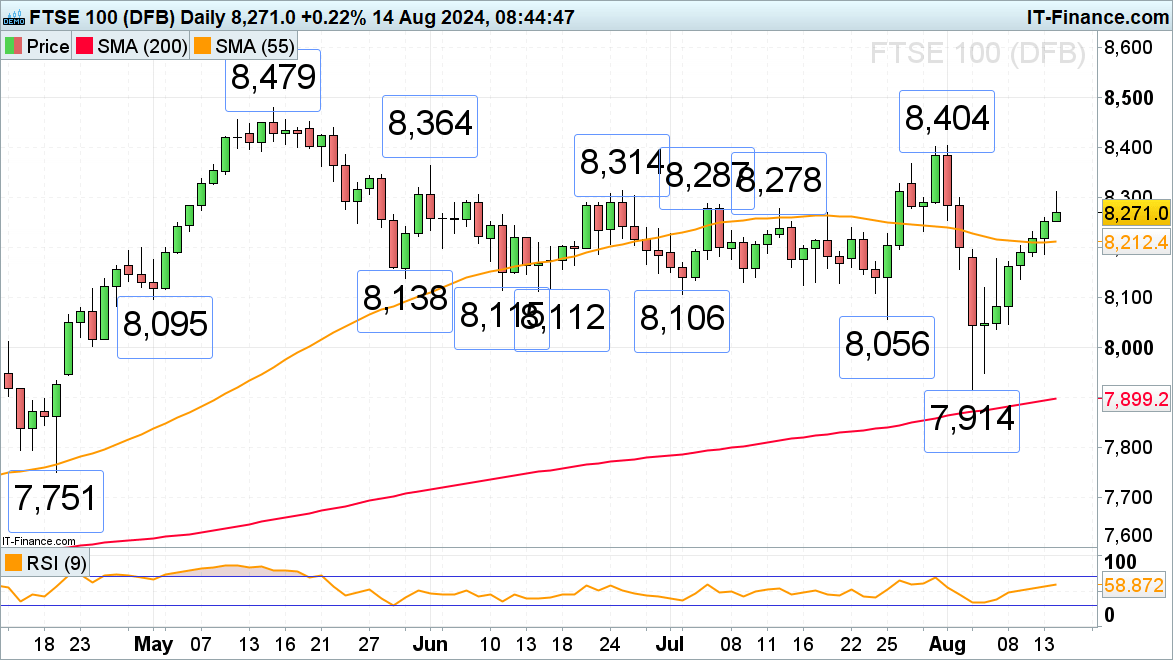

FTSE 100’s Advance May Face Resistance After Six Consecutive Gains

The FTSE 100 has enjoyed six straight days of gains and is approaching a potential pause as it nears the 8,278 to 8,314 resistance zone, which marked the highs from late June to mid-July. If the index manages to break through this level, the early August high at 8,404 could come back into focus.

Key support is seen around the 55-day simple moving average (SMA) at 8,212.

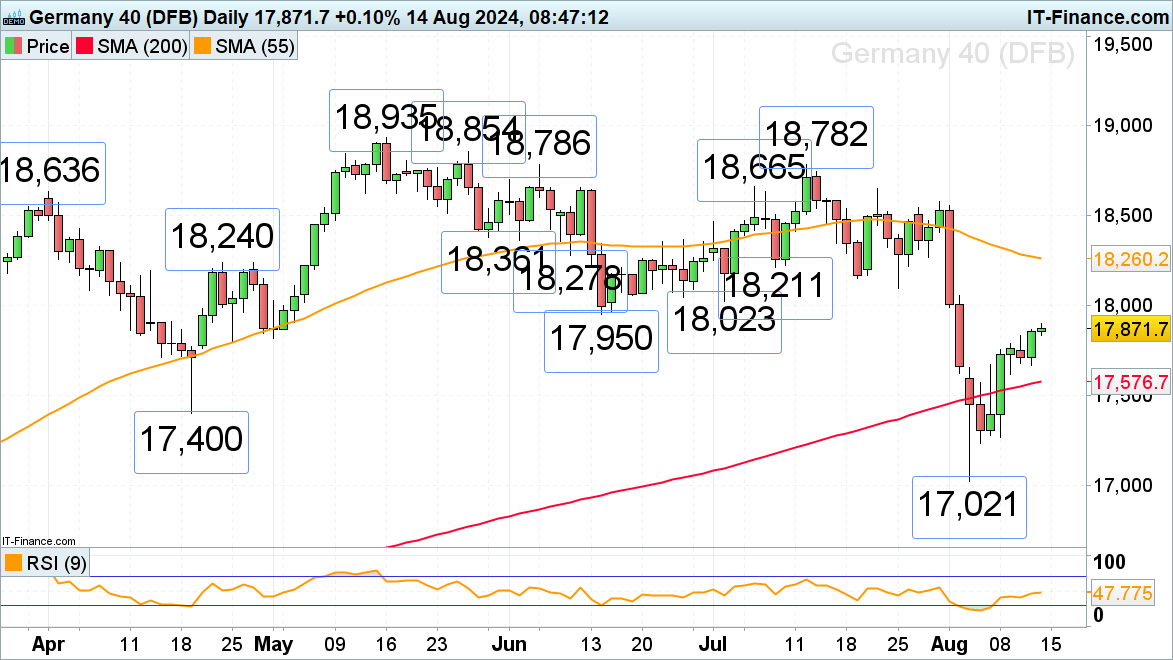

DAX 40 Slows Down as It Nears Resistance

The DAX 40 has been recovering from last week’s low of 17,021, but its upward momentum is fading as it approaches the 17,950 mark, the low from mid-June. This level, along with the 18,023 early July low, is expected to serve as a resistance zone.

A drop below Tuesday’s low of 17,669 would bring the 55-day SMA at 17,577 into play as support.

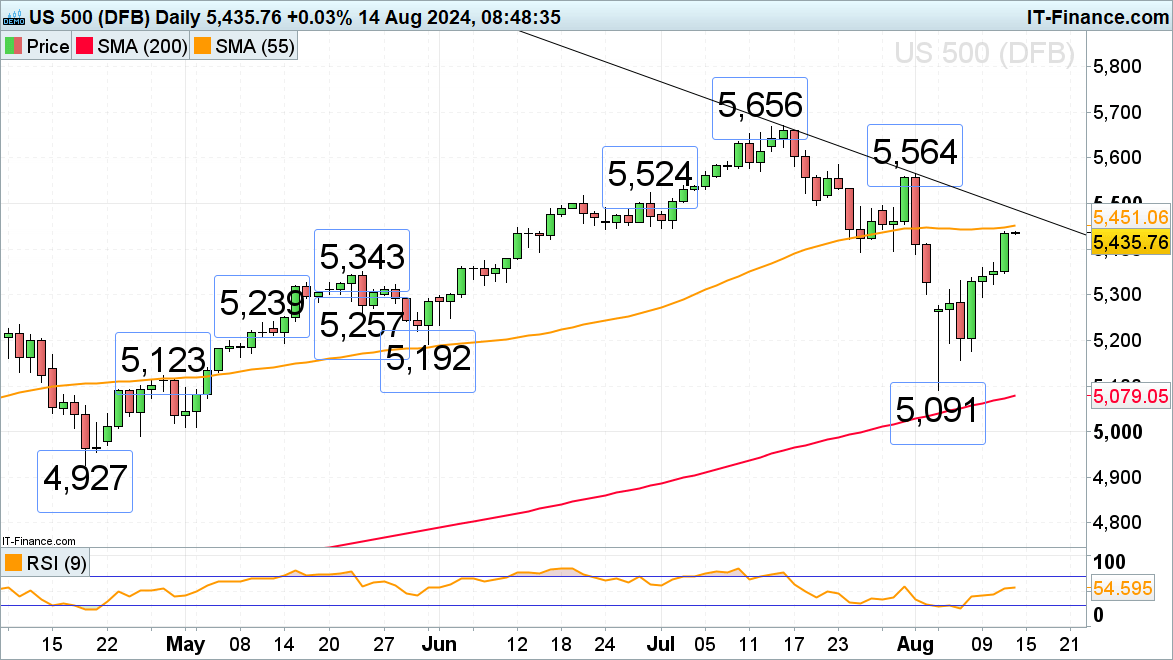

S&P 500’s Rally Could Pause After Four Days of Gains

The S&P 500 has been rising for four consecutive days and is now nearing the 55-day SMA at 5,451, which, combined with the July-to-August downtrend line at 5,485, is likely to act as resistance in the near term.

Minor support is anticipated between the 25 and 30 July lows at 5,396 to 5,392.