FTMO Review

A Proprietary trading firm represents a genie in a bottle for struggling traders and investors. A prop firm's prominent role is to provide opportunities to potential traders and investors by giving away massive funds for trading objectives. FTMO is also a prop firm that aims to finance potential traders and investors who can earn profits for themselves and the firm.

However, as it sounds too good to be true, there are many obstacles and hurdles to reaching funds of up to $1million for investments. Therefore, FTMO evaluates traders through specific trading challenges in two different phases. Nevertheless, individuals who prove to be skilled, passionate, and consistent can eventually lay their hands on these funded accounts.

Trading experience is a must before getting registered at the FTMO company. Those with hands-on experience and sound risk management are more likely to survive with a demo account on FTMO. On the contrary, a trader who is merely enticed by the funds and does not have the will to perform and learn would t be able to make it through the FTMO challenges.

This FTMO review will provide relevant information regarding the trading benefits, platforms, evaluation process, trading features, and other essential details regarding starting your journey with this Prop firm. Moreover, traders and investors will also be able to find out the drawback and flaws of the firm so that they are in a better position to choose the right prop firm for themselves.

What is FTMO?

FTMO is an abbreviation of Filip, Tomas, Marek, and Otakar, the first team members of the popular prop trading company. This Firm originated in the Czech Republic in the year 2014. The vision of this company was to provide capital to those skilled and potential traders who are reluctant to step into trading due to a budget shortage; however, they can earn massive profits.

Therefore, FTMO is a proprietary trading company that searches and provides fund opportunities of up to $ 1 million to trading talents. However, these funds are not handed over directly, but the traders have to go through a 2-step evaluation process, including trading challenges and account verification.

This evaluation process forces a trader to follow trading rules and generate profits for themselves and the firm. Hence, the profit split ratio is 80:20. If the candidate passes the FTMO challenge and verification, he becomes an FTMO trader and is ready for live trading in the financial market.

A potential trader must complete a two-stage active trading test. The first is the FTMO challenge, and the second phase is the verification stage. The first stage has a maximum of 30 trading days and a minimum of 10 trading days. The trader has to complete all the given trading objectives to ultimately receive massive funds of $ 1 million accessible for live trading.

Advantages and Disadvantages of Trading with FTMO

Benefits of Trading with FTMO

There are multiple benefits of trading with FTMO. First, the Cash flow is generated from the Proprietary Trading Firm's account. If a successful trading account generates profit, then the proprietary trading company will be getting a 10-20% of the trading capital, and a profit of 80-90% will be rewarded to the FTMO trader depending on the performance and consistency.

Second, traders have to pay a nominal fee to register with FTMO, through which they can get a platform, tools, assistance, and customer support to trade successfully. There are no restrictions on selecting the trading platform the trader prefers for themselves, including MT4, MT5, and cTrader.

The company works under European financial legislation; up to 90% of profit can be earned by those who have reached the scaling plan. Similarly, it is also affordable for many low-budgeted traders as the minimum deposit range is as low as $200. Moreover, the trading currency also has multiple options for traders, including USD, EUR, GBP, CZK, CAD, AUD, and CHF.

The main benefit of trading with this company is that the trader can use automated Expert Advisers(EAs) or scalping strategies to gain maximum profits from their trading strategies. Moreover, the evaluation process of FTMO is also designed to train and prepare the trader to achieve the profit targets effectively.

Many useful tools are provided for traders on the FTMO-funded trader's account, including an economic calendar, statistic indicators to assess the market conditions, a mentor application to get expert advice, the trade magazine for copy trading, account metrics for tracking trading progress, account analysis to evaluate one's trading performance and equity simulator for calculating risk probability.

FTMO Pros and Cons

Pros

- Achievable Profit targets

- Easy Withdrawals

- Useful and effective tools

- Advanced trading platforms

Cons

- Monthly Withdrawals.

- Uncertain future of the firm

Difficulties Met by the Traders who Participated in the Brokers Challenge

#1. The 5% Daily Drawdown

Drawdown means when the traders start to struggle and suffer losses due to the plunge in the prices of a trading asset. Drawdowns are measured from the highest profit point to the point of losses. However, the FTMO challenges only allow a 5% daily drawdown, which is difficult for even professional traders to achieve.

How to Overcome the Difficulty

Users can overcome the daily drawdown obstacle by using the stop-losses option in their trading activities or decreasing their trade volume. However, traders must assess the market conditions accurately before applying stop-losses, or this feature would be useless.

#2. High-Profit Target

The FTMO challenge phase 1 has a profit target of 10% of the initial payment and 5% of the initial payment in the verification phase. This target is to be achieved within 30 days in stage 1 and 60 calendar days in stage 2. Hence, traders who cannot achieve this target within the allotted time will be disqualified from the challenge.

How to Overcome the Difficulty

Traders can overcome this difficulty by calculating the net profit and dividing it into small profit milestones. In this way, the firm will be able to assess the trader's consistent capital returns and overall performance.

#3. Minimum trading days

The criteria for minimum trading days in the FTMO challenge is 30. However, only those days will be counted when the trader opens the trading positions. This can be a big challenge for traders to consistently maintain the daily loss limit, reach the profit target and maintain this position for ten days at the same time.

How to Overcome this Difficulty

Traders should focus more on the profit target than on anything else. If the trader can achieve the profit target before the 30-day limit, they will be advanced to the next verification phase before the 30-day limit. The same is the case with the aggressive accounts.

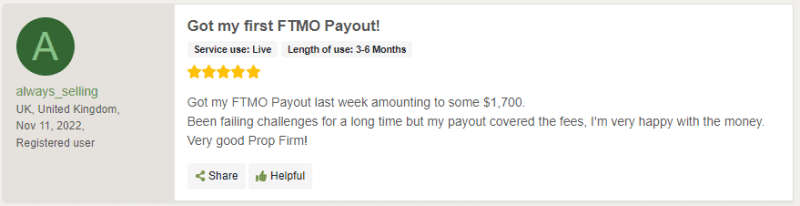

FTMO Customer Reviews

Customers worldwide positively show their reviews of successful transactions with the FTMO proprietary trading firm. Customers highlighted in their reviews that one advantage of trading with FTMO is that traders can access many profitable trading instruments available in the financial markets.

The FTMO traders can trade with Forex, Indices, Commodities, Stocks, Cryptocurrencies, and various CFDs. Hence, with a big funded account balance and various underlying assets, it is feasible to become a profitable trader.

Many comments on the firm also appraise the withdrawal process of the FTMO platform, Some said that they received their payouts instantly and conveniently due to the many withdrawal options available. Other customers also appreciated the responsive customer service of the company and said that the advanced trading platforms, including the cTrader, are the main highlight of this prop firm.

FTMO Fees and Commissions

As the FTMO evaluation process requires users to first open an account on the FTMO platform to be tested by the prop trading firm, each account subscription has a minimal refundable fee. The range of fees depends on the account balance that the trader chooses. For the account balance of $10 000, the charges are $170. As for account balances of $25,000, $50,000, $100,000, and $200,000, the charges are $270, $370, $580, and $1100, respectively.

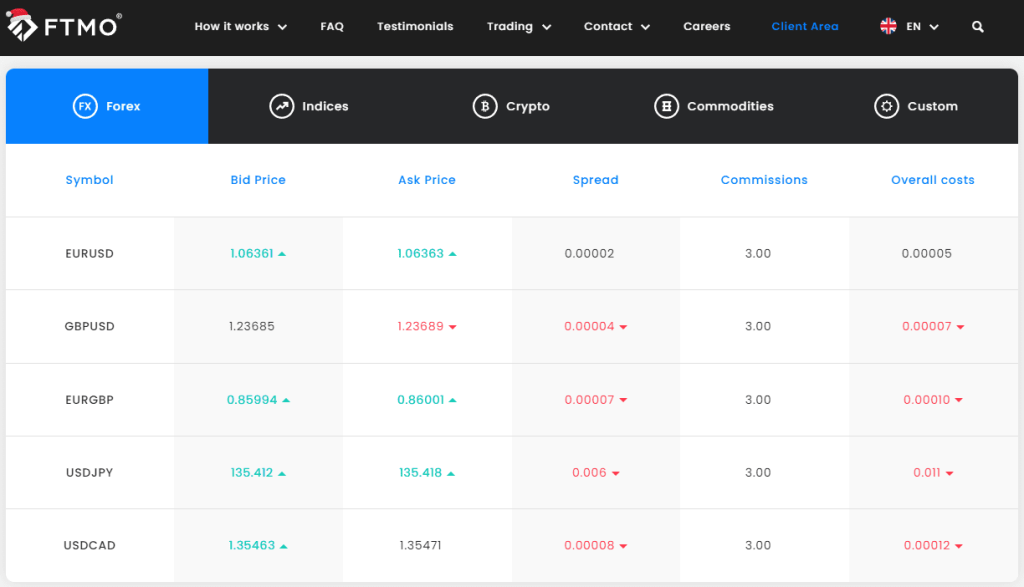

Furthermore, FTMO does not charge any commission for trading in indices and Cryptocurrencies, whereas for forex, there is a fixed commission of 3% on each trader per lot. The commission on commodities varies according to the asset. However, it is relatively lower than many other prop trading firms.

Other than the commission and account refundable fee (that is reimbursed in the first profit split), no other additional charges are applied on the FTMO platform. There are also no payout charges for traders other than the third-party charges and transfer fees that the bank applies.

Account Types

To gain access to incredible funds, the FTMO implies an evaluation process to assess the traders before entering them into the real-time trading scenario. To enter this evaluation process, traders must open an account on the FTMO platform. There are two types of accounts users can choose from.

Standard account

In a standard account, users have to subscribe to an account according to the trading balance. In the standard account, traders can opt for an account balance ranging from $10,000 up to $200,000. The trading criteria remain the same however, the profit loss, profit target, and refundable fee change following the account balance.

In the standard account, the first phase of evaluation criteria includes the maximum daily loss limit, which should not exceed 5% of the initial account balance. Similarly, the limit for maximum loss in the entire trading duration should not exceed 10% of the initial account balance. In addition to this, the Profit target for traders is set at 10% of the initial account balance.

The second phase, which is the verification stage, has 60 days to achieve all the given trading goals. The second stage criteria is a bit relaxed compared to the first stage. In this phase, the trader has the profit target reduced from 10% to 5%, and the maximum trading days also increased by 60 days the trader also does not have to pay any fee to the trader in the verification stage.

Aggressive account

Other than the standard account, traders also have the option to choose the aggressive account. This account type also has all the same features as the standard account however, as the name suggests, the profit target and profit loss criteria are much more combative than the standard account criteria.

The aggressive account holder has to follow the 10% maximum daily loss limit and 20% total loss limit. Similarly, the profit target is also high at 20%, compared to the 10% of the standard account. Hence, aggressive accounts are a better option for experienced and highly skilled traders who are confident enough to meet the set criteria given by the Prop trading firm.

How To Open Your Account?

Opening an account on the FTMO platform is fairly easy. The first step is to go on the FTMO official website and signup for a free account. The next step is to register yourself by filling up the registration form, clicking on “I'm not a robot” reCaptcha, and clicking the “Signup” button to submit all the details.

Once all the correct information is given, including the name, email address, phone number, and nationality, the user can click on the sign-up tab. For password verification, the user must check the email received with the verification link and click on the link to set the password.

After the registration, the user is set to use the FTMO platform and start the evaluation process's first phase by choosing any account type and submitting the required fee. If the trader feels the need to buy more time, there is also an option of a free 14-day trial where traders can familiarize themselves with the prop firm.

Once the trader finally decides to open an evaluation account on the prop firm, the first step of this process is to select the account type. There are two account types, standard and aggressive, and within each account type, the trader can choose from a range of initial account balances. The evaluation criteria of the platform vary with each initial account balance.

After selecting the account type and account balance, the user can click on the selected account type “open account” tab. The page will be redirected to the billing information page. Here the user will need to enter the billing details, including the credit or debit card number, expiration date, and CVC, and choose payment currency. Press the “Confirm and Proceed to Payment” button. After selecting the payment method, the payment will be processed and the user can start their journey through the received login details.

FTMO Customer Support

FTMO maintains a reliable customer support team for its customers worldwide. There are also financial experts available in the customer service staff, which is provided in 19 different languages. They have an excellent customer support team who push the profit targets further towards success.

Each team member is fully equipped with a large space, trading indicators, and the right technology to assist the traders in a successful trading outcome. There are highly determined, and motivated employees who are available for any queries, assistance, and future contracts.

There are multiple standard communication mediums for reaching the FTMO customer service. This include phone, email and a live chat box on the website. Along with these methods users can also connect with the FTMO representatives through various social media platforms including watsapp, facebook, twitter, Instagram and many others.

Advantages and Disadvantages of FTMO Customer Support

Contact tables

Security for Investors

Withdrawal Options and Fees

FTMO is one trading platform that has been successful providing fast and easy payouts to its customers. Along with this, the firm does not charge any withdrawal fee which makes the trading cost more affordable for the traders.

For withdrawal of payments there are many payment options available for the customers like credit and debit cards, online payment options including Skrill, Confirmo, Nuvi, Discover, Unlimited, etc. and also standard bank transfers.

For credit and debit cards as well as e-wallets and online payment platforms there is no additional charges from the FTMO platform. Furthermore, these payments are processed instantly wereas bank transfers have withdrawal charges that are applied by the local banks. Moreover, bank transfer can also take 4-5 business day for t he payment transactions.

Withdrawal of payments is only possible when the trader pass the two phase evaluation process and steps into the live trading account. The first condition for withdrawal of payments is that the trading period of 14 days should have passed, and the profit allocation system should include a 60-day period during which three times the amount can be withdrawn from the initial account balance.

If the client meets the condition of the company’s scaling plan, the balance of the FTMO account will automatically increase to 25%. The withdrawal is very convenient, and the employees ensure you get them on time.

What makes FTMO different from other Prop Firms

FTMO is a reliable prop trading firm that look out for potential and skilled traders and provide them with massive capital to do profitable trading. These funds are granted to the deserving trader only when they go through a two phase evaluation process.

FTMO is different from other prop firsm because it has a realistic and achievable evaluation process which any trader with effective trading strategies can accomplish. Therefore, it is a firm that aims to provide the opportunity to the most deserving traders.

Along with this, the rigorous evaluation process of FTMO ensures that the traders learns and gets prepared for the real-time trading set up. This system enables te users to trade successfully and make profits for themselves and for the firm as well.

Usually brokers and other prop trading firms do not provide a profit ratio of 80: 20. However, FTMO not only gives a profit split of 80:20 but also gives the option of a scaling plan where successful traders can increase their profit up to 90%. This feature make FTMO a promising prop firm for the traders worldwide.

How Can Asia Forex Mentor Help You Pass FTMO's Evaluation?

At Asia Forex Mentor, we understand the challenges traders face when trying to clear rigorous evaluations like that of FTMO. Our founder, Ezekiel Chew, launched Asia Forex Mentor back in 2008, right here in Singapore. What started as Ezekiel teaching a handful of friends about forex trading soon blossomed into a thriving community of eager learners. As word spread about the effectiveness of his teaching methods and unique insights, our community grew exponentially. Before we knew it, leading trading companies and banks were seeking Ezekiel's expertise to train their teams.

Recognizing the need for structured learning, Ezekiel distilled his extensive knowledge into the AFM Proprietary One Core Program. This program has been meticulously crafted to empower students to devise robust trading systems, dissect the forex market with precision, and manage their trading accounts with consistency.

Our course is more than just theory; it's a deep dive into the intricacies of trading. Across 26 comprehensive lessons, complemented by over 60 detailed subtopics, we provide students with studio-quality videos to ensure the concepts are grasped clearly. Ezekiel has personally curated examples and real-world interpretations, embedding them into every module, to provide a holistic learning experience.

For anyone taking their first steps or even those looking to refine their strategies, our program stands out as one of the most beginner-friendly and risk-averse resources available. We're here to ensure you're well-equipped to tackle evaluations like FTMO's and carve a successful path in the world of forex trading.

Our Journey at Asia Forex Mentor

At Asia Forex Mentor, our journey, spearheaded by Ezekiel Chew, has been a transformative one, touching countless lives along the way. From retail and bank traders to professionals employed by esteemed trading institutions and investment firms, Ezekiel's teachings have resonated deeply, leading to profound changes in many careers. We've witnessed incredible transitions, where novices, under our guidance, have metamorphosed into full-time forex traders. Some have even furthered their trajectories, becoming sought-after fund managers.

Our flagship offering, the Asia Forex Mentor One Core Program, is a testament to our commitment to holistic trader education. In its concluding sections, it delves into the nuanced realms of bar-by-bar backtesting and facets of trading psychology – crucial areas often overlooked in mainstream courses. Ezekiel, with his profound experience, shares invaluable insights on the importance of maintaining trading diaries, thereby helping our students introspect and grow.

This section of the One Core Program also demystifies essential trading strategies. From the simplicity of the set-and-forget approach and the innovation of our unique automobile stop-loss tool to deeper insights into the free trade concept, we cover it all. Furthermore, we elucidate the vital differences between large and small stop-loss levels, empowering our traders with knowledge to optimize their strategies.

Understanding the importance of a hands-on experience, we offer a seven-day free trial for the One Core Program. And for those ready to dive in, we provide an option to purchase the course at a one-time fee of $997. However, if you're confident about the value we bring to the table, you can avail of a special price of $940, bypassing the trial. Our goal remains clear – to equip our students with the best tools and knowledge to navigate the dynamic world of forex trading.

Conclusion: FTMO Review

All this concludes that FTMO provides an opportunity to find the inner trading skills of a potential trader and provides the platform where a skillful trader can start trading big funded accounts with no investment and earn good profits.

As learning is the key to success, FTMO ensures that the traders get monetory and technical assistance that is needed for successful trading. Moreover, by providing the useful tools FTMO helps traders to manage the risks involved in forex, commodities, and crypto trading by maintaining challenge standards and governing rules to mitigate huge losses.

Moreover, the evaluation process consists of a preparation technique for traders to train them for the successful completion of the trading objectives. By following a rigid criteria the traders can prove their worth and can also get the reward of $ 1 million funded account for a rfotable trading experience.

FTMO Review FAQs

Is the FTMO challenge worth it?

FTMO proprietary trading firm is an excellent platform for forex traders. This broker provides the tools, strategies, and services needed for successful trading. The rules and regulations are well documented and transparent, making it a reliable company for trading.

How long does FTMO take to pay you?

It takes around 4-5 business days for bank transfers, usually taken upon confirming the invoice. Other payment methods, such as e-wallets, credit and debit cards, online payment platforms, etc., provide instant funds. Profits can be received through Skrill, bank transfers, or cryptocurrencies.

How long does it take for FTMO to verify?

It takes minimum trading days of 60 calendar days to verify the FTMO challenge. If a person manages to pass the trading objectives sooner, he does not have to wait for the remaining duration days.