&P 500 Recovers Post Losses

Monday saw the S&P 500 index rebound after enduring three consecutive days of losses last week.

The bounce from 5500 now aims at the previous week’s highs, with the potential for a brief move to new record highs if gains continue. However, a close below 5500 would likely signal further short-term weakness.

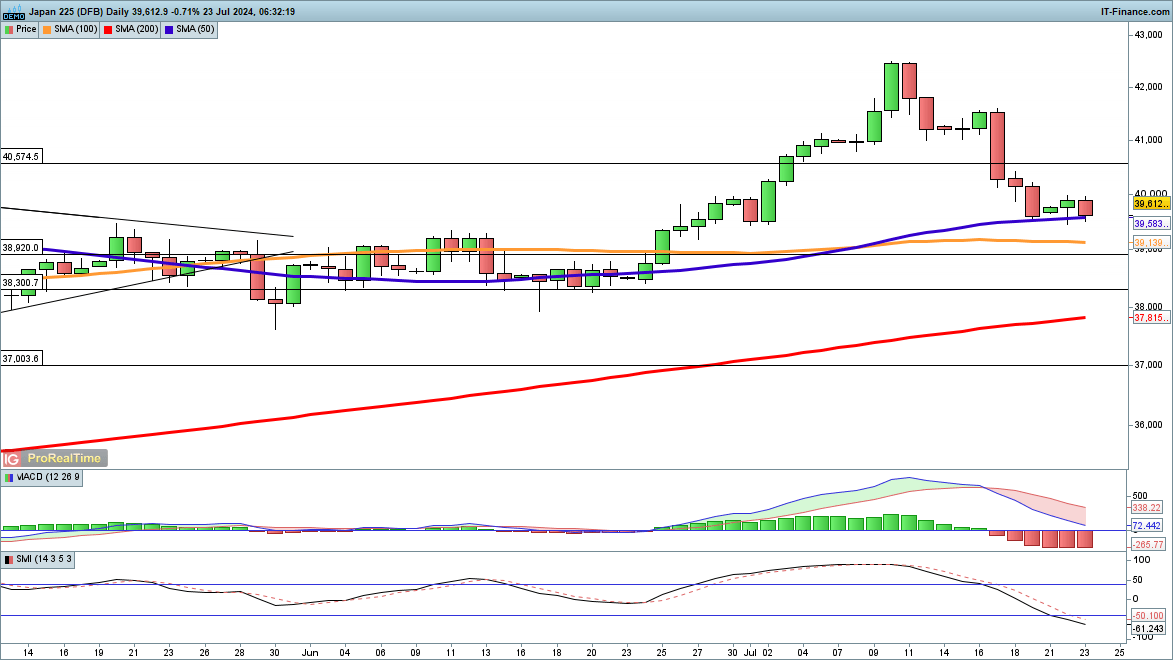

Nikkei 225 Reverses Trend

Monday's rally hinted at renewed upside for the Nikkei 225, but this has been postponed for now.

The index declined overnight but has so far avoided closing below the 50-day simple moving average (SMA). Bulls need a close back above 40,000 to suggest a possible low, while sellers will focus on a close below the 50-day SMA to indicate more near-term downside.